This post aims to help you find the best accounting software for your Shopify store in 2025. The right tool makes bookkeeping, sales tax, and reporting much easier. But here’s the part most sellers miss: you can lose 3–5% of your revenue every year from simple bookkeeping mistakes.

In this guide, we at SAL Accounting will show you how to avoid those mistakes. We’ll also walk you through the best tools, compare how they sync with Shopify, and share simple workflows to keep your finances accurate.

Quick Takeaways

- Best Shopify accounting software includes QuickBooks, Xero, or Wave, based on your store’s size.

- Look for auto-sync, tax tracking, and multi-currency to avoid costly errors.

- Use integrations like A2X or TaxJar to automate payouts and taxes.

- Start with free tools for beginners; scale up as orders grow.

- Test support and pricing to keep your shop compliant and profitable.

Why Shopify Sellers Need Specialized Accounting Tools

Shopify shows your sales, but it’s not full accounting. It misses costs, taxes, and bank matching. You need special tools to keep things tidy. Here’s why.

- Messy payouts: Lots of orders make payouts hard to track. Fees and refunds need clear splits. Doing it by hand causes mix-ups.

- Multi-currency trouble: Selling globally uses different currencies. Without tools, your books get messy.

- Tough taxes: Business taxes change by region. Shopify collects them but doesn’t file. Tools sort and report taxes right.

- Inventory and costs: Tracking product costs is key to profits. Spreadsheets lead to errors.

Pro Tip: Match payouts, not single orders. It saves time and keeps books clean. You can get expert support from our e-commerce tax accountant.

Key Features to Look For in Shopify Bookkeeping Software

Not every accounting tool fits Shopify. Some are for freelancers. Others suit big companies. Only a few work great for e-commerce. Read the comprehensive Shopify seller tax guide (2025) about sales and income taxes for more. Here’s what you need in a tool:

Auto Shopify Sync

Pick software that links to Shopify automatically. It grabs sales, refunds, and fees. No typing. No copy-paste mistakes.

Easy Tax Tracking

Taxes are tough. US sellers face state rules and nexus. Gain more info on sales tax nexus for e-commerce sellers to stay compliant. Canadians deal with GST/ HST, PST, or QST. Good tools organize taxes so you stay legal. Generally speaking, GST/HST returns in Canada are essential for Shopify sellers.

Multi-Currency Support

Many Shopify stores sell worldwide. You get paid in USD, CAD, GBP, or EUR. Your tool should:

- Handle exchange rates right.

- Show profits in your currency.

- Keep records clear for taxes.

Pro Tip: Log sales in their original currency. Let your tool convert them. It avoids math errors.

Clear Reports

Numbers need to make sense. Choose tools with simple reports for profits, cash flow, and costs. Look for dashboards that show key metrics at a glance. You spot trends fast, like rising costs or steady cash flow.

Works With Other Apps

You’ll need extra apps. Top accounting tools connect with:

- A2X or Link My Books for summaries.

- TaxJar or Avalara for taxes.

- Dext or Hubdoc for receipts.

Grows With Your Store

Get a tool that works now and later. Switching software is a hassle. See the best e-commerce accounting software in 2025 and compare it with your current one.

Pro Tip: Check pricing as you grow. Some apps charge by order count, which adds up fast.

Easy to Use, Great Support

A simple dashboard keeps things clear. Good support saves you when issues pop up. Look for:

- Live chat options.

- Clear guides or videos.

- E-commerce experts on call.

Pro Tip: Test support with a quick question before signing up. Their reply shows their service quality.

Here’s a fast guide to key features for Shopify bookkeeping software in 2025.

