We help you understand the branch profits tax for your Canadian business growing in the U.S., making the US tax on Canadian branches clear.

Surprisingly, 55% of Canadian companies, including FBA sellers, get hit with unexpected branch profit tax Canada-US bills due to missed U.S. tax rules, costing millions each year. The US branch tax for Canadian company operations can take 30% of profits sent home, but the Canada-U.S. Tax Treaty lowers this to 5% and exempts $500K. SAL Accounting explains the branch profits tax with clear examples and strategies to reduce your US tax on Canadian branches. Read on to master your U.S. tax requirements. Let’s dive in.

Quick Takeaways

- Understand BPT: See how the branch profits tax applies a 30% rate (or 5% with treaty) to profits sent back from a U.S. branch.

- Use the Treaty: Apply the Canada-U.S. Tax Treaty to reduce BPT to 5% and exempt $500K in profits.

- Pick the Right Setup: Compare branches vs. subsidiaries to minimize taxes and liability.

- Stay Compliant: File Form 1120-F branch profits and Form 8833 Canada-US treaty to avoid penalties and save money.

- Plan Wisely: Reinvest profits or create a subsidiary to lower or avoid the US tax on Canadian branches.

Who Pays Branch Profits Tax in the U.S.?

To understand the branch profits tax, you first need to know if it applies to your business. The US tax on Canadian branches applies to Canadian companies operating a U.S. branch. It is defined as a Permanent Establishment (PE) under U.S. tax law or the Canada-U.S. Tax Treaty.

What Triggers This Tax?

- A fixed U.S. location, like an office, warehouse, or FBA storage, establishes a PE. This makes profits, known as Effectively Connected Income (ECI), subject to U.S. taxes and the branch profits tax.

- Canadian corporations or partnerships with U.S. operations, not set up as subsidiaries, face this tax. For instance, FBA sellers with inventory in U.S. warehouses often trigger PE status.

Despite 65% of Canadian Amazon sellers reporting revenue growth in 2021, according to a 2021 EcomCrew report, many Canadian e-commerce businesses are facing unexpected tax bills.

What Is Branch Profits Tax? (Purpose and Structure)

The branch profits tax is a U.S. federal tax on Canadian companies operating a U.S. branch instead of a subsidiary. It taxes profits sent to the Canadian parent as if they were dividends, aligning with U.S. subsidiary rules. Without this US tax on Canadian branches, firms could avoid the 30% dividend withholding tax.

Why Does It Exist?

There are two reasons for this tax:

- Fair Taxes: Makes Canadian branches pay like U.S. subsidiaries when profits leave the U.S.

- IRS Funds: Brings in big revenue, with over 50,000 Forms 1120-F branch profits filed each year.

Compliance can be tricky. Around 82% of global businesses, including Canadian firms, struggle with cross-border tax rules, per a 2024 Avalara survey.

How Do You Calculate It?

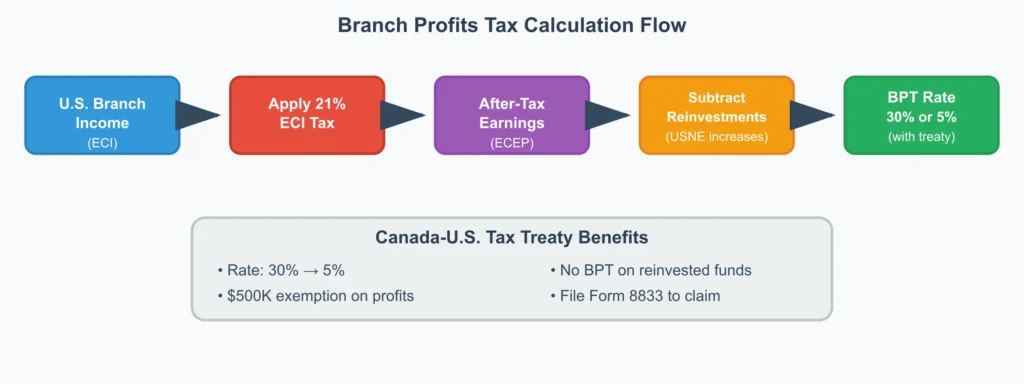

The branch profits tax takes 30% (or less with treaties) of the dividend equivalent amount (DEA), which is profits not kept in the U.S. Here’s how:

- Find Earnings: Get Effectively Connected Earnings and Profits (ECEP) after the 21% U.S. tax on Effectively Connected Income (ECI).

- Adjust for Investments: DEA is ECEP minus U.S. Net Equity (USNE) increases (e.g., buying assets) or plus decreases (e.g., withdrawals).

- Tax It: Apply 30% or a treaty rate, like 5% vs 30% BPT for Canadians.

