More Canadians want to buy homes in the U.S. lately. Things like different weather, lively cities, and money-making chances drive this trend. Canadians made up 13% of foreign buyers of U.S. homes in 2024, snapping up 7,100 houses worth 5.5 billion USD. If you want in, you need to know the steps and figure out the tax side of buying a U.S. property as a Canadian.

We at SAL Accounting put together all the info you need. Check out our easy guide to see how you can buy U.S. property without a hitch.

Quick Takeaways

- Canadians buy U.S. property with no legal barriers, just an ITIN and funds needed.

- U.S. property taxes range from 0.3% to 2.5% based on home value and location.

- Mortgages demand 20-30% down from U.S. or Canadian banks using Canadian credit.

- Rental income gets taxed 30% by the IRS unless deducted, and 15-46% in Canada with a credit.

- No visa required to own or rent U.S. property, but stays cap at six months yearly.

Can Canadians Buy Property in the U.S.? (The Basics to Know)

Yes, Canadians can buy property in the U.S. with no problem. The U.S. real estate market opens its doors to international buyers. Canadians face no special legal roadblocks to owning property. But to make it work, you need to get a handle on taxes, financing, and legal steps. We’ll break it all down for you next. Explore our real estate tax accounting services for tax support.

Steps to Buying Property in the U.S. as a Canadian

Here’s how you can buy property in the U.S. the easy way. Check out these steps:

1. Decide Your Goal and Budget

Decide on your goal first. You might want a sunny vacation spot in Florida, a rental cash cow in Nevada, or a chill retirement home in Arizona. After that, set your budget. Calculate the house price, then add in extra fees and yearly costs.

🌟 Pro Tip: Look up local house prices online first. It keeps your budget real.

2. Open a U.S. Bank Account and Get an ITIN

Open a U.S. bank account. It makes paying for the house, taxes, and bills way simpler. A U.S. account beats using a Canadian one for this. You’ll also need an ITIN, a U.S. tax number. Grab it with your ID and proof of address. You need the ITIN to buy, rent out, or even open that bank account.

🌟 Pro Tip: Start getting your ITIN early. It takes a few weeks, not days.

3. Pick the Right Spot in the U.S.

The U.S. has tons of different places. Snowbirds love warm areas like Florida. Growing spots like Texas work great for rental income. Once you’ve got your goal set, choose the best location for you. Here are some top spots for buying property in the U.S. as a Canadian:

- Florida (Miami and Orlando): Warm beaches and fun cities, perfect for snowbirds and rental cash from tourists.

- Arizona (Phoenix and Scottsdale): Sunny desert and cheap homes, awesome for retirees or growing investments.

- Texas (Austin and Dallas): Busy growth and no extra taxes, ideal for rental income or affordable living.

- California (Los Angeles and San Francisco): Cool lifestyle and rising prices, great for fun or big returns.

- New York City: Fast city life and fancy homes, top for excitement or steady value.

- Pacific Northwest (Seattle and Portland): Pretty nature and tech jobs, nice for chill vibes or rental wins.

4. Figure Out the Money

You can pay cash for your property. It’s really easy if you have it. No cash? A loan does the trick. Some U.S. banks want 20-30% of the house price upfront. They need proof you make money in Canada. If you don’t have any U.S. credits, you use your Canadian credit. Or hit up a Canadian bank with U.S. branches for U.S. real estate investing.

5. Get Experts on Your Team

You don’t need to do this solo! Hire a real estate agent, a lawyer, and a tax accountant who knows U.S. and Canadian rules. They’ll get you that dream property without stress. Plus, they might even save you some cash. Check out our bookkeeping for real estate investors for more support.

🌟 Pro Tip: Pick pros who get both countries. Regular ones miss the tricky stuff.

6. Make an Offer and Check the House

Spot a home you like. Contact the seller and make an offer. Add some conditions, like making sure the house is in good shape or that you can get a loan. Visit the place yourself or pay someone to inspect it. They’ll catch any issues and let you know.

