We’re here to help you connect your Shopify store to Xero for easy accounting in 2025 and show you how to automate sales, refunds, taxes, and payouts.

What might surprise you is this: almost 40%of online sellers report tax or payout errors simply because their systems don’t talk to each other. That’s a big deal. Even profitable stores lose cash or face tax headaches for reasons that have nothing to do with sales, but everything to do with broken processes.

In this blog from SAL Accounting, we’ll cover the tools, step-by-step setup, and pro tips to make your Shopify Xero sync super simple.

Quick Takeaways

- Shopify integration with Xero automates sales, refunds, taxes, and payouts, saving time.

- Use Xero’s free app for small shops or A2X/Synder for advanced tax handling.

- Match tax codes in Shopify and Xero to avoid GST/HST or sales tax errors.

- Synder or A2X syncs multi-channel sales like PayPal and Stripe for clean books.

- Set payout rules to match Shopify deposits with Xero, simplifying reconciliation.

What Is Shopify Integration with Xero and How Does It Work?

Shopify integration with Xero links your store to Xero’s cloud accounting app (Xero eCommerce). It syncs sales, refunds, taxes, and payouts automatically. No manual data entry. Shopify tracks transactions. Xero organizes your finances, like income and expenses. Daily summaries keep your books accurate. This saves time and cuts errors for Shopify sellers in Canada, the US, or worldwide. Consult with our eCommerce accountant in Toronto to set up your Shopify–Xero sync right.

Top Benefits of Shopify Xero Sync for E-Commerce Sellers

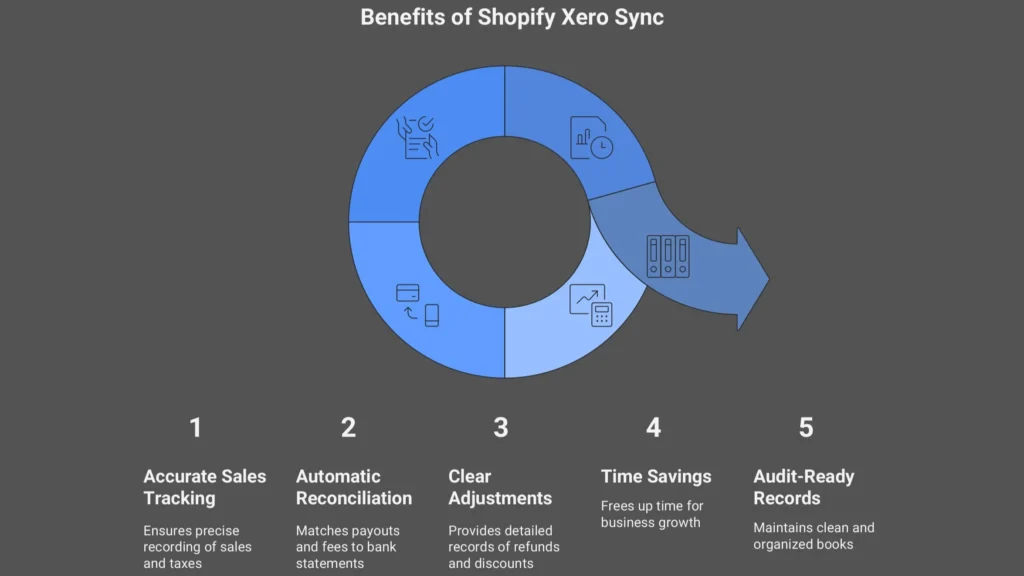

Connect Shopify with Xero, and your bookkeeping becomes simple. You avoid manual entry and messy spreadsheets. Learn more details on the Shopify seller tax guide for 2025. Here are the main benefits:

- Accurate sales and tax tracking. Sales, refunds, discounts, and taxes go to the right accounts. That covers GST/HST in Canada, U.S. sales tax, and VAT.

- Automatic reconciliation. Payouts and fees from Shopify, PayPal (Shopify PayPal setup), and Stripe match your bank.

- Clear refunds and discounts. Each adjustment shows exactly as it happens.

- More time for growth. You spend less time on books and more on your store.

- Audit-ready records. Your books stay clean and ready for tax season.

This link keeps your numbers right and your business stress-free. E-commerce accounting in 2025 will be much easier with such an integration.

Best Tools and Apps to Connect Shopify to Xero

To connect Shopify to Xero, you need a good tool. Each fits different store needs, from free to advanced automation. Have a look at top Shopify accounting software in 2025, too. Here’s the lowdown with a comparison.

- Xero’s Native App

Xero’s free app in the Shopify App Store syncs sales and payouts daily. You can also set up Shopify tax exemptions. It’s dead simple and costs nothing. It handles basic summaries but doesn’t shine for complex taxes or big stores. Great for small shops.

