As a Canadian taxpayer, our 2025 guide helps you get an ITIN with ease. We’ll cover what an Individual Taxpayer Identification Number is and how you apply from Canada without errors. Here’s the surprising part: In 2023, the IRS issued nearly 900,000 ITINs worldwide, showing huge demand for this tax ID. Yet many miss tax treaty benefits that cut 30% withholding.

In this post, we’ll break down every step with clear tips to ensure your ITIN application succeeds. Do not miss this comprehensive guide from the SAL Accounting team.

Quick Takeaways

- An ITIN helps Canadians file U.S. taxes for income like freelance or rental cash.

- Simple steps in 2025 include filling Form W-7 and sending verified papers like a passport.

- Skip mistakes like wrong codes or missing proof to get your ITIN in up to 11 weeks.

- Treaty benefits with an ITIN cut U.S. withholding from 30% to 0-15%.

- Certified documents like a passport prevent application rejections.

What is the IRS ITIN Number for Canada?

An ITIN is a 9-digit number from the IRS. It helps you, as a Canadian, file U.S. taxes if you don’t qualify for a Social Security Number (SSN) (source). You need it to report U.S. income, like freelance or rental cash. An SSN is for U.S. citizens, but an ITIN, starting with 9, is for non-U.S. residents like you. It’s just for taxes, not work or immigration. Our cross-border tax accountant can provide you with expert help with it.

Why Do You Need an ITIN as a Canadian Citizen

An ITIN is your U.S. tax ID if you can’t get a Social Security Number (IRS Publication 1915). It lets you report U.S. income or claim tax breaks. Check these reasons why you would need one:

- Earning freelance money from U.S. sites like Upwork.

- Getting rent or royalties from U.S. places, like a Florida condo.

- Investing in U.S. stocks or real estate.

- Using Canada-U.S. tax treaty benefits to cut 30% withholding to 0-15%.

- Filing taxes as a spouse or dependent of a U.S. citizen.

Pro Tip: Look at how they work for double taxation first. Check IRS Publication 901 to find exemptions and save money.

What’s the Difference Between an IRS ITIN Number for Canada and an SSN?

Clear differences between an IRS ITIN number for Canada and a Social Security Number (SSN) help you report your Canadian income on a U.S. tax return correctly. You can find the key points in the following list:

- Purpose: ITINs let Canadians file U.S. taxes for income. SSNs handle taxes, jobs, and benefits for U.S. citizens or workers.

- Number Format: ITINs begin with nine and have nine digits. SSNs also have nine digits but use other ranges.

- Eligibility: Canadians get ITINs for U.S. income. SSNs need U.S. citizenship or work permission.

- Use: ITINs are just for taxes, not jobs or immigration. SSNs allow work and government benefits.

IRS ITIN number Canada vs. SSN differences are in the table below:

| Aspect | ITIN for Non-U.S. Residents | SSN for U.S. Citizens/Workers | Scope |

| Purpose | IRS ITIN number Canada files U.S. taxes for non-residents. | SSNs cover taxes, jobs, benefits. | ITINs: taxes only; SSNs: work, aid. |

| Number Format | Starts with 9, 9 digits. | 9 digits, other ranges. | ITINs: 9XX format; SSNs: state-based. |

| Eligibility | Non-residents qualify for tax reporting. | Needs U.S. citizenship or work permit. | ITINs: foreign taxpayers; SSNs: U.S. status. |

| Use | Taxes only, not jobs or immigration. | Allows work, benefits. | ITINs: IRS filings; SSNs: jobs, aid. |

What Forms Do You Need for an ITIN Application in Canada?

Specific IRS forms make your 2025 ITIN application easy. See the must-have forms for Canadians below.

- Form W-7: Your main ITIN form. Add your name, address, reason code, and signature to Form W-7. Get the December 2024 version for 2025.

- Form 1040-NR: The U.S. tax form for non-residents. Include Form 1040-NR for taxes or skip with an exception.

