Selling on eBay in Canada? It’s a solid way to make cash. But taxes come with it, and you need to understand them. In 2025, eBay Canada will report sellers with over 30 transactions and CAD 2,800 (net sales) to the CRA. (Source) That’s a new rule hitting lots of people. So, knowing your eBay taxes matters.

This guide by SAL Accounting covers all types of taxes, deductions, filing, and more to help you save profit. Stick around to the end!

Does eBay Charge Tax in Canada? A Look at Canadian eBay Taxes

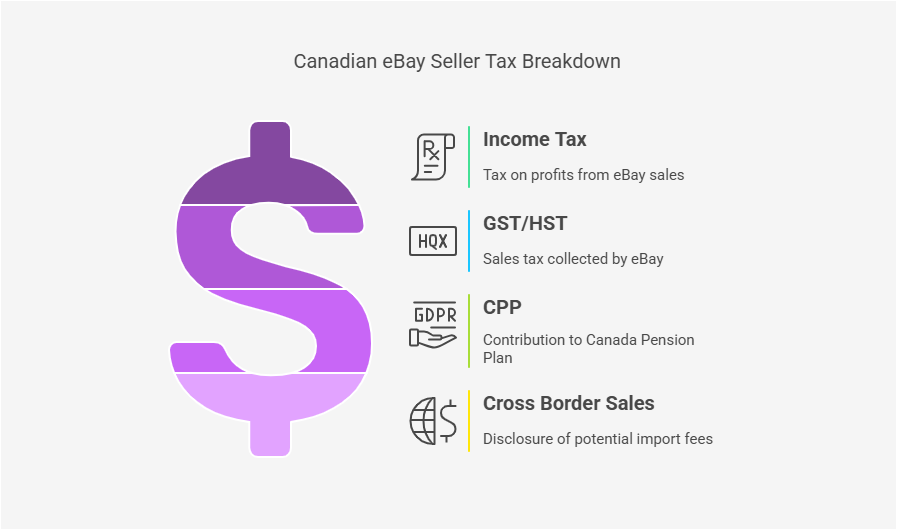

Yes, Canadians selling on eBay pay taxes if they make money. Here’s the rundown:

- Income Tax: Sell a lot or run an eBay business for profit? The Canada Revenue Agency (CRA) expects you to report your cash and pay tax. Hobby sellers with no profit usually skip it.

- GST/HST: eBay grabs this tax on Canadian sales since July 2022. But if your sales top $30,000, you sign up with the CRA.

- CPP: Earning over $3,500 net business income a year as self-employed means you pay into the Canada Pension Plan.

- Cross-Border Sales: Going global? Let buyers know they could be on the hook for import charges depending on their location.

We’ll dive into each tax type with more details below!

Check out our E-Commerce Bookkeeping Services for expert help.

eBay Income Tax from Canada: Rules and Tips

Sell on eBay in Canada and make a profit? If you sell a lot or run it like a business, you pay income tax on what’s left after costs. Hobby sellers, like someone offloading old clothes or toys, don’t owe tax. The CRA uses these items to figure out if you’re a business or just having fun:

- Selling weekly means business. Selling once in a while is a hobby.

- Buying stuff to flip it means business.

- Posting ads to earn cash means business.

- Aiming to make money means business. No profit goal means a hobby.

- Also Read: Amazon Tax Guide for Canada and U.S.

How Much Income Tax Do eBay Sellers Pay in Canada?

Your tax on eBay earnings in Canada depends on all your income. In 2025, federal income tax rates start at 15% for up to $57,375 and go up to 33% over $253,414. Provincial rates vary, like Ontario’s 5.05% to 13.16% or Alberta’s 10% to 15%. The CRA adds your eBay profit to your other income to calculate your total tax.

