As a Canadian dentist, orthodontist, periodontist, or oral surgeon, you shine in patient care. Managing finances is key to success as well. Taxes can be costly. In 2025, new CRA rules require exact GST/HST credits for orthodontic treatments, ending the 35% estimate. Smart tax planning can save thousands.

This guide from SAL Accounting provides essential tax tips for dentists in Canada. It will help you maximize your 2025 tax return. Read through to the end.

Quick Takeaways

- Self-employed dentists pay 15%-50% personal income tax; incorporated pay 12%-15% across provinces.

- Missing April 30 or June 30 tax deadlines risks hefty CRA fines.

- Deductions for equipment, education, and home office save dentists thousands on taxes.

- RRSP contributions up to $31,000 cut taxable income and grow tax-free.

- A dentistry-savvy accountant prevents missed deductions and simplifies GST/HST rules.

CRA Dentist Tax Obligations: Master Your 2025 Bill

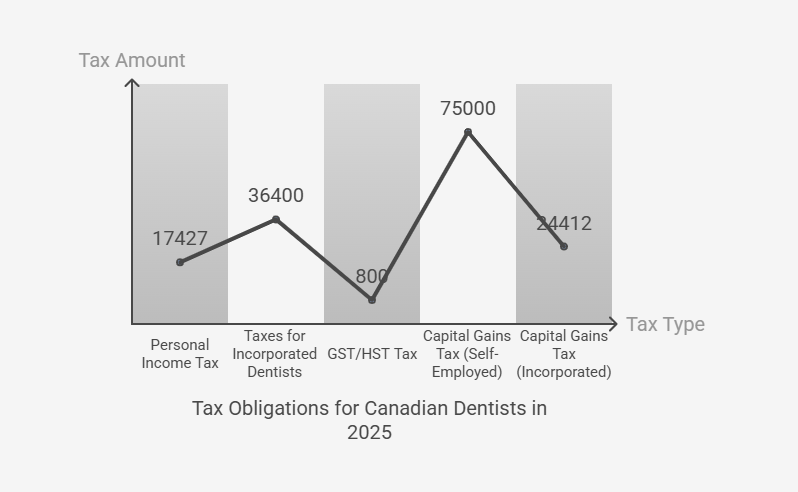

Canadian dentists pay different taxes depending on their practice setup. Understanding these taxes lets you plan wisely and keep more cash. Get help from our accountant for dentists to boost your tax strategy. Here, we list the taxes you need to pay:

- Personal Income Tax for Self-Employed Dentists

Self-employed dentists run their own practice. You tell the CRA about money you earn and spend, like patient fees, supplies, rent, or fees, on your personal tax return. You pay income tax on what’s left. Taxes start at 15% for income up to $55,867 and can go to 50% for high earners (Source).

Pro Tip: Keep clear records to save money and stay out of trouble with the CRA.

Example: Dr. Patel, self-employed, earns $150,000 and deducts $50,000 in expenses. She pays federal tax on $100,000, with rates starting at 15% up to $55,867.

- Taxable Income: $150,000 – $50,000 = $100,000

- Federal Tax: ($55,867 × 0.15) + ($44,133 × 0.205) = $8,380 + $9,047 = $17,427

- Total: $17,427 (plus provincial tax)

- Taxes for Incorporated Dentists

Incorporated dentists own a company and pay tax on its profits, about 12-15% in most provinces (for example, 12.2% in Ontario). Check corporate tax deadlines in 2025 to stay compliant. You pay tax on salary or dividends you take from the company. Salary gets higher taxes and CPP payments, up to $3,867 in 2025. Dividends get lower taxes, around 12%.

Pro Tip: Consult a tax advisor to balance salary and dividends. Dividends often save more, but a small salary can maximize RRSP contributions.

Example: Dr. Wong’s corporation earns $200,000, paying 12.2% Ontario corporate tax. She takes $100,000 as dividends, taxed at 12% personally.

- Corporate Tax: $200,000 × 0.122 = $24,400

- Dividend Tax: $100,000 × 0.12 = $12,000

- Total: $24,400 + $12,000 = $36,400

- GST/HST Tax

Some Canadian dentists register for GST/HST (Check it here), collecting taxes on services like cosmetic procedures and sending them to the CRA. Cleanings and fillings are exempt. Payments go quarterly or yearly. Provincial taxes vary: Ontario 12.2%, Alberta 11%, Quebec 11.5%. Learn more in the GST/HST return guide for businesses in Canada.

