Running an online business means dealing with tons of financial data. Canadian e-commerce is exploding in growth, making manual bookkeeping nearly impossible for busy store owners. Manual data entry, payout matching, and tax calculations eat up your time, and a single error can throw off your books.

This guide will show you how to handle everything with Shopify accounting and bookkeeping. You can also consider Shopify expense and sales automation if you need. Stay with SAL Accounting to know the best tools, step-by-step setup, and simple ways to keep your bookkeeping, sales tax, and reports accurate as your store grows.

Quick Takeaways

- Pick Top Tools: Use QuickBooks Online Global, A2X, or Link My Books to automate Shopify bookkeeping, taxes, and reports.

- Link Accounts: Connect Shopify to tools like A2X or Link My Books for seamless data syncing.

- Set Up Rules: Automate expense tracking, tax calculations, and categories for accuracy.

- Test: Run sample orders to ensure correct payouts and tax reporting.

- Review Weekly: Monitor reports to keep finances accurate as your store scales.

Why Do Shopify Sellers Need Accounting Automation?

As your Shopify store grows, manual accounting becomes increasingly difficult to manage. High transaction volumes can create data entry backlogs. Here’s why automation is essential for e-commerce sellers.

- Save Time: You can save over 50 hours a month. This lets you focus on growth, like product development and marketing.

- Clear Taxes: You handle tax calculations easily, including sales tax, GST/HST, and VAT, to avoid overpayments and audits.

- Real-Time Insights: You access instant data on profit margins, cash flow, and expenses to make smarter decisions.

- Less Errors: Automation helps you keep more accurate financial records. It reduces costly mistakes in payouts and expense categorization. Learn about common ecommerce accounting mistakes to avoid.

There are many different tools to help you easily automate your business accounting. Consider our professional ecommerce bookkeeping services for hands-off automation.

Top 6 Accounting Automation Tools for Shopify

Picking the right tools for Shopify is really important. Here are the most popular choices to help you find what works for your business and support automated accounting for eCommerce.

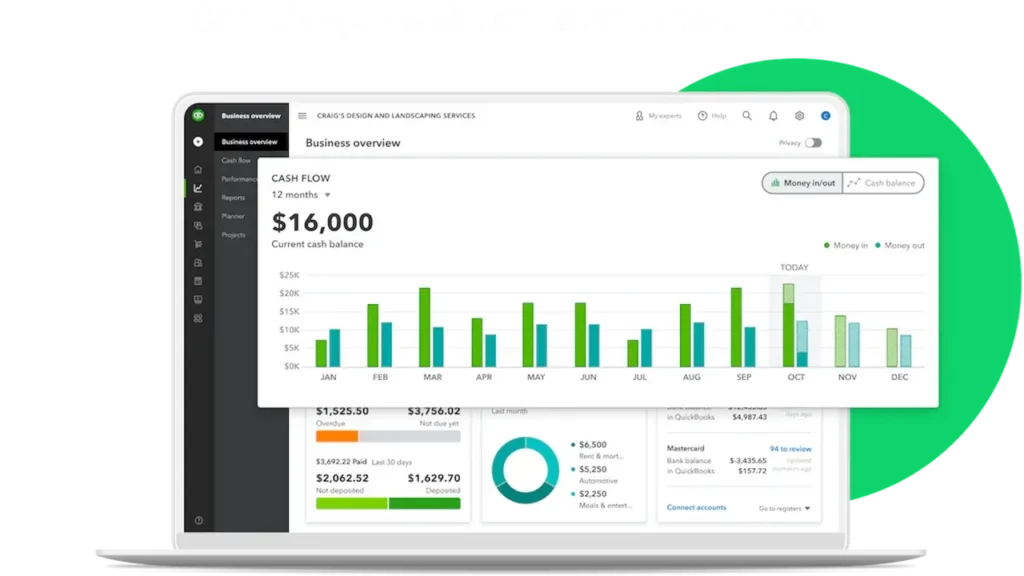

1. QuickBooks Online Global: The Top Choice

Main Features:

- Automatically matches and checks payouts with reliable syncing

- Uses AI to sort and automate expenses with inventory tracking

- Automates sales tax for different states and international markets

- Creates custom reports and handles multi-storefront management

Best For: Small business owners and dropshippers who want reliable, complete accounting automation. Need accurate dropshipping accounting in Toronto? We can help.

