Our goal is to help Canadian entrepreneurs, freelancers, e-commerce sellers, and consultants maximize US LLC tax deductions, claim business expenses on Canadian returns, simplify reporting, and legally lower taxes.

The IRS taxes the income straight to you at personal rates. The CRA sees the LLC as a foreign corporation. It taxes profits at the corporate level first, then taxes you personally again when you pull money out. This can create effective tax rates over 70% on the same income, a silent profit-killer.

We at SAL Accounting break down this trap in plain terms and give you practical, legal solutions like foreign tax credits, deductions, management fees, and smart entity elections to stop double taxation and let you claim the most deductions possible in 2026.

Quick Takeaways

- US LLCs risk double taxation over 70% for Canadians due to IRS pass-through vs. CRA foreign corporation treatment.

- Deduct office supplies, marketing, professional fees, home office, processing costs, and more on Canadian returns.

- Report income on T2125, file T1135 if assets >$100K CAD, and complete US filing first for credits.

- Claim foreign tax credits (T2209) and subsection 20(12) deductions to offset US taxes and reduce double hit.

- Restructure with Canadian CCPC and management fees to qualify for $500K small business deduction at 9–15% rates.

How Are US LLCs Taxed in Canada?

Many Canadians pick US LLCs because they make entering the US market easy and offer solid liability protection. But the tax rules differ a lot between the IRS and CRA. If you want to ensure that you get the best results, consult a cross-border tax expert. This difference often surprises owners. Here’s how the two countries tax US LLCs:

US Treatment (IRS):

The IRS treats most single-member LLCs as “disregarded entities” (unless you choose corporate status). Income flows straight to you. You report it on your personal Form 1040. You pay US federal tax at personal rates (up to 37%) plus any state taxes. No separate LLC return for income taxes.

Canadian Treatment (CRA):

The CRA treats US LLCs as foreign corporations when you open an LLC from Canada. The LLC faces Canadian corporate tax on worldwide profits (combined federal/provincial rates usually 26–27%). When you take money out as distributions, the CRA taxes it as dividends at your personal rate (up to 48–54% in provinces like Ontario or Nova Scotia).

Example: Mia runs an online store from Toronto via a single-member US LLC. The LLC earns a $200,000 USD profit.

- US side: Mia pays around $55,000 in federal tax (personal rates).

- Canada side: The CRA taxes the profit at the corporate level (around $54,000 tax), then adds personal tax on distributions (around $70,000+ at top rates).

Without proper planning, Mia loses well over half her profit to taxes.

➜ Read More: “Can a Canadian Corporation Own a US LLC?”

What Are the Common Tax Deductions for Canadians Operating a US LLC?

