Fees on US purchases with your Canadian card add up quickly. Canadians made 8.0 million trips to the US in 2024, spending $6.4 billion. The best US banks for Canadians keep fees low and transfers easy for people like snowbirds in Florida, students in New York, business owners paying US suppliers, and more.

The SAL Accounting team created this detailed guide to cover the best banks for Canadians in the US, compare features, and share tips to manage your account. Read on for details.

Quick Takeaways

- Pick BMO or TD to avoid monthly and wire fees on US accounts.

- Transfer CAD to USD with Wise for lower exchange rate costs.

- Hire a tax pro to handle FATCA reporting for high-balance accounts.

- Secure Chase or TD apps with two-factor authentication to prevent fraud.

- Use TD’s app to monitor US spending and avoid overspending.

Why You Need a US Bank Account as a Canadian

A US bank account saves Canadians money and simplifies US spending. Some accounts skip 2–3% purchase fees. Here are the other key benefits of cross-border banking for Canadians:

- Avoid ATM withdrawal fees.

- Hold USD to avoid exchange rate changes.

- Pay US bills like rent or mortgages easily.

- Send USD directly to vendors or landlords.

- Build US credit for future loans or cards.

To make the most of your US account’s financial benefits, consult our cross-border tax CPA today.

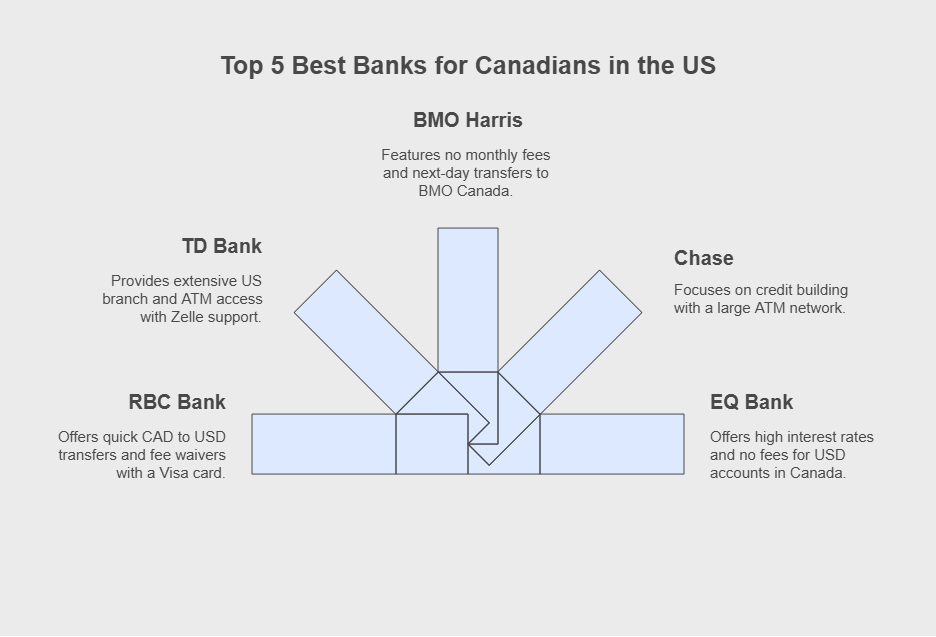

Top 5 Best Banks for Canadians in the US

Here are five great banks for Canadians looking to manage US finances. They provide low fees and handy features. To learn how to open a US bank account as a Canadian, check out our detailed guide. Each bank’s unique features are below:

1.RBC Bank: Quick Transfers

RBC Bank’s account moves CAD to USD instantly with RBC Canada accounts (More on RBC cross-border banking). The Direct Checking account costs $39.50 a year. An RBC Visa card waives the fee. You get 10 free outgoing transactions monthly. You’ll need a US address later, so plan a branch visit.

2.TD Bank: Travel-Friendly

TD Bank’s TD Canada Trust US account gives access to over 1,100 branches and 2,600 ATMs in the US (Services for Canadians). The Convenience Checking account is free with a $100 balance. Your US funds show on your Canadian profile. TD supports Zelle for fast US payments.

3.BMO Harris: No Fees

BMO Harris’s Smart Advantage account has no monthly fees with paperless statements. It offers free incoming wires. You open it by phone with a Canadian address and electronic signing. Transfers to BMO Canada accounts clear the next day.

- Read More: “How to Report T5 Slip Income in Your U.S. Taxes”

4.Chase: Build Credit

Chase’s Total Checking account costs $12 a month. You can waive it with certain conditions. It provides 15,000+ ATMs, digital banking, and credit-building options like Chase credit cards. You need to visit a branch to open it, great for Canadians near the border.

