If you run a US business as a non-US resident, IRS Form 5472 is something you need to handle. It’s not the most exciting part of owning a company, but it’s important for staying compliant with the IRS. This form tracks transactions, such as payments or services, between your US business and foreign owners or related parties, like family or overseas partners. Make a mistake, and you could face big fines.

This blog explains what Form 5472 is, who needs to file it, and how to complete it step by step. It also covers deadlines, common errors to avoid, penalties, and real-world examples to make everything clear. By the end, you’ll know how to manage it or when to get help from SAL Accounting experts.

Disclaimer: This blog is for informational purposes only and is not tax advice. SAL Accounting is not responsible for any forms filed based on this guide. Consult a tax professional to ensure accurate Form 5472 filings.

Quick Takeaways

- What’s Form 5472? A report for transactions between a US business and foreign owners or related parties.

- Who files it? US businesses with 25% or more foreign ownership, foreign corporations in the US, and foreign-owned single-member LLCs.

- When’s it due? Usually April 15 with your tax return, but you can extend it with Form 7004.

- Why care? Missing it or getting it wrong costs $25,000 per form, with more fines possible.

- Key tip? File a separate form for each related party. Don’t combine them.

What Is Form 5472 Used For?

Form 5472 is the IRS’s way to keep track of transactions between your US business and foreign owners or partners. It covers cash payments and non-money deals, like services, to ensure no one avoids taxes through unfair pricing or hidden profits. The Tax Cuts and Jobs Act of 2017 made the rules stricter, requiring foreign-owned LLCs to file and increasing penalties for errors. Filing it correctly shows your business is open and follows the law.

Pro Tip: Think of Form 5472 as a transparency checklist. Lay out all your foreign dealings to avoid problems later.

Form 5472 Requirements: Who Needs to File?

Not every business has to deal with Form 5472. It’s only for those with some foreign ties. Here’s who needs to file:

- US Corporations with 25% Foreign Ownership: If someone from outside the US owns 25% or more of your company’s stock, whether by vote or value, you’ve got to file. The IRS has rules to figure out ownership, so even shares through others count.

- Foreign Corporations Doing Business in the US: If your company is based abroad but does business in the US and works with related folks, like a parent company or a sister firm, you need to file.

- Foreign-Owned Single-Member LLCs: Since 2017, if you’re a non-US resident with a US LLC that’s treated as a disregarded entity (meaning it skips separate taxes) you have to file when you’ve got deals with foreign owners or others.

Pro Tip: you need a separate Form 5472 for each person or group you deal with. For example, if your LLC pays you as the foreign owner and also pays your cousin, that’s two forms. Sometimes, just having a foreign owner means you file, even if there’s no activity.

You can skip it if you don’t have any reportable deals or if a US person already filed Form 5471 with Schedule M for the same party. If you’re thinking about starting a US LLC as a non-resident, check out our LLC services in USA for non-resident for tips.

➜ Read more: “How to Open an LLC in the US From Canada: A 6-Step Guide”

