This post helps you build a clear and simple cash flow forecast for your small business. We aim to show you step by step how to plan your cash. But here’s something you might not expect: 82% of small businesses fail because of cash flow problems, not because they aren’t making sales or profits. That number shows just how important it is to manage your cash the right way.

We at SAL Accounting will explain why forecasting your cash matters and walk you through how to create a forecast that keeps your business strong. Do not miss it.

Quick Takeaways

- Cash flow forecasting tracks money in/out to prevent shortages for your business.

- Forecasting spots cash gaps early, enabling smarter financial decisions.

- List inflows (sales), outflows (rent), net cash; adjust for risks, update often.

- Cash flow is real money for daily bills; profit includes unpaid sales.

- Avoid overestimating sales, lowballing costs, or using outdated forecasts.

What Is Cash Flow Forecasting for Small Businesses?

A cash flow forecast for your small business guesses how much money comes in and goes out over 3 to 12 months. It tracks cash inflows, like sales, and outflows, like rent or supplies (SBA guide). This helps you plan and avoid cash shortages. Profit might look great on paper, but cash flow shows the real money you can use. Talk to our small business tax accountant in Toronto online today and keep your cash flow on track.

Small Business Cash Flow Planning: Why It Matters in 2025

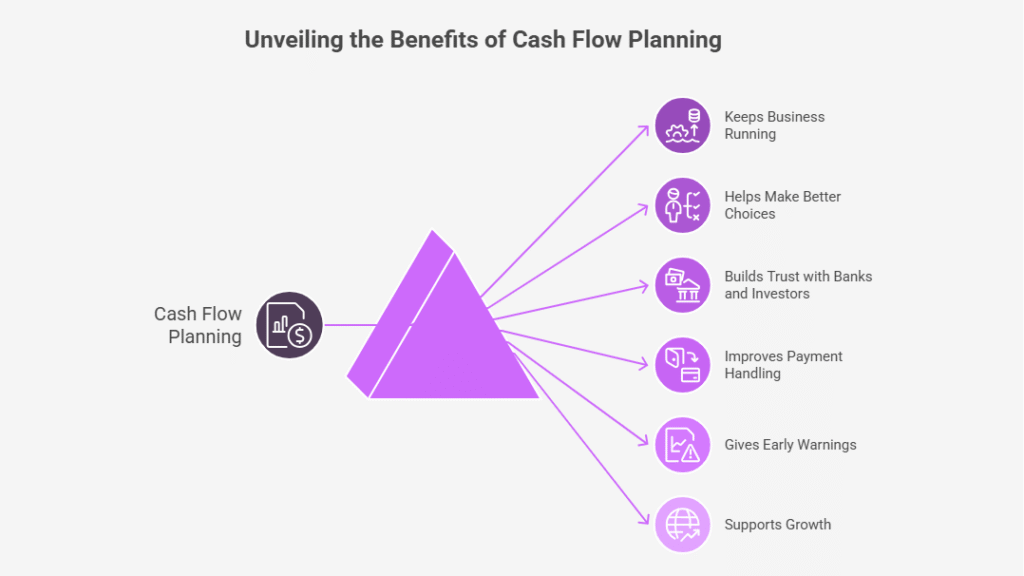

Small business cash flow planning keeps you ready. It spots cash shortages early. You must also know how small businesses can minimize tax liabilities. With rising costs in Canada and the US, it’s a must. Here’s why cash flow forecasting is awesome:

1. Keeps Your Business Running

Many businesses fail not because they don’t make sales, but because they run out of cash (ISED small business stats). Forecasting shows when money might get tight. Knowing the business structures and their tax implications in Canada can also help. You can act early and avoid a crisis.

2. Helps You Make Better Choices

When you know what money comes in and goes out, you make better decisions, and:

- You spot safe times to hire staff.

- You know when to buy equipment.

- You plan expansion without overspending.

3. Builds Trust with Banks and Investors

Banks and investors like businesses that plan ahead. A good cash flow forecast shows you’re serious and reliable. It makes it easier to get loans or attract investment.

4. Improves How You Handle Payments

A forecast shows when customers pay and when suppliers need payment.

- You plan collections to speed up cash.

- You negotiate better supplier terms.

- You maintain strong vendor relationships.