5.EQ Bank: Canadian USD Option

EQ Bank’s USD account works in Canada, except in Quebec (source). It offers 3.0% interest and no fees. It pairs with Wise for cheap transfers. It’s not a US bank, but it suits holding USD without crossing the border.

So, which US bank is the best for Canadians?

This table compares key features of RBC, TD, BMO, Chase, and EQ Bank to help you decide:

| Bank | Monthly Fee | Wire Fees | ATM Access | Opening Process | Unique Perk |

| RBC Bank | $39.50/year | $15 incoming | Limited | Online, US address later | Instant CAD-USD transfers |

| TD Bank | $0 ($100 balance) | $15 incoming | 2,600+ US ATMs | Online or branch | US balance on Canadian profile |

| BMO Harris | $0 (paperless) | $0 incoming | Moderate | Phone, e-signing | No-fee incoming wires |

| Chase | $12 (waivable) | $34 incoming | 15,000+ US ATMs | In-person | Credit-building potential |

| EQ Bank | $0 | Varies (via Wise) | None (digital-only) | Online | 3.0% interest on USD |

Digital US Banking Options for Foreigners

You don’t need to rely on traditional banks for US banking. Modern, tech-based tools can save you cash and make things easier. Here’s a quick look at two great options for Canadians:

- Wise: Moves CAD to USD with super low fees, up to 6x cheaper than banks. Uses real exchange rates. Great for one-off payments like US supplier bills. All online and safe with FINTRAC rules.

- Wealthsimple USD Account: Offers no-fee banking and investing. Covers foreign ATM fees. Ideal for travellers or US market investors. Digital-only with a handy app.

Pro Tip: Use Wise for cheap transfers, but keep TD or RBC for daily tasks like paying bills or using ATMs.

- Read More: “How to Buy a Business in the US as a Canadian”

US Banking Challenges for Expats + Solutions

Cross-border banking for Canadians may face some hurdles, but you can handle them with the right know-how. We cover the main issues and share simple fixes to keep your banking smooth:

Keeping Fees Low

Monthly or wire fees can raise costs fast. Chase charges $34 for incoming wires, but BMO gives them free. TD skips monthly fees with a $100 balance. Pick BMO for no-fee accounts or TD for low costs.

Pro Tip: Use online banking alerts to track balance requirements for fee waivers.

Example: Sarah, a Toronto landlord, switched from Chase to BMO for free wire transfers, saving $300 annually.

Getting Better Exchange Rates

Banks add big markups to exchange rates, costing you CAD-to-USD swaps. Wise offers mid-market rates to save up to 8x. Use Wise for transfers like US supplier bills, and check our guide to transferring money from Canada to the US for tax tips.

Example: Liam in Vancouver paid a $2,000 US client invoice with Wise to keep $150 more than bank rates.

Making Account Access Easy

Some banks, like Chase, require a US address, which can be tricky. TD and RBC accept Canadian addresses. Check address rules first. Use a friend’s US address or mail service if needed later.

Example: Emma, a Calgary snowbird, uses her Canadian address with a TD account to pay Florida condo bills smoothly.

Staying on Top of Taxes

US bank accounts might need Foreign Account Tax Compliance Act (FATCA) reporting to the IRS if your balance is high. Skipping it risks penalties. Work with a tax pro to stay compliant with US and Canadian tax laws.

Example: Raj, a Montreal business owner, relies on his tax advisor to file FATCA forms for his EQ Bank USD account and avoids a $1,000 penalty.

Timing Your Currency Swaps

Swapping CAD to USD at a bad time can cost you if rates shift. Watch rates on tools like XE.com and transfer when they’re good. Set rate alerts on Wise or bank apps to catch the best moment.

Example: By setting Wise rate alerts, Ottawa student Mia transferred $500 to her US account at the best rate and saved $20.

Getting Easy ATM Access

Banks like RBC have fewer US ATMs, so you might face withdrawal fees. TD has 2,600+ ATMs, and Chase offers 15,000+. Choose a bank with lots of ATMs if you travel often, or go with EQ Bank’s digital account to skip ATMs entirely.

Pro Tip: Pair a TD account with a no-ATM-fee digital option like Wealthsimple for flexibility.

Example: On US trips, Victoria traveler Noah sticks to TD’s 2,600 ATMs, avoiding $5 withdrawal fees.

