You want your Shopify store to stay profitable and stress-free, and that starts with getting your accounting right. This post shares the best accounting practices for Shopify, enabling you to stay organized, compliant, and confident. But here’s the surprise: the deposit from Shopify is not your real revenue.

Fees, refunds, discounts, and chargebacks come out before the money reaches your bank. If you only track deposits, your books will be wrong, your margins won’t add up, and your tax bill could be a shock.

In this guide, we at SAL Accounting will walk you through the best accounting practices that keep your numbers accurate and your business ready to grow.

Quick Takeaways

- Your Shopify payout is not your revenue; it is net of fees, refunds, and discounts.

- Reconcile every payout to see your true profit and avoid costly tax surprises.

- Accurately track inventory and Cost of Goods Sold (COGS) to understand your real margins.

- Automate your bookkeeping with tools like QuickBooks Online and A2X to save time and prevent errors.

- Close your books monthly to spot financial issues early and maintain control over your business.

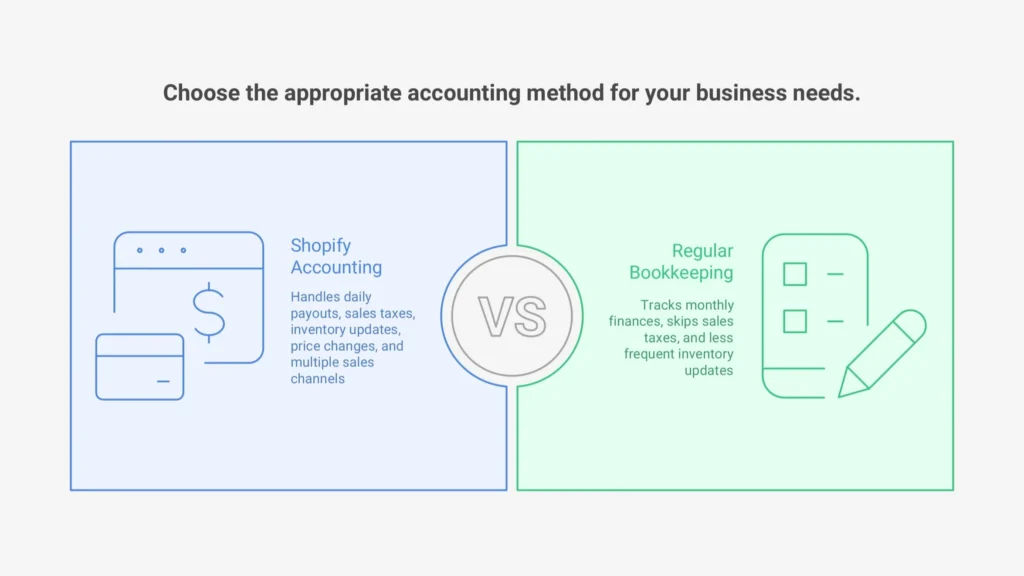

Why Shopify Accounting Practices Are Different From Regular Bookkeeping

Shopify accounting is different from regular bookkeeping. Online stores have special challenges (Shopify beginners’ guide). You need the best accounting practices for Shopify to make money and follow tax rules. Our expert e-commerce accountant can help you set things up the right way. Here’s why:

- Daily payouts: Shopify sends cash to your bank every day. Check these often. Normal shops track money once a month.

- Sales taxes: US stores handle state taxes. Canadian stores handle GST/HST. Regular bookkeeping skips these details.

- Inventory updates: Shopify inventory tracking keeps stock right. It stops overbuying or running out. Regular shops update their stock less.

- Price changes: Shopify stores often run sales or discounts. Track these to keep profits safe. Normal shops don’t change prices as much.

- Multiple sales channels: Selling on Shopify, Amazon, or social media makes things tricky. Regular bookkeeping doesn’t cover this. Check more on the Shopify seller tax guide for Canada and the US.

Best Accounting Practices for Shopify Sellers

Good accounting gives you a clear picture of your Shopify store. You can also learn what Shopify tax exemptions are and how to set them up. It shows profit, tax, and cash flow in real numbers. These practices keep your books clean and your business ready to grow.

