Residency matters a lot in Canada’s tax system. You live here or take off somewhere else, either way, a few big things pop up. Statistics Canada estimates around 4 million Canadian citizens lived abroad in 2023. Many of them still connect to our tax system.

That’s where factual vs. deemed residency comes in to sort your taxes out.The SAL Accounting team made this guide to explain Canadian tax residency simply. It helps you get through it without worry. Stick with us to the end.

Quick Takeaways

- Factual residents: taxed on all income if you have a Canadian home or spouse.

- Deemed residents: taxed on all income plus 48% surtax if here 183+ days or a government worker abroad.

- Use Form NR73 to confirm your residency status if unsure with CRA.

- File T1 General (factual) or Non-Resident T1 (deemed) by April 30.

- Under $10,000 or 183 days in the U.S./Canada? Treaty stops double tax.

What Is Canadian Tax Residency? (Understanding the Basics)

Canadian tax residency shows how you connect to Canada, which is different from your citizenship. It decides if you pay taxes here. Two main types exist:

- Factual Residents: People who live here or have big ties (like a spouse or a house).

- Deemed Residents: People who don’t stay here full time but still count as residents for different reasons.

Let’s figure out your group and tax duties. You can also check out our bookkeeping services in Toronto for expert help.

Deemed Resident vs. Factual Resident: Tax Implications & Rules

Below, we’ll talk about each type of Canadian tax residency in detail and show you how the CRA figures out if you’re a factual or deemed resident:

Factual Residency: How Ties Trigger Taxes

Factual residents are people the Canadian government still counts as living here for taxes. You might leave for a while, but you’re still in this group. Your spot on the map doesn’t matter. The CRA checks what you keep in Canada.

How Does Canada Decide You Are a Factual Resident?

The government looks at your links to Canada. The CRA checks your ties carefully. Big ones that mark you as a factual resident include:

- Having a Home: You own, rent, or keep a place in Canada; that’s a major tie.

- A Common-law Partner or a Spouse: Your spouse or partner lives here. Even if you’re abroad, you still count as a resident.

- Dependents: You support elderly parents, kids, or others here. They link you to Canada as a factual resident.

Key Point: You might have smaller ties, like cars, club memberships, bank accounts, health plans, or regular visits. They don’t make you a factual resident by themselves. They just help prove the big ties matter.

Examples:

- An expat has worked in the U.S. for a year, but his family lives in Toronto. He’s a factual resident.

- Students who study in another country, like England, and their parents keep their rooms in Canada fit the factual residency group.

- Workers live abroad but hold onto a Canadian home for themselves. They count as factual residents.

Tax Implications for Factual Residents

Factual residents tell the government all their income (money from Canada or anywhere else). They pay two kinds of income taxes:

- Federal Tax: The CRA taxes your income. It starts at 15% for the first $57,375 you earn. Make more, and it climbs up to 33% for anything over $253,414. These federal income tax rates work for 2025.

- Provincial Tax: This depends on where your ties sit, like your home’s spot. In Ontario, you pay 5.05% on the first $51,446, and it hits 13.16% over $220,000.

Glance at this table to understand the progressive tax rates applied to various income brackets:

| Taxable Income Range | Tax Rate | Tax Paid Example |

| $0 – $57,375 | 15% | $7,500 (on $50,000) |

| $57,376 – $114,750 | 20.5% | $3,075 (on $15,000) |

| $114,751 – $177,882 | 26% | $5,200 (on $20,000) |

| $177,883 – $253,414 | 29% | $5,800 (on $20,000) |

| Over $253,414 | 33% | $6,600 (on $20,000) |

Example: Sarah lives in Ontario. She makes $65,000 in 2025, $45,000 from a U.S. job and $20,000 from freelancing here.

Her Federal Tax:

- The CRA takes 15% of her first $57,375: 15% × $57,375 = $8,606.25

- The leftover $7,625 gets 20.5%: 20.5% × $7,625 = $1,563.13

- Total Federal Tax: $8,606.25 + $1,563.13 = $10,169.38

Her Provincial Tax (Ontario):

- Ontario takes 5.05% of her first $51,446: 5.05% × $51,446 = $2,598.02

- The rest, $13,554, gets 9.15%: 9.15% × $13,554 = $1,240.19

- Total Ontario Tax: $2,598.02 + $1,240.19 = $3,838.21

- Also Read: US Citizen Working Remotely for Canadian Company Taxes Explained

Filing Requirements for Factual Residents

Factual residents use the T1 General Income Tax and Benefit Return. That one matches your province or territory and comes from their regular tax package.

