Running an online business in Canada is tough enough without tax stress on top. Many e-commerce sellers, freelancers, and new owners quietly wonder: “Do I need to register for GST?” Plenty cross the line without realizing that the rules aren’t always clear.

The simple rule is that if your taxable sales exceed $30,000 in any rolling 12-month period, you must register for GST/HST right away. Don’t wait. Mistakes grow fast. Once you pass the threshold, the CRA eventually. Delay too long, and you risk back taxes, GST penalties, or a full audit.

We a SAL Accounting are going to explain what happens and when you should register for GST. We will also show you the simple steps to fix it now if you are not registered yet.

Quick Takeaways

- If an e-commerce seller isn’t registered for GST/HST in Canada and passes $30,000 in any rolling 12 months, registration is required.

- The CRA can retroactively register you and charge back taxes, interest, and penalties if you register late.

- Charging GST/HST without being registered creates trust money obligations and high audit risk.

- Some e-commerce sellers must register immediately, even below $30,000 (non-residents, FBA, marketplaces).

- Registering early and claiming input tax credits can prevent penalties and reduce your overall tax bill.

When Does an E-commerce Seller Need to Register for GST/HST?

Many e-commerce sellers, freelancers, and new business owners get this wrong at first. You don’t have to register just because you had a couple of strong months or hit a good quarter. Consult an accountant for e-commerce to get everything. Here are the rules:

Who Qualifies as a Small Supplier (No Registration Needed)?

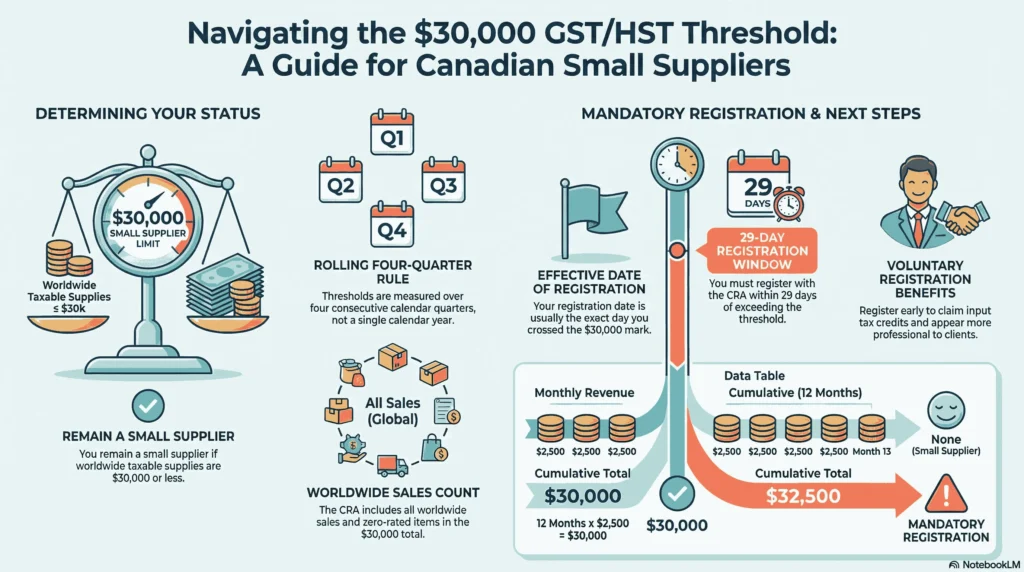

You’re a small supplier (no mandatory registration required) if your total worldwide taxable supplies stay under $30,000 in both:

- any single calendar quarter, and

- the last four consecutive calendar quarters combined.

2026 note: The threshold is still $30,000, no changes this year according to current CRA guidance. Taxable supplies include zero-rated items, and the CRA counts worldwide sales. Learn more about GST/HST returns in Canada.

What Triggers Mandatory Registration?

The key trigger happens when you exceed $30,000 in either a single calendar quarter (like landing a big $35,000 project in one go) or any rolling four consecutive calendar quarters. The CRA uses this rolling look-back, not calendar years, which catches many people by surprise.

When to Register and Start Charging GST/HST

Once you cross the $30,000 threshold, you must register for GST/HST. GST and HST rules for Shopify sellers are the same. You should follow these steps:

- Register within 29 days of the date you went over $30,000.

- Your effective registration date is usually the day you exceeded the threshold.

- Start charging GST/HST on taxable supplies from your effective registration date (place-of-supply rules).

- Remit the collected GST/HST to the CRA.

Pro tip: If you’re nearing $30,000 or expect growth, register voluntarily early to claim input tax credits sooner and look more professional to clients.

Example: You bill $2,500 per month for online consulting to Canadian clients. After 12 months: $30,000. By month 13: $32,500. The rolling four quarters now exceed $30,000 → register within 29 days and charge GST/HST on future invoices.

Who Must Register for GST/HST Immediately (E-Commerce Sellers)

Most e-commerce sellers can wait until taxable sales hit $30,000. But some must register right away, even from the first sale or well below the threshold. You must register immediately if you are:

- A non-resident seller selling to Canadians. You sell physical goods, digital products, SaaS, subscriptions, or online services to Canadian customers. Do not consider Canada’s digital service tax (DST).

- An e-commerce seller using Canadian fulfillment or warehousing (e.g., Amazon FBA Canada, Shopify Fulfillment Network, or any Canadian 3PL).

- An online seller who already charges GST/HST without registration, you added GST/HST to checkout or invoices. The CRA sees this as trust money.

- A marketplace or platform-based seller You sell through Shopify, Amazon, Etsy, or dropshipping platforms.

- A fast-growing seller close to $30,000. You expect to cross the threshold soon.

The table below shows e-commerce sellers that must register for GST/HST immediately, even below $30,000:

| Seller Type | What Applies | $30,000 Threshold | When to Register | Main Risk |

| Non-resident seller | Sells goods or digital services to Canadians | No | From first sale | CRA cross-border enforcement |

| Seller using Canadian fulfillment | Inventory stored in Canada (FBA, 3PL) | No | When goods enter Canada | Canadian tax presence |

| Seller who charged GST/HST | Charged tax without registration | No | When tax was charged | Trust money penalties |

| Marketplace seller | Sells via Shopify, Amazon, Etsy | Sometimes | Depends on platform rules | Platform reporting audits |

| Fast-growing seller | Near $30,000 in sales | Yes (soon) | Before or at threshold | Retroactive registration |

- Read More: “Best Financial Software for Your Amazon FBA Business”

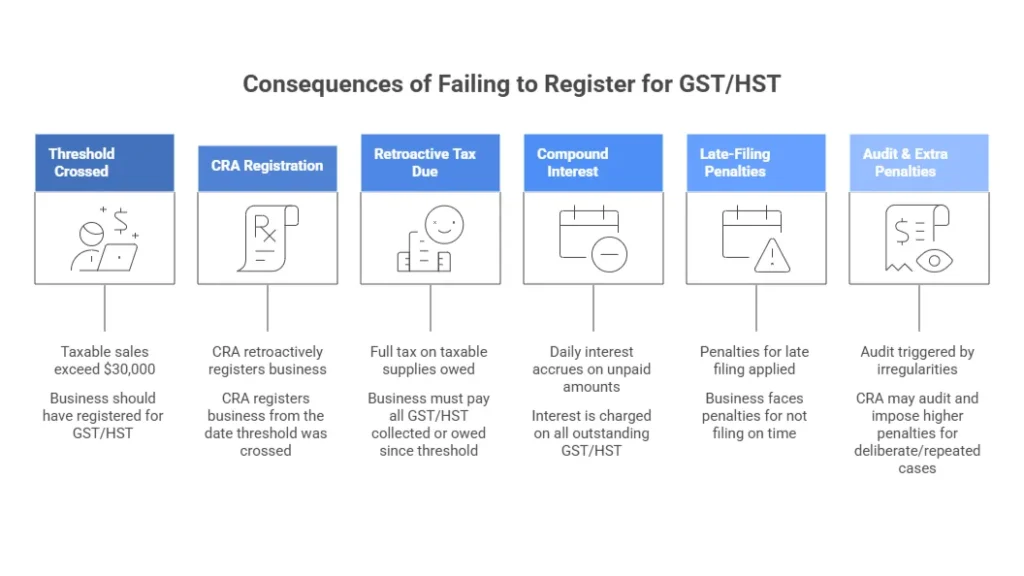

What Happens If You Didn’t Register for GST/HST When You Should Have?

If your taxable sales cross the $30,000 threshold without registering for GST/HST, the CRA can retroactively register you from that date. This is what you see in the 2026 accounting rules for e-commerce as well. Below are the penalties you may face:

- Retroactive GST/HST owing: Full tax on taxable supplies back to that date (paid out of pocket if not charged to customers)

- Compound daily interest: On all unpaid amounts from the due date (prescribed interest rates).

- Late-filing penalties: Typically 1% of net tax owing + 0.25% per full month late (up to 12 months; doubles for repeat offenders in the last 3 years)

- Audit & extra penalties: Triggered by irregularities, leading to reassessments, denied ITCs, or higher penalties in deliberate/repeated cases.

Example: Suppose you crossed the $30,000 threshold six months ago but didn’t register. You should have collected about $1,500 in GST/HST over that time. The CRA backdates your registration, so you owe the $1,500 out of pocket, plus interest and penalties.

- Read More: “Best eCommerce Accounting Software in 2026”

Common Mistakes E-Commerce Sellers Make with GST/HST Registration

Even experienced online sellers trip over GST/HST rules because the details hide in plain sight. E-commerce accounting and bookkeeping mistakes are common. These six mistakes happen often and lead to extra taxes, penalties, or audits. Spot them early so you can avoid the CRA headache.

Ignore the Rolling 12-Month Threshold

Many sellers track only calendar years or the last 12 months that end in December. The CRA uses any four consecutive calendar quarters. A strong Q4 plus the previous three quarters can push you over $30,000 without warning. Track sales every quarter to stay safe.

Wait Until You Exceed $30,000

Sellers often plan to register at the exact moment they hit $30,001. This approach creates problems. This is not the way e-commerce taxes work in Canada. Here is why you should act earlier:

- Any delay in registration leads to retroactive risk.

- The CRA can backdate your registration to the date you crossed the threshold.

- Voluntary registration a little early allows you to claim input tax credits on past expenses.

- Early action prevents backdating issues and extra costs.

Forget Provincial Sales Taxes (PST/QST)

In provinces without HST (British Columbia, Manitoba, Saskatchewan, Quebec), separate PST or QST registration may be necessary. Thresholds differ (for example, $10,000 in BC for some sellers), and rules change for digital or physical goods. Failure to register leads to separate provincial penalties.

Pro Tip: Scan your sales dashboard monthly. If 10%+ of sales go to BC, MB, SK, or QC, register for that provincial tax right away, even under the $30,000 federal threshold.

Use the Wrong Tax Rate for Customers

E-commerce sellers must apply the tax rate that matches the buyer’s province or territory (shipping address for goods, billing address for digital services). Use of 5% across Canada instead of 13% HST in Ontario or 15% in Atlantic provinces causes under-collected tax. The CRA will reassess you for the difference.

Pro Tip: Turn on auto tax calculation in your platform (Shopify, WooCommerce, etc.) after registration. Use built-in rules or apps like Avalara/TaxJar for correct rates and audit-proof records. For example, automating your Shopify accounting helps a lot.

Fail to File or File Late After Registration

Once registered, you must submit returns (quarterly or annually) even when you owe zero tax. Late or missing returns trigger automatic penalties. Here is what happens:

- Late-filing penalties apply: 1% of net tax + 0.25% per month late (up to 12 months).

- These penalties occur even on zero-balance returns.

- Missing deadlines increases the total cost over time.

- Repeated late filings double the penalties in some cases.

Fail to Claim Input Tax Credits (ITCs)

Many new sellers do not track or claim GST/HST paid on business expenses (software, shipping, advertising). This leaves money unclaimed. You can only claim ITCs when you register and file returns correctly.

Pro Tip:Use a dedicated business card or folder for GST/HST expenses. Enter receipts into accounting software within 7 days to claim every ITC and recover hundreds/thousands yearly.

These are the most common GST/HST mistakes e-commerce sellers make and why they cause CRA problems:

| Common Mistake | What Happens | CRA Risk | How to Avoid It |

| Ignore rolling 12-month threshold | Only track calendar year sales | Retroactive registration | Review sales quarterly |

| Wait until $30,000 exactly | Delay registration too long | Back taxes and interest | Register early if close |

| Forget PST / QST | Skip provincial registration | Provincial penalties | Track sales by province |

| Use wrong tax rate | Charge 5% everywhere | CRA reassessment | Enable auto tax tools |

| File late or not at all | Miss or skip returns | Automatic penalties | Set filing reminders |

| Miss ITCs | Don’t claim GST/HST on expenses | Pay more tax than needed | Track receipts properly |

Case Study: Toronto Dropshipper Dodges $6,300 in CRA Penalties1

A Toronto dropshipper in Liberty Village adds 13% HST to Shopify orders for 11 months to build trust, before reaching $30,000 or registering.

Problem

He collects ~$4,800 HST but never remits it. CRA treats it as trust money. Non-remittance risks full repayment, daily interest, penalties (1% + 0.25%/month late, up to 12 months; doubles on repeats), and audit.

What We Do

We verify the collected HST from Shopify exports and statements. We tell him to stop charging HST immediately. We file a voluntary disclosure (VDP) before CRA contact.

The Result

VDP is accepted unprompted. He remits only $4,800 (no extra cost). 100% penalty waiver + 75% interest relief (2026 rules). He saves ~$6,300. No audit or criminal risk. He registers at the threshold and claims ITCs on Toronto expenses.

Consult our GST/HST filing experts to avoid any mistakes.