Price: Free to install for existing users; starts at $30/month (QBO Essentials plan) for new users.

Note: Choose “QuickBooks Online Global” over the regular “QuickBooks Online” app. Users say the Global version works better with fewer sync problems and better support.

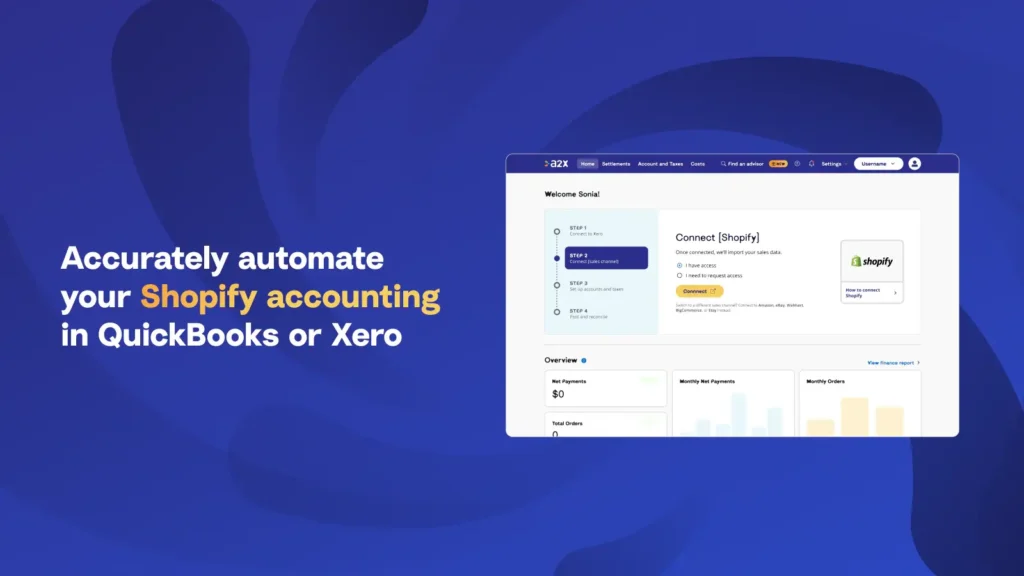

2. A2X: Made for Shopify

Main Features:

- Matches Shopify payouts with accounting records in QuickBooks, Xero, Sage, and NetSuite

- Creates summary invoices instead of tracking individual transactions

- Handles sales tax mapping and supports multiple channels, including Amazon

- Provides error-checking tools and COGS tracking for accurate reporting

Best For: Dropshippers and growing businesses with high transaction volumes who need accurate payout reconciliation.

Price: Starts at $29/month (covers up to 200 orders).Note: Users praise A2X for excellent customer support and a smooth onboarding process that ensures proper setup from day one.

