The Global Minimum Tax, part of the OECD’s BEPS 2.0 plan, affects businesses that send money between Canada and the U.S. Canada’s 2024 budget predicts this tax will add over $6 billion over three years from 2026. This creates a major impact for companies.

Our team at SAL Accounting has put together this comprehensive guide to explain the Pillar Two tax effects and share tips for staying prepared. Keep reading.

Quick Takeaways

- Global Minimum Tax raises taxes on Canada–U.S. payments for firms with €750M+ revenue.

- Pillar Two overrides treaty benefits, adding taxes when U.S. rates fall below 9% or 15%.

- Canada enforces Pillar Two rules since 2024; the U.S. delays implementation.

- Small businesses avoid Pillar Two taxes but face client price increases.

- File GloBE reports by June 2026 to avoid heavy penalties.

What is the Global Minimum Corporate Tax Rate?

The Global Minimum Tax, part of OECD’s BEPS 2.0, ensures firms with €750M+ revenue pay 15% tax globally (GMT guide). Over 140 countries curb profit shifts. Canada started rules on January 1, 2024, for fiscal years after December 31, 2023. The US has no start now, waiting on Congress to act. Consult our cross border tax specialist for compliance help.

What Are BEPS 2.0 and Pillar Two Taxes?

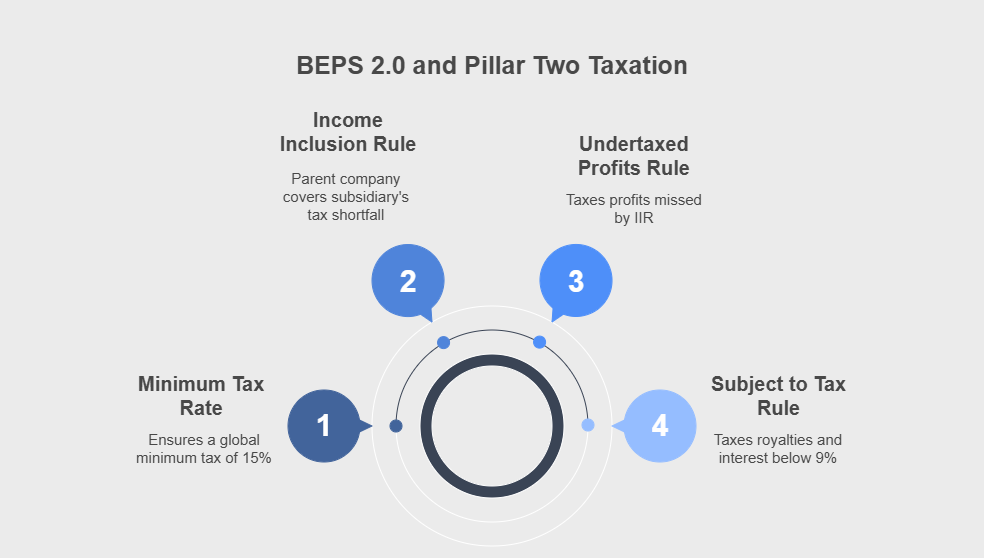

Base Erosion and Profit Shifting (BEPS) 2.0 Tax, led by the OECD Inclusive Framework (140+ countries), ensures fair corporate taxation by stopping profit shifting to low-tax countries. Pillar Two tax requires firms with €750M+ revenue to pay a 15% minimum tax globally, enforced by three rules:

- Income Inclusion Rule (IIR): A subsidiary pays less than 15% tax. The parent company adds the difference.

- Undertaxed Profits Rule (UTPR): IIR misses low taxes. This taxes profits elsewhere to hit 15%.

- Subject to Tax Rule (STTR): Royalties or interest taxed below 9% get extra tax to meet the minimum.

Canadian firms must address US subsidiaries of Canadian company taxes for compliance. They need to plan.

