Small businesses in Canada fuel the economy, but many pay more tax than needed. The Canada Revenue Agency notes that a small business earning $500,000 in Ontario can save $71,500 annually (up to 54%) through the small business deductions. This guide shares clear, legal ways to how small businesses can minimize tax liabilities in Canada.

We at SAL Accounting explore deductions, credits, and smart business structures. Whether you’re a local startup or managing a cross-border venture, these tips help you keep more of your profits.

Tax Obligations for Small Businesses in Canada

Taxes can feel tricky for small business owners. Understanding them helps you cut taxes legally. In Canada, you’ll deal with income tax, GST/HST, and payroll taxes. For expert help, contact our small business tax accountant. We’ll also explain each simply:

1.Income Tax

Income tax takes part of your business profits (revenue minus expenses). Sole proprietors report it on personal tax forms; corporations file separately. Provincial rates vary for the first $500,000 (e.g., 12.2% in Ontario). Late filings incur a 5% fine + 1% monthly.

Pro Tip: Estimate your income tax quarterly using CRA’s online calculator to budget for payments and avoid surprises.

2.GST/HST

GST/HST is a 5%–15% sales tax for businesses earning over $30,000 yearly (GST/HST rates). Collect it, subtract expenses, and remit the rest to the CRA. Late filings cost a 5% fine + 1% monthly. Learn more about your GST/HST return in Canada for businesses & cross-border taxation.

Pro Tip: Note that British Columbia, Alberta, Saskatchewan, Manitoba, and Quebec use GST or QST instead of HST.

3.Payroll Taxes

Payroll taxes apply when you have employees. Deduct CPP, EI, and income tax, then remit to CRA. CRA sets rules and checks records. Late or incorrect filings cost a 5% fine + 1% monthly.

Pro Tip: Use CRA’s Payroll Calculator and check records biweekly for accurate deductions.

This table outlines small business tax liabilities in Canada, covering types, calculations, and penalties for compliance:

| Tax Type | Description | Who Pays? | How Calculated | Penalties |

| Income Tax | Taxes profits. | Sole proprietors; corporations. | Profit-based; rates vary (e.g., 12.2% Ontario, $500,000). | 5% + 1%/month fine. |

| GST/HST | 5%–15% sales tax. | Businesses over $30,000/year. | Collect sales tax, subtract expense tax, remit rest. | 5% + 1%/month fine. |

| Payroll Taxes | CPP, EI, income tax deductions. | Businesses with employees. | CRA payroll calculator for deductions. | 5% + 1%/month fine for late/wrong. |

Common Tax Deductions for Small Businesses in Canada

Tax deductions are business expenses you take off your income before taxes. These expenses must be for your business. Here are deductions to cut your tax bill:

- Home Office Expenses: Part of your rent or utilities for a work area, like 20% of $500 monthly rent ($100/month).

- Vehicle Expenses: Mileage for work trips, like 500 km/month, at $0.68/km (2025 CRA rate, $340).

- Travel Expenses: Costs for client meetings, like a $300 hotel for a conference.

- Supplies: Work purchases, like a $1,000 computer or stationery.

- Advertising Costs: Money for promotions, like $500 for online ads or flyers for Canadian clients.

- Professional Fees: Payments to accountants or lawyers, like $1,000 for tax help.

- Insurance: Business insurance costs like $600/year for liability coverage.

- Capital Cost Allowance (CCA): Depreciate equipment, like 30% of a $10,000 machine’s value each year.

Example: Lila, a Toronto freelancer, uses deductions to save taxes on her $80,000 profit. The table shows her savings:

| – Home Office | $1,200 | 20% of $500 rent × 12 = $1,200. |

| – Vehicle | $2,040 | 250 km/month × $0.68/km × 12 = $2,040. |

| – Supplies | $1,000 | $1,000 computer. |

| Total Deductions | $4,240 | Sum of deductions. |

| Taxable Income | $75,760 | $80,000 – $4,240. |

| Tax Savings | $1,060 | $4,240 × 25% tax rate = $1,060. |

Case Study: Retail Shop’s Deduction Fix

Problem: A Vancouver retail shop owner faced a CRA audit for $18,000 in deductions on a $90,000 profit in 2024. Missing $10,000 in receipts risked $4,000 in fines and taxes.

What We Did: We advised pulling bank statements to verify $7,000 in supplies and advertising. We reconstructed $2,000 home office costs (20% of $833 rent × 12) and guided Form T2125 filing.

The Result: The CRA accepted $9,000 in deductions, lowering taxable income to $81,000, saving $2,250 at 25%.