You skip BPT by keeping all profits in the U.S. or shutting down U.S. operations. A Branch-Level Interest Tax (BLIT) may take 30% (treaty can lower it) on extra interest deductions.

| Component | Description | Rate/Formula |

| ECI Tax | U.S. tax on branch income | 21% flat rate |

| DEA | Profits sent to Canada | ECEP ± USNE change |

| BPT | Tax on DEA | 30% base (treaty can lower) |

| BLIT | Excess interest | 30% (treaty may lower to 0-15%) |

Pro Tip: Use accounting software to easily track U.S. branch asset changes. Around 82% of tax experts expect tougher tax reporting rules soon, which could lead to more audits for U.S. operations, per Deloitte’s 2025 Global Tax Policy Survey.

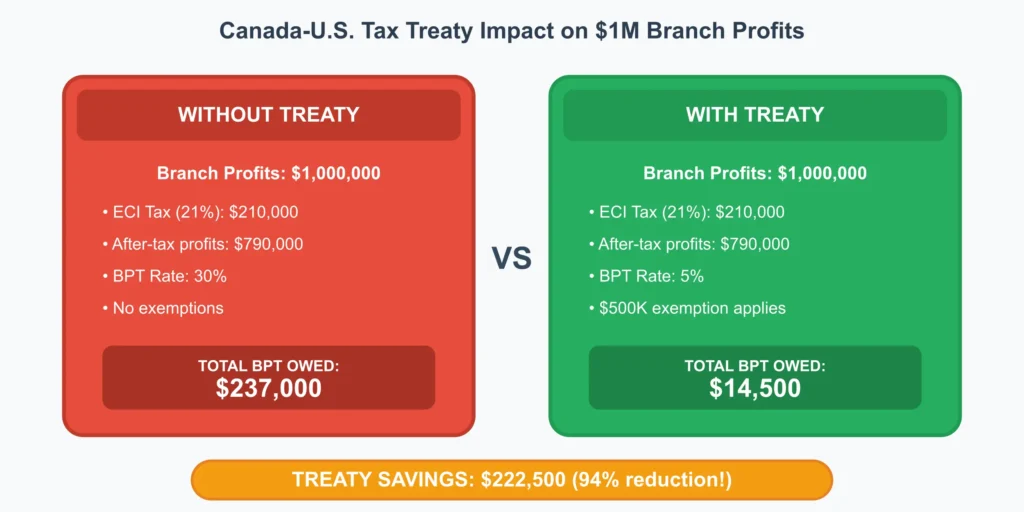

Example: A Canadian manufacturer with $1M U.S. income pays $210K in tax. If the rest ($790K) isn’t kept in the U.S., BPT adds thousands in costs.

What Do Canadian Companies Face in the U.S.?

Canadian businesses running U.S. branches (in retail, logistics, or FBA) pay two taxes: 21% on Effectively Connected Income (ECI) and the US branch tax for Canadian company profits sent to Canada. FBA storage often creates a Permanent Establishment (PE), triggering the US tax on Canadian branches.

Canadian companies usually have three main challenges:

- PE Triggers: A fixed U.S. spot, like a warehouse, makes profits taxable.

- Filing Rules: File Form 1120-F branch profits section (see our Form 1120-F filing guide), even with no tax due, or risk 25% penalties.

- State Taxes and Withholding: See below.

U.S. State Taxes and Withholding

Canadian branches also face state taxes, averaging 5-10% on income (e.g., California’s 8.84% franchise tax). Payments like interest or royalties may have withholding taxes, but the Canada-U.S. treaty often lowers these to 0-10%. For example, a Canadian retailer with $1M in California revenue might owe $50K in state taxes, plus federal branch profits tax.

Pro Tip: Talk to our US tax expert to check PE risks and state tax obligations, especially for FBA sellers, to avoid surprise costs.

| Case Study: Toronto E-commerce Company Avoids Massive BPT BillA Toronto FBA seller contacts SAL Accounting:Problem: They got hit with a $240K BPT bill after the IRS found their U.S. warehouses created a PE. Three other accounting firms said they had to pay the full 30% rate.What We Do: We discover missed treaty benefits and file Form 8833 retroactively. We restructure their U.S. operations and reinvest profits to qualify for exemptions.The Result: We cut their BPT from 30% to 5% and claim the $500K exemption. Final bill: $15K. They save $225K and avoid future surprises. |

Branch vs. Subsidiary: Which Is Better?

