Running a Shopify store in Canada has exciting opportunities and serious tax responsibilities. Whether selling maple syrup to locals or shipping tech gadgets across provinces, understanding GST/HST isn’t just smart business; it’s the law.

GST/HST compliance is critical. Late filing costs 1% of tax owing plus 0.25% monthly (up to 12 months). Ignore a CRA demand? That’s a $250 penalty. As of 2024, paper filing triggers $100-$250 penalties, and interest compounds daily at 6-10% annually on unpaid balances.

GST/HST compliance doesn’t have to be complicated. This guide from SAL Accounting covers everything from the $30,000 registration rule to setting up Shopify taxes for each province. Learn when to register for GST/HST, how to set up Canadian taxes in Shopify, and how to avoid costly errors. You’ll get a clear plan for Shopify GST registration in Canada, covering tax overrides and filing deadlines.

Key Takeaways

- Register at $30,000 in sales – You have 29 days after hitting this limit.

- Tax rates vary by Province – Ranging from 5% (Alberta) to 15% (Maritimes). HST provinces use one tax line; GST+PST use two.

- Set up Shopify correctly – Choose “instead of” for HST provinces, “added to” for GST+PST. The wrong choice overcharges customers.

- File on time to avoid penalties – Late filing costs 1% plus 0.25% monthly. File annually (under $1.5M), quarterly, or monthly based on revenue.

- Claim Input Tax Credits – Recover GST/HST on business expenses. Keep receipts 6 years; need supplier GST numbers for purchases over $150.

When to Register for Shopify GST/HST in Canada?

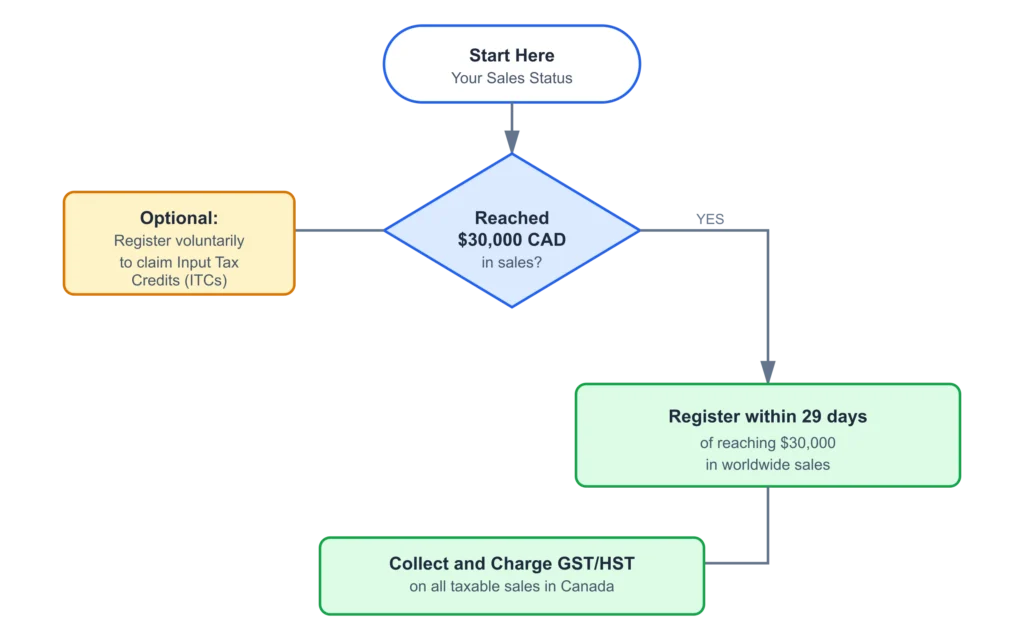

Understanding when to register GST HST Shopify is critical. If your worldwide taxable sales reach $30,000 CAD, you need to register for a GST/HST account. This includes all taxable sales, both in and out of Canada, but does not include exempt supplies like most financial services.