Deemed Residency: Taxes Without the Big Ties

Deemed residents don’t have major ties in Canada, like a home or family. But taxes still see them as residents. Your situation, not your address, puts you here.

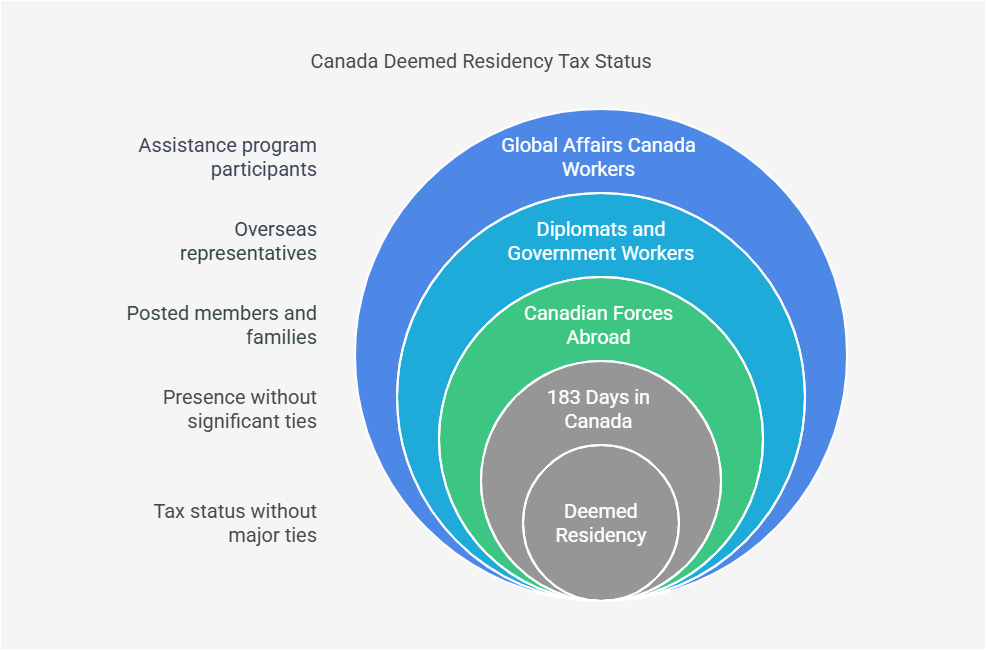

Who Are Canada Deemed Residents?

Deemed residents match at least one of these:

- People stay 183 days or more in Canada in a year and lack big ties, if no other residency fits.

- Canadian Forces members or their families get posted abroad.

- Ambassadors, ministers, or government workers (or their families) who work outside Canada.

- People working for Global Affairs Canada (or their families) join an assistance program.

What Taxes Deemed Residents Pay?

If you’re a deemed resident, you pay taxes like this:

- Federal Tax: You pay Canada’s usual tax on all your cash from anywhere. In 2025, it starts at 15% on the first $57,375 you make. It jumps to 33% if you earn over $253,414.

- Extra Surtax: You skip provincial tax and pay an extra fee called a surtax instead. It adds to your federal tax, usually 48% of that base amount.

Pro Tip: Claim every foreign tax credit you can. It cuts that surtax sting big time.

Example: Mike’s a deemed resident. He works for the Canadian government abroad. He makes $60,000.

His Federal Tax:

- The CRA takes 15% of his first $57,375: 15% × $57,375 = $8,606.25

- The leftover $2,625 gets 20.5%: 20.5% × $2,625 = $538.13

- Total Federal Tax: $8,606.25 + $538.13 = $9,144.38

His Surtax:

- The CRA takes 48% of his federal tax: 48% × $9,144.38 = $4,389.30

- Total Surtax: $4,389.30

Case Study: Diplomat’s Surtax Shock

Problem: Maria, a diplomat in France, earned $85,000 in 2024 with no Canadian ties. She filed her Non-Resident T1, reporting $0 Canadian income, but the CRA deemed her a resident for her government job.

