Have you ever checked your bank account after a busy week of sales, only to find your Shopify deposit is less than what you expected? This is a common frustration. The difference between what you see in your Shopify dashboard and what arrives in your bank can be confusing.

Recent research shows that businesses spend 25 hours each week on manual data entry and matching data between different apps. This ecommerce reconciliation guide will help you understand how to reconcile Shopify payouts, master Shopify sales matching, and use tools that make Shopify accounting reconciliation faster.

In this guide, you will learn how to reconcile Shopify payouts step by step, how to spot problems, and which tools can make Shopify accounting reconciliation faster. This guide from SAL Accounting keeps things simple so every Shopify seller can understand and act.

Key Takeaways

- Net deposits are less than gross sales – Shopify deducts fees, refunds, and chargebacks before paying you.

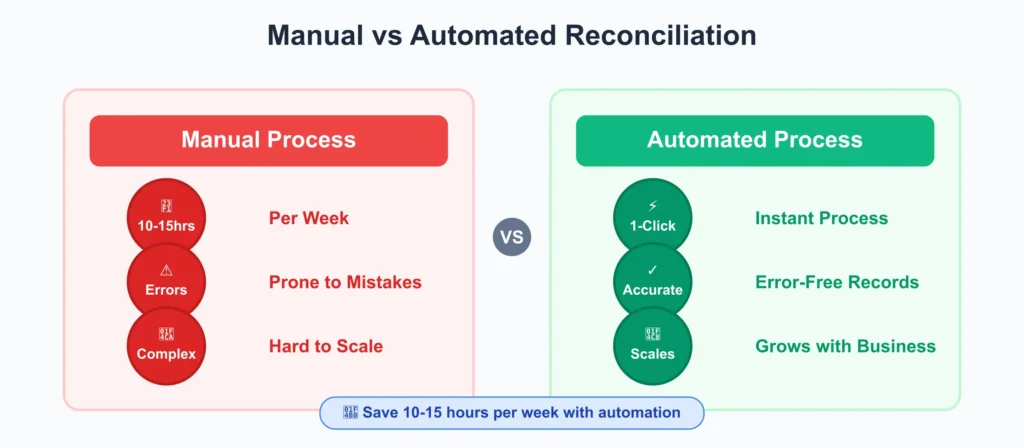

- Manual reconciliation wastes 10-15 hours weekly – Prone to errors and difficult with multiple payment gateways.

- Automation tools save massive time – A2X, Link My Books, and Synder auto-match transactions in clicks.

- Tax compliance matters – Canada: track GST/HST over $30K. U.S.: manage state sales tax per jurisdiction.

- Reconcile monthly minimum – Weekly or daily for high-volume stores to catch issues early.

What Are Gross and Net Payouts in Shopify Accounting Reconciliation?

When you work on Shopify accounting reconciliation, you might notice your Shopify dashboard shows gross sales. This is the total amount customers paid. But your bank usually gets a smaller amount, called the net deposit. Why? Shopify takes out different fees before sending money to you. These fees can include transaction and processing fees, refunds, chargebacks, app subscriptions, and currency conversion costs.

To keep your records clear, start with your net deposit from Shopify. Then, add each type of fee or deduction as its own expense in your books. Doing this helps you see your real sales totals, understand all your business costs, and learn what it really takes to run your online store.

Why Is Manual Shopify Accounting Reconciliation Difficult?

Doing Shopify accounting reconciliation by hand can be tough. Here’s why:

- Takes a lot of time: Many sellers spend 10–15 hours each week trying to match Shopify deposits to their sales. That’s time you could spend on growing your business.

- Easy to make mistakes: Entering data manually means it’s easy to miss something or make an error. These mistakes can lead to problems with your financial reports and taxes.

- You get less detail: Shopify often groups several days’ worth of sales, refunds, and fees into one payment. This makes it hard to spot problems with individual orders.

- More complex with several payment gateways: If you use PayPal, Stripe, and other options alongside Shopify Payments, you have to go through the process separately for each one. It can be confusing to match each deposit to its correct sales.

- Taxes are harder: If you manually separate sales tax for different regions, it’s easy to make a mistake or miss something, especially if you sell in several areas.

Pro tip: Start with your biggest deposits first. It helps you catch major problems quickly before spending time on smaller transactions. Consider working with our ecommerce accountants in Toronto to avoid these issues.

How to Manually Reconcile Shopify Payments: A Simple Overview

Here’s how you can manually match your Shopify payouts with your business accounts:

Step 1: Collect Your Reports

Download your bank statements and Shopify payout reports for the time you want to check. If you use other gateways like PayPal or Stripe, get their reports too.

Step 2: Compare Deposits

Match the net deposit amounts in your bank account to the net payouts listed in Shopify. Remember that deposits may take 1-3 business days to appear, so account for timing differences.

Step 3: Break Down the Deposit

For each deposit, create a detailed record that shows total sales, all fees, any refunds, and what you actually received. Don’t just label it as “Sales.” This ensures your records show both actual revenue and processing costs.

Example for a $970 deposit from $1,000 sales:

| Account | Debit | Credit |

| Bank Account | $970 | |

| Shopify Fees | $20 | |

| Processing Fees | $10 | |

| Sales Revenue | $1,000 |

Total: $1,000 debits = $1,000 credits ✓

Note: To record Shopify sales deposit of $970 from $1,000 in gross sales, net of platform fees ($20) and payment processing fees ($10).

Step 4: Fix Any Differences

If the numbers don’t match, look for timing issues, refunds, chargebacks, or currency adjustments. Make corrections until everything lines up.

Following this process means your records will accurately show both what you earned and all the costs your business faced.