🌟 Pro Tip: If the seller says yes, sign the purchase agreement. Toss in 1-3% as “earnest money” to show you’re serious.

7. Finalize the Loan and Close

If you borrow, lock in your mortgage rate. The bank checks the house’s value. Then close the deal: sign the deed, pay the rest (plus 2-5% in fees like title insurance), and grab the keys. A title company (folks who make sure the house’s ownership papers are good) handles the recording for you.

🌟 Pro Tip: Check different banks for loan rates. A small drop saves you money.

8. Take Over and Handle Taxes

You decide whether to settle in or rent it out. Call up to switch power and water to your name. Sort out taxes in Canada and the U.S. for buying property in the U.S. as a Canadian. Pay property taxes to the U.S. county every year. Tell Canada about any rent money, too, per the CRA foreign income rules. It’s part of the tax implications.

Key Point: Keep rent cash records. It makes taxes way easier.

Next up, we’ll dig into taxes, loans, and mortgages to keep your investment solid.

Ways Canadians Can Pay for U.S. Properties

Figuring out how to pay for a U.S. property as a Canadian is a big deal. You’ve got options. Here’s how they work in simple terms.

1. Using Cash for Cross-Border Real Estate Investment

Paying cash means you cover the full price upfront, no loans needed. It’s fast and skips bank headaches. Perfect for Canadians investing in U.S. real estate.

🌟 Key Point: The exchange rate shrinks your Canadian dollars in the U.S.

➜ Read More: “Transferring Money from Canada to US Tax Implications”

2. U.S. Mortgage Options for Canadians

You can borrow from a U.S. bank to buy your property. This lets you avoid paying everything at once. Interest rates on U.S. mortgages usually run higher than in Canada. Here’s what you need to get them:

- Down Payment: You’ll fork over a chunk upfront (typically 20% to 30%). It jumps higher if you plan to rent it out.

- ITIN: You need a U.S. tax ID called an ITIN for the loan and taxes since you’re not American.

- Proof of Income: The bank checks your income to make sure you can pay them back. They’ll want pay stubs, tax returns, or similar stuff.

Types of Mortgage Loans

Canadians looking to snag U.S. real estate have some awesome mortgage loans. Here’s a quick list of them:

- Foreign National Mortgage Loans: U.S. Foreign National Mortgage Loans work for non-residents like Canadians. You put down 20-25% upfront. They ask for less paperwork. They’re perfect for rental properties.

- DSCR Loans: DSCR Loans let the property’s rent pay for itself. Lenders figure out the Debt Service Coverage Ratio. You need 20-25% down. They don’t care about your personal income papers.

- ITIN Mortgage Loans: ITIN Mortgage Loans suit Canadians with an ITIN. They come with easygoing terms. They’re great if you find a lender who gets cross-border stuff.

🌟 Pro Tip: Check out lenders who understand Canadians. They might give you better rates or quicker closings if they handle cross-border stuff well.

3. Canadian Loans for U.S Real Estate Investment

You can get a loan from a Canadian bank, like RBC or BMO, to buy a house in the U.S. They use your Canadian credit and income to approve you. Expect a hefty down payment, 20% or more. The loan comes in U.S. dollars with interest rates like you’d get in Canada. Here’s what they bring to the table.

- RBC’s U.S. HomePlus Advantage: RBC U.S. HomePlus Advantage hands you 3-, 5-, 7-, or 10-year terms with a 30-year payoff stretch. They skip bank fees, so you keep up to $4,500 USD on closing costs.

- BMO’s Gateway Program: BMO cross-border mortgage lets you grab up to $2 million USD. They check your Canadian credit history. It fits vacation homes or rentals.

Navigate U.S. and Canadian tax rules with our cross-border tax accountant. Contact SAL Accounting today for a free consultation.

