You’re making sales, but are you actually profitable? Inventory shrinkage costs retailers $100 billion every year, but if you’re not measuring it, you can’t control it. Your inventory accounting holds the answer.

A common mistake is expensing inventory at purchase, causing losses when buying stock and inflated profits when selling. The result? Financial reports that hide your real profitability.

Taking a little extra time to set proper Shopify inventory accounting brings clarity to your finances. You’ll make smarter business decisions, stay tax compliant, and set the stage for real growth.

In this guide from Sal Accounting, we’ll walk you through everything you need to know, from inventory accounting basics to actionable setup steps. Whether you’re a new seller or a scaling brand, we’ll show you how to track inventory value, calculate cost of goods sold (COGS), and select solutions for your business.

Key Takeaways

- Inventory is an asset, not an expense – It only becomes a cost (COGS) when you sell it.

- Pick one counting method and stick to it – FIFO (most common), LIFO (U.S. only), or Weighted Average.

- Shopify’s tracking is basic – It counts stock but doesn’t auto-update costs or handle advanced methods.

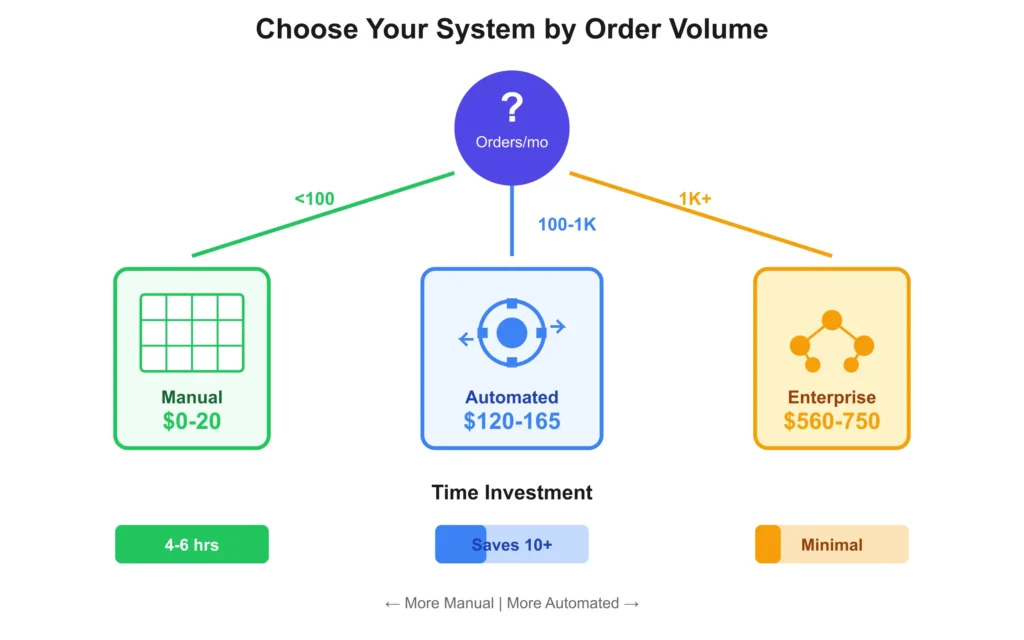

- Match tools to your size – Under 100 orders: use spreadsheets. 100-1,000 orders: add QuickBooks/Xero. Over 1,000: get pro tools.

- Check monthly, count yearly – Regular checks catch mistakes. Annual counts are required for taxes.

Why Do Shopify Sellers Need Inventory Accounting?

Shopify inventory accounting is the process of systematically recording, tracking, and valuing your stock. It’s a foundational practice for anyone serious about maintaining a healthy and profitable Shopify business.

There are four main reasons every Shopify seller should care about inventory accounting:

- Accurate Financial Reporting: Since inventory is often your largest asset, getting its value right means your whole financial picture is clear.

- Tax Compliance: Standards like GAAP and IFRS require precise tracking. Mistakes can mean penalties.

- Better Decision Making: Reliable numbers help you make smarter choices about pricing, cash flow, and reordering.

- Access to Funding: Investors and lenders pay attention to your inventory numbers. Professional financials show you’re running a serious operation. Work with our retail accountants to ensure your inventory records meet standards.

Many sellers mistakenly consider inventory an immediate expense. However, inventory is an asset. Spending $10,000 on products simply converts cash into stock of equal value, not a loss. The cost only becomes an expense once the items are sold, which is crucial for accurate profit tracking.