What I Did: I suggested verifying her deemed status and calculating her federal tax at $14,500. I recommended addressing the 48% surtax to ensure accuracy and proposed adding a $2,000 foreign credit from France.

The Result: The CRA accepted $16,500 total ($12,500 federal, $4,000 surtax) saving her $6,500 from the original bill.

Filing Requirements for Deemed Residents

Deemed residents file with the Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada (Source). It’s a T1 form from a special non-resident and deemed resident tax package.

Warning: Both Canadian residencies need it by April 30 next year. Self-employed? You get until June 15. But you still pay any taxes you owe by April 30.

How Does Your Residency Affect Cross-Border Taxes?

Your residency (U.S. resident in the U.S. or Canadian resident in Canada) decides who taxes your income. Working over the border makes it tricky. Time spent and cash earned set what you owe. Two setups pop up:

- You live in the U.S. but work in Canada.

- You live in Canada but work in the U.S.

Now, we’ll break down what goes on in these situations.

Rules and Limits That Affect Your Tax Residency

Earn less than $10,000 from a job or stay under 183 days in another country over any 12 months (starting or ending in the tax year), and the treaty says you might skip taxes there. Go past those limits, and you might owe taxes where you work.

Example: A Canadian works 200 days in the U.S. and earns $15,000. U.S. tax could apply.

Pro Tip: The Canada-U.S. tax treaty keeps you from paying twice. Your residency picks who taxes you first.

Need help sorting this out? Contact our Cross Border Tax Accountant today. SAL Accounting is your go-to partner for tax stuff.

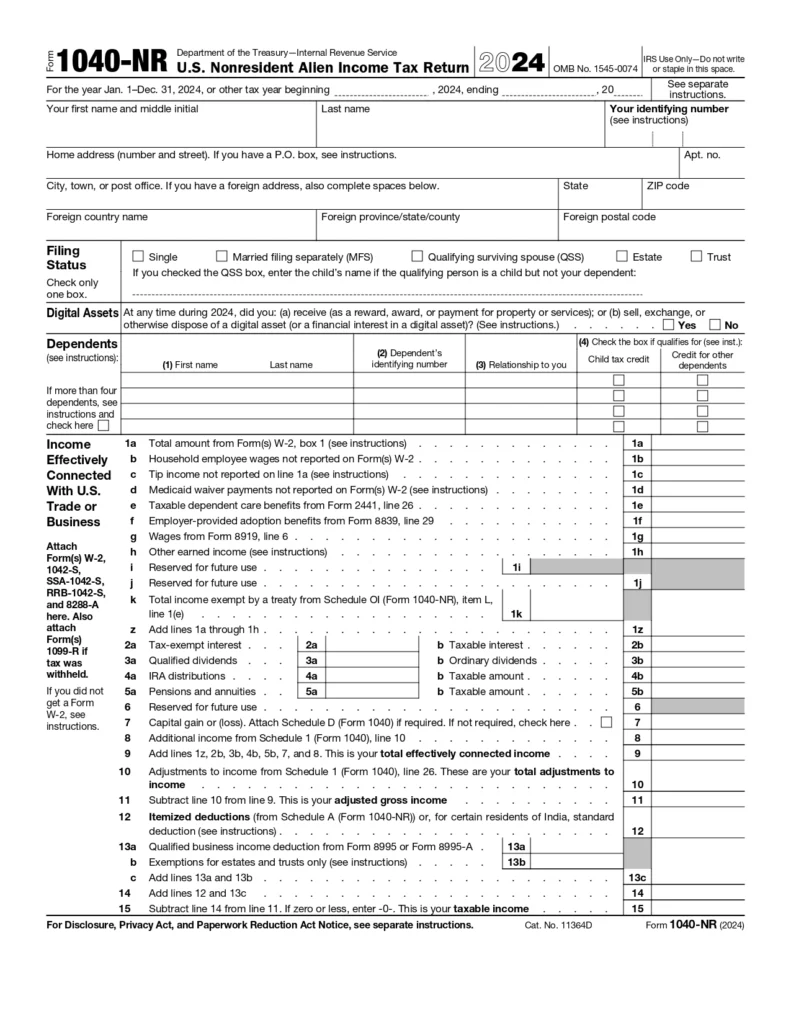

Filing When You Work Across the Border

If you’re a U.S. resident or citizen working in Canada, you report all your income, U.S. and worldwide, to the IRS every year. If you’re a Canadian resident working in the U.S., you tell the CRA all your income, Canadian and worldwide, each year. Here’s what forms you need:

- U.S. Residents in Canada

File a Canadian Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada (T1) with Form T2209 for foreign tax credits. Add a U.S. Form 1040 for all your income. You can grab the form here:

- Canadian Residents in the U.S.

File a U.S. Form 1040NR for non-residents. Pair it with a Canadian T1 for all your income. Take a look at the form below:

Case Study: Consultant’s Residency Fix

Problem: Sam, a consultant, split 2023 between Toronto (150 days) and New York (215 days), earning $75,000. With a rented apartment and car in Canada, he wasn’t sure, factual, or deemed. A wrong guess could mean $20,000 in extra taxes.

What I Did: I told him to file Form NR73, showing his days and ties (apartment, no family). I urged him to send it to the CRA fast before his tax deadline.

The Result: They ruled him a non-resident, only $10,000 Canadian income got taxed, saving him $15,000.

- Check Out: Tax Treaty Between Canada And The U.S.

The Difference Between Factual and Deemed Resident

Now that we’ve covered factual and deemed residents in Canada, let’s check out what sets them apart:

- Tax Responsibilities

Factual residents pay taxes on all their money (in Canada or anywhere else). They handle federal and provincial/territorial taxes. Deemed residents pay taxes on their worldwide income, too. But they skip provincial taxes. They just pay federal tax plus an extra surtax.

- Ties to the Country

Factual residents need solid connections to Canada, like a spouse, family, or a home here. Deemed residents connect through other stuff, like long visits or their job situation.

- Time Spent in Canada

Factual residency counts on strong ties here, like a home or family, not just time spent. Deemed residency doesn’t focus only on time spent here. It’s more about legal or special situations than being present.

- Criteria

Factual residents get this label from strong ties to Canada, like a home or family. Time spent here, even 183 days, isn’t the main deal. Deemed residents don’t always need 183 days. Special rules, like working abroad for the Canadian government or staying 183 days without ties, put them here.

- Filing Duties

Factual residents fill out the T1 General Income Tax and Benefit Return for their province. They report all income and assets. Deemed residents use the Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada. They follow similar reporting rules.

Take a quick look at this table to see factual vs. deemed residency differences:

| Category | Factual Resident | Deemed Resident |

| Tax Responsibilities | tax on worldwide income (federal + provincial/territorial taxes). | tax on worldwide income (federal tax + surtax, no provincial tax). |

| Ties to Canada | Strong ties (home, family, etc.). | Based on legal/special conditions (e.g., government work). |

| Time Spent in Canada | Time is secondary; strong ties matter more. | 183+ days may apply, but legal status is key. |

| Criteria | Determined by strong ties to Canada. | Special conditions like government work abroad or 183+ days without ties. |

| Tax Filing Duties | T1 General for their province | Non-Residents and Deemed Residents Return. |