- Read More: “Shopify Tax Exemption Explained in 2025“

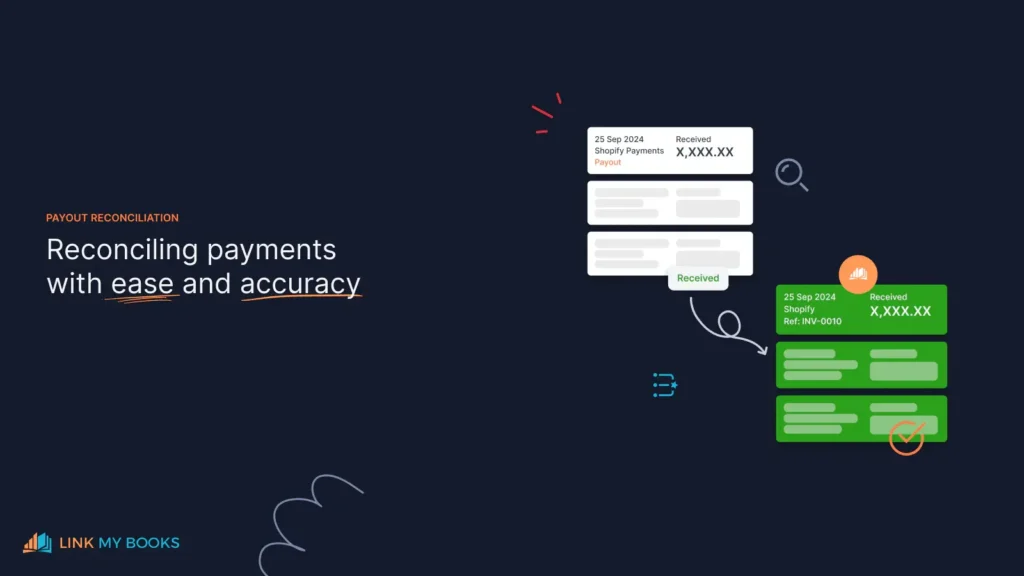

3. Link My Books: Transaction View

Main Features:

- Checks each transaction individually with exact payout matching

- Applies correct tax rates automatically for VAT, GST, and sales tax

- Combines orders from multiple sales channels, including Amazon, eBay,and TikTok Shop

- Creates summary invoices that match bank deposits for one-click reconciliation

Best For: Sellers who want detailed transaction tracking across multiple platforms with perfect reconciliation.

Price: Starts at $21/month (covers up to 200 orders).

Note: Users highlight the migration from other tools and a responsive support team with qualified accountants.

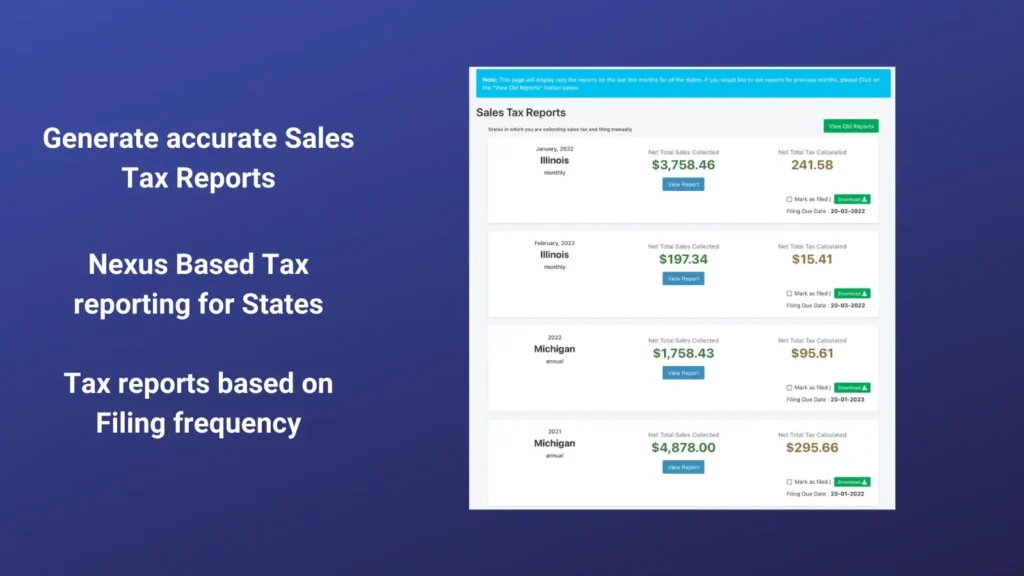

4. Tax Rex: Cross-Border Sales Tax Automation

Main Features:

- Economic nexus dashboard tracks thresholds across all US states

- Automated filing service with timely state portal submissions

- Accurate sales tax reports tailored to each state’s requirements

- Simplified state registration process for new compliance requirements

Best For: US sellers with multi-state tax obligations who need reliable automated filing and nexus monitoring.

