We want to explain the full story of DST Canada: how it started, why it ended so quickly, and what digital businesses can learn from it. This helps you handle Canadian digital tax rules better and stay prepared for future changes.

Canada’s Parliamentary Budget Officer estimated the tax would bring in C$7.2 billion between 2023 and 2027. Yet in June 2025, just weeks before the first big payments were due, Canada cancelled the entire tax because of strong U.S. trade pressure.

In this SAL Accounting guide, we will cover what the Canada digital service tax really was, who it targeted, why it disappeared, its real effects, and the practical steps every digital platform should consider now.

Quick Takeaways

- Canada cancelled DST in June 2025 before any major payments were made.

- As of 2026, DST is inactive — no filings, no payments, refunds coming.

- Only companies with €750M global + > CAD 20M Canadian digital revenue qualified.

- The current tax for digital sales to Canadians is GST/HST — register if over $30,000.

What Is the Canada Digital Service Tax (DST)?

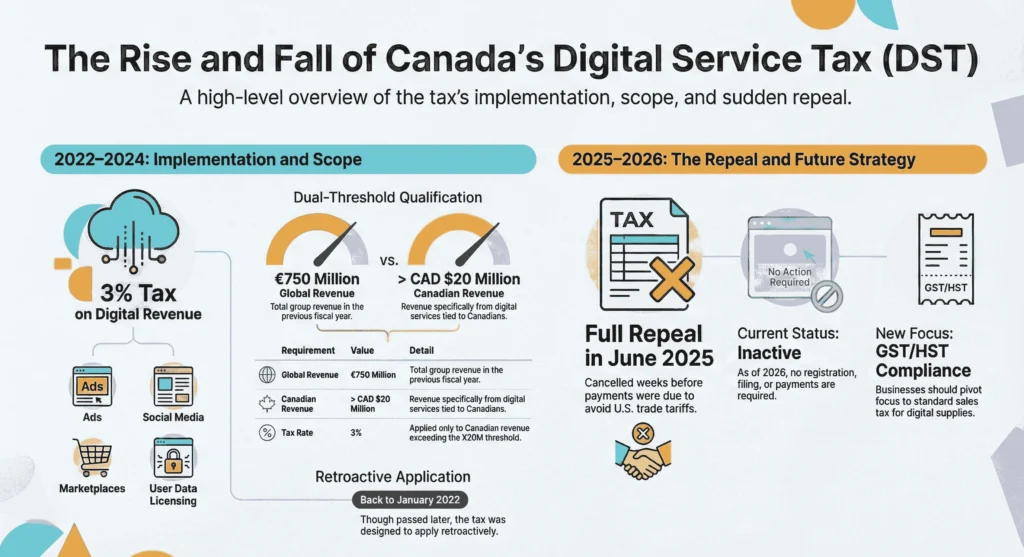

DST Canada was a 3% tax on the money that big digital companies made from Canadian users. The tax began on January 1, 2022 (even though the law came later in 2024). Big companies had to track how much money came from Canadian users and pay the 3% if they earned enough (CRA Guide on DST).

The rule also affected e-commerce accounting for businesses in Canada. In June 2025, the government stopped the tax completely. It only applied to these four types of services:

- Targeted online advertising

- Social media platforms

- Online marketplaces that connect buyers and sellers

- Selling or licensing user data collected from people in Canada

As of 2026, there is no DST. No one has to file or pay anything. The full repeal is being finalized, and any small early payments will be returned with interest. Still, you can contact our e-commerce accountant and consult about what to do now.

Why Was DST Canada Implemented? Why Was It So Controversial?

Canada brought in the digital services tax to fix one big issue. Large tech companies make tons of money from Canadian users, but many pay almost no tax in Canada. They do this because they have no offices or stores here.

The government wanted things to be fair. DST was meant to be a short-term solution until a bigger global deal comes through OECD talks. Talks about the tax started in 2019. Canada shared more details in 2020. Here’s why it caused so much trouble:

- It mostly hit U.S. giants (Google, Meta, Amazon, Uber), and many called it unfair and targeted. The guide on Amazon sales tax in Canada can tell you more.

- Companies passed costs on (Google added a 2.5% surcharge on Canadian ads in 2024) → higher prices for people and small businesses.

- Retroactive to 2022 → sudden huge bills for past years (seen as unreasonable).

- Canadian business groups warned it would raise costs for Canadians and hurt competition.

- The U.S. said it broke trade rules, threatened tariffs, and paused talks.

