Does your bank balance ever feel like a mystery? You check your records, and they do not quite match what the bank says. We’re here to help you master double-entry bookkeeping for your small business in 2025. This guide will show you how to track income, expenses, and everything in between.

Studies show that 82% of business failures are linked to poor cash management. Better bookkeeping could have avoided these financial mistakes. That’s a big deal. In this guide from SAL Accounting, we make double-entry bookkeeping simple, and we explain its advantages over basic spreadsheets. Learn how small businesses can implement it effectively, no accounting degree required.

Quick Takeaways

- Double-entry records every transaction twice – one debit, one credit, keeping your books automatically balanced.

- It shows your complete financial picture – tracks assets, liabilities, and equity, not just cash like spreadsheets do.

- Software does the technical work – you categorize transactions, it handles debits and credits behind the scenes.

- Required for business growth – banks and investors need the financial statements only double-entry creates.

What Is Double-Entry Bookkeeping?

At its core, double-entry bookkeeping is a system where every business transaction is recorded in at least two accounts. Think of it as telling the full story of every dollar. It is a system of checks and balances that shows both where money came from (the source) and where it went (the destination).

The Golden Rule: Accounting Equation

The entire system is built on a simple, powerful formula called the accounting equation:

Assets = Liabilities + Equity

This equation must always be in balance after every single transaction because it is a fundamental accounting principle. Let’s break down what each part means:

- Assets: These are the resources your business owns. This includes cash in the bank, the equipment you use, any inventory you hold, and money owed to you by customers (accounts receivable).

- Liabilities: These are what your business owes to others. This includes bank loans, credit card debt, and money you owe to suppliers (accounts payable).

- Equity: This represents the owner’s investment and stake in the business. It is what is left over for the owner after all liabilities are paid off.

The magic of the double-entry system is that by always keeping this equation balanced, it automatically ensures your books are accurate and complete.

What Are Debits and Credits in Double-Entry Bookkeeping?

The terms “debit” and “credit” are often the most confusing part of accounting for newcomers. The first thing to know is that they do not mean “plus” and “minus” like they do on your bank statement.

In double-entry accounting, debits and credits are simply directions, like left and right. Debits (Dr) go on the left side of an account, and Credits (Cr) go on the right side.

Easy Rules to Remember

The beauty of this bookkeeping system for small business lies in its consistent rules:

Debits (Dr) INCREASE:

- Asset accounts (cash, inventory, equipment)

- Expense accounts (rent, utilities, supplies)

Credits (Cr) INCREASE:

- Liability accounts (loans, accounts payable)

- Equity accounts (owner investment, retained earnings)

- Revenue accounts (sales, service income)

Here’s a simple mnemonic to help: PEARLS

- Purchases, Expenses, and Assets increase with a debit

- Revenue, Liabilities, and Shares (Equity) increase with a credit

Every transaction requires at least one debit and one credit, and the total debits must always equal the total credits. This is how the accounting equation stays in balance.

- Read More: “Sales Tax Nexus Explained for E-commerce businesses“

How Does Double-Entry Bookkeeping Help Small Businesses?

Many new business owners start with single-entry bookkeeping, which is like a basic cash log or chequebook. Each transaction is recorded once, tracking money in and money out. While this might work for a very small business with few transactions, it doesn’t give you a full or accurate picture of your finances.

Switching to double-entry bookkeeping offers big benefits for protecting and growing your business.

Spots Errors Automatically

Double-entry bookkeeping balances your accounts, so if something doesn’t add up, you’ll know right away. This helps catch mistakes quickly and prevents common bookkeeping errors, which cause about 60% of accounting issues. Learn about other common accounting mistakes that can cost your business.

Gives a Full Financial Picture

Single-entry shows your cash flow, but double-entry tracks everything: your assets, debts, and overall financial health. You’ll know how much cash you have, what you owe, and the value of your assets.

