Canadians moving to the U.S., U.S. citizens with Canadian investments, or dual citizens filing U.S. taxes face tricky cross-border tax rules. You must report T5 slip income on your U.S. tax return. About 1.5 million U.S. tax returns claimed foreign tax credits, many for Canadian T5 income (IRS, 2023). This shows a growing need for clear guidance.

That’s why we at SAL Accounting put together this simple guide to report Canadian T5 on Form 1040. Let’s go through each step together, from start to finish.

Quick Takeaways

- T5 slip income, like interest or dividends, must be reported on Form 1040 for U.S. taxes.

- Convert T5 amounts from CAD to USD using the IRS yearly average exchange rate.

- Report Box 13 interest on Schedule B, Part I, and Box 11/25 dividends on Part II.

- Use Form 1116 to claim a credit for the 15% Canadian tax withheld on T5 dividends.

- File by April 15, or June 15 if abroad, and pay taxes by April 15 to avoid penalties.

What’s a T5 Slip and Why Does It Matter for U.S. Taxes?

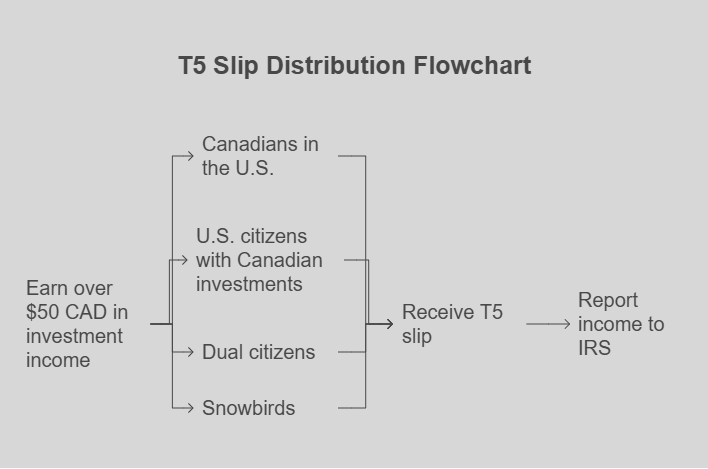

A T5 slip comes from the CRA. It shows Canadian investment income, like interest or dividends, over $50 CAD (According to CRA’s T5 guideline). Banks send it through the CRA. U.S. citizens or residents must report it to the IRS, which tracks all income, including from Canada. The T5 slip helps you claim tax credits to avoid double taxation. Consult our cross-border tax accountant to get it right.

Who Gets a T5 Slip?

The CRA sends T5 slips to anyone earning over $50 CAD in Canadian investment income. If you file U.S. taxes, this is an important step. Here’s who gets one:

- Canadians in the U.S.: If you moved to the U.S. but kept Canadian bank accounts, you’ll get a T5 for interest or dividends.

- U.S. citizens with Canadian investments: If you own Canadian stocks or funds, you’ll receive a T5.

- Dual citizens: If you file taxes in both Canada and the U.S., you must report T5 income to the IRS. It is a key consideration for US-Canada dual citizenship taxes.

- Snowbirds: Retirees with Canadian accounts, like GICs at BMO, get T5s for their income.

What Are Types of Income on a T5 Slip

A T5 slip lists different types of investment income. Each type goes in a specific spot on your U.S. tax forms, usually Schedule B of Form 1040. Here’s what you’ll find:

- Interest (Box 13): Cash from savings accounts, bonds, or GICs. Report this on Schedule B, Part I.

- Dividends (Boxes 11, 25): Money from Canadian companies. Eligible dividends (Box 25) might get lower U.S. tax rates. Non-eligible dividends (Box 11) get taxed normally. Put these on Schedule B, Part II. See how to report Canadian income on a U.S. tax return for more.

- Capital Gains Dividends (Box 18): Capital gains dividends come from mutual funds or trusts. Report them on Schedule D.

- Foreign Income (Box 15): Money from non-Canadian sources. The IRS keeps a close eye on this. Convert all amounts to U.S. dollars. Use an IRS-approved rate, like the yearly average currency exchange rates from the IRS (here).

- Read More: “7 Canada US Tax Treaty Benefits You Need to Know”

This table outlines T5 slip income types and their corresponding U.S. tax forms:

| T5 Box | Income Type | Description | U.S. Tax Form |

| 13 | Interest | From savings accounts, bonds, GICs | Schedule B, Part I (Form 1040) |

| 11 | Non-Eligible Dividends | From Canadian companies, taxed normally | Schedule B, Part II (Form 1040) |

| 25 | Eligible Dividends | May qualify for lower U.S. tax rates | Schedule B, Part II (Form 1040) |

| 18 | Capital Gains Dividends | From mutual funds or trusts | Schedule D (Form 1040) |

| 15 | Foreign Income | Non-Canadian sources, convert to USD | Form 1040, links to Form 1116 |

