Selling a U.S. property as a Canadian in 2025 means handling tax requirements like capital gains and reporting. U.S. tax rules can surprise you. Canadians grabbed 25% of foreign home sales in the U.S. from April 2023 to March 2024, up from 11% the year before. That jump shows taxes are crucial.

This roadmap from SAL Accounting makes selling your U.S. real estate easy. You get simple steps, real examples, and pro tips. Let’s dive into the essentials to make your sale a success.

Quick Takeaways

- Pay U.S. capital gains tax, 15% FIRPTA withholding, and Canadian tax on half your profit.

- File Form 8288-B before closing to reduce FIRPTA withholding for sales under $300,000.

- Notify CRA with Form T2062 within 10 days to avoid fines and get clearance.

- Main home exemptions can save taxes but are tough for Canadians with U.S. homes.

- List upgrades and time CAD conversions to cut taxes and boost profits.

Do Canadians Pay Taxes When Selling Property in the U.S.?

Yes, selling property in the U.S. as a Canadian means paying taxes in both countries. Here’s what you pay:

- U.S. Capital Gains Tax: Pay up to 20% on your sales profits.

- U.S. Withholding Tax: The U.S. holds 15% of the sale price under FIRPTA, but you get a refund if overpaid.

- Canadian Capital Gains Tax: Canada taxes half your profit, reported to the CRA.

Our real estate tax accountant can simplify these rules and save you money. More details about taxes are coming up. Stay tuned!

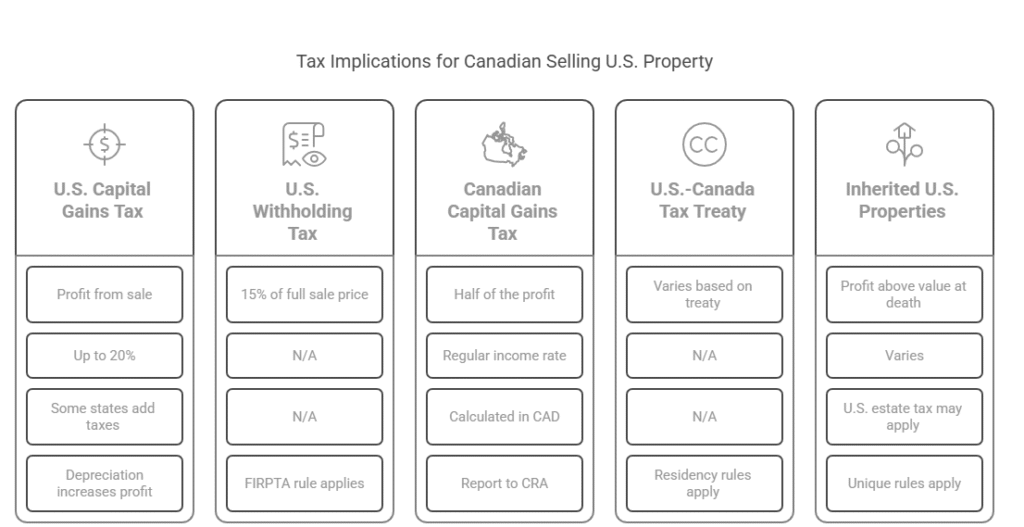

Tax Implications for Canadians Selling U.S. Property

You owe taxes in both the U.S. and Canada when you sell your U.S. home. Don’t worry. It’s pretty simple once you get the basics. Here’s the tax breakdown for your U.S. property sale:

U.S. Capital Gains Tax

You pay tax on the profit from your U.S. property sale, sale price minus what you originally paid when buying your U.S. property as a Canadian, plus fix-ups like a new deck. The rate can reach 20%, based on how long you have owned it. For rentals, depreciation claimed increases your taxable profit. Some states, like California, add their own taxes; others, like Florida, don’t.

Example: John sells his rental condo in California. He bought it years ago, made upgrades, and claimed depreciation. Here’s the tax breakdown:

- He buys for $200,000, adds $20,000 in fix-ups, claims $10,000 depreciation, and sells for $350,000.

