In this 2025 Amazon FBA bookkeeping guide, we’re here to help you organize your sales, fees, returns, and inventory to grow your profits. Our goal is to make tracking your finances straightforward. But the surprising part is that we’ve seen careless bookkeeping cut a business’s value by $50,000 to $500,000+ when it’s time to sell.

We’ll walk you through avoiding these traps, nailing Amazon seller accounting, and building simple systems that work. Keep reading this SAL Accounting comprehensive post.

Quick Takeaways

- Amazon FBA bookkeeping tracks sales, fees, returns, and inventory for true profits.

- Grab Seller Central’s Payments, Inventory, and P&L Reports for clean records.

- Choose accrual accounting to match FBA’s fast-moving inventory.

- Avoid errors like missed returns by reconciling monthly and logging fees weekly.

- Use QuickBooks or A2X to automate bookkeeping and cut mistakes.

Why Amazon FBA Bookkeeping Matters for Sellers

Bookkeeping for Amazon sellers keeps businesses clear and profitable. Amazon’s fees can eat 15–30% of your sales. Without solid records, you lose track of profits or miss costly returns. This can lead to IRS or CRA fines. Good bookkeeping helps you plan inventory and file taxes easily. Our bookkeeping for Amazon sellers can get your business finances organized. Below, we’ll share steps for more:

Understanding Amazon FBA Fees and Their Bookkeeping Impact

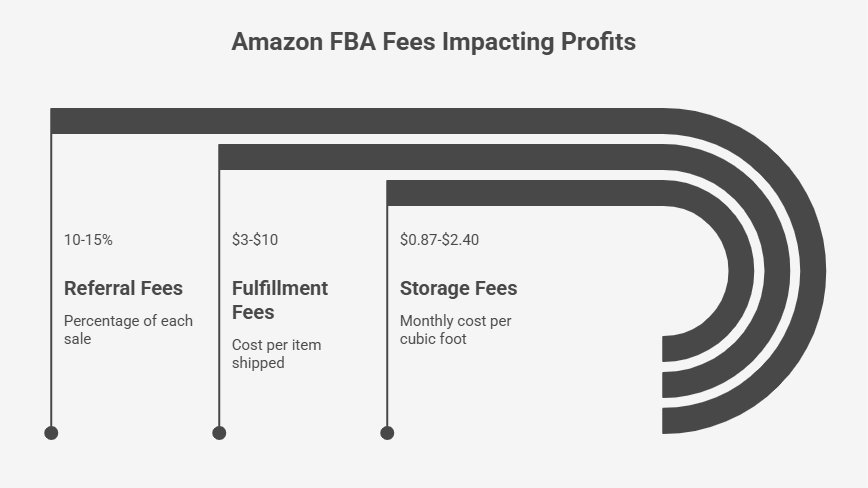

Amazon FBA fees shrink your profits fast. Track them to know your true earnings (Amazon standard fees). Check the Amazon tax guide for the US and Canada for sales tax, income tax, and deductions, too. Here are the main fees:

- Referral Fees: 10–15% of each sale, based on product type.

- Fulfillment Fees: $3–$10 per item, depending on size and weight.

- Storage Fees: $0.87–$2.40 per cubic foot monthly, more in October–December.

- Advertising Costs: PPC ads, often $100–$1,000 monthly.

Example: A $50 book sale might face a $7.50 referral fee (15%), a $4 fulfillment fee, and a $0.50 storage fee, leaving $38 after fees.

Pro Tip: Sort fees into separate categories to make tracking simple. Get numbers from the Payments Report in Seller Central.

Key Amazon FBA Reports for Bookkeeping

Amazon FBA reports make bookkeeping a breeze. They show your sales, fees, and inventory clearly. You grab them from Seller Central. Learn what small businesses need to know about e-commerce accounting in 2025. Here’s the rundown on the main reports for easy Amazon FBA reports bookkeeping:

1. Payments Report

This report lists your sales, refunds, and fees. It updates weekly or every two weeks. Check it to see what Amazon sends to your bank. For example, if you sell $1,000 but lose $200 to fees, it shows $800. Match it with your bank to spot mistakes.

2. Inventory Report

The Inventory Report tracks your stock and COGS (cost of goods sold). It shows what’s in Amazon’s warehouses. Use it to manage inventory and keep profits accurate (download). Here’s how:

- Check stock levels to avoid running out or overstocking.

- Track COGS, like 50 units at $5 each for $250 total.