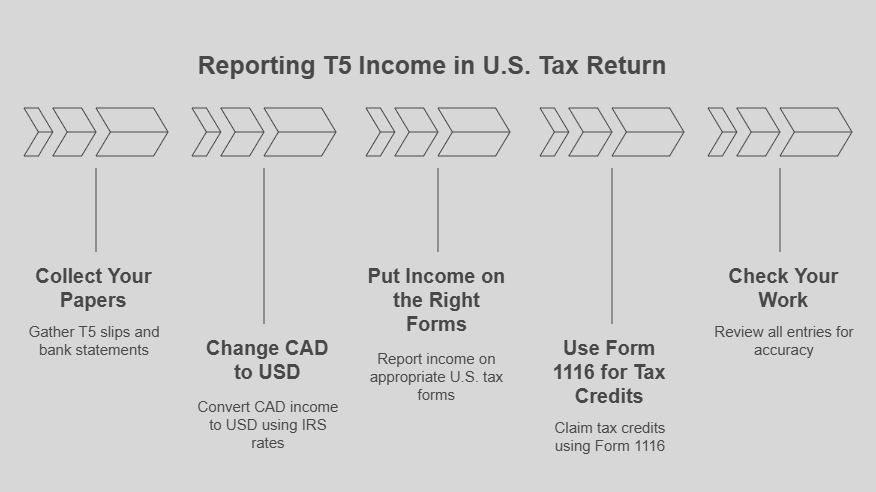

How to Report T5 in the U.S. Tax Return: Step-by-Step Guide

The following five simple steps will help you report T5 income correctly and stay on track with IRS rules. You can also check the form below:

- Collect Your Papers

Get your T5 slips. Banks like RBC or TD send them through the CRA for income over $50 CAD. If you can’t find your T5 slip, check CRA’s My Account or call your bank. Collect bank statements to confirm interest or dividends. Find 2025 IRS exchange rates on IRS.gov or the Federal Reserve. Keep all documents in a folder.

Example: Sarah, a Canadian in the U.S., gets a T5 from TD for $1,000 CAD dividends. She downloads it from CRA’s My Account. She gathers TD statements and saves the IRS exchange rate.

Pro Tip: Make a tax folder now. Put T5 slips, bank statements, and IRS rates in it. Keep it digital or paper. Find documents fast when filing.

- Change CAD to USD

The IRS wants income in U.S. dollars. Change your T5 amounts from CAD using the IRS yearly average rate or Federal Reserve rate. Don’t use daily rates. They make things tricky. Multiply your CAD by the rate and save the source for audits.

Example: Sarah’s T5 shows $1,000 CAD dividends. The IRS rate is 0.74 USD/CAD. She multiplies: $1,000 × 0.74 = $740 USD. She puts this in a spreadsheet and saves the IRS rate.

- Put Income on the Right Forms

Check your T5 income and report it on the correct U.S. forms. Here’s where each box goes:

- Box 13 interest from savings or bonds goes on Schedule B, Part I of Form 1040.

- Box 11 and 25 dividends go on Schedule B, Part II, and Box 25 may qualify for a lower tax rate.

- Box 18 capital gains go on Schedule D.

- Box 15 foreign income goes on Form 1040 and links to Form 1116.

This ensures IRS compliance.

Pro Tip: Look at your T5 dividend boxes. Box 25 might save you money with lower rates. Box 11 gets normal tax. Check twice to avoid mistakes.

Example: Sarah’s T5 has $1,000 CAD in Box 25 (dividends). She changes it to $740 USD and puts it on Schedule B, Part II. She knows Box 25 might get a lower tax rate.

- Use Form 1116 for Tax Credits

Canada takes a 15% tax on T5 income like dividends, thanks to the U.S.-Canada treaty, a key aspect of taxes for U.S. citizens working remotely for Canadian companies. Use Form 1116 to get tax credits and avoid paying twice. List the withheld taxes. Call the income passive. Figure out the credit. Don’t let it be more than your U.S. tax on that income.

Pro Tip: Try tax software for Form 1116. It guides you step-by-step. Enter your T5 withheld taxes and it will check if your credit fits. Less math, fewer errors.

Example: Sarah’s T5 shows $1,000 CAD dividends with $150 CAD withheld. She changes it: $150 × 0.74 = $111 USD. On Form 1116, she lists $111 USD as tax paid on passive income.

- Check Your Work

Check everything twice. The IRS and CRA share info, so mistakes can cause audits. Make sure T5 income is on the right forms. Use IRS exchange rates. Match bank statements to T5s.

In 2023, 12% of cross-border returns got flagged for errors. Tax software or a pro can find mistakes, especially with multiple slips. Get audit-proof T5 help from our non-resident tax accountant.

Deadlines and Penalties for Canadian T5 Slip U.S. Taxes

Missing deadlines or making errors can lead to costly penalties. Don’t worry; we’ve outlined the key dates and penalties clearly. Follow these guidelines to stay compliant with the IRS and CRA and keep your finances safe.

