Here’s a simple Form T1134 guide to help you manage your U.S. LLC taxes as a Canadian and meet CRA rules easily. Canadian direct investment abroad reached $2.47 trillion in 2024, with over $1.29 trillion placed in the U.S. Still, many owners face penalties up to $2,500 for missing or late filings, plus double taxation risks from Canada-U.S. differences.

Most people overlook one key fact. The CRA treats U.S. LLCs as foreign affiliates, so you must file Form T1134 if you own 10% or more, even if the LLC is pass-through for the IRS.We at SAL Accounting will explain exactly what it means for your LLC that needs to file, simple steps, treaty benefits, common mistakes, and ways to stay penalty-free.

Quick Takeaways

- CRA treats U.S. LLCs as foreign affiliates — file Form T1134 if you own 10% or more, even if pass-through for IRS.

- File Form T1134 within 10 months after your tax year-end (e.g., October 31 for December 31 year-ends).

- Report all amounts on T1134 in CAD using Bank of Canada exchange rates.

- Canada-U.S. Tax Treaty cuts double taxation with lower withholding and foreign tax credits — claim on your Canadian tax return, not T1134.

- Keep good records (ownership proof, financials, transactions) to file correctly and avoid mistakes like missing deadlines or USD reporting.

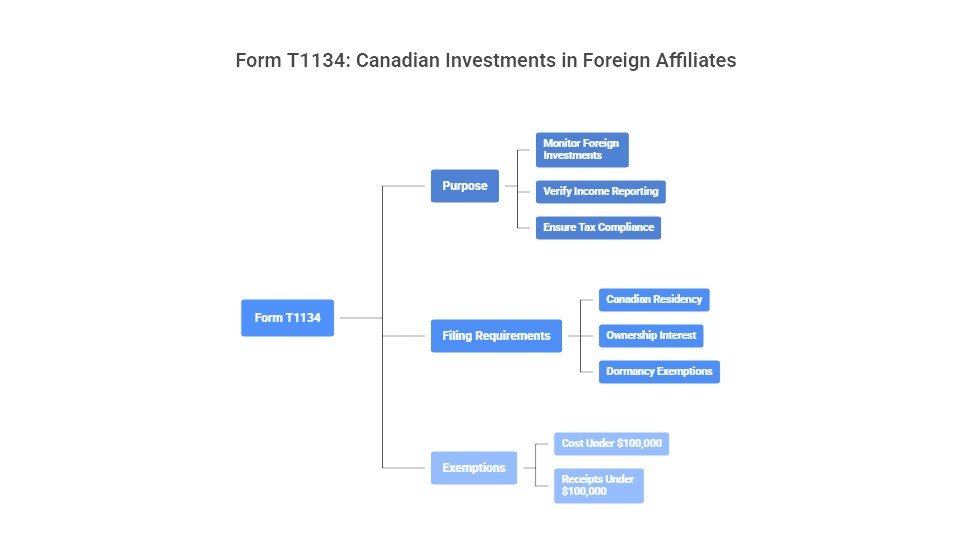

What Is Form T1134 and Why Do Canadians Need to File It?

Form T1134 is a CRA information return that tracks Canadian investments in foreign affiliates by collecting ownership, financial, and activity details (CRA’s guide). The CRA treats every U.S. LLC as a corporation, even single-member ones that are pass-through for the IRS. If you (or you with related parties) own 10% or more of the LLC, it counts as your foreign affiliate, and you must file Form T1134. You must file if:

- You are a Canadian resident (individual, corporation, trust, or certain partnerships). Check your Canadian residency first.

- You own a direct or indirect interest in a foreign affiliate at any point in the year.

- The affiliate does not meet dormancy exemptions (cost and receipts both under $100,000 CAD in some cases).

The CRA wants this data to monitor foreign investments, verify income reporting (like foreign accrual property income), and ensure tax compliance. Consult our cross-border tax accountant to ensure you file it.