Pro Tip: Alberta and territories have 5% GST only. BC, Manitoba, Saskatchewan add PST (6-7%); Quebec adds 9.975% QST. Corporate rates: Ontario 12.2%, Alberta 11%, Quebec 11.5%. Check your province’s tax website.

Example: Dr. Kim collects 13% HST on $10,000 for cosmetic veneers and claims $500 in GST/HST credits, paying the net amount to the CRA.

- HST Collected: $10,000 × 0.13 = $1,300

- Net Payable: $1,300 – $500 = $800

- Total: $800

- Capital Gains Tax

Selling a dental practice, clinic property, or investments triggers capital gains tax on the profit (Source). Self-employed dentists add half the gain to their income, paying up to 50% tax. Incorporated dentists pay tax via their company, with two-thirds of the gain taxed in 2025. This tax applies during retirement or investment cash-outs. Smart planning saves cash.

Example: Dr. Chen sells her practice for a $300,000 gain. Self-employed, she taxes 50% of the gain at up to 50%. Incorporated, her company taxes 66.7% at 12.2%.

- Self-Employed: $300,000 × 0.5 = $150,000 × 0.5 = $75,000

- Incorporated: $300,000 × 0.667 = $200,100 × 0.122 = $24,412

- Total: $75,000 (self-employed) or $24,412 (incorporated)

- Read More: “Tax Tips for Doctors in Canada 2025”

The table below summarizes key tax obligations for Canadian dentists in 2025:

| Tax Type | Who Pays | Tax Rate | Key Details |

| Personal Income Tax | Self-employed dentists | 15%-50% (up to $55,867) | Report income/expenses on T1; |

| Incorporated Dentists | Company owners | 12-15% (e.g., 12.2% Ontario) | Salary taxed higher + CPP ($3,867); dividends ~12% |

| GST/HST Tax | GST/HST-registered dentists | Varies (e.g., 13% HST) | Collect on cosmetic procedures; quarterly/yearly |

| Capital Gains Tax | Self-employed or incorporated | 50% (self-employed), 66.7% (company) | Applies on practice sales; |

Tax Planning for Dentists in Canada: Forms and Compliance

Canadian dentists avoid CRA headaches by keeping clear records and sending forms on time. Here’s how to stay compliant and handle forms:

T1 Tax Return

Self-employed and incorporated dentists file a T1 tax package to report income, expenses, salary, or dividends. Send by April 30, 2025, or June 15, 2025 (self-employed), but pay taxes by April 30.

T2125 Form

Self-employed dentists add a Form T2125 to their T1 to list business earnings and costs, like rent or equipment. File by April 30, 2025, or June 15, 2025, but pay taxes by April 30. Check the form below:

T2 Tax Return

Incorporated dentists file a T2 tax return to report company income and expenses, like revenue or costs. Complete within six months of fiscal year-end, often June 30, 2025.

GST/HST Returns

GST/HST-registered dentists file GST/HST-related forms to report taxes from services like cosmetic procedures and claim credits. Send quarterly (April 30, July 31, October 31, January 31) or yearly, or face penalties.

- Read More: “How to Set Up a Corporation in Canada”