| Feature | Why It Matters | What It Does |

| Auto Shopify Sync | Stops typing errors | Pulls sales, refunds, fees automatically |

| Easy Tax Tracking | Keeps you legal | Organizes U.S. nexus, Canada’s GST/HST/PST |

| Multi-Currency Support | Handles global sales | Manages USD, CAD, GBP, EUR clearly |

| Clear Reports | Makes numbers easy | Shows profits, cash flow, costs in dashboards |

| Works With Other Apps | Boosts efficiency | Links to payout, tax, receipt apps |

| Grows With Your Store | Avoids switching hassle | Scales with more orders |

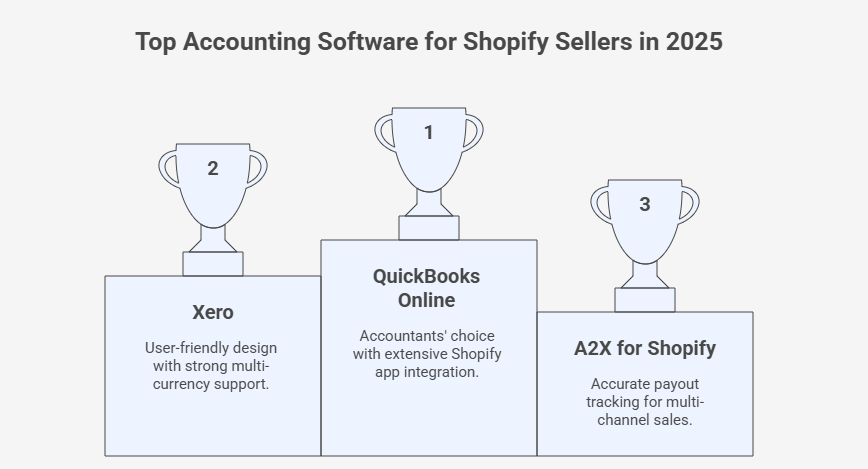

Top 7 Best Accounting Software for Shopify Sellers in 2025

No single tool fits every Shopify store. Some are great for newbies. Others handle big sales. Here’s a look at the best picks for 2025, what they do, and who they’re for:

1. QuickBooks Online (QBO)

QuickBooks Online is super popular for small and medium-sized shops. Most accountants know it. With apps, QBO tackles payouts, taxes, and reports without much hassle.

Key Features:

- Hooks up with Shopify via A2X, Link My Books, or Webgility.

- Tracks sales, refunds, discounts, and fees neatly.

- Handles US and Canadian tax rules.

- Gives clear reports on profits, cash flow, and costs.

Pricing: Plans run $30 to $90/month, based on features. Costs grow with extra users or tools. Check current QBO pricing.

Best For: US or Canadian Shopify sellers needing a full system. Perfect if your accountant uses QuickBooks. Check how to set up Shopify tax exemptions for your store, too.

Pros:

- Accountants trust it.

- Works with lots of Shopify apps.

- Grows with your store.

- Tons of online help.

Cons:

- Tricky for beginners.

- Needs apps like A2X for a clean Shopify sync.

- Costs add up with more features.

Pro Tip. Skip syncing every order to QuickBooks. Use A2X or Link My Books for daily summaries. It keeps books tidy and speeds up reconciliation.

2. Xero

Xero’s a go-to for small and medium Shopify stores, especially in Canada. Its clean design and auto-features make accounting easy. Great for global sales. Xero is among the best bookkeeping tools for small businesses in Canada.

Key Features:

- Links to Shopify with A2X, Link My Books, or Xero Bridge.

- Tracks payouts, fees, refunds, and global currencies.

- Supports Canada’s GST/HST and the UK’s VAT with MTD rules.

- Shows clear sales, cost, and cash flow reports.

Pricing: Plans cost $15 to $78/month, depending on features. Prices rise with advanced plans. Check the latest Xero rates.

Best For: Canadian sellers needing multi-currency and tax help. Awesome for global stores.

Pros:

- Easy-to-use design.

- Handles Canadian/UK taxes well.

- Great for multi-currency sales.

- Lots of online guides.

Cons:

- Weak inventory tracking without add-ons.

- Fewer US tax apps than QBO.

Pro Tip: Set Xero’s bank feeds up first. It automates payout tracking and spots errors fast.

3. A2X for Shopify

A2X is perfect for Shopify sellers needing clean payout tracking. It works with QuickBooks or Xero. Thousands of e-commerce business owners trust A2X to save time. Consider using it with a tax deduction checklist for Canadian and US small businesses.

Key Features:

- Grabs Shopify payouts and posts clean entries to QBO/Xero.

- Tracks fees, refunds, discounts, and sales tax/VAT.

- Works for Shopify, Amazon, and Etsy sales.

- Meets UK’s MTD tax rules.

