Our Form 1120-F Guide helps foreign companies tackle U.S. tax filing in 2025. We break down complex IRS rules, like reporting U.S. sales income or avoiding penalties. Here’s the surprising part: in 2024, the IRS checked just 34 Form 1120-F filings and spotted $221 million in refunds, roughly $6.5 million per company. Many foreign businesses overpay taxes because U.S. rules are so tricky.

But in today’s post at SAL Accounting, we dive into the details with clear steps to file right and possibly reclaim your money. Stay with us to learn more.

Quick Takeaways

- Form 1120-F reports U.S. income for foreign companies, like sales or royalties.

- File by April 15 or extend to October 15 using Form 7004.

- A protective filing starts the IRS audit clock without ECI.

- Late filings trigger $195 monthly penalties, so file on time.

- Treaties and Form 8833 help lower taxes for Canadian businesses.

What is the IRS Form 1120-F for Foreign Companies?

IRS Form 1120-F is the tax return for foreign companies working in the U.S. You use it to report cash from U.S. sales or services and figure out your taxes (source). It covers effectively connected income (ECI). It also handles U.S.-source income, like royalties from American clients. Plus, it deals with branch profits tax. Our cross border tax accountant in Toronto helps you file correctly and save money. We’ll explain these terms more soon.

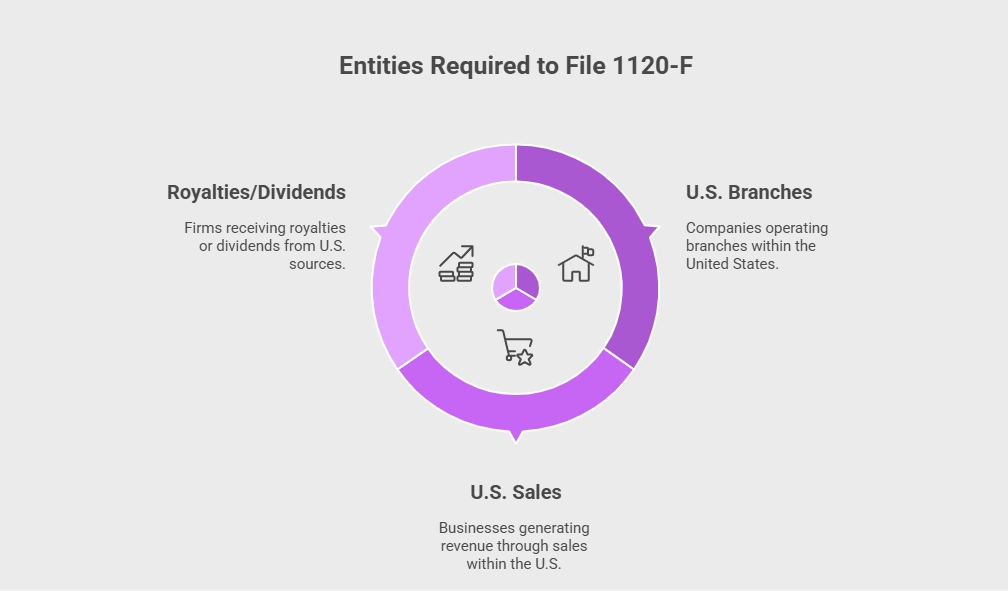

Who Must File 1120-F Nonresident for U.S. Taxes?

Foreign companies doing business in the U.S. must file a 1120-F nonresident if they have a U.S. trade, earn effectively connected income (ECI), or get U.S.-source FDAP income, even if treaty-exempt. Nonresident individuals use Form 1040NR instead. You can file a protective return to start the IRS’s clock without ECI. Here’s who files:

- Companies with U.S. branches.

- Businesses with U.S. sales, like on Amazon. Check the Amazon tax guide for Canada and the U.S.

- Firms earning U.S. royalties or dividends.

Pro Tip: Shopify sellers, check state nexus laws. File protectively if ECI’s unclear. The Shopify seller’s tax guide about income and sales taxes may help you.