Tax Implications for Canadians Owning U.S. Property

Owning a U.S. home means dealing with taxes, not just in the U.S. but also in Canada. Here’s what you need to know about taxes on both sides of the border.

Annual U.S. Property Taxes

You’ll pay property taxes to the local U.S. government every year. The amount depends on your home’s value. Taxes vary by location. For example, Florida charges about 1% of your home’s value. In New Jersey, it jumps to 2%. This table shows what you’ll pay for a $300,000 home in top states for Canadians:

| State | Property Tax Rate | Example (on $300,000 Home) | Notes |

| Florida | ~1% | $3,000/year | Varies by county (e.g., Miami-Dade) |

| New Jersey | ~2% | $6,000/year | Higher in urban areas |

| Texas | ~1.8% | $5,400/year | No state income tax |

| Arizona | ~0.7% | $2,100/year | Lower rates, retiree-friendly |

| California | ~0.8% | $2,400/year | Stable due to Prop 13 |

| New York | ~1.7% | $5,100/year | High in NYC metro, lower upstate |

| Washington | ~1% | $3,000/year | No state income tax, Seattle higher |

| Oregon | ~0.9% | $2,700/year | Stable, popular for nature |

| Nevada | ~0.6% | $1,800/year | Low rates, no income tax |

| Colorado | ~0.5% | $1,500/year | Among lowest, growing market |

Possible Deductions for U.S. Property Taxes

You can lower your U.S. property taxes with some deductions. These depend on where your house is. Check these out:

- Homestead Exemption: Use the house as your main place, even part-time as a snowbird. You could cut the taxable value by $25,000 to $50,000 in states like Florida or Texas.

- Senior Discount: Over 65? Some states knock off $250 to $1,000, especially if your income is low.

- Veteran or Disability Break: Veterans or people with disabilities might get $5,000 or more off, depending on the spot.

🌟 Pro Tip: Apply for these as soon as you buy a property. Waiting could cost you a year of savings.

☞ Example: Paul owns a $300,000 condo in Miami-Dade County, Florida, where he spends winters. The local rate in Miami-Dade is about 1% of his condo’s value. Here’s how his U.S. property taxes shake out:

- 1% × $300,000 = $3,000 per year.

Paul qualifies for a homestead exemption because he uses the condo as his part-time main residence. Florida offers a $50,000 homestead exemption for primary or part-time residents.

- Taxable value drops: $300,000 – $50,000 = $250,000.

- New tax: 1% × $250,000 = $2,500 per year.

Required Forms for U.S. Property Taxes

Your U.S. property taxes show up in an annual bill. No special forms are needed to pay them. But if you want deductions, you’ve got to report them right. Use these:

| Form | Purpose | Filing Deadline | How to File | Required Documents |

| DR-501 | Homestead Exemption | March 1 | Online or by mail | Property details, residency proof (deed, passport) |

| PTR-1 | Senior Discounts | October 31 | Online or by mail | Proof of age, income (birth certificate, tax return) |

| DR-501DV | Veteran or Disability Breaks | March 1 | Online or by mail | VA disability letter, ITIN if needed |

Heads up: Each state has its own form, so check yours.

➜ Read More: “Tax Implications for Canadians Owning US Property”

Renting Out Your Property

Renting out your U.S. property means you’ll owe taxes on the rent in both the U.S. and Canada. Whether it’s a house, apartment, or condo, that rental cash counts as income. You’ll get taxed twice. Here’s how it works:

- In the U.S.: The IRS grabs 30% of your rent. They tax Canadians and other non-residents on what you earn there, per the IRS rental income rules. It’s a flat 30% unless you report your profits and deductions instead.

- In Canada: You report the rent on your Canadian tax return like any other income, per the CRA rental income guide. List it with your regular earnings. They tax it at your personal rate, based on what you make overall—federal (15% to 33%) plus provincial (5% to 13%).

🌟 Pro Tip: File your Canadian taxes on time. Claim the full U.S. tax credit; for every buck you pay, the IRS lowers your Canadian bill.

