The Canada-U.S. border offers big real estate opportunities for investors. Stats say foreign buyers took 54,300 U.S. homes from April 2023 to March 2024. Canadians led with 13% of those deals. Both sides chase investment, retirement, or a new vibe. Cross-Border Real Estate Transactions? They get tricky fast.

That’s why we at SAL Accounting put together this guide. It breaks down cross-border property stuff, taxes, rules, financing, and more. Don’t skip this.

Quick Takeaways

- U.S. estate tax hits Canadians at 40% over $60,000—gift it before you go to save up to $96,000.

- Canada’s 25% rent tax on U.S. owners drops if you file for net income—keeps thousands yearly.

- FIRPTA holds 15% of your U.S. sale price—like $37,500 on $250,000—file Form 8288-B to get it back fast.

- Ontario’s 25% speculation tax adds $50,000 to a $200,000 buy—Alberta skips this cost.

- U.S. capital gains tax is 15-20% if you hold over a year, 37% under—saves you 17% on profit.

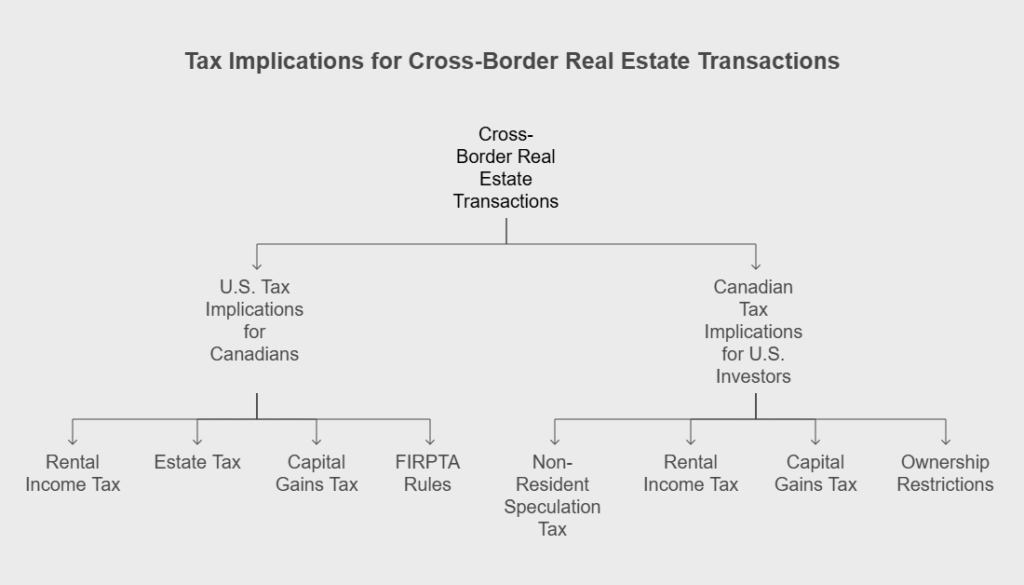

What Are Cross-Border Property Investment Transactions?

Cross-border real estate deals happen when a Canadian buys or manages property in the U.S. or an American does the same in Canada. These deals let you invest in, own, or manage property across the border. Canadians and Americans pick cross-border real estate for a few reasons:

- They tap into markets they can’t get at home, like cheap U.S. homes or special Canadian spots.

- They spread their cash across the border for bigger profits.

- They grab a place for vacations, retirement, or a new beginning.

But here’s the thing. These house deals aren’t like local ones. Taxes, laws, currency, and other stuff make them different. Let’s break it all down next. Consult with our cross-border tax accountant for expert tips and further help.

Tax Implications of U.S. Real Estate Transactions for Canadians

When Canadians jump into the U.S. real estate game, they hit taxes that don’t exist back home. U.S. laws set these rules, and they’re not just small fees. Mess up, and your investment could take a hit. Here’s what you’ll deal with.

1. U.S. Rental Income Tax for Canadians

Rent from your U.S. property means you owe 30% of the total cash before expenses. It’s the U.S. federal tax rate on rental income for foreign landlords like Canadians. Some states add their own tax, too (5-13% on that rent money). It stacks on top of the federal bite.

