Your WooCommerce shop needs a simple tax setup. And, we’re here to help you nail your WooCommerce Canada tax setup for GST, HST, and QST. You, as a small business owner or freelancer, can follow the steps in this guide to avoid fines. Shockingly, 68% of small businesses fail to comply with tax regulations by using incorrect address rules.

At SAL Accounting, we show you how to set up GST in WooCommerce, add HST for provinces like Ontario, and handle QST. Clear steps and tips make WooCommerce Canadian taxes easy.

Quick Takeaways

- Use the customer’s shipping address to charge correct GST, HST, or QST in WooCommerce.

- Set up GST (5%) and HST (13–15%) in WooCommerce > Settings > Tax for accurate taxes.

- Add QST (9.975%) for Quebec with a “compound” setting to comply with Revenue Québec.

- Test your tax setup monthly with sample orders to avoid fines and customer complaints.

- Choose plugins like TaxJar for complex sales, or stick with WooCommerce’s built-in tools

How to Set Up GST/HST and QST Taxes in WooCommerce

Set up taxes in WooCommerce to skip fines. Add GST, HST, and QST rates in settings (WooCommerce guide). Use the customer’s shipping address to stay legit. Test your WooCommerce Canada tax setup at checkout. Our e-commerce accountant simplifies your tax setup. We’ll also break it down into easy steps.

Canadian Sales Taxes for WooCommerce: GST, HST, QST Explained

The GST/HST WooCommerce setup starts with understanding Canada’s sales taxes. Each province has different rules. We will explain it in the following:

- GST: A 5% federal tax applies to most products, like clothes or digital downloads, across Canada.

- HST: Combines GST with provincial taxes in some provinces (GST/HST for businesses). Ontario charges 13% HST. Nova Scotia charges 14%.

- QST and PST: Québec adds 9.975% QST on top of GST. Other provinces, like British Columbia, add 7% PST to GST.

Register for GST/HST returns in Canada if your annual sales exceed $30,000. Sign up for QST if Québec sales top $30,000, Revenu Québec. See key 2025 tax rates below (Nova Scotia’s HST dropped to 14% on April 1, 2025):

| Province/Territory | GST/HST Rate | PST/QST Rate | Total Rate |

| Alberta | 5% GST | – | 5% |

| British Columbia | 5% GST | 7% PST | 12% |

| Ontario | 13% HST | – | 13% |

| Nova Scotia | 14% HST | – | 14% |

| Quebec | 5% GST | 9.975% QST | ~14.975% |

| Saskatchewan | 5% GST | 6% PST | 11% |

| Other Territories | 5% GST | – | 5% |

Example: Imagine you sell a $100 graphic tee on your WooCommerce store. Here’s how taxes work:

- In Alberta, add 5% GST ($5), making the total $ 110.

- In Ontario, add 13% HST ($ 13.60), making the total $ 113.60.

Note: Territories (Yukon, Nunavut, Northwest Territories) and other HST provinces (e.g., New Brunswick, Newfoundland at 15%) follow similar patterns. Check RetailCouncil.org for full tax rates by province.

Step-by-Step: WooCommerce Canada Tax Setup

Set up Canadian taxes in WooCommerce with easy steps to get GST/ HST, and QST right. These instructions make your tax setup simple. E-commerce accounting for small businesses in 2025 is a breeze.

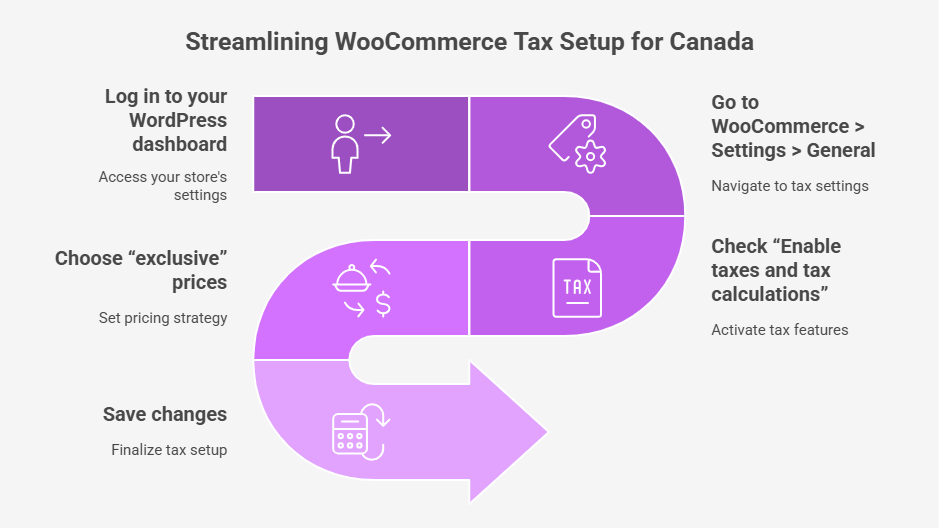

1. Enable Taxes in WooCommerce

Turn on tax settings to prepare your store for Canadian taxes. Follow these steps to do it smoothly

- Log in to your WordPress dashboard.