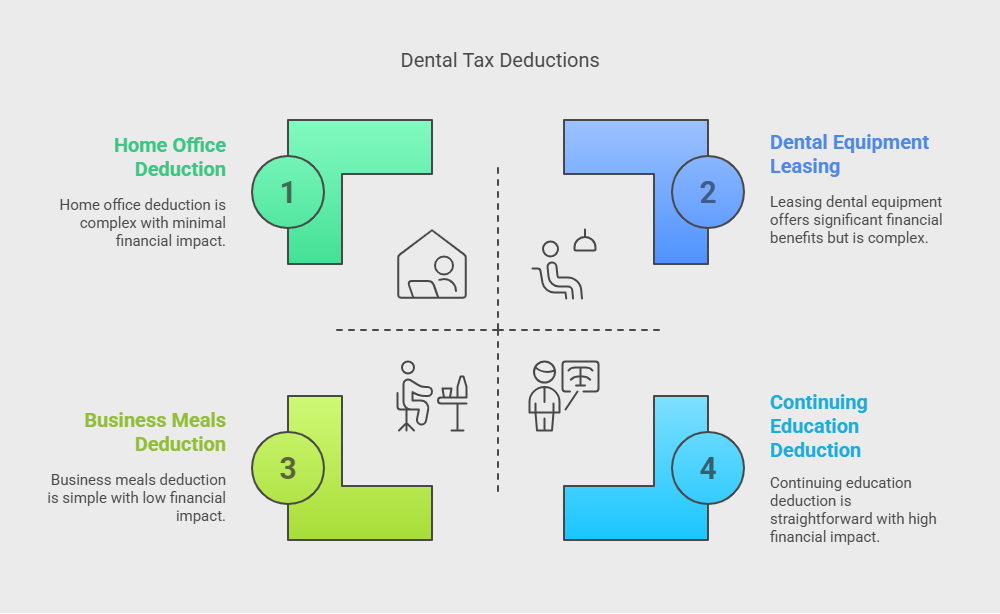

Dental Tax Deductions in Canada: Opportunities for Dentists

Deductions lower your taxes and keep more money in your pocket. Canadian dentists can claim these:

- Dental Equipment: Buy chairs, X-ray machines, or scanners and deduct their cost with Capital Cost Allowance (CCA). Lease instead and deduct the full payment as a business expense.

- Continuing Education: Attend courses or conferences to stay sharp and deduct the fees, plus travel and lodging costs.

- Home Office: Work from home and deduct part of your rent, utilities, or internet based on the space used for work.

- Business Meals: Eat out for work and deduct half the bill.

- Professional Fees: Pay dues to dental associations or licensing boards and deduct those costs.

- Advertising and Marketing: Spend time promoting your practice and deducting costs for websites or ads.

- Read More: “How Taxes Work in Canada: A Complete Guide for Businesses & Residents”

Top Tax-Saving Strategies and Tips for Canadian Dentists

Smart tax planning saves Canadian dentists a ton of cash. Whether you work solo or own a company, tax tips for dentists in Canada keep thousands in your pocket. Check out the best tricks to cut your taxes here:

1. Dentist Incorporation Tax Benefits

Incorporate to save big. In Ontario, your company pays 12.2% tax on profits, far less than personal taxes up to 50%. Keep money in the company, then take dividends at 12%. Accounting costs $2,000–$5,000 yearly, but savings make it worth it.

2. Retirement Planning

Retirement savings cut taxes and grow funds. RRSPs and TFSAs are great for dentists. In 2025, contribute up to $31,000 to an RRSP to lower taxable income, growing tax-free until withdrawal. Incorporated dentists can use IPPs, saving $40,000–$50,000 yearly, deductible. TFSAs have a $7,000 limit, tax-free.

Pro Tip: Start RRSP savings early to grow more.

3. Health Spending Accounts

Health spending accounts help incorporated dentists save tax. Your company pays medical costs like dental care, tax-free for you, and deducts them. For $10,000 in family costs, you save tax, and funds often roll over.

Pro Tip: Use an HSA for family medical bills to save money.

4. Lifetime Capital Gains Exemption (LCGE)

The LCGE helps incorporated dentists save tons on taxes when selling their practice. You can skip taxes on up to $1 million in gains (2024 limit, grows yearly) if your practice counts as a small business corporation. It needs to be Canadian-controlled, with 90% of assets used in your active business. Only shares qualify, not assets. Check the CRA capital gains guide for more.

5. Family Payments

Pay family for real work, like bookkeeping or front desk help, to save taxes. If they pay lower taxes (e.g., 20% vs. your 40%), you save more, like $8,000 on $20,000 paid to your kid in Ontario. Ensure the work is legit.

6. Registered Retirement Savings Plans (RRSPs)

RRSPs help dentists save for retirement and cut taxes. Contribute up to $31,000 in 2025 to lower taxable income, with savings growing tax-free until withdrawal. Self-employed or salaried dentists qualify, but dividends don’t count.

7. Charitable Donations

Charity donations save taxes for incorporated dentists with a tax credit up to 75% of profits. Donate $5,000 in stocks to save $2,250, with unused credits carrying forward five years (List of charities)

8. Mortgage Interest Savings

Incorporated dentists can pay home loans with practice money, then borrow that amount for business. The business loan’s interest is deductible, unlike home loan interest. Use $50,000 to save tax.

9. Year-End Tax Planning

Review finances by December 31, 2025, to save more. Meet your accountant to add to RRSPs, buy deductible equipment, or prepay expenses, cutting taxable income.