How to Automate Shopify Payment Reconciliation?

If you want to know how to reconcile Shopify payouts faster, automation is a great solution. Automation tools can save hours of manual work and easily handle growing transaction volumes.

How Automation Tools Help

Automation tools link your Shopify store to popular accounting software like QuickBooks or Xero. You can check our comprehensive Shopify accounting software guide for detailed comparisons. Here is how most of them work:

- They pull in detailed transaction data for each payout, including all sales, fees, and refunds.

- They create the right accounting entries automatically.

- They match Shopify deposits with your bank records or other gateway payouts.

- You can often finish the reconciliation process with just a click, saving you hours.

For hands-off management, our virtual bookkeeping experts can handle all reconciliation tasks for you. Now, let’s look at the best automation tools available for Shopify sellers.

Top 4 Automation Tools for Shopify Sellers

Here are some great options for Shopify payment reconciliation and ecommerce reconciliation:

A2X

A2X creates summary entries for each time Shopify pays you. This tool is good for sellers who want detailed records and need help matching Shopify with their bookkeeping software.

Synder

Synder gives you real-time updates and handles different currencies. This is especially helpful for merchants with international sales or who use several payment services.

Link My Books

Link My Books connects to Xero and QuickBooks, handles taxes automatically, and can manage multiple stores in one place. This saves you a lot of time each month.

Amaka

Amaka summarizes your daily sales and keeps your Shopify payout records up to date with very little effort from you.

Tip: Xero and QuickBooks have basic Shopify connections, but you may still need manual work. Using one of these connector apps usually gives you smoother, faster reconciliation.

How to Stay Compliant with Tax Reconciliation in Canada and the U.S.?

Tax rules make Shopify payment reconciliation even more challenging, and they change depending on where you sell.

Canadian Sellers (GST/HST)

In Canada, you must register for GST/HST if your annual sales are more than $30,000 CAD. To stay on the right side of the law, your Shopify accounting reconciliation needs to:

- Clearly show the GST/HST collected on sales and shipping.

- Make sure you set up your tax settings for each product and province in Shopify.

Keeping this information organized is important when filing with the Canada Revenue Agency.

Tip: Tools like Link My Books can automatically break out GST/HST amounts and make tax time easier.

U.S. Sellers (State Sales Tax)

U.S. sellers have to deal with state sales tax rules. You usually have to collect tax in a state if you make at least $100,000 in sales or have 200 transactions in that state (understand sales tax nexus requirements) in the past year.

Shopify collects sales taxes if you set it up correctly, but you are still responsible for filing tax returns and sending payments to each state yourself.

Use Shopify’s Sales Tax Report to check the amounts you need for filing. It can get complicated to track everything across multiple states.

Tip: Automation tools like QuickBooks and Link My Books can help by sorting and tracking the taxes for each state automatically.

Top Shopify Reconciliation Challenges and Solutions

Managing Shopify payments can be tough, especially as your store grows. Here are some common e-commerce reconciliation problems and tips for better Shopify sales matching.

1. Multiple Payment Gateways

Using more than one payment processor, like Shopify Payments, PayPal, or Stripe, makes reconciliation harder. Each one has different fees, payout times, and reports. It’s hard to match deposits when sales come from different gateways.

Solution: Use separate bank accounts for each gateway and reconcile them on different days. This stops you from mixing up deposits from different sources.

2. International Sales

Selling to customers in other countries means dealing with currency conversion fees, exchange rate changes, and different payout schedules. This makes it hard to know exactly what you earned.

Solution: Track exchange rates on the day of each sale and record conversion fees as separate costs. Set up different accounts for each currency in your books.

3. Subscription and Recurring Payments

Stores with subscriptions have special problems. You need to handle failed payments, customers changing plans mid-month, and tracking revenue when people upgrade or downgrade.

Solution: Use Shopify’s subscription reports and create separate tracking for upgrades and downgrades. Set up alerts for failed payments so you catch problems quickly.

If these challenges sound hard, don’t worry. You can ask our ecommerce bookkeeping team to help with all your ecommerce reconciliation needs. We’ll help make your Shopify sales matching process easy, no matter how complicated things get.

Conclusion

In this ecommerce reconciliation blog, we explained why payment reconciliation matters for every online business. Manual reconciliation is possible, but it is slow, open to mistakes, and hard to maintain as your business grows.

Using automation tools makes payment reconciliation and Shopify sales matching faster and more accurate. Your records will be organized, your cash flow will be easier to manage, and you’ll be ready come tax time. With automation handling your reconciliation, you can save 10 to 15 hours a week and put that time toward growing your store.

You deserve clear insight into your finances with less risk. Reach out to our Shopify accounting experts for a free consultation on which reconciliation solution is best for your business.

Frequently Asked Questions

This is the process of matching your Shopify sales with your bank statements and accounting software. It helps make sure every transaction is correctly recorded so your financial reports are accurate.

Check the net deposits in your bank. Compare them to Shopify payout reports. For each payout, record the total sales, subtract all fees and refunds as expenses, and make sure the numbers match.

Yes. Apps like A2X, Link My Books, and Synder connect Shopify to QuickBooks or Xero. They automatically bring in transactions, sort out fees, refunds, and support multiple payment gateways. This saves you time and reduces errors.

Set up separate categories for each fee and refund type in your accounting software. Use Shopify’s detailed payout reports to record each fee and refund accurately.

No, Shopify does not reconcile payments for you. You get the data and reports, but you need to match payouts with your bank and organize your financial records yourself or use an automation tool.

It’s a good idea to reconcile your transactions at least once a month. If your business is growing quickly or handles a lot of sales, reconciling every week or even every day can help you spot problems early.