Pro Tip: Digital taxes often run into political fights. Keep an eye on OECD Pillar 1 updates. They could bring the next set of rules.

DST Canada Thresholds, Rate, and Who Had to Pay?

Only very large companies ever faced DST Canada. Small and medium digital businesses stayed out of it completely.

Who Qualified for the Tax?

A company had to meet two clear thresholds. This is how taxes work in Canada. The whole group worldwide needed at least €750 million in total revenue in the previous year. Plus, they had to earn more than CAD 20 million from qualifying digital services tied to Canadian users in the calendar year. If both happened, the company qualified.

What Was the Tax Rate?

The rate stayed at 3%. Companies paid this only on Canadian digital services revenue above CAD 20 million. They got some deductions and safe harbors first. Here is a quick reference table:

| Item | Threshold / Rate | Detail / Condition | Who It Affects |

| Global revenue threshold | €750M | Group revenue, previous fiscal year | Large multinationals only |

| Canadian CDSR threshold | > CAD 20M | Revenue from qualifying services to Canadians | Companies with high Canadian user revenue |

| Tax rate | 3% | Fixed rate | Only companies meeting both thresholds |

| Taxed amount | CDSR > CAD 20M | After deductions & safe harbors | Excess Canadian digital revenue |

DST Rate and Threshold Reference Guide

- Global revenue threshold: €750 million

- Canadian digital services revenue (CDSR) threshold: > CAD 20 million (calculating your revenue)

- Tax rate: 3%

- Taxed amount: CDSR above CAD 20 million (after deductions)

Who Actually Got Hit?

Giant tech platforms like Google, Meta, Amazon, Uber, Airbnb, and Booking.com took the main hit. Small sellers, indie SaaS, and Canadian startups rarely qualified, so they had no direct obligation. For instance, GST/HST for Shopify stores matter the most.

Pro Tip: If your business grows internationally, track Canadian revenue separately now. It makes GST/HST easier today and prepares you if high-threshold rules return someday.

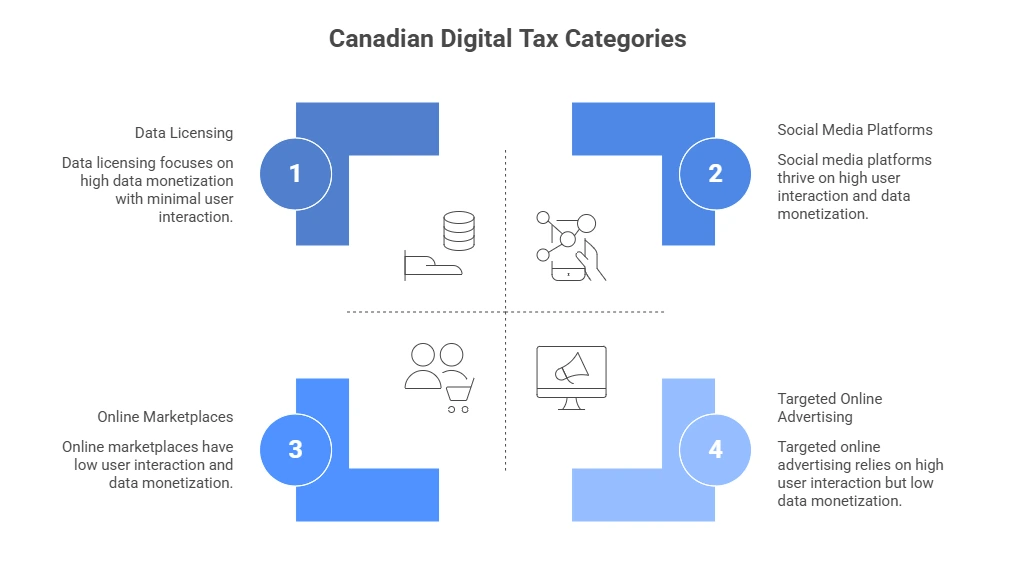

What Services Fall Under the Canadian Digital Tax? Full Breakdown

DST Canada only taxed revenue from specific digital services tied to Canadian users. The rules focused on four main categories. Companies had to figure out how much of their money came from Canadians (using things like IP addresses, location data, or user engagement signals).

Targeted Online Advertising Services

These covered ads are shown based on user data or behaviour. Examples include Google Ads or Meta ads targeted at people in Canada. Revenue from these impressions or clicks is counted if the user was in Canada.

Social Media and Intermediary Platform Services

Platforms that let users create content, interact, or share got taxed on activity from Canadian users. The tax applied to monetization tied to Canadians on these platforms. You may need to know e-commerce tax types in Canada as well. This category included:

- Sites where people post, like, comment, and engage with content created by others (e.g., Meta’s Facebook and Instagram feeds).

