If you’re a Canadian planning to sell your U.S. property, you might face a tax called FIRPTA. Last year, over 7,000 Canadians sold U.S. properties and dealt with tricky IRS rules. Snowbird or investor, learn what FIRPTA tax is to reduce your tax burden.

The SAL Accounting team put together a clear guide that breaks down FIRPTA and its fixes. Don’t miss it.

Quick Takeaways

- FIRPTA withholds 15% over $1M, 10% for $300,001–$1M, 0% under $300,000.

- Exemptions like zero profit or low-price sales skip FIRPTA withholding.

- File Form 1040NR to claim refunds for excess FIRPTA withholding.

- Missing affidavits cost $30,000 on $200,000 sales. Get them early.

- Buyers skipping Form 8288 face 25% fines, delaying refunds.

What is FIRPTA Tax? (A Quick Breakdown)

FIRPTA stands for Foreign Investment in Real Property Tax Act. It’s a U.S. law that requires non-Americans, like Canadians, to pay taxes when they sell property, including condos, houses, lands, or rentals (Source). Buyers withhold 15% of the sale price for the IRS. Schedule a consultation with our cross border tax accountant to simplify the process.

How FIRPTA Tax Started?

In 1980, FIRPTA was enacted to ensure foreigners, like Canadians, pay taxes on U.S. property sales (like houses, land). Before, non-residents could pocket profits and skip IRS taxes. FIRPTA changed that. Here’s why:

- Catch Tax Cheats: Foreign sellers dodged taxes, which hurt U.S. funds.

- Boost Tax Money: Property sales now help fund the government.

- Track Foreign Deals: The law keeps an eye on non-residents to collect what they owe.

How Does FIRPTA Withholding Work for Canadians

FIRPTA tax is a step in the property-selling process. The buyer holds back 15% of the sale price when a Canadian sells their U.S. property. The buyer sends this money to the IRS. This amount is like a deposit on the full sale price, not just your profit.

Who Manages the Withholding Process?

The buyer handles FIRPTA withholding. Their legal agent, like an escrow company, might do it instead. They calculate the right amount to keep back. No Canadian seller has to manage this. You might need to show papers. A Canadian passport or ITIN works to prove your foreign status.

How Is FIRPTA Withholding Process?

When a Canadian sells U.S. property, such as a vacation home, rental, or investment property, the buyer withholds 15% of the sale price for the IRS. Key details include:

- Withholding Process: The buyer deducts 15% from the sale price and sends it to the IRS within 20 days of closing.

- Seller Impact: Sellers receive reduced proceeds until they file for a refund.

Explore more on cross-border real estate transactions for Canada and the U.S..

FIRPTA Withholding Rates in 2025

Withholding depends on property use and price. The IRS sets 2025 rates. Review them below:

- 15% standard rate: A Canadian seller offers a rental, office building, or home over $1 million. The buyer keeps 15% for the IRS.

- 10% reduced rate: The sale hits $300,001 to $1 million. The buyer holds 10% if they sign a form to live there half the time for two years.

- 0% for exempt sales: The property costs $300,000 or less. The buyer plans to live there. No withholding happens.

Pro Tip: Confirm the buyer’s residency plans in writing before closing. It locks in the 10% or 0% rate and avoids disputes.

This table gives a quick glance at FIRPTA withholding rates for Canadians:

| Sale Price | Buyer’s Use | Withholding Rate |

| Over $1 million | Any use (rental, office, home) | 15% |

| $300,001–$1 million | Lives there half the time, 2 years | 10% |

| $300,000 or less | Lives there | 0% |

Example: Sarah, a Canadian, sells her Florida condo for $500,000 in 2025. Buyer John will live there and sign an affidavit. The price ($300,001–$1M) means 10% FIRPTA withholding. John’s escrow takes $50,000 and sends it to the IRS in 20 days.

- Read More: “Tax Implications for Canadians Owning US Property”

Steps to Comply with FIRPTA When Selling U.S. Property

Canadian sellers handle U.S. real estate sales with five steps. These steps nail tax duties. They keep costs low and sales smooth:

- Get a U.S. Tax Number

You need a U.S. tax number to report your sale. Apply for it before or after selling. The IRS takes one to two months to process it. This number helps you report taxes right. It also lets you claim back extra withheld money.

- Check Buyer’s Withholding Job

Make sure the buyer knows they hold back 15% of the sale price for FIRPTA. Confirm this step. It keeps records straight. You need those for your tax reports.

- Try for Less Withholding

Sellers expecting under 15% tax request an IRS withholding certificate before closing. Submit profit details. Approval lowers the rate. The certificate guides the buyer’s withholding amount.

