We are here to make IRS Form 8233 easy for you, whether you’re a Canadian contractor or student, so you can claim U.S. tax treaty benefits with confidence. The surprising fact is that 68% of nonresidents miss out on tax savings due to Form 8233 mistakes. This form can slash or wipe out the 30% US tax on your income from services like freelancing or teaching. Simple errors can cost you thousands.

We at SAL Accounting will walk you through Form 8233 instructions, give a clear filing guide, compare it to W-8BEN, and share tips to help you keep more of your money.

Quick Takeaways

- IRS Form 8233 lets nonresidents cut or eliminate the 30% U.S. tax on service income.

- You must have a valid SSN or ITIN and a U.S. tax treaty to qualify.

- File Form 8233 before your first U.S. paycheck to avoid upfront withholding.

- Canadians often use Article 14 (independent services) or Article 16 (students) for exemptions.

- Form 8233 must be refiled each year to keep your tax treaty benefits active.

What is IRS Form 8233, and Who Uses It?

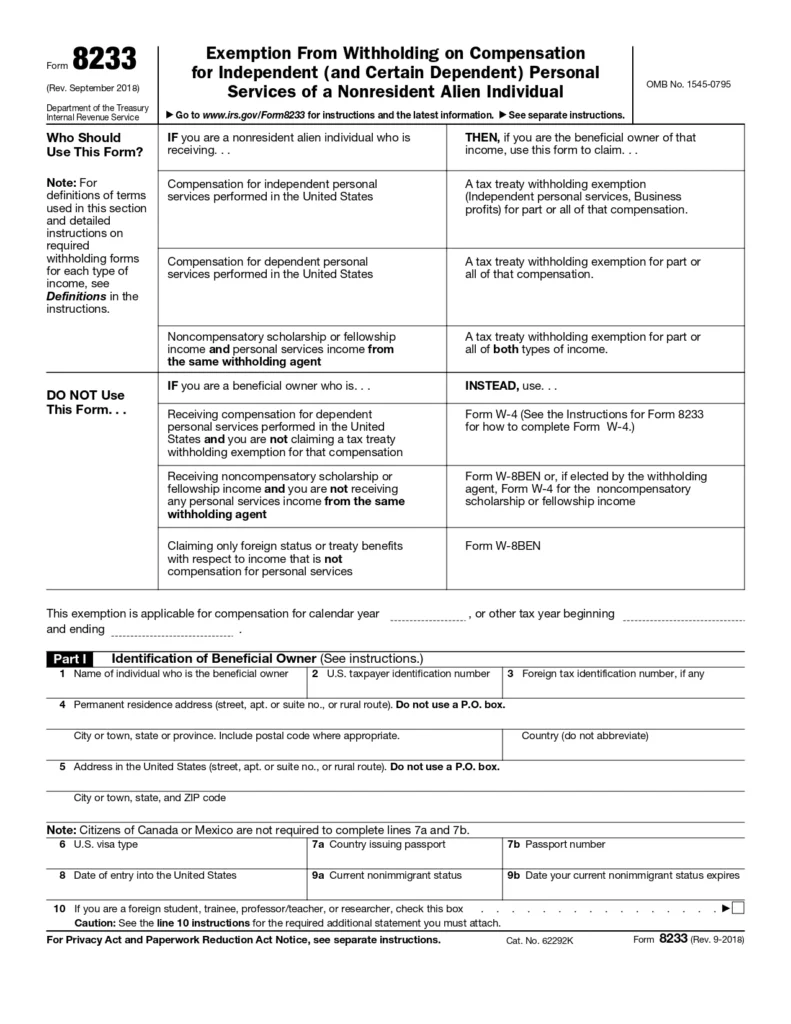

IRS Form 8233 lets you, as a nonresident alien, reduce or avoid the 30% US withholding tax on income from services like consulting or speaking (details on IRS). This form uses US tax treaties to lower or eliminate taxes. It covers only service-based income, not dividends or royalties. Consult with our cross-border tax accountant to get it right. You qualify if you meet these requirements:

- You’re a nonresident alien (not a US citizen or resident).