Key Filing Deadlines

To stay compliant with U.S. tax obligations, meet the appropriate filing and payment deadlines to avoid penalties.

- General Deadline: File your U.S. tax return by April 15.

- U.S. Citizens Living Abroad: You have until June 15 to file, with no additional forms required. However, taxes owed are due by April 15 to avoid penalties.

- Payment Deadline: Pay any taxes owed by April 15, regardless of filing deadline, to prevent interest and penalties.

Penalties for Late Filing or Payment

Missing deadlines or failing to report income, like T5 income, can lead to costly penalties. The IRS and CRA share data, so accuracy is critical.

- Late Filing Penalty: 5% per month on unpaid taxes, capped at 25%.

- Late Payment Penalty: 0.5% per month, also capped at 25%.

- Failure to Report T5 Income: Risks severe consequences, including audits and double taxation due to IRS-CRA data sharing.

How to Stay Penalty-Free

To avoid penalties, pay taxes by April 15, file by your deadline (April 15 or June 15 if abroad), and report T5 income accurately. Use reminders, tax software, or a professional. Correctly reporting T5 income prevents audits and saves you money, which is crucial for avoiding double taxation between U.S. and Canada too.

Pro Tip: Don’t wait until April. Talk to a tax pro early. They spot T5 errors fast. Fix issues before the IRS does.

Here’s a clear overview of U.S. tax deadlines and penalties for T5 income reporting:

| Category | Deadline/Penalty Details | Notes |

| Filing Deadline | April 15 (June 15 if abroad) | No extra forms needed for extension |

| Tax Payment Deadline | April 15, even with extension | Pay on time to avoid penalties |

| Late Filing Penalty | 5% per month, up to 25% of unpaid taxes | Applies to unreported T5 income |

| Late Payment Penalty | 0.5% per month, up to 25% of unpaid taxes | Avoid by paying by April 15 |

| Non-Reporting Penalty | Harsher penalties for unreported T5 income | IRS and CRA share information |

Common Mistakes to Avoid with T5 Dividends U.S. Tax Return

Small errors can lead to trouble with the IRS and CRA. Here’s a clear list of common mistakes and how to avoid them to keep your taxes smooth:

- Missing Documents: Forgetting T5 slips or bank statements can cause underreporting. Collect all T5s from the CRA, sent through banks like RBC, and statements to verify income.

- Wrong Currency Conversions: Using daily exchange rates leads to errors in USD reporting. Use the IRS or Federal Reserve’s yearly average rate. Save the source and track conversions in a spreadsheet.

- Misplacing Income Types: Putting T5 income on the wrong form creates issues. Check each box carefully.

- Skipping Form 1116: Canada withholds 15% tax on dividends. Not filing Form 1116 means paying double. List withheld taxes, mark income as passive, and verify calculations.

- Read More: “How to Report a T4, T4A, and T4A-NR on Your U.S. Tax Return”

Case Study: Dual Citizen Fixes T5 Tax Errors

Problem: A dual U.S.-Canadian citizen living in the U.S. contacted us. She holds Canadian mutual funds and got a T5 slip for $1,800 CAD in dividends. She put the dividends on the wrong tax form and used a daily exchange rate. The IRS charged a $200 penalty.

What I Did: We suggested moving the dividends to Schedule B, Part II. We recommended using the IRS rate (0.74) to convert to $1,332 USD. We advised filing Form 1116 for her $270 CAD withheld taxes.

The Result: The IRS waived her penalty. She saved $270 in credits. She now checks forms and rates with our help, avoiding IRS trouble.

Leverage professional cross-border tax accountant services to prevent T5 reporting errors.

Final Thoughts

Reporting T5 income on your U.S. tax return can seem tough. You need to do it to avoid IRS penalties or audits. Cross-border tax rules are tricky. So, getting it right matters. This guide walks you through every step to make it easier. A tax pro can lower your stress. They spot small mistakes and save you money.

And if you’re feeling unsure, we’ve got your back. Contact us at SAL Accounting for a free consultation. Your T5 reporting will be smooth!

Frequently Asked Questions (FAQs)

Yes. U.S. citizens or residents report T5 income, like interest or dividends, on Form 1040. The IRS wants all income, even from Canada.

Put T5 interest from Box 13 on Schedule B, Part I of Form 1040. Change it to USD with the IRS yearly rate.

Yes. Use Form 1116 to get credits for Canada’s 15% tax on dividends. This avoids double taxes.

Use the 2025 IRS yearly rate or the Federal Reserve rate. Skip daily rates to keep it simple.

Report T5 dividends from Boxes 11 and 25 on Schedule B, Part II. Box 25 might get a lower rate. Box 11 gets regular tax.

Yes. U.S. citizens report T5 interest from Canadian banks on Schedule B, Part I of Form 1040.

No. T5 income, like interest or dividends, is investment income, not earned income.

The Foreign Earned Income Exclusion covers only earned income, not T5 income. It’s up to $126,500 for 2025 for U.S. citizens abroad who qualify.