- Send Sale Info to the IRS

After your sale wraps up, share your sale details with the IRS. Include your profit. They figure out your tax bill. You can ask for a FIRPTA withholding refund if your tax is less than the withheld cash. Good reporting gets you extra funds back fast.

- Keep Your Sale Records

Hold onto all sale documents. Save your sale price, original cost, and withholding info. These papers make audits easy. They stop delays too.

What is FIRPTA Form? (Filing Responsibilities)

Non-US sellers, including Canadians, handle FIRPTA filing to settle taxes or claim your refunds. These forms make the process easy. They keep you on track and save money. Explore the key forms you need below:

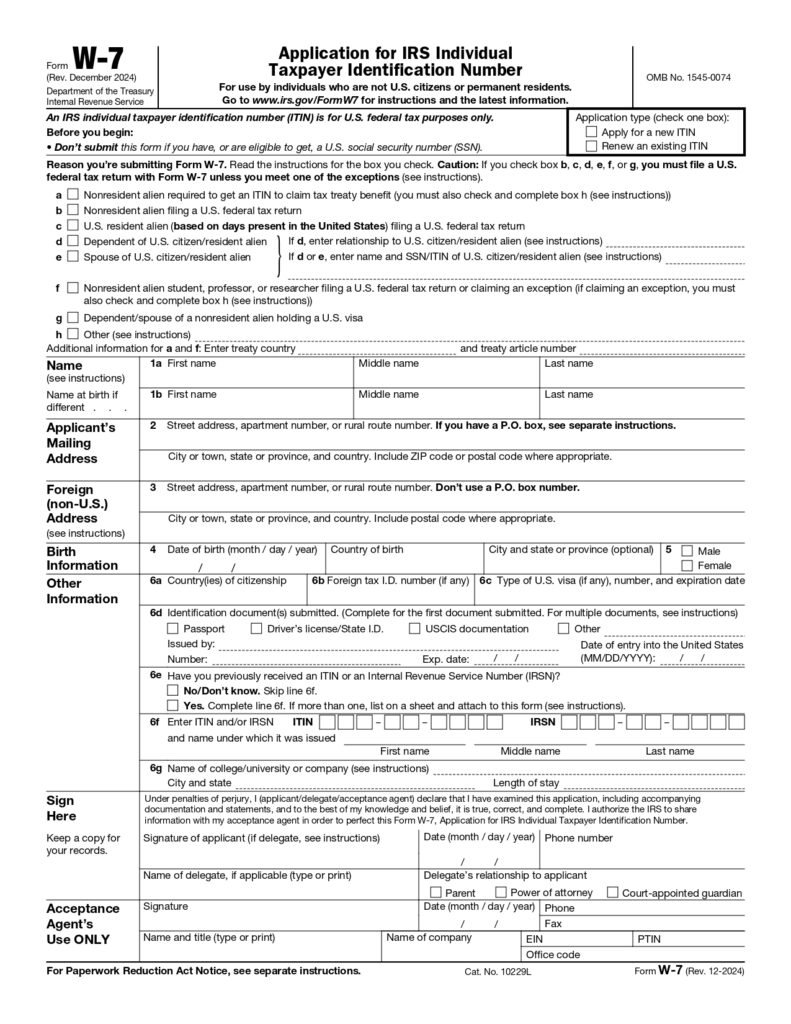

- Form W-7: Get an ITIN

Sellers without a U.S. Social Security Number file Form W-7 after the sale. It gives you an ITIN. This form lets you report your taxes on U.S. property. It also helps you claim a FIRPTA withholding refund. Here’s the form you need:

- Form 1040NR: Report Your Sale and Profit

You file Form 1040NR after closing. It shows your sales and profit. This form figures out your tax on U.S. property. You send it by April 15 next year. Extensions work if you need them. It spots any extra withholding too.