- Your country has a tax treaty with the US.

- You earn money from services done in the U.S. (e.g., a Canadian graphic designer working for a US client).

- You have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Learn more about US-Canada dual citizen tax implications and filing requirements to stay compliant. Check the form header below:

How Form 8233 Helps Reduce Withholding Tax for US Nonresidents

Form 8233 helps you cut or skip the 30% US withholding tax on money from services like teaching. Without it, the IRS grabs 30% of your earnings right away. Here’s what you get:

- Slash Taxes: Drops or wipes out the 30% tax on your service income.

- Use Treaty Benefits: Saves you thousands with tax treaties. See how the US-Canada tax treaty works to avoid double taxation.

- Cover Key Work: Works for services like consulting or speaking.

- Pick the Right Treaty: Needs the correct treaty article (IRS Publication 901).

Treaty benefits depend on your country. Canada’s treaty might exempt $10,000 for students. India covers some professional fees. China may fully exempt teaching income. See the table below:

| Country | Treaty Article | Exemption Limit | Eligible Income |

| Canada | Article 14 | Up to $10,000 (students) | Teaching, consulting |

| India | Article 22 | Varies by service | Professional fees |

| China | Article 19 | Full exemption (some cases) | Teaching, research |

| United Kingdom | Article 14 | Full exemption (some cases) | Independent services |

| Germany | Article 14 | Full exemption (some cases) | Independent services |

Example: Sarah, a Canadian student on an F-1 visa, earns $8,000 teaching a US summer course. She files Form 8233 under Canada’s treaty and saves $2,400 in taxes.

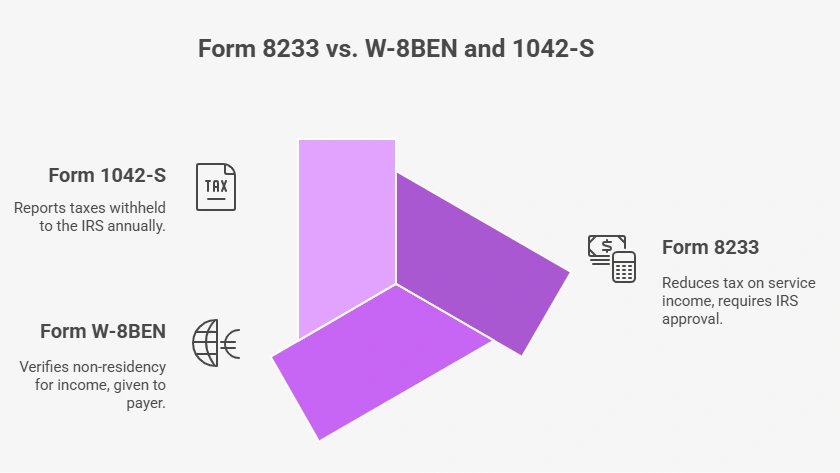

Form 8233 vs. W-8BEN and 1042-S: Key Differences

Form 8233, Form W-8BEN, and Form 1042-S do different things for nonresidents. Here’s the breakdown:

- Form 8233: Cuts the 30% tax on money from services like consulting. You and your employer send it to the IRS with a tax treaty. It needs IRS okay (10-day wait) and a yearly redo.

- Form W-8BEN: Shows you’re not a US resident for income like dividends. You give it to your payer, not the IRS. It lasts three years, so no approval is needed. Check out the comprehensive guide on the W-8BEN for foreign individuals.

- Form 1042-S: Tells the IRS about taxes already taken. Your employer or client files it every year. It tracks taxes withheld, not exemptions. You must know the Form 1042-S instructions and how to report US income.

Step-by-Step Form 8233 Guide: How to File Form 8233

These IRS Form 8233 instructions help you cut or skip the 30% US tax on your income. Here’s how to file Form 8233 the easy way.