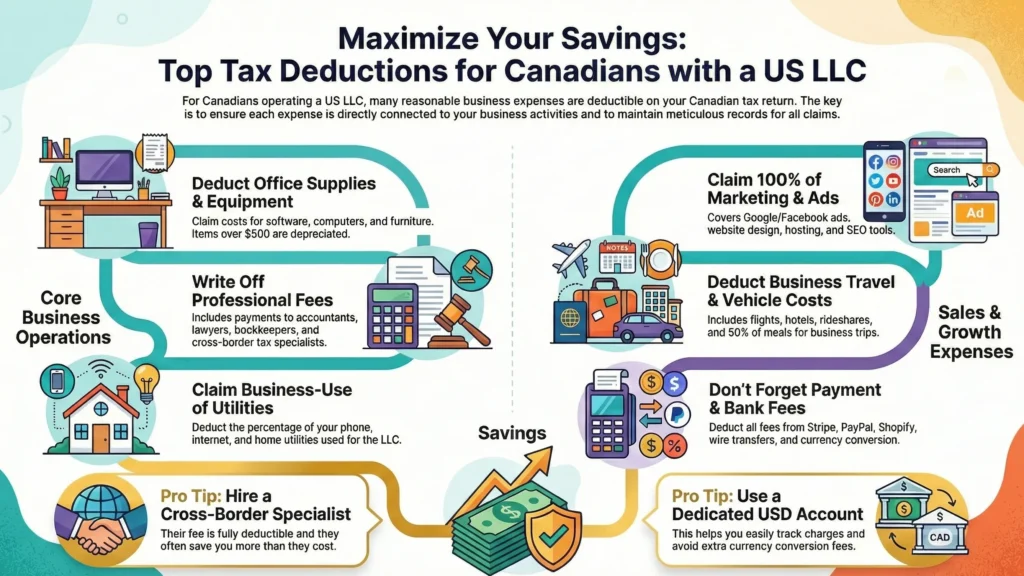

You can deduct most reasonable business expenses from your US LLC when you file your Canadian taxes. Just make sure the expenses connect directly to your business, and you keep good records. A tax deduction checklist for small businesses will help. Here are the deductions most Canadians grab:

1. Office Supplies and Equipment

You deduct everyday business items for your LLC:

- Pens, paper, printers, and other small supplies

- Computers, monitors, and office furniture

- Software subscriptions (e.g., Adobe Creative Cloud or Microsoft 365)

If an item costs less than $500, you usually write off the full amount in the year you buy it. For bigger items, you use capital cost allowance (CCA). This lets you deduct a percentage each year, typically 20–55%, depending on the asset class.

2. Marketing and Advertising

You claim 100% of what you spend on Google Ads, Facebook, or Instagram campaigns, website design, hosting, domain names, SEO tools, email platforms, business cards, or banners. E-commerce sellers and freelancers who target US customers often rack up the biggest numbers here.

Pro Tip: Pay for ads directly from your LLC accounts. You get the full deduction in Canada and grow your US sales at the same time. Pick the best business structure for online retail and gain the highest profit.

3. Professional Fees

You deduct what you pay accountants, lawyers, bookkeepers, virtual assistants, or cross-border tax experts for LLC help. This covers setup costs, annual filings, and advice. So, if you get bookkeeping services for managing your LLC finances, the fees are deductible.

Pro Tip: Bring in a cross-border specialist from the start. You deduct their full fee, and they usually save you way more than you pay them.

4. Phone, Internet, and Utilities (Business Portion)

You claim only the part you use for business called home office deduction. For example, if 70% of your home internet helps the LLC, you deduct 70%. The same rule applies to cell phones and utilities when you have a home office. You avoid US LLC tax problems as a Canadian in this way.

5. Travel and Vehicle Expenses

You deduct flights, hotels, rideshares, and 50% of meals on business trips to see US clients or suppliers. For your car, you claim the business share of gas, insurance, maintenance, and parking. Or you use the CRA’s per-kilometre rate. You need solid logs.

Pro Tip: Start tracking with an app like MileIQ or TripLog on day one. It keeps everything accurate and makes audits stress-free.

6. Payment Processing and Bank Fees

You deduct these common fees tied to your US sales:

- Stripe, PayPal, Shopify, and Amazon processing charges

- Credit card merchant fees

- Bank service charges and wire transfer costs

- Currency conversion fees and FX spreads.

These add up to thousands of dollars a year for most online businesses. Many owners miss the small ones, like monthly platform fees or hidden FX spreads. The CRA allows 100% deduction as long as the fees link directly to LLC revenue.

Pro Tip: Use a dedicated US dollar business account (like Wise). You skip extra conversion fees and track charges easily.

7. Shipping and Inventory Costs

If you sell physical products, you deduct freight, courier, brokerage, packaging (boxes, tape, labels), and inventory costs when items sell (cost of goods sold). You claim inventory only after shipping. Inventory software keeps timing right. This deduction can be significant for Amazon or Shopify sellers shipping to US buyers. See how the Shopify inventory accounting is.

Pro Tip: Use tools like Shopify inventory or TradeGecko. They match costs to sales automatically.