Concepts for Form 1120-F Guide: U.S. Source Income, ECI, and Branch Profits Tax

These terms can feel like a puzzle, but we’ll make them clear. Let’s jump in.

What is U.S. Source Income?

U.S. source income is money from U.S.-based activities (source of income). Think dividends from a U.S. company or cash for services done in the states. It’s any money linked to the U.S., even if you’re based abroad.

What is Effectively Connected Income (ECI)?

ECI is cash from your U.S. business operations. For example, a Canadian company selling software to U.S. clients earns ECI from those sales. Treaties might cut your taxes, but you report ECI on Form 1120-F.

What is Branch Profits Tax?

This is a 30% tax on profits your U.S. branch sends home. If your branch makes $100,000 and transfers it, you might owe $30,000. Treaties can lower this rate.

Pro Tip: Keep detailed records of U.S. transactions. This helps prove ECI or claim treaty benefits. Here’s a table to clarify these concepts:

| Concept | Definition | Form 1120-F Role | Action | Pro Tip |

| U.S. Source Income | Money from U.S. activities | Reported if not exempt | Track U.S. payments | Save all payment records |

| ECI | Cash from U.S. business | Reported on main form | Use Schedule M-1 | Check income accuracy |

| Branch Profits Tax | 30% tax on profits sent home | Reported on Schedule P | Check treaty rates | Verify treaty eligibility |

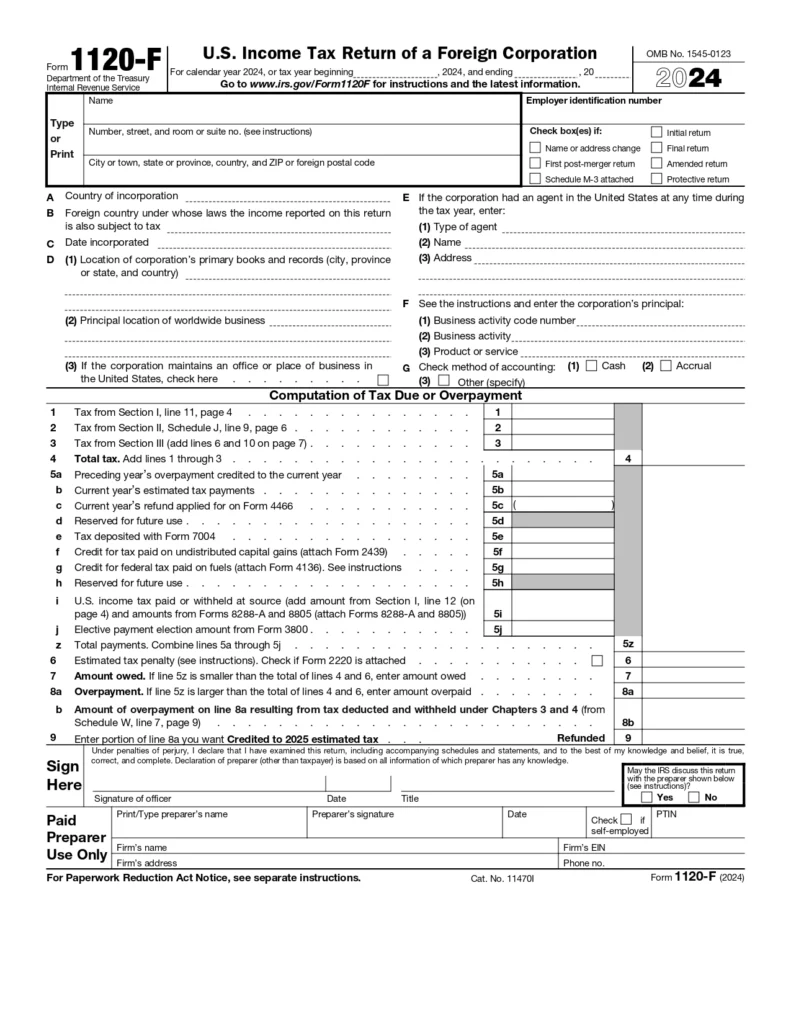

Components of IRS Form 1120-F for Filing

Form 1120-F has several parts you need to get right. Here’s what makes up the form:

- Main Form: Report your company’s U.S. income, deductions, and taxes owed. Fill in your business details and total income.

