Thinking about opening a US LLC from Canada? Or maybe you already have one? While US LLCs are popular for their easy setup and liability protection, they can create serious tax headaches for Canadian business owners. The biggest issue? You might end up paying taxes twice – once in the US and again in Canada.

Quick Takeaways

- Charge management fees: Have your Canadian company bill your LLC to reduce US profits.

- Switch to an LP: Limited Partnerships allow income to pass through in both countries.

- Change tax status: Elect for your LLC to be taxed as a corporation in the US to match Canadian rules.

- Sell your LLC interest, not assets: This lowers your taxable amount in Canada.

- Set up the right structure: Use a Canadian company to own your US LLC.

Canadian Tax Treatment of US LLCs: Benefits and Risks

Let’s start with the good stuff. US LLCs are popular with Canadian businesses for good reasons:

- They make doing business in the US way easier. You can get permits and follow rules without a headache.

- If someone sues your business, they can’t come after your personal stuff (like your house).

- You can set one up super quickly; usually in less than an hour.

- Buying US property becomes much simpler.

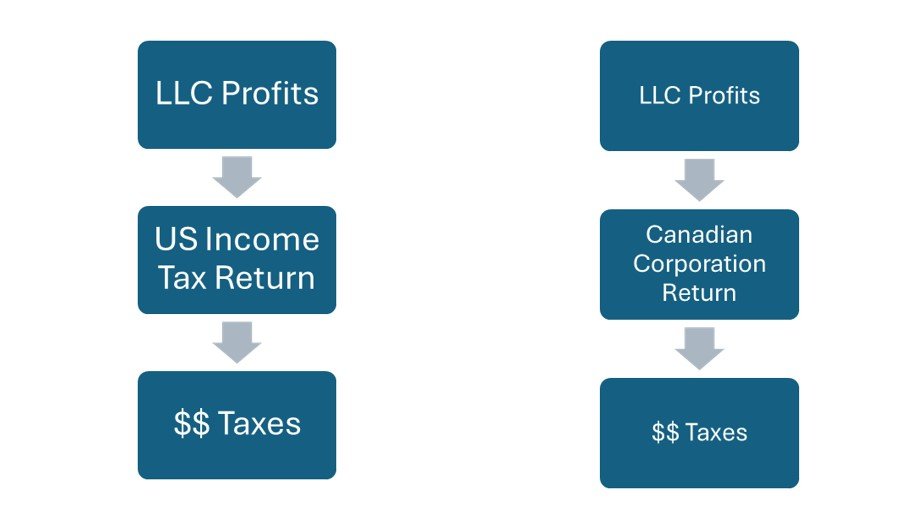

But here’s where things get challenging. The US and Canada have totally different views on LLCs. In the US, it’s as if your LLC doesn’t exist for tax purposes – all the money flows straight to your personal tax return. But Canada looks at the exact same LLC and says “That’s a corporation” and wants to tax it like a big company. This different view of your LLC is what creates all the tax problems.

Key Tax Challenges & Problems of LLC in Canada

Before expanding into the US, Canadians need to understand the tax challenges of owning a US LLC. Here’s what you need to know about the key tax issues and why they occur.

1. Double Taxation

One major issue for Canadian owners of US LLCs is double taxation.

- The US treats LLCs as pass-through entities, so profits are taxed on the owner’s personal income tax return.

- Canada classifies LLCs as corporations, taxing their income at the corporate level without allowing pass-through treatment.

This mismatch means the same profits can be taxed twice—once in the US and again in Canada—making it a costly challenge for Canadian residents and businesses.

Case Study: Sarah’s Double Taxation Wake-Up Call

The Problem: In my practice, I see this all the time – Sarah came to me totally stressed out. She’s a software developer from Toronto who started a US LLC for her American clients. Her LLC made $180,000 in its first year, and she thought she was all set after paying US taxes. Then boom – she got hit with a huge Canadian tax bill on the exact same money. Why? Because Canada saw her LLC as a corporation, not a pass-through entity like the US did.

What We Did: I’ve helped dozens of clients with this exact issue, so I knew just what to do. We set up a Canadian corporation to own her LLC – a structure I’ve seen work wonders. Then we had her Canadian company charge management fees to the LLC. Trust me, this is one of the cleanest solutions I’ve found in my years of practice.

The Result: arah’s tax bill dropped by about 30%. From what I’ve seen, this is huge for a small business owner. She now mainly pays taxes in Canada, keeps her US taxes super low, and still gets all the good stuff from both companies. Win-win!

2. Mismatched Income

The US and Canada can’t even agree on when to tax you. The US wants tax money as soon as your LLC makes money, even if you don’t withdraw it. Canada, on the other hand, only wants taxes when you actually take money out. This makes it really hard to handle your taxes in both countries, leading to extra issues for Canadian LLC owners.

