If you’re a US–Canada dual citizen, we’re here to make your tax filing clear and explain 2025’s tax rules. Here’s the shocker: many dual citizens, like Canadians born in the US, don’t realize they face huge penalties (up to $16,536 per unfiled FBAR) if they skip US tax returns. The IRS taxes your worldwide income, even if you’ve never lived stateside.

In this blog, we’ll break down how to avoid double taxation with the US–Canada tax treaty, master your IRS and CRA filings, and steer clear of those costly penalties. Come with us at SAL Accounting on this journey.

Quick Takeaways

- Dual citizens must file taxes in both the U.S. (worldwide income) and Canada (residency-based).

- Use the U.S.–Canada tax treaty to avoid double taxation through credits and exemptions.

- Key forms include Form 1040, FBAR, and Form 8938 for the IRS; T1 and T1135 for the CRA.

- Non-filing penalties include up to $16,536 per FBAR and 5% per month for late returns.

- Claim the Foreign Earned Income Exclusion (up to $130,000 in 2025) to reduce U.S. tax liability.

Do US–Canada Dual Citizens Have to File Taxes in Both Countries?

Yes, US–Canada dual citizens typically file taxes in both countries. Below is the breakdown:

- US: The US taxes your worldwide income. This applies even if you live in Canada.

- Canada: Canada taxes residents on all income. It taxes non-residents on Canadian sources like dividends (CRA dual citizens guide).

Most dual citizens file in both countries. They do this to stay compliant. The US–Canada tax treaty stops double taxation. Many people assume they only file where they live. That’s wrong. Our US Canada tax accountant helps you learn the complexities. Let’s dive into these tax implications for dual citizens in detail.

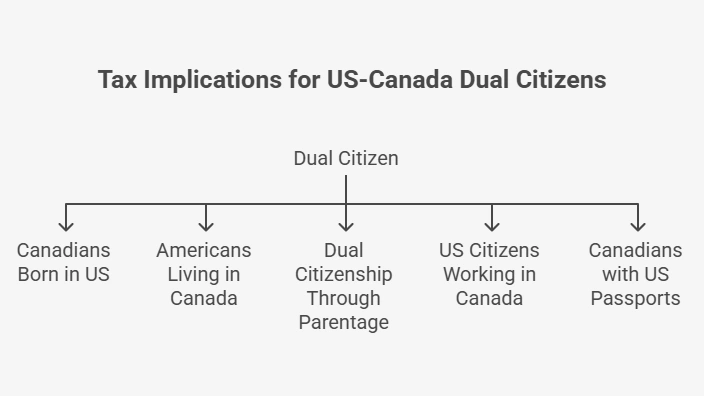

Who Faces Tax Implications of Dual Citizen Rules?

These tax rules apply to a range of US–Canada dual citizens:

- Canadians born in the US.

- Americans living in Canada.

- Anyone with dual citizenship through parentage.

- US citizens who moved to Canada for work. Check taxes for US citizens working remotely for Canadian companies.

- Canadians with US passports from short-term US residency, now back in Canada (IRS residency rules).

“Accidental Americans” often miss U.S. tax duties. They think Canadian residency is enough. It isn’t. The IRS tracks your worldwide income.

Pro Tip: Use the IRS Streamlined Procedures if you never filed US taxes. Catch up penalty-free.

US Canada Dual Citizenship Tax Obligations

US-Canada dual citizenship taxes mean you tackle both US and Canadian rules. Each country has its own tax duties. You are going to meet these to stay in the clear. We’ll walk you through what taxes you report to the IRS and CRA.

IRS Tax Obligations for Dual Citizens

US tax for Canadian residents means you deal with the IRS. You report all your income. This covers income tax on wages, capital gains from investments, and dividends from stocks, the whole deal. Grab an ITIN or SSN if you have no ID. You send your income details online. You must know how to file your US tax return while living in Canada. Here’s your game plan:

- Round up all income, like wages, capital gains, or dividends.

- Confirm your US citizenship with the IRS.

- Submit your taxes online by June 15.