Example: Sarah sells on eBay and makes $5,000 profit after costs (like shipping). She also earns $20,000 from a part-time job. Her total income is $25,000. She pays 15% tax. Here’s how her taxes break down in the table below:

| Category | Amount ($) | Calculation |

| Total Income | 25,000 | 20,000 (Job) + 5,000 (eBay Profit) |

| Federal Tax (15%) | 3,750 | 25,000 × 0.15 = 3,750 |

| Ontario Tax (5.05%) | 1,262.50 | 25,000 × 0.0505 = 1,262.50 |

| Total Tax Owed | 5,012.50 | 3,750 + 1,262.50 = 5,012.50 |

GST/HST (Sales Tax) for Canadian eBay Sellers

GST and HST are sales taxes in Canada that hit what you sell on eBay. Your sales top $30,000 in four quarters? You sign up with the CRA. Since July 2022, eBay has added GST/HST for businesses and all Canadian sales and sent it to the government. If you sign up, you file with the CRA and get back the tax you paid on stuff like supplies. Under $30,000? eBay takes care of it for you.

GST/HST Rates for eBay Sales in Canada

GST (Goods and Services Tax) sticks at 5% with no extra provincial taxes in places like Alberta. HST (Harmonized Sales Tax) mixes GST with provincial tax and changes by province. Ontario gets 13%, Nova Scotia bumps it to 15%.

Key Point: Not every province follows the HST. Quebec adds QST (9.975%) to the 5% GST. British Columbia adds 7% PST, Saskatchewan 6% PST, and Manitoba 7% PST, all on top of the 5% GST.

Here’s a fast look at GST/HST rates hitting your eBay sales across Canada:

| Province/Territory | Tax Type | Rate |

| Alberta, Northwest Territories, Nunavut, Yukon | GST | 5% |

| Ontario | HST | 13% |

| New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island | HST | 15% |

| Quebec | GST + QST | 5% + 9.975% |

| British Columbia, Manitoba | GST + PST | 5% + 7% |

| Saskatchewan | GST + PST | 5% + 6% |

Example: Lisa sells a $100 jacket on eBay to someone in Ontario. Ontario has a 13% HST. eBay slaps that tax on the sale and passes it to the CRA.

- 13% = 0.13 (HST rate in Ontario)

- $100 × 0.13 = $13 (HST amount)

- $100 + $13 = $113 (Total amount paid by the buyer in Ontario)

- Also Read: GST/HST Return in Canada

Must-Knows about Selling Cross-Border from Canada on eBay

If you are selling cross-border on eBay from Canada, let buyers know about extra charges to keep things smooth. You don’t grab those fees yourself. But tell buyers they might face duties or customs costs. Here’s how you ship stuff across borders:

- eBay GSP (eBay Global Shipping Program): eBay handles shipping and takes fees (like taxes) at checkout. You send items to a Canadian hub.

- Direct Shipping: Buyers pay customs fees when the item lands in their country. You don’t collect them, but give a heads-up.

Pro Tip: When shipping goods outside Canada, add this to your listing for buyers: “You might owe extra customs fees when it arrives at your destination. Price and shipping don’t cover these.” Buyers can check their country’s customs site to see the rates. Consult our Cross-Border Tax Accountant if needed.

Taxes on Your Cross-Border eBay Sales from Canada

You tell the Canada Revenue Agency (CRA) about all your overseas sales as part of your income. They tax your profit, what’s left after shipping and eBay fees. You don’t add GST/HST on overseas sales. That tax only hits buyers in Canada.

Example: A Canadian eBay seller lists a $50 CAD guitar pedal, and Hiro from Japan grabs it. Two ways to ship it go like this:

- GSP: Seller sends it to eBay’s Ontario hub for $8 CAD. eBay ships it to Hiro and charges him $12 CAD in fees at checkout.

- Direct: Seller ships it to Hiro for $20 CAD. Hiro pays $15 CAD in customs fees when it gets there.

Case Study: Ontario Seller’s Cross-Border Win*1

Problem: An eBay seller from Toronto reaches out to us. His $25,000 annual sales include $10,000 to US buyers via GSP. Buyers give low ratings and bad reviews over $5-$10 customs fees on $40 items.

What we Do: We update his listings with a clear note: “You might owe customs fees outside Canada, not in price or shipping.” We also move some sales to Direct Shipping, cutting his GSP costs from $6 to $4 per item.