- Go to WooCommerce > Settings > General.

- Check “Enable taxes and tax calculations.”

- Choose “exclusive” prices to add taxes at checkout.

- Save changes.

2. Set Up GST in WooCommerce

Add GST and HST rates to charge the right taxes across Canada. Stay careful with how taxes work in Canada. Use these steps to set up GST in WooCommerce correctly:

- Go to WooCommerce > Settings > Tax > Standard rates.

- Click “Insert row.”

- Enter GST: Country: CA, State: *, Rate: 5, Name: GST.

- Add HST: Country: CA, State: ON, Rate: 13, Name: HST.

- Repeat for Nova Scotia (14%), New Brunswick (15%).

- Check “Shipping” to tax delivery fees.

- Save changes.

Pro Tip: Grab a CSV from SatelliteWP’s GitHub to load rates fast. Check tax rates yearly, as places like Nova Scotia tweak HST.

3. Add QST for Québec

Set up QST for Québec sales without mistakes. Follow these steps for a perfect WooCommerce Québec tax configuration.

- In Tax settings, add “QST” under “Additional tax classes.”

- Save changes.

- Click the “QST rates” subtab.

- Add: Country: CA, State: QC, Rate: 9.975, Name: QST, Priority: 2, Compound: Yes.

- Save changes.

- Sign up for QST at Revenu Québec if Québec sales top $30,000.

Pro Tip: Use WP Staging to test changes safely. Get tax help from SAL Accounting’s e-commerce bookkeeping.

Example: Sarah, a Vancouver freelancer, sells $50 mugs on her WooCommerce shop. Her setup adds $2.50 GST in Calgary ($52.50) and $6.50 HST in Toronto ($56.50). This shows her tax setup works.

Advanced Options: Plugins to add GST/HST and QST to WooCommerce

Big sales get easier with plugins like Avalara for WooCommerce. They’re optional but super handy for shops selling in lots of provinces.

1. Why Use Plugins?

Plugins make taxes a breeze for shops selling across provinces. They sort out GST/HST rates, including QST, and stop mistakes. Built-in tools work for small shops, but plugins save time for big ones. Try the best bookkeeping tools for small business owners in Canada, too.

2. Which Plugins to Pick

Check these plugins to help your WooCommerce Canada tax setup.

- Avalara AvaTax: Sets GST, HST, and QST rates fast. Costs ~$420/month, Avalara. Great for big shops.

- TaxJar: Deals with GST/HST and Québec sales tax with live rates. Starts at ~$19/month, TaxJar. Perfect for medium shops.

| Plugin | Features | Pricing (2025 Est.) | Best For |

| Built-in WooCommerce | Manual rates, CSV import | Free | Small shops |

| Avalara AvaTax | Auto-calculations, filing | ~$420+/mo | Big shops |

| TaxJar | Live rates, QST support | ~$19+/mo | Medium shops |

3. How to Set Up a Plugin

Pick a sales tax plugin like TaxJar if you need one. Grab it from the WooCommerce marketplace TaxJar. Add your API key. Sync settings. Try a checkout to make sure taxes work.

4. Built-in Tools for Simpler Taxes

Most shops can handle WooCommerce Canada tax setup without plugins. Built-in tools manage GST, HST, and QST easily for small shops. Use plugins only for tough sales or auto-filing.

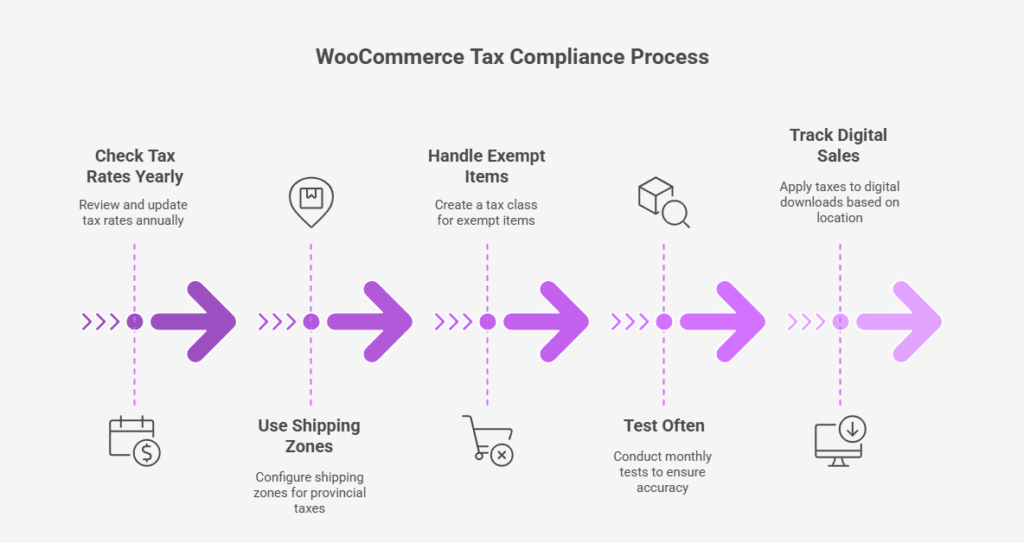

How to Keep Your WooCommerce Canada Taxes Compliant

Get your WooCommerce tax setup right to avoid fines and keep customers happy. Use these easy tips to stay on track:

- Check Rates Yearly: Check tax rates every year, as places like Nova Scotia change HST (RetailCouncil.org). Update rates to keep your GST/HST setup correct.

