Starting your online store is exciting. You select products, build your site, and watch those first sales appear on your dashboard. But then come taxes, which can quickly dampen that excitement. Don’t worry—this comprehensive guide walks you through everything step by step. We’ll explain Shopify tax, Shopify e-commerce sales tax, Shopify sales tax reports, and all the essentials for U.S. and Canadian sellers. You’ll also discover how SAL Accounting can simplify your tax obligations. Let’s begin.

Quick Takeaways

- Where to Collect: Collect sales tax in states or provinces where you’re connected, like having an office or hitting sales limits (e.g., $100,000 in Florida, $30,000 CAD in Canada).

- Shopify’s Role: Shopify figures out and tracks taxes but doesn’t send them in; you handle that part.

- Filing Duties: Send U.S. state taxes monthly or quarterly, Canada’s GST/HST quarterly or yearly, plus income tax every year.

- Save Money: Take off Shopify fees, home office, ads, and shipping costs; good records stop $1,700 average fines.

Why Taxes Matter for Your Shopify Store

Taxes aren’t just about following rules—they keep your business going smoothly. Setting them up right in Shopify stops you from doing math by hand or paying fines that cut your cash. Knowing your taxes helps you set better prices. Customers hate surprise tax at checkout—it can lose you sales.

Shopify powers over 4 million websites and has generated $631 billion in economic activity since 2016. As part of this ecosystem, managing your tax obligations effectively is essential for long-term success. Our Shopify accountants in Toronto can help you navigate these complexities.

Understanding the Tax Basics for Shopify Sellers

Let’s start with the fundamentals: what types of taxes will you encounter? Understanding these basics makes everything else more manageable, whether you’re determining your sales tax nexus or adjusting your Shopify tax settings.

Types of Taxes You’ll Face

- Sales Tax: Extra money customers pay when they buy. You collect it and give it to the government. In the U.S., 45 states plus D.C. have it—like 7.25% in California or 8.875% in New York, depending on where buyers are. Canada has a 5% GST, and provinces add more—like 13% HST in Ontario or 7% PST in BC. It’s based on where you’re linked, explained next.

- Income Tax: Tax on your profits—what’s left after costs. Solo sellers put it on personal tax forms in both countries. Companies file their own forms with different rules.

- Self-Employment Tax: In the U.S., solo sellers pay 15.3% on earnings: 12.4% for Social Security, 2.9% for Medicare. Canada skips this but taxes your income anyway.

- Payroll Tax: For U.S. workers, you split Social Security at 6.2% each and Medicare at 1.45% each, plus 6% unemployment tax on their first $7,000. Canada has its own worker tax rules.

- Excise Tax: Special items like alcohol or tobacco get extra taxes, like $1.01 per cigarette pack in the U.S., plus $4.35 in New York.

- Customs Tax: Bringing goods in over $800 in the U.S. or $20 CAD in Canada means duties. It is important if you buy from overseas.

What Shopify Does (and Doesn’t)

Shopify doesn’t handle your taxes for you, unlike Amazon or eBay, so you decide what to collect and where it goes. Still, Shopify helps out with tools: it calculates sales tax at checkout once you set it up, you’ll find reports to track what you collect, and it offers Shopify Tax (U.S. only, costs extra) for exact rates and filing help. Once you know what Shopify handles, the first step is figuring out where you owe taxes.

➜ Read more: “E-Commerce Taxes in Canada Made Simple: Types, Tips & Strategies”

Step 1: Figure Out Where You Owe Shopify Ecommerce Sales Tax

Before you collect tax from customers, you need to know where you have to. This is about nexus—your starting point. It’s easy once you get it.

What Nexus Means

Nexus is a link between your business and a state or province. If you have it, you collect sales tax there. It used to be just about having a place like a store or warehouse, but a 2018 U.S. court ruling (South Dakota v. Wayfair) added sales amounts and where they go. Here are two main kinds.

Physical Nexus

- Your store or office, like your base in Texas or an apartment in Vancouver where you work

- Workers or storage, like an employee in Ohio or a Shopify warehouse in Alberta

Economic Nexus

- U.S.: States set limits, usually $100,000 in sales or 200 sales a year. California and Texas make it $500,000. It’s about how much you sell there.