8. Education and Training

You can deduct costs that help you build skills for your LLC. The CRA requires a clear business connection and accepts these when they improve or maintain skills for your current work. Many owners claim $1,000–$5,000 a year easily. Here are common examples:

- Online courses, workshops, and seminars

- Industry conferences and events

- Books, magazines, and paid subscriptions

- Professional certifications and training programs

Pro Tip: Add a short note on each receipt showing how it helps your LLC. This speeds up any CRA review.

Example: Liam runs digital marketing from Toronto via a US LLC. He spends $4,200 on software/tools, $6,500 on US ads, $3,000 on cross-border pros, and $2,100 on business phone/internet. He deducts over $15,800, saving $6,000–$8,000 in taxes. Look at the table below to understand it fully:

This table lists the most common tax deductions Canadians can claim for their US LLC on Canadian tax returns:

| Deduction Category | Examples | Deductibility | Notes |

| Office Supplies & Equipment | Pens, paper, printers, computers, monitors, furniture, software | 100% if <$500; CCA 20–55% for larger | Buy big items year-end for bigger CCA. |

| Marketing & Advertising | Ads (Google/Facebook), website, domains, SEO tools, email platforms | 100% | Pay from LLC for full deduction + US growth. |

| Professional Fees | Accountants, lawyers, bookkeepers, cross-border experts | 100% | Hire specialist early — saves more than cost. |

| Phone, Internet, Utilities | Cell/internet/utilities (home office portion) | Pro-rated % | Separate plan for 100% deduction. |

| Travel & Vehicle Expenses | Flights, hotels, 50% meals; car gas/insurance/maintenance | Pro-rated or per-km rate | Track with MileIQ/TripLog for easy audits. |

| Payment Processing & Bank Fees | Stripe/PayPal/Shopify/Amazon fees; card/wire/FX charges | 100% if revenue-linked | Use Wise USD account to cut fees. |

| Shipping & Inventory Costs | Freight, courier, packaging; COGS when sold | 100% when sold | Use Shopify/TradeGecko for auto-matching. |

| Education & Training | Courses, workshops, conferences, books, subscriptions, certifications | 100% with business link | Note on receipts how it helps LLC. |

➜ Read More: “What Is an LLC? Meaning, Structure, Pros and Cons”

How to Claim US LLC Business Expenses on Canadian Tax Returns

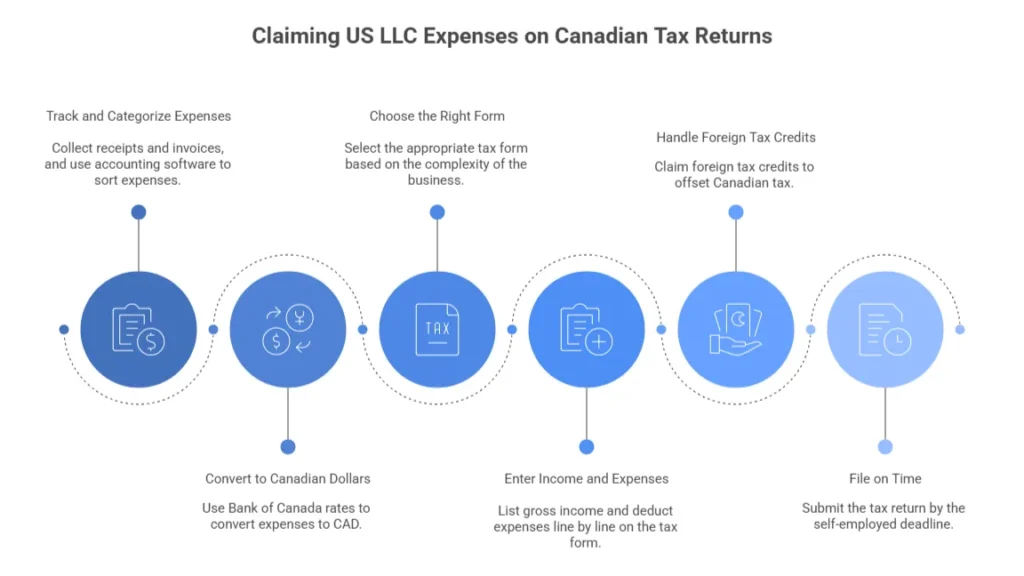

You claim your US LLC business expenses right on your Canadian tax return. They cut the LLC’s taxable profits before Canadian tax kicks in. Follow these steps to get it done correctly:

- Track and categorize expenses all year: Collect receipts and invoices. Use QuickBooks, Xero, or Wave to sort categories. Keep business separate from personal for easy proof.