Understanding Cost of Goods Sold (COGS)

Shopify COGS accounting is an important part of understanding your profitability. Cost of Goods Sold (COGS) includes all the direct costs of making or buying the products you sell. COGS reporting for Shopify usually includes:

- The price you pay for the product

- Shipping costs to get it to you

- Labour costs (if you’re making the product)

- Materials and parts

COGS Formula

Beginning Inventory + Purchases – Ending Inventory = COGS

When a product sells, its cost is moved from your ‘Inventory’ asset account to your ‘COGS’ expense account. This transfer is how you figure out your gross profit and is a core part of good inventory accounting.

An Example:

Let’s say you buy 100 units of a product for $20 each. You spend a total of $2,000.

- Month 1: You spend $2,000. This means your cash goes down, but your inventory (an asset) goes up by the same amount. This doesn’t affect your profit yet.

- Month 2 (You sell 30 units for $40 each): You make $1,200 in revenue (30 x $40). The cost of those 30 units was $600 (30 x $20), which is your COGS. Your inventory asset is now worth $600 less, and your gross profit for the month is $600 ($1,200 Revenue – $600 COGS).

In short, linking costs to the sales period they happened in gives you an accurate picture of your monthly profit.

How Do You Choose Your Shopify Inventory Tracking Method?

How you calculate your Cost of Goods Sold (COGS) depends on your Shopify inventory valuation method. Tax rules usually mean you have to stick with the method you choose, unless you get special permission to change. There are three main methods, and we’ll explain each one.

1. FIFO (First-In, First-Out)

FIFO means you sell your oldest items first. This is how most businesses naturally sell things, especially products that can spoil or go out of style.

Example Calculation:

| Quantity | Cost per Unit | Total | |

| Beginning | 50 | $10 | $500 |

| Purchase | 100 | $12 | $1,200 |

| Units Sold | 75 |

COGS (FIFO): (50 x $10) + (25 x $12) = $800

Ending Inventory: 75 x $12 = $900

Pros: Shopify FIFO tracking usually matches how you actually sell products. It can also make your profits look higher, which is good if you’re trying to attract investors. It’s accepted everywhere.

Cons: If prices are going up (inflation), this method can lead to higher tax payments.

- Read More: “Shopify Payment Reconciliation Guide“

2. LIFO (Last-In, First-Out)

LIFO means you sell your newest items first. But this method is only allowed in some countries, like the U.S.

Example Calculation:

| Quantity | Cost per Unit | Total | |

| Beginning | 50 | $10 | $500 |

| Purchase | 100 | $12 | $1,200 |

| Units Sold | 75 | $12 | $900 |

| Ending Inv. | (25 x $12) + (50 x $10) = $800 |

Pros: If prices are going up, LIFO can help you pay less in taxes because it makes your profits look smaller. It also matches newer costs with what you sell now.

Cons: Many countries don’t allow LIFO (only the U.S. does). It can also make your leftover inventory seem older than it really is.

3. Weighted Average Cost (WAC)

WAC averages all inventory costs together.

Example Calculation:

| Units | Total Cost | Weighted Avg Cost | |

| Begin | 50 | $500 | |

| Purchase | 100 | $1,200 | |

| Total | 150 | $1,700 | $11.33 |

COGS for 75 units: 75 x $11.33 = $850

Ending Inventory: 75 x $11.33 = $850

Pros: It’s simple to figure out. It also helps even out price changes.

Cons: Not as accurate when costs go up or down a lot.

- Read More: “Best Shopify Integrations for E-commerce“

Method Comparison Table

| Method | COGS | Ending Inventory | Gross Profit* |

| FIFO | $800 | $900 | Higher |

| LIFO | $900 | $800 | Lower |

| WAC | $850 | $850 | Middle |

*Assuming the same revenue in all cases.

Your choice impacts both profits and taxes.

How Do You Set Up Your Shopify Inventory Accounting System?

Shopify’s inventory tracking tools are good for simple tasks like tracking stock and adding item costs. But they don’t have advanced features like automatic cost calculations, FIFO, LIFO, or WAC methods, or direct links to Shopify inventory software. Managing product bundles can also be tricky. These tools work for basic needs but may not be enough for businesses needing advanced accounting options.

For example, imagine you have 100 units of a product, and the cost for each unit increases from $20 to $25. If you forget to manually update this cost in Shopify, your financial reports will be inaccurate by $500.