Step-by-Step Guide: How to Complete and File Form T1134?

Filing Form T1134 is simple when you have your records ready. Use the 2021 (or later) version for tax years starting after 2020. The form has a Summary (Part I) and one Supplement (Part II) per affiliate (your U.S. LLC). Remember to choose the best structure between LLC, LLP, and S Corporation. Take the steps below carefully:

Step 1: Gather your documents

Before you touch the form, collect everything you need. You can also check how to open an LLC from Canada if you haven’t opened one. Get these ready first:

- Proof of ownership (operating agreement, articles of organization, share details).

- U.S. LLC financial statements (balance sheet, income statement, equity changes).

- Details of any transactions (loans, contributions, distributions between you and the LLC).

- Your ownership percentage (direct and indirect, including related parties).

- The LLC’s EIN (U.S. tax ID) and NAICS code for its main business activity.

- Bank of Canada exchange rates to convert all USD amounts to CAD.

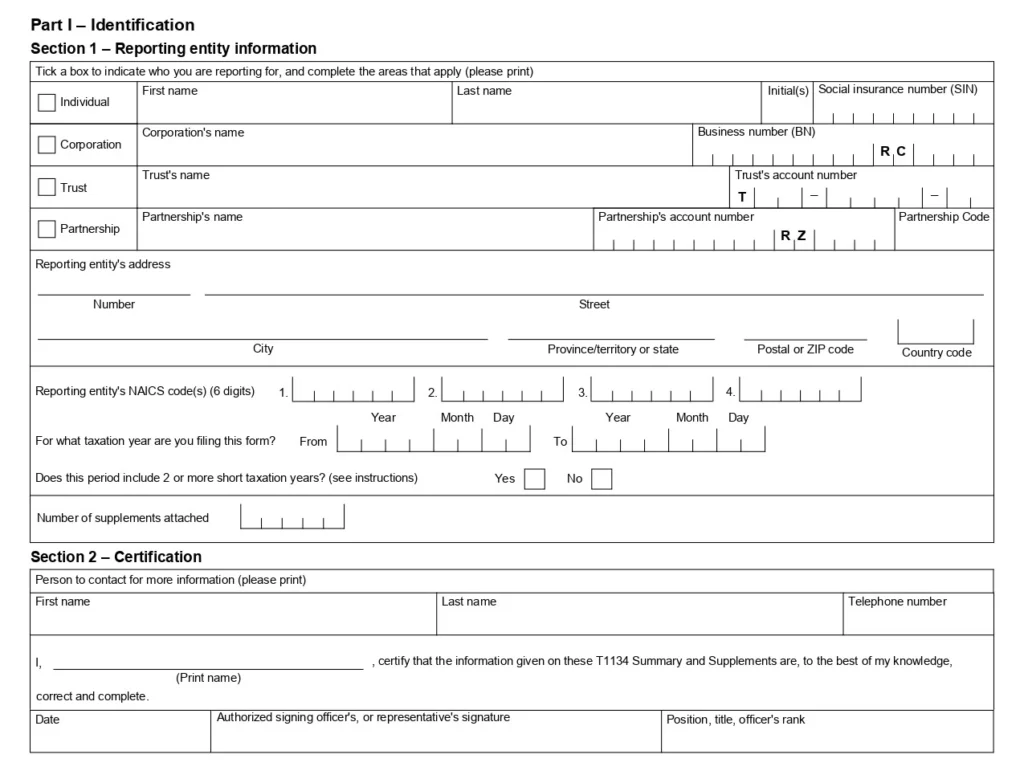

Step 2: Understand the form structure

The T1134 form is split into two main parts to keep things organized. Part I gives a quick overview of everything, while Part II dives into the details for each affiliate, like your U.S. LLC. Check what they are in the following:

- Part I – Summary: One page for the whole return. It lists you as the reporting person and all your foreign affiliates.