Maximize Tax Relief for Small Business Owners with CRA Credits

Tax credits shrink your tax bill fast. They’re a great way for small businesses to save cash. We’ll explain top CRA credits, how to get them, and tips to make them work for you:

1.Small Business Deduction (SBD)

The Small Business Deduction (SBD) credit lowers taxes on your first $500,000 of business income if you run a Canadian-controlled private corporation. In Ontario, you pay just 12.2% instead of 26.5%. That saves you a bunch of money.

Pro Tip: Confirm your corporation’s CCPC status annually with an accountant to ensure SBD eligibility

2.SR&ED Program

The Scientific Research and Experimental Development (SR&ED) program gives you a 35% refundable credit for research and development costs. Think of new products or tech. Spend $28,571 on R&D, and you save $10,000. See how to file foreign business income taxes in Canada to align with claims.

3.Canada Carbon Rebate

This credit helps cover costs for eco-friendly upgrades, like energy-efficient gear. The amount varies by province and project (CCR rebate amounts). It encourages green choices and cuts your taxes at the same time.

Pro Tip: Bundle SR&ED and Carbon Rebate applications to streamline paperwork and boost CRA tax credits for your business.

Forms to Claim Your Small Business Deductions

Filing the right forms makes claiming small business deductions simple. We’ll guide you through key CRA forms and easy steps to apply deductions, keeping your taxes low and hassle-free:

- Form T2125: Report income and deductions, like a home office or supplies, on Part 5 of form T2125. Keep digital or physical receipts for CRA audits.

- Form T2: Corporations claim deductions, and Small Business Deduction requires form T2. Include Schedule 1 (net income) and Schedule 8 (CCA).

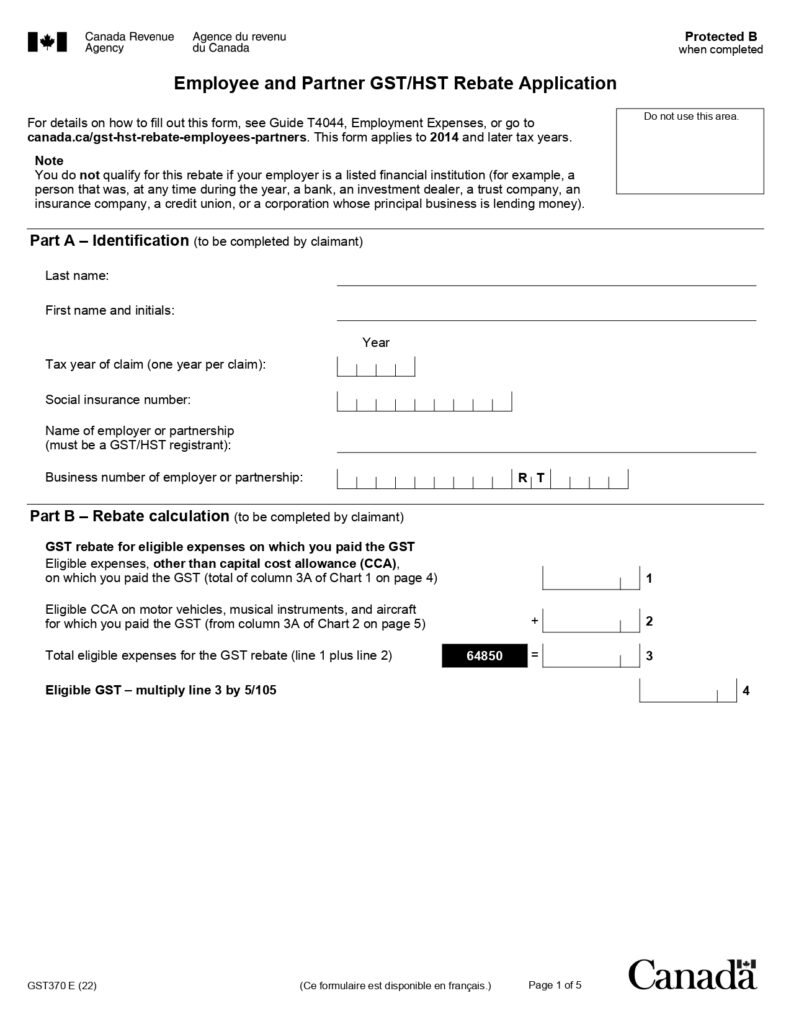

- Form GST370: Claim GST/HST on expenses using form GST370. Submit with GST/HST returns via My Business Account. Track expenses accurately. Check the form below:

- Read More: “What is IRS Form 8833?”

