New York calls Canadian entrepreneurs in 2025 with its lively economy and global possibilities. Over 1,700 international companies run here, with more than 500,000 workers, which creates a top spot for foreign businesses. Great trade deals, like the USMCA, ease the process of opening a company in New York from Canada.

We at SAL Accounting crafted this guide to show how to start a business in New York as a foreigner. We cover business structures, funding, and more. Read to the end.

Quick Takeaways

- Canadians can start a New York business without a U.S. address, using a registered agent.

- Choose an LLC for asset protection and simple taxes, costing $200 to file.

- Apply for an EIN online for free to handle taxes and banking without an SSN.

- Access funding like the $25,000 Global NY Fund to grow exports.

- Use the US-Canada tax treaty to avoid double taxation on your business income.

Why Start a Business in New York as a Foreigner?

New York grabs Canadians who want to start a business in New York. Its huge economy and global vibe pull in entrepreneurs. Here’s why it’s awesome:

- Big Market: Reaches many customers with over $1.7 billion in venture cash yearly.

- Cool Hubs: Silicon Alley in New York City rocks for tech startups; Buffalo and Albany shine for manufacturing and shipping.

- Super Close: It’s just a two-hour flight from Toronto.

- USMCA Perks: USMCA drops trade hurdles and helps online businesses; it is great to start an online business in New York as a Canadian.

Book a consultation with our US business incorporation accountant to start your New York business smoothly.

Legal Steps to Open a Company in New York from Canada

To start a business in New York, Canadians need a few easy steps. We list each one below to keep it clear.

1.Own a Business Without Living Here

Canadians can own US businesses without a US address. This makes New York a breeze for foreigners. You don’t need to move here to start. Explore similar opportunities with how to open a business in Florida as a Canadian.

Pro Tip: Partner with a trusted U.S.-based business service to handle your company’s mail and compliance needs remotely.

2.Pick a Business Type

Choose a business type, like an LLC or C-Corp, to set up your company. It decides how you run and pay taxes. This step helps you register an LLC in New York, Manhattan.

3.Sign Up with the State

Join the New York Department of State. They check your papers to make sure your business follows state rules. This keeps things legit.

4.Grab a Tax ID

Get an EIN (Employer Identification Number), a tax ID for your business. It works for taxes and banking, even without a Social Security Number. Apply at the IRS.

Pro Tip: Apply for your EIN online at the IRS website for free and get it instantly. Save the EIN confirmation for banking and tax filings.

5.Find a Local Agent

Hire a New York-based registered agent to pick up legal papers for you. They need a local address for stuff like court notices. This keeps you in the loop.

6.Get a Work Visa if Needed

If you want to work in your business, not just own it, you need a visa. The TN visa under USMCA fits folks like accountants or engineers. It lets you work legally.

Read More: “How to Register a Business in the US from Canada“

Choose Your Structure to Register an LLC in New York as a Foreigner

Choosing the right business structure is key for Canadians starting a business in New York. Each option has pros and cons, explained simply below:

LLC (Limited Liability Company)

An LLC suits small businesses. It protects personal assets and simplifies taxes. For Canadians, it’s a top choice to open an LLC in the US from Canada due to its straightforward setup.

- Pros: Shields assets, single taxation, easy setup.

- Cons: Less appealing to investors, $200 filing fee plus $9 biennially.

C-Corp (C-Corporation)

A C-Corp fits startups seeking investors. It allows share sales but has complex taxes.

- Pros: Attracts investors and supports growth.

- Cons: Double taxation, $125 filing fee plus $9 biennially.

Sole Proprietorship

This is the simplest setup but risks personal assets.

- Pros: No fees, full profit retention.

- Cons: No asset protection, hard to get funding.

Example: Omar’s Vancouver LLC protects his savings. A New York client’s lawsuit against his app development firm can’t touch his Canadian home. Setup cost $200.

Read More: “Business Structures in Canada: Pros, Cons & Tax Implications“

The table below compares LLC, C-Corp, and sole proprietorship to help you pick the right structure:

| Structure | Ideal For | Benefits | Drawbacks | Costs |

| LLC | Small businesses | Asset protection, single taxation, simple setup | Less investor appeal, biennial fees | $200 + $9 biennially |

| C-Corp | Investor-focused startups | Attracts investors, growth-friendly | Double taxation, complex taxes | $125 + $9 biennially |

| Sole Proprietorship | Freelancers | No fees, full profit control | No asset protection, funding challenges | $0 |

Business Visas for Canadian Entrepreneurs in New York

Canadians need a visa to work in their New York business, but two options make it easy:

- TN Visa (USMCA): The TN visa under USMCA allows professionals like accountants or engineers to work in the US for three years, renewable. You need a job offer, a degree, and a $50 fee. Apply at a US border or consulate. It suits Canadians who want to work there.

- E-2 Visa (Investor): The E-2 visa suits those with substantial funds, like someone launching a high-end Manhattan startup. It requires a significant investment, typically $100,000 or more, and fees start at $460. Apply at a US consulate with investment proof.