Possible Deductions to Lower Taxes on Rental Income

You can shrink your Canadian taxes by claiming these expenses:

- Property Taxes: That yearly U.S. property tax cuts your rental income.

- Mortgage Interest: Paid interest on your mortgage? Deduct it.

- Repairs and Maintenance: Fixed up the place, like painting or plumbing? Take those costs off.

- Legal and Professional Fees: Hired an accountant or lawyer? Deduct those fees, too.

- Travel Costs: Visited the property to check on it. That might count.

- Depreciation (U.S.-only): Depreciation lowers U.S. tax but increases Canadian tax.

☞ Example: Sarah owns a $400,000 house in Maricopa County, Arizona, and rents it out for $24,000 per year. Here’s how her rental taxes shake out in both the U.S. and Canada:

- U.S. Rental Tax: Gross rent $24,000 – $12,000 deductions (property tax $2,695, mortgage interest $8,000, repairs $1,305) = $12,000 net income. IRS tax: 30% × $12,000 = $3,600.

- Canada Rental Tax: Net income $12,000, taxed at 28% = $3,360. A foreign tax credit for $3,600 paid to the IRS reduces Canadian tax to $0.

Total tax: $3,600 (U.S.) + $0 (Canada) = $3,600. Profit after taxes: $24,000 – $12,000 – $3,600 = $8,400.

Forms You Need to File Your Rental Taxes

Here’s what you need to file taxes on your U.S. rental cash, some for the U.S., some for Canada.

Forms for U.S. Rental Taxes

These forms handle your U.S. taxes:

