You’re an online seller shipping across the U.S., and we’re here to simplify the sales tax nexus for you in 2025. More importantly, we want to save you from penalties for missing tax rules in states you’ve never visited. Surprisingly, many sellers face fines because they don’t know these rules exist.

In this blog from SAL Accounting, we’ll unpack this issue, explain sales tax nexus types, and share easy steps to stay compliant. Keep reading to the end:

Quick Takeaways

- Sales tax nexus requires collecting taxes based on your business’s state connections.

- Physical and economic nexus triggers from warehouses or high sales.

- Most states set $100,000 or 200 transactions for nexus in 2025.

- Skipping sales tax nexus rules leads to 10-25% fines and customer trust loss.

- Register, track sales, and use tools like TaxJar to stay compliant.

What Is the Sales Tax Nexus?

Sales tax nexus is when your business has enough activity in a state to collect and remit sales tax. Before 2018, you needed a physical location, like a store or office. The 2018 Wayfair ruling added an economic nexus, where sales or transaction thresholds trigger tax duties. Connect with our e-commerce accountant to keep compliant.

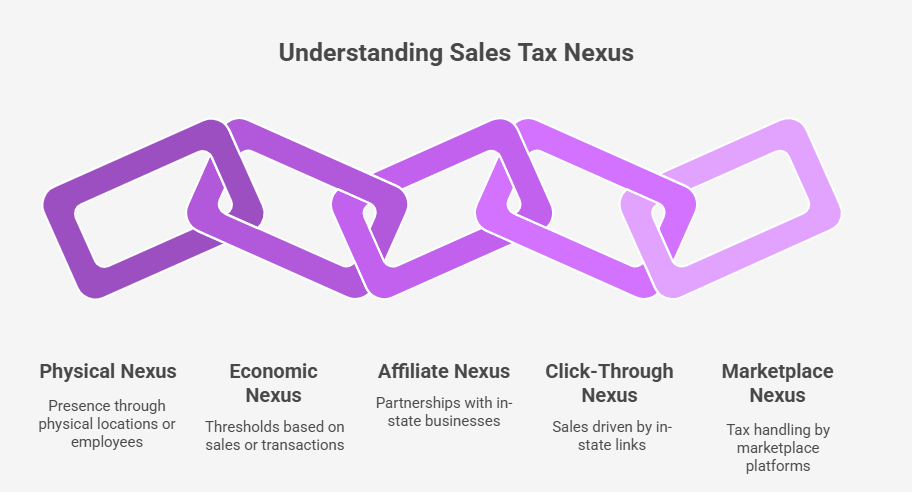

Types of Sales Tax Nexus: Physical, Economic, and More

Nexus comes in different types, each sparking tax duties in its own way. Here’s a quick rundown to get you in the know:

1. Physical Nexus

Physical nexus means you’ve got a real presence in a state. Think:

- An office, shop, or warehouse, like Amazon FBA stock in California.

- Workers, like a remote employee in Georgia.

- Short gigs, like a weekend trade show in Illinois.

Example: Jane runs a Shopify store from Nevada. She stores stuff in a Texas FBA warehouse. That triggers a physical nexus, so she collects Texas sales tax.

Pro Tip: Keep inventory in fewer states to dodge extra nexus. Search deeper in our comprehensive guide on sales vs. use taxes for Shopify and e-commerce sellers.

2. Economic Nexus

Economic nexus hits when your sales cross a state’s limit. Most states want $100,000 or 200 transactions yearly. Some vary, like California ($500,000) (California nexus guidelines) or Oklahoma ($10,000). In 2025, Alaska only cares about $100,000 in sales (ARSSTC guide for sellers).

Example: Mike’s WooCommerce store sells $150,000 to Arizona folks. Arizona’s $100,000 limit means he’s got an economic nexus.

Pro Tip: Check taxable and exempt sales every three months, since places like Louisiana count both.

3. Affiliate Nexus

Affiliate nexus comes from teaming up with in-state businesses, like a sister company or marketer. Paying an Ohio blogger for sales can trigger it. Learn what small businesses should know about e-commerce accounting in 2025.

Example: Sarah’s eBay store works with a Florida influencer. Their referrals create an affiliate nexus in Florida.

Pro Tip: Talk to a tax expert for multi-state affiliate deals to stay safe.

4. Click-Through Nexus

Click-through nexus happens when in-state links, like affiliate ads, bring in sales. New York pushes this if commissions are big (New York nexus rules). See how to start a business in New York as a foreigner.