1. Track Your Transactions Often

Do not wait until tax season to look at your numbers. Enter sales, refunds, and expenses every day or at least once a week. This keeps your books clear and helps you catch mistakes early. E-commerce accounting in 2025 gets much easier like this. If you wait months, the cleanup turns painful.

2. Reconcile Shopify Payouts

The deposit in your bank is not your total sales. Shopify takes out fees, refunds, and discounts before sending the money. Match payouts with your accounting software to stay accurate:

- Start with gross sales.

- Subtract refunds and chargebacks.

- Subtract Shopify and payment gateway fees.

- The rest is your net payout.

Pro Tip: Set up a “Shopify clearing account.” Post gross sales there, then deduct fees and refunds. The balance should always equal the bank deposit.

Example: You sell $100. Shopify takes $3 in fees. You give a $10 refund. The payout to your bank is $87. If you only look at the deposit, you miss the real numbers.

3. Stay on Top of Inventory and COGS

Inventory is tricky for Shopify sellers. Track what you pay for stock, packaging, and shipping. Add discounts when they cut into your margins. Cost of goods sold (COGS) shows your true profit and sets the right tax result. See what a cash flow forecast is for small businesses and how to build one.

Pro Tip: Use a Shopify app or accounting software that syncs stock for you. Spreadsheets may work for a small store, but they break down as sales grow.

Example: You buy an item for $20 and sell it for $50. Your profit is $30. If you run a 20% discount, the sale price is $40. Now your profit drops to $20. Discounts cut your margin.

4. Handle Sales Tax the Right Way

Sales tax rules change by location. In the US, states require collection once you cross sales thresholds. In Canada, GST/HST depends on the province of the buyer. Shopify’s tax tools, or apps like TaxJar and Avalara, can do the work for you. See how to file sales taxes in the US as an e-commerce business.

Pro Tip: Check your sales tax status each quarter. Thresholds come up fast, and early action keeps you safe from penalties.

Example: You sell $5,000 to customers in New York. Once you pass 100 sales or $500,000 in sales in that state, you must register for tax. In Canada, once sales hit $30,000, you must register for GST/HST.

5. Automate Wherever Possible

Manual entry wastes time and leads to errors. Link Shopify with QuickBooks, Xero, or A2X. These tools move sales, fees, and taxes into your books and keep reports up to date. The best e-commerce accounting software will help you with this.

6. Close Your Books Every Month

Do not wait until year-end. Close your books each month. Review three reports:

- Profit and loss

- Balance sheet

- Cash flow

Monthly reviews show you how your store really performs and let you fix problems before they grow.

7. Keep All Records Organized

Keep receipts, invoices, and supplier bills in digital folders or cloud storage. Organized records make tax filing easy and protect you if you face an audit. Stay on top of your numbers with our bookkeeping for e-commerce stores.

The table below lists key Shopify accounting practices:

| Accounting Practice | Action | Why It Matters | Benefit |

| Track Transactions | Track stock, shipping, and discounts for COGS. | Catches errors early. | Keeps books accurate. |

| Reconcile Payouts | Match sales to deposits, subtract fees/refunds. | Ensures accurate books. | Avoids tax surprises. |

| Inventory & COGS | Use software for sales, fees, and taxes. | Shows true profit. | Sets correct taxes. |

| Sales Tax | Handle state/provincial taxes. | Keeps you compliant. | Avoids penalties. |

| Automate | Review profit/loss, balance sheet, and cash flow. | Saves time, cuts errors. | Simplifies bookkeeping. |

| Close Books Monthly | Spot issues early. | Spots issues early. | Shows store performance. |

| Keep Records | Store receipts, invoices digitally. | Eases tax filing, audits. | Protects in audits. |

Case Study: Saving a Canadian Nonprofit with GST/HST Exemptions1

A Toronto nonprofit runs a Shopify store and sells $30,000 in fundraising gear. They charged $3,900 in HST by mistake because their CRA tax number is not set up correctly. Donors complain, and an audit becomes a real risk.