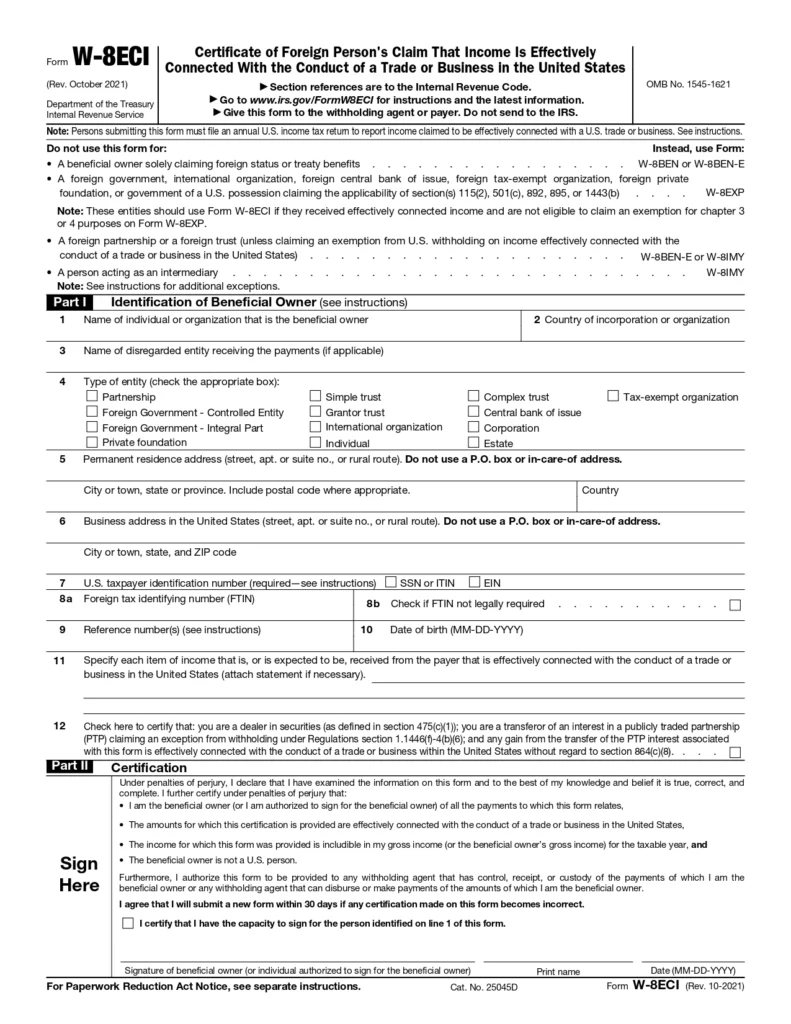

W-8ECI Form

Give Form W-8ECI to your tenant or manager before renting starts. It tells the IRS to skip the 30% cut and tax your profit after expenses, like repairs. Submit before the first rent payment or 30% is withheld until you file 1040-NR. Take a peek at the form below:

1040-NR with Schedule E

Form 1040-NR with Schedule E is your U.S. tax return for non-Americans. List your rent and expenses (like property taxes) here. Send it to the IRS by June 15 each year. It is due April 15, but it extends to June 15 if there are no U.S. wages; request via Form 4868 if needed. You can grab the form down below:

W-7 Form

You may need an ITIN. This gets you that U.S. tax number. File Form W-7 with your passport if you don’t have one yet. Takes 6-10 weeks; required if no SSN. File with 1040-NR or earlier. Got the form for you right here:

🌟 Pro Tip: Apply early; it takes 6-10 weeks, and delays can mess up your closing.

Forms for Canadian Rental Taxes

These forms cover reporting U.S. rent in Canada:

T1 with T776

The T1 income tax package is your regular Canadian tax return; add your U.S. rent here. T776 is an extra page for rent and expenses (like repairs). List gross U.S. rent and deductions separately. Don’t copy U.S. net income. Send it by April 30 every year. April 30 for most, June 15 if self-employed, but pay by April 30 to avoid interest. Here is the form:

Key Point: No special form is needed for the U.S. tax credit. Just use a line on your T1 to cut your Canadian tax by what you paid the U.S. Claim online 40500 of T1; attach Form T2209 if complex.

This table lists the key tax forms for Canadians owning U.S. property:

| Form | Purpose | Where It’s Filed | Deadline |

| W-8ECI | Skips 30% U.S. rent withholding | Tenant/Manager (U.S.) | Before rent starts |

| 1040-NR + E | Reports U.S. rental income, expenses | IRS (U.S.) | June 15 |

| W-7 | Gets your ITIN for U.S. tax ID | IRS (U.S.) | With 1040-NR |

| T1 + T776 | Reports U.S. rent on Canadian return | CRA (Canada) | April 30 |

| DR-501 | Claims U.S. homestead exemption | County Appraiser (U.S.) | March 1 |

➜ Read More: “Report Canadian Income on a U.S. Tax Return”

Case Study: Retiree’s Rental Tax Fix

Problem: Tom, a retiree from Mississauga, bought a $200,000 condo in Orlando in 2023 and rented it out for $15,000 a year. The IRS snatched 30% ($4,500) upfront, and Canada taxed his $10,500 net at 28% ($2,940) because he didn’t know about credits. He walked into our office looking for a fix.

What I Did: I confirmed he could file Form W-8ECI to cut U.S. tax to profits only, then calculated $2,100 U.S. tax after deductions (property tax, repairs). I applied a $2,100 foreign tax credit on his Canadian T1, wiping out the $2,940 CRA bill.

Result: Tom’s total tax dropped to $2,100 from $7,440, saving him $5,340 by syncing U.S. and Canadian rules.

Canadian Taxes on US Property vs. US Taxation: Key Differences

Property taxes work differently for Canadians owning U.S. property compared to back home. Here’s a simple breakdown of the key differences.

1. Who Decides the Taxes

In Canada, cities or towns set property taxes based on where your house is. Rates stay pretty steady across the country (usually 0.5% to 1.5% of your home’s value).

In the U.S., cities or counties decide the taxes. Rates swing a lot depending on the spot (anywhere from 0.3% in some places to 2.5% in others).

