We are here to help you understand your Shopify cash flow statement so you can see how money moves in and out of your store. But here’s something you might not expect: over 70% of eCommerce businesses run into cash flow problems even when they’re making a profit. This happens because cash doesn’t always arrive when sales do. Payouts, ads, refunds, and supplier costs hit at different times and create gaps that leave you short.

In this blog from SAL Accounting, we’ll explain those gaps, break down how to manage them, and share tools and templates to help you stay in control of your store’s cash.

Quick Takeaways

- A Shopify cash flow statement tracks real money movement and shows when cash comes in and goes out.

- It reveals if you actually have money on hand, not just profits on paper.

- Automate tracking with tools like QuickBooks, Xero, A2X, or Float to keep data accurate and current.

- Keep at least one month of expenses as a cash buffer to handle payout delays and refunds.

- Review cash flow weekly and use a 13-week forecast to predict gaps and stay cash-healthy.

What is a Cash Flow Statement for Shopify?

A Shopify cash flow statement shows how money comes in and goes out of your store. Inflows are things like Shopify Payments, PayPal deposits, and gift card sales. Outflows are costs such as products, shipping, ads, apps, wages, and taxes (Shopify guide).

A profit and loss statement tells you if you look profitable on paper. A cash flow statement tells you if the cash is actually in your account when you need it. Talk to our online retail accountant and keep your cash flow on track.

Example: You might make $10,000 in sales this week. But after refunds, fees, and payout delays, only $8,500 will land in your bank account next week. That gap is what a cash flow statement helps you track.

Why Cash Flow Matters for Your Shopify Store

Your Shopify store needs cash flow to stay alive. You use cash to pay suppliers, buy ads, and handle daily expenses. Even with good sales, you might not have cash when you need it. Cash flow problems can stop your store from growing. You may also get behind on what Shopify tax exemptions are and how to set them up. Here’s what you probably deal with:

- Payout delays: You sell something today. The money shows up days later. It feels like forever.

- Ad spend: You pay for ads first. Sales from those ads take time to bring cash. It’s a tough wait.

- Inventory orders: You buy stock with a lot of cash upfront. That money stays stuck until items sell. It can take a while.

- Refunds and chargebacks: These hit out of nowhere. A customer disputes a charge, and your balance shrinks fast.

These gaps make plans hard. You might need to use personal savings. That’s why cash flow matters for your Shopify store. It lets you see problems early. You can fix them before they get big. Gain more on the e-commerce accounting guide for small businesses in 2025.

Pro Tip: Save one month’s expenses in a separate account. This safety net helps with payout delays or sudden refunds.

This table lists Shopify cash flow challenges, their impacts, and quick fixes:

| Challenge | What Happens | Why It Hurts | Quick Fix |

| Payout Delays | Sales today, cash days later. | Slow cash flow. | Cash buffer or short-term loan. |

| Ad Spend | Pay ads first, sales cash later. | Drains cash fast. | Weekly budgets, track ROAS, cut flops. |

| Inventory Orders | Big stock costs lock cash until sold. | Limits daily funds. | Smaller or split orders. |

| Refunds & Chargebacks | Disputes/refunds cut balance suddenly. | Disrupts plans. | Clear info, fast shipping, quality. |

