You are a Canadian with foreign investments, and this Form T1135 guide makes your 2025 foreign asset reporting straightforward. You can file right and stay in the CRA’s good books. Even if your foreign assets earned nothing, skipping this form can bring you $2,500 in fines or even trigger long audits. In 2023, CRA audits flagged 15% of T1135 filers for errors, up from 5% in 2015.

In this blog, we at SAL Accounting will spell out who needs to file, what counts, and how to steer clear of CRA trouble.

Quick Takeaways

- File T1135 if foreign assets exceed $100,000 CAD in 2025.

- Report bank accounts, U.S. stocks, crypto, and rentals, not personal homes or RRSPs.

- Use simplified reporting for $100,000–$249,999 CAD, detailed for $250,000+.

- Avoid penalties by filing on time, listing all assets, and using VDP.

- Track costs yearly and get expert help for complex cases like joint ownership or ADRs.

What Is Form T1135 and Why Should You Care?

Form T1135 is a CRA form you file if you’re a Canadian with foreign assets over $100,000 CAD, like U.S. stocks or crypto. It helps the CRA track possible income (source). It’s about keeping things clear, not taxing assets. Miss it, even with no income, and you face $2,500 fines or long audits. Connect with our cross-border tax accountant for expert help. Check the form below:

Who Needs to File Form T1135? (Filing Requirements)

If you’re a Canadian with foreign assets over $100,000 CAD in 2025, you have to file Form T1135. Here’s who and what it covers:

- Covers you, corporations, trusts, or partnerships.

- Includes stuff like U.S. stocks or crypto outside Canada.

- New residents don’t file their first year.

- CRA looks at your tax residency, not citizenship. Have a look at factual vs. deemed residency for taxes in Canada.

The CRA is really watching global investments. Grab the latest form from their site to get it right. You will also avoid double taxation in Canada as a small business.

What Counts as Specified Foreign Property in Canada? Thresholds and Exclusions

Specified foreign property is stuff you own outside Canada worth over $100,000 CAD in 2025, based on what you paid, not current value. Here’s what’s in and out:

- Counts: Foreign bank accounts, U.S. stocks, crypto on foreign sites, rental properties abroad, money owed by non-residents.

- Doesn’t count: Vacation homes you use, RRSP or TFSA assets, Canadian funds with foreign stocks. Have a tax deduction checklist for Canadian and U.S. businesses handy.

- Threshold: Over $100,000 CAD means file; $250,000+ needs extra details.

Pro Tip: Use Bank of Canada rates to convert values. Write down foreign assets yearly to catch the $100,000 mark.

Here’s a simple table to break down included and excluded assets:

| Category | Included Assets | Excluded Assets | Notes |

| Financial | Foreign bank accounts | Canadian RRSP/TFSA funds | Convert to CAD |

| Investments | U.S. stocks, crypto on foreign sites | Canadian ETFs with foreign holdings | Cost base matters |

| Real Estate | Rental properties abroad | Personal-use vacation homes | Business use counts |

| Other | Money owed by non-residents | Personal-use depreciable | UCC for depreciable |

T1135 Simplified Method vs. Detailed Reporting: Which One Applies to You?

You pick Form T1135’s simplified or detailed reporting based on what your foreign assets cost (form Q&A guide). Simplified is for smaller amounts; detailed is for bigger ones. Here’s how they work:

Simplified Method (Part A)