Prepares You for Investors

If you ever need a loan or want to attract investors, you’ll need professional financial statements like a Balance Sheet or Income Statement. Double-entry bookkeeping makes it easy to create these reports.

Helps Prevent Fraud

The double-entry system has built-in checks to make it harder for transactions to be lost or manipulated. This extra layer of control can protect your business from fraud. According to ACFE survey, small businesses lose an average of $200,000 to fraud, often because they don’t have systems like this in place.

How Does Double-Entry Bookkeeping Work in Action?

Understanding theory is one thing, but seeing how transactions work in practice makes everything click. Here are common scenarios every small business face in real world:

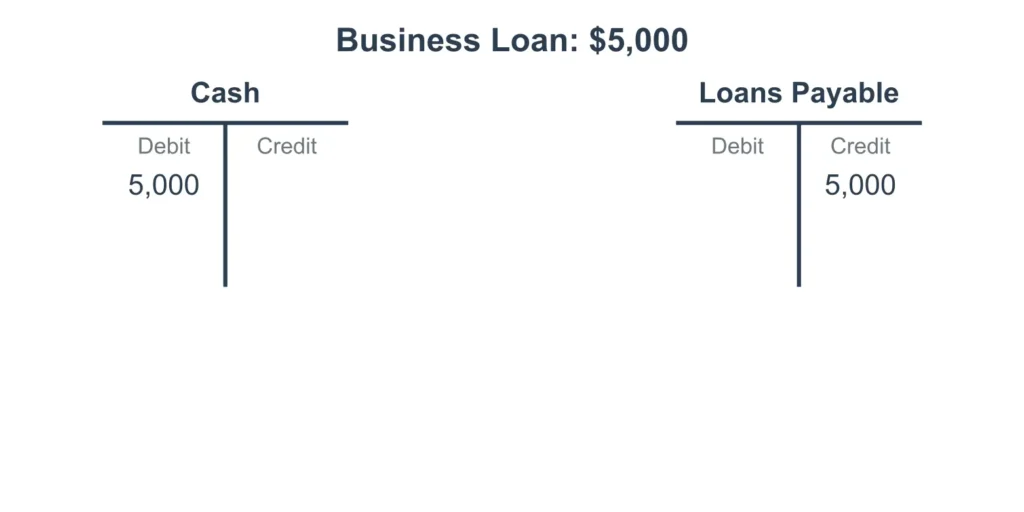

Example 1: Taking Out a Business Loan

Imagine your business gets a $5,000 loan from the bank.

- Debit: Cash (Asset) for $5,000 ↑ (increases your cash)

- Credit: Loans Payable (Liability) for $5,000 ↑ (increases what you owe)

The equation stays in balance: Assets (+5,000) = Liabilities (+5,000) + Equity.

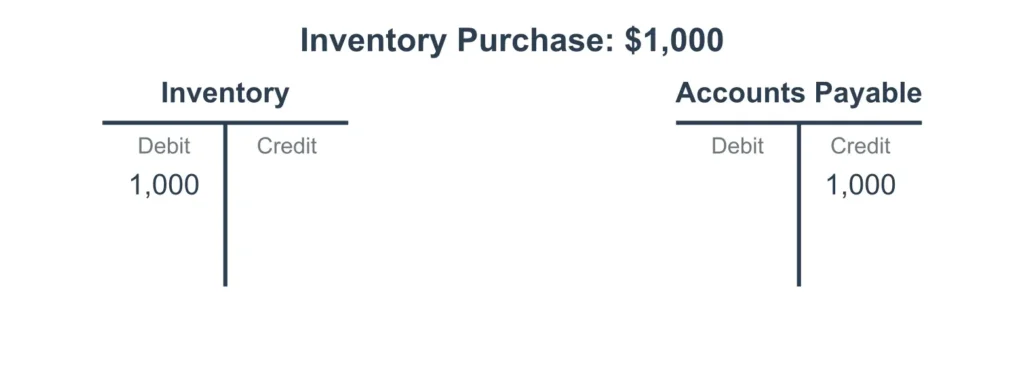

Example 2: Buying Inventory on Credit

You purchase $1,000 worth of inventory from a supplier, who will bill you later.