- Schedule M-1: Match your accounting income with taxable income. List any differences, like non-deductible expenses in Schedule M-1.

- Schedule M-3: For companies with assets over $10 million, detailed financial data. Schedule M-3 is more complex than M-1.

- Schedule P: Report branch profits tax on money sent to your foreign headquarters.

- Schedule H: List deductions, like operating costs, tied to U.S. income.

- Attachments: Include Form 8833 for treaty benefits or Form 5472 for related-party deals. Check how to fill out Form 5472 for the best result.

Check out the form’s header below to see it:

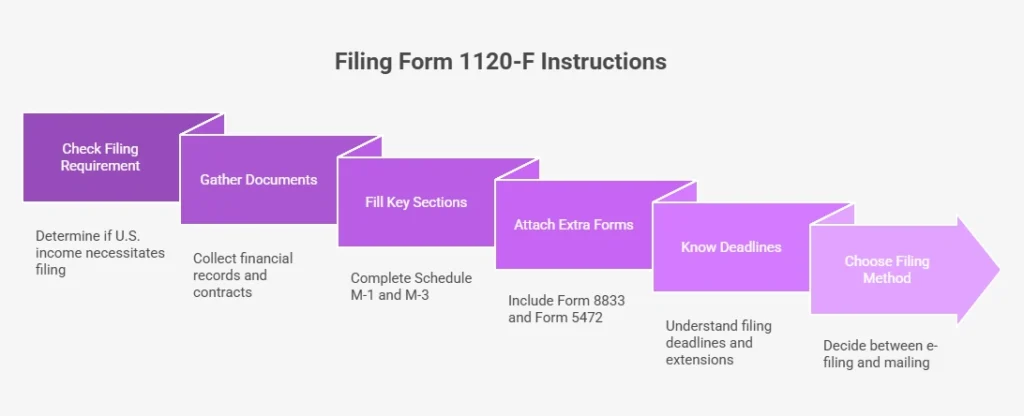

Step-by-Step Form 1120-F Instructions for Filing

Filing Form 1120-F is easy with the following instructions. These steps make the process clear.

1. Check If You Need to File

See if you earn money from U.S. sales or services. You need this form if you do. A protective return covers you even with no income. Check treaties or state rules to confirm.

Example: Ana, who runs a Canadian retail company, sees her $50,000 in U.S. software sales and decides to file.

2. Gather Your Documents

Get financial records ready. Collect income and expense reports, plus U.S. contracts or bank statements. Sales records from PayPal or Shopify help too. This avoids IRS issues. Use a 2025 bookkeeping checklist for Canadian small businesses to ensure everything is right.

Example: Ana collects PayPal statements showing $50,000 in U.S. sales and her U.S. server contract.

3. Fill Out Key Sections

Fill Schedule M-1 to match your income with IRS rules, for assets over $10 million, complete Schedule M-3 for extra details. List all U.S. income to stay compliant.

Example: Ana writes $50,000 in U.S. sales on Schedule M-1, line 3, and $10,000 in expenses on line 5.

4. Attach Extra Forms

Add Form 8833 to claim treaty benefits and lower taxes. Include Form 5472 for deals with related companies, like a parent firm. These keep you in the clear.

Example: Ana fills Form 8833 to use a Canada-U.S. treaty to cut her tax on $50,000.

5. Know Your Deadlines

File by April 15 if your tax year ends December 31. If you need more time, file Form 7004 for a 6-month extension. Late filings bring penalties.

Example: Ana files by April 15 but uses Form 7004 for an October 15 extension.