Price: Starts at $5/month (covers 200 orders) + $20 per filing per state.

Note: Users consistently praise the responsive customer service and reliable automated filing. It eliminates their tax compliance headaches.

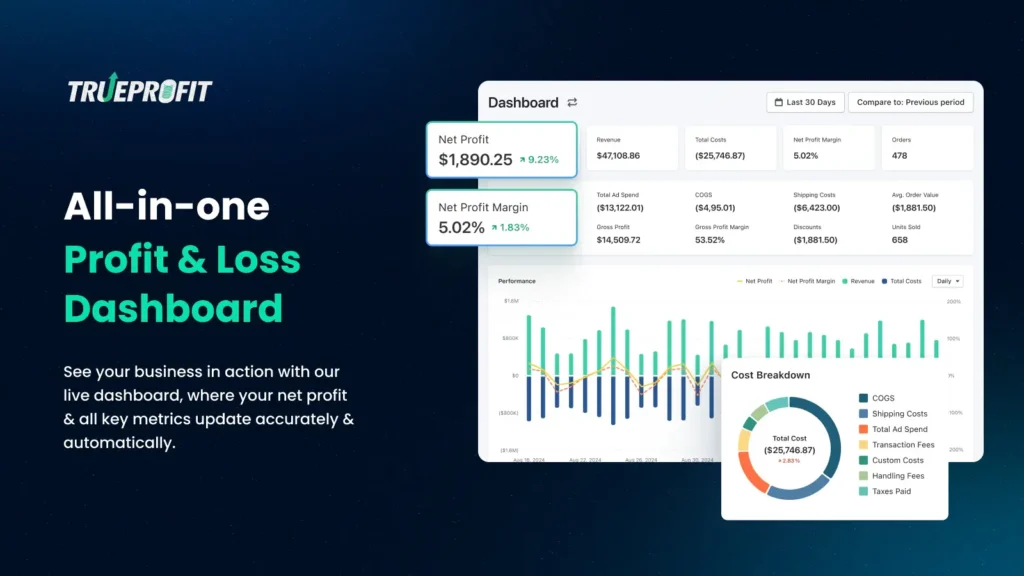

5. True Profit Analytics: Profit Tracking

Main Features:

- Real-time net profit dashboard with automated cost tracking (COGS, shipping, fees)

- Multi-currency support with ad spend sync from Facebook, Google, TikTok, Amazon

- Product-level analytics and customer lifetime value (LTV) calculations

- Mobile app access with P&L reports and marketing attribution insights

Best For: Canadian sellers who need detailed profit analysis across multiple ad channels and want to track true profitability in real-time.

Price: Starts at $35/month (covers 300 orders).

Note: Users praise the responsive support team and accurate profit tracking that eliminates manual spreadsheet work, especially valuable for cross-border selling with currency conversions.