2. U.S. Estate Tax for Canadian Owners

If a Canadian owner dies with U.S. property, estate tax kicks in. Anything over $60,000 gets taxed up to 40%. Canada doesn’t do this. They base it on the property’s value at death, a detail lots of folks miss. Some states have extra rules you can explore on state government sites.

Pro Tip: Hand the property to the family while you’re around. It dodges that 40% estate tax. Team up with a pro to nail it.

3. The U.S. Capital Gains Tax For Canadian Owners

You pay U.S capital gains tax when you sell your property. Hold it over a year, and the rate is 15-20% of your profit. Flip it in under a year, and it jumps to 37%. Long holds save you cash, but quick sales sting more.

4. FIRPTA Tax Rules for Canadians Selling US Property

Buyers hold back 15% of the sale price, not just profit until you sort it with the IRS. This Foreign Investment in Real Property Tax Act (FIRPTA) rule targets foreign sellers like Canadians.

Pro Tip: Keep the U.S. property for over a year. You pay 15-20% on profit, not 37%.

- Read More: “Tax Implications for Canadians Owning US Property”

Example: Sarah, a Canadian, buys a U.S. condo for $200,000. She rents it out for $12,000 a year. The U.S. takes 30%. Two years later, she sold for $250,000 with a low tax rate. FIRPTA holdback cash ‘til filing. Living there gets her an exemption. She gifts it later at $300,000 to skip estate tax. Here are her taxes:

- Rent Tax: $12,000 rent. 30% to the U.S. = $3,600.

- Profit: $250,000 sale – $200,000 buy = $50,000.

- Gains Tax: 15% of $50,000 = $7,500.

- Exemption: Primary home? $50,000 profit = $0 tax.

- FIRPTA: 15% of $250,000 = $37,500 held.

- Estate Save: $300,000 – $60,000 = $240,000. 40% = $96,000 saved.

These figures show how tax rules shape Sarah’s journey.

Tax Implications of Canadian Real Estate Transactions for U.S. Investors

U.S. investors stepping into Canada’s real estate market face a tax system way different from the IRS setup. Canada throws extra costs and twists at non-residents. You need to know this stuff before diving in. Here’s the deal:

1. Non-Resident Speculation Tax for U.S. Owners

U.S. buyers in Canada may face the Non-Resident Speculation Tax. Ontario NRST charges 25% extra on the purchase price. British Columbia applies 20%. You pay this amount upfront, not on rent or sales. Canada uses it in busy markets to favor local buyers. Not every province has it.

Pro Tip: Choose provinces like Alberta. They avoid this extra tax.

2. Canada Rental Income Tax for Americans

Canada takes 25% of the total cash from your rental property as a withholding tax. You lose a quarter right off the top. To lower it, file to subtract expenses like repairs (see the CRA’s rental income guide for details). That’s how Canada deals with U.S. investors who don’t live there.

3. Canada Capital Gains Tax for U.S Residents

You pay Canada capital gains tax when you sell your place. Canada taxes 50% of your profit, called the inclusion rate. Unlike the U.S., where the full gain gets taxed at rates based on hold time, Canada’s 50% stays steady no matter how long you hold. Some spots, like Vancouver, add a 1% yearly tax if you leave it empty.

Pro Tip: Time your Canadian sale to max your cash. 50% tax is steady, but when you sell shifts the take-home.

4. Ownership Restrictions and Tax Overlaps in Canada

Canada skips a federal estate tax, unlike the U.S. But U.S. investors might still owe U.S. estate tax on Canadian property if it’s part of their estate. Some Canadian areas make it tough for foreigners to own property. If you move here and then leave Canada, departure tax hits 50% of the gain, even if you didn’t sell.

Pro Tip: Use a trust to dodge ownership blocks in Canada. It costs more but keeps you in the game.

