If you sold stocks, a house, or crypto lately, you need to know about capital gains tax in Canada. We want to make it simple: explaining what it is, how it works, and how to cut your taxes in 2025. Most importantly, we’ll help you avoid surprises with CRA rules. A 2024 study found 52% of capital gains taxes come from families earning $150,000 or less (not counting those gains). Many everyday Canadians get hit hard.

We at today’s SAL Accounting post dive into this, covering calculations, reporting, and smart tax-saving tips in this guide.

Quick Takeaways

- Capital gains tax in Canada taxes half your profit from selling assets at your income rate.

- The capital gains inclusion rate stays at 50% in 2025 after a planned hike was canceled.

- Calculate taxable capital gain by subtracting costs and fees from the sale price, then taking half.

- Exemptions like principal residence or $1.25 million for small businesses cut your tax bill.

- Report gains on CRA Schedule 3 and file by April 30 to stay compliant with CRA rules.

What Is Capital Gains Tax in Canada?

Capital gains tax in Canada hits profits from selling things like stocks, real estate, or crypto (source). You pay it only when you sell for more than you paid. The CRA taxes half your profit, called a taxable capital gain, at your income tax rate. Our bookkeeping services in Toronto can help you stay compliant. Here’s the breakdown:

- Adjusted Cost Base (ACB): What you paid for the thing, plus fees like broker costs.

- Taxable Capital Gain: The CRA taxed Half of your profit in 2025.

- Capital Loss: Selling for less than you paid. Losses cut taxes by balancing gains.

Pro Tip: Track your ACB for everything you buy. Use a spreadsheet or app to log prices and fees like commissions.

What Is the Capital Gains Tax Rate in Canada for 2025?

The CRA taxes half your taxable capital gain at your regular income tax rate. The capital gains inclusion rate stays at 50% after a plan to raise it was cancelled in March 2025 (2025 Update). Your tax rate depends on your income and province. Higher income means higher taxes. These are the combined federal-provincial rates:

| Income Level | Income Level | BC | Alberta | Alberta | Nova Scotia |

|---|---|---|---|---|---|

| Up to $55,000 | 19–25% | 20–26% | 25–30% | 26–31% | 23–30% |

| Around $100,000 | 31–43% | 32–44% | 36–42% | 36–41% | 37–43% |

| Over $250,000 | 47–53.53% | 47–53.50% | 46–48% | 50–53.31% | 50–54% |

How to Calculate Capital Gains Tax in Canada?

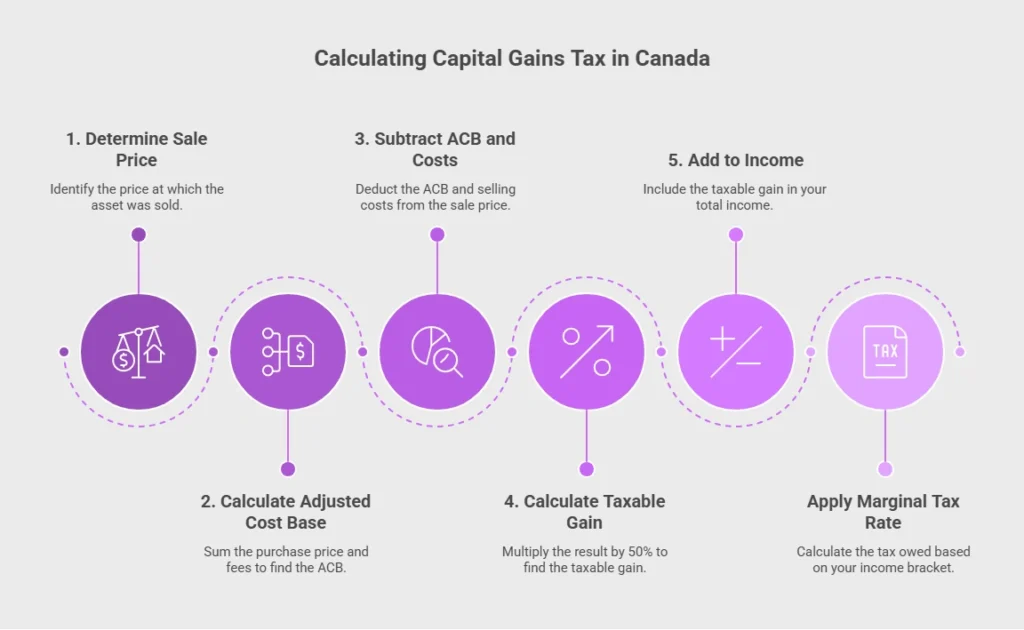

You can figure out your taxable capital gain with a simple formula under CRA capital gains rules. It helps you know what to report on your taxes. Use this to find your taxable gain:

Taxable Gain = (Sale Price – What You Paid – Fees) x 50%

Your Adjusted Cost Base (ACB) is what you paid plus fees like broker costs. You may need to know tax rules when selling property in the US as a Canadian. Follow these steps:

- Subtract ACB and selling costs from the sale price.