How to Fill Out Form 5472: Step-by-Step Instructions

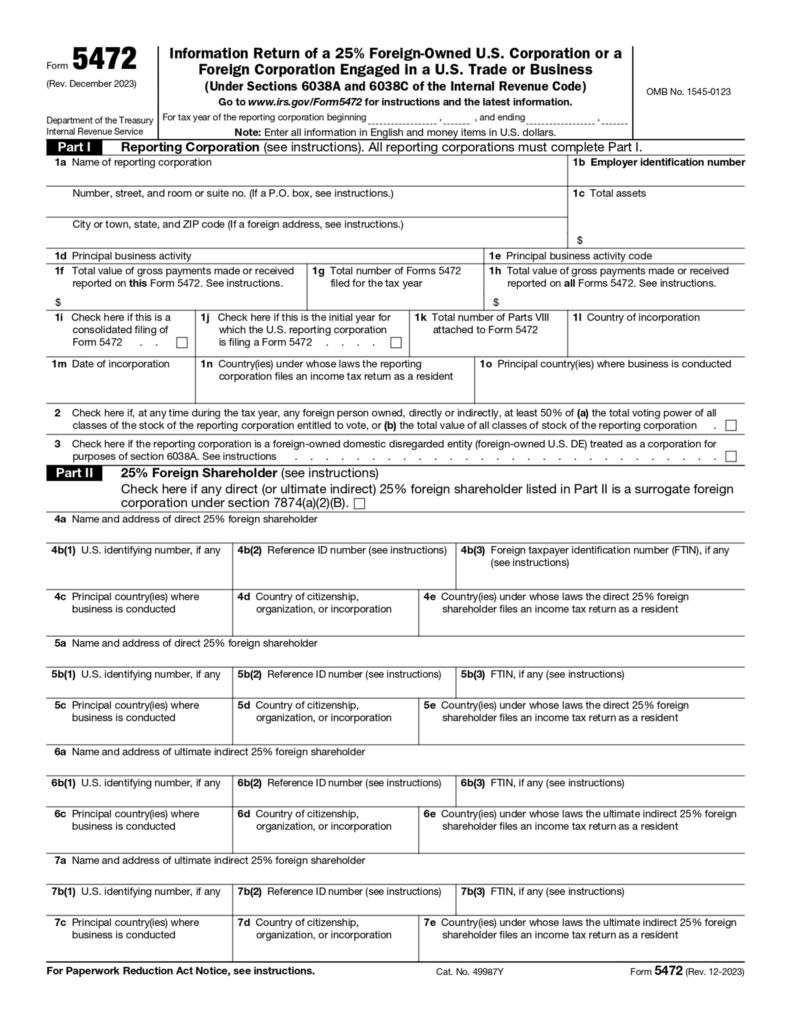

Form 5472 has nine parts, but you probably won’t need them all. Here’s how to complete it:

Step 1: Gather Your Documents

Having everything ready saves you from searching through files later. Collect these before you start:

- Your business’s Employer Identification Number (EIN).

- Names, addresses, and tax IDs, if any, of foreign owners or related parties.

- Records of all transactions, like payments, loans, or services, with dates and amounts.

🌟 Pro Tip: Use a spreadsheet to log transactions as they happen. It’s a lifesaver when filling out the form.

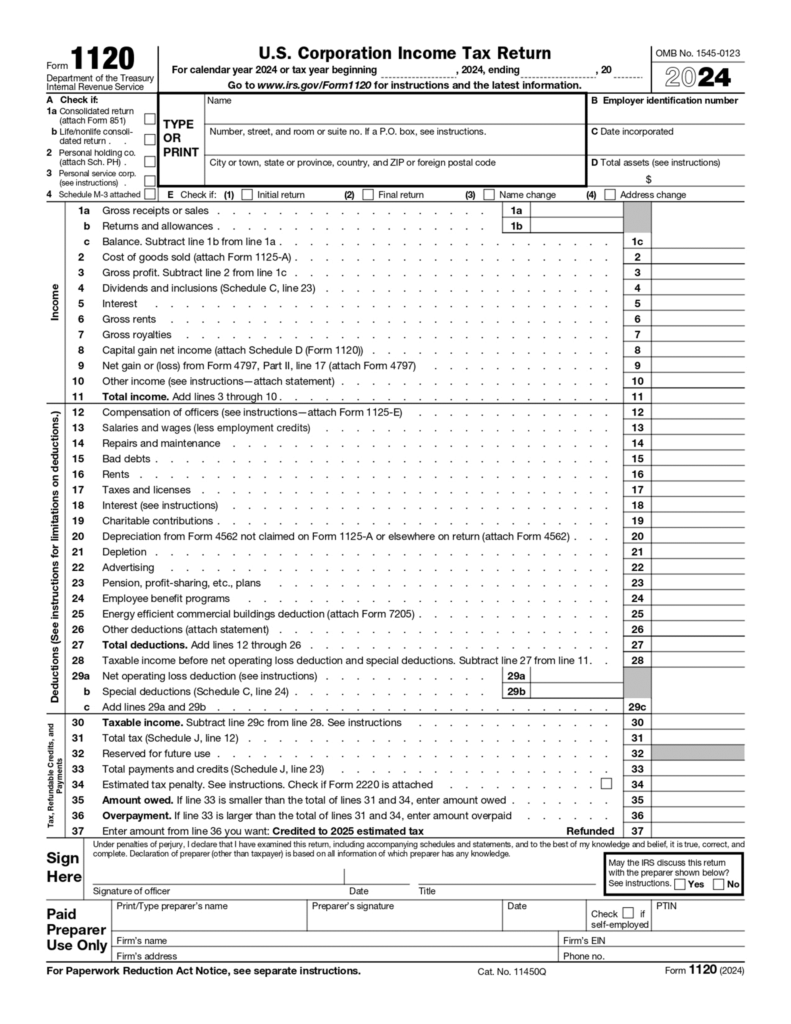

Step 2: Prepare a Pro Forma Form 1120 (For LLCs)