Case Study: Edmonton Dentist’s Big Sale Win

Problem: An incorporated dentist in Edmonton contacted us last year. They planned to sell their practice shares but worried about a massive tax bill.

What We Did: We suggested using the LCGE to skip taxes on up to $1 million in gains. We also recommended tweaking assets to meet the 90% active business rule.

The Result: They saved a huge chunk of taxes, paying only on gains above $1 million, boosting their retirement fund.

Track expenses with our bookkeeping for dentists to maximize these strategies. Ready to save more? Contact SAL Accounting for a free consultation!

CRA Dentist Tax Advice: Avoid These Tax Mistakes

Nobody wants CRA problems. Good planning saves money, but errors cost you. Check the mistakes you should avoid as a Canadian dentist in the list below:

- Missing Deadlines: Late tax payments mean fines. In Ontario, pay personal taxes by April 30, 2025, or company taxes by June 30, 2025.

- Bad Records: No receipts, no savings. Keep proof for expenses dentists can claim in Canada, like chairs or meals. Track GST/HST credits exactly. Use the best bookkeeping tools for small businesses to stay organized.

- Skipping Deductions: Don’t miss claims for gear or work trips. You lose big savings.

- Choosing the Wrong Accountant: Pick the wrong accountant, and you’ll miss savings. Choose one who knows dentistry. They’ll spot deductions. Ask if they’ve worked with dentists before.

This table lists key mistakes to avoid as a Canadian dentist in 2025:

| Mistake | Consequence | Action to Avoid |

| Missing Deadlines | Fines for late payments | Pay personal taxes by April 30; company taxes by June 30 |

| Bad Records | No receipts, no savings | Keep proof for expenses. Track GST/HST credits. |

| Skipping Deductions | Lose big savings | Claim gear and work trip expenses. |

| Choosing Wrong Accountant | Miss savings, overlook deductions | Pick a dentistry-savvy accountant with experience. |

Case Study: Mississauga Dentist’s Deduction Recovery

Problem: A self-employed dentist in Mississauga reached out to us. They skipped deductions for equipment and conference trips, facing a huge tax bill.

What We Did: We suggested reviewing their expenses to claim deductions for dental chairs, X-rays, and training travel costs. We recommended tracking all work-related costs.

The Result: They claimed thousands in missed deductions, slashing their tax bill and boosting savings.

Future Tax Planning for Dentists Beyond 2025

Future tax rules show up fast. Stay smart to save lots. Below is what you can do:

- Capital Gains Tax: Remains at 66.7% for companies after 2025. Plan sales carefully to keep more money.

- Passive Income Rules: Earn over $50,000 in passive income, like interest or rent, and you lose tax perks. Pick investments carefully.

- Family Dividend Rules: TOSI gets harder. Show the CRA your family works or owns shares.

- Ontario Health Premium: High-income dentists in Ontario pay up to $900 in health premiums. Budget for it.

Pro Tip: Plan how to pass on your practice. Passing your practice to family can trigger capital gains tax. Use estate freezes or trusts to minimize it.

Get expert help from our accountant services for dentists to plan for future taxes.

Final Thoughts

Canadian dentists do great work for patients, but taxes can reduce your profits significantly. Know your tax rules to keep more money. If you run your own practice, have a company, or plan to sell, good tax plans save you thousands. This guide provides the best tax tips for dentists in Canada, from deductions to obligations.

Need more help? Contact us for expert advice. We make the hard task easy so you can focus on your patients. Reach out to SAL Accounting today for a free consultation!

Frequently Asked Questions (FAQs)

Claim dental equipment (CCA or lease), education fees, home office costs, half of business meals, professional fees, and advertising expenses.

Incorporate to save big. The company pays 12-15% tax (e.g., 12.2% Ontario) vs. personal taxes up to 50%. Dividends save more, but accounting costs $2,000-$5,000.

Max RRSPs ($31,000), use health spending accounts, pay family for work, donate to charities, and use LCGE to shelter $1 million in gains.

Track income, expenses (supplies, rent), receipts for deductions, and GST/HST for taxable services. Use accounting software.

Hire a dentistry-savvy accountant for incorporation, practice sales, or complex taxes like GST/HST. They catch savings.

Yes. File T2 for company, T1 for salary or dividends by April 30 or June 15 (self-employed), but pay by April 30.

Personal taxes by April 30. Self-employed file T1/T2125 by June 15, pay by April 30. T2 by June 30. GST/HST quarterly or yearly.