The Result: His ratings jump to 4.8 stars. Buyers stop complaining, and he saves $200 yearly on shipping.

- Read More: Types of E-Commerce Taxes in Canada

Do Canadian eBay Sellers Pay CPP?

Lots of Canadian eBay sellers count as self-employed. Make over $3,500 in profit a year? You pay into the CPP (Canada Pension Plan) for both parties, the employee and the employer. In 2025, you shell out 11.9% on profit between $3,500 and $71,300. The most you’ll pay is $8,064.60.

Key Point: If your profit is under $3,500 annually, you skip CPP. Casual sellers with small sales dodge it completely.

Our CPA accountants in Toronto are ready to assist if you need further help. Contact SAL Accounting for expert guidance on your taxes today.

eBay Sellers Tax Reporting & Filing in Canada + Forms

We will break down tax filing and reporting to keep eBay selling in Canada easy.

Income Taxes

If you’re a regular seller, you file and tell the CRA about your profit by April 30. Self-employed folks get until June 15. Either way, you pay by April 30 to dodge penalties, 5% of what you owe plus 1% extra each month. eBay tips off the CRA about sellers with 30+ sales and $2,800 CAD.

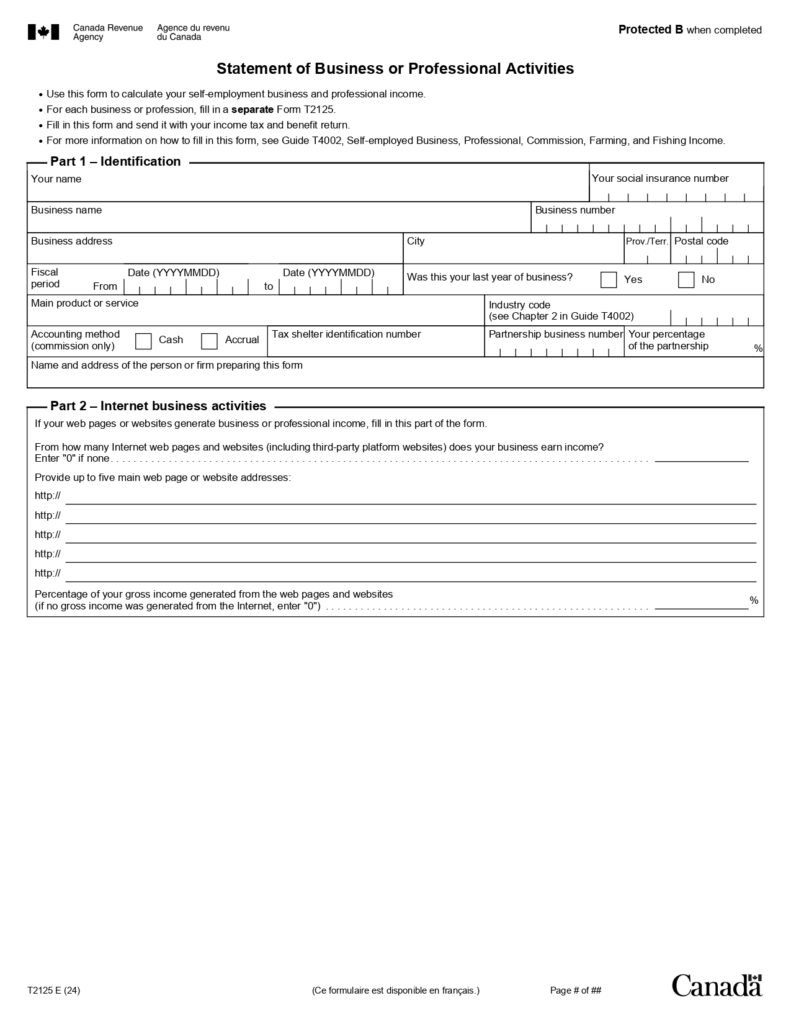

Required Forms

T1 General (which covers all your income) and T2125 (which shows eBay sales, costs, and profit). Check the form below.