If you have a foreign-owned single-member LLC, you’ll attach Form 5472 to a pro forma Form 1120. It’s simple. Just add your business name, address, EIN, and check “Initial return” if it’s your first filing. Write “Foreign-owned U.S. DE” at the top and sign as “Owner.” You don’t need the full tax return.

Example: Ahmed, from Dubai, starts a US LLC in July 2025. He fills out the top of Form 1120 with his LLC’s name, EIN, and address, marks “Initial return,” and notes “Foreign-owned U.S. DE.” It takes him 10 minutes.

Step 3: Fill Out Part I – Reporting Corporation

Enter your business’s name, address, EIN, and what it does, such as “online retail.” Find your principal business activity code in the IRS instructions. Note your currency, usually US dollars, and check “initial return” if it’s new. For LLCs formed mid-year, include your start date, like “August 1, 2025.”

🌟 Pro Tip: Copy your EIN directly from your IRS letter to avoid mistakes.

Step 4: Fill Out Part II – 25% Foreign Shareholders

List up to two direct and two indirect foreign shareholders owning 25% or more. Include their names, addresses, US or foreign tax IDs if they have them, country of residence, and ownership percentage for voting power and value. If you have no shareholders at this level, skip it.

Step 5: Fill Out Part III – Related Parties

Name any foreign related parties, like owners, family, or affiliated companies, involved in transactions. Include their address, tax ID or a unique reference ID if they don’t have one, what they do, and their relationship to you, such as “parent company.” Clear details prevent confusion.

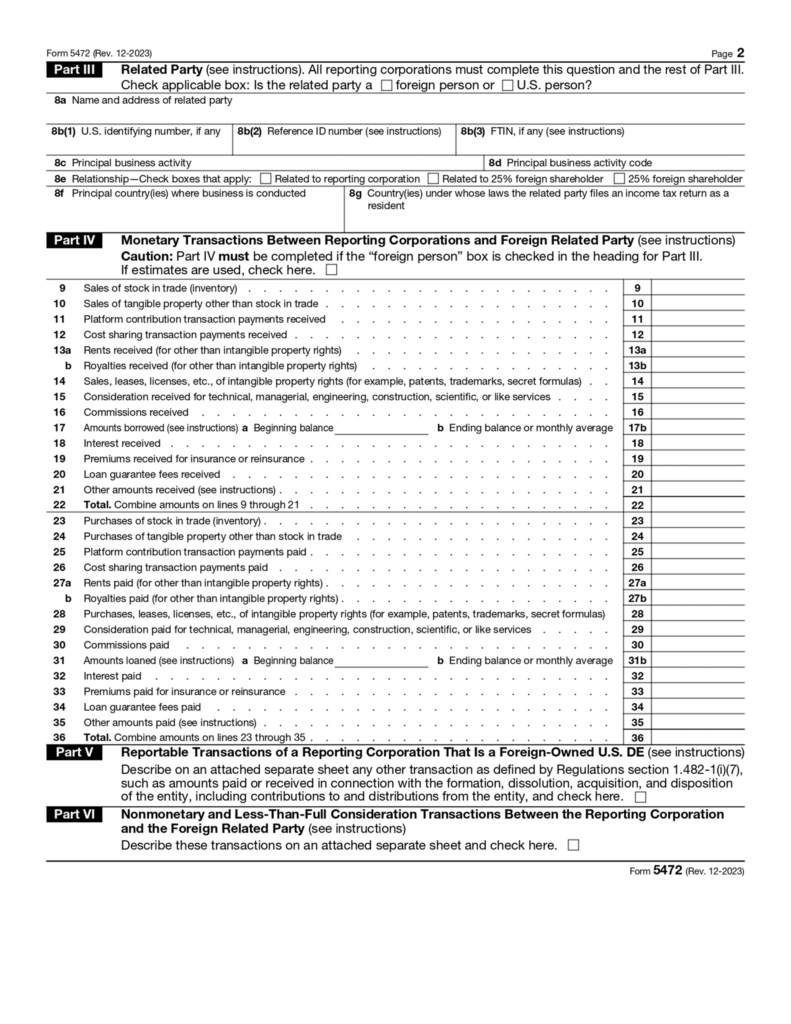

Step 6: Fill Out Part IV – Monetary Transactions

Report taxable or deductible money transactions, like paying for services or loan interest. Examples include sales, rents, or fees. If a transaction is $50,000 or less, you can write “$50,000 or less” instead of the exact amount. If you have no taxable deals, like non-taxable contributions, leave it blank.