- Take 50% of that gain.

- Add it to your income.

- Pay tax at your marginal rate (19% to 53%, based on income and province).

Example: You buy an asset for $10,000, sell it for $15,000, with $200 in fees. Your profit is $4,800. The CRA taxes half, so your taxable capital gain is $2,400. You owe $720 at a 30% rate. This table shows how the capital gains tax in Canada works:

| Sale Price | ACB | Fees | Profit | Taxable Gain (50%) | Tax Owed (30%) |

|---|---|---|---|---|---|

| $15,000 | $10,000 | $200 | $4,800 | $2,400 | $720 |

Capital Gain vs Capital Loss in Canada

Capital gain versus a capital loss, it’s super easy to get. Here’s the breakdown:

- Capital Gain: You sell something for more than you paid (your Adjusted Cost Base, or ACB). Your ACB is the purchase price plus fees like broker costs. In 2025, the capital gains inclusion rate taxes 50% of your profit.

- Capital Loss: You sell for less than your ACB. Losses can cancel out gains to lower your taxes (CRA capital losses guide).

Small business owners score a bonus. You can make up to $1.25 million tax-free, per CRA rules, if you sell qualified business shares or farm property. Just pay attention to the fair market value (FMV) and what small businesses must know about taxes.

Pro Tip: Save money by timing your sales. Check your tax rate before you sell. With high income this year, sell assets in a lower-income year. This cuts your capital gains tax in Canada, especially on big profits.

- Read More: “What Is a Capital Dividend Account (CDA)? Tax-Free Withdrawals for Canadian Corporations”

Canadian Capital Gains Tax on Different Assets

Capital gains tax in Canada works differently depending on what you sell. Stocks, real estate, crypto, or other assets each have unique rules. Let’s break it down so you know what to expect.

1. Stocks and Investments

You sell investments and pay the Canadian tax on investments based on your profit. The CRA taxes 50% of it. Watch out for this:

Superficial loss rule: You sell at a loss and buy back within 30 days, so you can’t use that loss to cut taxes.

Example: Sell investments for a $5,000 profit. Only $2,500 gets taxed at your income rate.

2. Real Estate

Your main home is usually tax-free if you tell the CRA it’s your principal residence. Capital gains on real estate in Canada, like rentals, are taxed at 50%. If you flip a house in under a year, that profit might count as business income and get fully taxed. Learn more about the tax implications of the US rental income for Canadians and how to report it.

Pro Tip: For real estate, file your principal residence designation with the CRA right away.

3. Crypto

Crypto like Bitcoin counts as a capital gain if you’re not a full-time trader. The CRA taxes 50% of your profit. Keep good records, crypto gets tricky. Here’s why: Track every buy and sell for your Adjusted Cost Base (ACB).

Pro Tip: For crypto, use apps like CoinTracker to track your ACB.

Example: Buy Bitcoin for $5,000, sell for $20,000. Your $15,000 profit means $7,500 is taxable.

4. Other Assets

You sell art, collectibles, or business assets and face capital gains tax in Canada. Art and collectibles follow the 50% rule, so half the profit is taxed. Small business owners get a break. You sell qualified business shares and skip taxes on up to $1.25 million in 2025, per CRA rules.

Pro Tip: Get ahead by checking exemptions early. This saves you stress when filing CRA Schedule 3, especially if you sell a lot.

This table shows how each asset’s taxable capital gain works for 2025:

| Asset Type | Tax Rate | Exemption | Key Rule | Record-Keeping |

|---|---|---|---|---|

| Investments | 50% | None | Superficial loss: No deduction if rebought in 30 days. | Track ACB. |

| Real Estate | 50% | Non-traders are taxed at 50%. | Flipping under 1 year may be fully taxed. | File designation. |

| Crypto | 50% | None | Non-traders taxed at 50%. | Track buys/sells. |

| Other Assets | 50% | Small business shares: $1.25M tax-free. | Art/collectibles taxed at 50%. | Check exemptions. |

Recent Changes and CRA Capital Gains Rules for 2025

Capital gains tax in Canada stays steady in 2025. The big win is the capital gains inclusion rate holding at 50%. A plan to bump it to 66.67% for gains over $250,000 was canceled in March 2025. This keeps taxes lower for everyone. CRA capital gains rules focus on simplicity. Here’s what’s new:

- Eco-sensitive land donations skip taxes on gains.

- Small business and farm sales stay tax-free up to $1.25 million.

- No new reporting limits. Use CRA Schedule 3 as usual.

- Read More: “What is FIRPTA Tax? A Complete Guide for Canadian Property Sellers in the U.S.”

