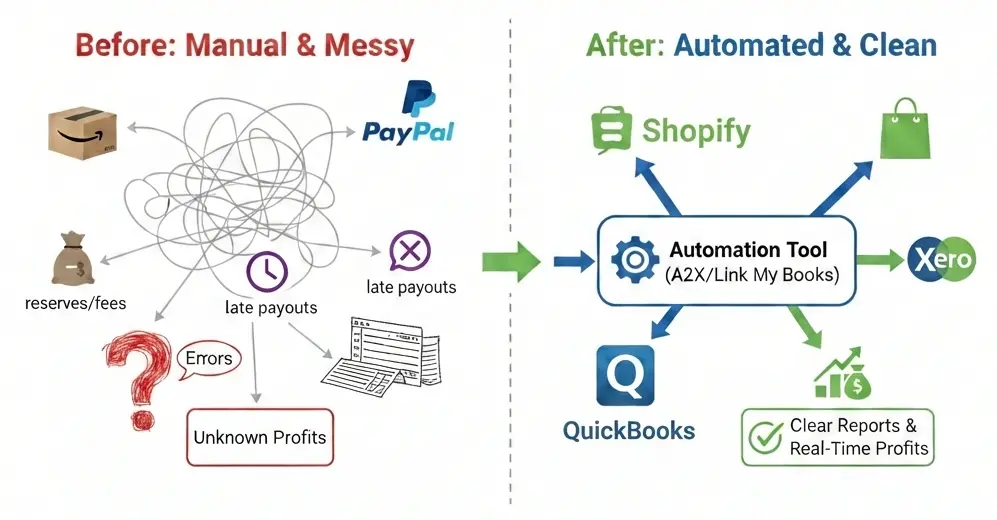

It is a big headache when your store starts growing, but the numbers do not feel right. You stay up late matching Amazon payouts to Shopify and PayPal, chasing fees and refunds, wondering if you are really making money.

Many Shopify, Amazon, and multi-channel sellers go through this. The business you built for more freedom ends up taking your time and energy away from what you enjoy. Canada’s ecommerce market reached nearly US$89 billion in 2024 and continues to grow, but bad books drain cash flow and hide problems.

Small mistakes grow fast, tax rules change without notice, and inventory choices turn into guesses. This guide from SAL Accounting compares in-house and outsourced ecommerce accounting, real costs, control, expertise, scaling, and risks, to help you pick what fits your business now.

Quick Takeaways

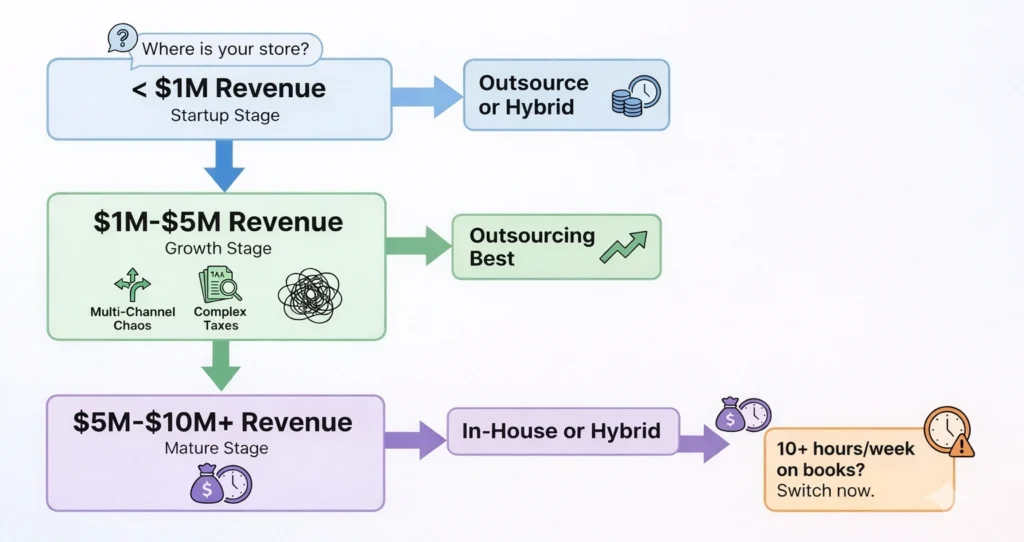

- Most stores growing to $1M-$5M revenue do best with outsourcing.