Example: A Connecticut affiliate drives $200,000 in sales for your shop. That creates a click-through nexus.

5. Marketplace Nexus

In 45+ states, marketplace laws let platforms like Amazon or Etsy handle taxes for you. Your own website sales might still trigger nexus. List states where you’ve got a presence, sales, or partnerships to find nexus triggers.

Example: eBay covers your California sales. But your Shopify store’s $600,000 in direct sales triggers nexus.

Pro Tip: Lean on marketplace laws to ease your tax load where platforms collect. Check this overview to understand types of sales tax nexus:

| Nexus Type | Description | Trigger | Key States in 2025 |

| Physical Nexus | Real presence in a state. | Offices, warehouses, workers, or trade shows. | CA, TX, GA |

| Economic Nexus | High sales or transactions. | $100,000 or 200 transactions in most states. | AZ, AK, NJ |

| Affiliate Nexus | Ties with in-state businesses. | Partnerships with marketers or subsidiaries. | OH, FL |

| Click-Through Nexus | In-state referral links. | Affiliate ads with big commissions. | NY, CT |

| Marketplace Nexus | Platforms collect taxes. | Sales via Amazon or Etsy. | 45+ states |

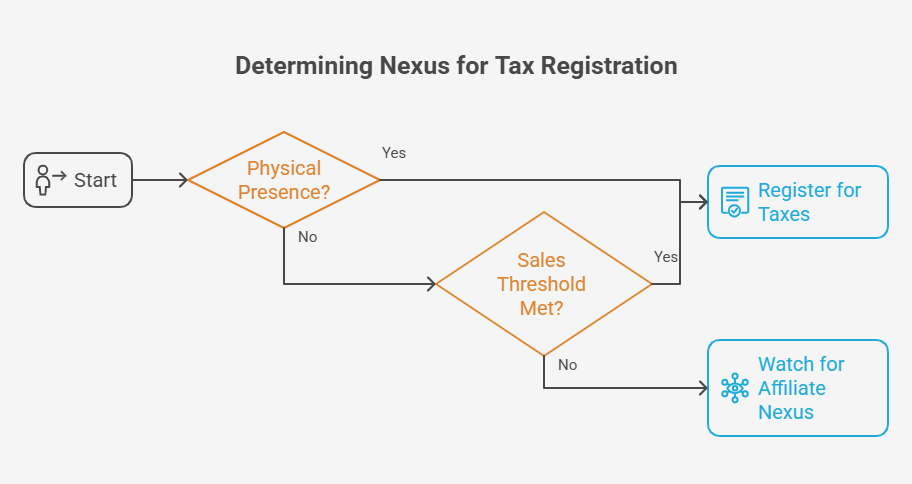

Sales Tax Nexus for E-Commerce: How to Find Your Obligations

Follow these steps to easily sort out the sales tax nexus for e-commerce.

- Check Physical Stuff: List offices, warehouses, or workers. Amazon FBA stock counts. Include trade shows too.

- Track Sales: Use TaxJar for sales tax by state, or others to check sales by state. Compared to limits like $100,000 or 200 transactions.

- Review Partners: Affiliates or bloggers driving sales may trigger nexus in their states.

- Check Marketplaces: Amazon or Etsy often handles taxes. Direct sales on your site might still cause nexus. Visit the Amazon tax guide for Canada and the U.S for more.

Example: Lisa’s Shopify store sells $90,000 in Ohio and $150,000 in Georgia. Georgia’s $100,000 limit triggers nexus. Her Ohio remote worker adds a physical nexus. You can always get free consultation from our Shopify accounting and bookkeeping CPA experts.

Pro Tip: Track sales monthly with TaxJar to catch limits early. Visit TaxJar’s Economic Nexus Insights to review obligations.

Sales Tax Laws by State: 2025 Economic Nexus Thresholds

Every state has its own sales tax laws, and they don’t always match. Most set sales tax thresholds at $100,000 in sales or 200 transactions yearly. Some, like California or Oklahoma, go their own way. Check these states for 2025 thresholds:

| State | Sales Threshold | Transaction Threshold | 2025 Changes |

| Alaska | $100,000 | None | Dropped transactions Jan 1, 2025. |

| Arizona | $100,000 | None | No change since 2021. |

| Arkansas | $100,000 | 200 | No change. |

| California | $500,000 | None | No change. |

| New Jersey | $100,000 | None | Dropped transactions, pending confirmation. |

| New York | $500,000 | 100 | Both needed. |

| Oklahoma | $10,000 | None | Low threshold; register fast. |

| Texas | $500,000 | None | No change. |

Nexus Rules 2025: Key Updates for Sellers

New nexus rules in 2025 shake things up for online sellers. Check out the big changes:

- Alaska: Drops 200-transaction threshold. Only $100,000 in sales matters starting January 1, 2025.

