Today, we aim to help small business owners, just like you, understand fair market value (FMV) and ease tax filing for asset sales or transfers. Above all, we want to prevent you from undervaluing assets to cut taxes, which risks a CRA fair market value audit or IRS trouble. Shockingly, CRA audits in 2021–2022 lasted 348 days on average, often due to FMV mistakes.

Our team at SAL Accounting has gathered this post to explain FMV, how to get it right, and tips to avoid tax trouble. Keep reading:

Quick Takeaways

- Fair market value (FMV) sets the true market price for assets to avoid tax issues.

- Use market data or appraisals to calculate FMV accurately for CRA/IRS compliance.

- Selling below FMV risks higher taxes and audits from CRA or IRS.

- Save FMV proof like listings or reports to prevent penalties.

- FMV ensures fair pricing in buyouts and transfers, avoiding disputes.

What Is Fair Market Value (FMV)?

Fair market value (FMV) is the price an asset, business, or share would fetch in an open market, agreed by informed, unpressured buyers and sellers (CRA guide on FMV). It reflects true market value. Small businesses use FMV to price equipment. The CRA and IRS apply FMV for taxes like capital gains. Consult our small business tax accountant for accurate FMV.

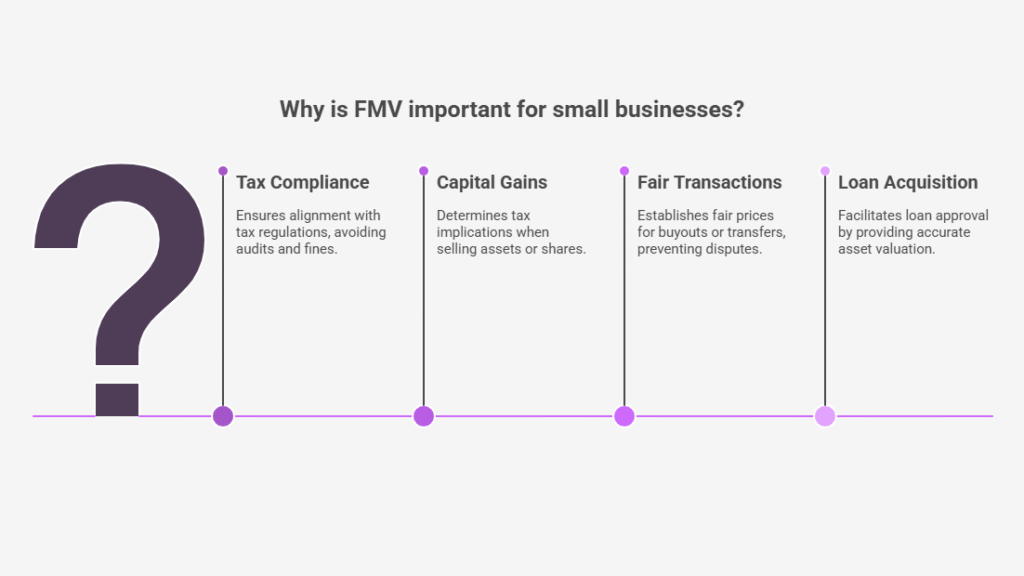

Why FMV in Small Business Matters for Taxes

Fair market value (FMV) does more than set prices. It keeps small businesses out of tax trouble. It can be one of the ways a small business can minimize tax liabilities. Here’s why it counts:

- Taxes Stay Clean: Right FMV aligns with CRA and IRS rules to avoid audits and fines.

- Capital Gains Matter: FMV decides the tax when small businesses sell assets or shares (definitions for capital gains)

- Deals Stay Honest: FMV sets fair prices for buyouts or transfers, avoiding fights.

- Loans Get Easier: Banks use FMV to check assets for small business loans.

Pro Tip: Save records of how you pick FMV, like appraisals or market data. This shields small businesses from a CRA fair market value audit or IRS trouble.

FMV for Small Business in Canada and the U.S.: Key Uses

Here’s how FMV works in key situations for businesses in Canada and the U.S., with easy examples. Also, check the business structures in Canada for tax implications.

1.Selling Assets

FMV sets the price for things like equipment when doing taxes. It helps you get capital gains right. This keeps you safe from the Canada Revenue Agency (CRA) or the Internal Revenue Service (IRS).

Example: Sarah, a Canadian freelancer, sells her computer for $2,000. FMV is $2,500, cost $1,500. CRA uses $2,500 FMV, so her capital gain is $1,000. $500 is taxable.

2.Shareholder Buyouts

FMV keeps the price fair when an owner leaves a business. It stops tax problems with the CRA or IRS (IRS tax guide for SMBs).

Example: A U.S. startup owner sells their 50% share for $100,000, its FMV from a business valuation. They report a capital gain (FMV minus what they paid).