- Outsourcing costs less and brings experts who know Shopify, Amazon, and multi-channel setups.

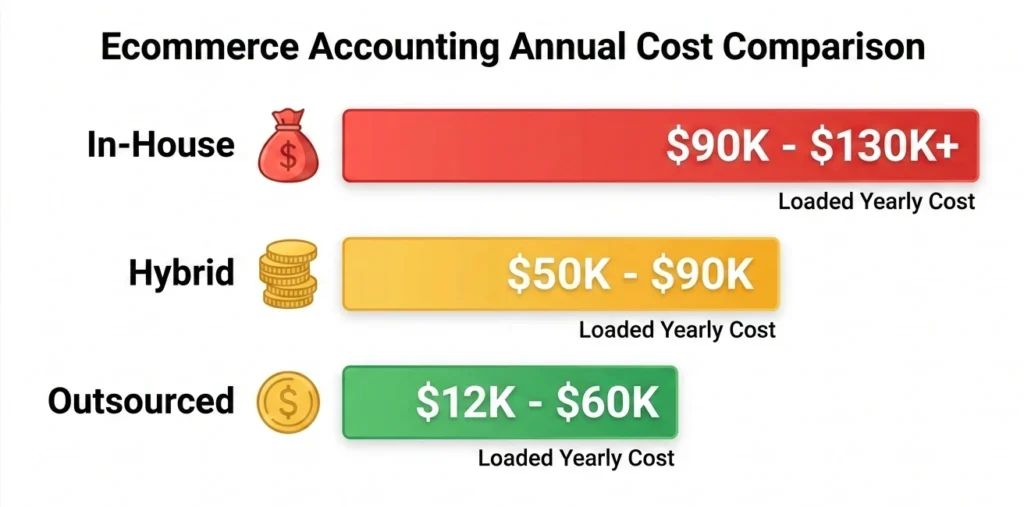

- In-house costs $90K-$130K+ a year all-in. Outsourcing is $1K-$5K a month.

- Outsourcing handles busy seasons easily and stays more accurate on taxes and rules. In-house gives you daily control but risks gaps if someone quits.

- Hybrid works well for many: keep easy tasks inside, outsource the tough ones.

- Switch when bookkeeping takes 10+ hours a week or feels too much.

Looking for reliable help? Click on the button:

Why Is Ecommerce Accounting Harder Than Regular Bookkeeping?

Normal businesses track simple income and expenses. Ecommerce has a confusing mix of platform rules that mess up your numbers if you’re not careful. Here are the three main reasons it’s tougher:

1. Key Platform Challenges

Amazon holds back reserves, includes referral fees (typically 15%) and FBA storage costs in payouts, and delays real cash. Shopify payouts can land a few days late. Refunds, returns, and promotions make revenue hard to track.

Pro tip: Set up automation early with tools like A2X or Link My Books. They connect your platforms to QuickBooks or Xero and pull in fee details you’d miss otherwise.

2. Inventory and COGS Rules

You can’t expense inventory right away. It stays on the balance sheet as Cost of Goods Sold (COGS) until the item ships. With 3PL warehouses or FBA, timing errors happen fast and can make profits look wrong or cause tax issues.

3. Tax and Compliance Issues

Tax and compliance rules are some of the biggest headaches in ecommerce accounting. Here are the main ones most sellers run into:

- US: All 45 sales-tax states have economic nexus (typically $100K-$500K sales per state triggers filing).

- Canada: GST/HST starts at $30K taxable supplies. Marketplaces collect on their sales, but you’re responsible for the rest and accurate reporting.

- Cross-border: Use exact currency conversion rules (CRA requires Bank of Canada rates) or face fixes later.

These affect cash flow, real profits, and compliance. One missed nexus deadline can cost thousands in penalties.

| Case Study: A Multi-Channel Seller Facing US Tax Penalties |

| A $3M seller on Shopify and Amazon came to us after their generalist accountant missed filings in two US states. They were looking at $14K in penalties and an audit. We went through their sales data to figure out which states they actually had nexus in, then filed voluntary disclosure agreements to get most of the penalties waived. We also helped them set up a hybrid system where their junior staff handled daily uploads and we took care of US compliance. They got most of the overpayments back and grew to $7M without hiring more people. |

What Does In-House vs Outsourced Ecommerce Accounting Cost?