5. Gives You Early Warnings

Think of a forecast as a radar. It warns you about trouble before it happens. Sales might drop, expenses might rise, or seasons might slow things down. Also, have a tax deduction checklist for Canadian and US small businesses to pay less. Forecasting gives you time to adjust. Check CRA small business resources to help you with obligations.

6.Supports Growth

Clear forecasts show when you’ll have money to invest in growth. Whether you want to open a new location or launch a new product, you’ll know if the timing is right. It helps you grow without risking your cash.

Pro Tip: Always forecast a worst-case scenario to cushion unexpected delays, like late client payments. The table lists benefits, impacts, and tips for small business cash flow planning

| Benefit | Description | Impact | Tips |

| Sustains Operations | Spots cash gaps. | Prevents failure. | Track cash monthly. |

| Informed Decisions | Tracks cash flow. | Enables hiring, expansion. | Forecast 12 months. |

| Builds Trust | Shows planning. | Secures loans, investments. | Include in pitches. |

| Manages Payments | Tracks payments, terms. | Speeds cash, strengthens ties. | Negotiate terms. |

| Early Warnings | Flags sales, cost issues. | Allows adjustments. | Use worst-case scenarios. |

| Drives Growth | Identifies cash for reinvestment. | Supports expansion. | Align with cash peaks. |

What to Include in a Small Business Cash Flow Forecast

A cash flow forecast needs the right stuff to keep things smooth. You must track cash coming in and going out without missing a thing. Here’s what to consider:

- List cash coming in, like sales or payments from clients.

- Include cash going out, like rent or supplies.

- Add your starting cash to know where you begin.

- Save some cash for surprises, like broken gear.

- Note big dates, like tax deadlines or sales spikes. Check tax deadlines for businesses in 2025 and stay compliant.

For Canadian businesses, consider GST/HST payments. GST/HST return for small businesses in Canada is really important. In the US, add state taxes or shipping costs.

Small Business Cash Flow Types: What You Need to Know

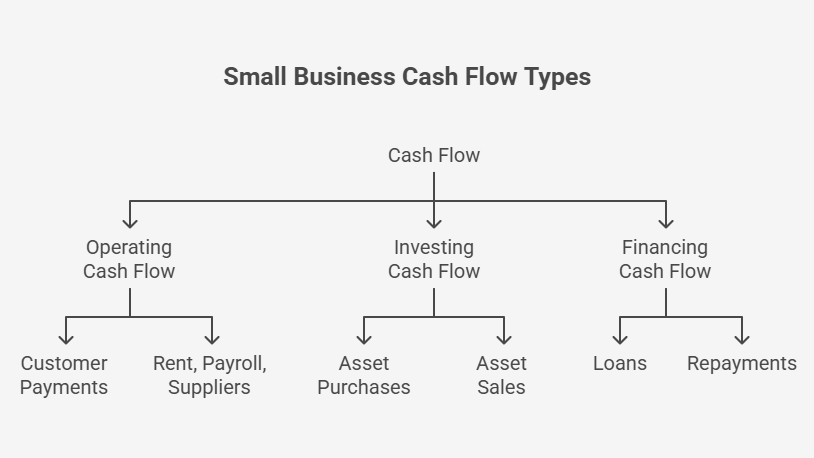

Cash flow tracks money moving in and out of your business. Each type shows a different part of your financial picture. Below, we explain the three main cash flow types with clear examples.

Operating Cash Flow (OCF)

This cash comes from daily business tasks. Customers pay you (OCFS guide). You pay for rent, payroll, or suppliers. Shows the daily “money in, money out” of your business.

Example: A bakery sells bread and cakes. Cash from sales, minus costs for flour, wages, and rent, equals its operating cash flow.

Investing Cash Flow (ICF)

This cash relates to purchases or sales of assets, like property, equipment, or investments.

When you buy assets to grow, cash flow decreases; when you sell assets, cash flow increases.

It highlights investments for growth, not daily tasks. When selling assets, knowing the fair market value (FMV) for small businesses is a must.

Example: A bakery spends $10,000 on a new oven, and the cash goes out. It sells an old delivery van, and cash comes in.

Pro Tip: If you sell assets at a profit, capital gains tax in Canada can cut into the cash you keep, so it’s important to plan ahead.