GST/HST

Your sales top $30,000 in a year (checked every four quarters)? You sign up with the CRA for GST/HST and send in reports. eBay already takes this tax, but you still file if you’re signed up. You can handle it online with your My Business Account. Don’t do it; you get a 5% fine plus interest!

Key Point: Pick your reporting time: monthly (due a month after the month ends), quarterly (due a month after the quarter, like April 30 for January-March), or yearly (due three months after the year, like March 31, 2026, for 2025).

Required Forms

You use the GST34-2 (Goods and Services Tax/Harmonized Sales Tax Return) to show tax and credits.

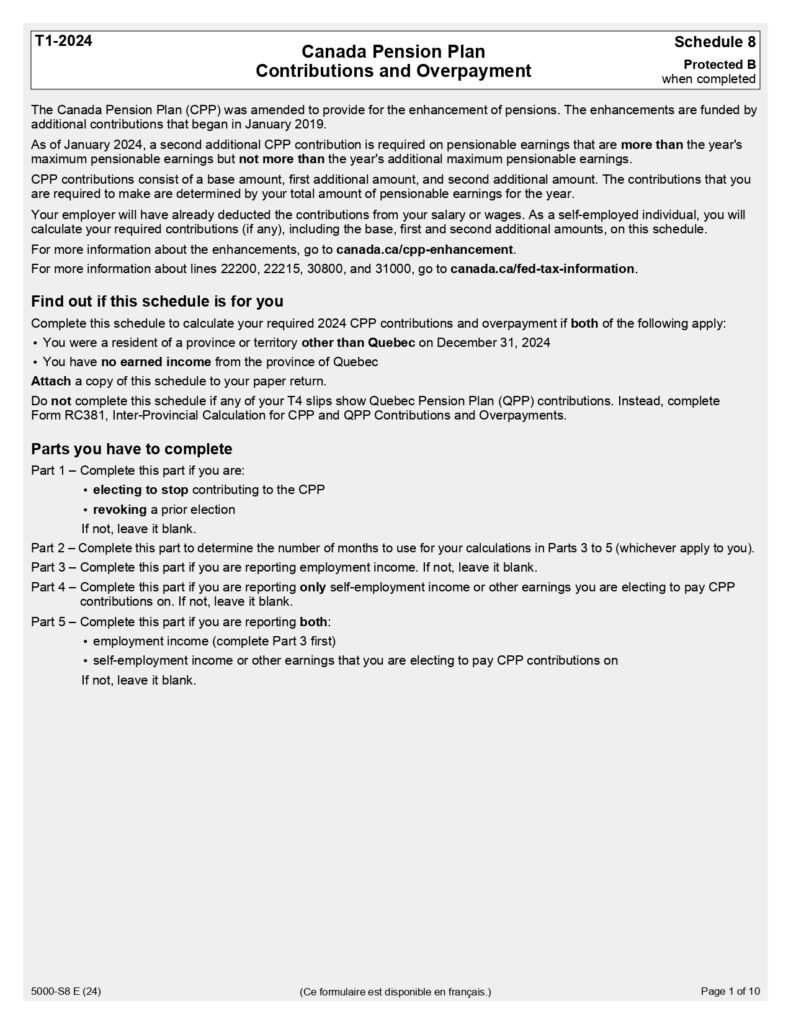

Canadian Pension Plan (CPP)

If you’re self-employed, you file this with your income tax by April 30, or June 15. Pay your self-employed income tax by April 30 to skip late fees. You figure out and report contributions once a year, not per sale. Make less than $3,500 in profit? You don’t file at all.

Pro Tip: Hang onto sales, expense, and receipt records for six years. The CRA might check you anytime in that window.