- Update your books monthly with these numbers.

3. P&L Report

The Profit and Loss Report (P&L) sums up your monthly earnings. It takes your sales and subtracts fees, refunds, and costs. Check it to see if you’re in the green. For instance, $2,000 in sales with $600 in fees shows your profit. Use it to plan smarter.

This table breaks down key reports for Amazon FBA reports bookkeeping:

| Report | Purpose | Key Data | Check When |

| Payments | Tracks money flow | Sales, refunds, fees | Weekly or biweekly |

| Inventory | Manages stock | Stock levels, COGS ($5/unit = $250 for 50 units) | Monthly |

| P&L | Shows profits | Sales minus fees/costs ($2,000 – $600) | Monthly |

What Are Amazon Inventory Bookkeeping Essentials

Amazon FBA inventory bookkeeping shows your true profits. You track stock, COGS (cost of goods sold), and returns. Good Amazon inventory bookkeeping keeps your numbers clear. Here’s how to do it:

- Track COGS: Write down what each item costs. For example, 100 mugs at $4 each are $400 in COGS.

- Check Stock Levels: Look at the Inventory Report in Seller Central. It shows what’s in Amazon’s warehouses. This stops stockouts or extra fees.

- Track Amazon Returns: Check returns in Seller Central. A $300 return cuts your sales and profits.

- Log Storage Costs: Record storage fees ($0.87–$2.40 per cubic foot monthly) to avoid surprises. Have an ultimate bookkeeping checklist for small businesses handy for better results.

Example: If you sell 50 mugs at $15 each ($750 total), with $200 COGS and $75 in returns, your profit is $475 minus fees.

Pro Tip: Match inventory with sales each month to catch mistakes fast. Update your books monthly using Amazon’s reports. This keeps records clean.

Choosing the Right Bookkeeping Method: Cash vs. Accrual for Amazon FBA

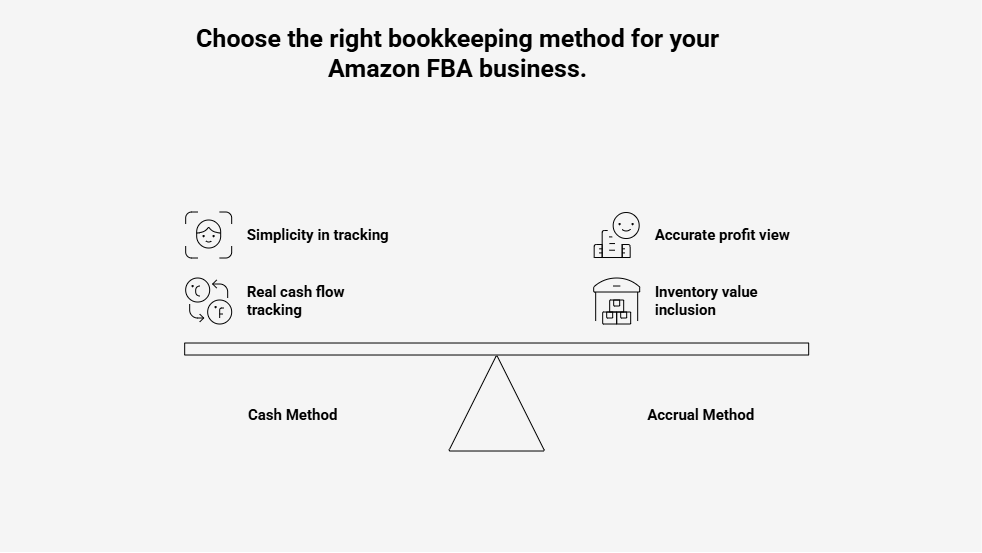

Choose the best method to track Amazon FBA profits. Cash or accrual are your options. You should know how to file Form 1099-K as an e-commerce seller. See below and compare in the table.

Cash Method

The cash method is simple. You record income when Amazon pays you. You log expenses when you pay them. This tracks real cash flow.

For example, if you sell $5,000 but get paid later, you wait to record it. It works for small sellers with low inventory. But it misses the inventory value in profits.

Accrual Method

The accrual method shows true profits. You record sales when customers buy, not when paid (accepted payment methods). You log expenses when incurred. This tracks inventory better.

For example, ship $5,000 in stock and record it now. It’s more work, but great for growing businesses. Use it for accurate profit views.

