In 2025, we want to help Amazon, Etsy, and Shopify sellers like you handle e-commerce withholding tax and keep more of your money. Here’s the surprising part: in 2021, the IRS withheld $40.9 billion from non-U.S. sellers. About 60% of sellers overpaid because they missed out on tax treaty benefits. If you don’t file the right form, you could lose thousands.

At SAL Accounting, we’ll show you how to cut or avoid these taxes, stay IRS-compliant, and increase your payouts. Let’s dive in.

Quick Takeaways

- Ecommerce withholding tax cuts 30% from non-US sellers’ US sales; W-8BEN reduces it to 0% via treaties.

- US sellers skip withholding but report $600+ earnings on 1099-K for 2025 taxes.

- Canadians skip the 30% IRS tax by filing a W-8BEN using the Canada-US treaty.

- Shopify withholding tax vanishes for non-US sellers with a W-8BEN in PayPal or Stripe.

- Etsy, PayPal, and other platforms need a W-8BEN to cut or skip withholding tax

What Is E-commerce Withholding Tax and How Does It Affect You?

E-commerce withholding tax is a 30% IRS cut from your US customer earnings if you’re a non-US seller on Amazon, Etsy, or Shopify (IRS digital tax guide). It hits sales, royalties, or digital products, called “FDAP” income by the IRS. Platforms deduct it and send it to the IRS before you’re paid. You can’t avoid it, but forms like W-8BEN can lower your tax bill. Consult with our e-commerce accountant for free about it. We will talk more about it in detail further.

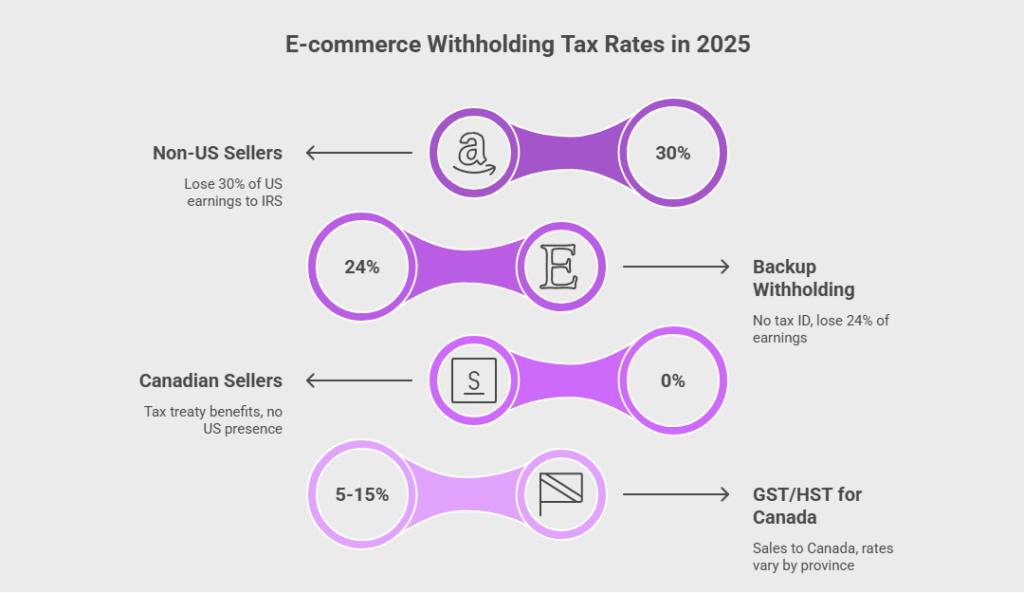

What Are E-commerce Withholding Tax Rates in 2025?

E-commerce withholding tax rates can cut into your profits. You need to know what the IRS takes and how to save cash. Let’s break it down so you keep more money in 2025:

1. Standard IRS Withholding Rates

Non-US sellers on Amazon, Etsy, or Shopify lose 30% of US earnings to the IRS. This hits sales or digital products. If you have no tax ID, you might lose 24% as backup withholding. US sellers skip this but report earnings over $600 on a Form 1099-K. See how to file Form 1099-K for e-commerce.

2. Tax Treaty Benefits for Canadians

Canada’s tax treaty saves you big. You can dodge that 30% IRS hit with these benefits. Learn more about the guide to withholding taxes under the U.S.-Canada tax treaty.

- Pay 0% on business profits with no US permanent establishment, like an office or 183+ days in the US with 50%+ US income.

- You skip withholding if you earn under $3,000 and stay less than 90 days in the US.

- File a W-8BEN for individuals or a W-8BEN-E for businesses to claim treaty rates.