- New Jersey: Plans to ditch transaction count. Likely sticks with $100,000 sales threshold.

- Marketplace Laws: Over 45 states let platforms like Amazon or Etsy collect taxes, Shopify doesn’t qualify, as explained on the Shopify seller tax guide (2025) for U.S. and Canada businesses.

- Digital Goods: Louisiana raises tax on e-books and software to 5% from January 2025 (Louisiana sales tax rate).

Register, Collect, and File: Stay Compliant with Sales Tax Nexus

Nexus shows up, and now you need to handle taxes. Follow these steps to keep your small business compliant and avoid trouble.

1. Register

Get a state sales tax registration on the state’s revenue site, like the Texas Comptroller. States expect this within 30 days of hitting a nexus threshold. Follow these steps:

- Find the state’s online tax portal.

- Complete the registration form.

- Get your sales tax permit to collect legally.

2. Collect Taxes

Add sales tax at checkout with Shopify or WooCommerce. Tools like Avalara calculate rates for thousands of jurisdictions. Rates vary by state, so automation saves time. Get help from the best e-commerce accounting software in 2025 for a smooth process.

3. File Returns

Submit tax returns monthly, quarterly, or yearly, based on state rules. Each state sets its own schedule. Use apps to automate filing and payments. This keeps you compliant without missing deadlines.

4. Monitor

Check sales and nexus triggers every three months. Track where you sell or have workers. New sales or partnerships can create a nexus. Stay proactive to avoid audits. Consult our e-commerce accountants for expert help.

Common Mistakes and Penalties with Sales Tax Nexus

Avoid these pitfalls to keep your sales tax nexus compliance on track. Do not forget that some e-commerce accounting errors cost you thousands.

- Overlook nexus triggers: Miss physical locations or sales limits. States fine you for unregistered sales.

- Skip registration deadlines: States want registration within 30 days of nexus. Late sign-ups lead to penalties.

- Use wrong tax rates: Pick outdated or incorrect rates. You collect too little or too much, risking audits.

- Keep poor records: Don’t track sales by state. Audits get messy without clear records. Check out bookkeeping services for e-commerce at SAL Accounting to avoid mistakes.

Case Study: Etsy Seller’s Turnaround Triumph

Problem: An Etsy seller from Oregon called us in 2024. She sold $180,000 in Arizona and had a California FBA warehouse. Those triggered a sales tax nexus in both states. She didn’t register, used wrong tax rates, and got bad reviews with a 3.5-star rating.

What We Advised: We told her to register with Arizona and California tax sites. We suggested TaxJar to track sales right. We also said to add clear tax notes at checkout and check nexus every three months.

Result: She skipped $8,000 in fines, boosted her rating to 4.9 stars, won back customer trust, and made tax filing easy with automation.

Final Thoughts

E-commerce sellers need to master the sales tax nexus to protect profits. Keep track of warehouses, sales, or partners in every state. Follow 2025 nexus rules to skip fines. This guide covers nexus types and easy steps to stay on track.

SAL Accounting helps with tricky tax stuff. Don’t let nexus mess up your profits. Contact us for a free consultation to keep your business safe and growing.

Frequently Asked Questions (FAQs)

Sales tax nexus is a business’s link to a state requiring tax collection. Establish it through physical presence, sales thresholds, or in-state partnerships.

Types include physical (warehouses), economic (sales limits), affiliate (in-state partners), click-through (referral links), and marketplace (platform sales).

All 46 states with sales tax have economic nexus rules, typically $100,000 or 200 transactions, like California ($500,000) or Oklahoma ($10,000).

Track physical locations, sales, and partnerships. Use tools like TaxJar to check state thresholds. Review state tax sites for rules.

No, collecting sales tax without a permit is illegal in most states and risks penalties.

Yes, Amazon FBA warehouses create a physical nexus. High sales trigger an economic nexus. Amazon often collects taxes for you. You can always get free consultation from our Amazon sellers bookkeeping and accounting experts in Toronto.

States charge 10-25% penalties on unpaid taxes, plus interest and audits.