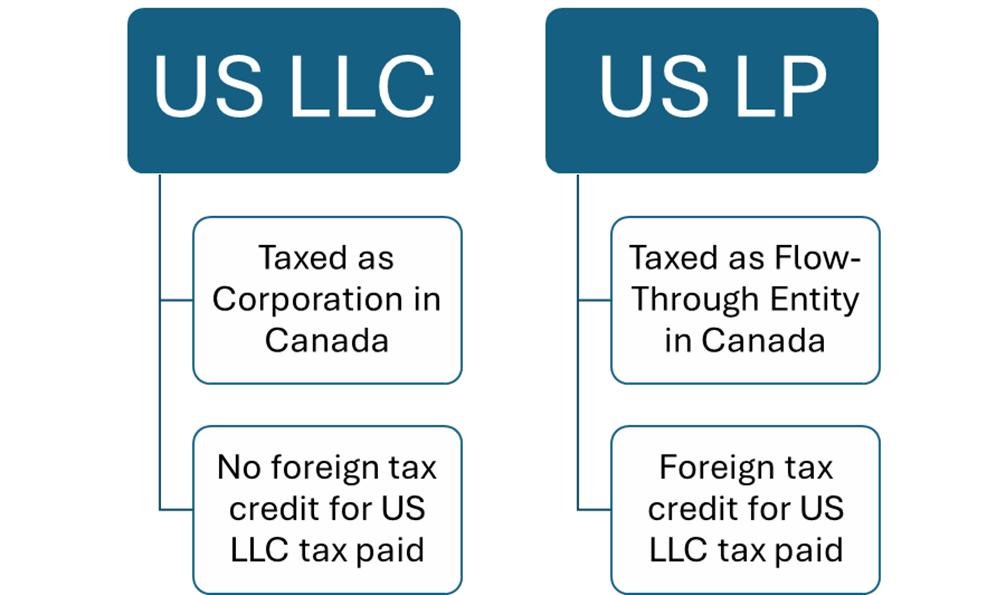

3. No Foreign Tax Credit

Canadians with US LLCs have trouble claiming foreign tax credits. To get these credits, you need to report foreign income on your Canadian personal tax return. But Canada sees LLCs as corporations, so the income doesn’t pass through to you. Without this, you can’t report it personally and can’t claim credits for the US taxes you’ve paid.

4. LLC Asset Sales

When your LLC sells something (like a building), Canada hits you with a surprise. The US only taxes what you made in profit, but Canada taxes everything you got from the sale. Also, Canada’s capital gains tax can take up to two-thirds of your profits.

- Example: Let’s say you sell a property for $200,000 that you bought for $125,000 through your LLC. It creates a profit of $75,000. The US taxes your $75,000 profit, but Canada taxes the whole $200,000. It’s a big loss.

| US Tax Treatment | |

| Net Sale Price | $200,000 |

| Less: Basis | ($125,000) |

| Tax Base | $75,000 |

| Canada Tax Treatment | |

| Net Sale Price | $200,000 |

| Less: Basis | $0 |

| Tax Base | $200,000 |

5. Additional Taxes

Canadians with US LLCs can face extra taxes. If the LLC is managed from Canada, it may get hit with Canadian corporate tax. If a Canadian company owns part of the LLC, it could also owe a US branch tax. These taxes add more costs and headaches for Canadian owners.

6 Solutions to Avoid LLC Double Taxation in Canada

If you’re a Canadian with a US LLC, you’ve probably noticed how tricky the tax rules can get. The good news is that there are ways to ease the tax burden. Here are some strategies our LLC experts often suggest to clients to deal with these tax challenges:

1. Use Management Fees

This is one of the simplest ways to avoid double taxation. The process has four easy steps:

- Start a Canadian company.

- Have it charge your LLC for help running the business

- Make the fee match your LLC’s profit

- Only pay taxes in Canada.

Note: You must still file US tax returns even with zero profit.

- Example: Let’s say your LLC makes $100,000. Your Canadian company would charge $100,000 for management services, leaving your LLC with no profit and thus no US tax. The Canadian company gets the money, and you only pay Canadian tax on amounts paid out. While this doesn’t remove all taxes, it stops you from paying twice.

| US Tax Treatment – No Management Fees | |

| Net Income | $100,000 |

| Less: Fees | $0 |

| Tax Base | $100,000 |

| US Tax Treatment – With Management Fees | |

| Net Income | $100,000 |

| Less: Fees | ($100,000) |

| Tax Base | $0 |

➜ Read more: “How to Report Canadian Income on a US Tax Return“

Case Study: David’s Rental Property Tax Save

The Problem: I remember when David first walked into my office – he was pretty frustrated. He owned three rental properties through his US LLC, bringing in $250,000 yearly. He was losing almost half of it to taxes! Between corporate rates in Canada and personal tax in the US, about 45% of his profits were going poof. In my experience, this is a common nightmare for Canadian real estate investors.

What We Did: Let me tell you what really works – we set up a Canadian management company. I’ve used this strategy countless times. His Canadian company started charging the LLC for things like property management and tenant screening. From what I’ve learned, the key is setting the fees just right – enough to minimize US taxes but not raise any red flags.

The Result: His US tax bill dropped dramatically. In fact, based on similar cases I’ve handled, this saved him around $50,000 in double taxation each year. And here’s what I always tell my clients – we did it all by the books, no gray areas. That’s the way I like to work.