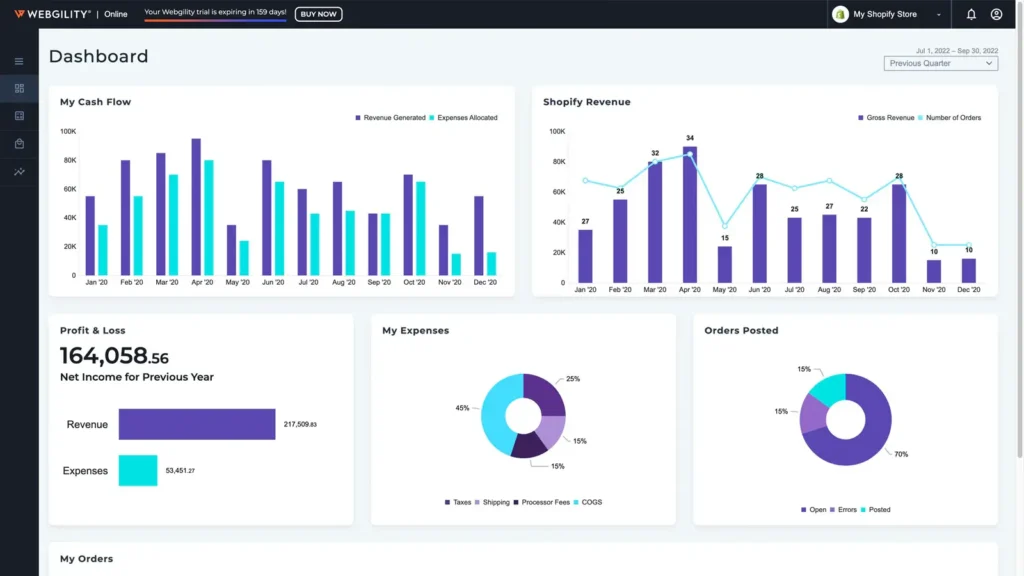

6. Webgility: QBO & Xero Sync

Main Features:

- Real-time sync across 30+ platforms including Amazon, eBay, Walmart

- Centralized inventory management with automatic stock level updates

- AI-powered financial tracking for revenue, expenses, and profitability insights

- Advanced B2B features with PO numbers, payment terms, and 2-way payment sync

Best For: Growing businesses selling across multiple channels who need inventory and financial management.

Price: Starts at $39/month (covers up to 100 orders, 1 sales channel).

Note: Users with 10+ years of experience praise its reliability and comprehensive feature set. For QuickBooks Desktop users, Webgility also offers a dedicated Desktop version starting at $139/month with more detailed transaction tracking.

How to Choose the Best Option?

As you read, there are different options for Shopify accounting and bookkeeping automation. So here is a table to help you choose the most suitable item meeting your specific needs. Also check our comprehensive ecommerce accounting software comparison for more options.

| Tool | Best For | Key Strength | Price (2025) | Multi-Channel | Tax Automation |

| QuickBooks Online Global | US/International sellers | AI expense sorting; 4.9/5 rating | $30+/month | Yes (Shopify, Amazon) | Sales tax automation |

| A2X | Dropshippers/scaling brands | Payout summary invoices | $29+/month | Yes (Amazon, FBA) | Basic tax support |

| Link My Books | Multi-channel sellers | Perfect reconciliation; 5.0/5 rating | $21+/month | Yes (Amazon, eBay, TikTok) | Auto VAT/GST/sales tax |

| Tax Rex | US/Canadian tax compliance | Cross-border nexus tracking | $5+/month + filing fees | Shopify focused | Automated US/Canada filings |

| True Profit Analytics | Profit-focused sellers | Real-time profit tracking | $35+/month | Multi-platform ad sync | Basic tax tracking |

| Webgility | Multi-channel businesses | 30+ platform sync | $39+/month | Yes (eBay, Amazon, Walmart) | Limited tax focus |

Pro Tip: Start with free trials from QuickBooks Online Global or A2X to test automation without risk.

How to Set Up an Automated Accounting System?

Setting up automated accounting for Shopify needs careful planning. Follow these steps.

Step 1: Analyze Your Current Situation

Start by reviewing how you currently manage your accounting tasks. Document your bookkeeping process, time spent, and common error areas.

Ask yourself:

- How many hours do you spend on bookkeeping each month?

- What are your tax compliance requirements?

- Which expenses need more precise tracking?

This review helps you identify your biggest challenges and decide what to automate first. Canadian businesses can reference CRA business expense guidelines to ensure proper categorization.

Step 2: Choose Your Automation Stack

Next, select the tools that best fit your needs, budget, and growth plans. Look for online software that works well with Shopify and updates information automatically.

Opt for tools that can support automated accounting for eCommerce, Shopify transaction tracking, and revenue reconciliation. Make sure these tools support multi-channel sales and different tax needs.

Pro Tip: Always separate your business and personal finances to avoid tax errors when automating.