You can reach this $30,000 limit in two ways:

- In a single quarter: If you make more than $30,000 in one three-month period, register within 29 days and charge GST/HST on the sale that pushed you over the limit.

- Over four quarters: If you earn more than $30,000 over four consecutive quarters, you have 29 days after the end of that year to register.

You can also choose to register early, before you hit the $30,000 mark. This allows you to claim Input Tax Credits (ITCs), which are refunds for the GST/HST you paid on your business expenses, like inventory, equipment, or software. This is useful for new businesses with high startup costs.

Important: Once you register, you must collect and pay GST/HST on all of your taxable sales in Canada, even if your revenue drops below $30,000 later.

GST/HST Registration for Non-Canadian Shopify Sellers

Non-Canadian merchants must understand their international e-commerce tax obligations under GST/HST rules. If you’re selling to Canadian customers, GST/HST rules may apply. You must register if you sell taxable products to Canadians and store or ship them from a Canadian warehouse, like Amazon FBA. If you ship directly from outside Canada, customers pay the tax at the border.

Our e-commerce tax experts can help you through complex international sales scenarios.

Pro Tip: For digital products, if your sales to Canadians exceed $30,000 annually, you must register for GST/HST, even without a physical presence in Canada.

What Are the Canada GST HST Rates by Province?

Canada’s tax system changes depending on the province. Some provinces have a Harmonized Sales Tax (HST). Others charge the federal GST and a separate Provincial Sales Tax (PST).

Here’s the HST provinces list Shopify merchants need for 2025:

| Province/Territory | Tax System | Rate | Total |

| Alberta, NWT, Nunavut, Yukon | GST Only | 5% | 5% |

| British Columbia | GST + PST | 5% + 7% | 12% |

| Saskatchewan | GST + PST | 5% + 6% | 11% |

| Manitoba | GST + RST | 5% + 7% | 12% |

| Quebec | GST + QST | 5% + 9.975% | 14.975% |

| Ontario | HST | 13% | 13% |

| New Brunswick | HST | 15% | 15% |

| Newfoundland & Labrador | HST | 15% | 15% |

| Prince Edward Island | HST | 15% | 15% |

| Nova Scotia | HST | 14% | 14% |

Note: Nova Scotia’s HST rate was reduced to 14% on April 1, 2025.

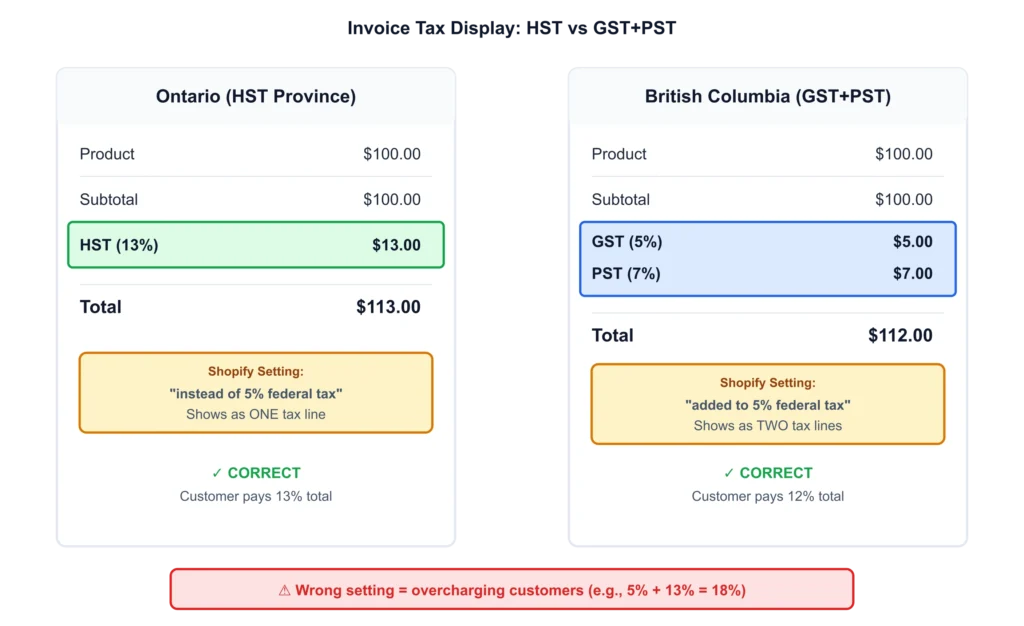

In HST provinces, invoices show one tax line. In GST + PST provinces, there are two separate lines. For PST/QST provinces, you need to register with provincial tax authorities separately.