- Short-video or social sharing apps (e.g., TikTok).

- Any similar digital interfaces focused on user-generated content and social connections.

Revenue came mainly from ads, subscriptions, or premium features shown to or used by Canadian users. Private messaging (like direct video calls or voice chats) did not count.

Online Marketplace Services

This included sites that connect buyers and sellers or help transactions happen. Examples are Amazon Marketplace (third-party sellers), Airbnb (bookings in Canada), or Uber (rides for Canadian users). The tax applies to fees or commissions from Canadian activity. Learn more about Amazon FBA bookkeeping here.

Sales or Licensing of Canadian User Data

If a company sold or licensed data collected from Canadian users, that revenue was taxable. This category focused on data derived from Canadian behaviour. It included:

- Aggregated user insights (e.g., trends or patterns from Canadian browsing, shopping, or app usage).

- Profiles built from Canadian user activity (e.g., anonymised demographic or interest-based profiles sold to advertisers).

- Any licensing of raw or processed data originating from Canadian users (e.g., data sets used for AI training or market research). Check the tax loopholes for e-commerce to gain more.

Case Study: Saving GST/HST for a Mississauga Nonprofit Near Square One1

A Shopify store near Square One Shopping Centre in Mississauga contacts SAL Accounting:

Problem

They sell $52,000 in fundraising merchandise (hoodies, water bottles, wristbands) to a registered Ontario charity. They charged $6,760 in 13% HST by mistake. The charity’s CRA GST/HST number was not tagged correctly in Shopify. Donors complained about the extra charge, and the store feared a CRA audit.

What We Do

We verify the charity’s GST/HST number via the CRA Registry. We add the “Zero-Tax-ON” tag in Shopify for Ontario charities. We create a “No-Tax-Charity-ON” collection for exempt items. We refund $6,760 HST to the charity.

The Result

The nonprofit saves $6,760 for local programs. Donors pay the correct price. The store avoids audit risk. Exemptions now apply automatically for future Ontario charity orders.

How Is the Current Status of DST Canada in 2026

As of January 2026, DST Canada is inactive. Canada rescinded it on June 29, 2025, days before large retroactive payments were due. The U.S. called it unfair to American companies and threatened trade action. Canada dropped the tax to protect broader trade talks.

The CRA stopped all filings, payments and penalties. Bill C-15 (introduced Nov 2025) will repeal it retroactively to June 2024 once passed. Refunds with interest are planned for any early payers. Specifically, no one has to:

- Register for DST

- File any returns

- Make payments

- Worry about penalties or interest.

Pro Tip: Keep 2022–2024 Canadian revenue records just in case refunds are processed after repeal. Check the CRA website for Bill C-15 updates. Consult our cross-border tax expert for OECD Pillar 1 developments (global digital tax rules that may affect large firms soon).

How Would Canada’s DST Have Affected E-commerce, SaaS, and Digital Businesses?

If Canada had not cancelled DST in June 2025, the tax would have added extra costs for many digital companies. Small businesses would have felt it mostly in indirect ways.

Direct Costs for Large Platforms and Qualifying Companies

Big platforms that met the thresholds would have paid 3% on Canadian revenue above CAD 20 million. Companies could have faced millions in extra tax each year. They would likely raise fees, subscription prices, or ad rates to cover the cost. It could affect the Shopify sellers’ sales taxes to a significant extent.

Indirect Impact on Small E-commerce Sellers and SaaS Users

Small e-commerce sellers and independent SaaS companies rarely hit the high thresholds, so they would not pay DST directly. They would still feel the impact through higher platform costs. For example:

- Amazon Marketplace sellers could see higher seller fees or commission rates.

- SaaS users might pay more for tools like Shopify, HubSpot, or cloud services if those companies passed on the DST costs.

Canadian consumers could end up paying 2–3% more on affected services, things like ads, bookings, rides, or subscriptions. This matches what happened with similar digital taxes in other countries. See the Shopify tax exemptions that can help.

Competitive and Operational Changes

The tax would have given a small advantage to companies below the thresholds. Local Canadian platforms or smaller international players might have gained an edge on price. This would have meant extra work for big companies, such as:

- Gaining a small price advantage for companies below the thresholds

- Local Canadian platforms are competing better on price.

- Smaller international players are getting an edge.

- Large companies are spending more time and money tracking user locations, calculating Canadian revenue, and preparing annual filings.