Step 3: Connect Your Accounts

Connect your Shopify store to your chosen accounting software. Usually, you can do this by installing the Shopify app for your platform or by using a specific connector such as A2X or Link My Books.

Grant permissions as needed and determine update frequencies to ensure accurate and timely tracking.

- Read More: “Best eCommerce Accounting Software in 2025“

Step 4: Configure Automation Rules

Customize rules to automate your accounting tasks. Set up logic for product grouping, automatic expense categorization, and tax calculations for different states and countries.

If you work with a team, implement workflow triggers for approvals to streamline processes. These setups ensure your system handles most tasks automatically.

Step 5: Test and Validate

Test your integrations and rules before launching. Place sample orders, process refunds, and log expenses to check data transfer accuracy.

Testing checklist:

- Confirm correct tax calculation for all relevant areas.

- Verify accurate expense assignment and categorization.

- Ensure Shopify payouts match your accounting records and summary reports.

Step 6: Monitor and Optimize

Once the system is live, create routines to review transactions daily and conduct reconciliations weekly. Regularly check your reports and audit your automation rules over time. It keeps your Shopify accounting automation accurate and efficient.

- Also read: “Comprehensive Shopify Seller Tax Guide (2025)”

Common Challenges in Shopify Accounting Automation

Automation has many benefits but presents certain challenges.

Transferring Old Data

- Issue: Importing data from spreadsheets often causes gaps

- Solution: Organize and clean your data before moving. Implement your new system in phases, checking data accuracy as you go.

Complex Tax Rules

- Issue: Managing tax rules across multiple regions can be overwhelming.

- Solution: Use tax automation tools like Tax Rex for US/Canadian compliance, or QuickBooks Online Global for international tax handling. Learn more about sales tax vs. use tax for Shopify sellers.

Software Integration Problems

- Issue: Different systems may create data conflicts or lack integration.

- Solution: Choose automation solutions with proven integration records. Always test connections before adding and integrating theml to your workflow.

Training Your Team

- Issue: Adapting to new processes can make team members confused.

- Solution: Offer clear training and continuous support. Introduce new systems step-by-step for easier use. For complex setups, work with our ecommerce accounting experts.

Pro Tip: Use AI features in tools like True Profit Analytics for accurate cost tracking and profit analysis.

Conclusion

Automating your Shopify accounting boosts efficiency and keeps your books accurate. By moving from manual bookkeeping to an automated system for eCommerce, you save time to grow your business. Features like Shopify accounting, bookkeeping, expense, and sales tax automation. Also transaction tracking, and revenue reconciliation ensure accuracy and support growth.

This guide provided you with the tools and steps to set up a system that scales with you. Start by checking your current setup, pick the right tools, and begin automating now. Call our Shopify accounting experts and ask us any questions you have in a FREE consultation.

Frequently Asked Questions

Link your Shopify store to software like QuickBooks Online Global. Use connectors like A2X or Link My Books for seamless Shopify bookkeeping automation. They transfer sales data, match payments, and categorize transactions automatically.

A2X is excellent for payout matching and transaction tracking. Link My Books offers detailed reconciliation. Webgility works well for multi-channel sellers. Choose based on your transaction volume and complexity needs.

No, but A2X helps with high transaction volumes. It simplifies Shopify transaction tracking with summary invoices that match payouts exactly, keeping your records organized.

Yes! Tools like Tax Rex provide Shopify sales tax automation for US/Canadian compliance. QuickBooks Online Global also handles international tax calculations with up-to-date rates across states.

Shopify tracks sales and platform fees but not external expenses like advertising or supplies. Use profit tracking tools like True Profit Analytics for expense and profit monitoring with automated cost tracking.

It depends on your needs: QuickBooks Online Global for comprehensive accounting, A2X for payout matching, Link My Books for detailed transaction tracking, and True Profit Analytics for real-time profit analysis.

Most tasks can be automated, but you should review records regularly to ensure accuracy and catch any errors.