Step 1: Check If You Can Use It

Make sure you’re a nonresident alien with a US tax treaty. Your money must come from work, like consulting or speaking. A Canadian freelancer on a J-1 visa can use it, for example. Look up your treaty in IRS Publication 901. You need a Social Security Number or ITIN. See what an ITIN is and how to get one as a Canadian.

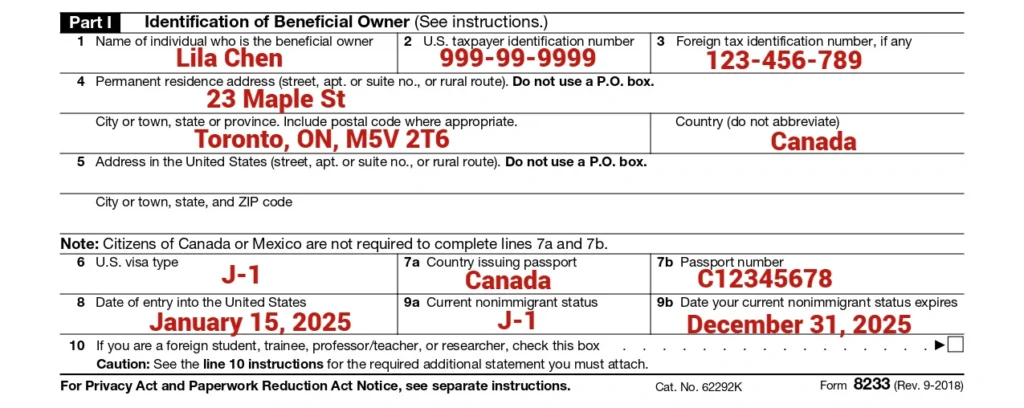

Example: Meet Lila Chen, a Canadian freelancer from Toronto on a J-1 visa. She earns $15,000 consulting for BrightTech Solutions, a Seattle tech firm, in 2025. Lila confirms her nonresident status and finds Article 14 for consulting.

Pro Tip: Ask your US payer if they accept treaty exemptions before you start.

Step 2: Get Your Papers Ready

Grab your passport, visa, and SSN or ITIN. Find your country’s treaty article for your work. Canada’s Article 14 covers consulting, for example. Have a contract ready. This keeps your info right.

Example: Lila saves Canada’s Article 14 details and her $15,000 contract digitally.

Pro Tip: Save digital copies of your papers to share with your employer fast.

Step 3: Fill Part I – Your Info

Get Form 8233 from the IRS (download). Write your name, address, SSN or ITIN, and visa type. Add your foreign tax ID if you have one. Check for errors.

Example: Lila writes “Lila Chen, 123 Maple St, Toronto, ON, ITIN 999-99-9999, J-1 visa.”

Pro Tip: Use your home country address to avoid mix-ups with temporary US addresses.