Choosing a branch for your branch profit tax Canada US operations exposes your entire Canadian company to U.S. taxes and liabilities, unlike a subsidiary.

| Aspect | Branch | Subsidiary |

| Tax on Profits | 21% on ECI + 5% BPT (treaty) | 21% on income; no BPT |

| Repatriation | BPT on DEA; $500K exemption | 5% dividend withholding |

| Liability | Full company risk | Limited to subsidiary |

| Admin | Separate branch records | Separate filings; GILTI possible |

| Effective Rate ($1M) | ~26% if sent home | ~26%, but deferrable |

Branches suit short-term projects, but 70% of Canadian firms pick subsidiaries for better liability protection. Branches raise taxes by 5-15%, and 2025 BPT increases could make them less appealing.

Pro Tip: Choose a subsidiary for long-term U.S. growth to cut liability and delay taxes, especially if profits top $500K yearly. Our US business incorporation experts can guide you through the process if you need help setting up a US subsidiary.

| Case Study: Montreal Manufacturer Switches to SubsidiaryA Montreal manufacturer contacts SAL Accounting:Problem: Their U.S. branch was bleeding money on double taxation. Previous advisors missed that their structure exposed the entire Canadian company to U.S. lawsuits.What We Do: We uncover the liability risks and convert them to a Delaware subsidiary. We implement cross-border tax planning to defer $100K annually.The Result: They eliminate BPT forever and protect their Canadian assets. Our restructuring saves them $300K over three years while cutting legal exposure. |

How Can Canada-U.S. Tax Treaty Cuts Branch Profits Tax?

The 1980 US-Canada Tax Treaty reduces the branch profits tax burden. File Form 8833 with Form 1120-F to claim benefits, or you risk losing them for income over $100K. Here are key ways the treaty helps:

➡ Read more: “Canada-US Tax Treaty: How It Works & How to Avoid Double Taxation“

1. Taxes Only U.S. Profits

Article VII taxes profits in Canada only if your business has a U.S. Permanent Establishment (PE). It uses fair pricing to split profits, so you pay branch profits tax only on U.S. income.

2. Lowers BPT and Exempts $500K

Article X cuts the branch profits tax from 30% to 5% for owners with 10%+ voting stock and skips tax on the first $500K in profits.

3. No BPT on Reinvested Funds

The treaty skips BPT on profits kept in U.S. assets, like equipment (when U.S. Net Equity increases). Reinvesting all profits avoids the tax on Canadian branches for those funds.

Pro Tip: Check Form 8833 Canada US treaty filings carefully. Mistakes can lead to audits with 40% penalties, per IRS branch profits tax rules. Check out our Form 8833 filing guide.

6 Strategies to Minimize or Avoid Branch Profits Tax

To minimize the branch profits tax, use these strategies. They can cut BPT by 50-100% and are aligned with IRS branch profits tax rules:

- Claim Treaty Benefits: Use Form 8833 to secure the 5% rate and $500K exemption.

- Reinvest Profits: Boost USNE (e.g., buy equipment) to reduce DEA to zero.

- Form a Subsidiary: Eliminates BPT; dividends face 5% tax but can be deferred.

- Close Operations: No BPT in the final year if you fully wind down.

- Optimize Interest: Use Reg. 1.882-5 to minimize BLIT.

- Track Earnings Separately: Keep clear U.S. branch records to avoid over-taxation.

Pro Tip: Keep detailed U.S. branch records to protect against IRS audits, especially on transfer pricing, which can trigger 10-40% penalties. For complex situations, consider pro international tax planning.

➡ Read more: “Transfer Pricing Explained: Canada–U.S. Strategies and Compliance Tips“

Conclusion

The branch profits tax can make your U.S. expansion a headache. Clear branch profit tax Canada US rules save you thousands. Manage US tax on Canadian branches via FBA or an office with IRS branch profits tax rules. Also dont forget to file Form 1120-F branch profits and Form 8833 Canada US treaty.

Finally, book a free consultation with our cross-border tax expert about your US branch tax for Canadian company needs. Contact now!

Frequently Asked Questions

A 30% U.S. tax (lower with treaty) on profits a Canadian branch sends to Canada, treated like dividends.

It takes 30% of the dividend equivalent tax US (DEA), or 5% with the treaty, based on profits not kept in the U.S.

Yes, if they have a U.S. Permanent Establishment (PE), they pay BPT on profits sent home, cut to 5% with a $500K exemption via the treaty.

It reduces BPT to 5% vs 30% BPT, skips tax on $500K in profits, and taxes only PE-related income.

File Form 8833 Canada US treaty with Form 1120-F branch profits for treaty benefits like the 5% rate, needed for income over $100K.

Branches face BPT and full risk; subsidiaries skip BPT, lower risk, and let you delay taxes.

DEA is profits after tax not kept in the U.S., taxed as if sent to Canada. Keeping profits in the U.S. avoids it.

Use treaty benefits, keep profits in the U.S., set up a subsidiary, or close operations, per IRS branch profits tax rules.