- Debit: Inventory (Asset) for $1,000 ↑ (increases your stock)

- Credit: Accounts Payable (Liability) for $1,000 ↑ (increases what you owe suppliers)

The equation stays in balance: Assets (+1,000) = Liabilities (+1,000) + Equity.

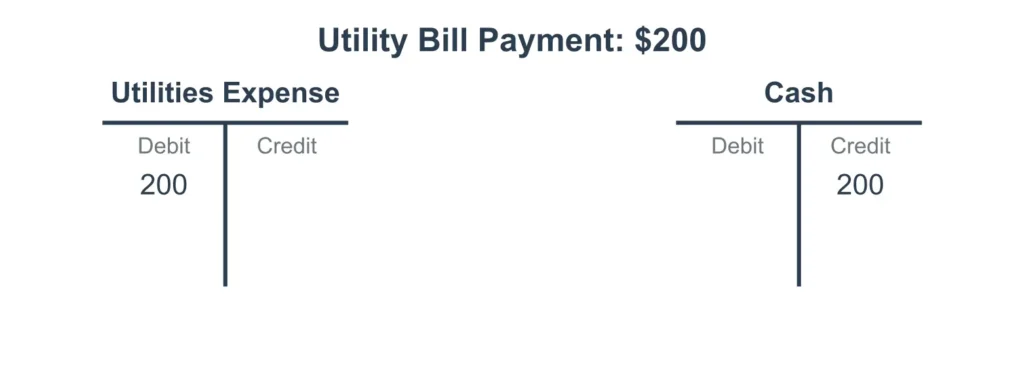

Example 3: Paying a Business Expense

You pay a $200 utility bill with cash.

- Debit: Utilities Expense for $200 ↑ (increases your expenses)

- Credit: Cash (Asset) for $200 ↓ (decreases your cash)

This transaction reduces your equity and the equation stays in balance: Assets (-200) = Liabilities + Equity (-200).

Example 4: Making a Sale

A customer purchases your product for $500, paying immediately.

- Debit: Cash (Asset) for $500 ↑ (increases your cash)

- Credit: Sales Revenue for $500 ↑ (increases your income)

If the product cost you $300, you’d also record:

- Debit: Cost of Goods Sold (Expense) for $300 ↑ (increases your expenses)

- Credit: Inventory (Asset) for $300 ↓ (decreases your stock)

The equation stays in balance: Assets (+200) = Liabilities + Equity (+200).

How to Set Up a Chart of Accounts for Double Entry Accounting?

Before starting double-entry bookkeeping, you need a chart of accounts. This is just a list of all the accounts your business will use to track money. Think of it as a filing system for your finances.

The Five Main Account Types

Your chart of accounts should include:

- Assets – Things your business owns (e.g., cash, accounts receivable, inventory, equipment).

- Liabilities – Money your business owes (e.g., accounts payable, loans, credit cards).

- Equity – The owner’s share of the business (e.g., investment, retained earnings).

- Revenue – Money your business earns (e.g., sales, service income, interest income).

- Expenses – Money your business spends (e.g., rent, utilities, supplies, marketing).

Most accounting software comes with ready-made templates, so setting this up is easy, even for beginners.

How to Get Started with Double-Entry Bookkeeping?

You don’t need complex paper ledgers. Modern accounting software automates double-entry bookkeeping, making it easy for any small business.

Platforms like QuickBooks, Xero, and Wave handle the heavy lifting. Connect your bank accounts, and the software imports transactions automatically. Simply categorize them (e.g., “Office Supplies” for a Staples purchase), and the software creates the correct debit and credit entries behind the scenes. Check out our bookkeeping software comparison for more information.

Here’s how to get started:

Step 1: Pick Your Software

QuickBooks, Xero, Wave, and FreshBooks are popular choices for small businesses. Many offer free trials, so you can try before you buy.

