Choosing the right setup for your business is crucial. It impacts your taxes, personal liability, and growth opportunities. A good choice can save you money and protect your personal assets, while a bad one can lead to extra costs or legal issues.

Here’s the good news: you have proven options. Most small businesses in the U.S. choose LLCs (43%), S Corps (30%), or traditional corporations (18%) because they balance flexibility with protection. This guide will help you figure out which one fits your business best.

This guide from SAL Accounting is for new or small business owners looking to understand LLCs, LLPs, and S Corps. We’ll break down their differences in liability, taxes, and ownership to help you decide.

Key Takeaways

- They’re different things – LLC and LLP are business types formed with your state. S Corp is a tax option filed with the IRS.

- LLCs work for most businesses – Easy setup, flexible ownership, good protection. Best under $80K profit/year.

- LLPs are for professionals only – Required in many states for lawyers, accountants, architects. Protects you from partners’ mistakes.

- S Corp cuts your tax bill – Saves ~$6K+ yearly on self-employment tax when profits hit $60K-$80K. Needs payroll and more paperwork.

- Start LLC, add S Corp later – Begin with LLC for simplicity, switch to S Corp tax status once profits justify the costs.

Understanding the difference between LLC and LLP and S Corp is needed for finding the best business structure for small business owners. Let’s break down each option.

What Are the Differences Between LLC, LLP, and S Corp?

To understand the difference between LLC and LLP and S Corp, let’s break down each structure.

1. Limited Liability Company (LLC)

An LLC is a business structure that protects its owners (called “members”) from being personally responsible for business debts. It combines the liability protection of a corporation with the simplicity and tax benefits of a partnership.

Key Features

Legal Protection: Your personal assets, like your home or savings, are safe from business debts and lawsuits.

Taxation:

- If you’re the only owner, the IRS treats your LLC like a sole proprietorship.

- If there are multiple owners, it’s taxed like a partnership.

- You can also choose to have your LLC taxed as an S Corp to save on taxes.

Formation: To start an LLC, you file “Articles of Organization” with your state.

Pro Tip: LLCs are great for small businesses that want flexibility and protection without too much paperwork.

2. Limited Liability Partnership (LLP)

An LLP is a type of partnership designed for professionals like lawyers, accountants, or architects. It protects each partner from being responsible for the mistakes of others.

Example: A group of lawyers might form an LLP so they can work together while protecting themselves from liability if one partner makes a mistake.

Key Features

Ownership: The owners are called “partners.”

Requirements:

- You need at least two partners to form an LLP.

- In some states, LLPs are only for licensed professionals.

Taxation: Profits and losses go directly to the partners’ personal tax returns.

Pro Tip: If you’re a licensed professional, check your state’s rules to see if an LLP is the right choice.

3. S Corporation (S Corp)

An S Corp isn’t a type of business but a special tax status. It lets businesses pass their income, losses, and deductions directly to their owners’ personal tax returns.

Key Features

Tax Benefits: Avoid “double taxation” from regular corporations and reduce self-employment taxes for LLC owners.

Formation:

- First, create an LLC or a C Corporation.

- Then, file IRS Form 2553 to elect S Corp status.

Requirements: Maximum 100 shareholders (must be U.S. citizens or residents) and only one class of stock allowed (read more here).

Pro Tip: If your business makes over $80,000 in profit each year, switching to an S Corp could save you money on taxes.

Need help with US business formation and tax elections? Our US Canada cross border tax accountants handle everything from entity setup to IRS filings.

How Do LLCs, LLPs, and S Corps Protect Your Assets?

All three structures offer legal protection, but the level of protection differs. Limited liability keeps your personal assets separate from your business debts.

| Feature | LLC | LLP | S Corp |

| Protection from Business Debts | Members’ personal assets are safe. | Partners usually protected, but not always. | Shareholders’ personal assets are safe. |

| Protection from Co-Owner Negligence | Members aren’t responsible for each other’s actions. | Partners not liable for other partners’ mistakes. | Owners not liable for company debts or actions. |

| Key Vulnerability | Lose protection if you mix business and personal money. | Still responsible for your own mistakes. | Lose protection if you don’t follow rules. |

Tip for Professionals: No matter your business type, professional liability insurance is a must. It protects you from personal risk caused by professional mistakes or negligence.

Tax Differences: LLC vs LLP vs S Corp Explained

Understanding the tax differences LLC vs LLP vs S Corp can save you thousands. Below, we’ll cover S Corp taxation explained in detail, plus how LLC and LLP taxes work.

LLC and LLP Taxes

As an owner of an LLC or LLP, you typically pay a 15.3% self-employment (SE) tax on all business profits. This tax covers Social Security and Medicare.