6. Choose Your Filing Method

E-file if your assets are over $10 million; it’s required. Smaller companies can mail paper forms to the IRS. E-filing saves time.

Example: Ana mails her form since her assets are $5 million.

Exemptions from Filing IRS Form 1120-F for Foreign Companies

Some foreign companies don’t need to file Form 1120-F. Here’s when you can skip it:

- No U.S. Income: Don’t file if you have no U.S.-source money or business activities.

- No Permanent Establishment: Your country’s U.S. treaty might say you have no U.S. office or base. This often means you’re free.

- Exempt Income: Some income, like portfolio interest, doesn’t need filing if you document it right (exclusions from income).

- No ECI: Skip filing if you have no effectively connected income and don’t claim treaty benefits.

Pro Tip: Save records showing you have no U.S. income. This keeps you safe if the IRS checks later.

Form 1120-F Deadlines and Penalties for Nonresident Filers

File Form 1120-F on time to avoid IRS trouble. Follow these tips to stay safe:

- Deadlines: File by April 15 if your tax year ends December 31. Other tax years? File by the 15th day of the fourth month. Use Form 7004 to extend to October 15.

- Penalties: Late filings cost $195 a month, up to 25% of unpaid taxes. Underpay, and you pay interest plus a 5-25% penalty.

- Stay Compliant: File early. Use Form W-8BEN-E for the right withholding. Keep clear records. Check more details in the guide about Form W-8BEN for foreign individuals.

Pro Tip: Put April 15 and October 15 in your calendar. File Form 1120-F right with our corporate tax accountant.

1120-F Protective Filing Scenarios for Foreign Companies

Foreign companies face different 1120-F scenarios. Let’s make it clear with simple examples.

Filing with ECI vs. Without

If your company earns U.S. business income, like store sales, file Form 1120-F to report ECI. Without ECI, file for U.S.-source income, like dividends, or treaty benefits.

Pro Tip: Use QuickBooks to track ECI. This keeps your records straight and makes audits easy.

1120-F Protective Filing

A protective filing keeps you covered. You file without ECI to start the IRS’s three-year audit clock. This protects you if the IRS claims ECI later. Learn more about the U.S. subsidiary of a Canadian company that may need to file Form 1120-F.

Pro Tip: Chat with a tax pro before filing protectively. They’ll check if your U.S. activities, like servers, could count as ECI.

Mistakes to Avoid in Form 1120-F Guide Scenarios

File Form 1120-F correctly and avoid these common mistakes:

- Wrong ECI: Some mark U.S. sales as non-ECI or miss U.S. office income. Track U.S. money separately.

- Missing Form 5472: Skip this for deals with related companies, and pay a $25,000 fine per form. Include it if needed.

- No Protective Filing: Skip this, and IRS audits can hit later. File to start the three-year audit clock.

- Bad Treaty Claims: Wrong Form 8833 claims mean overpaying taxes. Check your U.S. treaty.

- Incomplete Schedules: Miss Schedule P or H, and face IRS notices. Review all schedules.

- Ignoring State Nexus: Skip state tax rules, and risk extra penalties. There is information every e-commerce seller must know about sales tax nexus.

Below is the table to learn about mistakes:

| Mistake | What Happens | Fix It |

| Wrong ECI | IRS flags incorrect taxes | Track U.S. income separately |

| Missing Form 5472 | $25,000 fine per form | File Form 5472 for related deals |

| No Protective Filing | Long-term audit risk | File protective return |

| Bad Treaty Claims | Overpay taxes | Verify treaty with Form 8833 |

| Incomplete Schedules | IRS sends notices | Review all schedules |

| Ignoring State Nexus | State penalties pile up | Check state tax rules |

Case Study: Fixing Form 1120-F Slip-Ups for a Toronto Retailer*

A Toronto retailer selling clothes on Shopify calls SAL Accounting:

Problem: They make $150,000 from U.S. sales but call it non-ECI, thinking their online store doesn’t count as a U.S. business. They skip Form 5472 for $30,000 paid to their Toronto parent company. The IRS hits them with a $25,000 fine for the missing form. An audit catches their ECI mistake, piling on more penalties.