- Part II – Supplement: One per affiliate (your U.S. LLC). This is where you put the detailed ownership, financial, and transaction information.

Step 3: Complete the Summary (Part I)

Fill in your details first: your name, SIN for individuals or business number for corporations/trusts, and the tax year. Then list each affiliate: the U.S. LLC’s name, full address, EIN, country (USA), and whether it’s controlled (over 50% voting rights) or non-controlled. If any affiliate is exempt, note that exemption clearly in the Summary. See how to get your EIN from Canada.

Example: You live in Toronto and own 25% of a Delaware LLC running an e-commerce business. The LLC is non-controlled (under 50% votes). In Part I, you list the LLC’s name, address, EIN, USA, and “non-controlled”. You reported it even though no cash came to you.

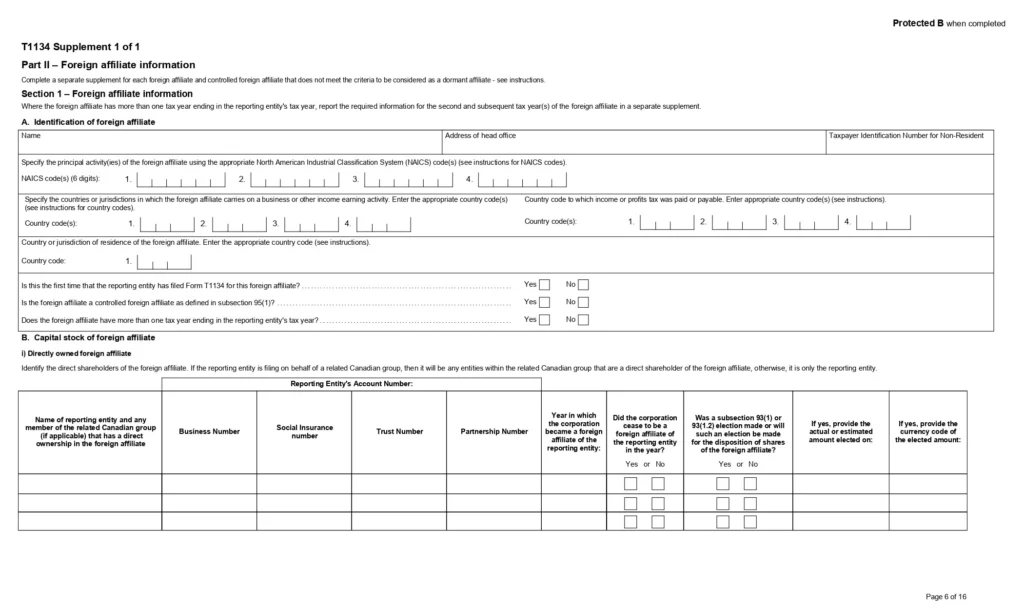

Step 4: Fill out the Supplement for your U.S. LLC (Part II)

The Supplement is the detailed section where you report everything specific to your U.S. LLC. As a corporation, check if a Canadian Corporation can own a US LLC. Here’s what goes in each part:

- Section 1: Basic info (name, address, EIN, NAICS code, countries of operation).

- Section 2: Ownership details (your % interest, related parties, any changes during the year).

- Section 3: Financial data (surplus/deficit, income types, FAPI if applicable).

- Section 4: Transactions (amounts paid or received with the affiliate). Put everything in CAD. If the structure is complicated, attach a simple organization chart (electronic filings allow this).

Step 5: Review everything carefully

Check the form for any mistakes or missing information; the CRA can charge penalties if it’s incomplete or incorrect. Sign the form (an electronic signature is fine for online filing). If you used a tax preparer, include their authorization. Avoid US LLC tax problems for Canadians.

Step 6: Submit the form

- Best way: File electronically through CRA’s My Business Account (for individuals) or Represent a Client portal (for authorized reps). Many tax programs like TaxCycle or ProFile support EFILE for T1134. You get instant confirmation.