Example: Mike, a U.S. investor, buys an Ontario condo for $200,000. He pays a 25% speculation tax. Rent is $12,000 yearly, and Canada takes 25%. He sells for $240,000 after two years. Canada taxes 50% of the profit. A trust skips ownership rules. He avoids departure tax. Here are the taxes:

- Speculation Tax: $200,000 × 25% = $50,000

- Rent Tax: $12,000 × 25% = $3,000

- Gains Tax: ($240,000 – $200,000) = $40,000 × 50% = $20,000 taxable; at 20% rate = $4,000 tax.

- Departure Tax: Avoided, else $40,000 × 50% = $20,000

U.S.-Canada Tax Filing for Cross-Border Real Estate Deals + Forms

You need to file the right stuff on time for real estate deals across the U.S.-Canada border. Otherwise, the tax folks will give you grief. Here’s a simple rundown of what forms to use and when to send them.

For Canadians with U.S. Real Estate

You need to tell the IRS about rent or sales cash from U.S. property, and these are the forms to use:

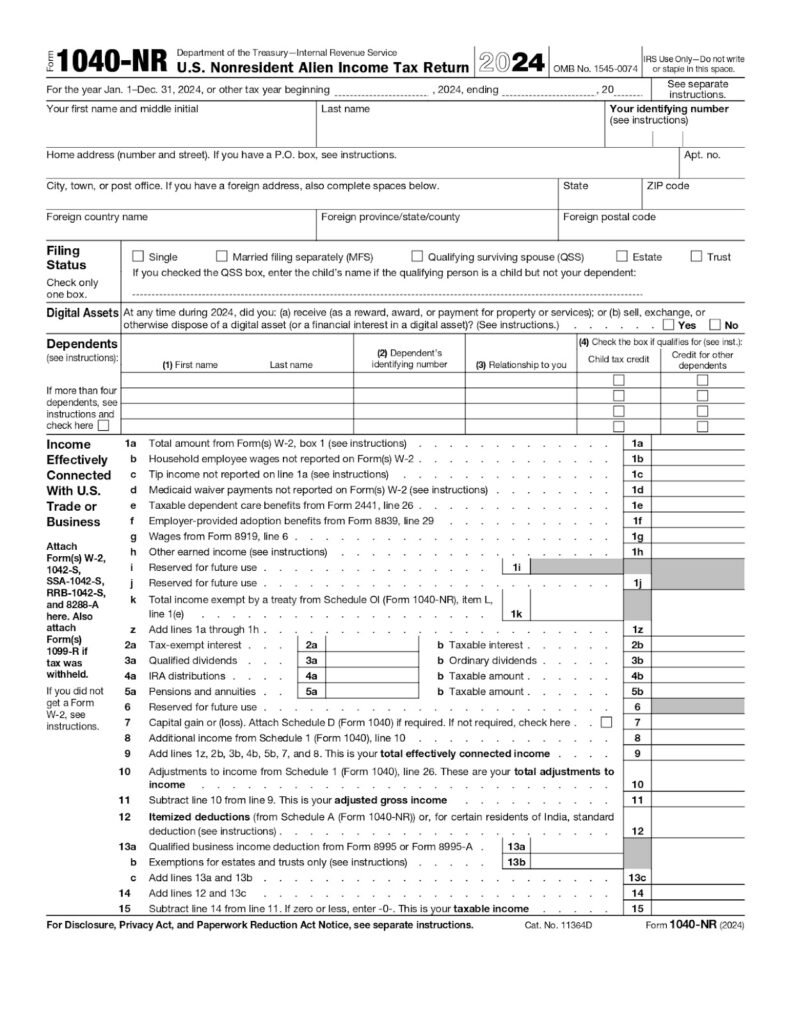

- Form 1040-NR (U.S. Non-resident Alien Income Tax Return)

File Form 1040-NR if you got rent or sold your U.S. property. It shows the IRS your money. Due June 15 next year for rent or sales. If you have U.S. wages, it’s April 15. Pay taxes by the deadline. If you need more time, send Form 4868 by then for six extra months. You’ll see the form below:

- Form 8833 (Treaty-Based Return Position Disclosure)

This form uses the Canada-U.S. Tax Treaty to stop double taxes, like rent hit in both places. Add Form 8833 to your 1040-NR. Due June 15, or April 15 with wages. Skip it, and you’ll pay more than you should.

