Every sale on your Shopify or e-commerce store feels like a win. Taxes, though, can complicate things. The US has over 12,000 tax zones. That’s tough to keep up with. Data shows 68% of online sellers faced use tax fines in 2024. Sales tax vs use tax confuses dropshippers, international sellers, and Shopify users.

Our guide at SAL Accounting breaks it down simply. It covers nexus rules and differences between sales and use taxes. Read on to manage them with ease.

Quick Takeaways

- Sellers collect sales tax at checkout; buyers handle use tax for out-of-state buys.

- Shopify Tax calculates sales tax rates based on buyer location, but you file returns yourself.

- Track nexus with Shopify Tax to identify states where sales hit $100,000 and collect taxes.

- Add a checkout note to tell customers they owe use tax on untaxed purchases.

- Keep detailed records of sales and untaxed buys to avoid audit fines.

Sales Tax vs. Use Tax: What’s the Difference?

Sales tax and use tax change how e-commerce sellers deal with taxes. They’re different. Book a consultation with our e-commerce accountant to sort these taxes. Let’s make it super clear:

Sales Tax

Sellers add sales tax when customers buy stuff online. It covers things like clothes and sometimes digital items. Tax rates change by place. Sellers collect sales tax in states with nexus, like a shop or warehouse. Follow our US sales tax filing guide for e-commerce businesses for more.

- Example: A Shopify seller in Texas sells a $50 phone case to an Austin buyer. They add 8.25% sales tax ($4.13) and send it to Texas.

- Pro Tip: Check state tax sites like California CDTFA for the right sales and use tax rates and filing help.

Use Tax

Use tax happens when sales tax isn’t added, usually for out-of-state purchases. The buyer pays it to their state. It taxes things used in the state, like business supplies or gear. States often check if businesses pay it (state tax administrators).

- Example: An e-commerce seller in Florida buys $500 in untaxed packaging materials from an out-of-state supplier. They owe 6% use tax ($30) to Florida for business use.

- Key Point: Buyers owe use tax, but e-commerce sellers must track it for business buys.

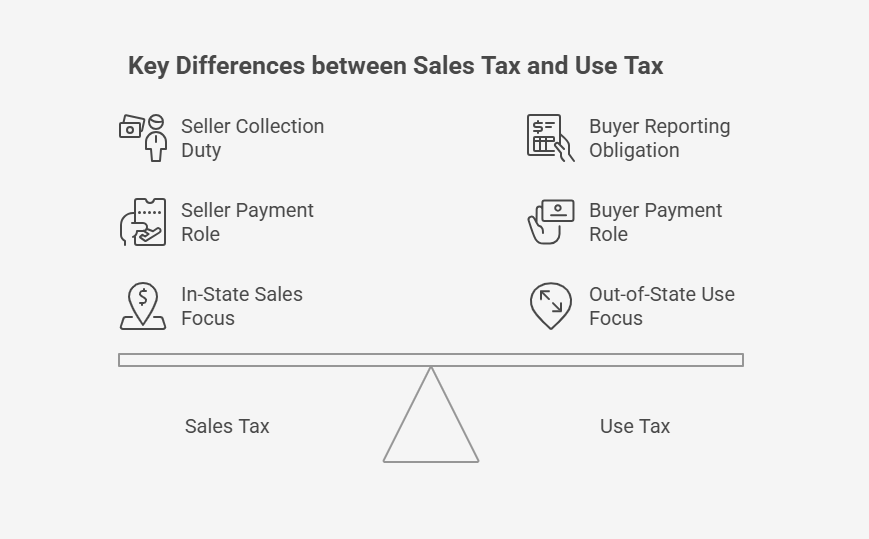

Key Differences between Sales Tax and Use Tax

The difference between sales tax and use tax matters for e-commerce sellers. Here’s the deal:

- Collection: Sellers grab sales tax at checkout. Buyers report use tax on their own.

- Responsibility: Sellers send sales tax to the state. Buyers or businesses pay use tax, but businesses get more attention from auditors.

- Application: Sales tax hits in-state or nexus sales. Use tax covers out-of-state stuff used locally.