Example: Priya’s US corporation pays her UK-based sister $2,000 for graphic design. She reports it in Part IV as “consideration for services” since it’s deductible. A non-deductible $5,000 loan from her sister goes elsewhere.

Step 7: Fill Out Part V – Disregarded Entity Transactions

For LLCs, list contributions, money in, or distributions, money out. Attach a statement, like: “Star LLC, a foreign-owned single-member LLC, reports $20,000 in contributions, including $150 formation fees, and $4,000 in distributions for 2025.” Include owner-paid fees, like state filings.

🌟 Pro Tip: Write your Part V statement in a separate document first. It’s easier to edit before attaching.

Step 8: Fill Out Part VI – Non-Monetary Transactions

Describe non-money deals, like “Foreign owner provided consulting from abroad.” Note the fair market value, such as “valued at $3,000.” Add a statement if it’s complex. If you have nothing to report, leave it empty.

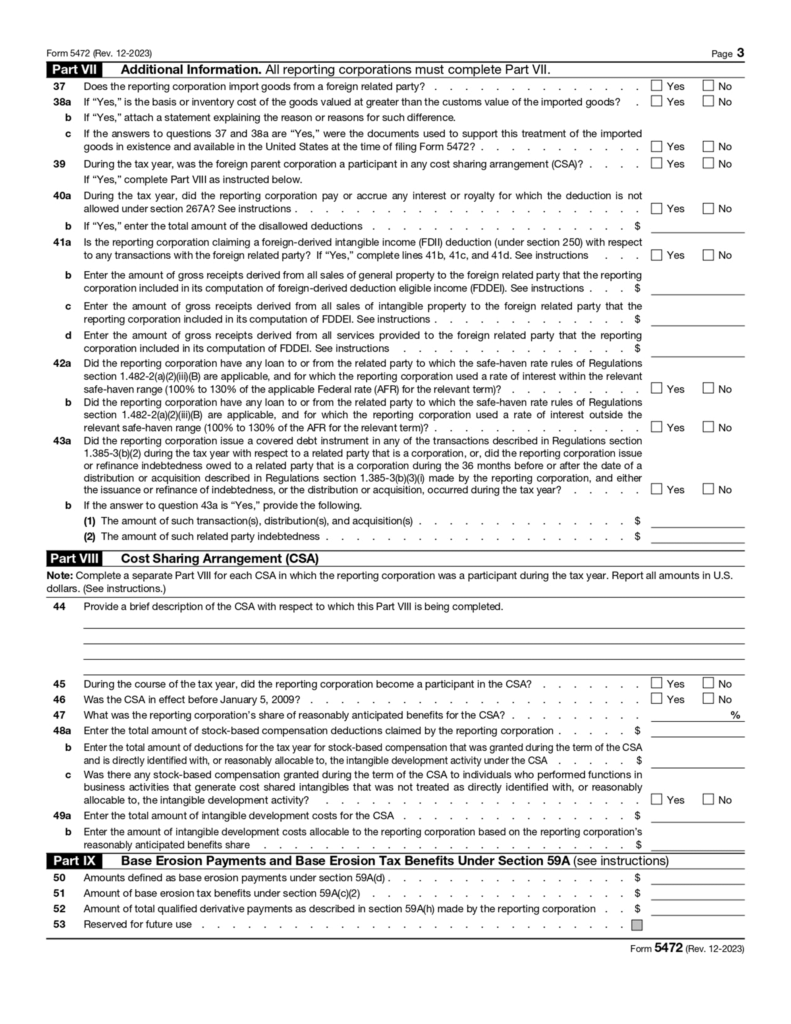

Step 9: Complete Parts VII–IX (If Needed)

These cover rare cases like cost-sharing deals or base erosion payments. Most filers won’t use them. Just answer “no” to the yes/no questions unless you’re certain they apply.