- Canada: If you sell $30,000 CAD over four quarters, even from the U.S., you need GST/HST. It’s where your stuff goes, not where you are.

Physical nexus means any real setup you have, while economic nexus changes by place—look up state or province limits to be sure.

Example: Say you’re in Oregon (no state tax there) and sell $150,000 of jewelry to Florida buyers in a year. Florida’s limit is $100,000, so you’ve got a nexus and need to collect tax on those sales.

Case Study: Vancouver E-Commerce Seller’s Sales Tax Win

The Problem: A Vancouver clothing brand came to me in a panic. They’d been selling to U.S. customers for over a year and just learned about economic nexus. With $120,000 in sales to California and $90,000 to New York, they were worried about massive penalties for not collecting sales tax.

What We Did: In my experience, this panic moment happens to almost every Canadian seller. I knew exactly what to do. We registered them for sales tax permits in both states and configured their Shopify store to collect the correct rates—8.68% for California and 8.52% for New York. I thought their situation wasn’t as dire as they feared since they’d only recently exceeded California’s threshold.

The Result: Within two weeks, their Shopify store was properly collecting sales tax with a clear filing schedule. They avoided potential penalties of $10,000+ and gained peace of mind. I personally showed them how to use Shopify’s tax reports to track collections by state, making quarterly filing simple.

U.S. and Canadian Nexus Breakdown

Here’s a quick look at where you might owe taxes based on nexus rules. These are samples; each spot has details, but this gives you a solid start.

| U.S. Economic Nexus Limits | |||

| State | Limit | Avg. Tax Rate | Notes |

| Alabama | $250,000 | 9.22% | Tax based on buyer’s spot |

| California | $500,000 | 8.68% | Uses both seller and buyer rules |

| New York | $500,000 + 200 sales | 8.52% | Clothes under $110 skip tax |

| Texas | $500,000 | 8.19% | Tax based on seller’s spot if in Texas |

| Florida | $100,000 | 7.08% | Shipping taxed unless optional |

| Alaska/Delaware | None (no state tax) | Varies/None | Alaska has some local taxes |

Check more at the Sales Tax Institute.

| Canadian GST/HST and Provincial Taxes | |||

| Province | Tax Type | Rate | Notes |

| Ontario | HST | 13% | Mixes GST with province part |

| Quebec | GST + QST | 5% + 9.975% | QST needs its own form |

| British Columbia | GST + PST | 5% + 7% | PST if you’re asking for sales |

| Alberta | GST | 5% | No extra province tax |

Limit: $30,000 CAD over four quarters starts GST/HST.

Now you know where nexus applies—let’s set up Shopify to collect those taxes.

Step 2: Set Up Sales Tax in Shopify

With your nexus determined, it’s time to configure Shopify to collect taxes where required. This process is simple when broken down into steps.

