The Capital Dividend Account lets Canadian private companies pay tax-free dividends to shareholders. It’s a super easy way to hold onto your cash. A 2024 CFIB study says 72% of business owners skip this tax-saving trick.

If you own a business or deal with taxes, this guide from the SAL Accounting team explains CDA planning and keeps you from messing up. Jump in to grab tax-free savings and level up your money game.

Quick Takeaways

- CDA Canada tracks tax-free funds for private companies’ dividends.

- Verify your CDA balance to avoid 60% tax penalties from CRA.

- Submit Form T2054 to CRA before paying tax-free dividends.

- Pay dividends after big gains or before public offerings, mergers.

- Optimize CDA tax planning with expert help for maximum savings.

What Is a Capital Dividend Account (CDA)? Tax-Free Dividend Benefits

A Capital Dividend Account (CDA) is a record for private Canadian companies (source). It tracks tax-free cash for shareholders. Think of it as your business’s tax-free piggy bank. Only private companies qualify. It’s great for small business owners. Our small business tax accountant can maximize your CDA savings. Here’s why CDAs matter:

- Tax-Free Cash: Shareholders get dividends without taxes.

- For Private Companies Only: Public companies miss out.

- CRA Tracks It: The Canada Revenue Agency monitors your balance.

How CDA Tax Planning Boosts Dividends

A Capital Dividend Account (CDA) collects tax-free money your private Canadian company earns. You can pay this cash to shareholders tax-free. The CRA watches your CDA balance. See how small businesses can minimize tax liabilities in Canada, too. Let’s check out this tax-saving tool:

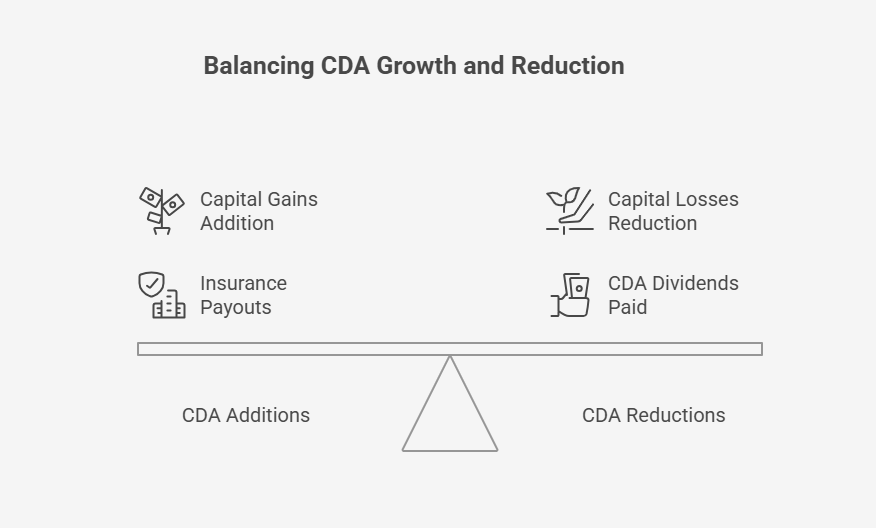

What Adds to Your CDA

Your CDA grows from these tax-free sources:

- Capital Gains: Half of your capital gains (before June 25, 2024) or one-third (after June 24, 2024, due to new tax rules) go to the CDA. For example, a $100,000 gain before 2024 adds $50,000. Track these changes with corporate tax deadlines in 2025.

- Life Insurance Payouts: Money from life insurance, minus premiums paid, boosts your CDA. A $500,000 payout with $50,000 in premiums adds $450,000.

- Other CDA Dividends: Tax-free dividends from other private companies pile on. Like, $20,000 from another firm.

- Trust Payments: Tax-free gains or dividends from trusts also count.

Example: Sam’s coffee shop sold a machine for a $60,000 profit in 2023. This added $30,000 to his CDA. He got a $200,000 insurance payout minus $20,000 premiums, which added $180,000. His CDA hit $210,000 for tax-free dividends.

What Lowers Your CDA

These things shrink your CDA balance:

- Capital Losses: Half of any capital losses cut your CDA. A $10,000 loss reduces it by $5,000.

- CDA Dividends Paid: Every tax-free dividend you pay drops the balance by that amount.

Example: Sam paid himself a $50,000 tax-free dividend, which cut his CDA by $50,000. He sold a broken machine for a $20,000 loss, which cut another $10,000. His balance fell by $60,000.