Read More: “Can a Canadian Corporation Own a US LLC?“

How to Start a Business in NYC, Manhattan as a Non-Resident

To start a business in New York and Manhattan, Canadians need to complete a few simple steps to launch their company. Follow these steps to get started:

1.Pick a Name

Make sure your business name’s free on the New York Department of State’s website. Don’t use words like “bank” unless you get the okay. A one-of-a-kind name keeps your brand cool.

Pro Tip: Search for your name’s availability early and check trademark databases to avoid conflicts later.

2.File Your Papers

Submit the correct documents to the New York Department of State. For an LLC, file Articles of Organization ($199 fee). For a C-Corp, provide a Certificate of Incorporation ($125 fee) online or by mail.

3.Secure a Tax ID

Grab an Employer Identification Number with IRS Form SS-4. It’s your tax ID, and you don’t need a Social Security Number. Just use mail, fax, or phone. This helps with taxes and bank stuff. Learn why EIN is needed for Canadian companies to understand its role.

4.Sign Up for Taxes

Pick up a Certificate of Authority from the New York State Department of Taxation and Finance if you sell things like snacks or clothes that get taxed. This lets you collect sales tax the right way. Not every business needs it, so double-check.

Pro Tip: Check your product’s tax status on the New York State Department of Taxation before registering. This avoids unnecessary filings.

5.Look for Licenses/Permits

Review city regulations on the NYC Business Portal (here) for additional permits. For example, a café requires health permits to remain compliant. This ensures your business follows local laws.

6.Get a Local Agent

Connect with a registered agent to grab legal papers for you, like court stuff. They need a local address to keep you in the know. Every New York business needs one. Launch your US venture now with LLC Incorporation accounting consultation in the USA from Canada.

The table below guides you to start a Manhattan business with costs and resources:

| Step | Task | Cost | Resource |

| Name | Check NY State availability | $0 | NY DOS |

| Documents | File LLC ($199) or C-Corp ($125) | $199/$125 | NY DOS |

| EIN | Apply via IRS | $0 | IRS |

| Taxes | Get Certificate for sales tax | $0 | NY Tax |

| Permits | Check NYC for licenses | $100-$500 | NYC Portal |

| Agent | Hire registered agent | $100-$300/yr | Agent services |

Open a Bank Account to Start a Business in New York as a Foreigner

A US bank account eases handling funds for your New York business. It simplifies payments and transfers, perfect for a bank account in the US for foreigners. Canadians need these to start:

- EIN (business tax ID).

- Passport for identification.

- Business documents.

- A US address (your registered agent’s address suffices).

Pro Tip: Select banks like Chase for in-person service or online platforms like Wise Business for fast setup and low fees. Explore the best US banks for Canadians in 2025 to find top options for your business.

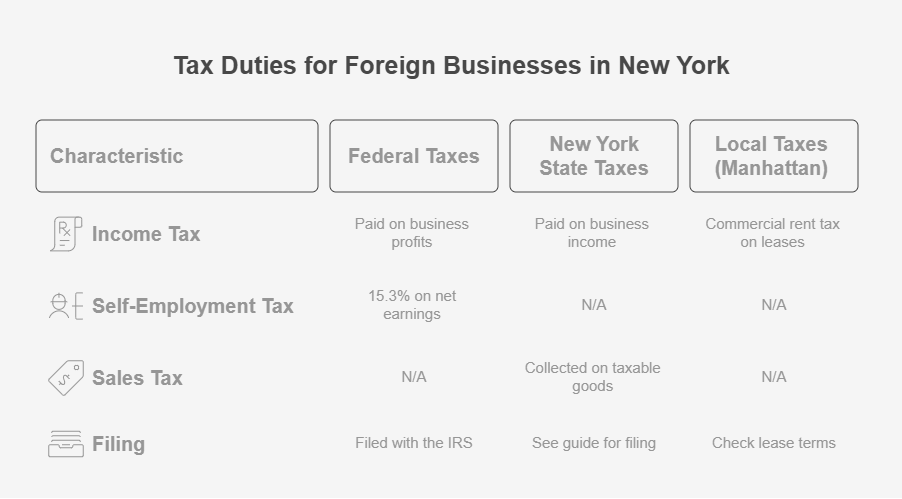

Tax Duties for Foreign Businesses in New York

Canadian non-residents face clear tax duties when they operate a New York business. You handle federal, state, and sometimes local taxes. The US-Canada tax treaty helps avoid paying twice.

1.Federal Taxes

You pay federal income tax on business profits. Self-employment tax, about 15.3% on net earnings, covers social security and Medicare. File these with the IRS.

Example: Tara’s NYC bakery earns $40,000 profit. She pays $8,000 federal income tax and $6,120 self-employment tax (15.3%). She files online with the IRS yearly.

2.New York State Taxes

New York State taxes your business income at rates from 4% to 10.9%. If you sell taxable goods, like clothes or electronics, you collect sales tax. See how to file sales tax in the US for a step-by-step guide.