- Profit = $350,000 – $200,000 – $20,000 + $10,000 = $140,000

- Federal tax at 20% = $140,000 × 0.2 = $28,000

- California’s state tax at 13.3% = $140,000 × 0.133 = $18,620

Pro Tip: Use a tax app to track depreciation on rentals yearly. This keeps your records tight and avoids surprises when calculating your profit (check IRS Publication 515)

U.S. Withholding Tax

The U.S. holds back 15% of the full sale price, not just your profit. They call it FIRPTA, a rule for foreign sellers. It’s not your final tax. It’s like a deposit. If your actual tax is lower, you get a refund. Many Canadians receive refunds this way.

Example: Sarah sells her Arizona vacation home. The sale goes smoothly. Here’s the tax breakdown:

- Sale price = $300,000. U.S

- withholds 15% = $300,000 × 0.15 = $45,000

- Actual tax = $20,000. Refund = $45,000 – $20,000 = $25,000.

Pro Tip: Estimate your actual tax early using online calculators. This helps you predict your FIRPTA refund and plan your cash flow.

Canadian Capital Gains Tax

Canada taxes half of your profit since you report all income to the CRA (Source). You convert your U.S. profit to Canadian dollars, which can shift what you owe. Canada taxes that half at your regular income rate. Report it to avoid penalties.

Example: Ahmed sells his U.S. property and makes a profit. He needs to report it to Canada.

Here’s the tax breakdown:

- U.S. profit = $100,000 converts to $140,000 CAD

- Taxable = $140,000 ÷ 2 = $70,000

- Tax at 30% = $70,000 × 0.3 = $21,000

Pro Tip: Track exchange rates daily for a month before reporting to the CRA. Picking a high CAD Day for conversion lowers your taxable profit.

The table lists taxes for Canadian U.S. property sales, with rates and tips:

| Tax | What It Is | Rate | Tip |

| U.S. Capital Gains | Tax on house sale profit. | Up to 20%, plus some state taxes. | List upgrades to lower taxes. |

| U.S. Withholding (FIRPTA) | 15% of sale price held by IRS. | 15% of sale price, refundable. | File Form 8288-B to cut withholding. |

| Canadian Capital Gains | Half your profit taxed by CRA. | Half profit at income rate, in CAD. | Use high CAD rates to save. |

Tax Considerations for Inherited U.S. Properties

Selling an inherited U.S. property has unique tax rules, but they’re simple. The U.S. sets the property’s value at the owner’s death. You pay tax only on profit above that. In Canada, the estate pays tax on gains up to the death date. You report any extra profit to the CRA, with half taxed at your rate. U.S. estate tax skips most Canadians unless the estate tops $13.6 million in 2025.

Example: Alex inherits a Colorado cabin worth $400,000 in 2024, bought for $150,000. He sells for $410,000. Here’s the tax breakdown:

- U.S. gain = $410,000 – $400,000 = $10,000. U.S. tax at 20% = $2,000.

- Canadian estate gain = $400,000 – $150,000 = $250,000

- Alex’s gain = $10,000, half ($5,000) taxed at his rate

Pro Tip: Find old property records to verify the original purchase price. It helps set your Canadian tax basis accurately.

- Read More: “How to Open a US Bank Account as a Canadian”

Step-by-Step Process for Canadian Selling Real Estate in the U.S.

As a Canadian with a U.S. property to sell, you’ll need to prepare for taxes, paperwork, and cash transfers. These six steps simplify the process and help you save more money. Let’s dive in:

1.Grab Your ITIN

Start by getting a U.S. tax ID, called an ITIN. It lets you file taxes since you’re not a U.S. resident. Send an application with your ID, like a copy of your passport, to the IRS. It takes 6–10 weeks, so don’t wait. Without an ITIN, you can’t file taxes or claim refunds for overpaid withholding.

Pro Tip: Apply for your ITIN right after deciding to sell. Starting early avoids rush fees for expedited ID verification.

2.Fix Up Your Property

Get your property ready for buyers. Choose a U.S. realtor familiar with Canadian sellers to price it right. Inspect for issues like leaks and fix them early. Track your cost basis, what you paid plus upgrades like a new kitchen. Save receipts for flooring or paint to lower taxes.