Costs add up fast, especially with 2026’s accountant shortage pushing salaries higher.

How Much Does In-House Actually Cost?

A good ecommerce accountant starts at a $70K-$100K base salary (Canada average).

Add:

- Benefits and payroll taxes (20-30%)

- Software subscriptions ($500-$1K/month for tools like TaxJar or A2X)

- Recruiting fees and training time

You’re easily at $90K-$130K+ loaded yearly. Hidden extra costs include long hiring waits (months in this market), lost knowledge if someone quits, and no backup during busy seasons or vacations.

Pro tip: Budget 20-30% above base salary for the real yearly cost. Many owners forget this.

Not sure what level of support your store needs? Our bookkeeping services scale with your business.

How Much Does Outsourcing Actually Cost?

Basics run $500-$1K/month for simpler setups.

Full multi-channel support (reconciliations, inventory, taxes): $1.5K-$5K/month. Many plans include tools, automation, and even fractional CFO advice. It usually costs 40-60% less than in-house, with fixed monthly fees and no extra overhead.

Pro tip: Go for fixed retainers instead of hourly. It is way easier to forecast cash flow and avoid surprises.

What About a Hybrid Approach?

Lots of growing brands keep a junior in-house for uploads and daily stuff while outsourcing reconciliations, compliance, and strategy.

You keep control where it counts (quick internal chats) and get expert depth for the hard parts (multi-state taxes, inventory valuation). It’s often the best balance for $2M-$8M stores.

| Aspect | In-House | Outsourced | Hybrid |

| Annual Cost | $90K-$130K+ loaded | $12K-$60K (scalable) | $50K-$90K (junior + expert support) |

| Expertise | Depends on your hire | Dedicated ecommerce team | Daily access + deep specialists |

| Scalability | Slow – requires new hires | Instant – adds resources as needed | Flexible with retained control |

| Accuracy & Compliance | Risk of platform knowledge gaps | Higher – peer-reviewed + current rules | Strong balance |

| Operational Risk | High turnover/single-point failure | Provider fit | Lowest overall |

| Daily Control | High | Moderate (scheduled reviews) | Good balance |

For multi-channel sellers managing Shopify, Amazon, Etsy, and eBay stores, outsourcing often makes the most sense at the growth stage. These platforms each have unique payout structures, fee schedules, and compliance needs that expert ecommerce accountants handle daily.

What Are the Pros and Cons of Each Approach?

Both in-house and outsourced ecommerce accounting have real strengths and real weaknesses. Here’s an honest look at what each setup actually delivers.

In-House Accounting: Pros and Cons

In-house ecommerce accounting gives you control, but at a cost.

Advantages

- Full daily control and quick questions

- Tight fit with your team and culture

- Real-time access to data for urgent decisions

Drawbacks

- High fixed costs and tough hiring

- Struggles to scale during peaks

- Risk of gaps if your person isn’t deep on ecommerce platforms

Outsourced Accounting: Pros and Cons

Ecommerce accounting outsourcing brings expertise, but needs the right fit.

Advantages

- Team that gets Amazon reserves, Shopify timing, and nexus rules

- Better accuracy with peer review and fast closes

- Backup built in and good tools

Drawbacks

- No instant in-person access

- Needs clear communication and schedules

Make sure you analyze everything before making your final decision.

- Read More: Best eCommerce Accounting Software in 2026

How to Find the Right Ecommerce Accounting Team?

No setup is perfect if the people aren’t right. Here’s what to watch for on both sides.

What Are In-House Red Flags?

If your in-house accountant can’t explain things like Amazon reserves or 3PL fees, that’s a red flag. Same goes for month-end reports that are always late or need you to fix them.

And if everything breaks when one person is sick or on vacation, that’s a problem. Relying on just one person is the hidden risk of in-house setups.

Outsourced Red Flags

Be careful with vague or changing pricing. If they can’t give you a clear number, expect surprises later. No regular check-ins or custom reports is a bad sign too.

And if they give generic answers without real Shopify or Amazon knowledge, they’re probably not true ecommerce accountants.

So, What Does a Great Outsourced Provider Look Like?

- Strong ecommerce focus: multi-channel reconciliations, COGS timing, nexus monitoring

- Transparent pricing with no hidden fees

- Monthly check-ins, custom reports, and references from similar stores

- Bundled tools (A2X, TaxJar) and proactive updates for tax changes

- Fast responses and a real team (multiple people, not just one)

Pro tip: Ask for niche references and try a short trial month. It is the quickest way to know if they fit your platforms.