CRA Tax Obligations for Dual Citizens

Tax implications dual citizens face in Canada come from CRA rules. If you live in Canada, report income tax on all income, capital gains on property sales, and dividends. Be careful about factual vs. deemed residency for taxes in Canada. If you don’t live there, report taxes on Canadian-sourced income, like rent or investment dividends. Here’s what you do:

- Figure out if you’re a resident.

- Gather your income, capital gains, and dividend details.

- Submit your taxes online by the deadline.

Pro Tip: Check your residency status every year. It changes what taxes the CRA expects. Peek at the Bank of Canada for exchange rate help.

This table breaks down your US and Canadian tax obligations in a snap:

| Aspect | U.S. (IRS) | Canada (CRA) |

| Who Reports | All U.S. citizens | Residents or non-residents with Canadian income |

| Tax Basis | Citizenship | Residency |

| Taxes | Income, capital gains, dividends | Residents: Income, capital gains, dividends; Non-residents: Rent, dividends |

| Deadline | June 15 | April 30 (June 15 for self-employed) |

| Submission | Online | Online |

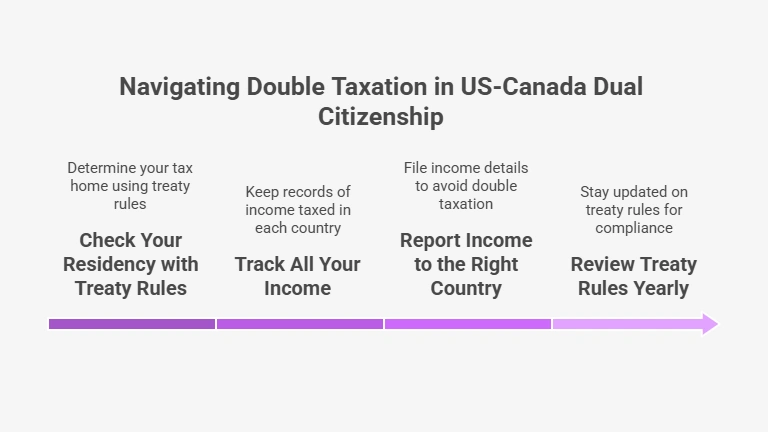

Avoiding Double Taxation in US Canada Dual Citizenship

Double taxation in dual citizenship can impact your finances. Paying tax twice on income like dividends hurts. Use the US–Canada tax treaty to avoid double taxation. It keeps your tax implications dual citizen-friendly. Follow these steps:

1. Check Your Residency with Treaty Rules

Use tax treaty rules to pick your tax home. If you live mostly in Canada, that’s your tax home. The treaty checks ties like family or work.

Pro Tip: List your home, family, and job ties using the treaty’s Article IV checklist to confirm your tax home.

2. Track All Your Income

Know what’s taxed where. Track income like wages or rents. This helps you report to the right country.

3. Report Income to the Right Country

Send your income details to the correct country. Don’t let both tax the same cash. This avoids double taxation and dual citizenship issues. Learn how with the guide on filing the Form 8833 for tax treaty benefits.

Pro Tip: Note your treaty position when reporting to claim exemptions, like US income on a Canadian return.

4. Review Treaty Rules Yearly

Stay updated on treaty rules. Check them yearly to avoid mistakes. This keeps you compliant.

Pro Tip: Subscribe to IRS and CRA newsletters for updates on treaty amendments or court rulings. Schedule an annual review to catch changes before tax season starts.

- Read More: “How to Avoid Double Taxation in Canada: A Complete Guide for Small Business Owners in 2025”

Example: Mike in Toronto earns $80,000 from his Canadian job and $5,000 in US dividends. He reports his salary in Canada, his tax home, and uses the treaty to skip US taxes on it. He reports US dividends in Canada with a treaty exemption.

Common Concerns: TFSA/RESP Treatment, Tax Credits, and FATCA

US Canada dual citizenship taxes spark plenty of questions. TFSAs, RESPs, tax credits, and FATCA can trip you up. We’ll tackle these tax implications dual citizens face to keep you in the clear:

1. TFSA and RESP Treatment

TFSAs are tax-free in Canada. The US sees them as foreign trusts, so you report their income and may owe taxes. Use Form 3520 or Form 8938 for this. RESPs work the same. Canada loves them, but the US taxes gains and may need PFIC reporting.

