Form W-8BEN challenges many seeking global income. Tax forms worry even experienced earners. Errors cost a lot. The IRS collects over $10 billion yearly from missing or incorrect paperwork. Complex rules shouldn’t reduce your profits.

This 2025 guide from SAL Accounting simplifies Form W-8BEN and related tax forms with clear tips to avoid errors. Tackle U.S. tax forms confidently with our easy steps.

Quick Takeaways

- Form W-8BEN blocks 30% withholding on U.S. income for non-residents.

- Without it, you face payment delays and lose treaty tax savings.

- The U.S.-Canada treaty offers 0% royalty rates with proper filing.

- Errors in submission trigger financial penalties and IRS scrutiny.

- It stays valid for three years, requiring updates within 30 days.

What Is Form W-8BEN? A Simple Explanation

Form W-8BEN helps non-U.S. people show they’re not U.S. taxpayers. It’s for people, not companies. It proves your foreign status. This IRS form lowers taxes on your U.S. earnings (source). You fill it out to avoid extra tax deductions. An accurate form prevents costly tax errors. Consult our CPA tax accountants for expert help.

All W-8 Forms: Choose the Right IRS W-8BEN Tax Form

The IRS has five W-8 forms for different taxpayers. Pick the right one to avoid tax mix-ups. Wrong forms cause delays or penalties. Below are the types of this form:

1.Form W-8BEN

Form W-8BEN shows you’re not a U.S. taxpayer. It lowers your U.S. taxes. This form is easy to fill out. You need basic personal info. It helps with international tax deals. Learn about what IRS Form 8833 is for tax treaty benefits to claim additional tax savings.

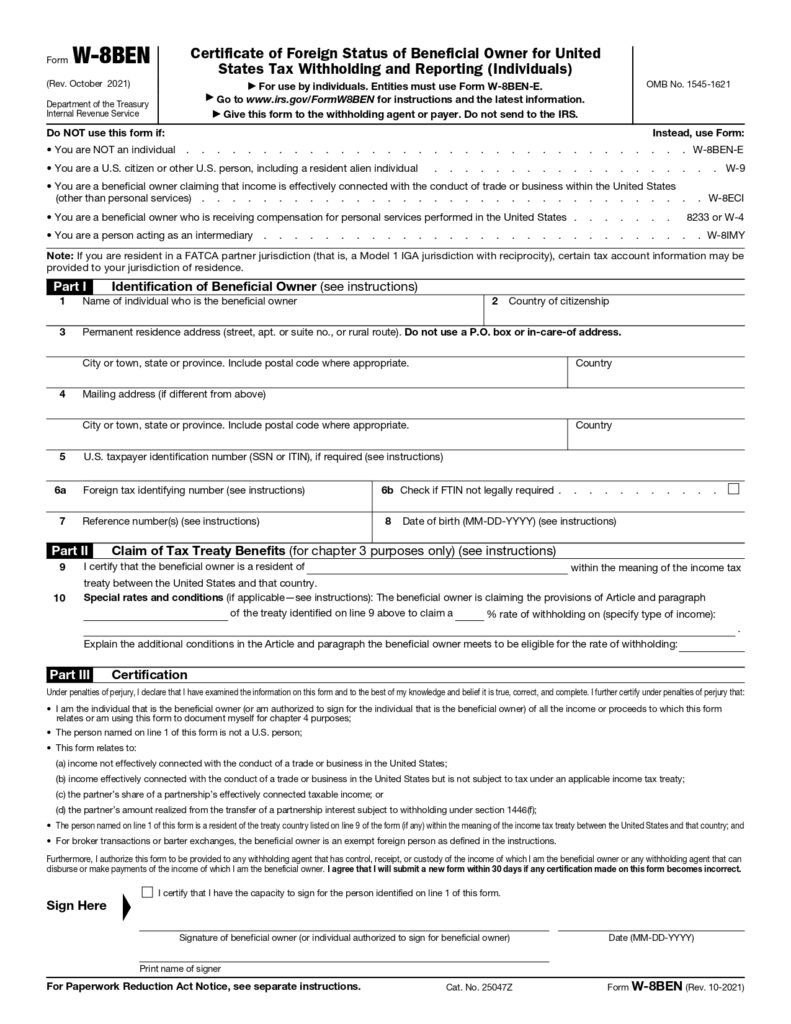

Pro Tip: Keep a copy of the form you submitted for your records. This ensures you have proof if issues arise. Here is the form:

2.Form W-8BEN-E

W-8BEN-E is for non-U.S. businesses. It proves they’re foreign. This form follows FATCA rules for global taxes. It’s tricky and needs lots of business details. Businesses use it to save on taxes.