- Read More: “US-Canada Joint Venture Tax Guide in 2025”

How Pillar Two Tax Rules Impact Canada–US Payments

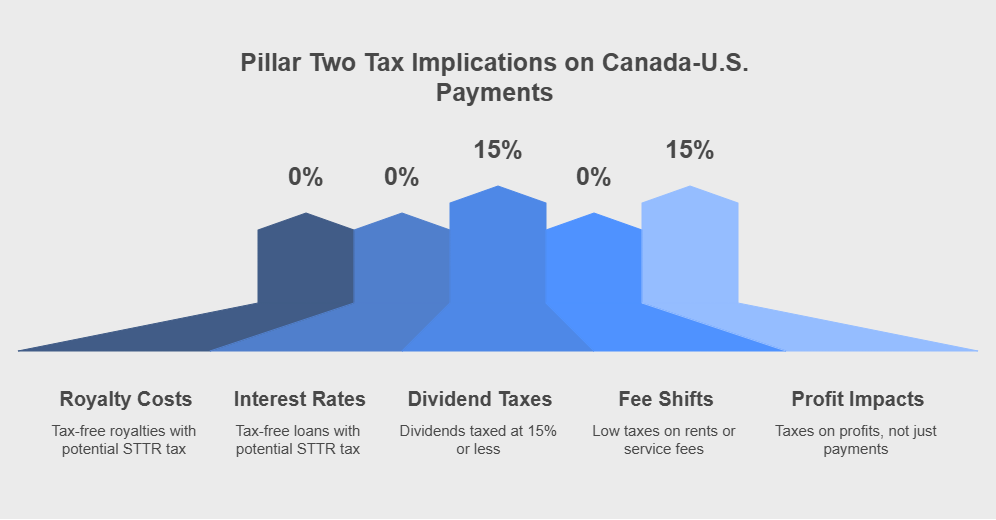

If you handle cross-border payments, you must understand how Pillar Two tax rules impact Canada–US royalties, interest, and dividends (Global Minimum Tax Act). Here’s the simple breakdown:

- Royalties: Money for using things like software or patents. Usually no tax (0% withholding).

- Interest: Cash paid on loans between companies. Often, there is no tax either.

- Dividends: Profits a subsidiary sends to its parent company. Typically taxed at 15% or less.

File foreign business income taxes in Canada to stay compliant with Pillar Two rules and avoid costly penalties. The table below shows Pillar Two taxes on Canada–U.S. payments, with rates and impacts:

| Payment Type | Treaty Rate | Pillar Two Rate | Trigger Condition | Impact on Firms |

| Royalties | 0% | Up to 9% (STTR) | U.S. tax < 9% | Higher costs |

| Interest | 0% | Up to 9% (STTR) | U.S. tax < 9% | Pricier loans |

| Dividends | 15% or less | 15%+ (IIR/UTPR) | U.S. tax < 15% | Costly profits |

| Service Fees | 0% or low | Up to 9% (STTR) | U.S. tax < 9% | Extra fees |

New Canada–US Payment Taxes Under Pillar Two

In the following, we will explore Pillar Two tax changes to Canada–U.S. payment taxes and reporting rules for firms.

1.Royalty Costs

The Canada–U.S. treaty keeps royalties at 0% tax, like for patents or software. Pillar Two adds up to 9% STTR tax if U.S. rates fall below 9%. Tax-free payments cost more.

2.Interest Rates

Loans between firms get 0% tax under the treaty. Borrowing stays cheap. Pillar Two STTR rule switches it. Canada adds up to 9% tax if US rates fall below 9%. Tax-free payments cost more now.

3.Dividend Taxes

Dividends hit 15% or less under the treaty. Pillar Two IIR or UTPR rules raise taxes to 15%+ if U.S. rates are below 15%. Canadian units top up for U.S. parents. Profits cost more to send.

4.Fee Shifts

Rents or service fees get 0% or low treaty taxes. Depends on the deal. Pillar Two STTR rule adds up to 9% tax if US rates go below 9%. Firms pay extra bucks.

5.Profit Impacts

Pillar Two IIR and UTPR tax profits, not just payments. Low U.S. taxes trigger Canada’s UTPR to hit 15%. Branch income faces tax if U.S. rates dip below 15%. Firms track global cash to save money.

These rules flip international corporate tax plans. Firms need plans to avoid unexpected costs by meeting corporate tax deadlines for Canadian businesses.