What we do: We check the GST/HST number with CRA’s tool. We fix the Shopify setup by tagging “Zero-Tax-CA” for tax-free sales and creating a “No-Tax Items” collection. We also help the nonprofit return the $3,900 HST to donors.

The result: The nonprofit avoids an audit. Exemptions apply automatically for future sales. Donors stay happy because the extra tax is refunded.

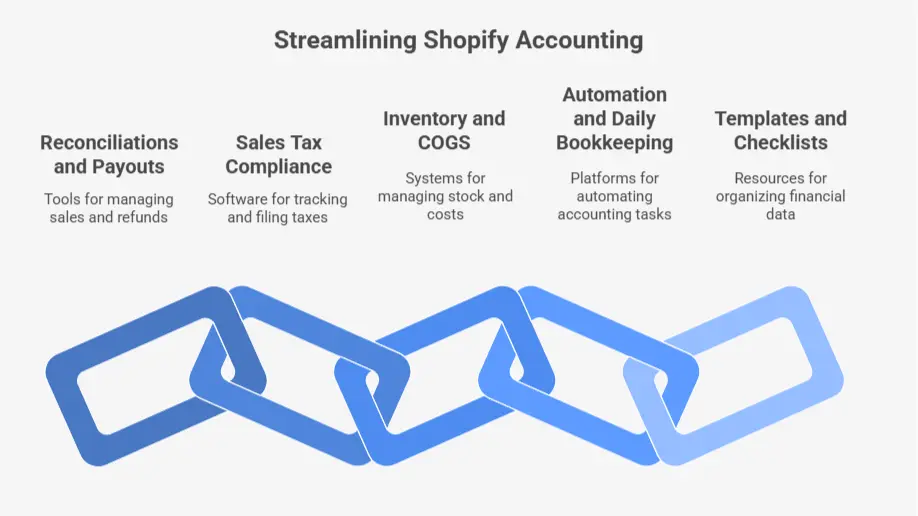

How to Put Shopify Accounting Best Practices Into Action with the Right Tools

Best practices only help if you can use them in real life. The right tools and templates make it easier to stay on top of your books without wasting hours. So you need to know the top accounting software for Shopify sellers in 2025. Here are some that connect directly to the practices we talked about:

1. For Reconciliations and Payouts

- A2X: Sends Shopify sales, refunds, and fees into QuickBooks or Xero. It makes reconciliation simple and keeps your clearing account accurate.

- Webgility: Connects Shopify with different accounting systems and payment processors. Webgility is good if you sell on more than one channel.

2. For Sales Tax Compliance

- Shopify’s tax settings – Handles basic GST/HST in Canada and state sales tax in the US. Works well for smaller stores. Check the difference between sales tax and use tax.

- TaxJar or Avalara – Tracks and files sales tax when your store grows or sells in many regions.

3. For Inventory and COGS

- Shopify Inventory: Built-in tool that works for small to mid-sized stores (Inventory management).

- Cin7 or QuickBooks Commerce: Better for larger sellers who need to track stock, bundles, and costs across channels.

4. For Automation and Daily Bookkeeping

- QuickBooks Online or Xero: Cloud accounting platforms that link directly with Shopify. They keep sales, expenses, and taxes in one place. Learn more about the Shopify integration with Xero and how it works.

- Finaloop: A newer tool that automates e-commerce accounting from end to end. Finaloop is good if you want less manual work.

5. For Templates and Checklists

- Chart of Accounts Template: Splits sales, refunds, fees, and taxes into clear accounts so you can follow best practice #1.

- Monthly Close Checklist: Reminds you to review profit and loss, balance sheet, and cash flow each month. Check out the month-end-close process and checklist for Shopify and e-commerce

- Expense Tracker: Helps you stay on top of shipping, packaging, and software costs.

Tools and templates do not replace best practices. They support them. They save time, cut down errors, and make sure your books show the real state of your Shopify store.