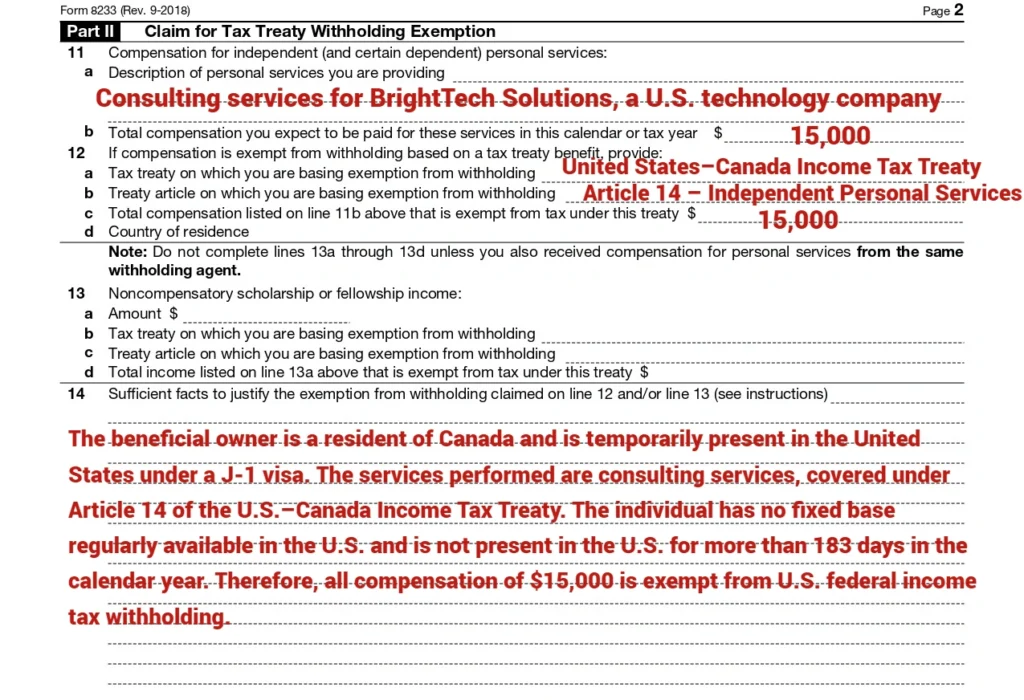

Step 4: Fill Part II – Tax Break Details

Say what you do, like “consulting for a U.S. company.” List the money you want to be tax-free. Pick the treaty article. Explain why you qualify.

Example: Lila writes “Consulting for U.S. client, $15,000, Canada Article 14, nonresident status.”

Pro Tip: Copy the treaty article exactly from Publication 901 to avoid rejection.

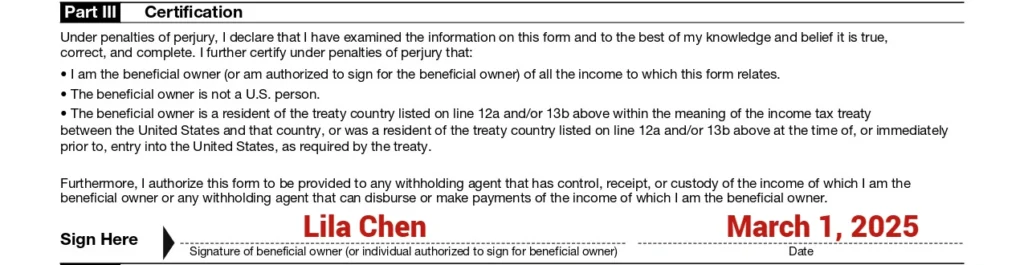

Step 5: Sign Part III – Promise It’s True

Sign and date to say everything’s correct. You’re swearing it’s true. A mistake can get your form rejected. Check it twice.

Example: Lila signs “Lila Chen, March 1, 2025,” and double-checks her form.

Step 6: Give It to Your Employer

Hand Form 8233 to your employer or client. They fill out Part IV, saying they handle taxes. They send it to the IRS in five days.

Example: Lila emails her form to BrightTech Solutions, the Seattle tech firm hiring her for consulting, who completes Part IV.

Pro Tip: Ask your employer to confirm they sent it to avoid delays. Send Form 8233 before your first paycheck to avoid the 30% tax.

Step 7: Wait for IRS Approval

The IRS takes 10 days to review. Your employer sends the form to the IRS (address on the form). Taxes apply until it’s approved. Check if it’s late.

Example: BrightTech Solutions mails Lila’s form to the IRS in Philadelphia on March 2, 2025.

Step 8: File Again Each Year

Form 8233 lasts one year. File a new one before January 1 to keep your tax break. If you miss this, the IRS takes 30% again. Set a calendar alert early.

Pro Tip: Keep old forms to make refilling quicker.