2. Taxes When You Rent

Suppose you rent out your U.S. property, Canada taxes that rental cash like regular income. Your personal rate, 15% to 46%, applies. You can lower it with expenses like repairs.

In the U.S., the government takes 30% of the rent upfront since you’re not American. Or you can switch to taxing your profit after costs at 10% to 30%.

3. How to Deduct Taxes

Canada doesn’t offer many ways to cut property taxes. Some cities give almost no discounts. In the U.S., you can trim taxes with breaks, like living there part-time, being over 65, or being a veteran.

Remember: U.S. deductions depend on the state and county. Some spots offer big savings; others don’t. Check your local tax office.

4. Who Pays the Taxes

In Canada, the owner always pays the property taxes. In the U.S., the owner pays too. But if you rent the place out, the renter might send part of the rent to the tax office for you. Or you can handle it yourself. That’s not a thing in Canada.

5. Taxes After Death

When you pass away in Canada, the house doesn’t get taxed just for being valuable. No extra hit unless someone sells it later.In the U.S., you file for estate tax if the home’s worth over $60,000 when you die, tax hits up to 40% only if your U.S. assets exceed a big limit tied to $13.61 million. The Canada-U.S. Tax Treaty can shrink that if you plan ahead.

🌟 Pro Tip: Planning with a cross-border trust or joint ownership can dodge the U.S. estate tax entirely. Check with a tax pro.

➜ Read More: “Canada Tax System vs U.S.”

This table shows how property taxes differ between Canada and the U.S. for Canadian owners:

| Aspect | Canada | U.S. |

| Who Decides the Taxes | Cities or towns; 0.5%–1.5% of home value | Cities or counties; 0.3%–2.5% of home value |

| Taxes When You Rent | Taxed as income (15%–46%); deductions allowed | 30% withheld, or taxed on profit (10%–30%) |

| How to Deduct Taxes | Few deductions available | Deductions for residents, seniors, veterans |

| Who Pays the Taxes | Owner always pays | Owner pays; renters may withhold tax |

| Taxes After Death | No extra tax unless sold | Estate tax if U.S. assets exceed $13.61M; up to 40% |

Why the U.S. Real Estate Market Rocks for Canadians

The U.S. real estate market grabs Canadians for some sweet reasons. Here’s why it’s a no-brainer:

- Bigger Bang for Your Buck: Your $400,000 CAD buys a condo in Toronto. In Phoenix or Dallas, it gets you a nice family house.

- Rental Money Rolls In: Places like Austin or Orlando churn out steady rent cash. Plus, U.S. mortgage interest cuts your taxes, and Canada skips that perk.

- Dollar Goes Further: $1 CAD turns into about $0.73 USD these days. That stretches your money more down there.

- Escape the Cold: Sunny Florida or Arizona beats Canadian winters, hands down. Great for a vacation spot or retirement digs.