Understanding provincial tax differences is just one part of a Canadian ecommerce tax strategy; explore all tax types that affect online sellers.

How to Set Up Shopify GST Registration in Canada?

Learning how to set up Canadian taxes in Shopify correctly is important to avoid overcharging customers and staying compliant.

Step 1: Add Your Tax Numbers

Go to Settings → Taxes and Duties → Canada in your Shopify admin. Click “Collect sales tax” and enter your 9-digit GST/HST number.

Note: Adding a GST/HST number automatically applies 5% GST across Canada and full HST rates in HST provinces.

For provinces with separate PST/RST/QST registration (BC, MB, SK, QC), click “Collect sales tax” again and add your provincial tax numbers.

Step 2: Set Up Tax Rates (Important)

This is a common area for errors. Choose the correct option from the dropdown:

For HST Provinces (ON, NB, NL, NS, PEI): Select “instead of 5% federal tax” to ensure you Shopify charge HST on orders correctly.

- Example: Ontario correctly charges 13% HST.

- Wrong: Selecting “added to” would charge 5% + 13% = 18%.

For GST + PST Provinces (BC, MB, SK, QC): Select “added to 5% federal tax” for the provincial tax.

- Example: BC correctly charges 5% GST + 7% PST = 12% (shown as two separate lines).

Step 3: Set Tax Overrides for Special Products

Some products, like basic groceries, prescription drugs, and feminine hygiene products, are zero-rated (0% tax). Others are tax-exempt (no tax applied). Proper inventory categorization for Shopify and tax setup work together to ensure accurate cost tracking and tax compliance.

To Set Overrides:

- Create a manual collection of the products.

- Go to Tax Overrides in your tax settings.

- Choose the collection and region.

- Enter the correct tax rate (e.g., 0% for zero-rated items).

Tip: To override GST in non-HST provinces, select “Canada.” To override only provincial tax, choose the specific province.

Step 4: Digital Products and Shipping

Digital Products: E-books, software, and online courses use the customer’s billing address to determine taxes. Sales outside Canada are zero-rated (0%).

Shipping Tax: Shipping is taxable if the shipped items are taxable. For mixed orders, Shopify calculates proportionally. If 3 out of 4 items are taxable, shipping is taxed at 75% of the rate.

Shopify GST Registration Canada: Filing to Avoid Penalties

Once you’re registered for GST/HST, staying compliant means understanding your filing obligations and keeping accurate records.

Filing Frequency and Deadlines

Your filing frequency depends on your annual revenue:

- Annual Filing: Under $1.5 million (due 3 months after your fiscal year ends)

- Quarterly Filing: $1.5 million to $6 million (due 1 month after the quarter ends)

- Monthly Filing: Over $6 million (due 1 month after each period ends)

2024 Update: All tax returns must be submitted online via CRA’s My Business Account. Filing by paper results in fines of $100 to $250. New to CRA’s system? Get step-by-step setup instructions for accessing and using My Business Account.

Input Tax Credits (ITCs) and Record Keeping

Input Tax Credits (ITCs) let you recover the GST/HST paid on business expenses.

Net Tax Payable = GST/HST Collected minus Input Tax Credits

Keep all receipts for at least 6 years. Expenses over $150 must include the supplier’s GST/HST registration number. Most ITCs can be claimed within 4 years of purchase.

Working with our small business tax accountant ensures you maximize all available credits and keep proper documentation.