Pricing: Plans run $29/month (200 orders) to $115/month (5,000 orders). Costs depend on order count. See A2X pricing.

Best For: Shopify sellers with lots of orders or multi-channel sales. Great for scaling shops.

Pros:

- Saves tons of time on month-end tasks.

- Super accurate payout summaries.

- Handles multi-channel sales.

- Awesome support team.

Cons:

- COGS setup takes manual work.

- Pricier than some options.

Pro Tip: Start A2X’s tax tracking early. It makes VAT/GST filings easy and skips audit stress.

4. Link My Books

Link My Books automates Shopify accounting for QuickBooks or Xero. It’s quick to set up and focuses on taxes. Sellers love its low cost and speed.

Key Features:

- Links Shopify to QBO/Xero in under 15 minutes.

- Auto-maps sales, fees, refunds, and taxes.

- Supports Shopify, Amazon, and Etsy sales.

- Gives profit-and-loss reports by channel.

Pricing: Plans start at $20/month for 1,000 orders. Costs grow with orders. Check rates (Link My Books rates 2025).

Best For: Shopify sellers wanting cheap, tax-focused automation. Great for small to medium shops. You can learn about e-commerce tax types and strategies in Canada here.

Pros:

- Fast and easy setup.

- Budget-friendly prices.

- Strong tax and VAT mapping.

- Free onboarding help.

Cons:

- Not as detailed as A2X for complex payouts.

- Fewer features than competitors.

Pro Tip: Test Link My Books in a sandbox month. It makes sure your tax mappings are right before going live.

5. FreshBooks

FreshBooks is a simple tool for small Shopify shops. Its clean design is perfect for beginners. Great for sellers with few products and basic needs. Knowing about how to file peer-to-peer tax returns in Canada will also be helpful.

Key Features:

- Connects to Shopify with a direct app.

- Tracks sales, costs, and fees as invoices.

- Handles basic US and Canadian sales tax.

- Lets you snap receipts on your phone.

Pricing: Plans cost $19 to $60/month, based on features. Prices rise with extra users. Check 2025 FreshBooks rates.

Best For: Beginner Shopify sellers or side-hustlers with small catalogs. Perfect for easy accounting.

Pros:

- Really easy to use.

- Cheap for small shops.

- Great for simple catalogs.

- Lots of online help.

Cons:

- Weak for multi-currency sales.

- Not made for big stores.

Pro Tip: Use FreshBooks receipt capture on your phone. It makes tax prep super easy.

6. Wave

Wave gives free accounting for Shopify newbies on a budget. It’s simple but not deep for complex needs. New sellers pick Wave to skip upfront costs. Also, have an ultimate bookkeeping checklist for Canadian small business owners available to you.

Key Features:

- Pulls sales and fees via Shopify’s app.

- Tracks basic costs and invoices for free.

- Handles simple sales tax.

- Offers basic money reports.

Pricing: Free for basics; add-ons start at $16/month. Costs depend on extras. Check the latest Wave rates.

Best For: New Shopify sellers with few orders and tight budgets. Great for starting out.

Pros:

- Totally free to start.

- Easy for newbies.

- No upfront fees.

- Simple design.

Cons:

- Not much automation for payouts.

- Weak for multi-currency or inventory.

Pro Tip: Check Wave’s manual syncs every month. It stops small errors from becoming big headaches.

7. Zoho Books

Zoho Books is a cheap accounting tool with solid automation. Shopify sellers like its value and growth potential. Zoho Books is a smart pick for cost-conscious shops.

Key Features:

- Links to Shopify via app or other connectors.

- Tracks sales, fees, refunds, and multi-currency.

- Supports basic sales tax and reports.

- Auto-handles invoices and bank matching.

Pricing: Plans run $10 to $80/month, based on features. Costs grow with advanced plans. Check Zoho Books pricing plans.

Best For: Budget-conscious Shopify sellers needing automation and room to grow. Great for small to medium shops.

Pros:

- Cheap for growing stores.

- Strong automation for the price.

- Scales with your shop.

- Easy-to-use design.

Cons:

- Smaller app options than QBO/Xero.

- Less familiar to accountants.

Pro Tip: Set Zoho’s automation rules early. It cuts manual work and saves time.