2. Use Tax Treaties

Tax treaties matter when the US and Canada don’t see your LLC the same way. The US might treat it like a pass-through, but Canada could see it as a corporation. This difference leads to tax problems.

Treaties can sometimes help you pay less tax. But they are hard to use and watched closely. That’s why most experts say to look at other options first. Treaties are not the simplest fix for most people.

3. Switch to LP

Switching your US LLC to a Limited Partnership (LP) can cut down on tax trouble. Key benefits of choosing an LP:

- Both countries see an LP as pass-through, so no tax confusion.

- You get credit in Canada for taxes paid in the US.

- Your personal assets stay protected.

It’s a clear and simple way to save on taxes and keep things smooth.

⭐ Pro Tip: Don’t confuse LPs with LLPs – they’re quite different. The CRA won’t allow certain LLPs to be taxed as pass-through entities, especially those from Delaware or Florida. They’ll be taxed as corporations in Canada. Getting this wrong means paying tax twice, even though setting up either one is similar.

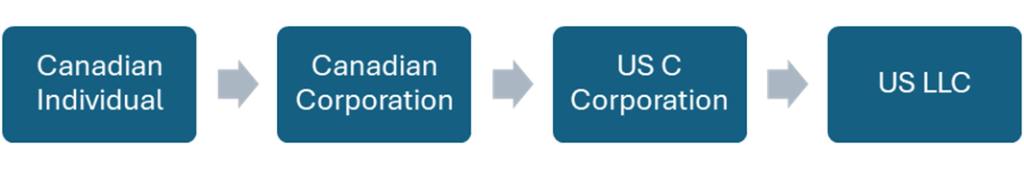

4. Change LLC Tax Status

You can have the US treat your LLC as a corporation, matching how Canada sees it. All LLC owners must agree to this change.

Tax Impact

US corporations pay 21% tax on all income they make worldwide. When they send money to owners, more taxes are added. This can mean paying tax twice in the US. However, Canada-US tax treaties can help lower these taxes.

5. Restructure Your Business

A more complex option is creating this chain:

This helps avoid tax issues while keeping LLC benefits. It gets more complicated with multiple owners, so try other options first. You can ask our LLC tax experts to set this up.

6. Sell LLC Smartly

When selling an LLC property, think about selling your ownership in the LLC instead of the property. This can save you money on taxes. Why? It lowers both the tax rate and the amount you’re taxed on. It’s a simple move that could make a big difference.

- Example: Say your US LLC owns a property worth $250,000, and you bought it for $150,000. If you sell the property and cash out the $250,000, the whole amount could be taxed. But if you sell your LLC ownership instead, only the $100,000 profit (the gain) gets taxed. This method helps you pay less tax.

| Canada Tax Treatment – LLC Sale | |

| Net Sale Price | $250,000 |

| Less: Basis | $150,000 |

| Tax Base | $100,000 |

| Canada Tax Treatment – Property Sale | |

| Net Sale Price | $250,000 |

| Less: Basis | $0 |

| Tax Base | $250,000 |

US LLC Tax Requirements for Canadians

Handling US LLC taxes is tough, and adding Canadian tax reporting makes it trickier. Don’t stress—we’ll cover the basics of reporting for US LLCs in both countries to keep it simple.

US Papers

You need to send:

- Personal tax return (Form 1040) for regular LLCs

- Partnership return (Form 1065) if you have partners

- State forms

- W-2s and 1099s if you have US workers

Canadian Papers

You need to file:

- Company tax return (T2) every year

- Form T1135 if your LLC owns property

- Other forms depending on what your business does

Filing these papers on your own usually leads to making huge mistakes. It is always better to ask for professional help.

How to Make the Right Choice?

Yes, US LLCs can give Canadian owners tax headaches. But if you plan things right – like using management fees or picking the right business setup – you can avoid most problems. Just don’t try to figure it out by yourself. Get help from our expert team at SAL Accounting who knows both US and Canadian tax rules.

Frequently Asked Questions

While the US sees your LLC as a pass-through entity, Canada views it differently – they’ll tax it like a corporation. This means you’ll need to pay corporate tax rates on your LLC’s income, even if you’re just a one-person business.

Absolutely! You can set up a US LLC as a Canadian, and many do it to expand into the US market. Just remember you might face double taxation since Canada and the US view LLCs differently.

The most popular way is to pay a management fee from your US LLC to a Canadian company. You could also file a “check-the-box” election or use the US-Canada tax treaty benefits. You can always rely on our US tax accountants to ensure a safe process.

Converting to a corporation can solve the entity mismatch problem, but try other strategies like management fees or treaty benefits first. If those don’t work for your situation, then corporation status might be your best bet, just remember it comes with more paperwork.

Canada sees LLC distributions as dividends from a foreign corporation, and you’ll be taxed based on your personal tax bracket and province.

It depends on your goals! LLCs are popular for being flexible and easy to set up, but consider factors like expected income, liability needs, and paperwork before choosing. Our cross-border tax accountants can help you in this journey.

Yes, you’ll need to file US tax returns even if your LLC makes no money. You’ll report this on Canadian taxes too, but can claim foreign tax credits to avoid double taxation.