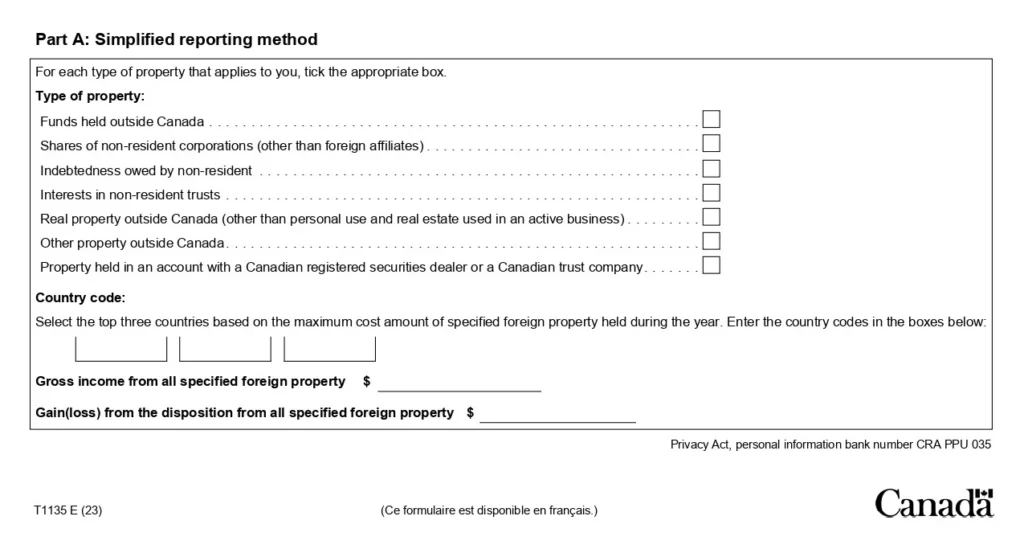

Use this if your assets cost $100,000 to $249,999 CAD. Lump them by type and name the top three countries. It’s fast for simple portfolios. Below, you can see Part A:

Detailed Reporting (Part B)

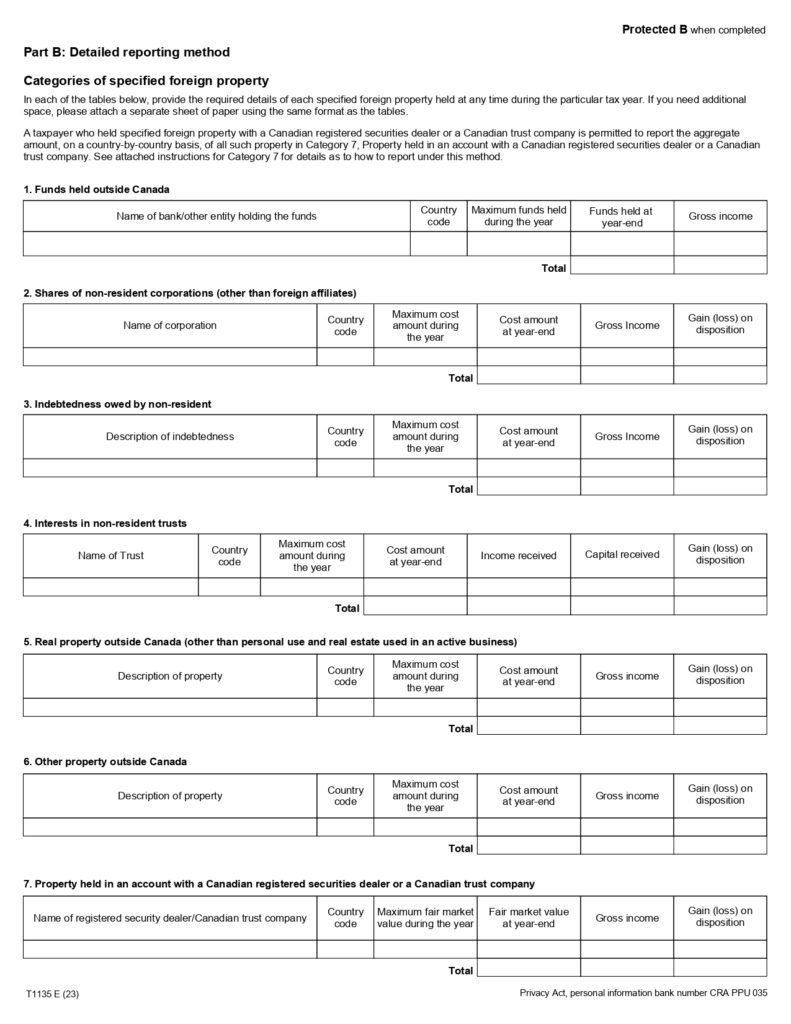

This is for assets worth $250,000 CAD or more. List each one with its name, country, top cost, and any income. It works for tricky stuff like real estate. You may need to know how to buy a business in the U.S. as a Canadian. Check Part B in the following:

Pick the Right Method

Check your assets’ total cost. Get details ready early if near $250,000. Simplified is quick; detail keeps things clear for the CRA.