Shopify Sales Tax: Why It Matters for Your E-commerce Store

Sales tax can trip up Shopify and e-commerce sellers. Getting it right keeps your business on track. Let’s unpack why:

How Does Shopify Sales Tax Work?

Sellers add sales tax when customers buy stuff. Shopify Tax figures out rates based on where buyers live. WooCommerce or Etsy may need manual setup or apps like those mentioned in our 2025 Etsy seller tax guide for the US and Canada. Sellers file taxes themselves.

What Are Nexus Things?

State nexus rules decide where you collect taxes. Nexus comes in two types:

- Physical Nexus: Stuff like warehouses, offices, or staff in a state.

- Economic Nexus: Impacts you when your sales spike, like $100,000 or 200 orders in a state. This started with the 2018 South Dakota v. Wayfair case.

Sales Tax Exemptions and Special Cases

Exemptions help Shopify and e-commerce sellers avoid overcharging or audit trouble. Many find it tough to spot tax-exempt products like medical supplies or groceries, or transactions like sales to nonprofits (tax-exempt status). Here are common exempt categories by state:

- Clothing: Pennsylvania, New Jersey, and New York (under $110) don’t tax clothing.

- Groceries: Texas and Florida skip taxes on unprepared food. Prepared foods might still get taxed.

- Medical Supplies: California exempts prescription drugs. Over-the-counter meds usually face tax.

- Manufacturing Equipment: Ohio doesn’t tax equipment used for production.

- Digital Products: Missouri exempts some digital goods. Texas taxes them. Visit state tax sites for details. Missing exemptions can lead to wrong tax charges.

Understand key sales tax factors through the table below:

| Factor | Description | Action | Compliance Tip |

| Nexus | Physical or economic state ties | Track and register | Monitor sales monthly |

| Tax Rates | Vary by state and product | Update settings | Check state rate updates |

| Exemptions | Non-taxable items like food | Verify with state | Save exemption documents |

| Filing | Monthly, quarterly, or yearly | File on time | Set deadline alerts |

| Records | Sales, refunds, untaxed buys | Keep clean records | Store records digitally |

E-commerce Use Tax: When Does It Apply to Online Sales?

In the following, we’ll explain when use taxes apply to your e-commerce business and provide clear steps to manage them:

What’s Use Tax?

Buyers pay use tax when no sales tax is added, like on out-of-state buys. It applies to cross-state or overseas sales, like dropshipping, where you lack a nexus (Treasury tax guide). Check dropshipping taxes in the USA (2025 update) for details.

- When it happens: No sales tax because you lack a nexus.

- Who pays: Buyers deal with use tax, not you.

- Main cases: Digital goods and cross-border sales.

What Should You Do about Use Tax?

You don’t collect e-commerce use tax. You just tell customers they might owe it.

- Inform customers: Include a notice at checkout about use tax obligations.

- Monitor Nexus: Track locations where your business has a tax connection.

Pro Tip: Pop a use tax note at checkout to stay safe. Next, let’s check out nexus rules to nail your tax duties.

Why Shopify and E-commerce Sellers Need to Care About Sales and Use Tax

Sales and use tax for online sellers can be a real hassle. Let’s unpack why it matters for Shopify and e-commerce sellers:

1.Wild State Rules

Every state sets its own tax rates and rules. Some tax clothes, others don’t. For instance, Florida taxes digital downloads like apps, but not food (Florida Sales and Use Tax). Sellers track these differences to stay safe. Missing a state’s rules brings fines.

Pro Tip: Subscribe to state tax newsletters for updates on rate changes. This keeps you ahead of new rules.

2.Marketplace Tax Issues

Platforms like Amazon or Etsy often collect sales tax for you, as covered in the Amazon tax guide for Canada and the US.. But sellers still owe use tax on untaxed buys, like non-marketplace sales. This confuses lots of sellers.

Pro Tip: Save invoices from non-marketplace buys to track use tax. Store them digitally for easy access.

3.Common Mistakes

Sellers often make errors by applying incorrect taxes to items, like saying something’s tax-free when it’s taxable. Forgetting a warehouse that counts as nexus starts audits. Bad filings also lead to penalties. Clean records fix these problems.

4.Stay Safe

Shopify Tax and platform apps make ecommerce tax compliance easy. They figure out rates and flag issues. Contact SAL Accounting to get bookkeeping for e-commerce and keep your taxes smooth.