Required Forms

You use Schedule 8 (Canada Pension Plan Contributions) to figure out and report it with your tax return. Below, you can find the form:

- Read More: Dropshipping taxes in Canada

Tax Deductions & Credits for Canadian eBay Sellers

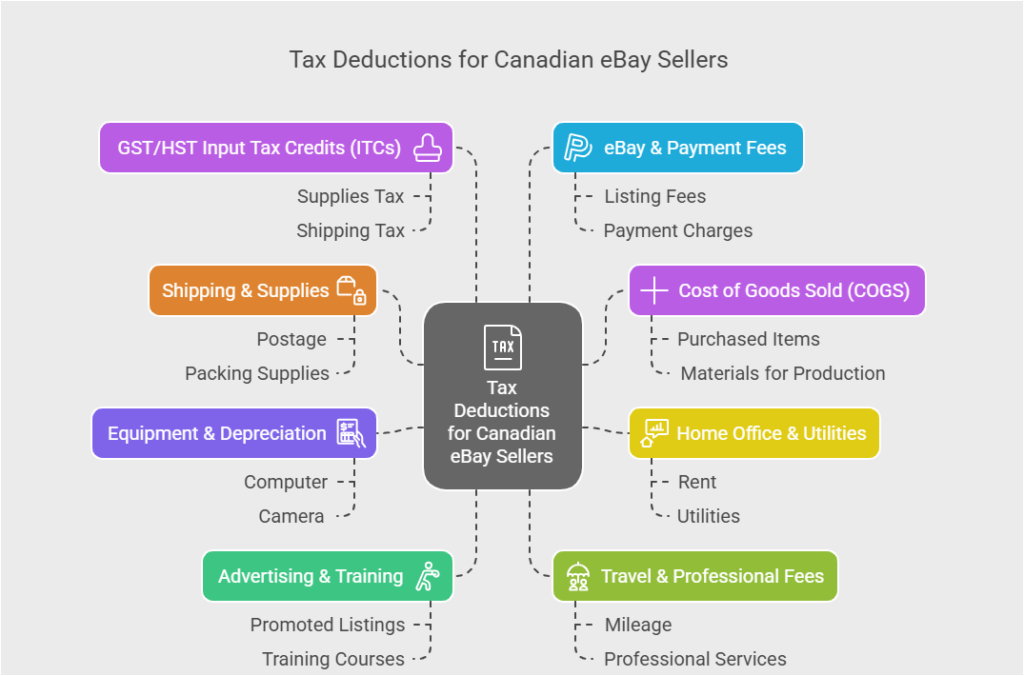

Canadian eBay sellers can shrink taxes by claiming costs tied to their business sales. Here are deductions and expenses to claim as a Canadian seller on eBay:

- Shipping & Supplies: Postage, packing stuff (boxes, tape, bubble wrap), shipping labels, local or international, plus office gear (ink, paper, pens) and packing helpers (envelopes, scales).

- Cost of Goods Sold (COGS): What you paid for items you sell, like stuff you bought to flip or materials to make things, keep it matching your sales records.

- Home Office & Utilities: A chunk of rent, heat, electricity, internet, or property taxes if you’ve got a set eBay workspace at home.

- Equipment & Depreciation: Some of the cost for a computer, phone, camera, or printer you use to sell.

- Advertising & Training: Cash spent on eBay promoted listings, social media ads, or flyers, plus courses or books to boost your selling game, like an eBay marketing class.

- Travel & Professional Fees: Mileage (2025: $0.70/km for first 5,000 km, $0.64/km after) or gas for picking up stock or shipping, plus fees to accountants, tax pros, or lawyers for eBay help.

- GST/HST Input Tax Credits (ITCs): Signed up for GST/HST because sales hit $30,000 in four quarters? Claim tax you paid on supplies or shipping. Here is the CRA’s guide to calculate the ITCs.

- eBay & Payment Fees: Listing fees, final value fees, store costs, and PayPal or other payment charges.