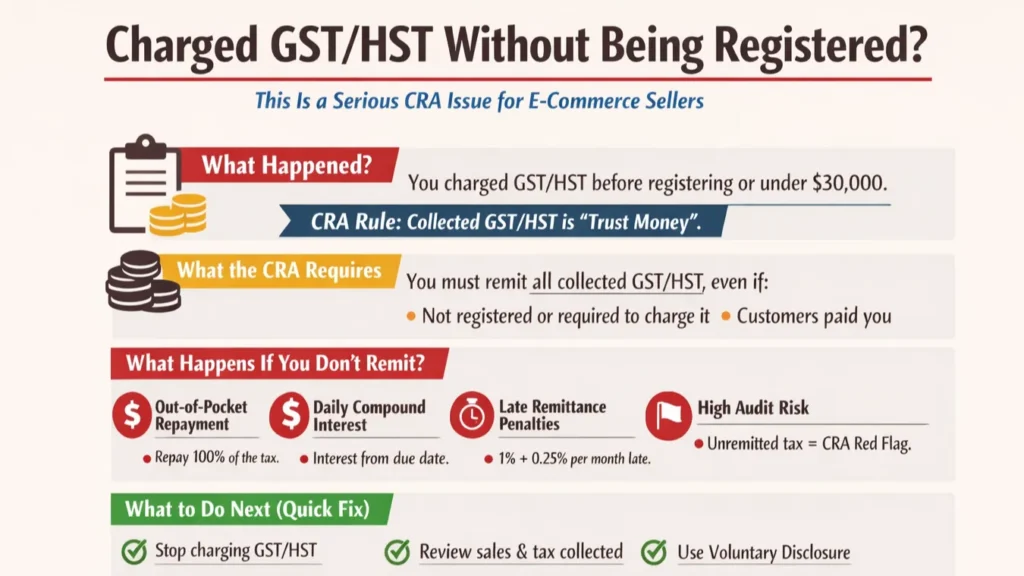

What If You Charged GST/HST Without Being Registered?

Some e-commerce sellers charge GST/HST too early, before the $30,000 threshold or registration. This is a serious issue. The CRA treats collected GST/HST as trust money for the government. You must remit it, even if unregistered and not required to charge it. If you don’t remit:

- Full remittance of the collected amounts (paid out of pocket if customers paid you the tax)

- Compound daily interest on unpaid amounts from the due date

- Late-remittance penalties (typically 1% of net tax + 0.25% per full month late, up to 12 months; doubles for repeat offenders in the last 3 years)

- Increased audit risk, the CRA flags unremitted collections as a major red flag

Case Study: Mississauga Shopify Seller Avoids $4,800 in GST/HST Penalties2

A Mississauga-based Shopify seller (home office near Square One) charges 13% HST on all sales for 9 months to look professional, before hitting $30,000 taxable supplies or registering.

Problem

The seller collects ~$3,900 HST but never remits it. CRA treats this as trust money. Unremitted amounts risk full back payment, compound interest, late-remittance penalties (1% + 0.25%/month, up to 12 months; doubles for repeats), and audit trigger.

What We Do

We review Shopify reports and deposits. We advise stopping the charging HST immediately. We prepare and submit a voluntary disclosure (VDP) before CRA contact.

The Result

VDP is accepted as unprompted. The seller remits only $3,900 collected HST (no extra out-of-pocket). 100% penalty relief + 75% interest relief applies (2026 rules). Total saved: ~$4,800 in penalties/interest. No audit occurs, no criminal risk. The seller now registers properly and claims ITCs on local expenses.

Final Thoughts

GST/HST rules can surprise many e-commerce sellers. The good news is you can avoid most problems. Track your sales monthly. Register early if you are close to $30,000. Use auto tax tools. Claim every input tax credit. If you make a mistake, use the voluntary disclosure right away to cut penalties and interest.

At SAL Accounting, we help sellers stay safe and save money. We handle registration, filing, and fixes. Contact us and book a consultation today. Let us make GST/HST easy for you in 2026.

Frequently Asked Questions (FAQs)

No. You don’t have to register if your worldwide taxable sales stay under $30,000 in any rolling 12-month period. You qualify as a small supplier. But voluntary registration lets you claim input tax credits (ITCs) and look more professional.

The CRA registers you retroactively from the day you exceeded $30,000. You owe GST/HST on all past taxable sales — even if you never charged it — plus daily interest and late-filing penalties. An audit may follow.

The CRA uses a rolling test of any four consecutive calendar quarters. They do not use a calendar year. A strong quarter can push you over the limit unexpectedly.

Yes. You can register anytime. Early registration lets you claim ITCs on expenses like software, ads, and shipping. It also prevents retroactive problems later.

This is serious. The CRA sees collected GST/HST as trust money. You must remit it to the CRA, even if you were not required to charge it. Failure to remit brings penalties, interest, and higher audit risk.

Yes, in some cases. British Columbia, Manitoba, Saskatchewan, and Quebec have separate taxes. Thresholds and rules differ. Online sellers often need to register for PST or QST even if under the federal $30,000 limit.

Yes, if you act first. Use the Voluntary Disclosures Program (VDP) before the CRA contacts you. VDP often removes or reduces penalties and interest. Many sellers fix late registration or unremitted tax this way and avoid audits.