Our goal is to help Shopify, Amazon, Etsy, WooCommerce, and DTC sellers make tax time easier and claim every legal ecommerce tax deduction to lower what you owe.

But most importantly, we want you to stop leaving money behind. Up to 90% of small business owners, including many online sellers, miss key deductions and leave an average of $15,000+ on the table each year. Many sellers skip simple write-offs like home-office space, platform fees, ads, and shipping, which may surprise you.

In this guide, we at SAL Accounting will cover these commonly missed tax deductions for e-commerce businesses with clear explanations, real examples, and 2026 tips to help you keep more money.

Quick Takeaways

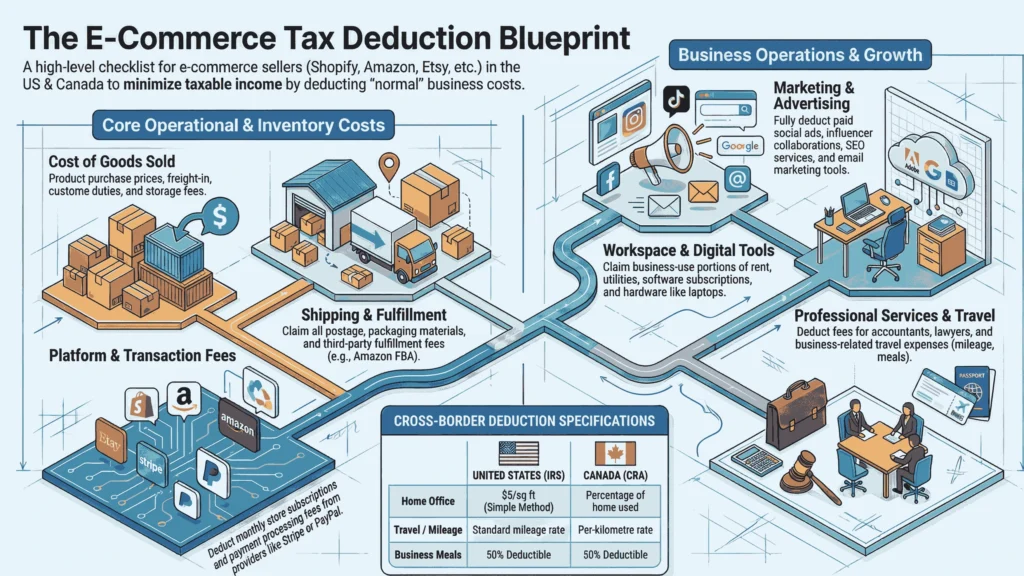

- The most important e-commerce tax deductions are COGS and inventory, advertising, platform and payment fees, shipping and packaging, home office, and software or equipment purchases.

- Many online sellers miss deductions every year and leave thousands of dollars unclaimed.

- Any ordinary and necessary expense used to run the store can usually be deducted legally.

- Keeping organized records and using accounting software makes deductions simple and audit-safe.

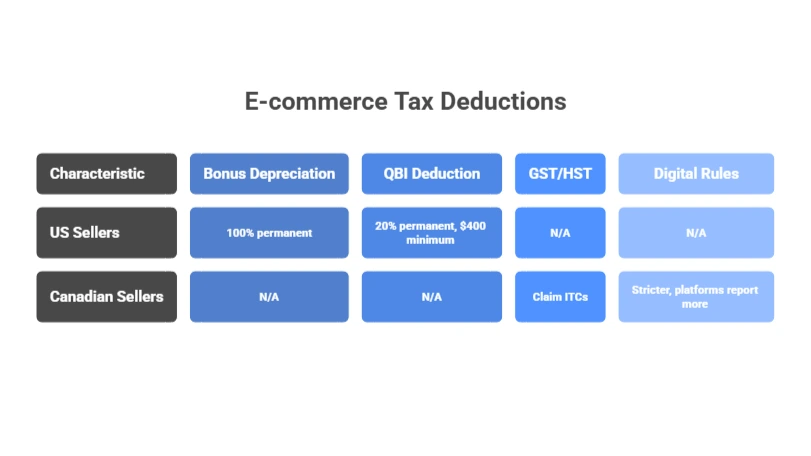

- 2026 tax rules like bonus depreciation, QBI, and GST/HST credits can significantly reduce total taxes owed.

What Are E-commerce Tax Deductions for Online Sellers?

E-commerce tax deductions are just the normal stuff you already spend money on to run your store. You subtract those costs from your sales revenue. Your taxable income goes down, and you pay way less tax. Totally legal. Every expense only needs to pass two easy checks:

- Ordinary → other online sellers spend money on it too.

- Necessary → it actually helps you make sales or run the business

If the expense helps you buy products, list items, run ads, pack boxes, or take care of customers, it counts as a deduction. Consult our e-commerce accounting and bookkeeping experts to gain more.

Why E-commerce Tax Deductions Matter So Much?

Tax deductions save you real money. Many online sellers save thousands of dollars every year. You already spend on ads, fees, shipping, and other business stuff. When you claim those costs properly, your tax bill drops a bunch. This is an important part of e-commerce accounting in 2026.

Main 2026 Tax Updates You Need to Know

For US Sellers: 100% bonus depreciation is permanent (One Big Beautiful Bill Act). Deduct the full cost of items like computers, cameras, or shelving in year one with no split. The 20% QBI deduction stays permanent, with a $400 minimum if you have $1,000+ qualified income.

For Canadian Sellers: Claim ITCs on GST/HST paid for business expenses (Shopify fees, ads, supplies). The 2026 digital rules are stricter. Platforms report more to CRA. Keep good records for fast refunds and no audit issues. See what happens if an e-commerce seller is not registered with HST/GST.

Case Study: Toronto Seller Near Yonge & Eglinton Saves $8,7001

A Toronto-based Shopify seller near Yonge & Eglinton sells custom phone cases and accessories. Revenue reaches $180,000 in 2026.

Problem: They spend heavily on Facebook ads, Shopify fees, packaging, and a new laptop + camera for photos, but claim almost nothing. They file a basic return and owe $18,200 in taxes.

What We Do: We review bank statements, Shopify reports, and receipts. We categorize advertising, platform fees, shipping supplies, and the home office portion, and apply 100% bonus depreciation on the laptop and camera (permanent in 2026). We also claim the full 20% QBI deduction (including the $400 minimum floor).

The Result: Taxable income drops sharply. Their tax bill falls from $18,200 to $9,500 — a $8,700 saving in one year. They now track expenses monthly with QuickBooks, scan receipts daily, and claim GST/HST ITCs automatically. More cash goes to ads and inventory instead of taxes.

- Read More: “In-House vs Outsourced E-commerce Accounting”

What Tax Deductions Can E-Commerce Businesses Claim?

You can deduct almost any normal business cost that helps run or grow your online store. Having a tax deduction checklist for Canadian and U.S businesses helps too. Here are the main ecommerce tax deductions most Shopify, Amazon, Etsy, WooCommerce, and DTC sellers use:

Cost of Goods Sold (COGS) and Inventory

COGS is often your biggest deduction. It covers the direct costs of products you sell. Here’s what you can deduct:

- Purchase price of products you sell

- Freight-in (shipping to receive inventory)

- Customs duties and import fees

- Storage and warehousing costs

- Supplies used to prepare or assemble goods

- Damaged, expired, unsellable, or obsolete inventory (with proof like photos or notes)

Drop-shippers don’t hold physical inventory, so they deduct supplier payments, fees, and commissions for the products they sell, rather than traditional COGS for stored stock. Check out to learn about tracking COGS for your Shopify store.

Pro Tip: Use FIFO costing when prices go up. It matches older (cheaper) stock to sales first and lowers your taxable income. Track with QuickBooks or A2X to stay accurate.

Home Office Expenses

You deduct part of your home costs if you use a space only for business (like managing orders or editing photos). This includes rent or mortgage interest, utilities, internet, insurance, and repairs.

In the US, pick the simple method ($5 per square foot up to 300 sq ft) or actual costs for home office deduction. In Canada, use the percentage of your home used for work.

Pro Tip: Take photos of the space to show it’s business-only. Keep a short log of how you use it. Shared spaces like the kitchen table usually don’t qualify.

Platform and Transaction Fees

You deduct every fee you pay to platforms and payment processors. This covers monthly plans (Shopify, Amazon, Etsy), sales transaction fees, Stripe/PayPal processing, app charges, and custom theme or coding costs. These fees add up fast as you sell more. So, you can use the best e-commerce accounting software with no worries about the cost.

Advertising and Marketing

You deduct all promotion costs. If it helps bring in sales, it counts with no limit. Here’s what you can deduct:

- Paid ads on Facebook, Google, TikTok, Instagram, and Pinterest

- Influencer payments and collaborations

- Email marketing tools (Klaviyo, Mailchimp)

- SEO services

- Sponsored posts and content

- Product photos for ads

- Giveaways and promo samples

Pro Tip: Save invoices and ad reports. This makes it easy to claim Input Tax Credits (ITCs) on GST/HST paid for advertising. This is how e-commerce taxes work in Canada.

Shipping, Packaging, and Fulfillment

You deduct postage, carrier fees (USPS, FedEx, UPS, Canada Post), boxes, mailers, bubble wrap, tape, labels, Amazon FBA fees, and return costs. Any expense to get orders out the door or handle returns qualifies.

Website, Software, and Tech

You deduct costs for your online store’s digital tools and equipment. Here’s what you can deduct:

- Website hosting and domain registration

- Business email services

- Design tools (Canva Pro, Photoshop)

- Accounting software, CRM, analytics, and security apps

- Equipment like laptops, cameras, phones, printers, or packaging machines

In Canada, you claim these as business expenses or capital cost allowance (CCA), depending on the item. Software subscriptions are usually fully deductible in the year paid. Equipment may be depreciated over time or claimed fully if it qualifies under CRA rules.

Professional Services

You deduct payments to people who help your business: bookkeepers, accountants, tax preparers, lawyers (for contracts or trademarks), consultants, web developers, photographers, virtual assistants, copywriters, and social media managers. The work must support your store to claim professional services deduction.

Business Insurance

You deduct premiums for business insurance: general liability, product liability, cyber insurance, errors & omissions, inventory coverage, or workers’ compensation (if you have staff). Personal insurance doesn’t count.

Internet, Phone, and Utilities (Business Portion)

You deduct the part of your internet, phone, and utilities used for business (customer emails, ads, supplier calls, and order work). Many sellers deduct 50-80% based on usage. A separate business line makes it easier. These are tax loopholes for e-commerce that cut down on your bill.

Travel and Mileage

You can deduct travel costs for business trips, like driving to the post office, picking up supplies, or attending trade shows. This includes mileage, parking, tolls, flights, hotels, and meals.

In Canada: Use the CRA’s per-kilometre rate or claim actual vehicle expenses based on business use. Also deduct parking, tolls, flights, hotels, and 50% of meals while traveling.

In the US: Use the IRS standard mileage rate (around 67 cents per mile in 2026, updated yearly). Also deduct parking, tolls, flights, hotels, and 50% of meals during business travel. Keep a mileage log.

Pro Tip: Use a mileage app like MileIQ or Everlance. It logs trips automatically and simplifies CRA or IRS reviews. Always note the business purpose for each trip.

Office Supplies and Small Equipment

You deduct everyday items like pens, paper, ink, labels, postage scales, label printers, cleaning supplies for your workspace, and small tools. Most of these small items get deducted fully in the year you buy them as regular business expenses. Also see how to claim the federal foreign tax credit with the Form T2209.

Business Meals

You deduct 50% of meals that have a clear business purpose. This includes meetings with influencers, suppliers, or partners, meals during travel, or client lunches. Keep the receipt and note who you met, when, and why it was for business.

Startup and Organizational Costs

New stores can deduct startup costs in the first year. Here’s what you can include:

- Market research and product testing

- Legal setup fees (incorporation, trademarks)

- Initial branding and logo design

- Website development and early marketing

You can deduct up to $5,000 in the first year. Anything extra gets spread over time through amortization. This gives you early tax relief when you launch your e-commerce business.

Bad Debts and Returns

If you use accrual accounting, you deduct money that customers never pay (bad debts). You also deduct costs from returns, including return shipping, restocking fees, and lost inventory value.

Deductible vs Non-Deductible: Are All E-commerce Business Expenses Deductible?

Many online sellers wonder which costs they can deduct and which ones do not count. Tax authorities allow expenses that are ordinary (common for e-commerce) and necessary (help you earn income). Here is a quick table to show the main differences:

| Expense Type | Deductible? | Explanation / Example | Tip |

| Inventory & COGS | Yes | Product purchases, freight-in, customs, storage, unsellable stock | Keep invoices and photos |

| Home office portion | Yes | Part of rent, utilities, internet for dedicated space | Exclusive use; calculate by square footage |

| Platform & transaction fees | Yes | Shopify/Amazon/Etsy plans, processing fees | 100% deductible; claim any sales tax credits |

| Advertising & marketing | Yes | Ads, influencers, email tools, SEO | No limit if business-related |

| Shipping, packaging & returns | Yes | Postage, boxes, labels, return shipping | Tied to fulfillment |

| Website, software & equipment | Yes | Hosting, domains, apps, laptops, cameras | Full expense or depreciation for equipment |

| Personal groceries/meals/clothing | No | Everyday food, family meals, daily clothes | Not business-related |

What Are Commonly Missed Tax Deductions for E-commerce Businesses

Lots of e-commerce owners miss out on easy money because they skip small or not-so-obvious tax deductions. They leave thousands on the table every year by missing these common ones:

- Website design, themes, and custom development. Premium Shopify themes, custom coding hires, or landing page builders are fully deductible.

- Product photography and image editing. Photographer fees, Photoshop subscriptions, or outsourced retouching count as deductible.

- Custom packaging and branding. Branded boxes, tissue paper, stickers, thank-you cards, and mailers used for shipping are 100% deductible.

- Customer service tools. Gorgias, Zendesk, Tidio, live chat apps, or paid help desk/CRM subscriptions qualify.

- Market research and competitor tools. Helium 10, Jungle Scout, SimilarWeb, or Ahrefs subscriptions help your business and are deductible.

Pro Tip: Check your statements quarterly. These small charges add up fast and are easy to miss. Track them now to lower your taxable income. Contact our expert bookkeeper to avoid missing even one deduction.

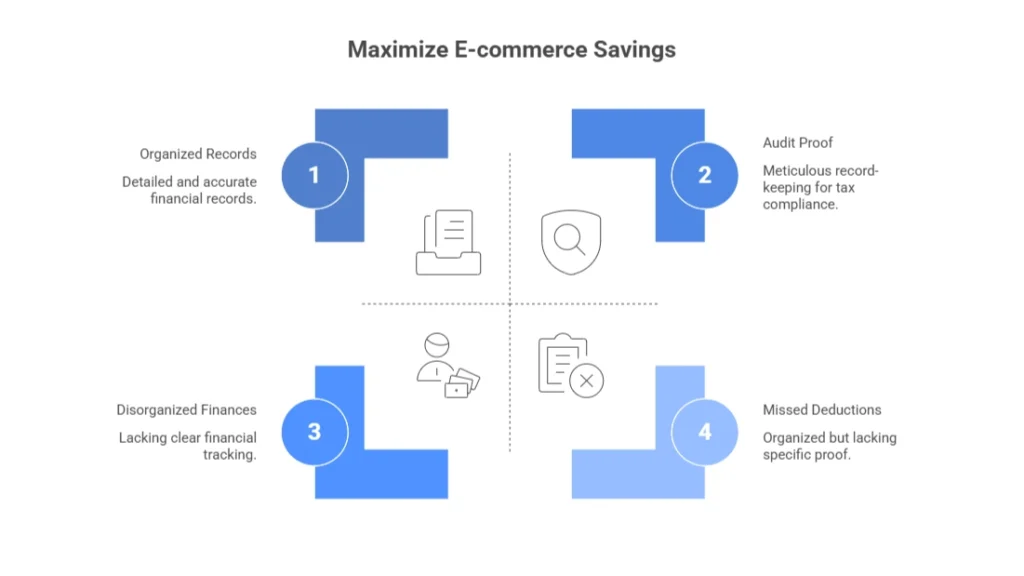

How to Claim & Maximize Your E-commerce Tax Deductions in 2026?

All tax deductions are easy to get when you stay organized. Build these habits now and use the 2026 rules to save more money.

1. Great Records Every Day

Separate business and personal money right away. Use a dedicated business bank account and credit card. Pay all business expenses (ads, fees, inventory) through them. Do these things to stay on top of everything:

- Track expenses with QuickBooks, Xero, or Wave. They connect directly to Shopify, Amazon, Etsy, and payment processors.

- Scan receipts quickly with apps like Expensify or Receipt Bank.

- Log business miles and write down the reason for every meal or travel expense.

This setup makes tracking automatic and painless. For instance, Shopify integration with QuickBooks simplifies every process for you.

2. Right Proof for Everything

Keep receipts, invoices, bank statements, and notes for 3–7 years. The IRS prefers 7 years. Store digital copies in Google Drive or Dropbox and keep them organized. Track dates and business use for home office or mileage. Apps like MileIQ handle miles automatically. Write a quick note on each receipt: who, what, when, and why.

Example: “Packaging for Amazon orders – Feb 10, 2026”.

3. Audit Safety

Reconcile accounts every month. Catch mistakes early. Never mix personal purchases on business cards. It raises red flags. Use a dedicated business credit card for everything. You get clear statements and often earn rewards for ads or stock.

4. 2026 Rules for Extra Savings

Maximize the QBI deduction. Most ecommerce owners (sole proprietors, LLCs, S corps) can deduct up to 20% of qualified business income. You now get a permanent minimum $400 deduction if your QBI is at least $1,000, and phase-out limits are higher, so more people qualify fully. Grab these big 2026 perks:

- 100% bonus depreciation on equipment (computers, cameras, racks) placed in service after January 19, 2025, full cost in year one

- Section 179 to expense up to ~$2.56 million in qualifying purchases

- Phase-out for Section 179 starts around $4.09 million. Check out the guide on LLC tax deductions for Canadians to learn more.

Case Study: Mississauga Seller Saves $7,900 in Taxes2

A Mississauga-based Shopify seller near Square One sells home decor items. Revenue hits $165,000 in 2026.

Problem: They spend heavily on Google/Facebook ads, Shopify fees, packaging supplies, and a new computer + lighting kit for product photos, but claim very few deductions. They file a simple return and owe $16,400 in taxes.

What We Do: We go through bank statements, Shopify reports, and receipts. We categorize ad spend, platform fees, shipping materials, and the home office portion, and apply 100% bonus depreciation on the computer and lighting (permanent in 2026). We also claim the full 20% QBI deduction (including the new $400 minimum floor).

The Result: Taxable income drops significantly. Their tax bill falls from $16,400 to $8,500 — a $7,900 saving in one year. They now track expenses monthly with QuickBooks, scan receipts daily, and claim GST/HST ITCs automatically.

If you have experienced the same process, our Shopify accountant is here to help. Contact us for a consultation today.

Final Thoughts

E-commerce tax deductions help you keep more cash in your business. You spend on ads, fees, shipping, software, and packaging every day. Most of those costs qualify and lower your taxes. Set up a separate business account, scan receipts right away, and check statements every few months. Start with one small step and watch the savings add up.

Contact us at SAL Accounting today for clear, e-commerce-specific help. We’ll get your books organized and make sure you claim every deduction you deserve.

Ordinary and necessary expenses: COGS, advertising, platform fees, shipping/packaging, home office, software/apps, professional services, insurance, mileage/travel, office supplies.

Yes — subscription fees, transaction fees, payment processing, apps, and theme/development costs are fully deductible.

Yes — 100% deductible: paid ads (Facebook, Google, etc.), influencers, email tools, SEO, sponsored content, promo samples.

No — deducted through COGS when items sell. Damaged/expired/unsellable inventory can be deducted with documentation.

Yes — if the space is used exclusively and regularly for business. US: simplified ($5/sq ft up to 300 sq ft) or actual. Canada: percentage of home costs. Keep photos and logs.

Yes — keep receipts, invoices, statements for 3–7 years (7 safest). Digital copies are fine. Use apps like Expensify.

Claim all qualifying deductions, maximize 2026 rules (QBI, 100% bonus depreciation, Section 179), separate finances, track expenses monthly, use accounting software. Consult a tax pro.