Step 2: Set Up Your Accounts

Most software has templates for different industries. Make it fit your business, but don’t make it too complicated. You can always add more later.

Step 3: Link Your Bank

Connect your business bank and credit card accounts to automatically bring in transactions. This means less typing and fewer mistakes.

Step 4: Sort Your Transactions

As transactions come in, put them into the right accounts. The software automatically handles the debits and credits. For instance, if you mark a payment as “Office Supplies,” the software will debit “Office Supplies expense” and credit “Cash.”

Step 5: Check Your Accounts Monthly

Monthly bank reconciliations make sure your records match your bank statements. This helps catch errors, unexpected charges, and bank fees you might have missed.

When to Get Professional Help?

Think about hiring a bookkeeper or accountant for:

- Setting up your accounting system

- Dealing with complicated money moves (like buying big assets or refinancing loans)

- Help with taxes

- Looking over your finances each month

Getting expert help early on can save you headaches and money down the road. Contact our expert virtual bookkpeers for more information.

4 Common Mistakes to Avoid in Double-Entry Accounting

When using double-entry bookkeeping, watch out for these common mistakes:

- Mixing Personal and Business Finances: Always keep separate bank accounts and credit cards for your business. Mixing them can cause messy records and tax problems.

- Inconsistent Record-Keeping: Set a schedule to update your records regularly, like once a week. This keeps things easy and avoids stress at tax time.

- Skipping Bank Reconciliations: Check your bank statements against your records every month. This helps catch mistakes and prevent fraud.

- Not Getting Professional Help: Don’t avoid asking for advice. Spending a little time with a professional can save you from big, expensive errors.

Avoid these mistakes to keep your books clean and your business growing. Contact our tax accountant for small businesses if you face any of these problems and don’t know what to do.

Final Thoughts

Double-entry bookkeeping helps small businesses move from guesswork to clear, accurate financial management. It shows you how double-entry bookkeeping works to track true profitability, catch issues early, and make better decisions.

Poor cash management causes most business failures, but a solid bookkeeping system for small businesses can prevent that. By using double-entry accounting, you’re building a strong foundation for your business’s success.

Take the first step today and contact our experienced bookkeepers in Toronto for a free consultation!

Frequently Asked Questions

Double-entry bookkeeping is an accounting system where every financial transaction is recorded in at least two accounts as a debit and a credit. This method ensures the accounting equation (Assets = Liabilities + Equity) always balances, providing a complete financial record.

Double-entry is better because it provides a full financial picture by tracking assets and liabilities, not just cash. Its self-balancing nature makes it much easier to detect errors and helps prevent fraud, which is why it is the standard for financial reporting.

Yes, almost all small businesses benefit from double-entry bookkeeping. It provides the accuracy needed for reliable financial reporting, tax preparation, and securing loans or investments. It is essential for any business that has inventory, owes money, or wants a clear view of its financial health.

A common example is buying equipment with cash. You would debit your Equipment account (increasing an asset) and credit your Cash account (decreasing an asset). Another is making a sale on credit: you would debit Accounts Receivable (an asset) and credit Sales Revenue (revenue).

The accounting equation is the foundation of double-entry bookkeeping: Assets = Liabilities + Equity. It means that everything a business owns (its assets) is financed by either what it owes (its liabilities) or what the owners have invested (its equity).

The easiest way is to use accounting software like QuickBooks, Xero, or Wave. These platforms automate the process. After you connect your bank accounts and categorize transactions, the software handles the debits and credits in the background.

Yes, QuickBooks is built entirely on the double-entry bookkeeping system. When you record an invoice, bill, or expense, QuickBooks automatically creates the corresponding debit and credit entries to keep your books balanced.

A chart of accounts is an organized list of every financial account for a business. It is like an index for your general ledger, with accounts grouped into categories like Assets, Liabilities, Equity, Revenue, and Expenses.