- Use Shipping Zones: Add zones in WooCommerce > Settings > Shipping for provincial taxes. This makes GST, HST, or QST work right.

- Handle Exempt Items: Make a “Zero rate” tax class for items like groceries. Check tax deductions for Canadian small businesses for more.

- Test Often: Try test products and addresses monthly to check your tax setup. Find mistakes early to skip audit trouble.

- Track Digital Sales: Add taxes to digital downloads based on customer address, including QST for Quebec (Revenu Québec).

Case Study: Toronto Seller’s Tax Fix

Problem: A Toronto WooCommerce seller called us last year. Her $40 phone cases had bad taxes. Customers complained about overcharges, costing her $500 a year.

What We Did: We suggested fixing her WooCommerce Canada tax setup. We told her to turn on taxes in Settings > General and add 5% GST for CA/*, 13% HST for CA/ON, and 9.975% QST for CA/QC (compound) Canada Revenue Agency.

The Result: Her taxes worked great. Calgary orders added $2 GST ($42). Toronto added $5.20 HST ($45.20). Complaints stopped. She saved $500. Her setup runs great.

How to Make Taxes Clear at Checkout in WooCommerce

Customers abandon carts if taxes look confusing. Clear displays keep your WooCommerce store friendly and professional. Follow these simple steps to show GST, HST, and QST plainly for shoppers across Canada.

1. Set Up Display Settings

Go to WooCommerce > Settings > Tax. Choose “Excluding Tax” for shop prices. Also, choose “Excluding Tax” for cart and checkout prices. This shows GST (5%), HST (13–15%), or QST (9.975%) separately.

2. Label Taxes Clearly

Head to the Tax tab in WooCommerce settings. Name taxes “GST,” “HST,” or “QST” instead of just “Tax.”

3. Add a Tax Breakdown

Grab Checkout Field Editor from the WooCommerce Marketplace. Add a field for GST/HST or QST IDs in Checkout Fields for B2B buyers.

4. Test Your Checkout

Try a test order for a $50 mug. Use addresses in Alberta ($2.50 GST, total $52.50), Ontario ($6.50 HST, total $56.50), and Quebec ($2.50 GST + $4.99 QST, total $57.49). Check if the totals are right. Connect with our bookkeeping experts in Toronto for easy tax setup.

This table summarizes steps to display taxes clearly at checkout in WooCommerce:

| Step | Purpose | Settings Needed | Tools/Plugins |

| Set Up Display Settings | Show GST, HST, QST separately | WooCommerce > Settings > Tax, “Excluding Tax” | None |

| Label Taxes Clearly | Use clear names like GST, HST, QST | Tax tab, name rates “GST,” “HST,” “QST” | None |

| Add a Tax Breakdown | Help B2B buyers with tax IDs | Add field in Checkout Fields | Checkout Field Editor |

| Test Your Checkout | Ensure correct tax totals | Test order with various addresses | None |

Final Thoughts

Your WooCommerce store needs a good tax setup for GST, HST, and QST. This protects your profits and keeps customers happy. Our guide helps you get along with your WooCommerce Canada tax setup. Use these steps to follow all tax rules. You’ll avoid expensive mistakes and make checkout easy.

SAL Accounting offers expert help to make taxes simple for you. Contact us today for a free consultation.

Frequently Asked Questions (FAQs)

Turn on taxes in WooCommerce > Settings > General. Add 5% GST for CA/*, 13% HST for CA/ON, 9.975% QST for CA/QC (check compound) in the Tax tab.

In Tax > Standard rates, add 5% GST for CA/*. Add 13% HST for CA/ON. Save. This sets up GST/HST WooCommerce right.

Add “QST” in Tax settings > Additional tax classes. Add 9.975% for CA/QC, check compound. Save. This sets up WooCommerce Quebec tax configuration Revenu Québec.

Sign up for QST if Quebec sales hit $30,000 yearly, Revenu Québec. This keeps your setup good.

WooCommerce works out taxes after you add GST, HST, or QST rates. Use the shipping address for your WooCommerce Canada tax setup.

Built-in tools handle GST/HST WooCommerce rates well. Use plugins like TaxJar for tough sales.

Get taxes wrong, and you risk CRA audits or big fines from the Canada Revenue Agency. Fix your setup.