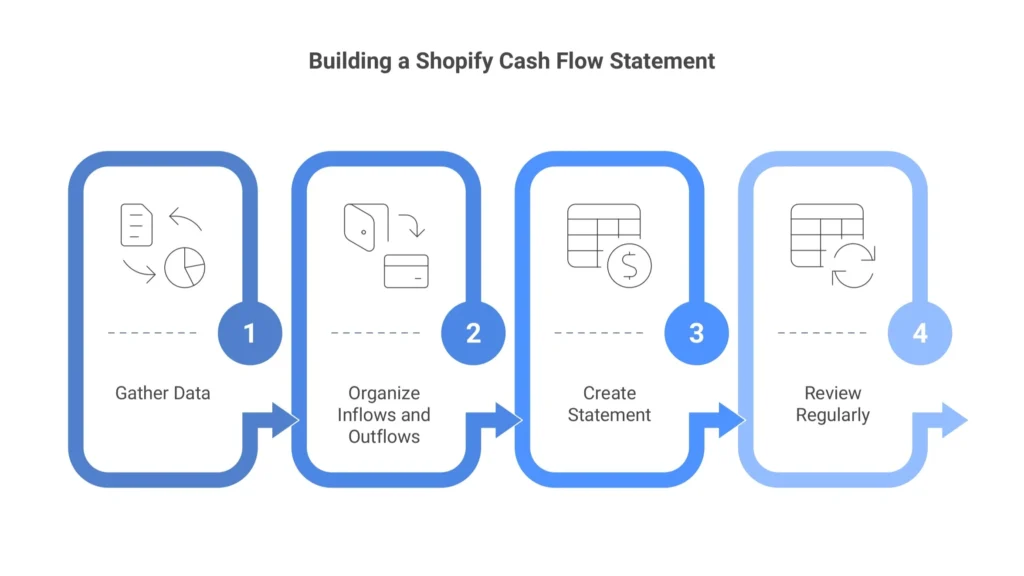

How to Build a Shopify Cash Flow Statement

A cash flow statement may sound complicated, but it’s not. When you break it into steps, it’s simple and very useful.

Step 1: Gather your data

Start by pulling your numbers together. Download payout reports from Shopify Payments, PayPal, or Stripe. Collect your expenses too (product costs, ads, apps, shipping, wages, and taxes). You may need to file Form 1099-K as a Shopify seller. Keep everything in one place, like a spreadsheet or an accounting app.

Pro Tip: Set a routine to grab these reports every week or month. Staying consistent makes sure you don’t miss anything.

Step 2: Organize inflows and outflows

Once you’ve gathered your numbers, separate the cash coming in from the cash going out. Inflows include things like Shopify payouts, PayPal deposits, and gift card sales. Outflows cover your main costs (inventory, ads, wages, taxes, and other expenses). To keep it simple, group them into three buckets:

- Operating: daily sales and expenses

- Investing: equipment or large inventory orders

- Financing: loans and repayments

Pro Tip: Track ads and inventory on their own. They usually take up the most cash, and keeping an eye on them makes budgeting easier. Check out the cash flow forecast for small businesses for more.

Step 3: Create the statement

Put it all together. Start with the opening balance in your bank account. Add your inflows. Subtract your outflows. The number you’re left with is your closing balance. That’s the cash you actually have on hand.

Step 4: Review regularly

The statement only works if you keep it fresh. Update it monthly at the very least. If your sales move quickly or your costs change often, review it weekly. The best Shopify accounting software in 2025, like QuickBooks, Xero, or A2X, connects with Shopify and can update everything for you.

Pro Tip: Try a rolling 13-week forecast. It gives you a clear short-term view and helps you spot cash crunches before they hit.

Example: Say you start the month with $5,000. You get $8,000 in Shopify payouts but spend $9,000 on ads, suppliers, and fees. You end with $4,000. Sales looked strong, but cash dropped because expenses came in faster than payouts.

Top Tools to Track and Forecast Shopify Cash Flow

A cash flow statement by hand takes time and often leads to mistakes. The good news is you don’t have to do it this way. Several tools connect directly to Shopify, your bank, and your expenses. The top e-commerce accounting software in 2025 updates automatically, saves hours of work, and gives you a clear view of your cash today and in the future.

1. QuickBooks Online

QuickBooks is one of the most popular accounting tools for small businesses. It connects to Shopify and your bank to track sales, expenses, and payouts. It works well if you want full accounting and cash flow in one place.

2. Xero

Xero is another easy-to-use accounting tool. It links with Shopify and provides solid cash flow reports. Many store owners pair Xero with Float for deeper cash flow forecasts. Shopify integration with Xero is perfect for sellers.

3. A2X

A2X is built for eCommerce sellers. It pulls data from Shopify and matches it with your bank deposits. This process makes payout reconciliation simple and accurate without hours of manual work.

4. Float

Float focuses on cash flow forecasts. It connects with QuickBooks or Xero and turns your accounting data into forward-looking cash reports. If you want to see what your balance looks like in the next weeks or months, this tool is a strong choice.