3.Form W-8ECI

W-8ECI deals with U.S. business income. It reports money taxed in the U.S. You use it for work done in the U.S. It shows your income comes from U.S. activities. Form W-8ECI stops extra tax cuts.

4.Form W-8EXP

W-8EXP helps governments or nonprofits. It lets them skip U.S. taxes. This form proves they’re tax-exempt. Groups like charities or central banks use it (W-8EXP Instructions). They show proof to qualify.

5.Form W-8IMY

W-8IMY is for banks or brokers. It shows they send payments to others. W-8IMY keeps taxes straight. It lists who gets the money. Banks file it to explain their role.

Pro Tip: Include all recipient details to avoid payment delays. Accurate details keep transactions smooth. The table below compares W-8 forms to help you choose the right one:

- Read More: “Canada-US Tax Treaty”

| Form | Who Uses It | Purpose | Complexity |

| Form W-8BEN | Individuals | Certifies non-U.S. status, claims tax treaty benefits | Simple, basic personal info |

| Form W-8BEN-E | Businesses | Proves foreign entity status, follows FATCA | Complex, detailed business info |

| Form W-8ECI | Individuals/Entities with U.S. business income | Reports U.S.-sourced income | Moderate, requires income details |

| Form W-8EXP | Governments, nonprofits | Proves tax-exempt status | Moderate, needs proof of status |

| Form W-8IMY | Banks, brokers | Tracks payments to others | Complex, lists recipient details |

Form W-8BEN vs. W-8BEN-E: Key Differences

Form W-8BEN and W-8BEN-E puzzle many non-U.S. taxpayers. They matter to avoid tax issues. Here’s how they’re different:

- Who Uses It: W-8BEN is for people; W-8BEN-E is for companies.

- Goal: Both show you’re not from the U.S.; W-8BEN-E adds company info.

- Ease: W-8BEN is fast; W-8BEN-E takes longer.

Pro Tip: Check with your payer if you’re a single-member LLC, as explained in our guide on Canadian ownership of a US LLC. Review your form yearly to stay on track.

Step-by-Step Guide: How to Complete Form W-8BEN

The IRS W-8BEN tax form feels simple with these steps. It has two main parts. Complete them correctly to save your U.S. earnings.

Step 1: Download

Get the form from IRS.gov (here). Use the October 2021 or 2025 version. Download the official PDF.

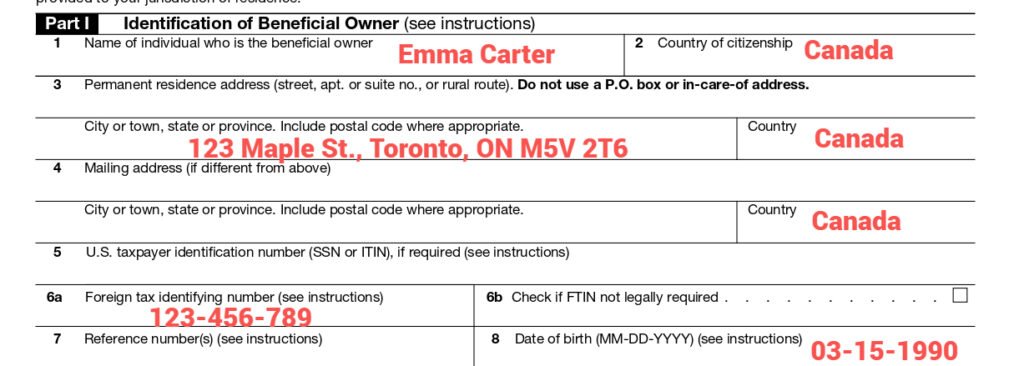

Step 2: Part I (Identification)

Fill in your details:

- Line 1: Write your full legal name.

- Line 2: List your citizenship country.

- Line 3: Add your permanent address.

- Line 4: Enter a different mailing address if needed.

- Line 5: Skip the U.S. TIN if none.

- Line 6: Include your foreign tax ID. Learn more about filing foreign business income taxes in Canada and your tax ID.