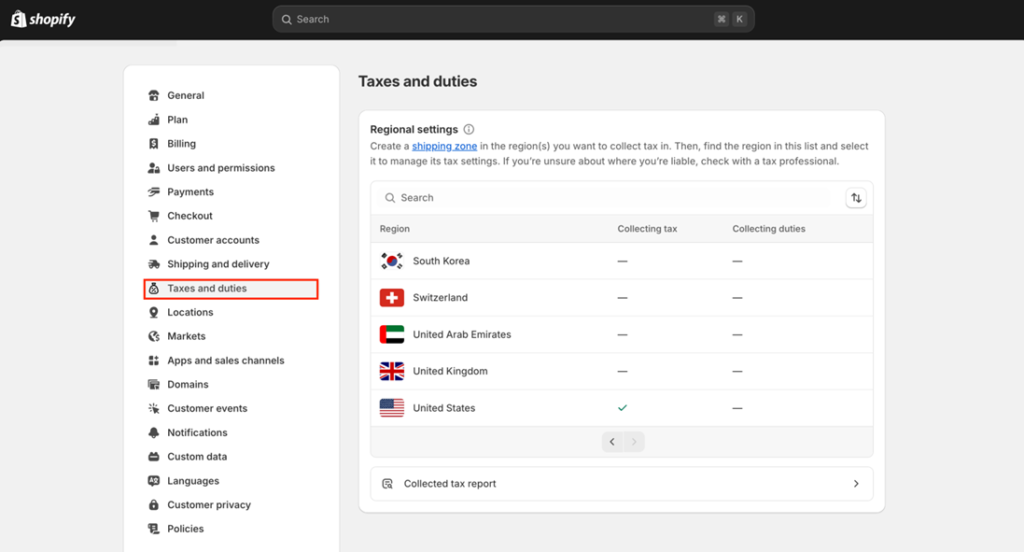

Navigate to Settings > Taxes and duties to access this screen where you’ll enable tax collection for regions where you have nexus. Notice the United States is already enabled (green checkmark) while other countries are disabled (dashes).

Get Your Tax Permits First

Here is how you can get tax permits:

- U.S.: Go to your state’s tax website, like Texas Comptroller or California CDTFA and give them your business name, address, EIN (your U.S. tax ID), and a guess at your sales volume; it’s a standard signup.

- Canada: If your sales top $30,000 CAD, head to the CRA website for your GST/HST number.

Keep these IDs handy since you’ll need them soon. Don’t have them yet? Visit your state’s tax site for the U.S. or the CRA for Canada.

Add Permits to Shopify

Head to Shopify tax settings in your admin panel at Settings > Taxes and Duties. Pick your country (U.S. or Canada), click “Collect Sales Tax,” choose your state or province from the list, enter your tax ID, and Shopify loads the right rates—like 8.19% for Texas or 5% GST for Alberta.

🌟 Pro Tip: Check rates with official sources. California’s 7.25% can go up to 10.25% in some places, and BC’s 5% GST hits 12% with PST if you’re asking for sales. Look at your tax authority’s site to stay right.

Adjust for Special Cases

- Exemptions: Selling kids’ clothes in New York? Stuff under $110 skips tax. Go to Tax Rates and Exemptions, pick Add Product Override, choose your items, set rate to 0%.

- Digital Goods: Over 30 states tax downloads—New York does, Texas doesn’t. Add rates for digital stuff where it applies.

- Exempt Buyers: For resellers or nonprofits, go to Customers, find their info, uncheck “Collect Tax.”

Test Your Setup

Try adding stuff to your cart, like a $50 hoodie, and set shipping to a place with nexus, like Ontario; you should see 13% HST added, which is $6.50. Then change shipping to a spot with no nexus, like Montana, where there’s no state tax, so no extra cost should show up.

If taxes don’t line up, fix your settings. It’s a fast check to make sure it’s right.

➜ Read more: “How to File Sales Tax in the US”

Step 3: Collect and Track Shopify Sales Tax Reports

Your setup is working—Shopify grabs taxes at checkout. Let’s look at how this happens and how you keep track.

How Shopify Collects Taxes

Shopify adds tax at checkout based on your store’s spot, where you ship, and what’s sold. A $50 shirt to Quebec gets $7.49 added (14.975% GST and QST). It uses the shipping address to get it right, doing it all if your nexus and rates are set.

Tracking What You’ve Collected

Check Analytics > Reports > Taxes in your Shopify admin to see totals, like $1,700 from California or $900 from British Columbia. If you use Shopify Tax (U.S. only, costs extra), it breaks it down by county and city.

“Shopify Tax cut my filing time to 15 minutes,” says Caleb Benoit, Connect Roasters. Reports make it easy.

Step 4: Report and Pay Shopify Ecommerce Sales Tax

Collecting taxes is just the beginning—you must also remit these funds to the appropriate authorities.

Filing and Payment Process

- U.S.: Use your state’s tax site (e.g., NY Tax), put in Shopify report numbers, pay—monthly ($100-$20,000), quarterly, or yearly depending on how much you collect.

- Canada: Send GST/HST to the CRA, quarterly or yearly based on your sales.

Deadlines are usually the 20th or last day after your period, like January 20th for yearly—check your local rules to stay on time.

Example: Lisa in California collects $2,000 every three months, uses CDTFA, and finishes in 20 minutes—shows how fast it can be when set up right.

Step 5: Tackle Shopify Seller Taxes (Income Tax)

Beyond sales tax, your business profits are subject to income taxation. Here’s how to manage this aspect effectively.