Case Study: A Canadian FBA Seller Grows Profits with Accrual*

A Toronto FBA seller contacts SAL Accounting:

Problem: They sell $60,000 in toys yearly but use the cash method. Payments come late, so profits look $15,000 lower. This confuses taxes and hurts growth.

What We Do: We switch to accrual and log sales when orders ship using QuickBooks. We track COGS and fees monthly. We check the Inventory Reports weekly.

The Result: They see $15,000 more in profits. Taxes match CRA rules. Their business value jumps 20%. Growth plans get clear and easy.

Step-by-Step Guide to Setting Up Bookkeeping for Amazon Sellers

Set up your bookkeeping for Amazon sellers to keep things organized and grow profits. These steps make it simple to create a clear system. Follow them for clean Amazon seller accounting. Use the table to plan tasks.

1. Open a Business Bank Account

Open a separate bank account for your FBA business. This keeps your personal and business cash separate. It simplifies tracking sales and expenses. For example, Amazon deposits go here, not your personal account.

Pro Tip: Use a no-fee business account like Chase to save on bank charges.

2. Pick a Tool

Choose a tool like QuickBooks, Xero, or spreadsheets. QuickBooks syncs with Amazon for about $31/month (see QuickBooks). Spreadsheets are fine for small sellers. Pick what works for your budget. Choose the best e-commerce accounting software in 2025 to streamline the process.

Pro Tip: Try Google Sheets templates for free FBA tracking at Sellerboard.

3. Import Amazon Data

Pull reports from Seller Central. Grab Payments, Inventory, and P&L Reports. Connect them to your tool for easy tracking. This puts all your sales and fees in one spot.

Pro Tip: Export reports as CSV to speed up imports into your tool.

4. Categorize Transactions

Break down your transactions to track profits clearly. This keeps your books organized. Do these tasks:

- Sort sales, fees, COGS, and returns.

- Log a $500 sale and $150 fees separately.

- Do this weekly to see clear profits.

Pro Tip: Use A2X or Fetcher to auto-categorize fees and sales, saving time.

5. Reconcile Monthly

Match reports to bank deposits each month. Look for errors like missing refunds. For example, ensure a $1,400 deposit matches $2,000 sales minus $600 fees.

Pro Tip: Use a checklist to spot refund mismatches in 5 minutes.

6. Review Quarterly

Every three months, check your books to stay ready for taxes. This keeps your records accurate and saves time later. Do these tasks:

- Update COGS and storage fees.

- Prepare books for tax season.

- Keep records clean for easy filing.

Pro Tip: Scan receipts with Expensify to prepare for CRA/IRS audits. Get expert help from our e-commerce accountant at SAL accounting for a smooth process. This table guides your amazon seller accounting tasks:

| Step | Purpose | Key Actions | Tools/Tips |

| Open Bank Account | Separate funds | Use separate account | No-fee account (e.g., Chase) |

| Pick a Tool | Choose software | Select QuickBooks, Xero, or sheets | Google Sheets (Sellerboard) |

| Import Data | Gather data | Pull Payments, Inventory, P&L | Export as CSV |

| Categorize Transactions | Track profits | Sort sales, fees, COGS, returns; log $500 sale, $150 fees; do weekly | A2X, Fetcher (A2X) |

| Reconcile Monthly | Ensure accuracy | Match $2,000 sales minus $600 to $1,400 deposit | Use checklist |

| Review Quarterly | Prep taxes | Update COGS, storage fees; prep tax data; keep clean | Expensify, SAL Accounting (SAL Accounting) |

Tools for Amazon Seller Accounting Efficiency

Pick tools to simplify Amazon seller accounting. These four options make bookkeeping easy:

- QuickBooks: Pulls Amazon data automatically. Costs ~$31/month. Great for growing sellers.

- Xero: Tracks fees and inventory clearly. Starts at $13/month (Xero). Perfect for small businesses.

- A2X: Auto-sorts fees and sales. Plans start at $19/month. Saves tons of time.

- Spreadsheets: Free Google Sheets templates. Best for beginners on a budget.

Pro Tip: Test A2X or Xero’s free trial to see which syncs best with Seller Central. This can cut your bookkeeping time by half and reduce errors. Check the best bookkeeping tools for small business owners in Canada for more.