This table shows reporting methods by asset value to help you choose fast:

| Asset Value | Method | Requirements | Best For |

| $100k-$249k | Simplified (Part A) | Group by type, top 3 countries | Simple portfolios |

| $250k+ | Detailed (Part B) | List each asset, cost, income | Complex holdings |

| Under $100k | No Filing | N/A | Basic investors |

| Near Threshold | Check Yearly | Max cost all year | Borderline cases |

How to File T1135: Step-by-Step Instructions for Compliance

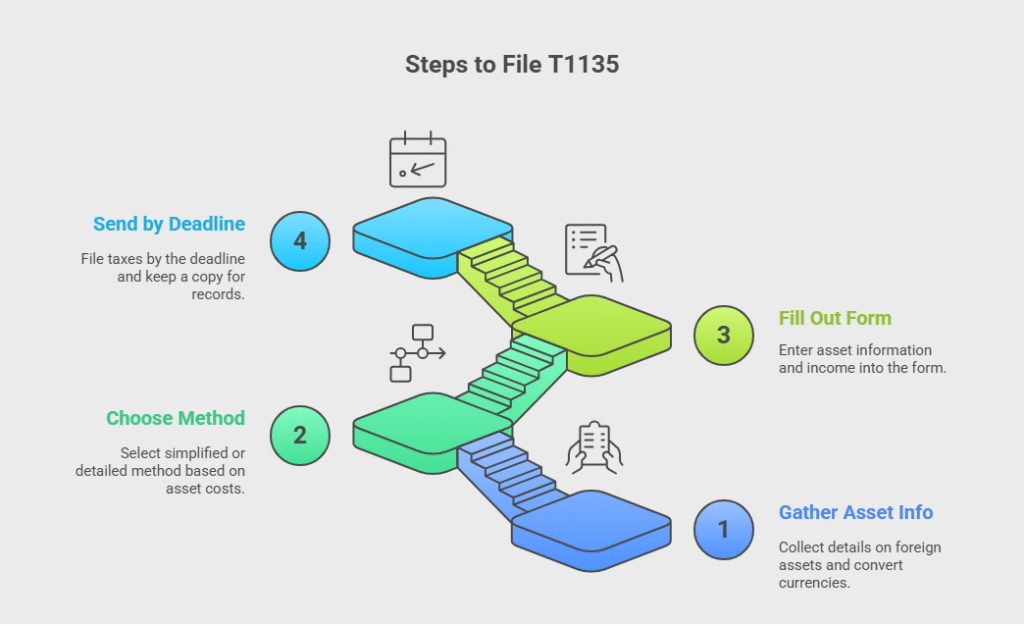

Form T1135 is easy to file if you follow these steps. Have your asset info ready. Here’s the deal:

1. Grab Your Asset Info

Collect details on your foreign stuff. Use Bank of Canada rates to switch currencies. Also, check the best U.S. banks for Canadians for easy cross-border banking.

Pro Tip: Make a spreadsheet with asset type, buy date, cost, and CAD value. It catches mistakes and saves time later.

Example: Emma, a 42-year-old Toronto consultant, lists her U.S. bank account costing $80,000 CAD and U.S. rental property at $90,000 CAD. Her total is $170,000 CAD. She notes purchase dates and account details in a spreadsheet.

2. Choose Your Method

Pick simplified (under $250,000 CAD) or detailed (over $250,000 CAD) based on asset costs. Add up your total to see which one fits.

Pro Tip: Check your assets’ highest cost all year, not just the end, to pick the right method and avoid changes.

Example: Emma’s $170,000 CAD total fits the simplified method (Part A). She checks her bank balance, which hit $85,000 CAD mid-2025, but stays under $250,000. She confirms no assets were sold to change costs.

3. Fill Out the Form

Put your info in Part A (simplified) or Part B (detailed). Add any asset income. Check boxes for asset types and countries.

Pro Tip: Use CRA’s PDF or approved software to add totals—check for tiny income amounts you might miss.

Example: Emma uses Part A, ticking “bank accounts” and “real estate.” She lists the U.S. as the top country. She adds $3,000 rental income from her U.S. property. She uses CRA’s fillable PDF to total her entries.

4. Send by Deadline

File your taxes by April 30, 2026, for 2025 assets. Use NETFILE or paper. Keep a copy for your records.

Pro Tip: File online for a confirmation number; save a copy and set a reminder two weeks early to double-check.

Example: Emma files her T1135 via NETFILE with her 2025 taxes by April 15, 2026. She gets a confirmation number. She saves a digital copy on her computer. She sets a calendar alert for April 1, 2026, to review next year’s filing.

How the CRA Verifies Foreign Income for Form T1135 Compliance

The CRA has simple tricks to catch unreported foreign income. They make sure you pay your share. Here’s how they do it:

- More people Checking Forms: The CRA brings in extra people to check tax forms. They look for missed foreign income. This means more eyes on tricky filings. They catch stuff you might skip.

- Watching Big Money Canadians: They keep a close eye on wealthy people. These folks often have foreign stuff like stocks. The CRA checks for missing details. This helps find hidden assets.

