Our goal is to give Shopify, Amazon, and Etsy sellers simple, fully legal ways to cut your taxes in 2025 and keep more cash. But most importantly, we want to shield you from the tax bomb that just hit. On January 1, 2025, the CRA started digital reporting for platforms on sellers over $2,800 CAD or 30 sales. Fresh surveys show 75% of online sellers still don’t get it and now overpay up to 15% in GST/HST on unclaimed ITCs.

This wipes out dropshipper margins overnight. You can turn it around with SR&ED credits, ITC refunds, and smart exemptions, some of the biggest tax loopholes for e-commerce right now. We at SAL Accounting will show you exactly how, step by step.

Quick Takeaways

- Tax loopholes for e-commerce are 100% legal CRA-approved deductions and credits that cut your bill.

- Incorporate as a CCPC when profit hits $100k → pay just 9–15% tax on the first $500k.

- Claim up to 35% cash back with SR&ED for product tests, photos, and custom apps.

- Write off 100% of laptops, cameras, and ads in the same year using AII + CCA.

- Get back 99% of duties on returns and re-exports with simple duty drawback filing.

What “Tax Loopholes for E-commerce” Really Means (and What It Doesn’t)

A tax loophole is not some shady trick or back-room deal with the CRA. It’s simply a legal provision in the tax code that lets you pay less. Nothing more. The CRA calls them deductions, credits, or input tax credits. We call them loopholes because they feel like shortcuts, and they are, as long as you stay 100% compliant. Here’s the only line that matters:

- Legal tax avoidance: You follow the rules exactly as written and keep more money. Completely allowed in 2025 e-commerce accounting for small businesses..

- Tax evasion: You lie, hide income, or fake receipts. That’s a crime with fines up to 200% and possible jail time. (combat tax evasion)

Most Shopify, Amazon, and Etsy sellers don’t cheat. They just overpay thousands every year because they never learned that these rules exist. They are not fully aware of the e-commerce taxes. Book a call with our e-commerce accounting expert today and claim every loophole you deserve.

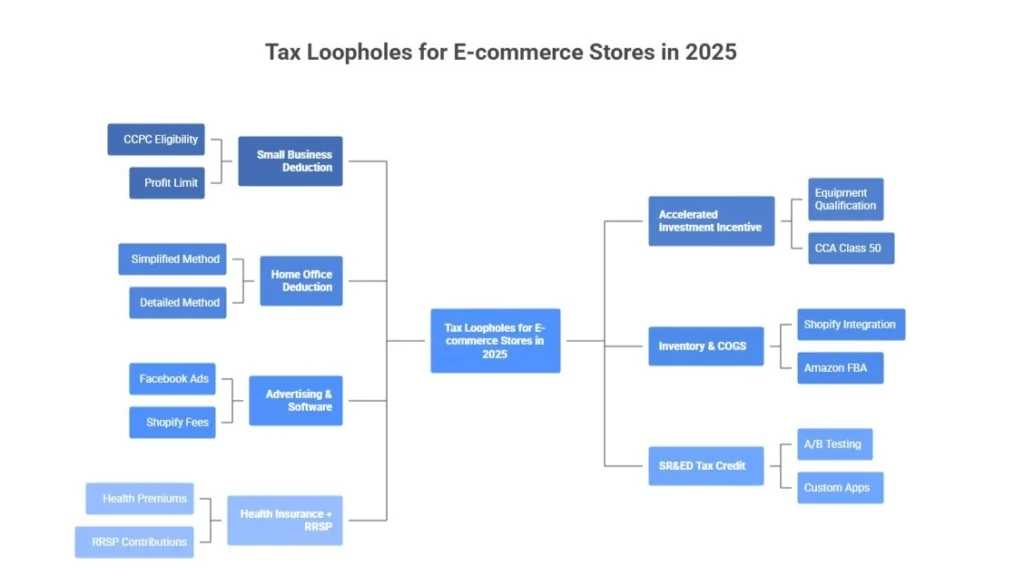

What Are the Best Tax Loopholes for E-commerce Stores in 2025?

These 7 are the most effective tax strategies currently used by Shopify, Amazon, Etsy, and dropshipping sellers. Every single one is 100% CRA-approved and still working strong:

1. The Small Business Deduction – The #1 Profit-Keeper

If you run your store as a Canadian-controlled private corporation (CCPC), you can deduct the first $500,000 of active business income at a low federal rate of 9% (combined with provincial rates for 11–15% total). You can set up Shopify tax exemptions to save more.

Example: $150k profit = about $12,150 less federal tax than the standard 15% rate.

Pro tip: Keep passive income under $50,000 to avoid the business limit reduction. Use QuickBooks to track active vs. passive earnings.

2. Accelerated Investment Incentive (AII) + CCA – Buy Gear, Deduct Fast

Any equipment you buy for the business (new or used) can be written off up to 100% in the year you start using it under CCA Class 50 for computers/software (Capital Cost Allowance). Laptops, cameras, packaging machines, shelving, and even a delivery van qualify.

- Works on brand-new and used items

- No limit for small CCPCs (under $500k income)

- AII boosts the rate to 1.5x normal CCA

Pro tip: Put the item in service before December 31. Even one day of use locks in the full write-off for 2025. Have a tax deduction checklist for Small Businesses to avoid missing them.

3. Home Office Deduction – The One Everyone Forgets

You can deduct a portion of rent/mortgage, internet, utilities, and even home repairs if you have a dedicated workspace. Two ways:

- Simplified: $2 per square foot (max 1,000 sq ft = $2,000)

- Detailed: Actual costs based on square footage percentage (e.g., 10% of home = 10% of bills)

Pro tip: Take a dated photo of your office setup every January 1 for home office deductions. It’s the easiest audit-proof step you’ll ever take.

4. Inventory & Cost of Goods Sold (COGS) – Usually the Biggest Single Deduction

Every dollar tied up in unsold inventory (whether in your garage or Amazon FBA) reduces your taxable income dollar-for-dollar. Shopify and Amazon both give you the exact numbers; you just have to use them. Many six- and seven-figure stores save $50k–$200k+ here alone. Learn more about inventory accounting in Shopify and how to handle it.

5. Advertising & Software – 100% Deductible, Same Year

Every cent you spend on Facebook ads, Google ads, Shopify fees, email tools (Klaviyo), product research (Helium 10), photography, or design software is fully deductible the same year you spend it. No limits for advertising deductions, no phase-outs.

Pro tip: Run a big profitable ad campaign in December. An extra $10k–$20k spend can drop your tax bill by the exact same amount, often turning a tax headache into a wash.

6. SR&ED Tax Credit – Yes, Even for Product Photos and Split Tests

The CRA gives you up to 35% back on qualified R&D costs, including A/B testing listings, pricing tests, bundle experiments, or building custom Shopify apps. Shopify integrations for e-commerce help you a lot. Many stores claim $5k–$50k with almost no extra work once they know what counts.

7. Health Insurance + RRSP Contributions – The Tax-Killing Combo

You can deduct 100% of private health premiums plus contribute up to $31,560 (2025 limit) into an RRSP, all tax-deductible.

Pro tip: You can fund the RRSP as late as March 1, 2026, and still wipe out 2025 taxes. Perfect for waiting until you know your exact profit.

| Loophole | How It Works | Typical Savings | Pro Tip |

| Small Business Deduction | 9% federal + provincial on first $500k (CCPC) | $12k+ on $150k profit | Keep passive < $50k → track in QuickBooks |

| AII + CCA | 100% write-off on equipment year one | Full cost of gear | Use before Dec 31 — one day counts |

| Home Office | $2/sq ft (max $2,000) or % of rent/utilities | $1k–$5k+ | Dated photo every Jan 1 |

| Inventory & COGS | Unsold stock reduces income dollar-for-dollar | $50k–$200k+ | Pull Shopify/Amazon reports |

| Advertising & Software | 100% deductible same year | Exact spend amount | Run big December ad push |

| SR&ED Credit | Up to 35% back on A/B tests & custom apps | $5k–$50k | Keep simple test log |

| Health + RRSP | 100% premiums + up to $31,560 RRSP | $10k–$20k+ | Fund RRSP by March 1, 2026 |

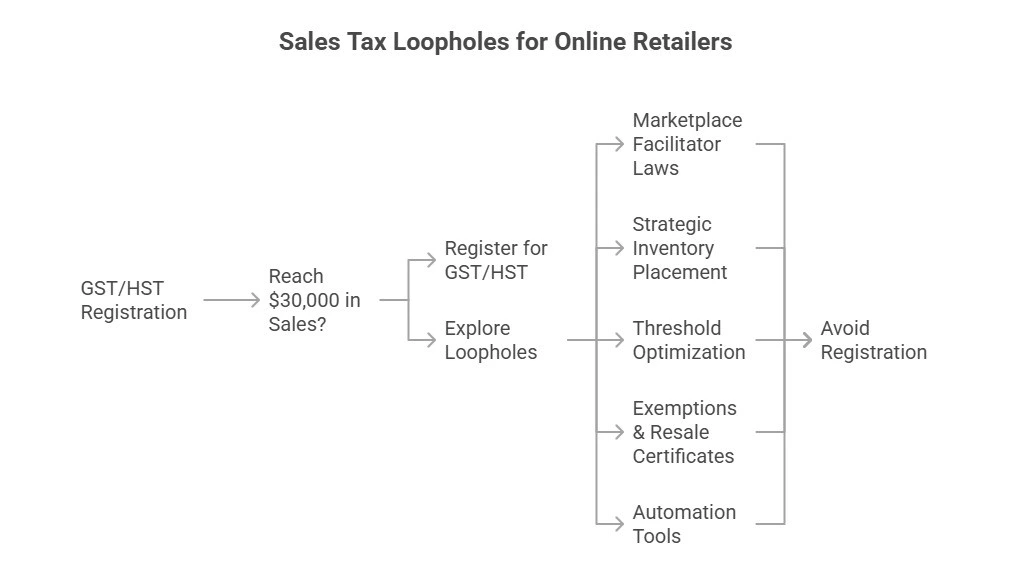

What Are the Sales Tax Loopholes for Online Retailers Still Working in 2025?

GST/HST registration is required once you reach $30,000 in taxable sales over four consecutive quarters (or a single quarter). Smart, fully legal loopholes still let you recover or avoid charging where possible. Here’s everything you need to know: how e-commerce taxes work in Canada, 2025 updates, and the top five strategies real stores are using right now.

1. Marketplace Facilitator Laws

Amazon, Etsy, Walmart, and eBay collect and remit GST/HST in all provinces for marketplace sales. These sales usually don’t count toward your personal $30,000 threshold, so direct sales can stay under it, and you avoid registering yourself. See how GST/HST works for Shopify sellers in Canada.

Pro tip: Pull separate marketplace vs. direct reports every quarter to avoid double-reporting penalties.

2. Strategic Inventory Placement

One FBA box in a province creates nexus instantly. Consolidate stock in low-rate areas (Alberta 5% GST only) or use 3PLs that don’t trigger registration. Many seven-figure stores stay under thresholds in 8+ provinces this way. Sales tax nexus for e-commerce sellers is important.

3. Threshold Optimization

Grow fastest in low-rate provinces (Alberta, territories at 5% GST) and high-volume ones like Ontario (13% HST). Registration isn’t retroactive, so cap sales in high-HST areas (Nova Scotia 15%) at $29,000 to delay it for years.

Pro tip: Geo-target ads to keep risky provinces under $29,000 until you’re ready.

4. Exemptions & Resale Certificates

Zero tax on B2B with valid certificates, basic groceries, medical supplies, or children’s clothing. Bundled shipping is often exempt, too.

5. Automation Tools

TaxJar Canada or Avalara handles 200+ rate changes, tracks thresholds, and files automatically for $20–$100/month. They save far more in penalties than they cost. There are some top e-commerce accounting software options you can always use.

Pro tip: Run a free threshold scan monthly; catching one hidden province early can save $10k+.

Key 2025 GST/HST Changes Every E-commerce Seller Must Know

These are the most important updates that actually affect your store right now:

- Platforms (Shopify, Amazon) must report sellers over $2,800 CAD or 30 sales to CRA starting January 1.

- Temporary GST/HST holiday on groceries and essentials from December 14, 2025, to February 15, 2026. Zero-rate those items.

- Voluntary registration threshold stays at $30,000, but ITCs now cover more digital services (e.g., cloud storage).

- Nova Scotia HST drops from 15% to 14% effective April 1.

- Over 200 local rate tweaks in Q1 2025, mainly in Ontario (13%) and BC (12%).

Pro tip: Review your nexus every three months. One missed province, or rate change, can cost $10k+ in back taxes and penalties.

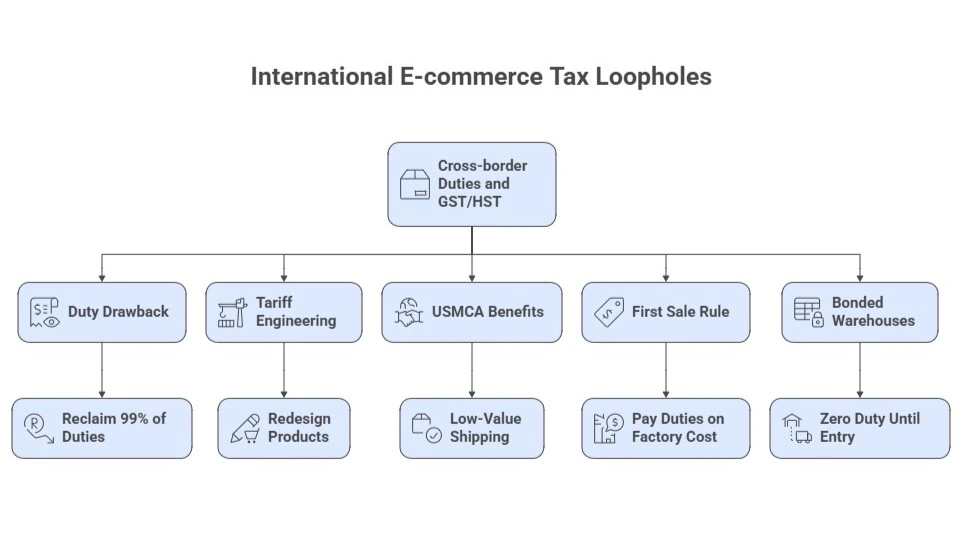

International E-commerce Tax Loopholes Still Working in 2025

Cross-border duties and GST/HST on imports can quietly kill margins. Smart Canadian sellers use these five fully legal loopholes to cut or recover what they pay to CBSA. For instance, the Canada-US tax treaty helps you avoid double taxation.

1. Duty Drawback – Reclaim 99% of Duties on Returns

Every returned or re-exported item gets nearly all duties back from CBSA. A store with 8% returns recovers $50k–$150k extra cash per year.

Pro tip: File monthly through the Single Window Initiative; refunds land in 4–6 weeks.

2. Tariff Engineering – Redesign Products to Slash Duty Rates

Small changes = big savings. Remove zippers, swap metal for plastic, or adjust fabric blends by 5% and the HS code (and tariff) can drop 50–90%. One Shopify brand cut average duty from 18% to 3% just by removing drawstrings and metal tips.

3. USMCA Benefits – Keep Low-Value Shipping Simple

Goods from Mexico or Vietnam enter Canada at 0–5% under USMCA. Sub-$150 CAD shipments still skip most paperwork:

- Perfect for high-volume dropshipping (Check out dropshipping taxes in Canada)

- No formal entry or customs bond required

- Works with any carrier

Pro tip: Use 3PLs like ShipBob or Flexport; they handle USMCA certificates automatically.

4. First Sale Rule – Pay Duties on Factory Cost, Not Retail

The factory sells low to your offshore entity, which then sells high to your Canadian business. CBSA calculates duties only on the lower factory price, cutting tariffs 30–70% for private-label imports. Fully legal with proper arm’s-length records.

5. Bonded Warehouses – Zero Duty Until Goods Enter Canada

Land inventory in a CBSA-bonded warehouse, store, repack, or assemble duty-free. Pay nothing until it leaves for a customer; pay zero if re-exported.

- Combine with tariff engineering inside the warehouse for double savings

- Ideal for seasonal or high-return products

Pro tip: Switch sourcing to Mexico or Vietnam under USMCA and pay 0–5% instead of China’s 20–30%. Our cross-border tax accountant saves you thousands. Contact us now.

What Are the Most Tax-Efficient Business Structures for E-commerce?

Your business structure is the single biggest tax lever you control. The right one can:

- Cut your effective tax rate by 15–20% or more

- Unlock the small business deduction (9% federal on the first $500k active income)

- Protect your house and savings from lawsuits

- Let you defer tax on profits you keep in the company

So, you should always choose the best business structure for online retail. Here’s the simple breakdown every Shopify, Amazon, or e-commerce seller needs:

| Structure | Best for profit level | Key tax win | 2025 note & pro tip |

| Sole Proprietorship | Under $100k | Zero setup cost, simple filing | Pays personal marginal rates (up to 53% combined). Easy start but no liability shield. |

| Incorporation (CCPC) | $100k–$500k+ | 9% federal + provincial small business rate (11–15% total) on first $500k | #1 move for most growing stores. File T2 return and claim the small business deduction. |

| Partnership | Family or co-owners | Split income among partners → lower brackets | Ideal for spouses or kids helping; drops effective rate 5–10%. |

2025 rule: If your 2025 profit exceeds $100k, incorporate as a Canadian-Controlled Private Corporation (CCPC) by December 31, 2025 (or before your fiscal year-end). This single change puts an extra five figures in your pocket every year, fully CRA-approved.

Is Tax Avoidance Legal for E-commerce? (5 Myths That Stop Sellers from Saving)

Most sellers skip these tax loopholes for e-commerce because they fear they’re “shady.” Wrong. Legal tax avoidance is using the tax code exactly as Parliament wrote it (deductions, credits, incentives). Everything here is 100% avoidance. Five myths that cost you thousands every year:

- “Big savings = CRA audit.” Reality: Audits hit sloppy books, not legal SR&ED or ITC claims.

- “International moves are illegal.” Reality: Duty drawback, bonded warehouses, and USMCA are used by Amazon and Walmart daily.

- “Only huge stores qualify.” Reality: $100k profit stores save $5k–$20k a year with these exact strategies.

- “Shopify/Amazon covers everything.” Reality: They handle GST/HST returns in Canada on marketplace sales only; you still owe income tax and import duties.

- “These loopholes vanish soon.” Reality: Budget 2025 made SR&ED and immediate CCA permanent.

Case Study: How a $180k/year Shopify Seller Stops Fearing International Loopholes1

A dropshipper contacts SAL Accounting in panic after the US de minimis shutdown.

Problem: His China-sourced margins drop 19%. He thinks duty drawbacks and First Sale are “illegal tricks” that will trigger audits.

What We Do: We file his first three months of duty drawbacks and set up clean First Sale documentation with his factory and offshore entity.

The Result: He receives $14,200 cash back from returns in 90 days, plus an average tariff cut from 21% to 6%. Total extra profit in 2025 hits $38,000 with zero red flags. He says, “I wasted two years being scared. SAL showed me it’s just paperwork the government wants you to file.”

Tax Planning for Online Stores: Best Tools & Experts to Stay Compliant

You have the loopholes. Now lock them in with the right tools and pros — most cost less than one extra ad spend and save you dozens of hours (and thousands in penalties).

Top Tools Every Store Needs in 2025

- TaxJar Canada or Avalara → Auto-tracks $30,000 thresholds, calculates GST/HST rates across provinces, files returns. Shopify & Amazon integrations. Starts free, then $19–$99/month.

- QuickBooks Online + Bench → Tracks COGS, ads, home office, and inventory in real time. Bench adds a human bookkeeper for $299/month (essential for FBA sellers). Check the guide on Amazon FBA bookkeeping.

- Helium 10 / Jungle Scout → Built-in provincial-sales reports and threshold alerts so you never accidentally trigger registration.

- CBSA Single Window (free) → File duty drawbacks yourself. Pair with ShipBob or Flexport for automatic low-value entries on sub-$150 CAD shipments.

When to Bring in a Pro (and Where to Find Them)

- Profit > $100k → Hire an e-commerce CPA now. One 60-minute call sets up CCPC, SR&ED credits, and RRSP plans that save $10k–$40k.

- Importing $200k+ → Get a licensed customs broker (most give a free 15-minute review). They handle USMCA, bonded warehouses, and tariff engineering paperwork so you don’t lose 10–25% margins.

One Non-Negotiable Rule

The CRA doesn’t care how smart your strategy is if you can’t prove it. One missing receipt can wipe out a $20k deduction and add penalties. So, have a bookkeeping checklist for small businesses available. Keep it simple:

- Home office → one dated photo + utility bill portion

- Inventory → Dec 31 count + Shopify report

- Ads & software → monthly PDF exports

- Equipment → receipt + photo of it in use

- International → invoices, HS code changes, return proofs

Create a single “2025 Tax Proof” folder in Google Drive or Dropbox. Drop everything monthly. Takes 3 minutes a month and makes every loophole in this guide 100% audit-proof. Let us handle your bookkeeping for e-commerce hassle-free.

- Read More: “Shopify Integration with QuickBooks”

Case Study: How a $420k Amazon FBA Seller Saves $22k With SAL’s Help2

An Amazon FBA seller reaches out to SAL Accounting, drowning in GST/HST filings across provinces.

Problem: Manual filing eats 18 hours a month, and she pays full personal tax rates. Penalties are piling up.

What We Do: We switch her to TaxJar Canada ($49/month), run her free threshold scan, and connect her with our vetted e-commerce CPA for a single $450 consult that sets up CCPC and SR&ED credits.

The Result: Filing time drops to 11 minutes a month. Year-one savings: $6,800 on penalties/overpaid tax plus $15,600 from CCPC and RRSP contributions. Total: $22,400 back in her pocket.

- Read More: “Amazon and Shopify Integration Complete Guide”

Final Thoughts

You now have the full list of tax loopholes for e-commerce that actually work in 2025, from the small business deduction and SR&ED credits to duty drawbacks, GST/HST shortcuts, and CCPC incorporation. These are real, legal strategies built into the tax code, not temporary tricks.

If you want help making it happen quickly and correctly, contact us at SAL Accounting. We turn tax planning for online stores into simple, stress-free savings.

FAQ – Tax Loopholes for E-commerce Stores

Legal deductions and rules like small business deduction, SR&ED credits, COGS, ITCs, and platform exemptions that cut your tax bill.

Claim small business deduction, write off equipment/ads immediately, use COGS and inventory, incorporate as CCPC above $100k profit, and automate GST/HST.

Yes — SR&ED for testing/apps, immediate CCA for equipment, platform collection in all provinces, and duty drawback on returns.

Register for GST/HST above $30k sales. Platforms handle marketplace sales; you handle direct sales and claim ITCs.

Yes — duty drawback, USMCA tariff reductions, First Sale valuation, low-value shipments under $150 CAD, and bonded warehouses.

Track every expense monthly, keep home-office photos, run inventory counts, separate platform vs. direct sales, and store all receipts.

Run quarterly threshold scans, automate with TaxJar Canada/Avalara, document everything, file drawbacks on time, and incorporate early.

Ignoring $30k registration, skipping SR&ED/ITCs/home office, paying full rates past $100k, missing duty drawbacks, and keeping no proof.