How it works:

Single-owner LLCs report business income on Schedule C with their personal tax return. LLCs and LLPs with multiple owners use Forms 1065 and Schedule K-1.

Pro Tip: If you actively work in your business, you pay SE tax on all net profits. So, a $100,000 profit means you’ll owe $15,300 in SE tax alone. Also check our tax deduction checklist to reduce your taxable income before calculating SE tax.

S Corp Taxes

Choosing S Corp taxation can lower your SE tax bill. As an owner who works in the business, you are also an employee and must pay yourself a “reasonable salary.”

- Your Salary: Your salary is taxed like a normal employee’s paycheck (W-2), with payroll taxes (similar to the 15.3% SE tax) split between you and the business.

- Your Distributions: Any profits left after paying your salary can be taken as “distributions,” which are not subject to self-employment tax.

Important: The IRS requires your salary to be reasonable. Paying yourself too little to avoid taxes can lead to audits and penalties.

Example: LLC/LLP vs. S Corp Tax Savings

The S Corp vs LLC comparison for taxes shows big savings. When you look at S Corp vs LLC for taxes, the difference is clear. Let’s compare taxes on a business with $100,000 in profit and a $60,000 salary.

| Entity | Income Taxed for SE | SE Tax Rate | SE Tax Paid |

| LLC/LLP | $100,000 (Full Profit) | 15.3% | $15,300 |

| S Corp | $60,000 (Salary Only) | 15.3% | $9,180 |

| Savings | N/A | N/A | ~$6,120 |

With an S Corp, you save about $6,120 a year by not paying self-employment tax on distributions.

This example doesn’t include income tax, just the SE tax savings.

When to Choose S Corp Status?

S Corp isn’t for everyone, especially new or low-profit businesses. Extra costs for payroll and complex tax filings (around $2,000–$3,000 yearly) can cancel out tax savings.

Pro Tip: S Corp usually makes sense when your business profit is consistently over $60,000–$80,000 a year. For smaller businesses, sticking with an LLC or LLP is often cheaper. Work with our small business tax accountant to determine your break-even point for S Corp conversion.

How Do Ownership and Management Differ in LLC vs LLP vs S Corp?

Your choice of business type decides who can own it and how it should be managed, including any ownership rules.

| Feature | LLC | LLP | S Corp |

| Maximum Owners | Unlimited | Unlimited | 100 Shareholders |

| Foreign Owners | Allowed (Non-U.S. citizens) | Allowed (State-dependent) | Prohibited (Must be U.S. citizens/residents) |

| Entity Owners | Allowed (Corporations, other LLCs) | Allowed | Prohibited (Cannot be owned by companies) |

Canadian entrepreneurs looking to form a US LLC? See our 6-step guide for non-residents to open LLC.

When comparing LLP vs LLC, LLCs are more flexible. The difference between limited liability partnership vs limited liability company is simple: LLCs let you have unlimited owners from any profession, which makes LLC vs LLP vs S Corp for startups a key choice if you want to grow.

What About Management and Profit Sharing?

Here’s how management and profit sharing work for each:

- LLC: Flexible. Owners can manage it themselves or hire managers. Profit sharing is based on an agreement, not ownership percentage.

- LLP: Partners share management and decide how to split profits in their agreement.

- S Corp: Requires a formal setup with a Board of Directors. Profits and losses are split based on ownership percentage.

What Are the Compliance Requirements for LLC, LLP, and S Corp?

The amount of paperwork and rules you need to follow changes how much time and money you spend running your business.

LLC and LLP are Simpler

LLCs and LLPs are easier to run than corporations. You usually just need to file a yearly report and pay state fees. It’s also smart to have an operating agreement (for LLCs) or a partnership agreement (for LLPs) to keep things clear among the owners.

S Corp is More Complex

S Corps have strict rules if you want to keep their tax breaks and protection from personal liability. This means you have to:

- Write down company rules (bylaws).

- Give out shares to owners.

- Have yearly meetings for the board and shareholders.

- Keep good records of these meetings.

Because of these rules, S Corps cost more to run. You’ll have extra expenses like employee salaries and needing special tax help.

Read our guide about bookkeeping tools for small business owners in Canada to simplify S Corp compliance.