2. Tax Credits for US Expat Taxes in Canada

You can cut your US tax bill with the Foreign Earned Income Exclusion. It covers up to $126,500 in 2025 with Form 2555. This helps US expat taxes in Canada stay manageable. Learn more with the US tax guide for Americans living in Canada.

3. FATCA Reporting

FATCA makes Canadian banks report your accounts to the IRS if you’re a US citizen. You report high-value accounts, too, to stay compliant. Choose the best banks for US citizens in Canada for tax compliance. Do this:

- Report TFSA/RESP income to the IRS.

- Claim tax credits to lower US taxes.

- Check FATCA rules for your accounts.

Example: Sarah in Vancouver has a TFSA worth $20,000. She reports its gains to the IRS. She claims a tax credit to offset US taxes. Her bank handles FATCA reporting.

Pro Tip: Switch TFSAs to RRSPs for better US tax treatment—RRSPs are treaty-friendly. See IRS FATCA Info.

Here’s a quick look at how TFSAs, RESPs, and RRSPs are taxed in Canada and the U.S.:

| Account Type | Canada Treatment | U.S. Treatment | Form Needed | Pro Tip |

| TFSA | Tax-free growth | Taxable as foreign trust | 3520/8938 | Switch to RRSP |

| RESP | Tax-advantaged | Taxable gains; PFIC possible | 3520/8621 | Claim tax credits |

| RRSP | Tax-deferred | Treaty-deferred | Election on return | Best for U.S. tax savings |

Case Study: Managing TFSA and FATCA Compliance for a Dual Citizen*

A Vancouver dual citizen contacts SAL Accounting:

Problem: Their $25,000 TFSA triggers US taxes as a foreign trust. FATCA reporting looms, risking penalties. Poor records complicate US-Canada dual citizenship taxes.

What We Do: We confirm TFSA income reporting via Form 3520. We ensure FATCA compliance with their bank. We recommend switching to an RRSP for treaty benefits.

The Result: They avoid IRS penalties and simplify US expat taxes in Canada. Their tax implications for dual citizens are manageable.

Key Tax Forms for US-Canada Dual Citizens

Dealing with US–Canada dual citizenship taxes means filing forms with the IRS (worldwide income, based on citizenship) and CRA (based on where you live) to avoid fines. Here’s a quick guide to the key forms you need.

- Form 1040 (US): Form 1040 is for a yearly return for all income, like wages or dividends; due June 15 if you are in Canada.

- FBAR (FinCEN 114) (US): Lists foreign accounts over $10,000; file FBAR (FinCEN 114) by October 15 via FinCEN. Skipping it risks a $10,000 fine.

- Form 8938 (US): Reports foreign assets (like Canadian accounts) over thresholds, like $200,000 for married filers abroad; file Form 8938 with 1040.

- Form T1 (Canada): Annual return for residents’ income; due April 30 (June 15 if self-employed).