Here’s a concise comparison of cross-border banking challenges and their solutions:

| Challenge | Solution | Best Tool/Bank |

| High fees | Choose no-fee or waivable accounts | BMO ($0), TD ($100 balance) |

| Poor exchange rates | Use mid-market rates | Wise (0.4% fee) |

| FATCA tax compliance | Work with a tax pro, keep statements | EQ Bank, BMO |

| Limited ATM access | Select banks with many US ATMs | TD (2,600+), Chase (15,000+) |

Finding the Perfect US Bank for You

Pick the right US bank to make cross-border banking easy and save you money. Here’s a quick look at which bank fits who. Check out the details below:

- RBC Bank: Great for business owners needing fast CAD-to-USD transfers.

- TD Bank: Perfect for travelers with 2,600+ US ATMs who can benefit from Canada’s travel money tips.

- BMO Harris: Ideal for property owners wanting no-fee accounts.

- Chase: Best for professionals looking to build US credit.

- EQ Bank: Suits freelancers saving USD with 3.0% interest.

Pro Tip: Compare bank fees online before choosing to ensure the best fit for your needs.

How to Keep Your US Bank Account Safe

Your US bank account needs protection from fraud and privacy risks. These easy steps keep it safe:

1.Stop Fraud

Create strong, unique passwords. Enable two-factor authentication for bank apps. Never share PINs or login details. Use secure Wi-Fi or mobile data for banking, not public networks. Monitor transactions often. Report odd ones to your bank immediately.

2.Protect Privacy

Ensure your bank complies with FATCA, sharing only IRS-required data for high-balance accounts. Check their privacy policies to limit data sharing. Review statements for unauthorized access. This protects your info.

3.Act Fast

Freeze your account in the app if you see fraud or odd activity. Call your bank’s fraud hotline quickly to fix things. Set up real-time alerts for transactions or logins to catch issues early.

Pro Tip: Save your bank’s fraud hotline number in your phone for quick calls.

Smart Ways to Manage Your US Bank Account

These quick tips cut fees, manage transfers, and keep your US bank account tax-compliant:

- Skip Fees: Keep a minimum balance, like $100 for TD or $1,500 for Chase, to avoid fees. Check your bank’s app to stay above the required amount.

- Save on Transfers: Use Wise for CAD-to-USD transfers to save up to 8x compared to bank rates. Set up transfers when rates are favorable.

- Watch Your Spending: Use TD or Chase apps to track spending in real-time. Set alerts to manage budgets and avoid overspending.

- Handle Taxes Right: Report high-balance accounts under FATCA to the IRS. Work with a tax pro to stay compliant.

Our US-Canada cross-border tax accountants in Mississauga helps you stay compliant and save money.

Case Study: Efficient Property Management with BMO

Problem: A Kelowna property owner faced $120 per $3,000 rent transfer and a $1,000 FATCA penalty risk for their $50,000 balance.

What I Did: I set them up with a BMO Harris account, Wise for transfers, a tax advisor for FATCA compliance, and BMO’s app for expense tracking.

The Result: The property owner saved $120 per transfer and avoided penalties, cutting $1,120 yearly.

Final Thoughts

The best US banks for Canadians, like RBC, TD, BMO, Chase, and EQ Bank, plus tools like Wise, save you money and simplify cross-border banking. Stay on top of fees, exchange rates, and rules to maximize benefits. This guide covers top banks, tips, and solutions to keep your finances smooth.

Need help? Contact SAL Accounting for expert advice. Optimize your US banking with a free consultation today!

Frequently Asked Questions (FAQs)

Depends: RBC for business owners’ fast transfers, TD for travellers’ 2,600+ ATMs, BMO for property owners’ no fees, Chase for professionals’ credit-building, EQ Bank for freelancers’ 3.0% USD interest.

RBC, TD, BMO, Chase. TD, RBC take Canadian addresses. BMO uses phone apps. Chase needs in-person visits. EQ Bank offers a Canadian USD account.

Yes, great for business owners with instant CAD-to-USD transfers, 10 free transactions. $39.50 fee waivable with RBC Visa. Needs US address later.

Wise offers cheap CAD-to-USD transfers, saving 8x. RBC does instant transfers, TD, and BMO the next day. EQ Bank pairs with Wise.

RBC: $39.50/year, waivable. Chase: $12/month, waivable, $34 wires. TD: $0 with $100 balance, $15 wires. BMO: $0. EQ Bank: $0, 3.0% interest. Wise: 0.4% fee.

Yes. Wise has low-fee CAD-to-USD transfers. Wealthsimple’s USD account skips fees, covers ATM costs. Both online, FINTRAC-safe.

Report $50,000+ accounts to the IRS with a tax pro to skip $1,000 fines. Keep digital statements for easy FATCA filing.

Disclaimer: Information for educational purposes; bank features subject to change—verify directly. Services from a Canadian perspective only; results may vary; no guarantees; consult for your situation.