Step 10: Double-Check and Submit

Review every detail, names, numbers, descriptions, to catch errors. A small mistake can cause issues. Attach the form to your tax return or pro forma Form 1120 for LLCs and send it off.

🌟 Pro Tip: Read your form aloud. It helps spot errors or unclear phrases quickly.

Form 5472 Deadline: When to File

Form 5472 is due with your tax return, usually April 15 for calendar-year businesses. If your fiscal year ends June 30, it’s September 15 for tax years before 2026. New LLCs formed mid-year report from their start date to December 31.

If you need more time, file Form 7004 for a six-month extension. It covers Form 5472 but not tax payments, so pay any taxes owed by the original deadline.

You can’t e-file this form. You have two options:

- Mail it to Internal Revenue Service, 1973 Rulon White Blvd, M/S 6112 Attn: PIN Unit, Ogden, UT 84201

- Fax it to 855-887-7737. Faxing is faster, and you get a confirmation to keep.

🌟 Pro Tip: Fax your form a week before the deadline to avoid any last-minute delays.

Mistakes to Avoid When Filing Form 5472

Small mistakes can lead to big penalties. Here’s what to avoid.

1. Missing Transactions

Every deal counts, even a $10,000 contribution or a $200 filing fee you paid. Missing one can cause IRS scrutiny. Keep a log of all transactions year-round.

Example: Juan, from Mexico, forgets to report $300 he paid for his LLC’s state registration. The IRS notices, and he faces a $25,000 penalty. Writing everything in a notebook could have saved him.

2. Using Incorrect IDs

Using the wrong EIN or foreign tax ID can ruin your filing. For example, entering “FOREIGNUS” instead of a proper ID or a unique reference ID might lead to rejection. Always check numbers against your records.

3. Filing Late

Missing April 15, or your extended deadline, brings a $25,000 fine per form, even if your business had no profit. Set reminders or file Form 7004 early to prevent this.

4. Not Filing Separate Forms

Each related party needs its own Form 5472. If you work with your foreign owner and their sibling, that’s two forms, not one combined. Mixing them up causes problems.

5. Vague Descriptions

Parts V and VI need clear details. Instead of “services,” write “$1,000 bookkeeping by owner’s sibling.” Unclear entries can lead to IRS questions or fines.

6. Poor Record-Keeping

The IRS may ask for proof years later. Without contracts, bank statements, or receipts, you’re in trouble. Store records for seven years. Digital folders work well.

🌟 Pro Tip: Scan records into a secure cloud folder. It’s easier to find than a stack of papers.

Penalties for Not Filing Form 5472 (And How to Avoid Them)

The IRS takes Form 5472 seriously, and penalties are steep.

What You’ll Pay

Miss a form, file it late, or get it wrong, and you face $25,000 per form. If you ignore an IRS notice, it’s another $25,000 every 30 days with no limit. Costs grow quickly.

Form 5472 Penalty Abatement

You may avoid penalties with these options:

- First-Time Abatement (FTA): If you have a clean tax record with no prior fines, FTA has a 60-70% success rate. You must have filed all required returns.

- Reasonable Cause: Explain delays with proof, like a family emergency or incorrect tax advice.

- 2019-2020 Relief: The IRS offered automatic relief for late forms filed by September 30, 2022, under Notice 2022-36, not applicable now.

Keep records, financial statements, contracts, emails, for seven years to support any relief request.

🌟 Pro Tip: If you receive a penalty notice, respond within 30 days. Quick action improves your chances of relief.

➜ Read more: “US LLC Tax Problems for Canadians: How to Avoid Double Taxation”

Form 5472 vs. Form 5471: A Quick Note

Form 5472 tracks deals for foreign-owned US businesses, unlike Form 5471, which US people file for owning foreign corporations. It’s quicker to do, taking about 8-12 hours, compared to 20-40 hours for Form 5471’s detailed schedules. You might need both if your setup spans borders. Our US tax accounting specialists can determine which forms apply to your situation.

| Feature | Form 5472 | Form 5471 |

| Who Files | Foreign-owned US businesses | US persons with foreign corps |

| What’s Reported | Related-party transactions | Foreign corp ownership |

| Time Needed | 8-12 hours | 20-40+ hours |

Other Forms to Know

You might also run into Form 1120-F for US income if you’re a foreign corporation, or FBAR for foreign accounts over $10,000. Our cross-border tax accountants can figure out what’s needed for your business.