- Form 8288-B (Withholding Certificate for U.S. Property Sales)

The buyer holds back 15% of the price under FIRPTA when you sell your U.S. place unless you file Form 8288-B. It proves your tax isn’t huge. Send it to the IRS before the sale. Takes weeks, so plan ahead, or wait for a 1040-NR refund.

- Form 706-NA (U.S. Estate Tax Return for Non-resident Not a Citizen)

If you pass away owning U.S. property valued over $60,000, your estate must file Form 706-NA. The tax takes 40% of the value above that amount. It’s due 9 months after death, or extend it 6 months with Form 4768. Late filing leads to quickly accumulating penalties.

Key Point: Some states (like California) might want extra tax on rent or sales. Figure 5-13% with forms like California’s 540NR. Due April 15 or June 15. Check your state. Missing it means late fees.

- Read More: “Transferring Money from Canada to U.S.”

For U.S. Investors with Canadian Real Estate

Got Canadian property? Here’s how you report rent or sales cash to the CRA and IRS—plus the key forms.

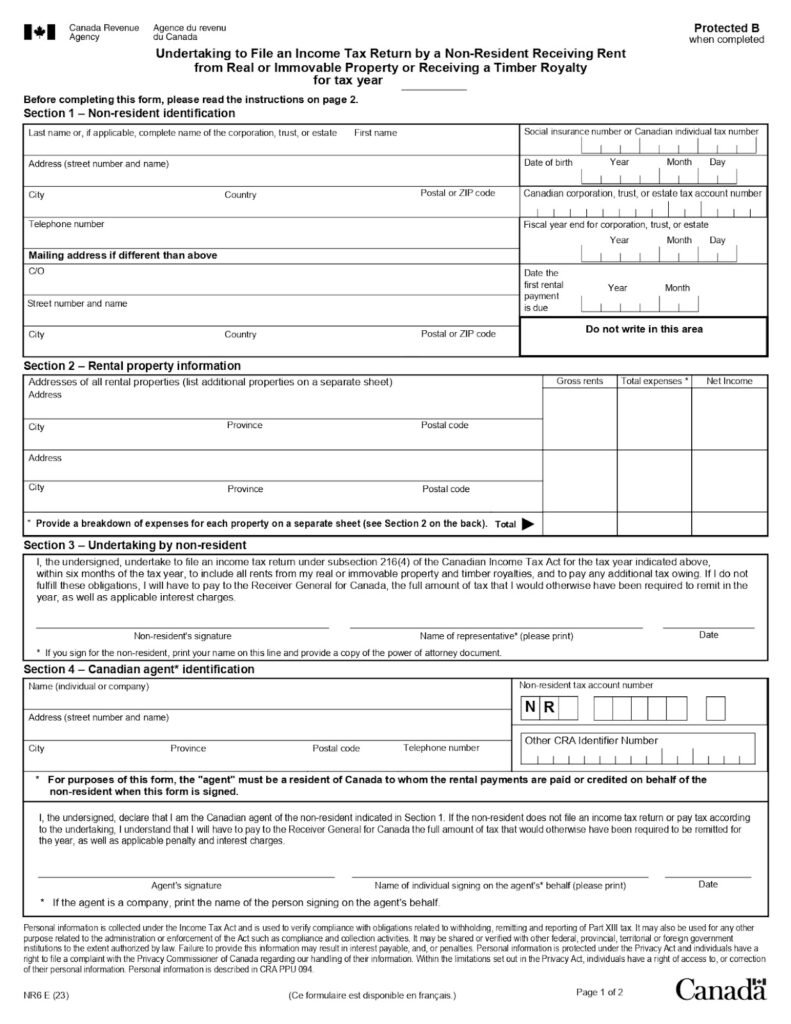

- Form NR6 (Undertaking to File an Income Tax Return by a Non-Resident)

File Form NR6 if rent comes from your Canadian property. It tells the CRA you’ll report net income later, drops the 25% withholding to something less. Send it before January 1 or your first rent payment. Miss it, and you’re stuck with 25% ‘til next year. The form’s right here for you:

- Form T1 (Income Tax and Benefit Return) with Section 216

File Form T1 with a Section 216 election for Canadian rent. It taxes only what’s left after expenses. It is due June 15 next year, like June 15, 2026, for 2025. Pay by then. No extensions unless you ask the CRA early.