Pro Tip: Confirm your CDA balance on CRA’s My Business Account to avoid slip-ups.

How to Pay Tax-Free Dividend in Canada

Pay tax-free dividends from your CDA with care. This lets your private company share tax-free cash. Follow these steps to avoid CRA trouble:

- Check Your CDA Balance

Use CRA’s My Business Account or file Schedule 89. Confirm your tax-free cash amount. Overpaying triggers a 60% tax penalty. Check first to stay safe.

Pro Tip: Call CRA’s Business Enquiries at 1-800-959-5525 to double-check your balance. This prevents errors if My Business Account shows outdated or unclear data.

- Get Board Approval

Have directors sign off on the dividend and date. A resolution proves agreement. This keeps your payout legal. Keep the document ready for CRA.

- File Form T2054

Send Form T2054 to CRA before the dividend. Add company name, tax number, and amount. This flags the payout as tax-free. File by the payment date. Check out e-commerce tax types and strategies in Canada for more tips.

Pro Tip: File T2054 online for faster processing. Track the status to ensure CRA gets it before your dividend payment date.

- Add Documents

Attach a signed resolution and Schedule 89 to T2054. The resolution shows approval. Schedule 89 proves your balance. Check everything before you send it.

- Pay the Dividend

Move cash to shareholders’ accounts. This sends the tax-free money out. Match the T2054 amount. Done right, no one pays taxes.

Pro Tip: Use direct bank transfers to shareholders’ accounts for accuracy. Keep bank statements as proof in case CRA questions the payout later.

This table summarizes steps to pay tax-free dividends with CDA Canada:

| Step | Action | Why It Matters |

| Check CDA Balance | Use My Business Account or Schedule 89 | Avoids 60% tax penalty |

| Get Board Approval | Directors sign resolution | Keeps payout legal |

| File Form T2054 | Submit before dividend | Flags tax-free status |

| Add Documents | Attach resolution, Schedule 89 | Proves compliance |

| Pay Dividend | Transfer cash to shareholders | Completes tax-free payout |

When to Use Your Capital Dividend Account

Pick a smart time to pay tax-free dividends from your CDA. Choose moments that work for your business and shareholders. These times make tax planning a breeze. Keep your cash tax-free with these tips:

- Big CDA Balance: Pay after a big capital gain or insurance payout. This uses your tax-free cash (CRA’s capital dividend guide). You get the most out of your CDA.

- Personal Cash Needs: Pay for stuff like a house or school fees. This gives shareholders tax-free money. It saves you cash.

- Go Public Soon: Pay before your company goes public. Public companies can’t use CDAs. Grab those tax-free dividends fast. Start with how to set up a Corporation in Canada.

- Mergers or Sales: Pay before a deal closes. The CDA goes to the new owner. Cash out tax-free now.

Case Study: Tech Owner’s Smart Dividend Move

Problem: A tech company owner contacted us. His firm made a $180,000 profit from selling assets. This boosted his CDA by $60,000. He needed cash for a house but planned to go public soon.

What We Did: We advised him to pay a $50,000 tax-free dividend before going public. We suggested he file Form T2054 early to keep it tax-free.

Result: He paid $50,000 tax-free and saved $15,000 in taxes. His CDA stayed compliant.

You can also use our business incorporation tax services for your private company and guarantee your success.

CRA Rules for CDA Canada Compliance

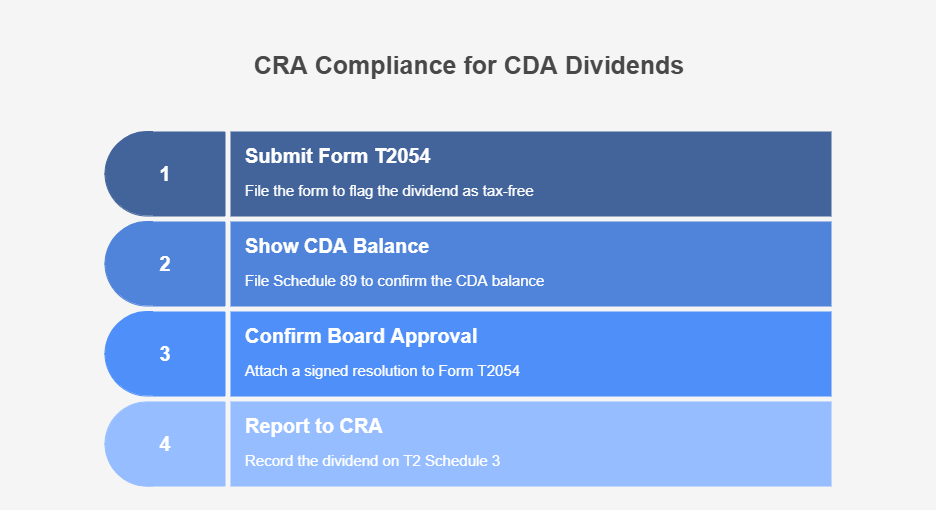

Follow CRA rules to keep CDA dividends tax-free. Do these steps to stay on track:

- Prove Your Dividend Is Tax-Free

Submit Form T2054 to the CRA before the dividend. Include company name, tax number (ITN), and amount. This flags the payout as tax-free.

Pro Tip: Save a draft of T2054 in your records. This helps fix errors fast if CRA spots issues.

- Show Your CDA Balance

File Schedule 89 to confirm your CDA balance. It’s optional but wise. This proves your math to CRA.

Pro Tip: Hire a bookkeeper to update Schedule 89 monthly. This catches gains or losses early for accuracy.

- Confirm Board Approval

Attach a signed resolution to Form T2054. This shows board approval. Keep a copy for your files.

Pro Tip: Name a director to store resolution copies safely. This speeds up CRA requests during reviews.

- Report to CRA

Record the dividend on T2 Schedule 3. This tells CRA about the payout. File it on time. Boost compliance with Best Bookkeeping Tools for Small Business Owners in Canada.

Pro Tip: Set a calendar reminder for T2 deadlines. This keeps your filing sharp and avoids late fees.

How to Avoid CDA Tax Planning Dividend Mistakes

CDA planning saves taxes, but errors cost money. Avoid these common mistakes to keep your tax-free dividends safe.

- Pay Too Much: Dividends over your CDA balance face a 60% tax penalty. Check your balance first.

- File T2054 Late: Late filings cost $41.67 per month or 1% of the dividend. Submit on time.

- Miscalculate Balance: Wrong capital gains or losses mess up your CDA. Double-check numbers.

- Ignore Non-Resident Rules: Tax-free dividends to non-residents face a 25% withholding tax unless a treaty applies. Plan ahead. Explore the Canada-US tax treaty to avoid double taxation in 2025. The table below highlights ways to prevent CDA dividend errors:

| Mistake | Cost | How to Fix |

| Pay Too Much | 60% tax penalty | Check CDA balance first |

| File T2054 Late | $41.67/month or 1% fee | Submit T2054 on time |

| Miscalculate Balance | Wrong CDA total | Double-check gains, losses |

| Ignore Non-Resident Rules | 25% withholding tax | Apply treaty rules |

Case Study: Retail Owner’s Costly CDA Mistake

Problem: A retail owner reached out after a CRA audit. He paid an $80,000 CDA dividend but had only $50,000 in his CDA. He missed non-resident rules for a U.S. shareholder, so he owed a $30,000 penalty and $7,500 in withholding tax.

What We Did: We advised him to reclassify $30,000 as a taxable dividend to skip the penalty. We suggested he check treaty rules to lower withholding tax.

Result: The CRA waived the penalty. Treaty rules cut withholding to $4,500, saving $25,500. You can also protect your CDA with our ecommerce tax accountant, CPA.

Final Thoughts

Capital Dividend Accounts save your business cash. Canadian private companies can pay tax-free dividends with smart CDA planning. Follow CRA rules to avoid costly errors. This guide simplifies CDA strategies for your success.

SAL Accounting offers expert support to navigate complex tax rules and ensure compliance. Contact us for a free consultation to maximize your tax-free dividends and boost savings today.

Frequently Asked Questions (FAQs)

A CDA tracks tax-free money for private Canadian companies. It holds cash from gains for tax-free dividends.

A CDA holds tax-free funds from specific sources. Private corporations pay tax-free dividends to shareholders.

Include half of the capital gains, insurance payouts minus premiums, trust dividends, and other CDA dividends.

Yes, CDA Canada dividends stay tax-free for Canadian shareholders. File Form T2054 and stay within your balance.

Add non-taxable gains, insurance payouts, and dividends. Subtract losses and paid dividends. Check CRA’s My Business Account.

Yes, life insurance payouts, minus premiums paid, boost your CDA balance for tax-free dividends.

No, file Form T2054 with CRA before payment. This ensures your dividend stays tax-free.

Excess dividends trigger a 60% tax penalty. Reclassify as taxable dividends to avoid penalties.