5. Report Pundit

Report Pundit is a Shopify app for custom reports (install Report Pundit). It creates cash flow views and other financial reports without the need to export spreadsheets. This table shows tools to help Shopify stores manage cash flow and accounting:

| Tool | Best For | Automation Level | Notes |

| QuickBooks | Full accounting + cash flow | High | Strong all-in-one solution |

| Xero | Simple accounting + integrations | High | Works well with Float for forecasts |

| A2X | Reconciling Shopify payouts | Very High | Saves hours on bookkeeping |

| Float | Cash flow forecasts | Medium–High | Needs QuickBooks or Xero to run |

| Report Pundit | Custom Shopify reports | Medium | Flexible reports, Shopify-focused |

Pro Tip: Pick one main accounting tool (QuickBooks or Xero) and pair it with a forecast tool (Float or A2X). This gives you accurate records and a clear picture of what comes next. Ask any questions you have from our Shopify accountant in Toronto today.

Case Study: Automating Cash Flow in a Skincare Store1

Problem: A Shopify skincare store in Montreal makes $50,000 a month. The owner spends hours each week checking payouts, ad costs, and refunds. Cash problems show up late, and personal savings fill the gap.

What We Do: We connect QuickBooks Online to Shopify and the bank so sales and expenses update automatically. We add A2X to match payouts with deposits. We set up Float to create a 13-week forecast that shows problems before they happen.

Result: The owner spots a January cash shortfall weeks early. He cuts ad spend and delays a supplier order. The store stays cash-positive, avoids dipping into personal funds, and reduces bookkeeping time from days to less than one hour a week.

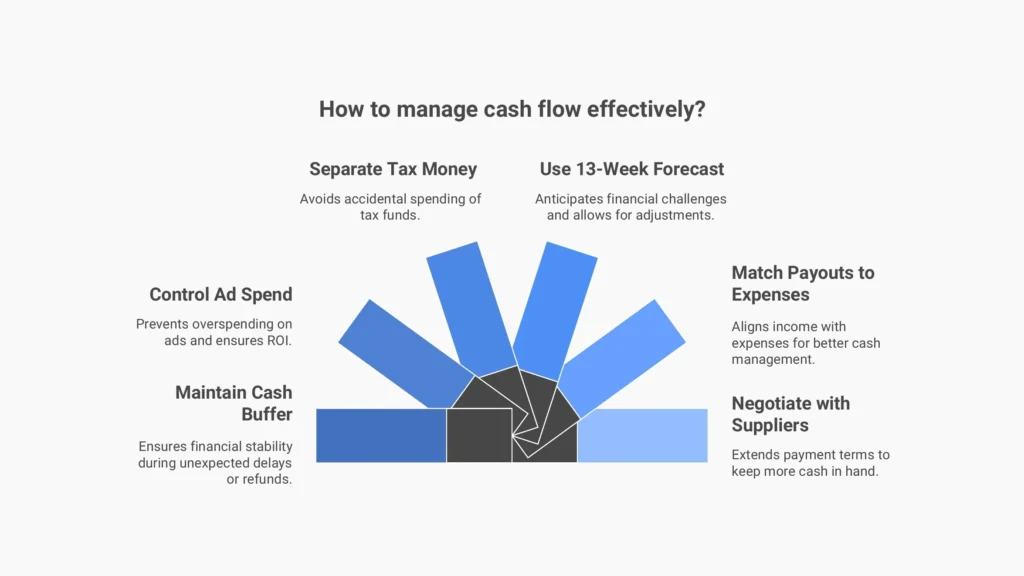

Shopify Cash Flow Management Tips Every Store Owner Needs

A cash flow statement and the right tools give you a clear picture of your money. But reports alone won’t keep your store safe. You need good habits to keep cash steady and avoid sudden gaps. Have a look at the best practices for Shopify sellers to gain more. Here are some best practices that help most Shopify owners.

1. Keep a cash buffer

Hold at least one month of expenses in reserve. This cushion protects you when payouts take longer than expected or refunds pile up.

2. Control ad spend

Ads often eat more cash than expected. A bookkeeping checklist for small business owners helps you avoid this. To stay safe:

- Set a strict weekly or monthly budget.

- Check if sales from ads actually cover the spend.

- Cut or pause campaigns that drain cash without strong returns.

3. Separate tax money

Move sales tax and income tax into a separate account as soon as you collect them. That way, you won’t spend it by accident and stress later when taxes are due. See how to file sales tax in the US as an e-commerce business.

4. Use a 13-week forecast

Look ahead with a short-term forecast. It helps you see slow periods or big expenses before they hit, and gives you time to adjust.

5. Match payouts to expenses

Try to line up big bills with incoming Shopify payouts. For example:

- Schedule supplier invoices right after payout dates.

- Time recurring costs (like apps or subscriptions) are close to expected deposits.

6. Negotiate with suppliers

Ask for longer payment terms when possible. Even a few extra days keep more cash in your account and give you breathing room.

Pro Tip: Don’t wait until the end of the month to check cash flow. A quick weekly review can highlight issues early and save you from nasty surprises.

Cash Flow Problems Shopify Store Owners Deal With

Even with a cash flow statement and good tools, issues appear. Generally, e-commerce accounting errors can cost you thousands. The good news is that you can fix most of them once you know what’s up. Here are common problems and simple ways to handle them.

- Payout delays: Shopify doesn’t send your money right away. You sell today, but the cash might take days to hit your bank.

Fix: Keep some extra cash on hand. Try short-term financing if payouts take too long.

- High ad spend: Ads bring in sales, but you pay for them first. If sales don’t come quickly, your cash runs low fast.

Fix: Set a weekly ad budget. Track your return on ad spend (ROAS). Drop ads that don’t work well.

- Bulk inventory orders: Big stock orders use up your cash before you sell products. This leaves little for daily costs.

Fix: Ask suppliers for smaller or split orders. It may cost a bit more per item, but you keep more cash free.

- Refunds and chargebacks: Refunds and chargebacks hit without warning. They shrink your cash and mess with your plans.

Fix: Check your refund rate often. Use clear product details, ship fast, and ensure quality to reduce them.

- Profits but no cash: Your profit report looks great, but your bank account stays low. This happens when bills come before payouts.

Fix: Track when cash hits your account. Line up expenses with those cash inflows.

Pro Tip: Watch your cash cycle (the time between paying suppliers and getting Shopify payouts). A shorter cycle means healthier cash flow. Switch to smart bookkeeping for e-commerce and save time.

Case Study: Cash Gaps in a Growing Apparel Brand2

Problem: A Shopify apparel store in Vancouver makes $30,000 in October sales. At the end of the month, only $4,000 sits in the bank. Shopify payouts take two days. The owner pays $12,000 upfront for inventory. Ads cost $8,000. Refunds take $1,500. Sales look strong, but there isn’t enough cash for payroll or shipping.

What We Do: We set up a 13-week forecast that shows when cash runs low. We create a savings account with one month of expenses as backup. We talk to suppliers and split large orders into smaller ones so the owner doesn’t lose all the cash at once.

Result: The store covers payroll, keeps orders moving, and stays cash-positive. After two months, the owner has enough room to grow without hitting constant cash gaps.

Final Thoughts

A Shopify cash flow statement gives you more than profit numbers. It tells you if you actually have money in the bank when you need it. With the right tools and habits, you can avoid cash gaps, plan ahead, and keep your store strong in 2025. This guide gave you the steps to build a statement, tips to manage inflows and outflows, and tools that make the work easier.

If you need help with Shopify accounting, cash flow, or forecasting, contact us at SAL Accounting. Book a free call today and get your Shopify cash flow under control.

FAQ on Shopify Cash Flow

A cash flow statement shows how money moves in and out of your store. It tracks payouts, expenses, and the cash you have left in your account.

You can pull payout reports from Shopify Payments or PayPal and compare them with your expenses. Accounting tools like QuickBooks, Xero, or A2X can do this for you automatically.

Shopify does not include a full cash flow report. You need accounting software or reporting apps to create one.

Start with the cash in your bank account. Add all the money coming in. Subtract the money going out. The result is your closing balance.

Connect Shopify with tools like QuickBooks or Xero for accounting. Add A2X or Float to handle automation and forecasting.

Yes. QuickBooks links with Shopify and your bank. It tracks sales, payouts, and expenses in real time.

Float, A2X, and Report Pundit are popular choices. They work with QuickBooks or Xero to give you both short- and long-term cash forecasts.

Profit and cash are different. Sales may look good, but payout delays, refunds, and big expenses can leave your account empty.