- Form T2062 (Request for a Certificate of Compliance)

The buyer keeps 25% of the price when you sell your Canadian spot unless you file Form T2062. It clears your tax bill with the CRA. Send it before the sale or within 10 days after.

- Form 1040 (U.S. Individual Income Tax Return)

Report Canadian rent or sales to the IRS with Form 1040. Add Form 1116 to claim credit for CRA taxes (avoids double hits with the treaty). Due April 15 next year, or June 15 for foreign income only. Pay by April 15.

Key Point: The IRS wants more, like FinCEN Form 114 (FBAR) if your Canadian accounts go over $10,000 USD anytime in the year. Due April 15, with an auto-extension to October 15. Skip it, and fines start at $10,000. Stay on top of it, or you’ll pay.

- Read More: “Dropshipping taxes in Canada”

This is a quick guide to key forms and deadlines. Check the table below:

| Form | Purpose | Due Date | Penalty for Missing |

| 1040-NR | Reports U.S. rent or sales | June 15 (April 15 w/ wages) | 5% of tax/month, max 25% |

| 8833 | Stops double tax w/ treaty | June 15 (April 15 w/ wages) | Pay extra without credits |

| 8288-B | Cuts FIRPTA 15% holdback | Before sale | $37,500 held ‘til refund |

| 706-NA | U.S. estate tax over $60,000 | 9 months after death | Penalties stack fast |

| NR6 | Lowers Canada’s 25% rent tax | Before Jan 1 or 1st rent | Stuck with 25% withholding |

| T1 + Section 216 | Taxes Canada rent after costs | June 15 next year | 5% tax + 1%/month, max 12% |

| T2062 | Clears Canada sale tax | Before sale or 10 days | 25% of price held back |

| 1040 + 1116 | Reports Canada income to IRS | April 15 (June 15 foreign) | 5% of tax/month, max 25% |

| FinCEN 114 (FBAR) | Flags $10,000+ in Canada | April 15 (Oct 15 ext.) | Fines start at $10,000 |

Canada-U.S. Tax Treaty in Cross-Border Real Estate Investments

The Canada-U.S. tax treaty keeps your cash safe in cross-border real estate. It stops double tax from hitting the same money. You own property across the border. This deal makes it all click. We’ll break down how it helps with rent, sales, estates, and more.

- Stops Double Tax

Rent or sales cash flows in. Both countries eye a cut. The treaty steps in. You pay tax once, where the property sits. Credits handle the rest. Check out our guide on avoiding double taxation between the U.S and Canada.

- Fixes Rental Income

Rental money comes your way. Canada grabs 25% upfront. The U.S. takes 30%. The treaty offsets one against the other. No double loss happens.

- Smooths Out Sales

You sell your property. Capital gains tax kicks in. The U.S. hits the full profit (15-20% long-term). Canada takes 50% of it. The treaty credits your payment. The second country eases up.

- Dodges Estate Overlap

You pass with property. The U.S. estate tax bites at 40%. Canada skips that. The treaty ensures no double hit on cross-border value.

Example: Lisa, a Canadian, rents her U.S. condo for $10,000 a year. The U.S. takes 30%, but the treaty offsets it in Canada. She sells it for $200,000 after buying at $180,000. The U.S. taxes the profit, Canada skips it. Her $300,000 estate avoids double tax at death.

- Rent: $10,000 × 30% = $3,000 U.S. tax, credit in Canada.

- Gains: $200,000 – $180,000 = $20,000 × 15% = $3,000 U.S. tax.

- Estate: $300,000 × 40% = $120,000 U.S. tax, Canada skips.

Case Study: Dual Property Tax Triumph

Problem: Lisa from Ottawa reached out in October 2024 with a tax mess. Her San Diego condo ($15,000 USD rent in 2024) lost $4,500 USD to U.S. withholding, and her Ontario cottage ($3,000 CAD rent in Q4 2024) had $750 CAD withheld by Canada—double taxation loomed.