- If you have US business income, use a W-8ECI to avoid withholding.

3. GST/HST for Sales to Canada

For sales to Canada, register for GST/HST if you hit $30,000 and store inventory there. Rates run 5-15% based on the province.

Sales Tax vs. VAT vs. Withholding Tax: Key Differences Explained

Here’s how withholding tax compares to sales tax and VAT:

- Withholding Tax: Platforms take 30% of your US sales if you’re not in the US. It’s about your cash.

- Sales Tax: Amazon or others grab this from US buyers at checkout. It’s their bill, not yours. See it on the Amazon tax guide for Canadian and US sellers.

- VAT/GST: You might deal with this (5-27%) for EU or Canada sales, especially digital stuff. Knowing the difference between sales tax and use tax for e-commerce sellers may be helpful. This table shows how each tax works:

| Tax Type | Who Pays | Rate | Details |

| Withholding Tax | Non-US sellers | 30% on US sales | Platforms like Amazon take it from your earnings. |

| Sales Tax | US buyers | Varies by state | Amazon or others collect it at checkout. |

| VAT/GST | Buyers in EU/Canada | 5-27% | You handle it for digital sales in Canada or the EU. |

Example: Say you’re a Canadian on Shopify. You earn $5,000 from US buyers. No W-8BEN? Shopify keeps $1,500 for the IRS. With the form, Canada’s tax treaty cuts it to 0%.

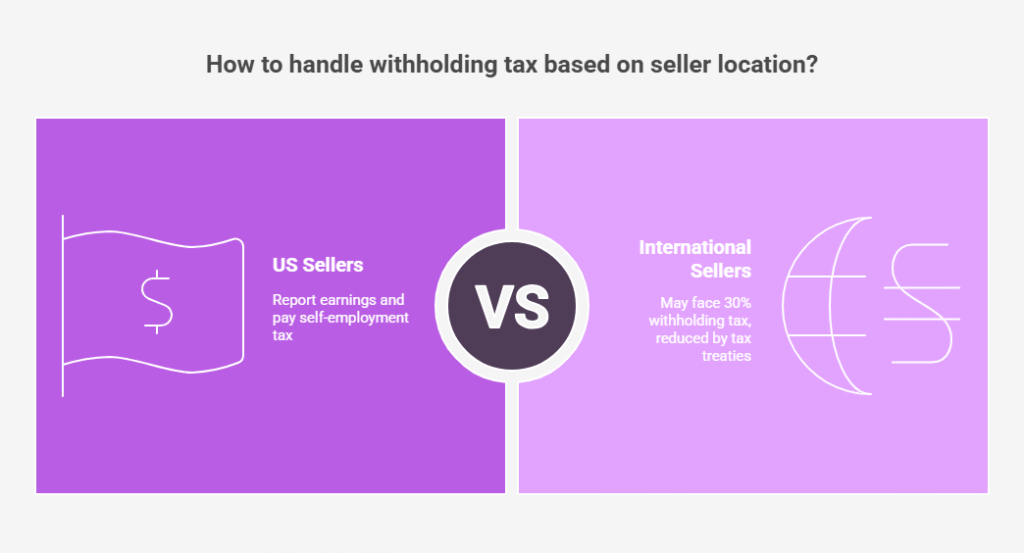

Withholding Tax for Online Sellers: US vs. International Rules

Where you live changes how withholding tax hits you. Let’s break it down for US and non-US sellers like you.

US Sellers: Just Report Your Earnings

If you’re in the US, you keep your sales from US buyers. No withholding tax for you. But if you make over $600 in 2025, platforms like Amazon or Etsy send you a 1099-K form. You report this to the IRS and pay self-employment taxes, about 15.3%. If you skip your tax ID, platforms might take 24% as backup withholding.

Example: Jake, a US Etsy seller, earns $10,000 selling crafts. He gets a 1099-K, keeps all his money, but owes self-employment tax.

International Sellers: The 30% Sting

If you’re in Canada or elsewhere, platforms might grab 30% of your US sales for the IRS. That’s money from US buyers. Tax treaties can cut that to 0% for Canadians or lower for others. You need a W-8BEN form to get those savings. Check the guide on how to file Form W-8BEN as a foreign individual. This table clarifies IRS and treaty rates for top countries:

| Seller Type | IRS Rate | Canada Treaty | UK Treaty | India Treaty | Australia Treaty |

| Non-US | 30% on US sales | 0% (no US office or <90 days & <$3,000) | 0% dividends/interest | 15% royalties, 30% others | 0% business profits, 10% royalties |

| US | 0% | N/A | N/A | N/A | N/A |

| No Tax ID | 24% backup | N/A | N/A | N/A | N/A |

Example: Lisa, a Canadian, earns $8,000 on Amazon from US buyers. Without a tax form, Amazon takes $2,400. With it, Canada’s treaty drops to 0%.