- Stopping Sneaky Tricks: The CRA hunts for ways people hide money abroad. They spot shady accounts or secret plans. See how pillar two tax affects Canada–U.S. cross-border payments.

- Using Tech to Find Problems: They use computers to spot weird patterns. This catches unreported stuff like foreign bank accounts. It’s like a trap for missing income.

Pro Tip: Keep all papers, like bank or trade records, in one spot. It helps back up your T1135 if the CRA asks.

Special Cases for Form T1135 Reporting: Joint Ownership, ADRs, and Country Codes

You run into special situations with T1135 reporting. This section helps you handle them. Here’s the scoop:

1. Joint Ownership on T1135

Joint owners split the asset cost. You file T1135 if your share tops $100,000 CAD in joint ownership. Calculate your part from the ownership percentage. This applies to shared stocks or real estate with family or partners. Always check the rules of selling property in the U.S. as a Canadian.

Pro Tip: Make a shared spreadsheet for split costs. Update it yearly to see if your share hits the threshold.

2. ADRs (American Depositary Receipts) on T1135

ADRs count as the underlying company’s country. Use that country code on T1135. If you can’t find it, pick “Other” as a fallback. Check the company’s base to get it right.

Pro Tip: Search ADRs on sites like J.P. Morgan to find the true country. Save the details for your records.

3. General Country Codes for T1135

Country codes come from CRA’s list. For stocks, it’s the company’s home base, not the exchange. Pick the right code for each asset. Confirm it to avoid mistakes.

Pro Tip: Download CRA’s country code list and keep it handy. Add codes next to your assets in a list.

4. Amending a Filed T1135

Made a mistake on your T1135? Use the latest form or the old version to fix it. Mark changes clearly and sends it to CRA. Use VDP if it helps fix big issues.

Pro Tip: Scan your old T1135 before changes. Compare the new one to catch everything fast.

This table sums up special cases for quick reference:

| Case | What It Means | How to Handle | Pro Tip |

| Joint Ownership | Split cost by share | File if your part > $100k CAD | Use spreadsheet for splits |

| ADRs | Use underlying country | Code as company’s base | Search J.P. Morgan site |

| Country Codes | CRA list for assets | Pick home base code | Download list for reference |

| Amending | Fix errors on form | Use VDP for big fixes | Scan old form before changes |

How to Avoid CRA Penalties for Form T1135 Non-Compliance

You can avoid T1135 trouble with simple steps. Here’s how to keep things clean:

- File on Time: Send your T1135 with your taxes by April 30, 2026, for 2025 assets. NETFILE is the fastest.

- List All Assets: Include all foreign stuff over $100,000 CAD, even with no income. Check it twice.

- Use the Voluntary Disclosures Program: If you missed a past filing, fix it with the CRA’s VDP to stay safe.

- Read More: “Canada-US Tax Treaty: How It Works & How to Avoid Double Taxation in 2025”

Case Study: Toronto Investor’s Penalty Save

Problem: A small business owner from Toronto reached out to us last year. He forgot to file T1135 for his U.S. stocks worth $150,000 CAD. He worried about fines after getting a CRA notice.

What We Did: We suggested using the Voluntary Disclosures Program right away. We advised him to list all assets and file a fix with the CRA. We told him to keep the records clean for next time.

The Result: The CRA waived his $2,500 fine. He now files on time each year. His stress dropped, and he saved money on penalties.

Key Steps for Canadian Investors and Expats with Foreign Assets

You can make the T1135 filing super easy with these steps. Here’s what to do:

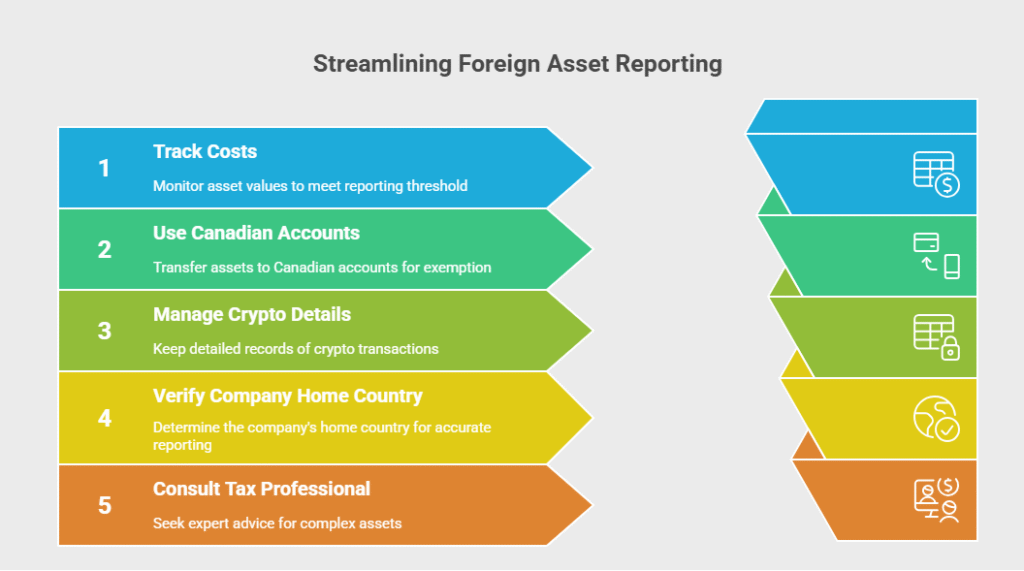

1. Track Costs Every Year

Write down what you paid for foreign stuff. Use a simple spreadsheet to keep it clear. This helps you know if you hit the $100,000 CAD mark. It also makes filing faster next time.

Pro Tip: Update your list monthly to catch assets hitting the $100,000 CAD mark early.

2. Use Canadian Accounts When You Can

Put foreign stocks in Canadian accounts like RRSPs or TFSAs. Use the CRA My Business account as a Canadian to manage everything correctly. These don’t go on T1135. It saves you time filling out the form. Plus, it fits better with Canada’s tax rules.

Pro Tip: Move U.S. stocks to a Canadian brokerage to skip reporting, but check tax rules first.

3. Get Crypto Details Right

Crypto on foreign sites counts as foreign property. Keep track of what you paid and where it’s held. Write down all buys and sells to stay accurate. The CRA’s watching crypto closely in 2025.

Pro Tip: Save records of crypto buys and platform details, as CRA’s watching crypto in 2025.

4. Check Company Home Country

Foreign stocks count based on where the company is based, not the stock exchange. Find out the company’s home country. Check their official website for the right info. You can also avoid US LLC tax problems for Canadians and double taxation.

Pro Tip: Look up the company’s headquarters on its website to know if it’s a foreign asset.

5. Hire a Tax Pro for Tricky Stuff

If you own complex things like foreign real estate, a tax pro makes sure your T1135 is right. They know the rules for expats and big investors. This helps with complicated portfolios or dual residency.

Pro Tip: Find a pro with cross-border tax experience to handle filings smoothly. Our cross-border tax accountant in Mississauga is ready to help.

Case Study: Vancouver Expat’s Asset Tracking Boost

Problem: In 2024, a Vancouver expat contacted us. His foreign stocks and real estate totaled $200,000 CAD. He struggled with tracking costs and country codes for Form T1135.

What We Did: We advised using a monthly spreadsheet for asset costs and consulting a tax pro for real estate details. We suggested Canadian accounts for some stocks to simplify reporting.

The Result: He filed T1135 accurately, avoiding CRA issues. His portfolio grew 15% that year. He now updates records easily and stays compliant.

Conclusion

Form T1135 keeps Canadians with foreign assets over $100,000 CAD in 2025 compliant. It makes tax filings clear for the CRA. This guide shows who files, what counts, and how to do it right. Keep up with the rules to stay safe. We help you with T1135 and cross-border taxes.

Contact us at SAL Accounting for a free consultation to master your T1135 filing with confidence.

Frequently Asked Questions

It’s a CRA form to report foreign stuff like stocks or crypto over $100,000 CAD. It makes sure you report any income from them.

Canadians with foreign assets over $100,000 CAD, like individuals or trusts, must file. New residents skip their first year.

List your assets’ costs on T1135, picking simplified or detailed based on total value. File it with your taxes.

It’s stuff like U.S. stocks, foreign bank accounts, or crypto on foreign sites. Personal-use homes or RRSPs don’t count.

You face $25/day up to $2,500 for late filing, or more for wrong info. Fix issues with the CRA’s VDP.

For assets worth $100,000–$249,999 CAD, group them by type and list the top three countries. It’s quick and easy.

Yes, if your U.S. account holds stocks or funds over $100,000 CAD. Track their cost, not market value.

Disclaimer: This Form T1135 guide is for general information only, not personalized tax or legal advice. Tax rules may change, so consult a tax professional or the CRA for your situation. SAL Accounting isn’t liable for errors or actions taken.