At SAL Accounting, we specialize in bookkeeping process for Canadian sellers with US operations.

Should You Outsource or Build In-House Right Now?

Your store revenue and chaos level are important factors to consider.

1. Startup or Under $1M Revenue

Outsource or hybrid. It keeps costs low and books clean without full payroll. Focus on sales while an accounting team handles basics.

2. Growth Stage: $1M-$5M Revenue

Outsourcing often works best. Multi-channel mess, 3PLs, and nexus cause problems. Specialists fix it cheaper and faster than training someone new.

This is especially true for cross-border businesses selling into the US market, where tax compliance spans two countries.

| Case Study: An Ontario Seller Struggling with Q4 |

| An Ontario-based Shopify and Amazon seller reached out after a rough Q4. Their one bookkeeper couldn’t keep up. Reconciliations were months behind, bad data led to overstocking, and storage fees kept adding up. We went through their Amazon payouts line by line, pulling apart FBA fees, refunds, and reserves that had all been mixed together. That’s how we found $9K in reimbursements Amazon owed them. We also set up A2X so future reconciliations would run automatically and they wouldn’t end up in the same spot again. |

3. Mature Stage: $5M-$10M+ Revenue

In-house or hybrid. You might want daily teamwork for complex operations, but still outsource compliance or seasonal spikes to avoid problems.

Other common triggers:

- 10+ hours a week on bookkeeping

- New markets or states/provinces

- No clear profit view per product or channel

- Planning funding or exit (clean books matter)

If you are preparing for growth or outside investment, accurate small business accounting becomes essential for due diligence.

Final Thoughts

In-house vs outsourced ecommerce accounting depends on where you are, but for most growing Shopify, Amazon, and multi-channel stores, ecommerce accounting outsourcing (or hybrid) gives better costs, scalability, accuracy, and peace of mind in today’s competitive market.

It lets you get back to building the business you love; sourcing winners, optimizing ads, delighting customers. Pick ecommerce accountants either way to keep margins healthy, cash flowing, and audits away.

Ready to make your finances simpler? We help Shopify, Amazon, and multi-channel brands figure out the best path. Reach out for a free e-commerce tax strategy call with our CPA.

FAQs: In-house Vs. Outsourced accounting

In-house means hiring someone on your team with salary and benefits. Outsourced means hiring an outside firm for a flat monthly fee. In-house gives more daily control. Outsourcing provides team expertise at lower total cost.

They reconcile payouts from Amazon and Shopify, track fees and refunds, manage inventory costs, and handle sales tax compliance. They break down platform fees, shipping, and ad spend to show real profit margins and catch errors general accountants miss.

For most growing stores, yes. ecommerce accounting outsourcing saves you 40-60% versus in-house, gets you platform expertise, and avoids turnover headaches while scaling during busy times.

$500-$1K monthly for basics, $1.5K-$5K for multi-channel support with reconciliations, inventory, taxes, and tools. More predictable than salary costs.

Usually not until $5M-$10M+ in sales. Before that, outsourcing or hybrid is cheaper with deeper ecommerce expertise.

Yes. Good ones work these platforms daily and understand fee structures, reserves, payout delays, and tax quirks better than generalists.

Turnover, no backup during busy periods, missing platform details, and falling behind on tax rules. These mistakes eat profits or trigger audits.

Not full-time until very large, but past $1M you benefit from CFO-level thinking. Many outsourced packages include fractional ecommerce CFO services affordably.

$1,500-$5,000 monthly for ecommerce businesses versus $150K-$250K+ yearly for full-time. Most stores under $5M benefit from fractional without the full price tag.

QuickBooks Online or Xero with A2X (Amazon) or Link My Books (Shopify and multi-channel) for automatic fee breakdowns and accurate profits.

Keep simple tasks (uploads, payments) in-house with junior staff while you outsource ecommerce finance team work like reconciliations, inventory COGS, tax compliance, and strategy to experts.

No. Most ecommerce accounting work happens online. Reconciliations, reports, tax filings, and calls are all remote. We’re in Toronto’s Financial District but work with Shopify, Amazon, Etsy, and eBay sellers across Ontario remotely.