3.Restructuring and Transfers

FMV sets the value of assets or shares moved between businesses, like in a reorganization. It keeps you on the right side of tax rules. Get the best bookkeeping tools for small businesses to remain mistake-free.

Example: A Canadian small business owner moves property to a new company. The FMV is $500,000; the book value is $300,000. The CRA taxes the $200,000 capital gain.

4.Taxation and Compliance

FMV affects taxes like capital gains or GST/HST. Getting it wrong can mess up your taxes.

Example: A Canadian sole proprietor moves equipment to their business. The FMV is $10,000; the cost was $6,000. The CRA taxes the $4,000 capital gain.

The table below shows how FMV for small businesses in Canada and the U.S. ensures compliance.

| Use Case | FMV Role | Tax Impact | Compliance Benefit |

| Selling Assets | Sets equipment price | Accurate capital gains | Avoids CRA/IRS audits |

| Shareholder Buyouts | Sets fair share price | Prevents tax issues | Fair FMV in small business |

| Restructuring | Values assets/shares | Avoids transfer penalties | Ensures legal transfers |

| Tax Compliance | Sets gains/GST/HST | Clean FMV for small business in Canada | Prevents audit penalties |

Tax Implications of Fair Market Value: How to Calculate FMV

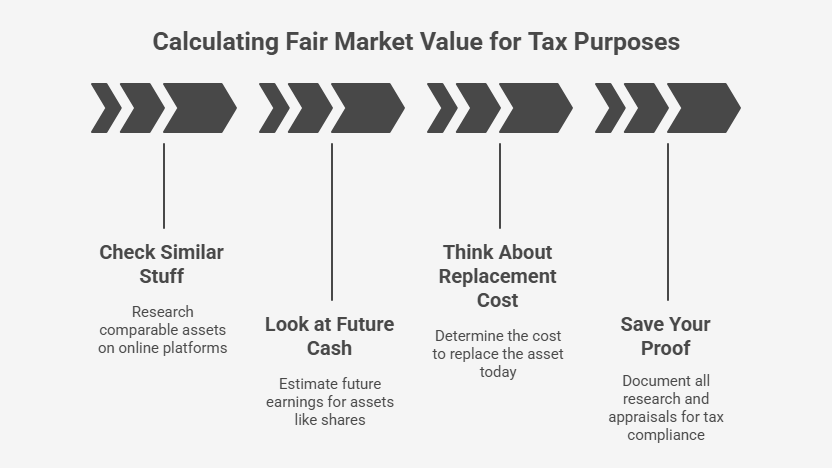

Figuring out fair market value (FMV) can feel like a chore, but it’s not that hard. The CRA and IRS want you to use FMV based on what an asset sells for today. Here’s how to do it right:

1. Check Similar Stuff

The easiest way to find FMV is to see what similar things sell for. Look on sites like Kijiji or eBay for used equipment. For cars or trucks, check AutoTrader.ca or Cars.com. This shows what people pay now.

Example: Jake, a Canadian mechanic, values his used delivery van. AutoTrader.ca shows similar vans sell for $15,000 (FMV). He saves listings to prove FMV to the CRA

2. Look at Future Cash

For things like business shares or goodwill, FMV comes from the money they could make later. This is tough, so you might need a pro like a Chartered Business Valuator (CBV). They check your business’s earning power to set a fair value (IRS business valuation guideline).

3. Think About Replacement Cost

You can also figure out what it costs to replace the asset today, minus any wear. This works well for things like machines or vehicles. A comprehensive bookkeeping checklist for small businesses will be helpful.

Example: A new machine costs $20,000, but yours is a bit old. You might set the FMV at $12,000 based on its shape.

4. Save Your Proof

No matter how you find FMV, you need proof to back it up. Good records keep you safe if the CRA or IRS asks questions. Here’s what to save:

- Screenshots of online listings or market data.

- Appraisal reporting from a CBV or appraiser, especially for big stuff like property or shares.

- All your research in a file for tax time.

Pro Tip: For tricky things like goodwill, a tax pro makes sure your FMV follows CRA and IRS rules. Consult our corporate tax accountant to keep your FMV proof compliant with CRA and IRS rules.

Case Study: FMV Calculation for U.S. Printer Transfer

Problem: In 2024, a Chicago design firm owner reached out during restructuring. They needed FMV for a printer (book value $5,000, bought for $8,000) to meet IRS rules. No proof risked audit and penalties.

What We Did: We advised checking printers on eBay and PrintEquipment.com, showing $7,500. We suggested an appraiser, setting FMV at $7,800 based on market and replacement cost ($10,000 new, adjusted). Save report, screenshots, and sales data for IRS proof.

Result: The IRS accepted the $7,800 FMV. The owner reported a $2,800 gain, avoiding audits. The restructuring went smoothly, with FMV records now kept.