What We Do: We check their U.S. sales records. We fix their Form 1120-F, listing $150,000 as ECI on Schedule M-1. We file Form 5472 for related-party payments. We start a 1120-F protective filing for next year.

The Result: The retailer dodges extra penalties. They save big by fixing their filing. Future audits don’t scare them.

Steps to Master Form 1120-F Instructions for Filing

Make your Form 1120-F filing easy with these simple tricks. They help foreign companies, like those on Amazon or Shopify, stay on track.

1. Track U.S. Income

Split your U.S. sales to keep Form 1120-F simple.

- Use QuickBooks to separate U.S. money from other cash.

- This makes ECI reporting clear and keeps records neat.

- It saves time on forms like Schedule M-1.

2. Check Your Treaty

Look at your country’s U.S. tax treaty before you file. Check how the US-Canada tax treaty works and avoid double taxation. It can cut taxes on ECI or branch profits. Use Form 8833 to claim treaty perks and avoid paying too much.

3. Make a Tax Calendar

Stay on top of Form 1120-F deadlines with a calendar.

- Mark April 15 for filing and October 15 for extensions.

- A yearly calendar keeps you organized.

- This stops late fees.

4. File a Protective Return

File a 1120-F protective even with no ECI. It starts the IRS’s three-year audit clock and keeps you safe from future problems. Write “Protective Return” on the form.

5. Hire a Tax Pro

Get a U.S. tax expert who knows Form 1120-F. They catch issues like permanent establishment and make your filing correct. This stops big mistakes. Simplify Form 1120-F filing with our US-Canada cross-border tax accountant today.

Case Study: Nailing Form 1120-F for a Vancouver Tech Startup*

A Vancouver tech startup with $100,000 in U.S. app subscriptions calls SAL Accounting:

Problem: They can’t track U.S. revenue clearly and worry about missing Form 1120-F deadlines. They’re confused about ECI and treaty benefits, risking overpayment or fines.

What We Do: We set up QuickBooks to track U.S. revenue easily. We review the Canada-U.S. tax treaty and file Form 8833 to cut ECI taxes. A U.S. tax pro confirms no permanent establishment issues. We file a 1120-F and add deadlines to a calendar.

The Result: The startup files accurate schedules like M-1 and P. They save thousands in taxes and skip penalties. Their Form 1120-F goes smoothly.

Final Thoughts

Form 1120-F filing helps foreign companies stay IRS-compliant in 2025. You can avoid penalties by reporting ECI, using treaties, and filing protectively. This guide shows simple steps to tackle schedules, deadlines, and common mistakes.

Master Form 1120-F filing with our team today. Contact us at SAL Accounting to make compliance easy and boost your savings.

*Hypothetical scenario

Disclaimer: This form 1120-f guide provides general information for educational purposes. It’s not tax or legal advice. Tax rules vary, so consult a professional for your situation. SAL Accounting is not liable for decisions based on this content.

Frequently Asked Questions (FAQ)

ECI is money from your U.S. business, like store sales. You report it on Form 1120-F. A treaty might lower your taxes.

You file this without ECI to start the IRS’s three-year audit clock. Mark “Protective Return” on the form. It keeps you safe from later claims.

File by April 15 if your tax year ends December 31. For other tax years, file by the 15th day of the fourth month. Use Form 7004 to extend to October 15.

You skip Form 1120-F if you have no U.S. money or business. Keep records to show this. It protects you if the IRS checks.

Form 1120 is for U.S. companies. Form 1120-F is for foreign companies with U.S. income. Both handle taxes, but for different businesses.

This is a 30% tax on profits your U.S. branch sends home. A treaty can cut this rate. Report it on Schedule P.

Canadian companies file Form 1120-F for U.S. business income or money like royalties. It keeps you compliant with the IRS.