Case Study: Canadian Firm’s UTPR Win

Problem: A Canadian firm got hit with a CRA audit for Pillar Two. Its US branch earned $1.5M profit, taxed at 8%. That risked a $105,000 UTPR tax.

What We Did: We told them to check US expense records for $250,000 in costs. Moving some work to Canada hit 15%.

Result: The CRA took the $250,000 deduction, killing the UTPR tax. That saved $105,000. Map profits to skip Canada’s 2025 UTPR rules and save cash.

Pillar Two vs. Canada–US Tax Treaty: What Changes?

Pillar Two Tax overrides Canada–US tax treaty savings (CRA tax treaties). Canada enforces Pillar Two; the US doesn’t. Canadian firms with US parents face STTR taxes if US rates fall below 9%. This alters corporate tax plans. Treaty rates weaken. Here are the treaty’s tax cuts:

- Royalties: 0% tax (patents, software).

- Interest: 0% tax (loans).

- Dividends: 15% or less (parent profits).

Example: A Canadian firm pays $200,000 in dividends to a US parent at 10% tax. Pillar Two’s IIR adds a 5% tax ($10,000). Treaty rates fail.

Pro Tip: Map profit sources to spot low-taxed income early. Shift operations to balance Pillar Two taxes, keeping branch profits safe from IIR or UTPR hits.

Compliance Deadlines and Penalties for Pillar Two in Canada

Pillar Two rules challenge Canadian firms with €750M+ sales. Meet deadlines to avoid penalties. Key info follows:

Filing Deadlines

File a GloBE Information Return (GIR) by June 30, 2026, for 2024, or 15 months post-fiscal year-end. After 2024, it’s due in 12 months, usually June 30. GIR needs 100+ profit/tax details. Keep records clean.

Pro Tip: Begin GloBE data collection early. Accurate records prevent monthly penalties and avoid CRA audits.

Penalties

Miss the GIR deadline or fail to make tax payments, and Canada’s CRA hits hard. File early to save cash. Here’s what happens if you don’t:

- Late GIR filing costs $25,000 a month, up to $1M.

- Unpaid taxes add a 5% fee plus 1% monthly interest, maxing at 17%.

- Wrong data or late payments trigger audits and extra costs.

Safe Harbours

Safe harbors cut the hassle. The permanent QDMTT safe harbor skips extra tax if Canada’s rate hits 15% and you file an election. Transitional safe harbours help low-risk places until 2027. Test them with sample data to be sure.

Pro Tip: File a QDMTT safe harbor election by the GIR deadline. This skips top-up taxes if Canada’s rate hits 15%. Book a consultation with our corporate tax accountant and meet Pillar Two deadlines.

The table below lists Pillar Two compliance deadlines, penalties, and steps:

| Requirement | Deadline | Penalty | Action |

| GIR Filing 2024 | June 30, 2026 | $25,000/month, up to $1M | File 100+ data points |

| GIR Post-2024 | 12 months post-fiscal year | $25,000/month, up to $1M | File by June 30 |

| Tax Payments | With GIR submission | 5% + 1%/month, max 17% | Pay top-up taxes |

| Data Accuracy | Ongoing | Audits + extra costs | Verify profit/tax |

| QDMTT Safe Harbour | With GIR election | None if elected | File election |

Pillar Two’s Impact on Canadian Businesses: MNEs and SMEs

Pillar Two tax changes how businesses handle Canada–US finances and adds new tax trouble that cuts profits. Here’s what happens:

- Big firms (MNEs) face hefty tax compliance reporting. They track over 100 data bits. That costs a lot (source).

- Small businesses (SMEs) skip Pillar Two for now. Sales under €750 million keep you clear. Growth adds risks. Check out business structures in Canada and their tax implications.

Pro Tip: SMEs should talk to big clients about Pillar Two price plans. Early chats help budget for cost hikes, keeping deals affordable.