How to Report Capital Gains to the CRA: Forms and Steps

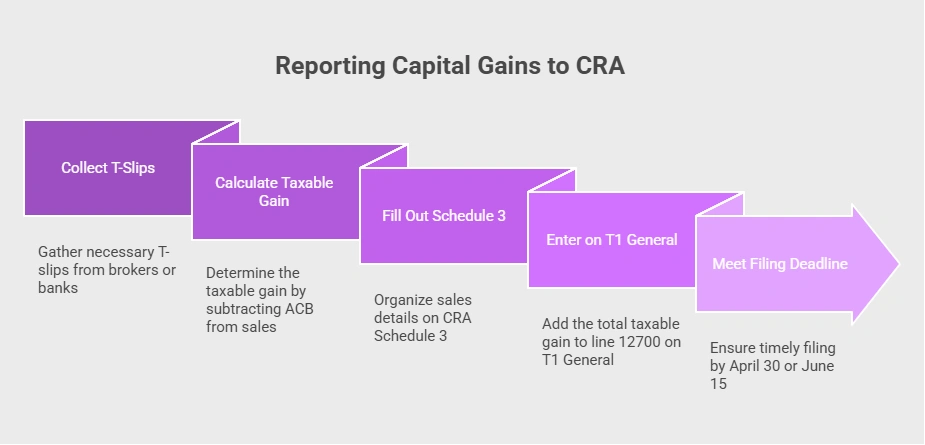

You earn profits from selling assets and must report capital gains to the CRA. It’s easy with the right steps. The following steps show how reporting capital gains to the CRA works:

1. Collect Your T-Slips

Pick up T-slips like T3 or T5 from your broker or bank. They list your sales and profits. If you can’t find them, call your broker quickly. See how to report T5 slip income in your US taxes.

Pro Tip: Check your broker’s online portal for T-slips. Set a February reminder to grab them early for smooth tax prep.

2. Calculate Your Taxable Gain

Figure out your Adjusted Cost Base (ACB), which is what you paid plus fees like broker costs. Subtract it from what you sold for, then take 50%. That’s your taxable gain.

3. Fill Out Schedule 3

Put your gains and losses on CRA Schedule 3. This form keeps your sales organized for the CRA. Add details like sale dates.

Pro Tip: Grab Schedule 3 from the CRA website and try a practice run. This catches errors before you file.

3. Enter on T1 General

Add your total taxable gain to line 12700 on your T1 General. This mixes it with your income for taxes.

Pro Tip: Use tax software like TurboTax to fill line 12700 automatically. It’s fast and cuts down on mistakes.

4. Meet the Filing Deadline

File by April 30, or June 15 if you’re self-employed. Bonus: CRA skips late fees until June 2, 2025, for 2024 returns.

Pro Tip: File early to avoid stress. Use CRA’s My Business Account to send it online and check your refund fast.

Case Study: Sarah Cuts Taxes with Easy Moves*

Problem: Sarah, a Toronto small business owner, sells assets for a $20,000 profit in 2025. Her taxable capital gain is $10,000. High income means a big tax bill. Bad planning risks extra taxes.

What We Do: SAL Accounting checks her assets. We sell a losing asset to cut $5,000 off her profit. We put future assets in a TFSA to skip taxes. We keep clean records.

The Result: Sarah’s taxable gain drops to $7,500, saving $750 at her 30% tax rate. Her TFSA plan skips future taxes. She follows CRA capital gains rules.

Exemptions and Deductions for Capital Gains Tax in Canada

You can skip or lower your capital gains tax in Canada with specific exemptions. The CRA capital gains rules let you avoid or reduce your taxable capital gain. You may need a tax deduction checklist for small businesses in 2025. These can slash your tax bill:

- Principal Residence Exemption: You sell your main home and owe no tax if you mark it as your principal residence on CRA forms for all years owned.

- Small Business and Farm Exemption: You sell qualified small business shares or farm property and skip taxes on up to $1.25 million in 2025, per CRA rules.

- Eco-Sensitive Land Donation: You donate eco-sensitive land to a charity or government and skip taxes on gains (ecological gifts program).

- Allowable Business Investment Loss (ABIL): You lose money on a small business investment and deduct half the loss against other income, not just gains.

- Selling Expenses: You pay fees like broker or legal costs and subtract them from the sale price to lower your taxable gain.