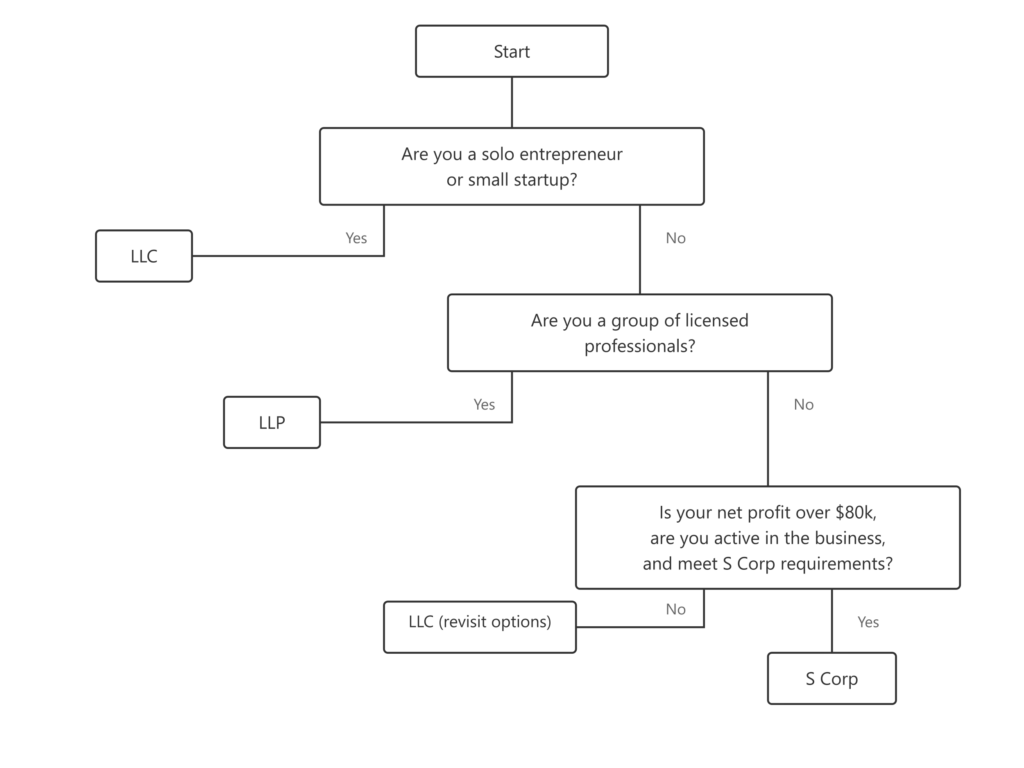

LLC vs LLP vs S Corp: Which Structure is Right for You?

So, which structure is right for your business? It really comes down to what you’re trying to achieve and how much money you expect to make. Here’s a quick checklist to help you decide.

LLC

I’m a solo entrepreneur or small startup owner.

I want a simple setup and strong asset protection.

My profits are under $80,000 a year.

I need flexible ownership options (e.g., international partners).

I want to split profits in a way not tied to ownership.

LLP

I’m a licensed professional (e.g., lawyer, accountant, architect).

My state requires an LLP or PLLC for my profession.

I want protection from my partners’ malpractice claims.

S Corp

My business earns over $80,000 a year.

I want to lower my self-employment taxes.

I meet the ownership rules (100 or fewer U.S. shareholders).

I’m okay with managing corporate formalities like meetings and payroll.

The Most Common Option

Most new business owners start with an LLC. It’s easy to manage and protect your personal assets. Once your business is making over $80,000 a year, you can switch to an S Corp for tax purposes. This strategy saves you money on taxes while keeping things simple.

Conclusion

Choosing between an LLC vs LLP vs S Corp is a big decision that affects your business for years. Finding the best business structure for small business means looking at the pros and cons LLC LLP S Corp each offer. When thinking about the difference between LLC and LLP and S Corp, consider how you want to run your business, your growth plans, your comfort with risk, and how much paperwork you can handle.

Rules and taxes vary by state, so what works for one business might not work for another. It’s always smart to talk with a tax expert or business attorney before making your final choice. Our bookkeepers in Toronto can guide you through the process.Need help deciding? Contact us for a free consultation!

For most small businesses, starting with an LLC is easier and more flexible. If your profits go over $60,000–$80,000 each year, you can choose S Corp tax status to save on taxes.

Yes! This is a common approach. By filing Form 2553 with the IRS, an LLC can be taxed as an S Corp. You get S Corp tax benefits but still keep the simplicity of an LLC.

No. An LLP is built for licensed professionals who want to protect themselves from their partners’ mistakes. An LLC is more flexible and works for many types of businesses. The difference between an LLP and an LLC is pretty big.

If your business is making good money, an S Corp usually helps you save more on taxes because you pay less self-employment tax. But if your profits are lower, an LLC is easier and cheaper to run.

It depends on your job. For licensed professionals like lawyers or accountants, some states require you to use an LLP so you’re protected from your partners’ mistakes. An S Corp is mainly about saving on self-employment taxes.

No. An LLP needs at least two partners. If you’re on your own, you’d start a single-member LLC instead.

You don’t have to change your LLC to a different business type. You just fill out IRS Form 2553 to be taxed as an S Corp. Legally, you’re still an LLC, but for taxes, you get the S Corp benefits.