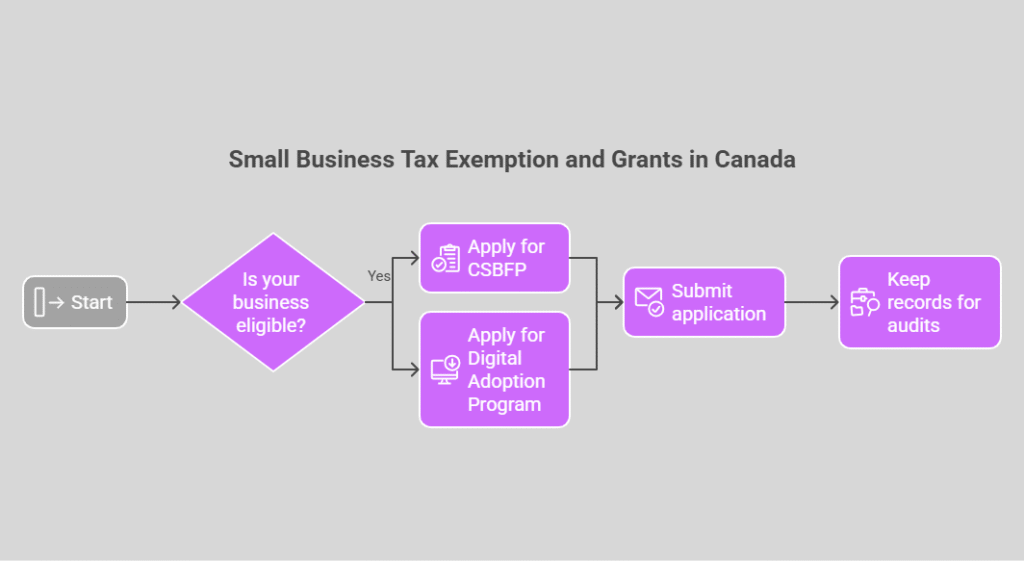

Small Business Tax Exemption and Grants in Canada

Grants and incentives offer free money to grow your small business, cutting costs without loans for equipment, expansion, or tech upgrades. Here’s what’s available and how to get them:

- Canada Small Business Financing Program (CSBFP): Funds equipment or expansion, like new machines or stores.

- Digital Adoption Program: Covers tech upgrades, like software or online stores.

Your business may qualify with revenue under $10 million or digital projects. Check size/industry rules. Apply via Innovation, Science and Economic Development Canada’s website (here) with budgets or goals. Keep records for audits.

Common Tax Mistakes and How to Avoid Them

Tax mistakes can cost your small business fines. Wrong claims or late filings add up fast. We’ll show you top mistakes and simple tricks to dodge them:

- Mixing Up Expenses: Don’t claim personal stuff like groceries. The CRA spots these in audits and hits you with fines. Stick to business costs, like supplies, and keep personal spending separate.

- Messy Records: Missing receipts or bad bookkeeping can spark CRA audits and fines. Save receipts in apps or folders to back up your claims.

- Missing Deadlines: Late tax filings cost you a 5% fine plus 1% each month on unpaid taxes. File on time, even if you can’t pay, to skip extra fees.

- Ignoring Cross-Border Rules: For Canada-U.S. businesses, file taxes with both CRA and IRS. Errors or missed filings lead to fines or audits. Keep records and follow both countries’ rules.

Save on taxes with our trusted cross-border tax accountant for seamless compliance. This table highlights common tax mistakes for small businesses and quick fixes to avoid penalties.

| Mistake | Consequence | How to Avoid |

| Mixing Up Expenses | Personal claims trigger audits, fines. | Claim only business costs, separate personal spending. |

| Messy Records | Missing receipts lead to audits, fines. | Save receipts in apps/folders to verify claims. |

| Missing Deadlines | Late filings cost 5% + 1%/month fine. | File on time, even if unable to pay. |

| Ignoring Cross-Border Rules | CRA/IRS errors cause fines, audits. | File with CRA/IRS, keep records, follow rules. |