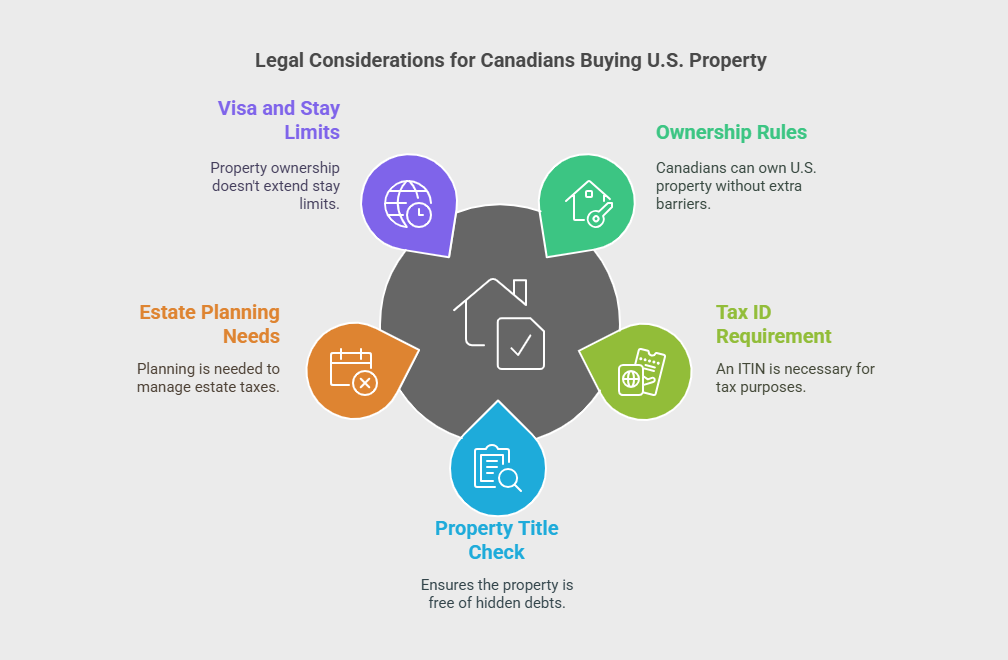

Legal Considerations for Buying Property in the U.S. as a Canadian

Buying U.S. real estate as a Canadian comes with some legal stuff you won’t see back home. Here’s what you need to know.

- Ownership Rules: Canadians can buy a U.S. house just like Americans; no extra hoops to jump through. You decide if the house goes in your name or a trust for your cross-border investment.

- Tax ID Requirement: You need a U.S. tax ID, ITIN. It’s a big deal to handle taxes. Grab it with your passport and a bit of paperwork.

- Property Title Check: A title search makes sure the seller actually owns the house and there’s no hidden debt. You need this to keep your purchase legit and clean.

- Estate Planning Needs: The U.S. taxes your property’s value when you die—Canada doesn’t do that. The Canada-U.S. Tax Treaty can cut this tax down, but you’ve got to plan ahead.

- Visa and Stay Limits: Owning a U.S. house doesn’t let you stay longer. You’re capped at six months a year like any tourist. No visa needed to own or rent it out, but you must follow U.S. rules.

Key Point: Watch the 182-day mark. Staying longer might trigger U.S. tax residency headaches, see the Substantial Presence Test.

➜ Read More: “Withholding Taxes Under the U.S.-Canada Tax Treaty”

Case Study: Estate Tax Escape

Problem: Ellen, a widow from Victoria, inherited a $600,000 Seattle home in 2023 from her late husband. U.S. estate tax loomed at 40% over $60,000, and she faced a $216,000 bill with no plan. She stopped by our office in a panic.

What I Did: I checked her U.S. assets against the $13.61 million exemption—still under—but filing Form 706-NA was due. I moved the title to a Canadian trust under the Canada-U.S. Tax Treaty, costing $2,500 in fees, to skip the tax.

Result: Ellen avoided $216,000 in U.S. tax, keeping the full $600,000 value for her kids with a simple trust tweak.