Reporting Your Business Income

- U.S. Sole Proprietors: Complete Schedule C with Form 1040. List your sales, deduct expenses, and the resulting net profit will be subject to 15.3% self-employment tax.

- Canadian Sole Proprietors: Use form T2125 with your personal tax return. There’s no separate self-employment tax, just standard income tax on your business earnings. Our cross-border tax accountants in Toronto can manage both domestic and U.S. sales to ensure compliance in both countries.

- Corporations: U.S. businesses use Form 1120, while Canadian companies file Form T2, with rates such as 15% on the first $500,000 CAD for Canadian corporations.

If you use Shopify Payments and make over $600 in gross payments in 2025, Shopify sends you a 1099-K by January 31, 2026, for U.S. income tax reporting (e.g., Form 1040 or 1120). Under that, or with other payment systems, use Shopify reports from Step 3 to track income.

Quarterly Payments

Without regular paycheck withholding, you’ll need to make periodic tax payments:

- U.S.: If you expect to owe more than $1,000, submit estimated payments on April 15, June 15, September 15, and January 15 (2026).

- Canada: If you’ll owe over $3,000 CAD annually, follow the same quarterly schedule.

🌟 Pro Tip: Missing payments can result in penalties—5% per month in the U.S. Add these dates to your calendar or set reminders to avoid unnecessary costs.

➜ Read more: “U.S. Subsidiary of Canadian Company Taxes”

Step 6: Save with Deductions

This is where you can significantly reduce your tax liability. Deductions lower your taxable income, keeping more money in your business.

What You Can Deduct

- Shopify Fees: Your monthly subscription ($29 to $299) plus transaction fees (2.4-2.9% + $0.30 per sale) are fully deductible.

- Home Office: If you have a dedicated workspace at home, U.S. sellers can claim $5 per square foot, up to $1,500 for 300 square feet. Canadian sellers can deduct a portion of rent or utilities if it’s your primary workspace.

- Advertising: Marketing expenses typically consume 15-30% of revenue—Google Ads, influencer partnerships, and other promotional costs can all be deducted.

- Shipping: Postage, packaging materials, and shipping supplies (averaging 8-15% of revenue) all qualify as deductions.

Studies show 61% of sellers mess up without records, costing $1,700 each time—use QuickBooks or a folder to keep it together!

Example: Jake in Texas makes $80,000 selling tees. He spends $15,000 on Shopify and shipping, leaving $65,000. He takes off $1,500 for his home office and $4,000 for ads—$5,500 total—dropping his taxable cash to $59,500, saving him money.

Banking Tip: Keep two accounts: one for daily business, another for taxes and investments. For U.S. sales, get a U.S. dollar account with your Canadian bank (CIBC, TD or BMO) to avoid conversion costs. I skip RBC since clients say it’s slow.

Case Study: Calgary Seller’s Deduction Discovery

The Problem: A Calgary-based jewelry maker came to me stressed about their profits. Their Shopify store was generating $250,000 in annual revenue, but after paying 21% in U.S. federal tax plus income tax in Canada, they felt they were barely staying afloat.

What We Did: I reviewed their books and immediately spotted several missed opportunities. In my experience, we find this pattern with 60% of new clients. We properly documented their home office ($1,500), Shopify subscription fees ($1,800), digital advertising costs ($35,000), and shipping supplies ($22,000)—all legitimate expenses they hadn’t been tracking.

The Result: Their taxable income dropped by nearly $60,000, saving approximately $12,600 in U.S. taxes and reducing their Canadian tax bill as well. With their newfound tax savings, they expanded their product line, increasing revenue by 30% the following year.

Step 7: Handle Special Cases—Dropshipping and Digital Goods

Dropshipping or digital goods have different rules, let’s go over them.

Dropshipping Taxes

When you dropship, taxes work a bit differently because someone else ships your stuff. Here’s what you need to know:

- Nexus: Even with dropshipping (suppliers ship for you), you collect tax. Supplier in Ohio, you in California, $120,000 to Texas—Texas limit is $500,000, so you’re okay, but watch other states.

- Customs: Stuff brought in over $800 U.S. or $20 CAD gets duties—customers pay or you add it to prices.

- Resale Certificates: Skip supplier tax—36 U.S. states let you use these.