- Convert everything to Canadian dollars: Use Bank of Canada rates, transaction date for accuracy, or annual average for simplicity. Stay consistent.

- Choose the right form: Most single-member owners use T2125 with a personal T1 return (report as foreign business income). Complex cases may need T2. Check out the CRA T2 tax form guide.

- Enter income and expenses: List gross income (CAD) on T2125. Deduct expenses line by line (e.g., ads on 8521, supplies on 8811). Home office goes in Part 7.

- Handle foreign tax credits and deductions: Claim FTC on T2209 to offset Canadian tax. Many also deduct US taxes paid via subsection 20(12), even without distributions. Attach proof.

- File on time: Self-employed deadline: June 15 (pay by April 30). File online via NETFILE software.

Case Study: Maximizing Deductions for a Toronto E-Commerce Seller in Liberty Village1

A Toronto entrepreneur lives in Liberty Village and runs a Shopify store selling fitness gear to US customers through a single-member US LLC. This year, the LLC earns $220,000 USD gross with $85,000 USD in deductible expenses (ads, Shopify/Amazon fees, shipping, software, and home office portion from his condo overlooking the lake).

Problem: He worries he will miss thousands in deductions and overpay Canadian tax because expenses feel messy and conversions confuse him.

What We Do: We set him up on QuickBooks Online with multi-currency tracking. We categorize all expenses properly, convert at Bank of Canada rates, claim full home office (20% of condo costs), and apply subsection 20(12) for US taxes paid. We file everything on T2125 with attached T2209 for FTC.

The Result: He deducts the full $85,000 USD equivalent (~$118,000 CAD), plus extra credits. This slashes his Canadian tax bill by over $28,000. He keeps accurate records automatically and enjoys bigger refunds, all while growing US sales from his Liberty Village base.

➜ Read More: “T2209 Form Guide: How to Claim the Federal Foreign Tax Credit”

How Do Canadian Owners Report US LLC Income for Tax Deductions?

You report US LLC income every year on your Canadian return — even if you don’t take money out. The CRA requires details on foreign income and assets. Miss deadlines and penalties add up fast.

Report Income Annually

Single-member LLC owners report profits as foreign business or professional income on Form T2125 (attached to your personal T1 return). Multi-member owners use their share from Schedule K-1. Convert all amounts to CAD using Bank of Canada rates.

File Foreign Reporting Forms If Needed

If the cost of your LLC’s foreign property (bank accounts, inventory, equipment) exceeds $100,000 CAD at any point in the year, file Form T1135 (Foreign Income Verification Statement). The deadline is April 30. Late penalties start at $25 per day, up to $2,500. Learn more about how to file Form T1135 and foreign asset reporting.

Handle US Filing First

Complete your US tax return before Canadian filing. Single-member owners use Form 1040 with Schedule C. Multi-member owners use Form 1065 and K-1. You need these numbers and proof of US tax paid for Canadian credits.

Claim Relief from Double Taxation

Use Form T2209 to claim foreign tax credits for US taxes paid. This reduces Canadian tax dollar-for-dollar. Many owners also claim a subsection 20(12) deduction for US taxes paid on undistributed profits. Attach proof.

Watch for Other US Requirements

If you control the LLC, you may need protective US filings like Form 5471. Report US bank accounts over $10,000 USD on FinCEN Form 114 (FBAR). Stay compliant on both sides.

➜ Read More: “Form 1040-NR Guide: How Nonresident Aliens File US Taxes.”