3.Handle Withholding

The U.S. withholds 15% of the sale price for foreign seller taxes. It’s a deposit, not your final tax. Refunds apply if your tax is lower. For sales under $300,000 with the buyer living there, request less withholding from the IRS before closing.

Pro Tip: Request a withholding certificate online via IRS e-services. It’s faster than paper forms and speeds up exemption approval.

4.File Your U.S. Taxes

After selling, file a U.S. tax return to report your profit. This calculates your capital gains tax, up to 20% on what you earned. If that’s less than the withheld amount, you get a refund. Check if the state adds its own tax (some do, others don’t). List upgrades to lower your profit. File by June 15 next year.

5.Tell the CRA

Notify the CRA about your U.S. sale within 10 days of closing to get a clearance certificate and avoid extra withholding. Report half your profit as taxable income on your Canadian return, converted to CAD, which exchange rates can shift. Miss the deadline, and you face penalties.

Pro Tip: File your CRA sale report electronically via My Account. It’s quicker than mail and reduces penalty risks if delayed.

6.Move Your Money

When the sale’s done, shift your cash to Canada. Use a service like MTFX to swap U.S. dollars for Canadian ones at a solid rate. Exchange rates shift, so time it right or lock in a rate to avoid losing cash. Check your bank for fees or limits. Keep records for taxes. Learn more about tax implications for Canadians owning U.S. property.

U.S. Property Tax Rules for Canadian Sellers + Forms

You need a few forms to keep your U.S. property sale in compliance with the IRS and CRA. These stop trouble and help you secure refunds. Here’s what you got to do.

- Form W-7 (ITIN): Form W-7 gets you a U.S. tax ID (ITIN) for filing taxes and refunds. Send it with your ID to the IRS. Takes 6–10 weeks.

- Form 8288 (Withholding): Form 8288 reports the 15% tax withheld at closing. The buyer’s agent files it.

- Form 8288-B (Exemption): Form 8288-B cuts withheld tax if your sale’s under $300,000 and the buyer lives there. File before closing.

- Schedule 3 of Your T1 (Canadian Personal Tax Return): File Schedule 3 of your T1 by April 30 of the following year.