Here’s the scoop on what eBay charges Canadian sellers for their sales:

| Fee Type | Description | Amount (CAD) |

| Insertion Fee | Fee per listing | Non-Store: 250 free/month, then $0.35 Store: Basic 400 free, $0.30 extra; Premium 1,000 free, $0.20 extra |

| Final Value Fee | % of total sale when item sells | Non-Store: 13.25% + $0.40/order Store: Basic 12% + $0.40/order |

| International Fee | Extra for buyers outside Canada | 0.4% for US 1% for rest of world |

| Promoted Listings Fee | Optional promotion fee if item sells | 2%-20% of total sale, you set rate |

| Listing Upgrade Fees | Optional listing extras | Subtitle: $1.50 Bold: $2 Gallery Plus: $0.35 |

| Store Subscription | Monthly store fee | Basic: $27.95 Premium: $74.95 Anchor: $349.95 (yearly discounts apply) |

Tax-Saving & Compliance Tips for eBay Sellers in Canada

Selling on eBay in Canada? Save cash and skip CRA penalties with these tips:

1. Cut Taxes with Costs & Deductions

Claim all your business costs, like eBay fees or shipping, to lower your taxes. Keep receipts for six years. Show them to the CRA if they ask to check.

Pro Tip: Use eBay’s sales reports to track profit and costs.

Case Study: Seller’s CRA Audit Turnaround*2

Problem: An eBay seller reaches out to us after a CRA audit. His $35,000 annual sales trigger a review, but he reports only $10,000 of his income. Missing receipts for $15,000 in inventory costs leave him facing $13,600 in back taxes, penalties, and interest.

What We Do: We pull eBay sales records to prove $7,500 in fees and shipping costs and secure those deductions. We reconstruct partial inventory expenses with bank statements and add $5,000 more.

The Result: The CRA accepts $12,500 in deductions, reducing his taxable income to $22,500 per year.

2. Buy on the Last Minute, Pay Quarterly

Grab inventory in December to deduct it that year and shrink your taxes. Self-employed? Pay taxes four times yearly (March, June, September, and December). That beats dumping it all in April.

3. Stay Small or Run a Business

Keep sales under $30,000, and eBay deals with GST/HST for you. No extra hassle. Over $50,000? Start a company for a 9% tax rate instead of 15%-33%. Report sales right either way. If you mess up, eBay flags over $2,800 or 30 sales so that CRA might peek.

- Read More: E-Commerce Accounting Errors

4. Share Cash, Split Accounts

Pay family members to help with eBay, like packing, to use their lower tax rates and cut your bill. Make sure they actually help. Keep eBay money in its own account. The CRA won’t buy your expenses if they mix with personal cash.

5. Check Your Category Fees

Pick the right eBay category for your items. Some have lower final value fees, like 9% for books vs. 13.25% for collectibles, saving you cash.

6. Get Expert Help

Hire a tax expert to find hidden savings and handle CRA rules. They catch details you might miss and keep your filings on track, saving you stress and cash. For professional assistance tailored to e-commerce, explore options with an e-commerce accountant.

Final Thoughts

If you are selling on eBay in Canada, you need to understand your taxes to hold onto your profit. Canadian eBay sellers should keep up with tax rules. Stay current with updates. That’s what this guide explains about eBay taxes in Canada. Need more assistance? Contact us for expert help. We’re ready to support you through the tough parts.

Ready to tackle your eBay taxes? Reach out to SAL Accounting today for a free consultation!

Frequently Asked Questions (FAQs)

Yes, if you make profit. You report to the CRA for income tax or CPP. Hobby sellers with no profit skip it.

You don’t collect it, eBay does from July 2022. Over $30,000 in sales in four quarters? Sign up with CRA and file.

Yes, eBay grabs GST/HST for Canadian sales. For overseas GSP, it takes fees at checkout; direct shipping, buyers pay customs.

Did you miss the April 30 payment? 5% fine plus 1% monthly interest. eBay flags 30+ sales or $2,800 CAD—CRA might audit.

eBay sets it at 5% GST in Alberta, 13% HST in Ontario, and 15% in Nova Scotia. Quebec adds 9.975% QST, and BC, SK, and MB add PST.

Yes, claim eBay fees and PayPal costs. Keep receipts for six years for CRA.

Yes, report profit to the CRA as income. There is no GST/HST—it’s just for Canadian buyers.

Use eBay’s sales records. Log profit, costs, and receipts. Keep it all six years for CRA checks.

Disclaimer: Services provided from a Canadian perspective only; results may vary; no guarantees; consult for your unique situation.