- Line 7: Add a reference number if asked.

- Line 8: Write your birth date, MM-DD-YYYY.

Example: Emma Carter from Canada enters her name, Canadian citizenship, 123 Maple St., Toronto, ON M5V 2T6, SIN 123-456-789, and birth date 03-15-1990. You can check this part for Emma in the image below:

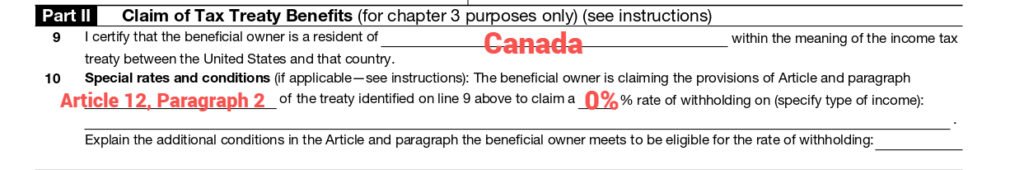

Step 3: Part II (Treaty Benefits)

Claim lower taxes. Use this section to claim lower taxes, as detailed in our guide to withholding taxes under the U.S.-Canada tax treaty. You can check this part in the image below:

- Line 9: Check the box and name your residence country.

- Line 10: List the treaty article and rate.

- Note: Check treaties at IRS Tax Treaties.

Example: Emma Carter from Canada checks the box, writes “Canada,” and lists “Article 12, Paragraph 2, 0% for royalties.”

Step 4: Sign and Date (Part III)

Confirm everything is correct. You can check this part in the image below. Sign your name and add the date. Electronic signatures may work if allowed.

Step 5: Submit

Send the form to your payer, not the IRS. Use secure methods, like portals or encrypted email. Keep a copy. Double-check your tax ID and treaty details to avoid errors.

Common Mistakes to Avoid When Filing Form W-8BEN

Form W-8BEN looks tricky, but errors cost you money. Avoid these common mistakes to save cash. Check “E-Commerce Accounting Errors That Could Cost You Thousands” for more tips on staying error-free.

- Wrong Form: Don’t choose W-8BEN-E or other W-8 forms. W-8BEN is for individuals, not companies.

- Incorrect Tax ID: Verify your foreign tax ID, like Canada’s SIN. A wrong number delays payments.

- Treaty Errors: Don’t misquote treaty articles or rates. Wrong details block tax savings.

- Sending to IRS: Send the form to your payer, not the IRS. Wrong delivery wastes time.

- Not Updating: Update within 30 days for address or status changes. Old info causes issues.

Keep your Form W-8BEN error-free with our bookkeeping services for ecommerce today.

Case Study: Canadian Shopify Seller’s Form W-8BEN Fix

Problem: A Canadian Shopify seller contacted us after skipping the IRS W-8BEN tax form for $12,000 in U.S. sales. Shopify withheld 30% ($3,600), froze payouts, and they missed the U.S.-Canada treaty’s 0% royalty rate.

What We Did: We advised filing Form W-8BEN with Shopify, claiming the 0% treaty rate under Article XII, showing bank records, and hiring a U.S. tax expert.

Result: Shopify stopped withholding, unfroze $4,000, and the seller recovered $5,000, keeping their store thriving.

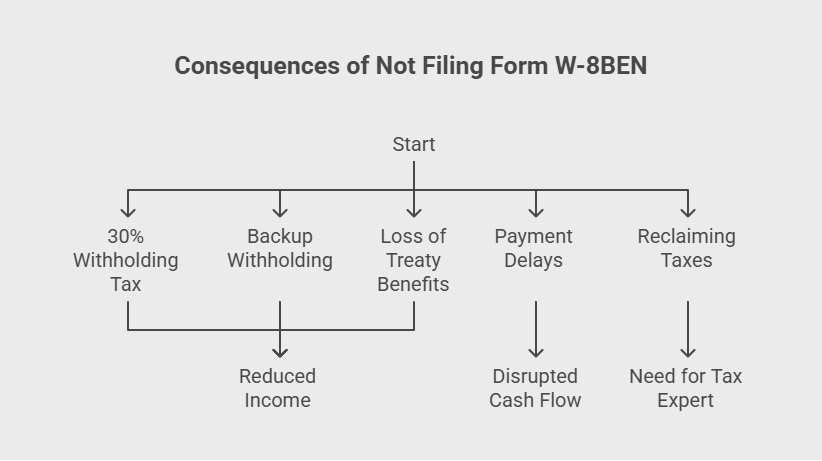

Why Form W-8BEN Is Critical: Consequences of Not Filing

Form W-8BEN saves non-U.S. taxpayers money. Without it, you face big losses. Here’s what happens if you don’t file.