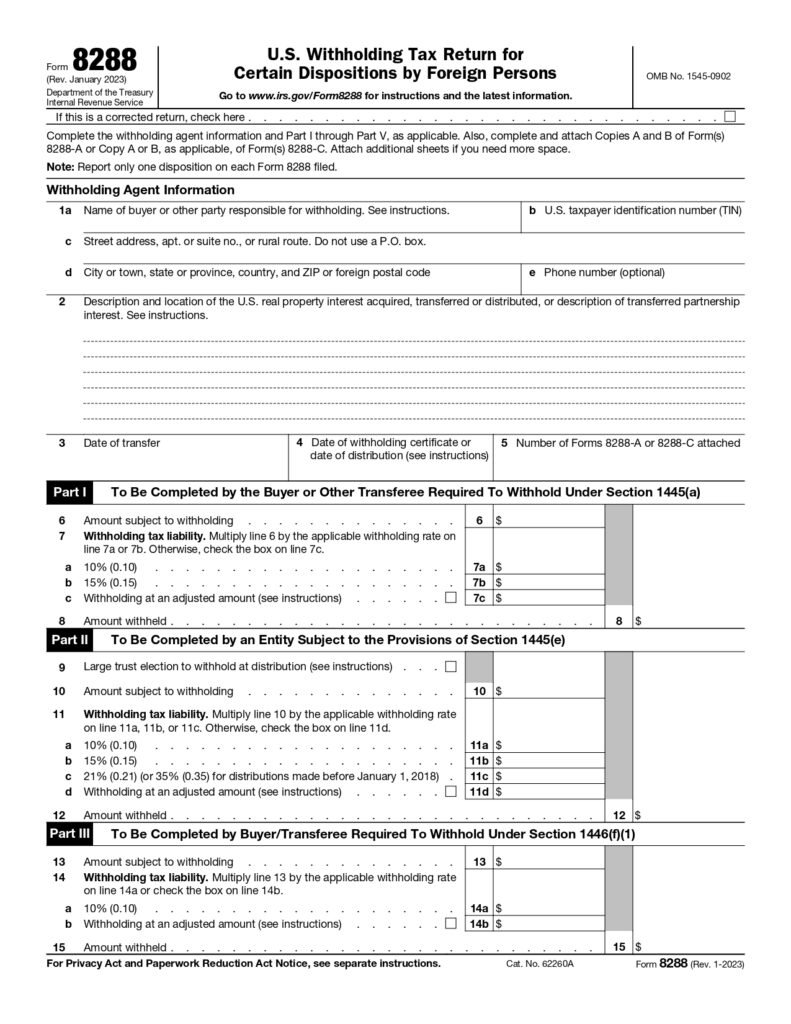

- Form 8288: Send Buyer’s Withholding

Buyers file Form 8288 to send the withheld amount, usually 15%. They do this within 20 days of closing. This form tracks the sale for the IRS. You don’t file it. But it sets up your refund records. Check out the form below:

- Form 8288-A: Show Withheld Amount

Buyers file Form 8288-A with Form 8288. It lists your sale’s withholding. You add this form to your 1040NR. It proves you overpaid and gets you a FIRPTA tax refund. Make sure it’s correct.

Pro Tip: File Form 8288-B for a withholding certificate six months before closing. It lowers withholding if your profit is small.

The Most Common FIRPTA Mistakes That Cost You Cash

Canadian sellers lose money with FIRPTA errors. Mistakes lead to big losses. Avoid these four errors to save cash:

- Skipping the Buyer’s Affidavit: You sell for $300,000 or less. The buyer lives there most of the time for two years. You avoid withholding. You need their signed affidavit. Without it, you lose 15%.

- Putting Off Your ITIN: You need an ITIN for forms or refunds. It takes weeks. Delay it, and your money waits. Fix it now. Apply with Form W-7 before selling.

- Messing Up Your Profit: Withholding takes 15% of the sale, not profit. You sell a $400,000 home bought for $350,000. Your $50,000 profit shouldn’t lose $60,000. Fix it smart.

- Forgetting Canadian Taxes: You report your sales to Canada. Skip it, and you pay tax twice, in the U.S. and Canada. That’s one profit hit hard. Fix it simple. File your T1 income tax package. Claim a U.S. tax credit.

Pro Tip: Use a spreadsheet to track sale price, purchase cost, and improvements. It proves your profit to the IRS and cuts withholding.

Case Study: Quebec Seller’s Affidavit Slip

Problem: A Quebec seller reached out after selling their $200,000 Tampa cottage. They forgot the buyer’s affidavit for home use. Escrow withheld 15% ($30,000).

What I Did: I suggested getting the buyer’s affidavit after the fact to prove home use. I also guided them to apply for an ITIN for a refund.

The Result: The IRS took the affidavit. They filed Form 1040NR. They got their $30,000 back. The process took six months.

Avoid these pitfalls with a consult. Book one with our cross-border tax experts today.

How to Get a FIRPTA Tax Refund or Reduce It

Canadian sellers can reduce or reclaim FIRPTA withholding to maximize U.S. property sale proceeds. The following steps minimize withholding, recover funds, and ensure proper documentation:

FIRPTA Certificate

A FIRPTA certificate lets Canadian sellers reduce the 15% withholding on U.S. property sales, ideal for low profits. Submit your expected profit to the IRS before the sale; approval, which takes months. The IRS explains how the Certificate Application is.

FIRPTA Refund

Buyers sometimes withhold too much. Sellers get it back after the sale. File a tax return. Show profit and calculate tax. Include the buyer’s paper proving 15% withholding. Claim the extra cash as a FIRPTA refund.