Form 5472 Examples: Real-World Scenarios

Seeing Form 5472 in action helps it make sense. This case study follows Sara, a small business owner from Germany, and how SAL Accounting helped her get her filings right.

The Situation

Sara runs a US single-member LLC from Germany, selling handmade jewelry online. She started in early 2025 to reach US customers. This year, she put in $15,000 to get going, paid $200 for state filing fees, took out $3,000 for personal expenses, paid her cousin Anna $600 for a website, and spent time managing sales from home. New to US tax rules, Sara was pretty nervous about messing up and getting hit with IRS fines.

How Sara Found SAL

A friend told Sara about SAL Accounting’s help with cross-border taxes. She reached out to us, wanting to make sure her Form 5472 was done correctly. With a new business, she needed someone to walk her through the process clearly.

How We Helped

We talked to Sara over a video call and went through her LLC’s transactions. She needed two Form 5472s—one for her own contributions and withdrawals, another for Anna’s payment—along with a pro forma Form 1120. Here’s what we did:

- Explained her LLC needed Form 5472 for related-party transactions.

- Helped her gather bank statements and receipts.

- Filed Sara’s Form 5472: Part V lists $15,200 contributions, $3,000 withdrawal, with a statement: “Sara’s LLC reports $15,200 contributions, including fees, and $3,000 withdrawals for 2025.” Part VI notes $2,000 for remote management.

- Filed Anna’s Form 5472: Part IV lists $600 website payment.

- Faxed forms with pro forma Form 1120 to IRS at 855-887-7737.

The Results

Sara got her filings done on time, no fines, and felt much better about it all. “SAL broke it down so well,” she said. “I was freaking out, but they made it easy.” We gave her a simple spreadsheet to track transactions, so next year will be a breeze. Her jewelry business is now growing strong.

This table details Sara’s filings:

| Transaction | Form | Section | Amount | Details |

| Contributions | Sara’s Form | Part V | $15,200 | $15,000 cash plus $200 state filing fees |

| Withdrawal | Sara’s Form | Part V | $3,000 | Money taken for personal expenses |

| Management Services | Sara’s Form | Part VI | $2,000 | Sara’s remote sales management, fair market value |

| Website Payment to Anna | Anna’s Form | Part IV | $600 | Deductible payment for website design |

This case shows how a small business owner, with SAL Accounting’s support, can handle Form 5472 filings smoothly.

➜ Read more: “How to File Foreign Business Income Taxes in Canada: Easy Steps & Tax Tips”

Conclusion

Form 5472 doesn’t have to be a problem. Use these steps, meet the deadline, and keep clear records. You’ll stay compliant and avoid fines. If your business has multiple parties or complex deals, professional help can save time and worry.

SAL’s cross-border tax team is ready to assist. Book a free consultation to get it right.

FAQ: Quick Answers to Common Questions

For LLCs, attach Form 5472 to a pro forma Form 1120 with your business name, EIN, address, and “Foreign-owned U.S. DE” at the top. For corporations, include it with your regular Form 1120 tax return. Make sure all transaction details are accurate to prevent issues.

Keep bank statements, contracts, receipts, and emails showing transactions for seven years. Digital copies are easiest to organize and find. These records prove your filings if the IRS asks for them.

Yes, file a corrected Form 5472 with “Amended” at the top and attach it to an amended Form 1120. Include a note explaining the changes to avoid fines. Act quickly to show you’re correcting the error in good faith.

Reportable transactions include payments, loans, services, or contributions with related parties. Non-reportable ones have no foreign connection or tax impact. Always check IRS guidelines to confirm what applies.

File on time, use correct IDs, report all transactions, and keep clear records. Working with our international tax experts can help catch mistakes early. Set calendar reminders to stay on track.

You usually don’t need to file if there are no reportable transactions, but foreign ownership alone may require it. Check with our expert bookkeepers to be certain. Keeping records of zero activity can protect you if questions arise.

Disclaimer: This blog is for informational purposes only and is not tax advice. SAL Accounting is not responsible for any forms filed based on this guide. Consult a tax professional to ensure accurate Form 5472 filings.