Common Bookkeeping Mistakes for Amazon FBA Sellers and How to Avoid Them

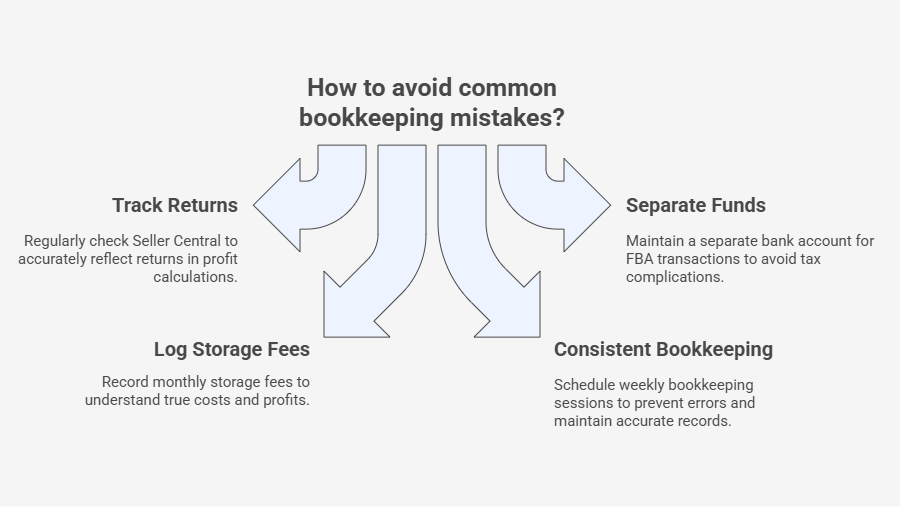

Bookkeeping mistakes hurt your Amazon FBA business. They cost time and cash. See more e-commerce accounting errors that cost you thousands. Here’s how to fix common problems for strong bookkeeping for Amazon sellers. Next, we’ll share tips to ace your books.

1. Missed Returns

Skipped returns boost your profit numbers wrongly. A $500 return you miss adds $500 to earnings. Check Seller Central weekly to grab all returns.

2. Mixed Personal and Business Funds

Mixed funds ruin your taxes. This confuses CRA or IRS filings (CRA Keeping Records). Get a separate bank account for FBA deposits.

3. Ignored Storage Fees

Skipped storage fees hide your real costs. Fees like $0.87–$2.40 per cubic foot add up. Log them monthly to know your true profits.

4. Inconsistent Bookkeeping

Spotty updates let errors sneak in. This messes up your profit numbers. Set a weekly time to keep books clean. Reach out to us today to get expert bookkeeping services for e-commerce.

Case Study: A US FBA Seller Skips IRS Fines*

A Florida FBA seller contacts SAL Accounting:

Problem: They sell $80,000 in fitness gear yearly, but mix personal and business funds. They miss $10,000 in returns, inflating profits. IRS threatens a $5,000 fine.

What We Do: We open a separate bank account. We use A2X to track returns weekly. We log storage fees monthly. We match books with Seller Central reports.

The Result: They avoid the $5,000 fine. Profits show $20,000 higher. Taxes fit IRS rules. Their business runs smoothly and cleanly.

Final Thoughts

Amazon FBA bookkeeping helps you grow profits and keep your business solid. This 2025 guide gives you easy steps to track sales, fees, returns, and inventory. You avoid mistakes like missing returns or mixing funds that hurt your business value. Clean records make CRA or IRS tax filings a breeze. Good Amazon FBA bookkeeping also boosts your business’s worth when you sell.

Start these steps now to stay on top of your money. Contact us at SAL Accounting for help with compliance and bigger profits. Free consultation available.

*Hypothetical scenario

Frequently Asked Questions (FAQs)

Track sales, fees, and inventory with Amazon FBA bookkeeping. Use Seller Central reports and tools like A2X. Reconcile monthly to stay accurate.

Grab Payments, Inventory, and P&L Reports from Seller Central. They show sales, fees, and profits. Check them weekly for clean bookkeeping for Amazon sellers.

Yes, Amazon’s income is taxable in Canada. Track sales and fees for CRA bookkeeping, Amazon seller rules. File accurately to avoid penalties.

Deduct fees, COGS, advertising, and shipping costs. Keep records of all expenses. Check with an accountant for full deductions.

Accrual suits growing FBA sellers with fast inventory. Cash works for small sellers. Choose based on your business size.

Use the Inventory Report to track Amazon returns and COGS. Log stock and costs monthly. This keeps profits clear.

QuickBooks helps, but isn’t required. Spreadsheets work for small sellers. Pick a tool that fits your budget.