Top 3 Inventory Tracking Systems for Your Business

Here’s how to choose the right system for Shopify inventory management due to your needs:

1. Manual Tracking (Micro Businesses)

Best for: Less than 100 orders/month, under 50 SKUs

Tools: Spreadsheets, SimplyCost app, or basic accounting software

Cost: $0–$20/month

Time: 4–6 hours/month

Steps:

- Export Shopify sales data each month.

- Manually calculate COGS in Excel or Google Sheets.

- Update inventory and add manual journal entries.

- Reconcile inventory monthly.

Manual tracking works for new businesses but becomes difficult as you grow. Consider talking to our professional ecommerce bookkeepers as your order volume increases.

2. Automated Options (Small Businesses)

Best for: 100–1,000 orders/month, 50–500 SKUs

Tools: QuickBooks/Xero, connector apps, advanced inventory tools (see our accounting software comparison for options)

Monthly Cost: $120–$165

Time Savings: 10+ hours/month

Steps:

- Use connectors (A2X, Taxomate, Amaka, or Link My Books).

- Sync Shopify with your accounting software.

- Automate COGS posting and review it monthly.

This method combines automation with enough control for most small businesses.

3. Enterprise-Level Integration

Best for: Over 1,000 orders/month, high SKU counts, multiple sales channels

Tools: Advanced accounting and Shopify inventory software, CPA support

Monthly Cost: $560–$750, plus CPA fees

Steps:

- Fully integrate your systems.

- Automate inventory management.

- Work with our certified CPA for accuracy.

- Get real-time, customized reports.

This option provides the highest level of accuracy and scalability.

- Read More: “Automating Your Shopify Accounting Guide“

Shopify Inventory: Must-Do Steps

No matter your setup, these steps are essential:

- Pick an inventory valuation method and write it down.

- Turn on tracking in Shopify:

- Go to Settings → Inventory.

- Check the boxes for “Track quantity” and “Enable cost tracking.”

- Add inventory locations if you have more than one.

- Set up your accounting tools based on your business’s size.

- Schedule and complete a monthly reconciliation to check your numbers.

Accurate Shopify inventory tracking helps you avoid stockouts and overstocking. It ensures smooth business operations

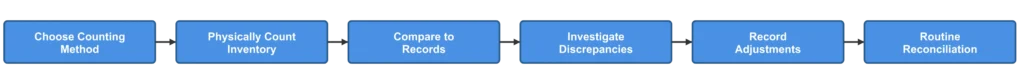

How Can You Keep Shopify Stock Numbers Accurate?

Keeping your Shopify inventory accurate is vital for smooth business operations and making good financial decisions. Things like lost or damaged products can occur, but checking your inventory regularly helps find and fix these problems. Doing regular checks makes sure your numbers are correct, leading to better choices.

Here’s how the Shopify stock reconciliation process flows:

Pro Tip: Don’t just track the wholesale price of your products. Make sure to also include other costs like shipping and taxes. Every time you get a new shipment, update these costs right away and write down any price changes. You should keep all your invoices for at least six years to be ready for taxes and audits.

Tax Rules for U.S. and Canadian Shopify Sellers

Understanding tax rules can be tricky, but here’s a simple breakdown for sellers in the U.S. and Canada. Also, read our blog to learn how to minimize your tax liabilities while staying compliant.

For U.S. Sellers (IRS Rules)

If you’re a U.S. seller with a lot of inventory, you usually need to use accrual accounting. To value your inventory, you can use methods like FIFO, LIFO, or Weighted Average Cost. Shopify FIFO tracking is the most common, but LIFO needs IRS Form 970. No matter what method you use, a year-end physical inventory count is important for taxes.

Note: Smaller businesses making less than $25–30 million a year might qualify for simpler accounting. Also you can contact our small business accountant for a free consultation.

For Canadian Sellers (CRA Rules)

Like U.S. sellers, Canadian sellers also need to use accrual accounting. When figuring out the value of your inventory, you must use the lower price between what you paid for it and what it’s currently worth. You can use methods like FIFO and weighted average, but LIFO is not allowed. Make sure to keep all your business records for six years.

Note: If you make more than $30,000, you’ll need to register for GST/HST.

For complete tax guidance and more information, check our comprehensive Shopify tax guide.

Common Mistakes in Shopify Inventory Accounting

It’s easy to make errors when managing inventory. Here are some of the most frequent mistakes and how you can steer clear of them.

A. Mixing Inventory Methods

Switching between methods can lead to inconsistent records and tax issues.

Solution: Pick one method and stick to it.

B. Missing Freight Costs

Ignoring shipping, duties, and fees can understate inventory value.

Solution: Always add shipping, duties, and fees to your inventory cost.