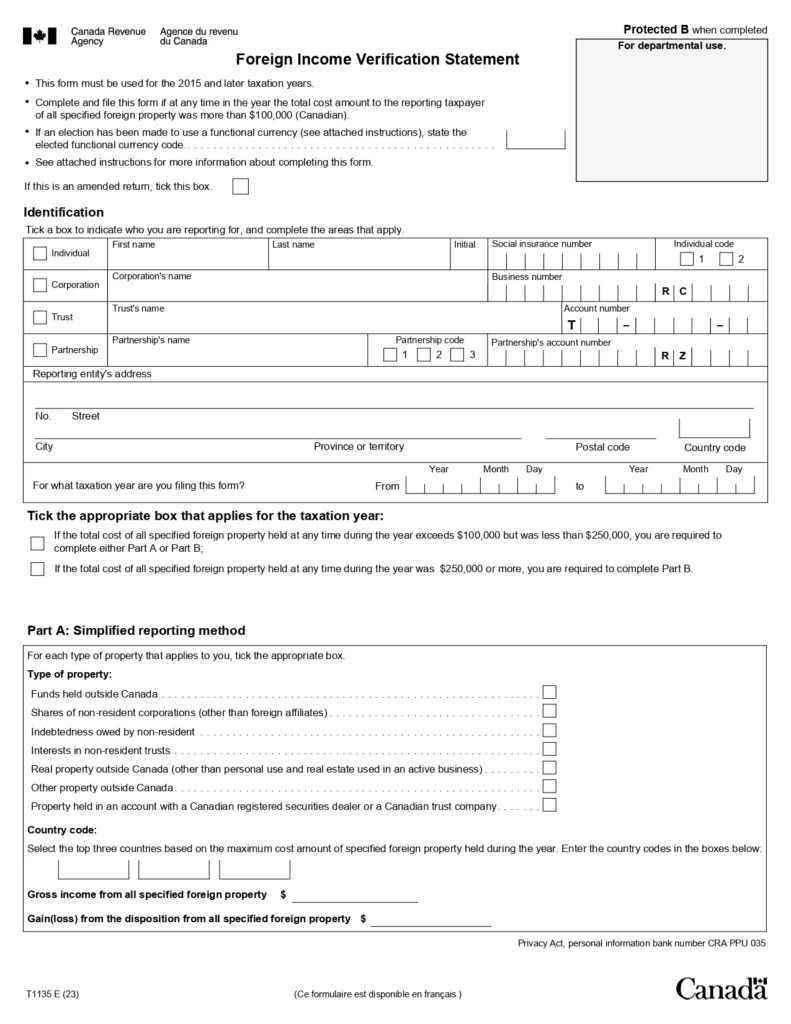

- Form T1135 (Canada): Lists foreign property over CAD $100,000; file with T1. Missing it can cost $2,500. The Form T1135 asset reporting guide will be helpful for you. Check the Form T1135 below:

Pro Tip: FBAR (US, penalty-focused) differs from T1135 (Canada, disclosure-focused). Check IRS Form 8938 and CRA T1135 to avoid mistakes.

Here’s a quick guide to key IRS and CRA forms for dual citizens:

| Form | Purpose | Country | Deadline | Penalty |

| Form 1040 | U.S. tax return | U.S. | June 15 (expats) | 5%/month, up to 25% |

| FBAR | Foreign accounts >$10,000 | U.S. | Oct 15 | $16,536, up to 50% (willful) |

| Form 8938 | Foreign assets (e.g., $400,000) | U.S. | With 1040 | $10,000+ |

| Form T1 | Canadian tax return | Canada | April 30 (June 15 self-employed) | 5% + 1%/month |

| Form T1135 | Foreign property >CAD $100,000 | Canada | With T1 | $100–$2,500 |

Penalties for Missing IRS and CRA Tax Filing Requirements

You have to stay on top of IRS and CRA rules to keep your tax implications dual citizen-friendly. Here’s what you need for 2025.

IRS Penalties and Deadlines for US Tax

- Tax Deadline: File by April 15, 2025. Expats get till June 15, 2025. Interest starts if you owe after April 15.

- Foreign Reporting (FBAR): Due April 15, 2025, extended to October 15, 2025.

- Late Filing Penalty: 5% per month on unpaid taxes, up to 25%.

- FBAR Penalty: $10,000 non-willful; willful cases up to $100,000+ or 50% of account balance. Be careful about the consequences of not filing US taxes while living abroad.

CRA Penalties and Deadlines for Canada Tax

- Tax Deadline: File and pay by April 30, 2025. Self-employed file by June 15, 2025.

- Foreign Property Reporting (T1135): Due with tax return.

- Late Filing Penalty: 5% of unpaid taxes + 1% per month, up to 12 months.

- T1135 Penalty: $100 to $2,500.

- Interest on Unpaid Taxes: Prescribed rate + 4% (e.g., prime + 4%).

Avoid fines with help from our bookkeeping accountants in Toronto at SAL Accounting.