The table below outlines the essential reporting steps for US LLC income on Canadian tax returns:

| Requirement | Form / Action | Deadline | Key Details / Risks |

| Report Income Annually | T2125 (with personal T1) or K-1 share | June 15 (self-employed) | Report profits as foreign business income in CAD. |

| Foreign Assets >$100K CAD | T1135 (Foreign Income Verification) | April 30 | File if LLC property (bank, inventory) exceeds threshold. Penalties: $25/day, max $2,500. |

| Handle US Filing First | Form 1040 + Schedule C (single-member) or Form 1065 + K-1 (multi-member) | US deadlines (usually April 15) | Need US numbers and tax proof for Canadian credits. |

| Claim Relief from Double Taxation | T2209 (foreign tax credit) + subsection 20(12) deduction | With T1 return | FTC offsets dollar-for-dollar; 20(12) for undistributed profits. Attach proof. |

| Other US Requirements | Form 5471 (protective, if applicable); FinCEN 114 (FBAR) | Varies (FBAR: April 15) | FBAR for US accounts >$10K USD. Penalties high if missed. |

Case Study: Compliant Reporting for a Toronto Tech Consultant in Yorkville2

A high-earning tech consultant lives in a Yorkville condo and serves US startups exclusively through his single-member US LLC. This year, the LLC generated a $280,000 USD profit and holds a US business bank account averaging $150,000 USD (pushing foreign property well over the $100,000 CAD threshold).

Problem: He fears skipping T1135 filing or missing subsection 20(12) opportunities, which could trigger CRA notices and unnecessary double taxation on retained earnings.

What We Do: We complete his US Schedule C first, then report income on T2125. We file T1135 on time (April 30), claim full foreign tax credits on T2209, and apply subsection 20(12) deduction for US taxes on undistributed profits. We also confirm no FBAR issues.

The Result: He avoids potential $2,500 T1135 penalties, recovers over $35,000 through proper credits and deductions, and eliminates double taxation on retained earnings. He files each year confidently from his Yorkville office, knowing everything stays fully compliant on both sides of the border.

Contact us for LLC incorporation in the US and keep the process going smoothly.

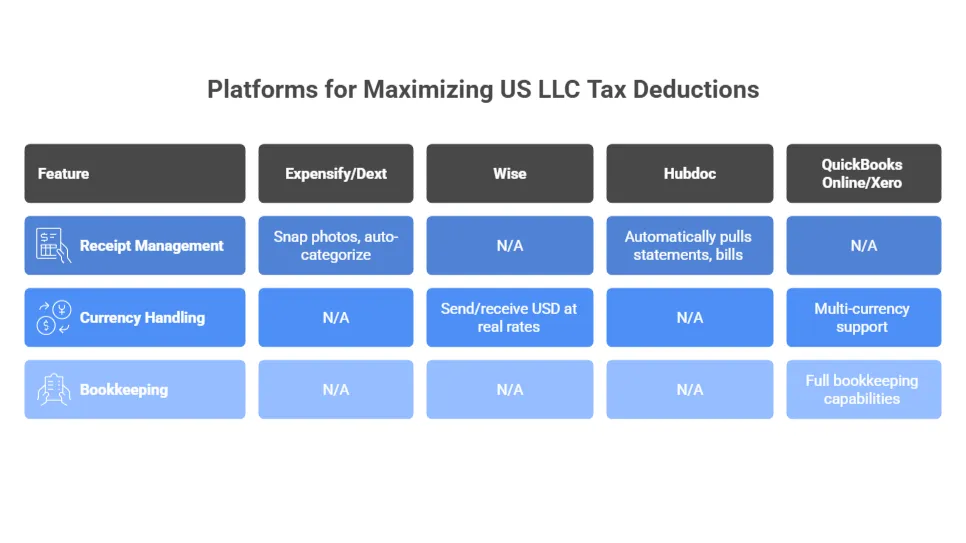

Which Platforms Help Canadians Maximize US LLC Tax Deductions?