- Other option: Mail the paper form to the Winnipeg Tax Centre (address is on the form). Paper is less common now. Keep copies and proof of submission for at least 6 years.

Pro Tip: If your U.S. LLC is dormant (cost basis and gross receipts both under $100,000 CAD), check the CRA exemptions. You might not need to report full details. Always grab the latest form from the official CRA website.

| Part / Section | What to Enter | U.S. LLC Example | Key Notes |

| Part I – Summary | Your info + affiliate list | Name, SIN/BN, tax year; LLC name, address, EIN, USA | One page for all affiliates |

| Part II – Sec 1 | Basic affiliate info | Name, address, EIN, NAICS, countries | Basic setup |

| Part II – Sec 2 | Ownership % and changes | Your % interest, related parties | Must show 10%+ threshold |

| Part II – Sec 3 | Financials & FAPI | Surplus/deficit, income types | All in CAD |

| Part II – Sec 4 | Transactions | Amounts paid/received | All in CAD; attach org chart if needed |

T1134 Reporting Deadlines and Penalties for Canadians with U.S. LLCs

The CRA gives you 10 months after the end of your tax year to file Form T1134. For most individuals and corporations, this deadline falls on:

- October 31 of the following year if your tax year ends December 31.

- 10 months forward from your year-end date if it differs (for example, January 31 for a March 31 year-end).

Extensions are rare for T1134, so plan ahead and file on time.

What happens if you don’t file Form T1134?

Failing to file on time can cost you a lot. You must consider it for US LLC tax deductions as well. The CRA starts penalties right after the deadline. Here are the main penalties:

- $25 for each day the form is late: The fine increases daily until you file.

- Minimum penalty of $100: Even if the form is only a few days late, you will pay at least this amount.

- Maximum penalty of $2,500 per form: No matter how late the filing is, the penalty for a single form will not exceed $2,500.

If the CRA demands the form and you ignore it, penalties climb even higher. Repeated misses or unreported income often spark audits, interest charges, and gross negligence penalties (up to 50% of any tax owed). Do not forget to get help from our US LLC formation experts to avoid penalties.

Case Study: Toronto E-Commerce Owner Gets Back on Track in 20261

A Toronto e-commerce owner near King West owns 50% of a Wyoming LLC that sells handmade goods online and generates U.S. sales revenue.

Problem: She delayed filing T1134 for 2025 because she focused only on her U.S. tax obligations and assumed the LLC’s pass-through status meant no Canadian reporting was needed until money reached her personally.

What We Do: We reviewed her ownership structure, pulled together the LLC’s financial statements and transaction history, filed the 2025 T1134 through the CRA’s electronic portal, and set up a simple annual checklist with calendar alerts and a dedicated digital folder for future years.

The Result: The filing was accepted smoothly, she gained peace of mind knowing her compliance is current, and she now treats T1134 as a routine step alongside her U.S. filings. She also started using a basic app to track exchange rates and ownership updates automatically, making next year’s filing even easier.

What Is the Difference between T1134 and T1135?

Form T1134 and Form T1135 are two different CRA information returns, but they serve very different purposes for Canadians with foreign interests. Here is a clear breakdown:

Purpose: T1134 reports foreign affiliates with detailed ownership, financials, transactions, and income types. T1135 reports specified foreign property (bank accounts, shares, bonds, real estate) if the total cost exceeds $100,000 CAD at any time in the year.

Who must file: T1134 applies to Canadians who own 10% or more of a foreign affiliate. T1135 applies to Canadians who own specified foreign property over $100,000 CAD.

What you report: T1134 requires detailed information (ownership percentages, balance sheets, income, transactions, surplus/deficit). T1135 requires only general information (property types, country, maximum cost amount, value ranges).