Financing Cash Flow (FCF)

This cash involves investors, banks, or owners. It includes loans, repayments, share issues, or dividend payments (Canada business financing). It reveals how you fund your business and manage debt or equity.

Example: A bakery takes a $50,000 bank loan—cash comes in. It repays $5,000—cash goes out.

Cash Flow vs. Profit in Small Businesses: Key Differences

Cash flow vs profit trips up lots of small business owners. A cash flow forecast for a small business keeps you focused on real cash. Here’s how they’re different:

- Tracks real cash: Cash flow shows money hitting or leaving your bank.

- Cares about timing: Cash flow tracks when you get paid, not just sales.

- Keeps you running: Cash flow pays bills daily, unlike profit’s big picture.

- Not like profit: Profit counts sales you book, even if cash isn’t there (CRA accounting methods).

- Not other reports: Cash flow skips balance sheets, focusing only on cash.

Example: You book a $5,000 sale but wait 60 days for the money. That’s profit now, but no cash flow yet. Grab more tips from SAL at sal.com/financial-tips.

Pro Tip: Ask clients for upfront deposits to speed up cash flow. This table breaks down their key distinctions:

| Aspect | Cash Flow | Profit | Insight |

| Definition | Tracks cash in/out. | Counts booked sales. | Cash flow: real-time; profit: accounting-based. |

| Timing | When cash moves. | When sales are earned. | Cash flow waits; profit books instantly. |

| Purpose | Pays daily bills. | Shows business health. | Cash flow runs operations; profit tracks success. |

| Scope | Only cash movement. | Includes non-cash items. | Cash flow skips balance sheets; profit doesn’t. |

| Example | $5,000 sale, unpaid 60 days = no cash. | $5,000 sale = instant profit. | Cash flow delays impact; profit shows gain. |

Read More: “CRA T2 Tax Form: Easy Guide for Canadian Businesses in 2025”

How to Create a Cash Flow Forecast for Small Businesses Step-by-Step

How to create a cash flow forecast? It’s an easy way to keep your small business running smoothly. These steps help you track cash coming in and going out, so you dodge surprises and make smart calls.

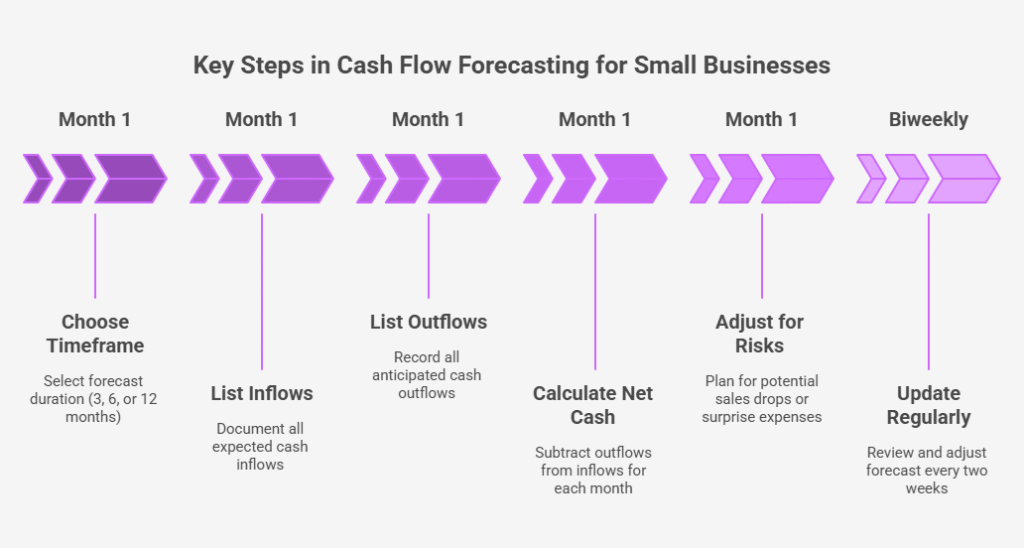

1. Choose a Timeframe

Pick a time frame, like 3, 6, or 12 months. Short ones, like 3 months, fit startups with tight cash. Long ones, like 12 months, help plan for big bills or taxes.

Pro Tip: Go for a 3-month forecast if you’re just starting. It’s way easier to guess short-term cash.