What I Did: I filed Form W-8ECI for the U.S. condo in November 2024, dropping her 2024 tax to $2,000 USD and Form 8833 to credit it in Canada in early 2025. For the cottage, I used Form NR6 in October 2024 to cut her Q4 2024 tax to $375 CAD after expenses, then filed Form 1116 in March 2025 to offset her U.S. tax.

The Result: Lisa’s 2024 tax fell from $5,250 to $2,375, saving $2,875 by April 2025. She’s thrilled with her cross-border cash flow now.

- Read More: “The Tax Treaty Between Canada And the U.S.”

Cross-Border Property Investment Transactions: Legal Essentials

You need to follow the other country’s rules when buying real estate across the Canada-U.S. border. We’ll walk you through what Canadians face in the U.S. and what Americans deal with in Canada.

Canadians Owning U.S. Property: Key Legal Stuff

U.S. property deals come with some must-know legal bits for Canadians.

- State Rules: Every state has its own property laws. Zoning, ownership limits, or HOA rules can vary a lot. Check the local regs.

- Title and Ownership: Make sure the title is clean. Use a U.S. title company. Liens, disputes, or sketchy ownership can mess up your buy.

- Visa and Residency: Owning a place doesn’t mean you can stay. Overstay a visitor visa (usually 6 months), and you’ll hit border trouble. Match your stay to immigration rules.

The U.S. Investors in Canada: Rules to Watch

Canada’s got its own legal hoops for Americans.

- Provincial Limits: Some provinces block foreigners from owning certain lands, like farms, to keep them Canadian. Look into it before you buy.

- Due Diligence: Dig into zoning, debts, and past owners. Canada’s system is different. Skip this, and your deal could flop. Check the CRA’s foreign reporting rules for extra steps

Hidden Costs of U.S.-Canada Property Deals

When buying or selling across the borders, watch out for sneaky costs. Here’s what you need to think about.

- Mortgage Challenges

Getting a loan across the border is tough. U.S. and Canadian banks don’t make it easy for outsiders. It can mean higher costs or no loan at all. Here’s the deal:

- U.S. banks often turn down Canadians. You need to live there, have a U.S. job, or put down 30-50%.

- Canadian banks do the same to Americans. They want proof you’re tied to Canada—like income or residency.

- Interest rates can hit 5-7%. Locals pay 3-4%.

- Higher rates mean bigger payments over time.

- Big down payments? You’ll need more cash ready.

Key Point: No loan means paying full price in cash. That ties up all your money in the property.

- Currency Swings

Prices use local cash: CAD in Canada and USD in the U.S. Exchange rates shift every day. Sometimes a lot. That can throw off your budget fast. Don’t lock in a rate? You’re guessing what you’ll pay. Even tiny changes hurt on big buys.

- Closing Costs

Buying a place, whether in the U.S. as a Canadian or Canada as an American, means closing costs. Here’s what they charge you:

- Title insurance makes sure it’s yours. It costs a chunk.

- Lawyers handle the paperwork. They take cash for every step.

- Property checks spot problems. You pay for those too.

These aren’t cheap. In the U.S., they’re 1-2% of the price. Canada’s about the same. Plan for them, or you’re in a bind.

- Tax Filing Costs

Owning property across the border means extra tax work. It’s more than just the tax bill. Here’s what you face:

- Hiring a tax pro can run $500 to $2,000 a year. Depends on how messy your papers are.

- Miss deadlines? Late fees hit $100 to $1,000 or more, based on how late you are.

- Mess up forms? Fixing it costs extra cash and hassle.

- Two countries mean double the paperwork. You might need paid storage or software.

Key Point: Sorting tax credits between the U.S. and Canada takes time. Double records might mean extra help or tools to keep it straight.

How to Minimize Taxes in U.S-Canada Cross-Border Property Deals

Cross-border real estate taxes can eat your cash. These pro tips shrink what you owe and keep you legal. Here’s how to roll.