Dropshipping and International Sellers: Special Sales and Use Tax Considerations

Dropshipping and international sellers face tricky tax things. Let’s clear it up:

- Dropshipping Taxes: Dropshippers owe tax when warehouses, like those in California, make nexus. They use resale papers to skip double taxes. Check Shopify dropshipping taxes.

- International Taxes: Non-U.S. sellers with lots of US sales, owe use tax. They sign up for US tax duties. Missing rules brings fines.

- Read More: “Dropshipping taxes in Canada: What You Need to Pay & How to Stay Compliant“

Case Study: Dropshipping Tax Challenges

Problem: A dropshipper contacted us after a Texas audit. Their supplier’s warehouse caused nexus. They owed $10,000 in use tax.

What We Did: We told them to track supplier bills for $8,000 in untaxed buys. We suggested resale papers to avoid double taxation.

Result: Texas cleared $8,000 in deductions. Their filings got clean. They avoided penalties.

How to Manage Shopify Sales Tax and Use Tax Compliance

E-commerce tax compliance saves Shopify and e-commerce sellers from headaches. These steps make it easy in 2025:

1.Track Nexus

Sellers use Shopify Tax to find physical or economic nexus. Shops or warehouses create a physical nexus. For example, sales hitting $100,000 or $500,000 in California start an economic nexus. Register in those states fast. Check nexus thresholds in the table below:

| State | Sales Threshold | Transaction Threshold | Registration Deadline |

| Texas | $500,000 | None | Next transaction |

| Florida | $100,000 | None | First day of next month |

| New York | $500,000 | 100 transactions | 30 days after threshold |

| Illinois | $100,000 | None (as of 1/1/2026) | First day of next quarter |

| Pennsylvania | $100,000 | None | 30 days after threshold |

| California | $500,000 | None | Next transaction |

| Alabama | $250,000 | None | Next transaction |

| Georgia | $100,000 | None | Next transaction |

| North Carolina | $100,000 | None | First day of second month |

| Washington | $100,000 | None | First day of next month |

2.Set Up Tax Rates

Sellers turn on Shopify tax settings for the right rates. States have different tax rules. WooCommerce or Etsy apps help with setup. Update settings monthly to stay accurate.

3.File Taxes Right

Sellers file taxes monthly, quarterly, or yearly, depending on state rules. Bad filings lead to audits. Keep records tight to stay safe. Platform tools track online sales tax return deadlines.

4.Automate with Tools

Shopify Tax and platform apps figure out rates and flag nexus. They make filings simpler. Check tools often to keep things smooth. Compare platform tools to simplify tax tasks in this table:

| Platform | Auto-Calculates Rates | Tracks Nexus | Simplifies Filings |

| Shopify | Yes | Yes | Yes |

| WooCommerce | With apps | With apps | With apps |

| Etsy | Yes (marketplace) | Yes | Yes |

| Amazon | Yes (marketplace) | Yes | Yes |

| eBay | Yes (marketplace) | Yes | Yes |

5.Handle Tax-Exempt Customers

Tax-exempt customers like nonprofits or resellers require careful steps to keep your Shopify store compliant and audit-safe.

- Get Exemption Certificates: Ask nonprofits or resellers for valid certificates. For example, an Illinois seller avoids 6.25% tax on a $5,000 charity sale with a certificate.

- Check and Save Them: Verify certificates on state websites. Store them for three years. A Texas seller got hit with a $2,000 fine for missing certificates.

- Read More: “Best eCommerce Accounting Software in 2025: Top Picks for Online Sellers“