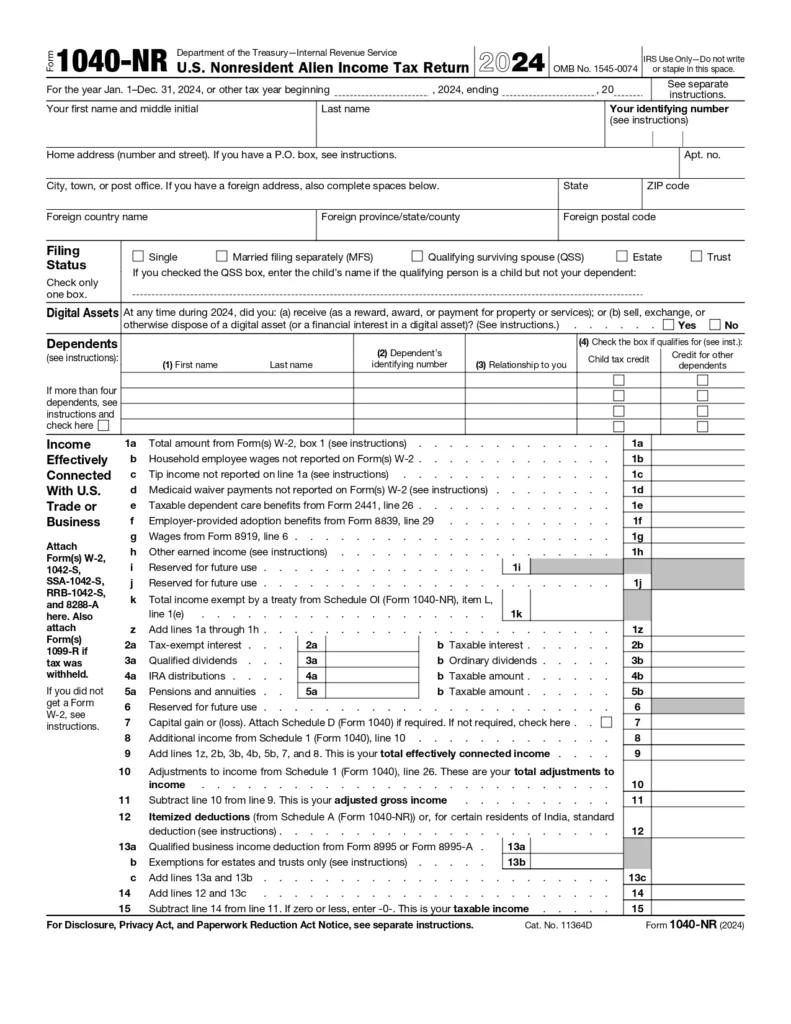

- Form 1040-NR (U.S. Taxes): Form 1040-NR shows your profit and gets refunds. File by June 15 next year. Below, you can check the form:

The table lists forms for Canadians selling U.S. property, with deadlines.

| Form | Purpose | Who Files | Deadline |

| W-7 | Gets ITIN for U.S. tax filing. | Seller | 6–10 weeks before taxes. |

| 8288 | Reports 15% FIRPTA withholding. | Buyer’s agent | At closing. |

| 8288-B | Requests withholding exemption (<$300,000 sale). | Seller | Before closing. |

| T2062 | Notifies CRA of sale for clearance. | Seller | Within 10 days of closing. |

| 1040-NR | Reports profit, calculates capital gains tax. | Seller | June 15 next year. |

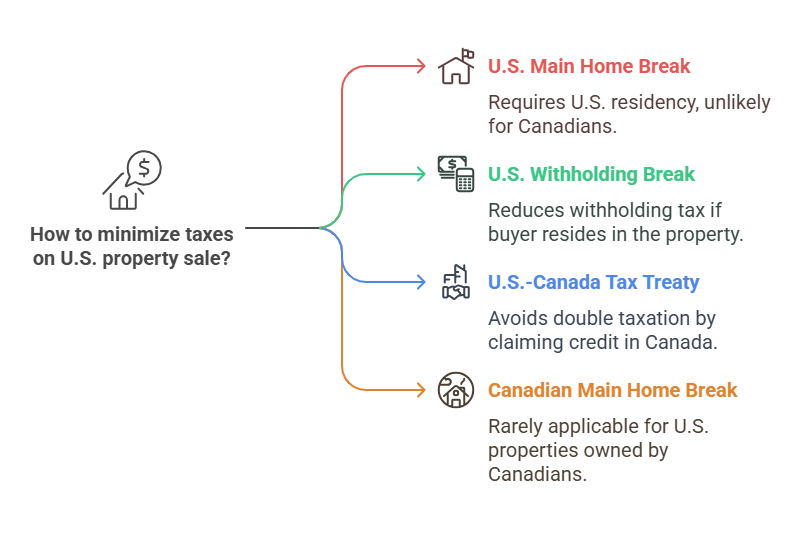

Exemptions for Selling Property in the US as a Canadian

These tax breaks help Canadians save money on their U.S. property sale by reducing taxes in the U.S. and Canada. Here’s the scoop for Canadians:

U.S. Main Home Break

The U.S. skips up to $250,000 in profit taxes if the property is your main home. You must live there for 2 or 5 years. It’s tough for Canadians, who usually live in Canada, so this break is rare. Selling a $400,000 Arizona condo with a $150,000 profit likely won’t qualify unless it’s your primary home.

U.S. Withholding Break

You can reduce the 15% U.S. withholding tax on your sale price. Sell under $300,000 with the buyer living there, and you might owe less or nothing. Request from the IRS before closing. A $250,000 sale saves $37,500.

Pro Tip: Check the buyer’s residency plan with a signed letter before closing. It strengthens your Form 8288-B request to cut withholding.