- A2X Shopify Xero

A2X rocks detailed reconciliations for sales, fees, and taxes. It maps transactions to Xero like a pro. It’s perfect for growing stores and starts at $19/month. Why choose A2X for Shopify?

- Canadian sellers map GST/HST easily.

- US sellers handle state taxes smoothly.

- High-volume stores save hours on payouts.

- Synder

Synder syncs Shopify sales to Xero like A2X. It’s great for multi-channel sellers, like Shopify and Amazon. It handles taxes and payouts well, starting at $15/month. Synder is ideal for complex setups.

- Other Options

Amaka offers a free basic sync for small stores. Parex Bridge supports multi-currency for global sellers. Hyve works for wholesale shops. These cost $10–$30/month, based on features.

Pro Tip: A2X gives the most accuracy. Synder gives the most flexibility. Shopify’s app gives the lowest cost. The best choice depends on the size of your store and how complex your sales are.

| Tool | Cost | Sync Type | Tax Handling | Best For |

| Xero Native | Free | Basic | Limited | Small shops |

| A2X | $19+/mo | Detailed | Advanced | Growing stores |

| Synder | $15+/mo | Detailed | Advanced | Multi-channel |

| Amaka | Free–$20/mo | Basic | Moderate | Budget users |

Step-by-Step Guide to Connect Shopify to Xero

You can connect Shopify with Xero in a few clear steps. Follow them one by one.

Step 1: Pick your app

Choose the app that fits your store. Shopify’s own app is cheaper and quicker to set up, but it has fewer features. Think about your sales size and the level of detail you want before you decide. Check the best accounting software in 2025 and choose the proper one.

Step 2: Install the app

Go to the apps.shopify.com and:

- Search for the app you chose

- Click “Add app” to install it.

- Approve the permissions so it links to your store.

Pro tip: Use the official version only. Copies can create errors and break the sync.

Step 3: Connect Xero

Log in to your Xero account from inside the app. Approve the connection when the app asks for access. Make sure you choose the right company file. If you manage more than one company in Xero, check this step carefully. Data must land in the correct books.

Step 4: Map your accounts

Tell the app where to send each type of transaction:

- Sales → revenue accounts

- Refunds → return accounts

- Taxes → GST/HST, U.S. business taxes, or VAT accounts

- Fees → expense accounts

Pro tip: Match your tax rates in Shopify and Xero. This step keeps reports accurate and prevents tax issues later.

Step 5: Set payout rules

Choose how the app records payouts in Xero. You can match Shopify Payments, PayPal, and Stripe deposits with your bank feed. Decide if you want to group payouts daily, weekly, or by transaction. Once set, your payouts in Xero line up with the deposits in your bank.

Step 6: Run a test sync

Sync a small set of sales. Check how they show in Xero. Review refunds, discounts, and taxes. Check how to withhold taxes on Shopify and other e-commerce platforms, too.

Pro tip: Ask your accountant to review the first sync if you feel unsure.

Shopify Bookkeeping Xero: What Gets Synced Automatically

When you connect Shopify with Xero, the key numbers move straight into your books. You don’t need spreadsheets or manual entry. Here’s what syncs:

- Sales: Every order goes into Xero as revenue. Product details and totals show up clearly.

- Refunds: Each refund links back to the sale it came from. This keeps your revenue correct.

- Discounts: All discounts appear in Xero, so your numbers match what customers actually paid.

- Taxes: GST/HST return in Canada, U.S. sales tax, and VAT flow into the right accounts without extra work.

- Payouts: Deposits from Shopify Payments, PayPal, and Stripe (Stripe Shopify case study) match your bank feed. This makes reconciliation simple.

- Fees: Transaction and gateway fees show as expenses so you see your true profit.

This sync covers the full cycle, from customer checkout to bank deposit. You end up with clean books and a clear picture of your business at all times.

Xero Accounting for Shopify: Canada, U.S., and Cross-Border Sellers

Taxes look different depending on where you sell. That is why the Shopify–Xero link matters so much for Canadian and U.S. sellers.

In Canada

Shopify and Xero work together to track GST and HST. When a customer in Ontario buys, the system records 13% HST in the right tax account. If the customer lives in Alberta, the sale shows with 5% GST only. Xero then keeps a clear report of all GST/HST collected.

Example: A $75 hoodie sold in Ontario shows $9.75 HST, while the same hoodie sold in Alberta shows only $3.75 GST.