Amazon Seller Tax Withholding: Tips to Reduce Deductions

Amazon seller tax withholding can reduce your profits if you’re not ready. Non-US sellers lose 30% of US sales to the IRS. It kicks in for US buyer earnings automatically. Send a tax form via Seller Central to avoid it. Here’s how it rolls:

- 30% deduction: Amazon takes this from non-US sellers’ US earnings for the IRS.

- W-8BEN fix: File this to claim tax treaty savings, like 0% for Canadians.

- US sellers: Get a 1099-K for reporting, no withholding.

- Backup withholding: No tax ID? Amazon might take 24%.

Example: Alex, a Canadian, earns $10,000 on Amazon from US buyers. Amazon keeps $3,000. With it, Canada’s treaty makes it 0%.

Pro Tip: Update your W-8BEN yearly in Seller Central to save big.

Shopify Withholding Tax: How to Stay Compliant and Save

Shopify withholding tax can hurt your cash if you’re non-US. Canadians lose 30% of their US sales to the IRS. Shopify lets PayPal or Stripe handle it. File a tax form to cut it, maybe to 0%. US sellers skip this, but get a 1099-K over $600 in 2025. Find more on the Shopify seller tax guide about sales and income taxes. Here’s the deal:

- IRS grab: PayPal or Stripe takes 30% from your US sales if you’re non-US.

- W-8BEN: Add it in Shopify or your processor’s dashboard to save money.

- US sellers: You just get a 1099-K, no tax taken.

- No tax ID: Processors might nab 24% as backup.

Pro Tip: Stick your W-8BEN in Shopify’s tax settings or your processor’s portal to keep your cash. Check the best e-commerce accounting software in 2025 that may help you.

International Seller Tax Platform Requirements: Etsy, PayPal, and More

You lose 30% of US sales to the IRS on Etsy or PayPal. Each platform has its own setup. File a tax form to cut it, maybe to 0% for Canadians. Have a look at the Etsy seller tax guide for the US and Canada (2025). Here’s how it works:

- Etsy’s cut: It takes 30% from your US sales without a W-8BEN.

- PayPal’s deal: It nabs 30% for the IRS unless you add a W-8BEN.

- Other platforms: Stripe or eBay play by similar IRS rules.

- Treaty benefits: A W-8BEN lets you use your country’s tax treaty.

Pro Tip: Pop your W-8BEN into Etsy’s tax settings or PayPal’s account (sign up for PayPal) to save cash.

Filing E-commerce Withholding Tax Forms: Step-by-Step Guide

Sorting out e-commerce withholding tax means getting your forms right. Non-US sellers need paperwork to avoid that 30% IRS hit. US sellers just handle reporting. Here’s how you deal with the main documents to keep your cash.

1. Grab an EIN or ITIN

You need an IRS tax ID. Pick an EIN or ITIN. Apply online for free. See how to apply for an EIN as a Canadian company. It takes a few weeks. This ID tells platforms like Shopify who you are.

2. Send in a W-8BEN

Send a W-8BEN into your platform’s tax settings. This form gets you tax treaty benefits. Canadians can often cut withholding to 0%. It’s a fast upload.

3. Deal with 1099-K

You get a 1099-K if you are a US seller and make over $600 in 2025. Use it for your taxes. Etsy or others send it automatically. Hold onto it.

4. Use T4A-NR for Canadians

Canadians, tell CRA about your US income with a T4A-NR form. This stops double taxation. You need to know how to report a T4, T4A, and T4A-NR on your US tax return. File it yearly to get foreign tax credits. This table guides you through the key steps:

| Form | Who Uses It | Purpose | Action |

| EIN/ITIN | Non-US sellers | Get IRS tax ID | Apply online |

| W-8BEN | Non-US sellers | Claim treaty benefits | Upload to platform |

| 1099-K | US sellers | Report earnings | Keep for taxes |

| T4A-NR | Canadians | Avoid double taxation | File with CRA yearly |

Pro Tip: Set up a digital folder to store all tax forms and track filing deadlines with a calendar app. This keeps you penalty-free and makes audits easy for US or Canadian taxes. Our bookkeeping for e-commerce will help you sort out things, too.