Digital Goods Taxes

Selling digital products introduces different tax considerations:

- U.S.: More than 30 states tax digital downloads—New York applies 8.52%, while Texas exempts them.

- Canada: GST/HST applies to digital products nationwide—5% in Alberta, 13% in Ontario, without exceptions.

- Implementation: In Shopify, go to Tax Rates and Exemptions to set special tax rates for your digital products based on where your customers live.

Step 8: Avoid Common Tax Traps

Mistakes can mess you up—here’s how to dodge them.

Missing Nexus

Selling $200,000 to Ohio without a permit means back taxes and fines. Shopify’s nexus tracker warns you at 80%, so use it to spot when you hit limits and get a permit before you owe too much.

Charging Wrong Rates

Charging 6% in Texas when it’s 8.19% means customers pay too much or you lose cash. Check Taxes and Duties every few months to match rates, then update them in Shopify to keep it right.

Keep Your Records Straight

No records mean problems since 23% get audits and 61% mess up without them, costing $1,700 on average. Use QuickBooks or folders to track everything, so you’re ready if the tax folks check you out. Also you can consider our professional bookkeeping services in Toronto to avoid costly mistakes.

Skipping Quarterly Payments

If you owe $4,000 and miss June, you get a $200 fine plus 5% more each month in the U.S. Mark April 15, June 15, September 15, and January 15 (2026) on your calendar and pay on time to skip the penalties.

➜ Read more: “6 E-Commerce Accounting Errors That Could Cost You Thousands.”

Step 9: Use Tools to Make It Easier

Tools and pros help a lot, here’s how!

- Shopify Tax: U.S., $50-$75 to file, right rates.

- Reports: CSVs from Analytics > Reports > Taxes.

- Nexus Tracker: Warns at 80%, 100%.

Get pros when you need them! SAL Accounting helps Shopify sellers—nexus, filings, cuts audits by 87%. Contact us now!

Your 2025 Tax Calendar

April 15: Q1 (Jan-Mar), U.S. Form 1040.

June 15: Q2 (Apr-May).

September 15: Q3 (Jun-Aug).

January 15, 2026: Q4 (Sep-Dec).

State/Province: Often Jan 20th or last day.

Keep It Simple, Stay Compliant

Taxes don’t have to be tough – you’ve got the know-how and tools to handle Shopify tax well! Handle Shopify ecommerce sales tax with nexus, use Shopify sales tax reports to track and send taxes, manage Shopify seller taxes, and max out deductions. This keeps you legal, saves your profits, and makes checkout smooth for customers. With 42% of sellers worried about taxes, you’re not alone, but this guide gives you confidence.

Need help? SAL Accounting’s services for Shopify sellers cut audit risks and save time. Questions? Contact our ecommerce accountant and book a free consultation for free!

FAQs for Shopify Sellers

Yes, collect sales tax where you have nexus and pay income tax on profits. U.S. sole proprietors use Schedule C, Canadians use T2125, and corporations file separately. All Shopify income is taxable, regardless of whether you receive tax forms. For specific information on cross-border taxation, read our article on How Does The Tax Treaty Work Between Canada And The US?

Shopify calculates and tracks sales tax but doesn’t file or remit payments. You’re responsible for submitting collected taxes to authorities. Shopify Tax (premium U.S. feature) offers additional filing assistance but doesn’t eliminate your responsibility.

Nexus is a connection to a jurisdiction that creates tax collection obligations. This can be physical (office location) or economic (sales volume exceeding thresholds). The 2018 South Dakota v. Wayfair decision significantly expanded economic nexus requirements, affecting most online sellers.

U.S. sole proprietors use Schedule C with Form 1040; Canadians use T2125. Submit quarterly payments if liability exceeds $1,000 U.S. or $3,000 CAD. Your Shopify sales reports, along with any provided tax forms, form the basis for your income reporting.

Deduct Shopify fees, home office expenses, advertising costs, shipping expenses, website fees, and business travel. Maintain comprehensive records to support these deductions in case of audit. Strategic tax planning can significantly reduce your overall tax burden.

Yes, if you use Shopify Payments and exceed $600 in gross payments during 2025, you’ll receive a 1099-K by January 31, 2026, for U.S. tax reporting. However, you must report all income regardless of whether you receive this form.