In the United States

Sales tax rules, such as sales tax nexus in 2025, change from state to state. New York has one rate, Florida another, and some states add local rates. The Shopify–Xero link makes sure each sale goes into the right tax account. If you sell in multiple states, this saves hours of work. It also lowers the risk of missing tax or paying the wrong amount.

Example: A $120 pair of sneakers shipped to New York shows $10.65 in tax, while the same pair shipped to Florida shows $7.20.

For Cross-Border Sellers

Many Canadian stores also sell into the U.S. or overseas. Shopify pays out in multiple currencies. Xero records each payout with the right currency and exchange rate. This keeps revenue and tax reports correct across borders.

Example: A U.S. buyer pays $200 USD for skincare products. Xero converts it to about $270 CAD using the daily exchange rate, so reports stay accurate. Do not forget that you can always get help of our US-Canada Cross-border experts.

The table below shows tax handling for Shopify integration with Xero:

| Region | Tax Type | How Shopify Xero Sync Works | Key Benefit |

| Canada (Shopify Xero Canada) | GST/HST | Tracks GST/HST. Xero creates tax reports. | Saves time with clear reports. |

| United States | State Sales Tax | Sorts state taxes. Sales hit right accounts. | Saves hours for multi-state sales. |

| Cross-Border | Multi-Currency Taxes | Handles multi-currency payouts. Uses daily rates. | Keeps global sales accurate. |

Shopify Xero Sync: Common Challenges and How to Solve Them

Shopify and Xero save time, but setup mistakes can cause problems. Most are easy to fix. Here are the main ones:

- Refund mismatches:

Refunds may not connect to the right order. This makes totals look wrong.

Fix: Check refund settings in your app. Run a small refund test and make sure it shows in the right account.

- Tax errors:

Shopify and Xero use different tax codes. If they do not match, GST/HST or sales tax can land in the wrong place. Be careful about common e-commerce accounting errors that cost you thousands.

Fix: Match tax codes before you sync. For example, link “GST 5%” in Shopify to “GST 5%” in Xero.

- Multi-channel sales:

If you sell on Shopify, PayPal, and Stripe, sales can spread across accounts. Reports then look messy.

Fix: Use Synder or A2X. These apps bring all channels into one set of books.

- Payout timing:

Shopify payouts often cover more than one day. This makes reconciliation hard.

Fix: Set payout rules in your app. Choose daily, weekly, or by transaction, depending on how you track deposits.

Once you fix these issues, the sync works without stress. Your books stay accurate and easy to follow. Our bookkeeping for e-commerce will also keep you on the right track.

Case Study: Saving a Canadian Non-Profit with GST/HST Exemptions1

A Toronto nonprofit runs a Shopify store that sells $30,000 in fundraising gear. Then a problem shows up. Their CRA tax number isn’t tagged right, so Shopify adds 13% HST on every order. That means $3,900 in extra charges. Donors start to complain, and an audit feels close.

What We Do: SAL Accounting steps in. We check the nonprofit’s GST/HST number with the CRA tool. We fix the tax tag in Shopify by adding “Zero-Tax-CA.” We also create a “No-Tax Items” collection to stop the same mistake in the future. Then we refund the $3,900 to the donors.

The Result: The nonprofit avoids paying unnecessary HST. Donors stay happy and keep supporting the cause. The store skips audit trouble because exemptions now apply on their own.

Final Thoughts

Shopify integration with Xero keeps your books clear and your business on track. You avoid manual entry, tax mistakes, and messy payouts. Many sellers lose money because their systems do not connect. You do not need to face the same problem. This post showed how to link Shopify with Xero, choose the right app, and keep sales, refunds, taxes, and payouts in sync.

If you need help with Shopify accounting, contact us at SAL Accounting. We can set up your Shopify–Xero sync so you stay compliant and focus on growth.

- Hypothetical scenario ↩︎

FAQs About Shopify and Xero Integration

Go to the Shopify App Store and grab Xero’s free app. Link your Shopify and Xero accounts. Set up daily syncs. A2X or Synder adds tax features.

A2X and Snyder are great for big or multi-channel stores. Xero’s free app fits small shops. Choose what matches your store’s size.

Nope, A2X isn’t a must. It simplifies taxes and payouts for bigger stores. Xero’s free app works for basic syncs. Try A2X here: A2X.

Yes! A2X or Synder maps GST/HST quickly for Canadian sellers. Xero’s free app needs manual fixes for accuracy.

Xero’s app costs nothing. A2X starts at $19/month, and Synder at $15/month. Check prices at Xero pricing.

It’s solid for small stores with basic needs. For tricky taxes or multi-channel sales, pick A2X or Synder.

Sales, refunds, taxes, and payouts go to Xero. Synder also syncs PayPal or Stripe data.