2. List Inflows

Write down all cash you expect, like sales or client payments. Canadian freelancers can list upcoming invoices. US e-commerce people can add holiday sales guesses. See how to file sales tax in the US to ensure everything is right.

Pro Tip: Plan for payments to take longer, like 45 days. This keeps your forecast safe from delays.

3. List Outflows

Write down every expense that leaves your bank. Check your bank statements to catch all costs. Here’s what to include:

- Add rent or salaries as fixed costs.

- Include supplies or ads as variable costs.

- Don’t miss one-time costs, like new gear.

Pro Tip: Bump up variable costs, like ads, by 10%. This covers surprise jumps in spending.

4. Calculate Net Cash

Take your inflows and subtract outflows for each month. A positive number means you’ve got extra cash. A bookkeeping checklist for small businesses would be beneficial. A negative one shows you’re short.

Pro Tip: Color negative months red in your spreadsheet. It makes cash gaps pop out fast.

5. Adjust for Risks

Think about stuff that could mess up your cash, like low sales or surprise bills. Plan for a 20% sales drop or a random repair cost. Use the best bookkeeping tools for small businesses to get it right. Here’s what to watch:

- Low sales can cut your inflows.

- Surprise bills, like repairs, hit hard.

- Late client payments mess up cash.

Pro Tip: Toss in a $1,000 emergency fund. It saves you from unexpected hits.

6. Update Regularly

Check your monthly forecast every couple of weeks. Sales or bills might shift, like a client paying late. Updating keeps your plan spot-on.

Pro Tip: Set a Monday reminder on your phone. It takes 10 minutes to keep things tight.

Cash Flow Projection Template for Small Businesses

A cash flow projection template makes it easier to plan your money. It shows what comes in and what goes out each month. You can build one in Excel, Google Sheets, or with tools like QuickBooks. Here is how to use the template:

- List inflows. Write down all income, sales, client payments, or other money coming in.

- List outflows. Add fixed costs like rent and salaries, and variable costs like supplies or ads.

- Subtract outflows from inflows. This gives your net cash flow for the month.

- Add your starting balance. That shows your closing balance for the month.

- Update often. Review weekly or monthly to keep numbers correct.

Here’s a simple example:

| Month | Cash In (Sales/Payments) | Cash Out (Rent, Salaries, Supplies) | Net Cash Flow (In – Out) | Closing Balance |

| January | $20,000 | $15,000 | $5,000 | $10,000 |

| February | $18,000 | $16,000 | $2,000 | $12,000 |

| March | $25,000 | $20,000 | $5,000 | $17,000 |

Pro Tip: Add a “worst-case” column. Lower sales by 20% and raise costs by 10%. This keeps you ready for delays or surprises.

Worst Small Business Cash Flow Forecast Mistakes to Avoid

Cash flow forecasts keep your business on track, but errors hurt. Below are five critical mistakes most businesses face:

- High Sales Expectations:

Many expect big sales. Customers delay or skip payments. High hopes cause overspending and cash shortages.

- Low Cost Estimates:

Businesses lowball expenses. Supplies or labor costs rise. Surprises drain cash fast.

- Outdated Forecasts:

Some create a forecast and never check it. Markets shift. Old data misleads. You miss risks. Check how peer-to-peer tax return filing in Canada works to avoid CRA penalties.

- Payment Delay Oversights:

Customers pay late. Suppliers demand quick payment. Wrong timing assumptions hurt cash flow. Learning about sales tax nexus helps you avoid cash shocks.

- Cash and Profit Confusion:

Profit isn’t cash. Sales on paper don’t mean money in hand. Expenses hit before revenue arrives. This table highlights five critical errors to avoid with concise insights

| Mistake | Description | Impact | Solution |

| High Sales Expectations | Assuming big sales without delays. | Overspending, cash shortages. | Forecast conservative sales. |

| Low Cost Estimates | Underestimating expenses like supplies, labor. | Unexpected cash drain. | Include cost buffers. |

| Outdated Forecasts | Using old, unchecked forecasts. | Missed risks, wrong decisions. | Update forecasts monthly. |

| Payment Delay Oversights | Ignoring late customer payments, fast supplier demands. | Cash flow disruptions. | Track payment terms, nexus. |

| Cash vs. Profit Confusion | Mistaking booked sales for cash in hand. | Expenses outpace revenue. | Separate cash flow, profit tracking. |

Case Study: Chicago Food Truck Cash Trouble*

Problem: A Chicago food truck expects $20,000 in monthly sales but gets $14,000. Costs hit $12,500, over the $10,000 budget. They don’t update their forecast and miss a new competitor. Late app payments and fast supplier demands cut cash. They count sales as cash, but delays stop payroll.