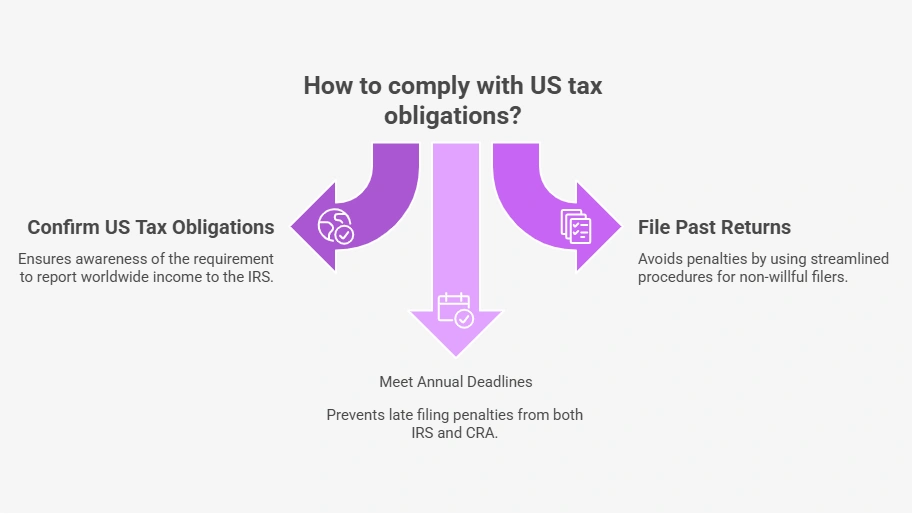

US Tax for Canadian Residents: Additional Tips for Compliance

These tips keep US expat taxes in Canada compliant and tax implications dual citizen-friendly.

1. Confirm US Tax Obligations

US citizens must report worldwide income to the IRS, no matter where they live. For dual citizens in Canada, this means filing a US tax return even if you’ve never lived stateside.

2. File Past Returns with Streamlined Procedures

Missed US taxes spark penalties. Streamlined Foreign Offshore Procedures let non-willful filers catch up penalty-free. John reports three years of income to stay compliant.

3. Meet Annual Tax Deadlines

IRS penalties hit 5% per month, up to 25%, for late taxes. CRA charges 5% plus 1% per month, with interest at prime + 4%. Timely filing avoids these fines. Our US-Canada cross-border tax accountant is here to help you.

Case Study: Catching Up on US Taxes for an Unaware Dual Citizen*

An Edmonton dual citizen contacts SAL Accounting:

Problem: Born in New York, they never filed US taxes, risking a 25% penalty. Unaware of US-Canada dual citizenship taxes, they face FBAR fines for unreported accounts.

What We Do: We guide them through IRS Streamlined Procedures. We file three years of returns penalty-free. We ensure FBAR reporting Canada compliance.

The Result: They avoid a $10,000 FBAR fine and meet the tax implications of dual citizen requirements.

Final Thoughts

US–Canada dual citizenship taxes can seem tough. No stress, you will handle it. Follow simple steps to avoid paying taxes twice on income like wages or investments. File on time with the IRS and CRA to stay away from big fines. Tax credits up to $130,000 in 2025 help lower your bill. Track both countries’ rules to stay compliant.

For easy cross-border tax support, contact us at SAL Accounting. We make compliance easier and help you save money, no matter where you call home.

*Hypothetical scenario

FAQs: US Canada Dual Citizenship Taxes

Yes, file in both. The US taxes worldwide income; Canada taxes residents’ or Canadian income. Tax treaty avoids double taxation. See How to File Your US Tax Return While Living in Canada.

Use a tax treaty for credits or exemptions. File Form 8833 (US) or T2209 (Canada). See Canada-US Tax Treaty: How It Works.

US: Form 1040, FBAR (accounts >$10,000), Form 8938 (assets, e.g., $200,000). Canada: T1, T1135 (>CAD $100,000). See Form T1135 Guide.

Yes, on worldwide income. File Form 1040 yearly. See How to File Your US Tax Return While Living in Canada.

Yes, US tax gains as foreign trusts (Form 3520/8938). RESPs may need Form 8621. See How to Report Canadian Income on a US Tax Return.

Form 1040: 5%/month, up to 25%. FBAR: $10,000, or 50% of the account if willful. See The Consequences of Not Filing US Taxes While Living Abroad.

Yes, use Form T2209 for US taxes paid. Check treaty eligibility. See How to Avoid Double Taxation in Canada.

You owe taxes on worldwide income. Use Streamlined Procedures for penalty-free catch-up. Contact SAL Accounting.