How to Avoid or Minimize Capital Gains Tax in Canada

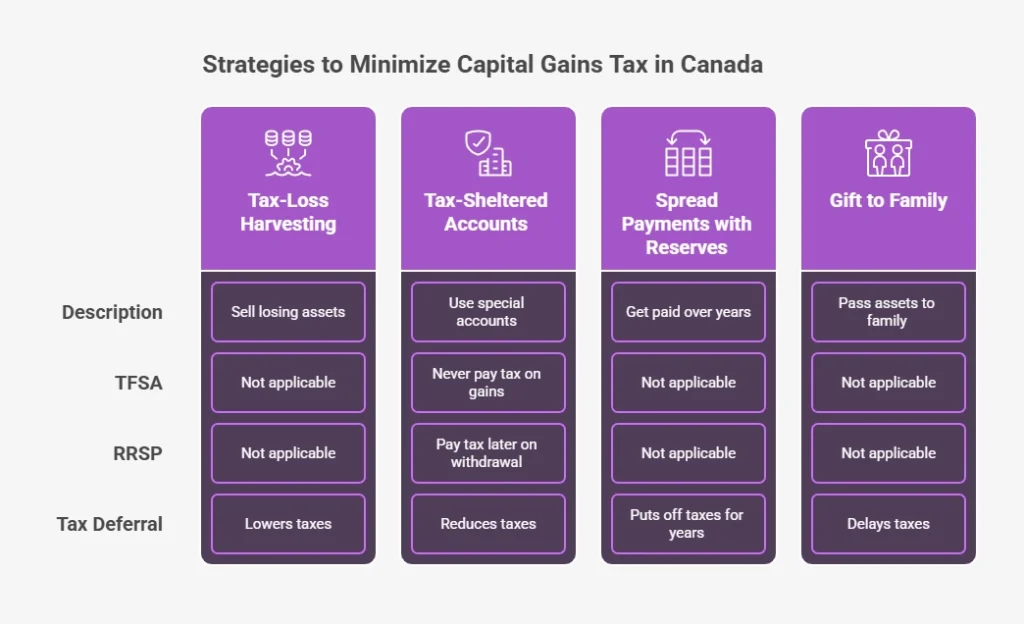

You can cut or push off your capital gains tax in Canada with a few easy tricks. CRA capital gains rules help you shrink your taxable capital gain. These moves save you money in 2025.

1. Tax-Loss Harvesting

Sell stuff that’s worth less to balance out your gains. This trick, called tax-loss harvesting, lowers your taxes. Stocks or crypto that lost value work great. Keep good records to stay on track.

2. Use Tax-Sheltered Accounts

Stash your assets in special accounts to reduce taxes. Also, have a look at the best US banks for Canadians. These accounts save you cash:

- TFSA: You never pay tax on gains.

- RRSP: You pay tax later when you take money out. Stocks or crypto in these accounts qualify.

3. Spread Payments with Reserves

Get paid over the years for a sale to spread the gain. This puts off taxes for up to five years. You get more time to sort out your money.

4. Gift to Family

Pass assets to your spouse or partner to delay taxes. This works in these cases:

- Spouse or common-law partner: They sell in a low-income year to cut taxes.

- Adult kids (sometimes): Check CRA rules for deferral. Check out the cross-border inheritance tax between Canada and the US.

Case Study: Mike Files Taxes Without Hassle*

Problem: Mike, a Vancouver freelancer, sells assets for a $15,000 profit in 2025. He lacks T-slips and cost records. Missing CRA Schedule 3 risks fines.

What We Do: SAL Accounting gets its T3 slip from its broker’s site. We figure his cost ($8,000 plus $100 fees) and taxable gain ($3,450). We fill out Schedule 3 and T1 General line 12700. We file via CRA’s My Account.

The Result: Mike’s $3,450 taxable gain is filed by June 15. He avoids fines and follows CRA capital gains rules. His records stay organized. Get expert help with our cross-border tax accountants in Mississauga at SAL Accounting.

Final Thoughts

Capital gains tax in Canada takes part of your profits from selling stuff. You can cut taxes with easy moves under CRA capital gains rules. Filing with CRA Schedule 3 keeps you in line. Exemptions for your home or small business save you tons. This guide makes figuring out taxes, filing, and saving money simple for 2025.

SAL Accounting helps with clean records and smart plans. Contact us to handle taxes easily and keep more cash.

*Hypothetical scenario

FAQs on Capital Gains Tax in Canada

The CRA taxes half your gain at your income tax rate. Rates range from 19% to 53%, depending on your income and province.

You skip taxes on your main home if you mark it as your principal residence on CRA Schedule 3. File the form to stay compliant.

The CRA taxes 50% of your gain in 2025. A plan to raise it to 66.67% got canceled in March 2025.

Subtract what you paid and fees from the sale price, take half, and add it to your income. You pay tax at your income rate.

ACB is what you paid for an asset plus fees. It lowers your taxable capital gain. Keep good records for accuracy.

You avoid tax on principal residence sales or TFSA gains. Tax-loss harvesting and reserves also cut taxes legally.

Crypto gains get taxed at 50% if you’re not a full-time trader. Keep clear records of buys and sells.