A series of accounting tools and software for e-commerce are updated with the new tax rules.

Why the Impact Stayed Limited in Reality

Canada rescinded DST in June 2025 before the first major payments were due. Most companies never paid anything to the CRA. The short life of the tax meant the full financial and operational burden never arrived.

Pro Tip: Use geo-location tracking and revenue attribution tools right now. They help with current GST/HST compliance on digital sales and prepare you for any future digital tax changes.

| Impact Area | Affected Businesses | Main Effect | Result |

| Direct DST | Large platforms, SaaS, ad networks | 3% tax on Canadian revenue > CAD 20M | Higher fees, prices, ad rates |

| Indirect Costs | Small sellers, SaaS users | Cost pass-through from platforms | Lower margins, higher expenses |

| Consumer Prices | Canadian users | 2–3% higher digital service costs | Increased end-user pricing |

| Competition & Ops | Local firms, multinationals | Small firms gain edge; big firms add compliance | Market shift; higher admin costs |

Canadian Digital Tax Compliance: What to Do Now and Future Strategies

With DST gone, focus on active Canadian digital taxes like GST/HST for online sales, subscriptions, and services to Canadians. Key steps for international digital businesses:

- Register for GST/HST returns in Canada if you exceed $30,000 in taxable supplies to Canadians (non-residents can register voluntarily or must if over threshold).

- Track user location accurately (IP, payment address, device data) to determine when GST/HST applies.

- Use automation tools like Stripe Tax, Avalara, or TaxJar to calculate and collect taxes automatically.

- Review pricing and terms, build in flexibility for tax changes or pass-through clauses.

If you need help with your GST/HST tax filing, do not hesitate to contact us at SAL Accounting.

Case Study: Helping a Toronto Nonprofit Save on GST/HST Near Eaton Centre2

A Shopify store near Eaton Centre in Toronto contacts SAL Accounting:

Problem

They sell $45,000 in fundraising items (t-shirts, mugs, tote bags) to a registered Ontario charity. They charged $5,850 in 13% HST by mistake. The charity’s CRA GST/HST number was not set up correctly in Shopify. Donors complained about the extra 13% charge. The store worried about a CRA audit or more complaints.

What We Do

We check the charity’s GST/HST number on the CRA’s official tool. We add the “Zero-Tax-ON” tag in Shopify for Ontario charities. We make a “No-Tax-Charity-ON” collection for exempt items. We send back the full $5,850 HST to the charity.

The Result

The nonprofit saves $5,850 in HST. Donors pay the right price with no extra charge. The store avoids audit problems. Exemptions now work automatically for future Ontario charity orders.

- Read More: “How to Automate Your Shopify Accounting”

Final Thoughts

Canada introduced the Digital Services Tax. It created big tension with the U.S. right away. Then, Canada fully cancelled it in June 2025. Right now, the tax is inactive. Bill C-15 is moving forward to repeal it completely. For digital businesses, the main thing now is GST/HST. Make sure you handle it properly for sales, subscriptions, and services to Canadian customers.

Need help with GST/HST registration, compliance, or cross-border digital taxes? Just reach out to SAL Accounting. We’ll keep things simple and easy for you.

Frequently Asked Questions: Canada’s DST

It was a 3% tax on the money big tech companies made from Canadian users. It covered things like online ads, social media, marketplaces, and user data sales. The tax started in 2022 but ended in 2025.

Only very large companies. They needed €750 million global revenue and more than CAD 20 million from Canadian digital services. Mostly big U.S. companies like Google, Meta, and Amazon.

The tax covered targeted online ads, social media platforms, online marketplaces (connecting buyers and sellers), and selling or licensing user data from Canada.

Companies paid 3% on Canadian digital revenue above CAD 20 million (after some deductions).

It is gone. Canada stopped it in June 2025. Bill C-15 is working to repeal it fully. No one has to file, pay, or register now. Refunds with interest are coming for anyone who paid early.

The United States said it was unfair to American companies. They threatened tariffs and stopped trade talks. Canada cancelled the tax to fix the trade problem.

No. The thresholds were too high. Small businesses and startups never had to pay. Any extra costs (like higher fees) never really happened because of the cancellation.

The DST is gone, so focus on GST/HST instead. Register for GST/HST if you sell enough to Canadians. Track where users are and use tools to collect the tax automatically.

Yes. If you paid anything early, you will get it back with interest once the repeal is complete.

GST/HST still applies to digital sales to Canadians. Watch OECD Pillar 1. It may bring new global rules for large tech companies in the future.