IRS Form 8233 Instructions: Key Treaty Articles for Canadians

These U.S.-Canada tax treaty articles help you reduce withholding tax for US nonresidents with the 8233 form for Canadians. They cut or skip the 30% tax on your work cash. Have a look at the US-Canada tax treaty benefits to gain more info. Here’s what they do:

- Article 14 (Independent Services): Covers your own gigs, like consulting or freelancing. You skip the 30% tax if you don’t have a US office.

- Article 15 (Dependent Services): Applies to pay from US jobs, like teaching for a company. Tax breaks depend on your job and your US stay time.

- Article 16 (Students): Lets Canadian students or trainees skip tax on up to $10,000 from US teaching or research.

Special Considerations for Canadians Using Tax Treaty Form 8233

The 8233 form for Canadians helps you save on US taxes. Learn more about how to avoid double taxation between the US and Canada. Follow these tips to nail it:

1. File Before Your First Payment

Submit Form 8233 before your first paycheck. This stops the 30% tax from hitting your income. Waiting too long means the IRS takes the tax upfront, and you’ll need a refund later.

2. Get an SSN or ITIN

You need a Social Security Number or Individual Taxpayer Identification Number to file. Apply for an ITIN through the IRS if you don’t have an SSN. Start early, as ITIN processing can take weeks.

3. Check Your Visa

J-1 or F-1 visas usually work for Form 8233. B-1/B-2 visas (visitor visas) often don’t qualify for exemptions. Check your visa status to avoid rejection by the IRS.

4. Talk to Your Employer

Tell your US employer about Form 8233. Ensure they know how to fill out Part IV and send it to the IRS. Clear communication prevents filing errors.

5. Refile Every Year

Form 8233 lasts one year. File a new one before January 1 to keep your tax break. Missing this triggers the 30% tax again. Our bookkeeping experts in Toronto can provide you with expert help. This table summarizes key tips for Canadians:

| Tip | Action | Benefit | Key Requirement |

| File Before First Payment | Submit Form 8233 early | Avoids 30% tax withholding | Completed form |

| Get an SSN or ITIN | Apply for ITIN if no SSN | Enables Form 8233 filing | ITIN application |

| Check Your Visa | Verify J-1 or F-1 eligibility | Prevents IRS rejection | Valid visa |

| Talk to Your Employer | Guide employer on Part IV | Ensures correct submission | Employer coordination |

| Refile Every Year | Submit new form before January 1 | Maintains tax break | Annual refiling |

Case Study: Canadian Student’s Form 8233 Triumph*

Problem: Noah, a Toronto student on an F-1 visa, reaches out to us after his employer withholds $2,700 from his $9,000 US summer teaching job.

What We Do: We file Form 8233 early under Article 16, confirm his F-1 visa, and guide his employer to complete Part IV and submit.

Result: Noah gets $2,700 back after IRS approval. His summer earnings are safe.

Penalties and Deadlines for IRS Form 8233

Form 8233 deadlines and penalties keep you on track. These IRS Form 8233 instructions help you file without issues.

Deadlines You Need to Know

Meet these deadlines to avoid the 30% tax:

- File Form 8233 before your first US paycheck.

- Your employer sends it to the IRS in 5 days.

- The IRS takes 10 days to approve.

- Refile every year before January 1 to keep your tax break. Filing late triggers a 30% tax until approved.

Penalties for Errors

Wrong forms, like bad treaty articles or missing info, lead to 30% tax withholding. The IRS can fine you up to $1,000 for false info. Incorrect filings delay your tax break and cost you cash. File right to avoid fines. You may need to know the consequences of not filing US taxes while living abroad.