Example: Eli’s Buffalo phone shop pays $2,400 state tax (8%) on $30,000 income. He collects $887.50 sales tax (8.875%) on $10,000 of sales.

3.Local Taxes in Manhattan

In Manhattan, leasing office space may add commercial rent tax. It’s roughly 3.9% on annual rent over $250,000. This applies only to specific commercial leases.

Pro Tip: Check lease terms to confirm if commercial rent tax applies to your office space.

Example: Zoe rents a Manhattan office for $400,000 yearly. She pays $15,600 commercial rent tax (3.9%). Her lease confirms the tax applies.

4.US-Canada Tax Treaty

The US-Canada tax treaty prevents double taxation. It provides credits for taxes paid in one country against the other’s tax bill (IRS Tax Treaties).

Case Study: Tech Startup Tax Audit Success in NYC

Problem: A Toronto AI app developer got in touch with us after an IRS audit for their Manhattan LLC’s $50,000 revenue. They reported only $20,000, missing $10,000 in expenses, facing $12,000 in taxes and penalties.

What We Did: We advised pulling cloud service invoices proving $8,000 in deductions. We suggested using the US-Canada tax treaty for $5,000 in Canadian tax credits.

The Result: The IRS accepted $13,000 in deductions and credits, lowering taxable income to $37,000. They paid $4,500 in taxes, saving $7,500.

Funding Support for Foreign Business Owners in New York

New York provides funds to help Canadians start a business in New York as a foreigner. These cash boosts help startups and exporters grow. You need an EIN for non-resident applications. Here’s how to access them.

- New York StartUP! Competition: Awards up to $15,000 for creative, original ideas. It suits tech or artistic businesses. Create a clear business plan with market details and financial estimates. Submit it by spring (Pace SBDC).

- Global NY Fund: Offers up to $25,000 to expand exports. It covers costs like trade shows, shipping, or ads abroad. You need one year in business and a solid export plan to apply (Empire State Development).

- SBA Loans: Provide loans from $500 to $5 million for equipment, inventory, or growth. Your EIN starts the process. Check options like 7(a) or microloans. Meet with lenders to apply.

Pro Tip: Visit the NYC Small Business Resource Center to improve your funding pitch and succeed.This table shows funding options with eligibility and steps for Canadians:

Read More: “How to Open a US Bank Account as a Canadian“

| Funding | Amount | Best For | Eligibility | Apply |

| NY StartUP! | Up to $15K | Tech, arts | Manhattan/Bronx/Staten Island, < $10K revenue | Business plan by spring (Pace SBDC) |

| Global NY | Up to $25K | Exporters | 1+ yr business, export plan | Submit plan (ESD) |

| SBA Loans | $500-$5M | Equipment, growth | EIN, good credit | Meet lenders (SBA) |

Case Study: Manufacturer Export Funding Win in Buffalo

Problem: A Vancouver entrepreneur got in touch with us after failing to fund their Buffalo eco-packaging C-Corp’s exports. Their $100,000 revenue needed $30,000 for trade shows, but grants were rejected.

What We Did: We advised improving their Global NY Fund application, highlighting the export plan and $20,000 shipping costs. We suggested ensuring their EIN and financials were correct.

The Result: They got a $25,000 Global NY Fund grant for a Berlin trade show. Exports doubled, adding $50,000 in revenue.

Challenges as a Foreign Business Owner in New York, Manhattan

New York’s business scene can throw challenges at Canadian entrepreneurs, but simple tricks make it easy. You can handle them with the right moves:

- Paperwork: Permits and licenses seem tricky, but a registered agent or lawyer sorts them out fast.

- Cultural Differences: New York’s fast business pace feels different from Canada’s.

- Language Barriers: Canadians don’t struggle much with language, but local slang or accents might confuse you.

Book a consultation with a US-Canada cross-border tax accountant at SAL Accounting to streamline your New York business taxes.

Final Thoughts

New markets can feel tricky, but Canadian entrepreneurs can do great with the right info. Know your legal, tax, and funding basics to start a business in New York with confidence. This guide lays out the steps clearly. Stay on top of rules and get expert help to keep things smooth.

If you have a business idea, Contact us for custom advice. We offer a free consultation to support you through every part of your business journey, from setup to success.

Frequently Asked Questions (FAQs)

Yes, non-U.S. citizens can start a New York business, like an LLC or C-Corp, without living here.

You don’t need a visa to own a U.S. business, but you need a work visa, like TN or E-2, to work in it.

An LLC works best for foreigners, offering asset protection, simple taxes, and easy setup for $200.

Apply online for an EIN with IRS Form SS-4, using your business name and U.S. address; no SSN required.

You need a U.S. address, but a registered agent’s address covers this for you.

Owning a business supports an E-2 visa with $100,000+ investment but doesn’t ensure a green card.

You can register an LLC or C-Corp in New York in 1-2 weeks via the NY Department of State.