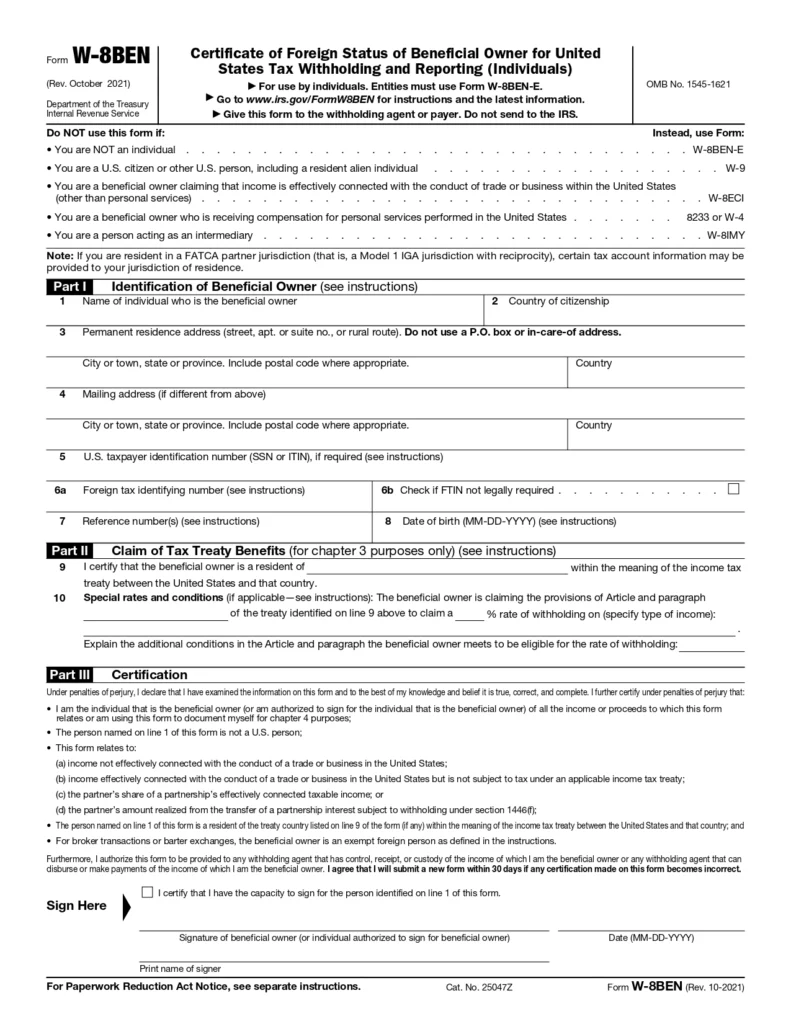

- Form W-8BEN: Proof for treaty benefits without a tax form. Use it with income papers to cut 30% withholding. Check the comprehensive guide on the form W-8BEN for foreign individuals.

- Supporting Documents: Show ID and Canadian status with one of 13 options, like a passport, certified driver’s license, and birth certificate. Below you can check the Form W-8BEN:

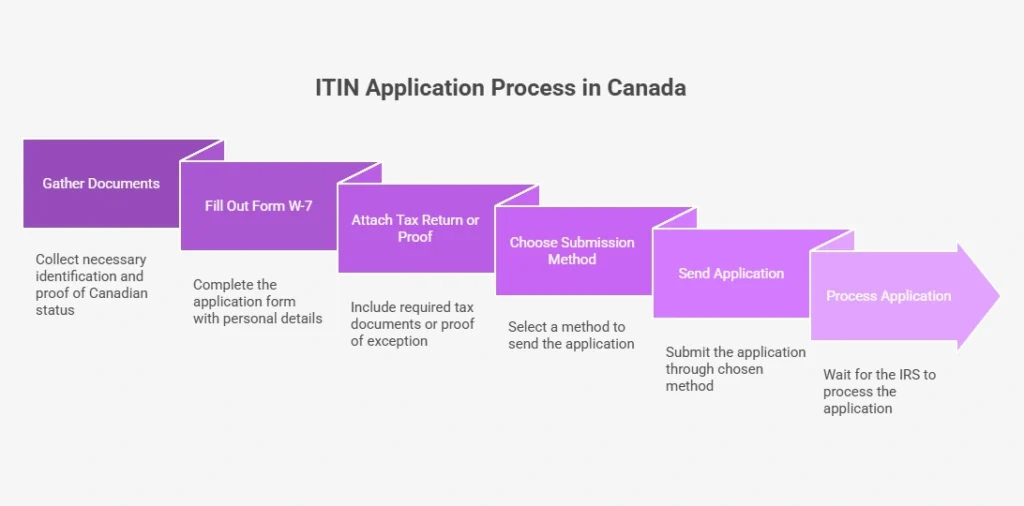

How Do You Get an ITIN in Canada in 2025?

These steps show you how to get an ITIN in Canada in 2025. It takes 9-11 weeks to process. In June 2025, the IRS listed 13 documents for ID and foreign status. A passport works for both. Kids might need extra papers, like school records.

1. Gather Your Documents

You need an ID and proof you’re Canadian. Try these:

- Passport (covers ID and status).

- Canadian driver’s license or birth certificate (use together).

- Certified copies from the issuing agency or originals with a CAA (Acceptance Agent Program). Docs must be recent or issued within 12 months. Don’t send uncertified copies; you’ll get rejected.