C. Failing to Track Product Bundles

Not adjusting inventory for components can lead to inaccurate stock levels.

Solution: Adjust inventory for each component in a bundle.

D. Not Updating Costs as Prices Change

Outdated costs can result in incorrect profit calculations.

Solution: Regularly review and update costs.

E. Waiting Until Tax Time

Waiting until tax time can cause rushed and inaccurate records.

Solution: Start early and maintain consistent tracking or consider our bookkeeping services to save time.

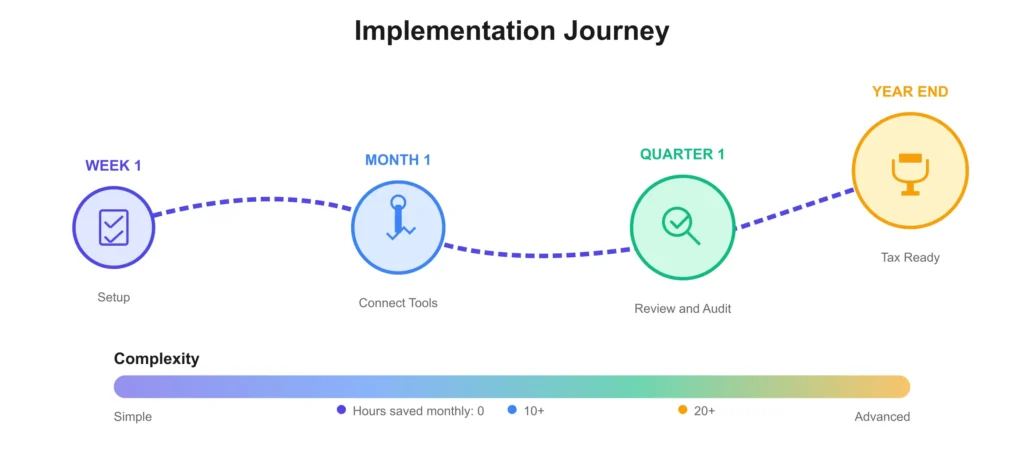

What Is Your Implementation Action Plan?

Ready to take action? Here’s a simple timeline to keep your accounting on track.

This Week: Set Up the Basics

- Pick and write down your inventory valuation method.

- Turn on Shopify’s inventory tracking features.

- Add the cost of your current inventory per item.

This Month: Improve Your Process

- Choose accounting tools that fit your business needs.

- Set up apps for automated inventory tracking.

- Make a schedule to check your inventory regularly.

- Track all costs (like shipping) for new purchases.

This Quarter: Review and Update

- Do a full inventory count.

- Check your COGS (Cost of Goods Sold) by product type.

- Talk to a CPA if you make more than $250k a year.

This Year: Year-End Prep

- Plan a big inventory count, usually on December 31.

- Tweak your inventory processes.

- Get all your COGS and inventory info ready for taxes.

Need help getting your inventory in shape? Talk to our Shopify accounting experts today.

Conclusion & FAQs

Accurate Shopify inventory accounting is vital for business growth. It offers insights into product profitability, cash flow, and pricing strategies. By tracking inventory and calculating COGS, you understand true profits and capital tied up in products.

For small stores (under 50 SKUs), start with spreadsheets. As your business grows (50-500 SKUs), consider inventory apps. Larger operations (500+ SKUs) should invest in professional tools for automation and real-time data. A robust inventory system streamlines operations and supports future growth.

Ready to optimize your Shopify inventory accounting? Contact Sal Accounting today for a free consultation!

Most Frequently Asked Questions

For small stores, use spreadsheets or simple apps to track your inventory and COGS. As you grow, connect Shopify to accounting software like QuickBooks or Xero to automate these tasks.

Shopify tracks item costs and stock, but doesn’t update costs automatically or use FIFO/LIFO. You need to update costs yourself or use an app.

Most use FIFO because it matches how products sell and is accepted worldwide. Weighted Average works for bulk items. LIFO is only for U.S. stores.

Yes, apps like A2X, Amaka, or Link My Books can sync your data automatically.

Shopify gives COGS estimates if you enter item costs, but doesn’t update them as costs change. Use a third-party app or update costs manually for accurate Shopify COGS accounting.

Inventory is what you have in stock. COGS is the cost of items you’ve sold.

It depends on your store’s size. Small businesses (under 50 products and 100 orders/month) can manage with spreadsheets. However, larger businesses (over 100 orders/month or selling on multiple channels) will save time and be more accurate with special accounting or inventory software.