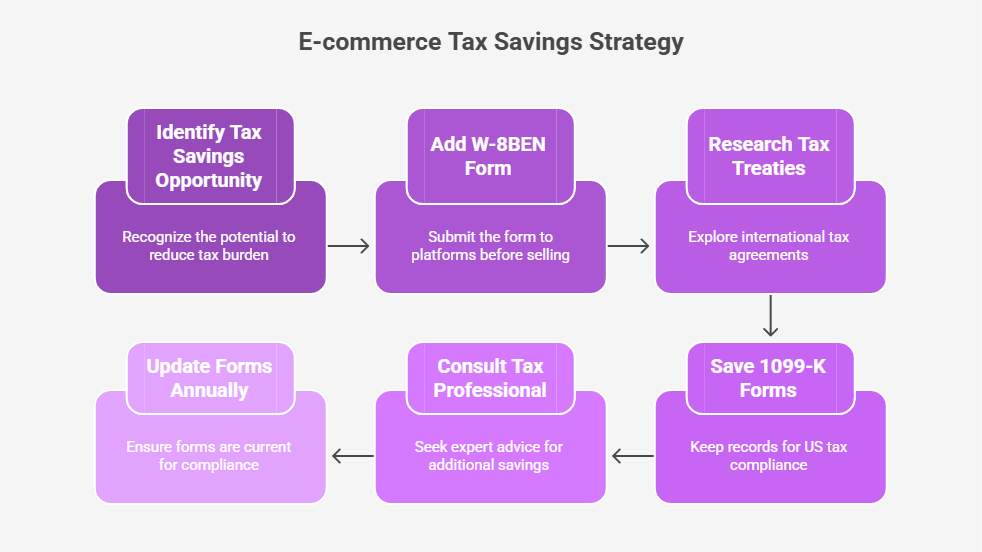

How to Save on Ecommerce Withholding Tax in 2025

You can beat the e-commerce withholding tax and keep more cash. These easy tricks help you dodge that 30% IRS hit in 2025. Here’s what to do:

- Pop in a W-8BEN fast: Add it to your platform before you sell big. Canadians can cut withholding to 0%.

- Look up tax treaties: Find your country’s deal with the US. Canada’s treaty saves tons.

- Save 1099-K forms: US sellers, keep these for tax time to stay on track.

- Chat with a tax pro: They find extra savings you might miss.

- Refresh forms yearly: PayPal and others need updated W-8BENs to keep your money safe. Connect with our e-commerce accounting expert in Mississauga for more tips.

Case Study: Saving Big on Shopify for a Canadian Seller*

A Canadian Shopify seller contacts SAL Accounting:

Problem: They earn $15,000 yearly from US buyers. The IRS takes 30% because they haven’t filed tax forms. They risk losing $4,500 and face double taxation in Canada. Poor records make it worse.

What We Do: We confirm their country’s tax treaty applies. We help upload a tax form to Shopify’s settings. We set up a cloud folder for records. We connect them with a tax pro to handle Canadian taxes. We remind them to update forms yearly.

The Result: The seller avoids $4,500 in withholding. They save $3,000 on Canadian taxes with credits. Their Shopify payouts run smoothly, and compliance is stress-free.

Final Thoughts

E-commerce withholding tax doesn’t have to cut into your profits in 2025. You can save money by sorting out taxes on platforms like Amazon, Shopify, Etsy, and PayPal. File the right forms to lower what the IRS takes. Keep up with reporting to stay penalty-free. Canadians, handle your home taxes, too.

Start today and set up your tax info and check country deals to keep more cash. For easy compliance, contact us at SAL Accounting for a free consultation and boost your savings.

*Hypothetical scenario

FAQs on Withholding Tax for Online Sellers

The IRS takes a cut of your US earnings if you’re a non-US seller on Amazon, Etsy, or Shopify. It hits sales or digital products. Platforms deduct this before you get paid. File forms to lower it.

Amazon takes 30% from non-US sellers’ US sales for the IRS. This happens automatically. You can reduce it with the right tax forms in Seller Central.

You can reclaim withheld tax if your country has a tax treaty with the US. File a tax return with the IRS. Canadians often recover it through home tax credits.

Canadians face 30% withholding on US sales. Country deals can drop it to 0%. Submit tax forms to platforms to avoid the hit.

Platforms take 30% of your US earnings without tax forms. You lose cash. File forms to keep more money.

Withholding tax cuts your US earnings as a non-US seller. Sales tax comes from US buyers at checkout. VAT applies to sales in places like Canada, at 5-15%.

US sellers skip withholding on US sales. You report earnings over $600 to the IRS. International buyers don’t change this.

Gateways like PayPal or Stripe take 30% from non-US sellers’ US sales. File tax forms in their portals to cut that.