- Read More: Filing U.S. Tax Return From Canada

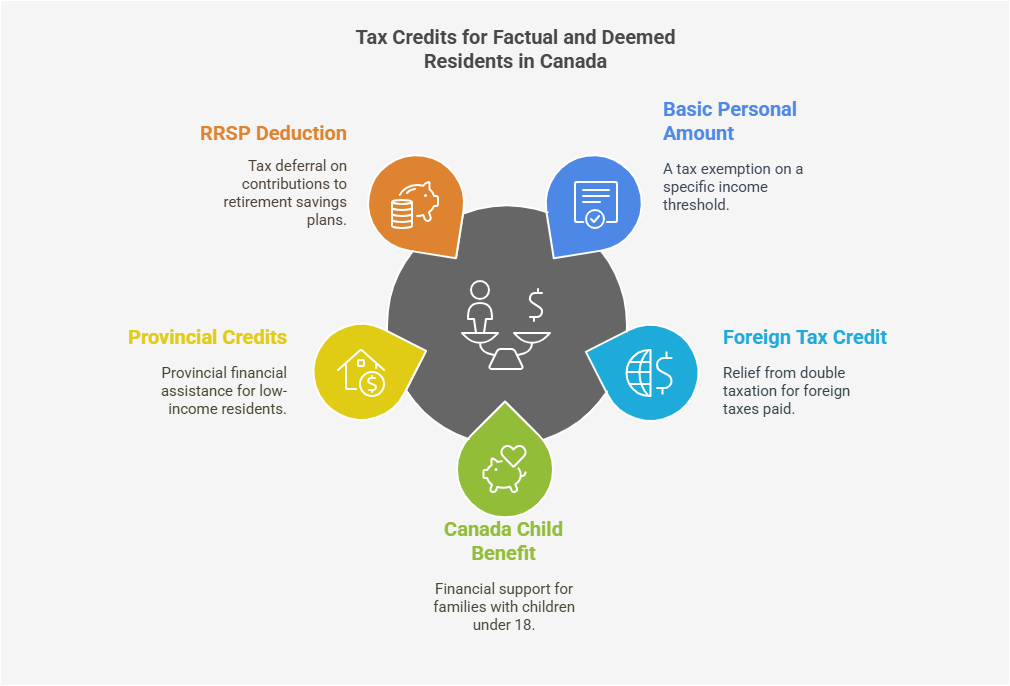

Tax Credits/Deductions for Factual and Deemed Residents

Here are some tax breaks you can grab as a factual or deemed resident in Canada to lower your taxes:

- Basic Personal Amount (BPA): You earn $15,705 in 2025, and Canada doesn’t tax it. They call it the Basic Personal Amount.

- Foreign Tax Credit: You pay tax in another place, like the U.S.? Canada cuts that amount off your Canadian tax. No double payments here.

- Canada Child Benefit (CCB): Factual residents in Canada who have kids under 18 get free cash monthly. It’s up to $7,437 a year per kid under six or $6,275 for kids six to seventeen. Only for factual residents.

- Provincial Credits: Your province chips in, like $1,259 in Ontario for rent or property tax if you make under about $50,000. Factual residents only can claim this.

- RRSP Deduction: You put money in an RRSP (up to $32,490 in 2025). That cash doesn’t get taxed right away. The CRA taxes you on a smaller amount of money.

Pro Tip: Max out your RRSP if you earn in Canada. It’s like a tax shield for your cash.

Get expert help now, explore our Accounting and Tax Services today!

Final Thoughts

Knowing the difference between factual and deemed residency in Canada keeps your taxes smooth. A home ties you here, or a government job flags you; either way, you’ve got tax stuff to handle. Check out our easy guide on factual vs. deemed residency. It helps you stay good no matter where you live. Contact us for a free consultation; we’ll sort your taxes together.

Cracking the residency code is easy with SAL Accounting. Grab expert tips today and tackle your taxes!

Frequently Asked Questions (FAQs)

The CRA checks ties for factual residency: home, spouse, and dependents. For deemed residency: 183+ days here with no ties or government jobs abroad. File NR73 if unsure.

Factual residents report all income. Federal tax: 15% on $57,375, up to 33% over $253,414. Provincial tax varies, like Ontario’s 5.05% on $51,446 to 13.16% over $220,000. File T1 General by April 30 (June 15 if self-employed).

Yes, deemed residents pay federal tax on all income, 15% on $57,375 to 33% over $253,414, plus a 48% surtax, no provincial tax.

Yes, factual residents get credits like Basic Personal Amount ($15,705), Canada Child Benefit (up to $7,437/kid), provincial credits, and RRSP deductions ($32,490 max).

Staying 183+ days in Canada with no big ties makes you a deemed resident unless another country claims you.

Yes, you might owe taxes abroad, but the Canada-U.S. treaty stops double taxation if you earn under $10,000 or stay under 183 days there.

The Canada-U.S. treaty decides who taxes first. Under $10,000 or 183 days in the other country? You might skip their tax. Residency status sets the priority.

Submit Form NR73 to the CRA. They’ll sort out your tax residency status if you’re leaving or confused. Check it below: