Our mission is to show you the best business structure for online retail. We’ll help you pick between LLC, S Corp, or sole proprietorship to cut taxes and protect your Shopify or Amazon store. Here’s what shocks most sellers: 80% of US e-commerce owners miss the 2025 QBI deduction. This 20% tax break can save you $20,000+ a year on profits over $100,000.

This rule only works with pass-through structures. It skips corporate tax completely. We at SAL Accounting walk you through how to grab it and which structure saves you the most, step by step, in this guide.

Quick Takeaways

- The best business structure for online retail depends on profit: sole proprietorship for under $50K, LLC for $50K–$80K, and S Corp for over $80K.

- Sole proprietorship offers easy setup but unlimited personal liability and full 15.3% self-employment tax on profits.

- LLC provides strong asset protection, pass-through taxes, and credibility without double taxation.

- S Corp reduces self-employment tax by splitting income into salary and distributions, saving thousands annually.

- Claim the 20% QBI deduction in all pass-through structures to cut taxes on qualified business income.

Why Your Business Structure for E-commerce Matters

Your business structure for e-commerce controls three key areas:

- Taxes you pay

- Liability if someone sues

- Growth and funding options

Choose wrong, and you pay more tax than needed. Choose wisely, and you keep more profit to grow your store. It’s the foundation of your online business. A weak choice limits you. A strong one supports long-term success. Hire our e-commerce tax accountant to secure your structure and taxes. Let’s begin with the default option most new sellers use:

Sole Proprietorship for Online Sellers: Simple Setup, High Risk

A sole proprietorship is the simplest business structure. You and your business are legally one. No formal setup needed.

What Is a Sole Proprietorship?

You launch a Shopify store. You make your first sale. By default, you operate as a sole proprietorship for online sellers. No registration required. No extra fees. You and the business are the same legal entity. Your business name is your personal name unless you file a DBA (doing business as). All income goes straight to your personal tax return. The e-commerce accounting guide in 2025 tells you more.

Advantages of Sole Proprietorship for E-commerce

- No cost to start: You skip state filing fees (often $100–$800 for LLCs). Start selling the same day you set up your store.

- Full decision-making power: No partners or board. You decide products, prices, and marketing without approval.

- Easy tax filing: Report all income on Schedule C with your personal Form 1040. No separate business return.

- No annual state reports: Avoid yearly compliance filings and fees that LLCs and corporations must submit. Also, check out the US LLC tax problems for Canadians.

Disadvantages of Sole Proprietorship for E-commerce

- Unlimited personal liability: If a customer sues over a defective product, the court can seize your personal savings, car, or home. No legal shield exists.

- Full self-employment tax: You pay 15.3% (12.4% Social Security + 2.9% Medicare) on every dollar of profit. No way to reduce it through salary vs. distribution splits. You must know how to file sales tax in the US as an e-commerce business.

- Limited funding options: Banks hesitate to lend. Investors rarely fund sole props. You rely on personal savings or credit cards.

- No tax optimization: You qualify for the 20% QBI deduction, but you can’t lower self-employment tax by paying yourself a salary. Every dollar gets hit.

Example: Sarah earns $45,000 profit from her Etsy shop. She pays $6,885 in self-employment tax. A customer dispute costs $12,000. The court rules against her—she pays from personal funds.

Pro Tip: Use a sole proprietorship only for low-risk testing under $50,000 in annual profit (solo proprietorship CRA guide). Switch as soon as you scale or sell physical goods.

LLC for Online Store: Best Protection for Shopify & Amazon Sellers

An LLC (Limited Liability Company) is the top upgrade for most online sellers. It puts a legal wall between your personal money and your business.

What Is an LLC?

You file a short form with your state. Fees range from $40 to $800. Once approved, your business becomes its own legal “person.” If the store owes money or gets sued, only business assets are at risk. Your personal home, car, and savings stay safe. You can run it alone or with partners. Taxes stay simple, and profits go to your personal return unless you choose otherwise. Learn more about the pros, cons, and structure of an LLC.

Advantages of LLC for Online Retail

- Strong personal protection: A lawsuit hits the business only. Your personal bank account stays safe.

- Pass-through taxes: No double tax. You still get the full 20% QBI deduction.

- Looks professional: “LLC” builds trust with suppliers, banks, and customers.

- Easy to grow: Add owners, get loans, or open business credit cards. See the difference between LLC, LLP, and S corporation and how to choose the best structure.

Disadvantages of LLC for E-commerce

- Setup cost: Pay $50–$800 to start, plus annual fees in some states.

- Extra paperwork: File once a year. Keep business and personal money separate.

- Full self-employment tax: You pay 15.3% on all profits (unless you elect S Corp later).

- State rules differ: California adds an $800 yearly tax even if you lose money (FTB tax guide for LLC).

Example: Mike sells kitchen tools on Amazon FBA. A customer claims a blender caused injury and sues for $50,000. Mike’s LLC means only business money is at risk—his personal savings stay safe.

Pro Tip: Form your LLC in your home state. Skip “Delaware LLC” myths unless you have a big reason. Use LegalZoom or Northwest Registered Agent to file fast and cheap—under $300 total.

- Read More: “How to Start DropShipping on Shopify in 2025”

S Corp for E-commerce Business: Tax Savings for Growing Stores

An S Corp is an LLC or corporation that elects special tax status. It’s the same as an LLC for liability, but smarter for taxes once you earn a good profit.

What Is an S Corp?

You start as an LLC (or corp), then file IRS Form 2553. The IRS treats you like a partnership for taxes. You pay yourself a reasonable salary (subject to payroll tax). The rest of your profit comes as a distribution. No self-employment tax. You still get the 20% QBI deduction on the distribution part. This split saves big money. Just make sure if a Canadian can own a US LLC or not.

Advantages of an S Corp for Online Retail

- Lower self-employment tax: Pay 15.3% only on your salary, not total profit. Save $5,000–$15,000+ per year.

- Full QBI deduction: 20% off qualified income. Combine with salary split for max savings.

- Same liability protection: Just like an LLC. Personal assets stay safe.

- Professional image: “Inc.” or “Corp.” helps with big suppliers and investors.

Disadvantages of an S Corp for E-commerce

- IRS salary rules: You must pay yourself a “reasonable” wage. If it is too low, the IRS can reclassify and add penalties.

- Extra payroll cost: Run payroll (even for yourself). Use Gusto or ADP. It costs $40–$100/month.

- More tax forms: File Form 1120-S plus K-1s. Hire a CPA (add $800–$2,000/year).

- Only 100 shareholders: Limits big investors. Must be US citizens or residents.

Example: Lisa runs a Shopify clothing store. She can use the best Shopify integrations for e-commerce for growth. Profit: $120,000.

- As LLC: Pays $18,360 in self-employment tax.

- As S Corp (salary $60,000): Pays $9,180 payroll tax + $12,000 QBI savings.

- Total saved: $15,000

Pro Tip: Switch to S Corp when profit hits $80,000+. Below that, an LLC is simpler and cheaper. Use the IRS “reasonable salary” tool or a CPA to set your pay.

LLC vs S Corp for Online Business: Which Saves More on Taxes & Liability?

You now know the three main options. Let’s compare LLC and S Corp for an online business side by side. We focus on taxes, liability, cost, and growth. You can also learn how small businesses can minimize tax liabilities in Canada.

| Factor | Sole Proprietorship | LLC | S Corp |

| Liability Protection | None – personal assets at risk | Full – personal assets safe | Full – same as LLC |

| Setup Cost | $0 | $50–$800 | $50–$800 + Form 2553 |

| Annual Fees | $0 | $0–$800 (state) | $0–$800 + payroll |

| Self-Employment Tax | 15.3% on all profit | 15.3% on all profit | 15.3% only on salary |

| QBI Deduction (20%) | Yes | Yes | Yes (on distributions) |

| Best For | < $50K profit, testing | $50K–$100K, protection | > $80K profit, tax savings |

Case Study: B2B Shopify Seller Avoids US Audit1

A California Shopify seller (running as a sole proprietorship) contacts SAL Accounting in panic. They sell $50,000 yearly to a reseller and mark every order “Tax-Free”, but never collect or save the Resale Certificate (CDTFA-230). A state audit notice arrives: $4,000 fine + back taxes at risk. Poor records make it worse.

What We Do: We verify the valid Resale Certificate, set up Avalara to auto-store forms, tag orders “Tax-Free-US” in Shopify, and archive everything in a secure cloud folder.