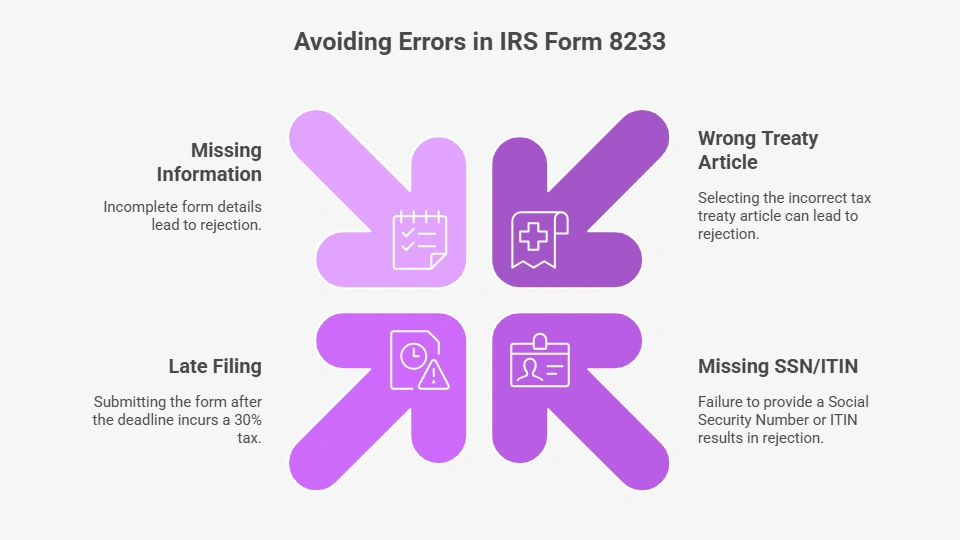

Common Mistakes to Avoid When Filing Form 8233

These IRS Form 8233 instructions help you avoid errors that cost money or get your form rejected. A mistake can mean extra taxes. Here’s what to dodge:

- Wrong Treaty Article: Choose the right tax treaty article, or the IRS says no.

- No SSN or ITIN: You need a Social Security Number or Individual Taxpayer Identification Number to file.

- Late Filing: Send Form 8233 before your first payment to avoid the 30% tax.

- Missing Info: Fill every box, like income or treaty details, to prevent rejection.

Pro Tip: Apps like Sprintax check your form for mistakes before you submit. Check your form twice to save cash. Book a free consultation with our US-Canada cross-border tax accountant to avoid mistakes.

Case Study: Canadian Consultant’s Form 8233 Rescue*

Problem: Sophie, a Vancouver consultant, contacts us after using the wrong treaty article for her $12,000 US workshop contract. The IRS rejects her Form 8233, withholding $3,600.

What We Do: We check IRS Publication 901, select Article 14 for independent services, refile her form, and confirm with her client.

Result: Sophie gets $3,600 back after IRS approval. Her workshop earnings stay intact.

Read More: US-Canada Joint Venture Tax 2025: A Guide to Easy Compliance and Bigger Profits

Final Thoughts

Form 8233 helps you reduce withholding tax for US nonresidents, saving tons on work income like consulting or teaching. This form 8233 guide gives you easy steps to file right, avoid errors, and use tax treaties, especially for Canadians. Filing correctly keeps the 30% tax off your cash. Whether you’re a freelancer or student, Form 8233 boosts your earnings.

Contact us at SAL Accounting for Form 8233 help to keep filing simple and save big in 2025.

*Hypothetical scenario

IRS Form 8233 FAQs

Form 8233 cuts or skips the 30% US tax on service income, like consulting, for nonresidents using tax treaties.

Nonresident aliens with a US tax treaty can file. You need income from US services, like a Canadian freelancer’s consulting gig.

No. Form 8233 is for service income, like teaching. W-8BEN is for non-service income, like dividends. Pick the right one.

No. You need a Social Security Number or ITIN. Apply for an ITIN at IRS.gov if you don’t have an SSN.

Only service income qualifies, like consulting or speaking. Dividends or royalties don’t count. Check your treaty for details.

Yes. Canadians use Form 8233 with articles like 14 or 16 to cut taxes on US service income.

Yes. The IRS must approve Form 8233, which takes 10 days. Taxes apply until you get approval.