Shopify Finance Management: Best Accounting Reports and KPIs to Track

Shopify finance management helps your store make money. You need the best accounting practices for Shopify to watch your numbers and stay legal in the US and Canada.

Essential Reports

- Profit & Loss (P&L): Shows money from sales minus costs. Check it monthly to see profit changes.

- Cash Flow: Shows Shopify payouts versus costs like ads. Use Shopify’s Net Payments report.

- Sales Tax: Shows taxes you owe by state or province. Use TaxJar for Shopify sales tax filing. Learn more about the GST/HST return in Canada.

Key KPIs

- Gross Profit Margin: (Sales – product costs) / Sales x 100. Try for 40-60% to set good prices.

Example: You sell $10,000 in products. Your product costs are $6,000. That leaves $4,000 profit. Your gross margin is 40%.

- Inventory Turnover: Product costs / Average stock. Aim for 4-6 turns a year for smart Shopify inventory tracking.

Example: You hold $5,000 in stock on average. You sell $20,000 in a year. Your turnover is 4. You sell through your stock every 3 months.

- Customer Lifetime Value (CLV): Average buy times, how often, times, years. Go for 3x your ad costs (check CLV).

Example: An average order is $50. A customer buys 5 times a year for 2 years. That adds up to $500. If it costs $100 to get that customer, your ratio is 5:1.

Strong KPIs help you see where to cut costs and grow faster. Our accounting services for Shopify give you the tools and support to make it happen. The table below shows top Shopify reports and KPIs to track:

| Report/KPI | What It Shows | Why Track It | Benefit |

| Profit & Loss (P&L) | Sales minus costs. | Spots profit changes monthly. | Keeps profits clear. |

| Cash Flow | Payouts vs. costs like ads. | Shows money flow. | Avoids cash shortages. |

| Sales Tax | Taxes owed by state/province. | Ensures compliance. | Avoids tax penalties. |

| Gross Profit Margin | (Sales – product costs) / Sales x 100. | Checks pricing health. | Sets good prices. |

| Inventory Turnover | Product costs / Average stock. | Measures stock efficiency. | Prevents overstock. |

| Customer Lifetime Value (CLV) | Average buy x frequency x years. | Gauges customer value. | Guides ad spending. |

Case Study: Fixing Cash Flow with Shopify KPIs2

A U.S.-based Shopify store makes $100,000 a year selling home goods. Sales look strong, but the owner runs out of cash. Reports explain why. Gross margin is 50%, but contribution margin drops to 30% after shipping and ads. Inventory turnover is only 2, so stock sits for six months before it sells.

What we do: We raise prices on low-margin products. We cut ad spend on weak campaigns. We improve inventory planning so stock moves faster.

The result: Cash flow improves in two months. The store frees up $15,000 in inventory, shortens the cash cycle, and has more money ready for growth.

Final Thoughts

The best accounting practices for Shopify keep your store organized and your books clear. They help you avoid tax problems and show the real profit of your business. When you track sales, check payouts, manage inventory, and review reports, you stay in control of your money. Tools and templates make the work faster, but steady habits keep your store safe.

If you need help with Shopify bookkeeping or cross-border tax in the US and Canada, contact us at SAL Accounting. We make accounting simple, keep you compliant, and help you save more profit.

FAQ: Your Shopify Accounting Questions Answered

Track sales and costs every day. Reconcile payouts and use TaxJar for taxes. These Shopify accounting tips keep your books right for US and Canadian stores

QuickBooks Online and Xero work great with Shopify. They handle sales, fees, and taxes, making daily bookkeeping Shopify-style super easy for growing stores.

Use a chart of accounts to record sales, refunds, and costs daily. A2X automates this in your Shopify bookkeeping guide to match your bank.

Small stores can use QuickBooks to manage books. Get an accountant for tricky taxes or if your store grows fast.

Match total sales to bank deposits, subtracting fees and refunds. A2X automates this, so your Shopify accounting tips avoid mistakes.

Use apps like Cin7 for accurate Shopify inventory tracking. Manual tracking is okay for small stores, but it messes up when sales grow.