FMV Business Taxes: FMV vs. Book Value vs. Sale Price

Fair market value, book value, and sale price can trip you up (IRS asset sales guide). Here’s what each term means and how it hits your taxes:

- Fair Market Value (FMV): The price you’d get for something in an open market. Buyers and sellers, both clued in and not in a rush, agree on it. The CRA and IRS use FMV for taxes like GST/HST.

- Book Value: What you paid for the thing minus any wear. It’s for your accounting books, not taxes, so it doesn’t affect what you owe.

- Sale Price: What you actually sell the thing for. If it’s way different from FMV, the CRA or IRS might pick FMV instead, which could raise your taxes.

- Read More: “GST/HST Return in Canada: A Guide for Businesses & Cross-Border Taxation”

Example: Jake, a Canadian mechanic, sells a van for $12,000 (book value $12,000, cost $20,000). FMV is $15,000 per AutoTrader.ca. CRA taxes $1,500 gain (half of $15,000-$12,000). Look at the table below:

| Term | Value | Tax Impact |

| FMV | $15,000 | Sets tax basis; CRA/IRS uses for capital gains. |

| Book Value | $12,000 | For accounting only; no tax impact. |

| Sale Price | $12,000 | If below FMV, CRA/IRS may adjust taxes. |

Common Mistakes with FMV in Small Business Taxes

Fair market value mistakes can get you in trouble with the CRA or IRS. Small business owners often slip up. Check e-commerce accounting errors that could cost you thousands, too. Here are traps to dodge for clean taxes.

1. Don’t Guess FMV

A random FMV number causes trouble. The CRA or IRS needs proof, like market data or appraisals. Without evidence, you risk audits and extra taxes.

2. Don’t Sell Below FMV

You might sell assets at a low price to save on taxes, but that can backfire. The CRA or IRS may use FMV instead, raising your tax bill.

3. Don’t Skip Records

Lack of FMV proof is risky. You need market data or appraisals to back your numbers. Without them, the CRA or IRS may add penalties.

4. Don’t Use Old Prices

FMV relies on today’s market, not old values. Outdated prices can mess up your taxes and spark an audit.

Pro Tip: Team up with a tax pro to nail FMV. It saves you from costly slip-ups. Connect without bookkeeping CPAs to avoid FMV errors and stay audit-free.

In this table, see how to avoid FMV in small business tax mistakes:

| Mistake | Risk | Solution | Audit Protection |

| Guessing FMV | Audits, extra taxes | Use market data/appraisals | Proof for FMV in small business |

| Selling Below FMV | Higher tax bill | Price at FMV with proof | Avoids CRA/IRS adjustments |

| Skipping Records | Penalties | Save listings/appraisals | FMV for small business in Canada compliance |

| Using Old Prices | Audit from old FMV | Use current market data | Keeps valuations audit-ready |

Case Study: FMV Errors in Canadian Bakery Sale

Problem: In 2023, a Toronto bakery owner contacted us after a CRA audit. They sold ovens for $15,000 to cut taxes, but the FMV was $25,000 per equipment site. With a $20,000 book value and no proof, the CRA added $5,000 to taxable gains and $2,000 in penalties.

What We Did: We advised gathering FMV proof from RestaurantSupply.com and Kijiji, confirming $25,000. We suggested an appraiser’s valuation report and told them to keep market data and emails for CRA compliance.

Result: The CRA accepted the $25,000 FMV, cutting the penalty to $500. The taxable gain was $2,500 (half of $5,000). Records now prevent audits.

Final Thoughts

Fair market value (FMV) is a must for small business owners to avoid tax trouble. It keeps your profits safe. Right FMV follows CRA and IRS rules. This stops costly audits. Stay updated on tax rules. This guide explains FMV basics for your business. Contact us to handle the tough stuff.

Get your FMV right for taxes with ease. Connect with SAL Accounting for a free consultation and expert support.

Frequently Asked Questions (FAQs)

FMV is the price an asset, business, or share would get in an open market, agreed by informed, unpressured buyers and sellers.

Check current market prices on sites like eBay or AutoTrader.ca, use replacement cost minus depreciation, or hire a Chartered Business Valuator (CBV).

The CRA or IRS may use the FMV instead, increasing your taxable capital gain and tax bill.

FMV determines the taxable gain (FMV minus cost) when selling assets or shares, impacting your capital gains tax.

Yes, incorrect FMV can trigger audits, leading to penalties or extra taxes if proof is missing.

No, book value is the original cost minus depreciation for accounting; FMV reflects current market value for taxes.

Not always, but appraisals from a CBV or expert strengthen proof for complex assets like shares or property.

Asset sales, shareholder buyouts, business restructurings, and transfers need FMV for capital gains or GST/HST taxes.