Here’s a quick look at 2025’s top Shopify accounting tools to keep your finances tight.

| Software | Key Features | Pricing (2025) | Best For |

| QuickBooks Online | Sync via A2X, tracks sales/fees/taxes, US/CA taxes, profit reports | $30–$90/mo | US/CA full system |

| Xero | Sync via A2X, multi-currency, GST/HST/VAT, sales reports | $15–$78/mo | CA/UK multi-currency |

| A2X | Payouts to QBO/Xero, tax/VAT, multi-channel, MTD | $29–$115/mo | High-volume scaling |

| Link My Books | Quick QBO/Xero sync, maps taxes, multi-channel, P&L | $20+/mo | Affordable tax focus |

| FreshBooks | Direct sync, invoices, basic tax, mobile receipts | $19–$60/mo | Beginners, small catalogs |

| Wave | Direct sync, free invoices/tax, basic reports | Free ($16+/mo add-ons) | New low-budget sellers |

| Zoho Books | App sync, multi-currency, basic tax, auto-invoicing | $10–$80/mo | Budget scalability |

Shopify Accounting Integrations: Benefits That Save Time and Cut Errors

Accounting tools are awesome, but they’re better with apps. Shopify sellers save time with integrations. They stop you from messing with spreadsheets and keep your data neat. Key Benefits of Using Integrations include:

- Less work: A2X or Link My Books sends payout summaries to QuickBooks or Xero. You don’t type every order.

- Fewer errors: Sales, refunds, fees, and taxes land in the right accounts.

- Fast matching: Bank deposits match your books quickly and easily.

- Easy taxes: TaxJar or Avalara sorts US sales tax. Canadians keep GST/HST/PST organized. See how to file sales tax in the US as an e-commerce business.

- Neat receipts: Dext or Hubdoc adds bills and receipts to your system.

- Ready to grow: Integrations handle more sales without extra hassle.

Pro Tip: Add one app at a time. Test it first to keep your books clean and skip sync errors. Our Shopify accounting services will also be helpful to get the most out of your sales.

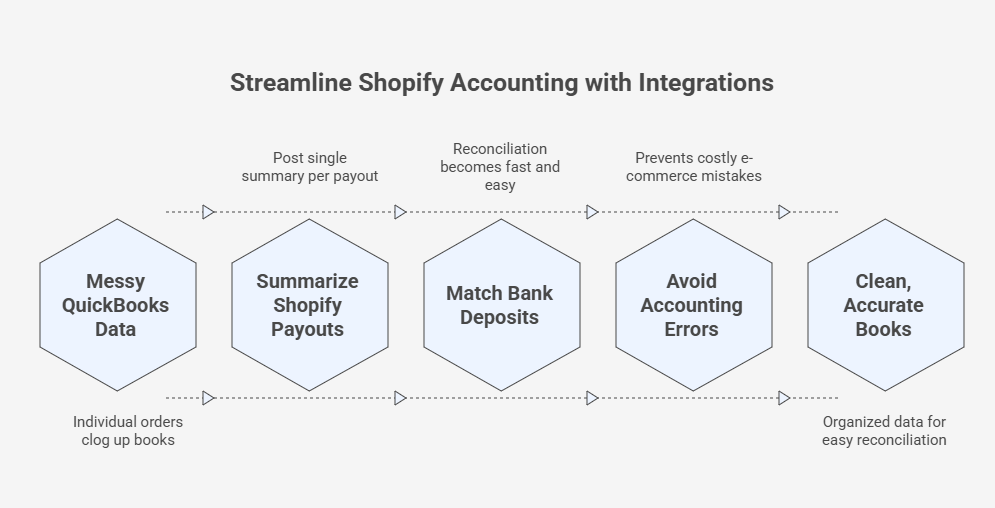

Shopify QuickBooks Integration: What Works (and Where A2X or Link My Books Help)

QuickBooks Online hooks up with Shopify through its app or tools like A2X and Link My Books. It pulls your sales data into your books. For small shops with few orders, this works okay. You get auto-sync for sales and basic reports for profits and cash flow.

Where QuickBooks Struggles

Direct sync has issues. It makes your books messy. Every order posts separately, clogging things up. Fees, refunds, and discounts often land in the wrong spots. Bank deposits don’t match payouts, so fixing errors takes ages.