1.30% Withholding Tax

Payers take 30% of your earnings without W-8BEN (Check NRA withholding). This hits interest, dividends, royalties, or service payments. For example, $10,000 drops to $7,000. Freelancers and creators lose significant income, hurting their budgets.

2.Backup Withholding

You face 24% extra withholding for non-compliance. The IRS applies this under section 3406 rules. This extra tax cuts your take-home pay further, adding financial strain.

3.Loss of Treaty Benefits

You miss tax savings without W-8BEN. Treaties, like the U.S.-Canada deal, offer 0% on royalties. Not filing means paying full taxes and reducing your hard-earned profits.

4.Payment Delays

Platforms like Amazon freeze your funds without W-8BEN, as noted in our Amazon tax guide for Canada and U.S. They hold payments until you submit W-8BEN. This delays your cash flow, disrupting your business or income stream.

5.Reclaiming Taxes

Getting withheld taxes back is tough. You need a complex U.S. tax return and should learn how to file your U.S. tax return while living abroad. The process takes time, feels confusing, and often requires a tax expert.

The table below highlights the costly risks of skipping Form W-8BEN:

| Consequence | Impact | Example |

| 30% Withholding Tax | Payers take 30% of earnings (interest, dividends, royalties, services) | $10,000 becomes $7,000 |

| Backup Withholding | 24% extra tax for non-compliance (section 3406) | Further cuts take-home pay |

| Loss of Treaty Benefits | Miss tax savings (e.g., 0% on royalties) | Pay full taxes, lose profits |

| Payment Delays | Platforms like Amazon freeze funds | Disrupts cash flow |

| Reclaiming Taxes | Complex U.S. tax return needed | Time-consuming, needs expert |

Case Study: Canadian Freelancer’s Form W-8BEN Fix

Problem: A Canadian freelance writer called us after errors with the IRS W-8BEN tax form for a $5,000 Fiverr job. They used Form W-8BEN-E, an old SIN, and a 10% U.S.-Canada treaty rate instead of 0%. They mailed it to the IRS and didn’t update their address. Fiverr withheld $1,500 and delayed payment.

What We Did: We told them to use the right Form W-8BEN. We advised checking their SIN. We suggested fixing the treaty rate to 0%. We recommended sending it to Fiverr. We helped them update their address on Fiverr’s portal.

Result: Fiverr returned the $1,500. They restored treaty benefits. They released the funds. The writer kept her income.

How Long Is Form W-8BEN Valid?

Form W-8BEN keeps your tax status active. Know its lifespan to avoid costly issues.

- Validity: It lasts from the signing date until December 31 of the third year (Instructions). For example, a form signed July 1, 2025, expires December 31, 2028. This ensures payers have current info to apply tax treaties correctly.

- Updates: Update within 30 days for address, citizenship, or residency changes. This keeps your tax benefits intact. Missing updates risk withholding or payment delays. Stay compliant with help from our cross-border tax accountant.

Final Thoughts

Form W-8BEN protects global earnings for non-U.S. individuals. Accurate filing saves money and prevents errors. Stay current with tax rules to keep your income secure. SAL Accounting offers professional guidance to simplify compliance.

Contact us today for a free consultation to streamline your U.S. tax process and maximize your earnings.

Frequently Asked Questions (FAQs)

Form W-8BEN confirms non-U.S. status. It claims treaty benefits to cut U.S. tax withholding on income like royalties.

Non-U.S. individuals with U.S. income, like freelancers or creators on Amazon or YouTube, need Form W-8BEN.

No, submit Form W-8BEN to your payer. The IRS doesn’t get it directly.

Yes, it helps non-U.S. freelancers earning U.S. income avoid withholding via treaties.

No, Form W-8BEN certifies foreign status to reduce withholding, not a tax form.

Payers withhold 30% of your U.S. income. You face delays and lose treaty benefits.

Yes, Form W-8BEN prevents 30% withholding for non-U.S. creators on these platforms.