The Result: The seller avoids the $4,000 fine and saves $4,125 in sales tax on the $50,000 in exempt B2B sales. Orders run smoothly. We form an LLC to shield personal assets from future disputes. At $120,000 profit, they elect S Corp status, paying a $65,000 salary and taking $55,000 as distributions. This saves $8,415 in self-employment tax vs. LLC alone.

Total savings: $16,540/year.

- Read More: “Best Shopify Integrations for E-commerce“

How Do Small Business Taxes for E-commerce Compare?

Taxes are the biggest reason sellers upgrade from sole proprietorship or LLC to S Corp. All three use pass-through taxation. Profits go to your personal return. You avoid corporate tax. But the self-employment tax (15.3%) is the real difference. The guide on taxes for Shopify sellers in Canada and the US will help you more.

- Sole Prop & LLC: You pay 15.3% on all profits.

- S Corp: You pay 15.3% only on your salary. The rest (distributions) skip this tax.

- QBI deduction (20%) applies to all, but an S Corp gives more after the salary split.

Here’s an example with $120,000 profit (after expenses):

| Structure | Salary | Self-Employment Tax | QBI Savings | Total Tax Paid* | You Keep |

| Sole Prop | — | $18,360 | $19,200 | ~$37,560 | $82,440 |

| LLC | — | $18,360 | $19,200 | ~$37,560 | $82,440 |

| S Corp | $60,000 | $9,180 | $12,000 | ~$28,380 | $91,620 |

S Corp saves almost $9,180 in tax. Numbers use the 2025 IRS S Corp rates. State tax not included.

Result: S Corp wins when profit exceeds $80,000. You save thousands on self-employment tax. Under $80,000, an LLC is simpler and still protects your personal assets.

Which Legal Structure for Shopify or Amazon Sellers Supports Growth Best?

Growth is more than just sales. You need funding, partners, and long-term stability. Shopify and Amazon integration works for many e-commerce sellers. Here’s how each structure handles scaling:

- Sole Proprietorship: Hard to get loans. Banks see high risk. No way to add investors. You fund growth with personal credit or profits only. Most Amazon FBA or Shopify sellers outgrow this by year 2.

- LLC: Banks approve loans faster. You can add partners (members) easily. Open business credit cards. Build real company value. Perfect for dropshipping or private-label brands hitting $100K+.

- S Corp: Same benefits as LLC, plus tax savings. Issue stock to up to 100 U.S. owners. Attract investors or employees with equity. Ideal for stores planning 7-figure revenue or exit.

Example: Jake started as a sole prop on Etsy. At $60K profit, he formed an LLC to get a $30K inventory loan. At $150K profit, he elected S Corp status—saved $12K in tax and gave 10% equity to a marketing partner.

Pro Tip: Start as an LLC. Elect S Corp later with IRS Form 2553. No need to refile with your state. Most sellers make the switch in under 30 days. Use a CPA to set your “reasonable salary” and avoid IRS red flags. Start Shopify accounting in Toronto with SAL Accounting today for tax savings and growth.

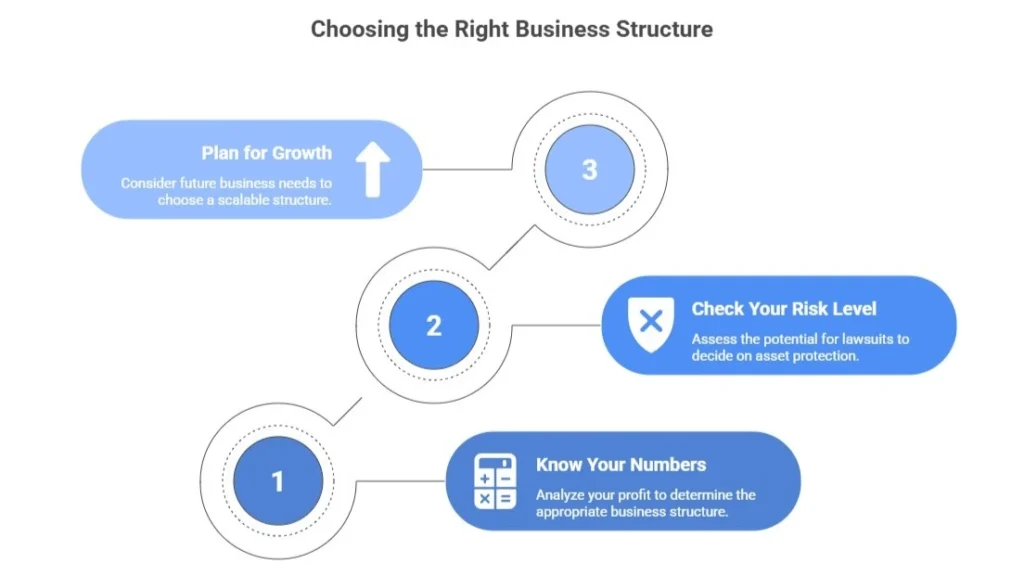

How to Choose the Best Business Structure for Your Online Retail: Step-by-Step

Use this simple 3-step guide to find the best business structure for online retail in under 10 minutes:

Step 1: Know Your Numbers

Look at your profit after expenses from last year or your forecast.

- Profit under $50,000 → sole proprietorship

- Profit $50,001 – $80,000 → LLC

- Profit over $80,000 → LLC → elect S Corp later

Why profit, not revenue? Taxes and liability rules depend on what you actually keep after ads, inventory, and fees. Withholding tax for e-commerce sellers is also possible.

Step 2: Check Your Risk Level

Ask one question: “Could a customer sue me?” Consider the following answers:

- If you sell physical products like FBA, dropshipping, or handmade items, the answer is yes. You need an LLC or an S Corp to protect your personal assets. Check out the Amazon FBA bookkeeping guide.

- If you sell digital downloads such as e-books or courses, the risk is low. Sole proprietorship is fine to start.

- If you use Amazon, Shopify, or Etsy, form an LLC by $50K profit to stay safe.

Example: One defective product can cost $10,000+ in a lawsuit. An LLC costs $300. Worth every penny.

Step 3: Plan for Growth

Think 12–24 months ahead. If you want to stay solo and keep it simple, start as a sole proprietor and upgrade to an LLC later. When you need loans or partners, form an LLC. If you want to save $10K+ in tax and attract investors, go LLC and select S Corp.

Pro Tip: Start as an LLC. It’s the perfect middle ground. It protects your assets, scales easily, and lets you switch to an S Corp for free when ready. Get bookkeeping for e-commerce sellers from SAL Accounting and keep more profit.

Case Study: Sarah Applies 3-Step Guide to Digital Course Business2

Sarah, a new Etsy creator selling digital printables, contacts SAL Accounting with $20,000 annual profit. She’s unsure if she needs a formal structure.

What We Do: We walk her through the 3-step guide:

- Step 1 (Know Your Numbers): $20,000 profit → Sole proprietorship (free, simple).

- Step 2 (Risk Level): Digital products = low risk → safe to start as sole prop.

- Step 3 (Plan for Growth): Wants to add physical add-ons later → plan LLC upgrade.

The Result: She launches as a sole prop, saves $300+ in fees, and tests her idea. By year 2, profit hits $65,000 with physical prints. We revisit:

- Step 1 → LLC

- Step 2 → Physical products = lawsuit risk

- Step 3 → Needs marketing loan

We form a Wyoming LLC ($150 total). A copyright dispute hits — her personal savings stay safe. At $120,000 profit, she elects an S Corp, saving $9,000 in self-employment tax.

Final Thoughts

The best business structure for online retail saves you thousands in taxes, protects your personal assets, and fuels your growth. You start with a sole proprietorship, upgrade to an LLC, or unlock S Corp tax savings. The right choice depends on your profit, risk, and goals. The 3-step guide and flowchart in this post help you decide in minutes. You avoid losing money and risking your savings.

For help with choice, formation, or switch, or a free tax review, contact us at SAL Accounting to set up your e-commerce business for success in 2025 and beyond.

LLC. It protects your assets and keeps taxes simple. Use sole proprietorship only under $50K profit. S Corp saves tax above $80K.

Start as sole proprietor if profit < $50K and digital only. Form LLC if you sell physical products or want protection.

All three structures use pass-through taxation. Profits go to your personal return. Pay 15.3% self-employment tax (S Corp only on salary). Claim 20% QBI deduction.

LLC for $50K–$80K profit (protection + simplicity). S Corp over $80K (saves $5K–$15K in tax via salary split).

Yes, get a sales tax permit in states with nexus. Some cities require a local business license even if home-based.

Yes, sole prop → LLC (file with state). LLC → S Corp (IRS Form 2553, free). No tax penalty if done right.

20% QBI deduction on profit. Deduct ads, shipping, inventory, home office. No double tax (pass-through). Build business credit.