Penalties for Late or Incorrect Filing

The CRA charges strict penalties for not following the rules:

- Late Filing: 1% of tax owing, plus 0.25% per month (up to 12 months)

- Demand to File: $250 penalty, even if no tax is owed

- Interest: 6 to 10% annually on unpaid taxes or penalties

Tip: Always file on time, even if you cannot pay right away. Filing late leads to higher penalties than late payment interest. Our bookkeeping accountants in Toronto help you stay on schedule and avoid CRA penalties.

Refunds and Returns (GST/HST Canada)

When you give a refund, you also need to refund the GST/HST you collected. Shopify usually handles the tax adjustments for refunds automatically.

Remember:

- Subtract the refunded tax from the total GST/HST you collected

- For partial refunds, only refund the tax on returned items

- Keep good records of all refunds for the CRA (Check out: How to reconcile Shopify payments, including tax adjustments for accurate financial reporting)

Need help with your HST return filing? Our HST filing services handle everything from calculations to CRA submissions.

Tax Updates for Shopify GST Registration Canada

Remember these updates in the process of tax accounting for your Shopify store:

1. Apply the Temporary GST/HST Holiday

For a limited time, the government has set the GST/HST rate to 0% for certain items like food, drinks, toys, and children’s products.

On Shopify: If you have set up your Product Categories correctly, Shopify will handle this for you. Just turn off any manual tax overrides for these items during this period to avoid errors.

2. Update Canada GST-HST Rates by Province

The HST rate in Nova Scotia changed from 15% to 14%. Update your Shopify settings to make sure you’re charging customers the correct tax.

3. Understand Zero-Rated vs. Exempt Supplies

| Type | Tax Rate | Can Claim ITCs? | Examples |

| Zero-Rated | 0% | ✓ Yes | Basic groceries, exports, prescription drugs |

| Exempt | No tax line | ✗ No | Financial services, most healthcare |

Customer Exemptions: For customers like First Nations status holders or diplomats, you can set up tax exemptions in their Shopify profiles.

4. Avoid CRA Audit Triggers

The CRA might audit your business if:

- You always ask for tax refunds (you paid more tax than you collected). This can slow down refunds returns GST HST Canada processing

- You claim a lot of tax back in your first year

- Your sales records don’t match what your payment processor reports

- Your numbers are very different from other businesses in your industry

Conclusion

GST/HST compliance is easier with proper Shopify GST registration Canada and accurate tax settings. This protects your business from penalties and lets you claim Input Tax Credits. Mistakes, like using the wrong Canada GST-HST rates by province or missing Shopify tax override Canada settings, can be costly.

Check your Shopify tax setup today. Test orders in different provinces, check rate calculations, and make sure your registration matches your revenue. Shopify can handle refunds and returns for GST/HST in Canada, but talk to our Shopify accountant if your revenue is over $100,000 or you sell in multiple provinces

Accurate taxes build trust and keep you compliant with the CRA. Contact us now for a free consultation and let us bring you peace of mind and a stronger business.

FAQs for Shopify GST/HST Registration

Yes, if registered. You must register if your business makes more than $30,000 CAD in worldwide sales. Below this limit, the small supplier rule GST HST Canada means registration is optional, but you can register voluntarily to claim ITCs on business expenses.

Within 29 days of going over $30,000 CAD in worldwide sales, either in a single calendar quarter or over four consecutive quarters.

The federal GST is 5% across Canada. Combined rates vary by province: Alberta and territories (5%), BC (12%), SK (11%), MB (12%), Quebec (14.975%), Ontario (13%), and Maritime provinces (15%, except Nova Scotia at 14% as of April 2025).

Yes, if registered for GST/HST. Keep all receipts and make sure purchases over $150 include the supplier’s GST/HST number. ITCs reduce your tax owing and can be claimed within 4 years.

Filing frequency depends on annual sales: under $1.5 million (annually), $1.5 million to $6 million (quarterly), over $6 million (monthly). All returns must be filed online as of 2024.