Steps to Meet Pillar Two Rules for Cross-Border Payments

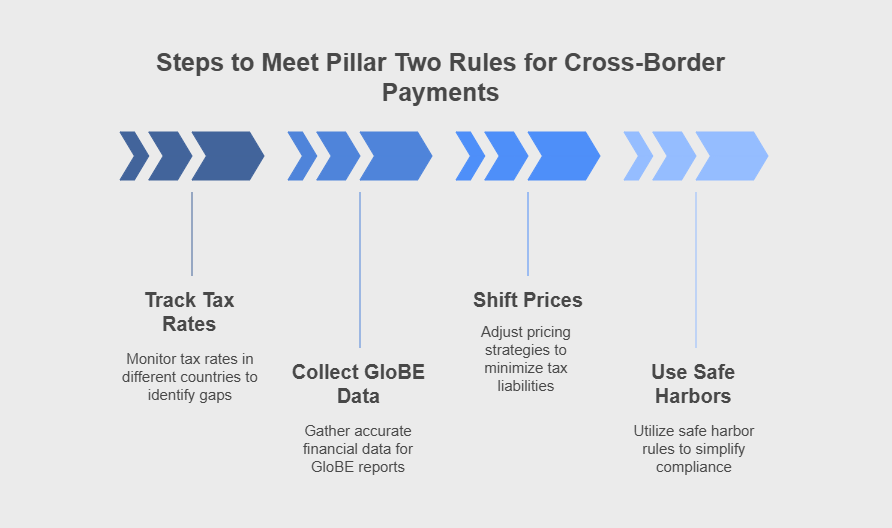

Pillar Two tax calls for sharp moves to keep costs low. These steps help firms stay compliant:

1.Track Tax Rates

Pillar Two demands 15% tax rates in Canada and the U.S. Firms track rates to catch gaps early, avoid extra taxes, and cut costs. Smart plans keep compliance smooth.

Example: A Canadian retailer tracks US branch taxes at 11%. Pillar Two demands 15%. It sports a 4% IIR tax ($40,000 on a $1M profit). Adjusting operations skips the tax, saving cash.

2.Collect GloBE Data

Global Anti-Base Erosion (GloBE) reports for Pillar Two need clean data. Firms collect profit and tax details across countries to avoid penalties. Inaccurate data triggers errors and higher costs. Clear records save money. Businesses maintain accurate tax reports for compliance.

3.Shift Prices

Firms shift prices to dodge Pillar Two taxes. Small tweaks cut tax bills. Smart plans skip STTR or IIR hits. This guards funds. Poor pricing boosts costs. Advisors find clever moves. Businesses control taxes better with price shifts for smoother compliance.

Use Safe Harbors

Safe harbor rules simplify Pillar Two reports, cutting paperwork and costs. They ease tasks, reduce errors, and ensure compliance. Consult our international tax accountant at SAL Accounting to adjust pricing.

Case Study: Canadian Firm’s CRA Audit Save

Problem: A Canadian firm got hit with a CRA audit for Pillar Two. They reported $3M in US branch profits but missed $600,000 in tax data. That risked a $60,000 penalty.

What We Did: We told them to grab bank records to show $400,000 in expenses. Tax software sorted the profit data fast. That rebuilt $500,000 for GloBE reports.

Result: The CRA took $500,000 in deductions, dropping taxable profit to $2.5M. Clean data dodged the penalty and saved cash. Firms need full records to nail Canada’s 2024 rules.

Final Thoughts

The Global Minimum Tax changes Canada–US business payments. Large firms face higher taxes. Smaller businesses see costlier deals. Canada’s rules stay tough. Plan smart to save cash, watch rates, sort data, tweak deals. SAL Accounting shares tips to reduce tax trouble and keep profits safe. Contact us for a free consultation. We make taxes simple. Start now to keep your business strong.

Frequently Asked Questions (FAQs)

The Global Minimum Tax makes big companies pay 15% tax everywhere. It’s part of the OECD’s plan to stop hiding profits in low-tax places. Over 140 countries joined in.

Companies with €750M+ in sales must follow. It hits big multinationals. Small businesses stay safe unless sales reach that level.

Canada began rules on January 1, 2024, for years after December 31, 2023. The US waits for Congress to decide.

It adds taxes to royalties and interest if US rates drop below 9%. Dividends cost more if below 15%. Free payments turn expensive.

Yes, Canadian branches of US firms with €750M+ sales pay taxes. Canada adds tax if US rates fall below 15%.

Watch tax rates, keep clean data, adjust prices, and use safe harbors.