- Go for Net Rental Income

Full rent tax takes a big chunk of your cash. You can switch to a system that taxes just your profit after subtracting costs like repairs. This keeps more money in your pocket right away.

- Play Smart with Sales

Hang onto U.S. property for over a year. You pay 15-20% on profit, not 37%. Canada takes 50% of the gain no matter the time. Waiting trims the U.S. bite.

- Tap the Treaty Yearly

Double tax is frustrating. Use Form 8833 for U.S. places or Form 1116 for Canadian ones every year. They credit what you pay across the border. You don’t lose cash twice. The IRS Canada tax treaty docs have all the fine print you need.

- Claim Deductions

Expenses cut your tax. Deduct repair costs, property management fees, and mortgage interest on U.S. or Canadian rentals. Track every penny. It lowers your net income tax big time. See how in the table below:

| Break | Where It Applies | What You Save | How to Get It |

| U.S. Primary Home Exclusion | U.S. Property | Up to $250,000 gain | Live there 2 years, sell as main home |

| Canada Principal Residence | Canada Property | Full sale profit | Use as primary home, no limit |

| Treaty Rent Credit | U.S. or Canada | 30% U.S. or 25% Canada | File Form 8833 (U.S.) or 1116 (Canada) |

| Foreign Tax Credit (U.S.) | U.S. on Canada income | Up to $4,000 (Mike’s case) | Report Canada tax on U.S. Form 1040 |

| California Property Tax Cap | California, U.S. | Limits tax to 1% value | Own as non-resident, check local rules |

- Grab Exemptions

Some breaks dodge tax entirely. In the U.S., exclude up to $250,000 of gain on a main home sale if you lived there for two years. Canada skips tax on your primary residence sale—no limit. Use these to skip the hit.

- Prep for Big Moments

Big life stuff needs a plan. Pass U.S. property to heirs before you go to dodge the 40% estate tax over $60,000. Skip moving to Canada, then bailing—it slaps a 50% tax on gains you didn’t sell. A pro nails these savings.

Need help with the taxes? Book a consultation with our real estate tax accountant at SAL Accounting.

Case Study: Phoenix Estate Tax Dodge

Problem: Tom, a Vancouver retiree, called us in January 2025 about his $1.5 million USD Phoenix home, bought in 2020. At 70, he feared a $576,000 USD estate tax for his heirs, and his $10,000 USD Q1 2025 rental income faced high taxes.

What I Did: I arranged a gift transfer to his daughter in March 2025, skipping the estate tax entirely, and filed Form W-8ECI in December 2024 to deduct $3,750 USD in Q1 expenses, cutting his rental tax from $3,000 USD to $1,875 USD.

The Result: Tom saved $576,000 USD for his heirs and $1,125 USD on Q1 rent tax. His family is thrilled about the tax-free inheritance.

Final Thoughts

Cross-border property investment transactions can be a goldmine for Canadians and Americans. You just need to nail the taxes and rules. Both sides have to stay on top of this stuff and watch out for updates to laws and rates. This guide breaks it all down for you. Grab some expert help if you still feel lost. We’ve got your back on the tough parts.

Ready to tackle your cross-border taxes? Contact us at SAL Accounting for a free consultation today!

Frequently Asked Questions (FAQs)

Yep, Canadians pay capital gains tax on U.S. property sales. Hold it over a year, you pay 15-20% of profit. Flip it fast, it’s 37%. Long holds save cash.

FIRPTA makes buyers hold back 15% of the sale price until you sort it with the IRS. It targets Canadians selling U.S. places. That’s cash you wait for.

Sure, Americans can buy Canadian property without living there. Some provinces block certain lands, like farms. Check the rules before you buy.

Cross-border deals mean extra tax work. File on time, or face grief. Tax pros cost $500-$2,000 a year. Miss deadlines and fees hit $100-$1,000.

Yeah, the treaty stops double tax for Canadians in the U.S. You pay once where the property sits. Credits keep your cash safe.

No fixed rate, varies by area. Ontario’s speculation tax is 25%, B.C.’s is 20%. Alberta skips it. Check local regs.