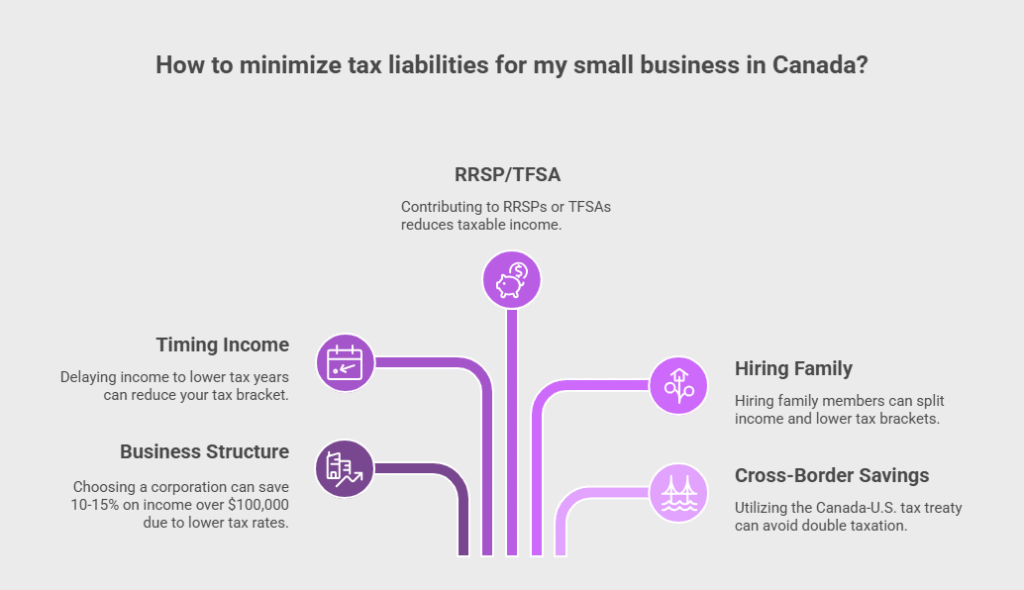

Effective Small Business Tax Planning in Canada to Minimize Liabilities

Smart tax planning saves your small business cash. We’ll share easy tips to keep your taxes low and profits up.

1.Business Structure

Pick a sole proprietorship or corporation. A corporation saves 10–15% on income over $100,000 with lower tax rates, like 12.2% in Ontario versus 26.5%. Sole proprietorships are simple but use higher personal tax rates. For more details, check business structures in Canada & tax implications.

2.Timing

Delay income to years with lower taxes. For example, wait to send invoices until January if next year’s income will be less. This lowers your tax bracket and saves you money.

3.RRSP/TFSA

Put cash in RRSPs or TFSAs to lower taxes. A $10,000 RRSP contribution cuts your taxable income by $10,000. You save money on taxes, like $2,500 at a 25% rate.

4.Hiring Family

Hire a family to split income legally. Pay them fair salaries for work, like $20,000 a year to a spouse. This moves income to lower tax brackets and cuts taxes.

5.Cross-Border Savings

For Canada-U.S. businesses, use the Canada-U.S. tax treaty to avoid double taxation, exempting U.S. profits from Canadian tax. Claim the 20% QBI deduction on U.S. income. Let SAL Accounting’s corporate tax accountant simplify your taxes and maximize savings.

Case Study: Tech Firm’s Tax Strategy Win

Problem: A Toronto tech firm with $140,000 profit, including $30,000 U.S. sales, risked double taxation and $3,500 in CRA/IRS penalties for faulty filings in 2025.

What We Did: We suggested using the Canada-U.S. tax treaty to exempt $30,000 in U.S. profits, applying a 20% QBI deduction ($6,000), and incorporating 12.2% Ontario tax. We guided Forms T2, U.S. 1040 filing.

The Result: The firm saved $9,000 ($4,000 treaty, $5,000 QBI), cut taxable income to $131,000, and avoided penalties.

Read More: “Understanding Taxes for US Citizens Working Remotely for Canadian Companies”

Final Thoughts

Small businesses in Canada can retain more profit with effective tax strategies. Compliance and avoiding errors like late filings or incorrect claims significantly boost savings. SAL Accounting’s experts provide guidance to minimize tax liabilities of small businesses in Canada and keep taxes on track.

Contact us for a free consultation to simplify the tax process and enhance profitability.

Frequently Asked Questions (FAQs)

Claim deductions (home office, vehicle), use credits (SBD, SR&ED), and choose a tax-efficient structure like a corporation.

Corporations save more at incomes over $100,000 with SBD; sole proprietorships are simpler but tax higher.

Yes, SBD cuts taxes on $500,000 income, SR&ED offers R&D credits, and Canada Carbon Rebate supports green upgrades.

Maximize deductions and time income/expenses, use RRSPs/TFSAs, and hire family to split income. Consult a tax pro.

Home office, mileage, travel, supplies, ads, fees, insurance, and CCA for equipment, if business-related.

Use deductions/credits, defer income, invest in RRSPs/TFSAs, and maintain solid records.

Yes, SBD lowers rates, accounting is simpler, and rules vary by province and structure (corporation vs. sole proprietorship).