You don’t need expensive tools to claim deductions, but good ones make life easier. They help you track every expense, cut errors, and grab every dollar you deserve. Have a look at the best e-commerce accounting tools in 2026, too. Here are the platforms most Canadians with US LLCs rely on:

- Expensify or Dext Snap photos of receipts with your phone. The app categorizes expenses automatically and creates clean reports for your accountant. Great for travel, supplies, and marketing costs.

- Wise Send and receive USD at real exchange rates with tiny fees. You save on conversions and deduct those low bank charges. It keeps your CAD tracking accurate.

- Hubdoc (free with Xero) automatically pulls bank statements, bills, and receipts from US banks, PayPal, Stripe, and Amazon. You get effortless records without chasing paper.

- QuickBooks Online or Xero Full bookkeeping with multi-currency support. They sort US LLC transactions and spit out reports ready for your T2125 or US Schedule C.

Most owners combine a receipt app (Dext or Expensify) with QuickBooks or Xero. The combo makes year-end filing quick and painless.

Pro Tip: Try the free trials first. Connect your US bank and payment accounts right away. Clean records from day one mean bigger deductions and zero stress at tax time.

➜ Read More: “Shopify Integration with QuickBooks”

What is the $500,000 Small Business Deduction for Canadians with a US LLC?

Many Canadians ask if their US LLC qualifies for Canada’s “$500,000 small business deduction.” Short answer: usually no, but you can restructure to access it on part or all of your income.

Rule: The small business deduction (SBD) lets Canadian-controlled private corporations (CCPCs) pay low tax, federal 9% plus provincial (combined around 9–15%, depending on province), on the first $500,000 of active business income earned in Canada (vs. regular rates of 26–27%). You can avoid double taxation as a small business.

A US LLC owned by a Canadian counts as a foreign corporation to the CRA. It does not qualify as a CCPC. Profits generally miss the SBD when reported personally. If you want to access the benefits, restructure like this:

- Set up a Canadian corporation (a CCPC) that controls the US LLC or charges its fees. The CCPC earns active business income (e.g., management or service fees from the US LLC). That income gets the SBD.

- Charge reasonable management/service fees from your Canadian CCPC to the US LLC. Common for consultants, freelancers, and e-commerce owners. Fee income hits the CCPC and enjoys a low rate.

See how to choose the best structure between LLC, LLP, and S Corporation.

Final Thoughts

US LLCs give Canadians strong access to the American market and great liability protection. But without the right tax moves, the hybrid mismatch quietly wipes out profits through double taxation. You can stop that. Claim every legitimate deduction and use foreign tax credits and subsection 20(12) smartly. Report accurately, and you end up keeping thousands more each year.

At SAL Accounting, we help Canadian LLC owners maximize deductions and kill double taxation every day in 2026. Contact us for a free consultation today.

FAQs: US LLC Tax Deductions for Canadians

Yes. Claim a pro-rated portion of rent, utilities, internet, insurance, and maintenance based on office square footage. Use the detailed method for maximum savings. Keep measurements, photos, and bills as proof. Skip CCA on the home.

TurboTax Premier, UFile, and H&R Block cross-border editions work well. For complex setups, use Profile or TaxCycle with a specialist.

QuickBooks Online, Xero, and Wave. They support multi-currency, expense tracking, and easy exports for T2125/Schedule C. Bench.co offers done-for-you bookkeeping.

Use foreign tax credits (Form T2209), subsection 20(12) deductions for US taxes paid, management fees to a Canadian CCPC, or elect US corporate status (Form 8832). Restructure early with cross-border advice.

Often yes for simple setups — they cause hybrid mismatch and double taxation. Alternatives like C-Corps, LPs, or Canadian CCPC structures work better for many. Consult a specialist before forming one.

Yes, if foreign property (including LLC assets like bank accounts) costs over $100,000 CAD anytime in the year. Deadline: April 30. Late penalties up to $2,500. File even with low income.