U.S.-Canada Tax Treaty

To avoid paying taxes twice, you can benefit from withholding taxes under the U.S.-Canada Tax Treaty. You claim a tax break in Canada for U.S. taxes, like 20% capital gains. Snowbirds, watch out! Over 183 U.S. days a year makes you a U.S. tax resident, messing with filings. Use the Bank of Canada’s sale date rate for CAD conversions to cut CRA taxes.

Pro Tip: Track your U.S. days in a notebook. It proves you’re a Canadian resident and avoids tax residency issues.

Canadian Main Home Break

Canada waives tax on profit if the property was your main home, requiring most-time residency (CRA’s principal residence). U.S. properties rarely qualify for Canadians living in Canada. A $200,000 profit could be tax-free if eligible.

Save on taxes for your U.S. property sale by consulting our cross-border tax accountant at SAL Accounting today.

Case Study: Toronto Couple’s Withholding Fix

Problem: Linda and Tom, a Toronto couple, sold their Nevada condo for $295,000. They contacted us when the $44,250 FIRPTA withholding risked their down payment for a new home, unaware of exemptions.

What We Did: We suggested confirming the buyer’s intent to live there and filing Form 8288-B online before closing to request a withholding reduction.

The Result: The IRS cut their withholding to $6,000. Their actual tax was $5,500, yielding a $500 refund. They saved $38,250 for their home purchase.

- Read More: “Factual vs. Deemed Residency for Taxes in Canada”

Avoiding Mistakes for Canadian Selling Real Estate in the U.S.

Nobody wants to mess up selling their U.S. property. These five mistakes can cost you cash or stress. Here’s how Canadians avoid them:

- Waiting on Your ITIN: You need a Form W-7 ITIN to file U.S. taxes and get refunds. Apply early. It takes 6–10 weeks. A late ITIN delays your cash.

- Missing CRA Deadlines: File Form T2062 with the CRA within 10 days of your sale. Missing it brings fines or tax holds.

- Messing Up Cost Basis: Your cost basis is what you paid plus upgrades, like a new patio. Miscalculate it, and you pay higher taxes. Keep receipts.

- Skipping the Withholding Break: You can reduce the 15% U.S. withholding tax with Form 8288-B if the sale’s under $300,000 and the buyer lives there. Don’t miss this.

- Bad Exchange Rate Timing: Converting U.S. dollars to CAD at a poor rate cuts your profits. Time your currency swap carefully.

Case Study: Montreal Artist’s CRA Crunch

Problem: Sophie, a Montreal freelance artist, sold her Oregon cabin for $200,000. Caught up in a mural project, she nearly missed the CRA’s 10-day deadline. She called SAL Accounting, worried about a $2,500 penalty, and withheld funds.

What We Did: We suggested filing Form T2062 fast through CRA’s My Account and adding an email alert for tax deadlines.

The Result: Sophie skipped the $2,500 fine and kept her profit. The email alert kept her art gigs on track.

Stay ahead of tax rules for your U.S. property sale by exploring our accounting and tax services. They keep errors at bay.

Final Thoughts

Selling U.S. property as a Canadian takes skill to boost your profits. You’ll tackle U.S. capital gains, withholding, and Canadian taxes. This guide covers the steps, tax breaks, and mistakes to avoid. Stay on top of tax rules to save cash.

Struggling with the taxes? SAL Accounting offers expert help. Contact us for a free consultation to handle your U.S. property sale with confidence.

Frequently Asked Questions (FAQs)

Yes, you pay U.S. capital gains tax (up to 20%), 15% FIRPTA withholding, and Canadian tax on half your profit.

You file Form W-7 for an ITIN, Form 8288-B for withholding cuts, Form 1040-NR for U.S. taxes, and Form T2062 for CRA.

No, the U.S.-Canada Tax Treaty gives you a Canadian tax break for U.S. taxes paid.

Yes, you need an ITIN to file U.S. taxes and get FIRPTA refund money.

You file Form 1040-NR by June 15. The IRS sends refunds after processing.

Yes, use MTFX to change U.S. dollars to Canadian and send them to your bank.

Yes, you file Form T2062 within 10 days to avoid CRA fines.