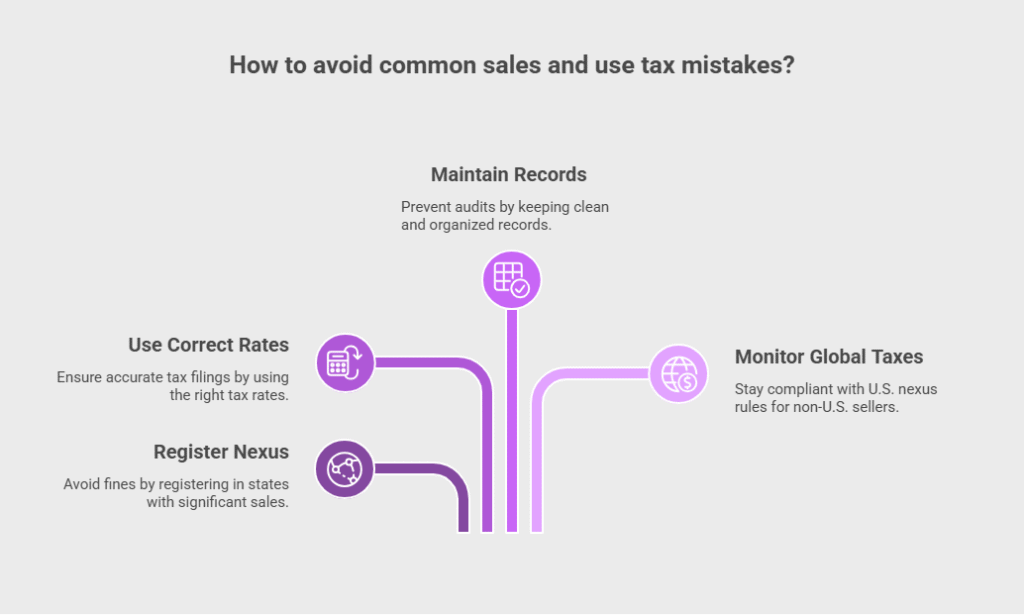

Common Mistakes E-commerce Sellers Make with Sales and Use Tax

Sales and use tax for online sellers can trip up Shopify and e-commerce sellers. E-commerce accounting errors cost you thousands. Avoiding them keeps your shop safe. Let’s break it down:

- Missing Nexus: Sellers skip registering in states with big sales. Economic nexus hits at limits like $500,000 in Texas or California. Not signing up brings fines. Track sales to stay safe.

- Wrong Tax Rates: Sellers charge bad rates or skip taxes on exempt sales. States tax items like clothes or digital files differently. Wrong rates complicate filings.

- Careless Records: Sellers lose track of refunds or untaxed buys. This hurts tax filings. Messy records spark audits. Keep clean records to avoid trouble.

- Ignoring Global Taxes: Non-U.S. sellers miss U.S. nexus rules. Missing rules means penalties. Monitor US sales. Contact our e-commerce accountants for expert help.

Case Study: Shopify Seller’s Audit Fix

Problem: A Shopify seller called us after a California audit caught $250,000 in untracked sales. They missed refunds and untaxed buys. This led to $30,000 in fines and back taxes.

What We Did: We advised them to grab Shopify logs to show $60,000 in refunds. We recommended checking bank statements for $35,000 in untaxed buys.

Result: California took $100,000 in deductions. Fines dropped to $6,000. Clean records kept their shop safe.

Final Thoughts

Selling on Shopify or e-commerce platforms means understanding taxes to keep profits safe. Shopify sellers track nexus and file taxes right. Stay updated with the 2025 rules. This guide from SAL Accounting covers sales and uses taxes in addition to their differences to avoid fines.

Book a free consultation with our experts. We help you tackle the complex challenges. Contact us and start managing your taxes today.

Frequently Asked Questions (FAQs)

Sellers add sales tax at checkout for in-state buys. Buyers pay use tax for out-of-state stuff. Sales tax goes to the state. Buyers report use tax.

Sellers don’t collect use tax. Buyers handle it themselves. Tell customers at checkout to stay safe.

Shopify Tax figures out rates and tracks nexus. Sellers file and pay taxes on their own. Check settings often to stay right.

No nexus means you skip sales tax collection. Buyers might owe use tax. Add a checkout note to tell them.

Digital items like eBooks are subject to use tax if no sales tax applies. Buyers pay it to their state.

Buyers pay use tax for untaxed orders. Sellers track use tax for their own purchases, like supplies.

Sellers owe use tax on untaxed buys, like out-of-state supplies. Check your bills monthly to stay clean.

States check for missed taxes. Messy records or filings bring fines. Keep records tight to avoid trouble.

Shopify Tax and platform apps sort out rates and nexus. Check them monthly to keep filings smooth.