Deadline: T1134 is due 10 months after your tax year-end. T1135 is due at the same time as your regular tax return (April 30 for individuals, 6 months for corporations).

| Item | Form T1134 | Form T1135 | Main Difference |

| Purpose | Report foreign affiliates (U.S. LLC) | Report foreign property > $100,000 CAD | Affiliates vs assets |

| Who files | 10%+ ownership in affiliate | Property cost > $100,000 CAD | Ownership vs total value |

| What you report | Detailed (ownership, financials, txns) | General (types, country, max cost) | High detail vs basic summary |

| Deadline | 10 months after year-end | Same as tax return (Apr 30 / 6 mo) | Earlier vs regular deadline |

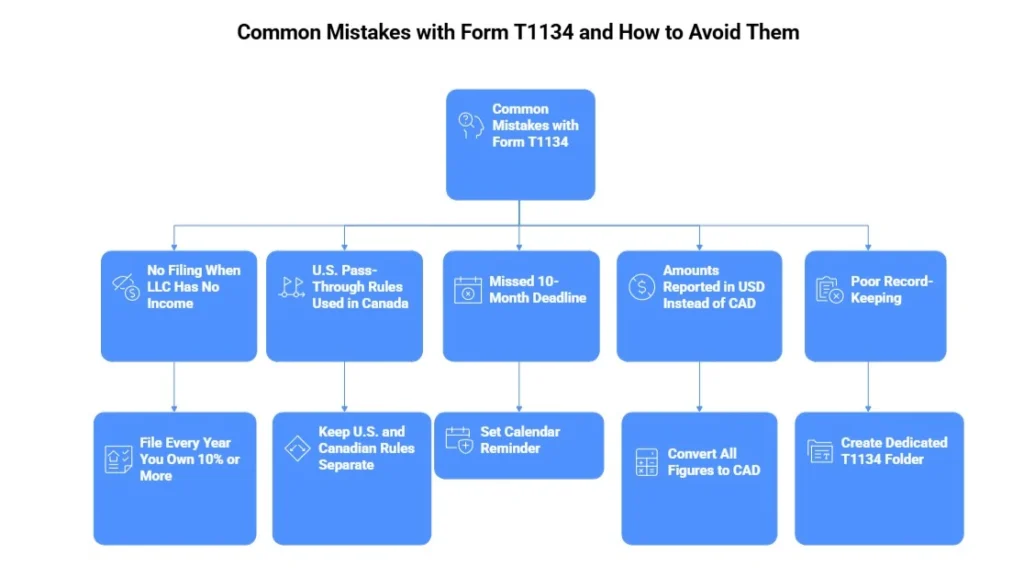

What Are Common Mistakes with Form T1134 ( How to Avoid Them)

Many Canadians make mistakes on Form T1134 because CRA rules are different from U.S. tax rules. Here are the most common mistakes, what they cost, and how to fix them:

1. No filing when LLC makes no income or distributions

Many people believe that zero income or no money sent to them means no form is required. Form T1134 is an information return. It reports ownership and basic LLC details even when the company earns nothing or pays nothing out. The filing rule depends only on owning 10% or more.

Cost: $25 per day late, minimum $100, maximum $2,500 per LLC per year.

Fix: File every year you own 10% or more, even with zero activity.

2. U.S. pass-through rules used in Canada

Single-member LLCs are often disregarded by the IRS, so owners think Canada ignores them, too, and skip the form. The CRA does not ignore it. It always treats a U.S. LLC as a corporation (foreign affiliate) for Canadian tax and reporting. Also, make sure whether an LLC is the best structure for online retail or not.

Cost: Full penalties plus higher audit risk.

Fix: Keep U.S. and Canadian rules separate. If you own 10% or more, file T1134.

3. Missed 10-month deadline

People often confuse T1134 with their regular tax return deadline (April for personal, 6 months for corporate). Form T1134 is due 10 months after your tax year ends.

Cost: $25 per day late, minimum $100, maximum $2,500 per form. Multiple LLCs make the fine grow fast.

Fix: Set a calendar reminder for year-end + 10 months and file 1–2 months early.