How A2X and Link My Books Help

A2X and Link My Books save the day. They don’t send every order. Instead, they post a single summary that matches your Shopify payout. It covers sales, refunds, fees, and taxes. This lines up with your bank deposits, making reconciliation super fast and easy. It also keeps you away from e-commerce accounting errors that could cost you thousands.

When to Add an Integration

- Small shop with low orders: QuickBooks alone is fine.

- Growing shop with hundreds or thousands of orders: Add A2X or Link My Books for clean, accurate books.

Pro Tip: Don’t wait for tax season to add A2X or Link My Books. Start when orders grow to skip messy cleanups later.

How Shopify Finance Tools Keep Your Business on Track

Shopify finance tools make your store’s money stuff easy. They save time, stop mistakes, and keep you legal. Here’s how they help different sellers.

- Newbies/Side-Hustlers: Free or cheap tools track sales and costs. You focus on selling, not numbers.

- Growing Shops: Strong tools with payout apps handle tons of orders. They wrap up payouts fast.

- Canada Sellers: Global currency tools tackle GST/HST/PST. They nail filings across provinces, dodging fines.

- US Sellers (Tax-Heavy): Tax tools sort state rules. They handle filings, so you stay compliant.

- Stock-Heavy Shops: Inventory tools track costs and stock. You get clear profit reports, no hassle.

Pro Tip: Use your accounting software as the hub. Add finance tools one at a time so you don’t overload your system. Our bookkeeping for e-commerce will also help you stay at the top.

Case Study: Helping a Canadian T-Shirt Shop Fix Currency Chaos*

A Toronto Shopify store called SAL Accounting:

Problem: They sell $50,000 in custom tees, split between USD and CAD. Different currencies mess up their books. GST/HST taxes get jumbled, costing $4,500 in mistakes. Reconciling takes hours every week.

What We Do: We add a currency app to their accounting tool. It tracks USD and CAD sales separately. We set up auto-tax rules for GST/HST. We fix old entries.

The Result: The shop saves $4,500 in tax errors. Their books stay clear for both currencies. Reconciling takes just 30 minutes a week. They focus on growing sales.

Conclusion

The best accounting software for Shopify helps you save time, avoid errors, and stay on top of taxes. From QuickBooks and Xero to A2X and Link My Books, the right setup depends on your store size and needs. This guide gave you simple steps to compare options, set up integrations, and manage your Shopify finances in 2025.

If you need help with Shopify accounting or tax compliance, contact us at SAL Accounting. We’ll make your books accurate, your taxes simple, and your business easier to run.

*Hypothetical scenario

FAQs

It depends. Wave’s free for beginners. QBO with A2X fits scaling stores (500+ orders). Xero’s great for Canada or global sales. QBO plus TaxJar handles US taxes. See top tools. Pick by order volume and taxes to avoid errors.

Yes, QBO syncs with Shopify directly or via A2X/Link My Books. Direct sync clogs books. A2X/Link My Books posts clean summaries. Use for 500+ orders. See integrations. QBO costs $20–$200/month; check rates.

Xero’s great for Shopify, especially Canada/UK. It handles multi-currency and GST/HST/VAT. Sync with A2X for clean payouts. Weak for US taxes. See Xero section. Plans start at $20/month (Oct 2025).

Yes, Shopify accounting tools are a must. Shopify skips costs, taxes, and bank matching. Wave (free) or QBO ($20/month) prevents errors. See why section. Start small, scale later.

A2X and Link My Books post payout summaries to QBO/Xero. Dext/Hubdoc handles receipts. TaxJar/Avalara do taxes. They save time. See integrations. A2X starts at $29/month, Link My Books at $20/month.

No, Shopify tracks sales, not full accounting. It skips COGS and tax filing. Use Wave, QBO, or Xero for clean books. See why section. Even small stores need basic tools.

FreshBooks ($19/month) and Wave (free) are the simplest. They suit beginners with small catalogs. Weak for multi-currency or big stores. See top tools. Test support first.

QBO with TaxJar/Avalara handles US taxes. Xero’s best for Canada’s GST/HST. A2X/Link My Books maps taxes well. Shopify doesn’t file taxes. See integrations. QBO starts at $20/month.