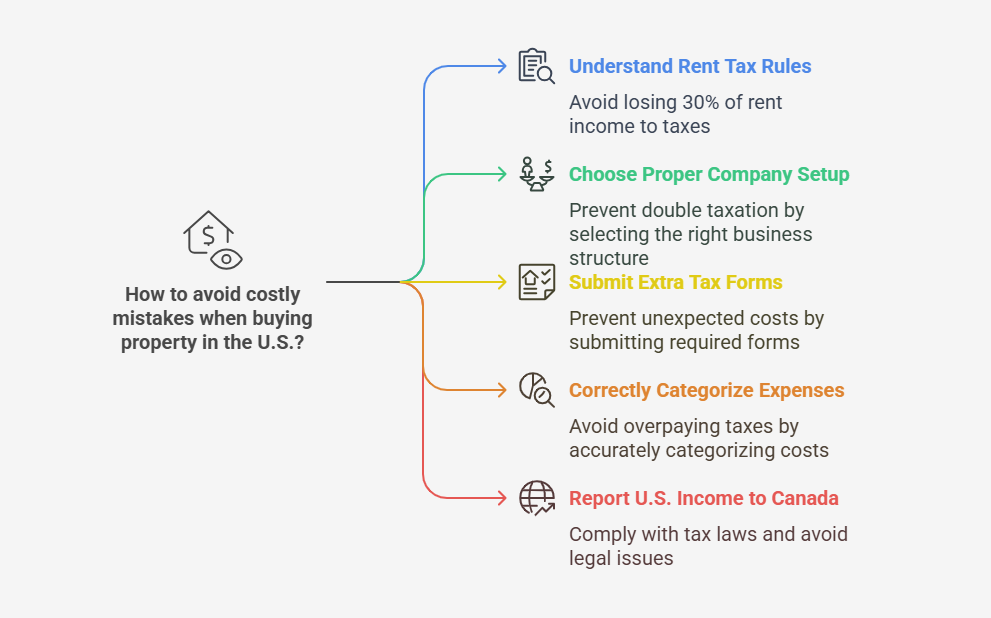

Costly Mistakes When Buying Property in the U.S.

Buying a U.S. property can trip you up with some pricey mistakes. Here’s what to watch out for so you don’t lose cash.

Missing Rent Tax Rules

Not understanding U.S. rent taxes can sting. If you rent out your house, the U.S. grabs 30% of the rent upfront under the taxation of nonresident aliens. Your tenant or manager takes it before you get a dime. You might get some back later, but skipping a way to lower it wastes your money.

Picking a Tricky Company Setup

Setting up a U.S. LLC sounds slick. ]t protects your stuff and simplifies U.S. taxes. But Canada calls it a business, so you end up paying taxes twice, once in the U.S. and once in Canada. That’s a huge hit for cross-border real estate investing.

➜ Read More: ”US LLC Tax Problems for Canadians”

Forgetting Extra Tax Papers

Some U.S. spots want extra tax forms for things like furniture in your rental. Miss them, and sneaky costs pile up. They track everything you use to rent, and skipping this messes up your budget big time.

Mixing Up House Costs

Lumping travel or repair costs, like a trip to check the place, with your rent income feels smart. But the U.S. says those are tied to the house price, not rent. Get it wrong, and you’ll overpay on taxes.

Hiding U.S. Money from Canada

Do not think you can keep your U.S. rent cash quiet from Canada. You have to report it. All your earnings count for Canadian taxes on U.S. property. Hiding it can land you in hot water. Luckily, the Canada-U.S. Tax Treaty keeps you from paying twice.

➜ Read More: “How Does The Tax Treaty Work Between Canada And The US”

Final Thoughts

Buying property in the U.S. as a Canadian is a smart move for your investments. Stay cautious about rules, taxes, mortgages, and legal details, though. This full guide supports you. Aiming for sun in Florida or rental income in Texas? We provide clear steps to make it yours, no guesswork.

Contact us for a free consultation; we’ll work through your U.S. property plan together! SAL Accounting keeps things straightforward. Take our tips, avoid the traps, and step in with confidence.

FAQs (Frequently Asked Questions)

Canadians don’t pay taxes just for buying. You’ll pay property taxes yearly, like 1% in Florida or 2% in New Jersey.

You can borrow from a US bank with 20-30% down and income proof. Or hit up a Canadian bank for U.S. real estate investing.

The IRS grabs 30% of your rent unless you deduct, and you report the rent on your Canadian tax return like any other income.

No visa needed to own or rent it out. You’re capped at six months a year like any tourist.

You’ll pay 1-2% of your home’s value yearly (Florida’s about 1%, New Jersey’s 2%.)

You report the rent on your Canadian tax return. List it with your regular earnings.

An LLC means taxes twice since Canada calls it a business. You decide, name or trust avoids that hit.