4. Amounts reported in USD instead of CAD

Some filers leave the numbers in U.S. dollars or use unofficial or incorrect exchange rates. Every amount on Form T1134, including balance sheet items, income figures, transactions, and surplus/deficit calculations. must be reported in Canadian dollars only. Learn more to know how to avoid double taxation for your small business as well.

Cost: The CRA may reject the return or demand a refile, leading to penalties.

Fix: Convert all figures using Bank of Canada rates. Keep a record of the rates used.

5. Poor record-keeping leads to errors or missing information

Messy or incomplete records cause people to submit wrong ownership percentages, use old financial statements, or forget transactions. This happens when documents are scattered, not updated yearly, or missing key details.

Cost: The CRA sees the return as invalid, applies penalties, and increases audit risk.

Fix: Create a dedicated T1134 folder. Update it yearly with ownership proof, financial statements, transactions, and exchange rates. Review before submitting.

Pro Tip: Keep the following quick checklist in mind to avoid any mistakes:

- If you own 10% or more of the LLC, file Form T1134 every year.

- Make sure the deadline is near and file early to avoid stress.

- Check that all amounts are converted to CAD.

- Confirm your records are complete and current.

Case Study: Mississauga Entrepreneur Avoids $7,500 Penalty in 20262

A Mississauga tech entrepreneur near Square One owns 35% of a Delaware LLC that develops AI tools and generates U.S. revenue.

Problem: He skips T1134 because the LLC is a pass-through for IRS purposes and made no distributions to him in 2025. The CRA issues an audit notice in mid-2026.

What We Do: We collect ownership documents, LLC financials, and transaction records, file a late T1134 through voluntary disclosure, explain the oversight, and set up annual reminders plus a secure shared folder system.

The Result: The CRA reduces the penalty from $7,500 to $1,800. He now files on time each year, uses electronic filing for instant proof, and avoids future issues with simple calendar alerts and quarterly record checks.

You can always ask for the help and free consultation of our Mississauga US Canada tax accountants.

Final Thoughts

Form T1134 looks tricky at first for Canadians with U.S. LLCs, but it gets easy once you know the basics. File it if you own 10% or more. Gather your documents early. Convert everything to CAD. Submit electronically so you have proof. The Canada-U.S. tax treaty can help cut double taxation on the income you report, so time your distributions right and claim foreign tax credits.

At SAL Accounting, we help Canadian U.S. LLC owners with T1134 filing, treaty benefits, and cross-border tax planning every day. If you are unsure about your situation or want a simple system for the future, contact our team today.

FAQ: Most Common Form T1134 Questions Answered

Ordinary and necessary expenses: COGS, advertising, platform fees, shipping/packaging, home office, software/apps, professional services, insurance, mileage/travel, office supplies.

Yes — subscription fees, transaction fees, payment processing, apps, and theme/development costs are fully deductible.

Yes — 100% deductible: paid ads (Facebook, Google, etc.), influencers, email tools, SEO, sponsored content, promo samples.

No — deducted through COGS when items sell. Damaged/expired/unsellable inventory can be deducted with documentation.

Yes — if the space is used exclusively and regularly for business. US: simplified ($5/sq ft up to 300 sq ft) or actual. Canada: percentage of home costs. Keep photos and logs.

Yes — keep receipts, invoices, statements for 3–7 years (7 safest). Digital copies are fine. Use apps like Expensify.

Claim all qualifying deductions, maximize 2026 rules (QBI, 100% bonus depreciation, Section 179), separate finances, track expenses monthly, use accounting software. Consult a tax pro.

Disclaimer: This guide offers general information on Form T1134 for Canadian U.S. LLC owners as of February 2026. It is not legal or tax advice. Tax rules change, and your situation may differ. Always verify the latest CRA guidelines and consult a qualified cross-border tax professional before filing or making decisions. SAL Accounting is not liable for actions based on this content.