What We Do: SAL Accounting sets a $15,000 sales forecast and $13,000 expense budget. We check it weekly, plan for 45-day payment delays, get better supplier terms, and track real cash, not profit.

Result: They avoid a $3,000 cash gap, save $2,000 on stock, and keep cash steady.

- Read More: “How to Avoid Double Taxation in Canada: A Complete Guide for Small Business Owners in 2025”

Best Practices for Small Business Cash Flow Forecasting

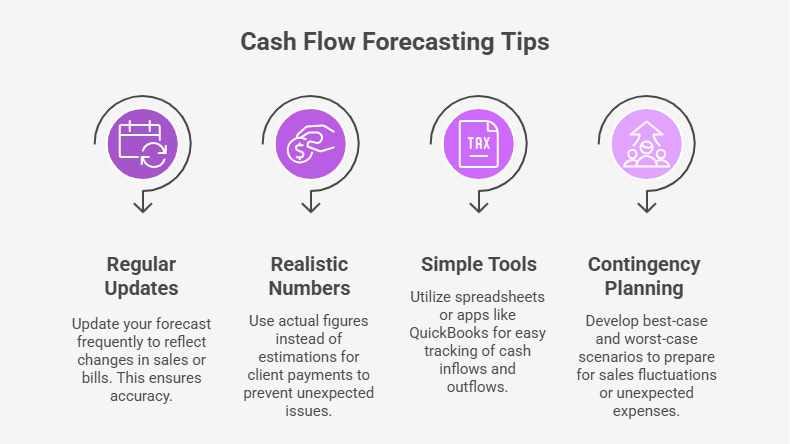

These tips keep your cash flow forecast simple and sharp:

- Update a lot: Update your forecast every week or month. It stays right when sales or bills change.

- Use real numbers: Don’t guess clients pay fast. Stick to honest numbers to avoid surprises.

- Pick easy tools: Use a spreadsheet or app like QuickBooks. They make tracking cash in and out super simple.

- Plan for ups and downs: Make a best and worst plan. It prepares you for slow sales or extra costs. Make sure you know how taxes work in Canada or the US to avoid surprises.

These tricks help you track cash in and out like a pro. They take a few minutes but stop cash problems. A good forecast keeps your business solid. Consult our bookkeepers to keep your business right.

Case Study: Vancouver Freelancer’s Cash Success*

Problem: A Vancouver freelancer has $5,000-$12,000 monthly sales and $4,000 surprise costs. Old forecasts don’t catch changes, risking rent payments.

What We Do: SAL Accounting makes a 3-month forecast, which is checked weekly. We use real invoice data with 60-day delays, track costs in QuickBooks with 15% extra for surprises, and plan best ($12,000) and worst ($5,000) sales cases.

Result: They hold a $2,000 cash buffer, pay a $1,200 bill, and cover rent easily.

Conclusion

A clear cash flow forecast ranks as one of the best tools for your small business. It shows you where your money goes and keeps your plans on track. You build and update a forecast to make better decisions, handle risks, and grow with confidence.

If you need help to set up a cash flow forecast or manage your small business finances, contact us at SAL Accounting. We guide you step by step so your business stays healthy in 2025 and beyond.

*Hypothetical scenario

FAQ: Cash Flow Forecast for Small Businesses

It predicts money in and out over 3-12 months, tracking sales and expenses like rent to avoid cash shortages.

It prevents cash shortages, guides smart choices, builds trust with banks, manages payments, spots issues early, and supports growth.

Choose 3-12 months. List inflows (sales). List outflows (rent, supplies). Subtract to find net cash. Plan for risks. Update often.

Profit counts booked sales, even unpaid. Cash flow tracks real money in and out to pay bills now.

Use Excel, Google Sheets, or apps like QuickBooks for simple cash tracking.

Update weekly or monthly to keep it accurate as sales or expenses change.

Yes. Clear forecasts show that banks and investors will manage your money well, improving loan or investment chances.