How to Avoid FIRPTA Tax Withholding: Exemptions for Canadian Sellers

Canadian sellers avoid FIRPTA withholding with smart exemptions. These strategies save money at sale time. Explore key ways to reduce taxes:

- Buyer’s Home Use Exemption

For sales of $300,000 or less, no withholding applies if the buyer uses the property as their primary residence for at least 50% of the time over two years. Canadian sellers of small vacation homes need a signed buyer statement to qualify.

- U.S. Resident Status

Canadians with U.S. residency, like a green card, dodge the 15% FIRPTA withholding. They submit proof they’re not foreign sellers (check info). This quick move suits those connected to both countries.

- Zero Financial Gain

No profit means no withholding. Your sale breaks even or loses money, like a $200,000 condo you bought for $210,000. You tell the IRS before selling to prove no tax applies. This move saves you a lot.

Pro Tip: Check if your sale qualifies for zero gain before listing. Submit proof to the IRS early to skip withholding entirely.

- Non-Taxable Sale Rule

The U.S.-Canada tax treaty helps some Canadians skip withholding. It depends on your tax status or residency. You check with the IRS first. If you qualify, this exemption keeps your cash safe. Learn about withholding taxes under the U.S.-Canada tax treaty to secure this exemption confidently.

- Business Transfer Exemption

You move property between related businesses. Strict IRS rules might let you skip withholding. Canadians with U.S. investment companies use this. You need the IRS okay before the sale. See the table for ways Canadians skip FIRPTA withholding:

| Exemption | Requirement | Outcome |

| Buyer’s Home Use | Sale $300,000 or less, buyer lives there | No withholding |

| U.S. Resident Status | Prove residency (e.g., green card) | Skips 15% withholding |

| Zero Financial Gain | No profit (sale ≤ purchase cost) | No tax, no withholding |

| Non-Taxable Sale Rule | Qualify via U.S.-Canada tax treaty | Exemption if IRS approved |

| Business Transfer | Move property between related businesses | No withholding with IRS okay |

Example: Mike sells his $280,000 Arizona condo. The buyer lives there half-time for two years. Under $300,000, Mike gets the Buyer’s Home Use exemption, skips FIRPTA withholding, and keeps all proceeds. Non-U.S. resident, $30,000 profit, no tax treaty, other exemptions fail.

Consequences for Non-Compliance with FIRPTA Withholding

Buyers ignoring FIRPTA rules face heavy penalties. They must file Form 8288 and pay tax within 20 days for a Canadian’s U.S. property sale, or face fines and deal delays. Canadians should stay proactive to avoid trouble. Penalties for non-compliance follow:

- Buyers don’t file Form 8288. They owe the seller’s tax. That means thousands lost.

- Buyers file late, past 20 days. They get fines of up to 25%. Interest builds quickly.

- Buyers skip withholding tax. They pay 15%, like $45,000, on a $300,000 sale.

Pro Tip: Include a FIRPTA clause in your sale agreement. It makes the buyer liable for penalties if they miss the 20-day deadline.

Case Study: Edmonton Seller’s Buyer Mishape

Problem: An Edmonton seller contacted us about their $400,000 Seattle lot sale. The buyer skipped FIRPTA withholding and Form 8288. Their refund stalled.

What I Did: We helped them file Form 1040NR to report the sale. We pushed the buyer’s escrow to file Form 8288 late to fix the records.

The Result: The buyer paid the $25,000 tax and a $6,250 fine. They got their refund after a year. The delay slowed their deal.

Avoid buyer slip-ups and keep your sale smooth with guidance from our real estate tax accountant.

Final Thoughts

FIRPTA taxes can significantly impact Canadian sellers, but strategic steps help keep more money in your pocket. This guide outlines ways to minimize your tax burden effectively. Master withholding, dodge mistakes, and grab exemptions. Keep tabs on IRS rules, because tax rules change quickly.

Tough tax rules challenging you? Contact us and set up a free consultation with SAL Accounting experts to handle your U.S. property sale confidently.

Frequently Asked Questions (FAQs)

FIRPTA taxes non-Americans, like Canadians, on U.S. property sales—condos, houses, land. Buyers withhold 15% for the IRS.

Over $1M: 15%. $300,001–$1M, buyer lives there: 10%. $300,000 or less, buyer lives there: 0%.

Exemptions skip withholding: $300,000 or less with buyer residency, zero profit, treaty rules, business transfers.

File Form 1040NR. Show profit, tax. Attach buyer’s Form 8288-A. Claim excess refund.

Buyers owe seller’s tax, face 25% fines for late Form 8288. Sellers wait longer.

Weeks to months after Form 1040NR. Missing papers delay it, sometimes six months.

Canadians use exemptions like low-price sales, no profit, or treaty benefits to skip withholding.

Green card holders skip 15% withholding. They prove U.S. residency to avoid it.