2. Fill Out Form W-7

Get Form W-7 Canada from the IRS website. Add your name, Canadian address, birth date, and country. Pick a reason: “a” for U.S. tax return, “e” for treaty benefits. Sign it. Check all fields to avoid mistakes.

3. Add a U.S. Tax Return or Proof

Attach Form 1040-NR for taxes. Send proof for an exception if you have no tax return, like a treaty income statement. This skips the return. Also, check out the 1042-S Form instructions to report U.S. income and claim refunds.

4. Choose How to Send It

Pick one way:

- Mail to: IRS, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

- Visit a U.S. Taxpayer Assistance Center near the border (check IRS locator).

- Use a certified acceptance agent Canada-based.

Pro Tip: Send your application after April to speed things up. Renew if your ITIN’s middle digits (like 70-88) are expiring. Contact our bookkeeping experts today and book a consultation to gain more information.

How Can You Avoid Mistakes in Your Canadian Citizen ITIN Application?

Errors in your Canadian citizen ITIN application can stop or delay it. Easy fixes for 2025 keep it smooth. Below, check both mistakes and their solutions.

1. Uncertified Documents

Uncertified ID or status papers get rejected. The IRS wants verified papers, like a passport. Use certified copies from the issuer or a Canada-based certified acceptance agent to prove they’re real.

2. Wrong Reason Codes

Wrong codes on Form W-7, like “a” instead of “e,” mix up the IRS. Codes show why you need an ITIN, like taxes or treaty benefits. Check Form W-7 instructions to pick the right one.

3. Missing Tax Return or Proof

No tax form or treaty proof stops your application. You must know how to avoid double taxation in Canada in the right way. The IRS needs Form 1040-NR for taxes or papers like an income statement for exceptions. Include these to explain your ITIN needs.

4. Incomplete Forms

Forms missing fields like your address cause denials. Every part, from name to reason code, must be filled. Check all fields before sending to avoid easy mistakes. Book a free consultation with our US-Canada cross-border tax accountant for more help. The table below lists fixes to keep it smooth:

| Mistake | Issue | Solution | Fix Details |

| Uncertified Documents | Uncertified ID gets rejected. | Use certified copies or CAA. | Get a verified ID like a passport from the issuer or agent. |

| Wrong Reason Codes | Wrong Form W-7 Canada codes confuse IRS. | Check W-7 instructions. | Pick code “a” for taxes, “e” for treaty benefits. |

| Missing Tax Return or Proof | No tax form or proof stops application. | Add Form 1040-NR or statement. | Include tax form or income proof. See how to avoid double taxation. |

| Incomplete Forms | Missing fields cause denials. | Fill all fields. | Complete name, address, codes. Book our cross-border tax accountant. |

Case Study: Helping a Toronto Freelancer Ace Her ITIN*

A Toronto freelancer chats with SAL Accounting:

Problem: She makes $25,000 a year from U.S. clients on Upwork. The IRS takes 30% ($7,500) without an ITIN. Her Form W-7 got rejected for unverified papers and a wrong code.

What We Do: SAL Accounting checks her passport with a Canada-based certified agent. We fill out Form W-7 (August 2019 version) with code “e” for treaty benefits after reading IRS Publication 901. We add a withholding statement and Form W-8BEN to skip Form 1040-NR. Submission goes out in May 2025 to dodge delays.

The Result: Her ITIN lands in 10 weeks. Treaty benefits drop withholding to 0%, saving $7,500 a year. No more rejections. Taxes stay on track. Save cash with our non-resident tax accountant.

*Hypothetical scenario

Final Thoughts

An ITIN opens doors for Canadians with U.S. income. It lets you file taxes or grab treaty benefits to cut 30% withholding. Our 2025 post covers the ITIN, how it differs from an SSN, and simple steps to nail your application. Dodge mistakes like missing forms or wrong codes to score your ITIN fast.

For help with your ITIN or taxes, contact us at SAL Accounting for expert advice and a free consultation today.

Frequently Asked Questions (FAQs)

An ITIN is a 9-digit IRS number for filing U.S. taxes without an SSN. Canadians need it for U.S. income, like freelance or rental money.

Canadians can mail Form W-7 to the IRS or use a Canada-based certified agent for remote filing.

Processing takes up to 11 weeks in 2025, longer during tax season.

Form 1040-NR is optional with treaty proof, like an income statement.

A passport covers ID and status, or combine a certified driver’s license and birth certificate. Docs need 12-month validity.

Treaty benefits with an ITIN drop 30% withholding to 0-15%. Check the US-Canada Joint Venture Tax 2025 for tax tips.

Expired ITINs (unused 3 years or middle digits 70-88, 90-92, 94-99) block tax filing. Renew early to stay compliant.