We are here to make your tax filing easier by guiding you through the CRA Form T2209, which lets Canadians claim a federal foreign tax credit on income earned abroad. But what’s most surprising is that almost 40 percent of Canadians with foreign income never file this form, meaning they end up paying tax twice on the same earnings. That’s money lost not to bad luck, but to missed paperwork.

In this post from SAL Accounting, we’ll show exactly what the T2209 form is, who needs it, and how to fill it out correctly so you can keep more of what you’ve already worked hard to earn.

Quick Takeaways

- Form T2209 helps you claim a foreign tax credit and avoid paying taxes twice.

- You need proof of foreign income, taxes paid, and exchange rates to complete the form.

- File Form T2209 with your regular tax return to reduce your Canadian tax liability.

- Ensure your foreign taxes paid are higher than your Canadian tax before carrying any excess forward.

- Use CRA-approved software to file Form T2209 electronically for a smoother process.

What Is CRA Form T2209 and Who Needs to File It?

CRA Form T2209 is a form that helps you get credit for taxes you’ve already paid to another country. It stops you from paying tax twice on the same income (source). You can avoid double taxation in Canada as a small business owner. Think of it as a way to show the CRA that part of your tax was already paid elsewhere. You need to fill out Form T2209 if you:

- Live in Canada and earn income in another country.

- Paid foreign income tax on that money.

- Want to lower your federal tax in Canada.

- Have foreign tax slips like a US W-2, 1099, or other proof of tax paid.

Pro Tip: Remember, T2209 only covers federal taxes. If you also want credit for provincial or territorial taxes, fill out Form T2036 as well. Talk to our cross-border tax accountant to file your T2209 correctly. Below, check a part of the Form:

Documents You Need to Complete Form T2209

Before you start, gather the papers you’ll need. Having everything ready makes things smoother and helps you avoid mistakes later.

1. Proof of Foreign Income

Collect any records that show the money you earned outside Canada. This can be payslips, bank statements, or tax slips like a US Form W-2 or 1099. If you made freelance or investment income abroad, keep those payment details too. Check out the tax implications of the US rental income for Canadians.

2. Proof of Tax Paid Abroad

Keep documents that show how much foreign tax you paid. These might be tax returns, payment receipts, or official notices from the other country’s tax office. If you worked in more than one country, keep separate proof for each one. You must know how to file foreign business income taxes in Canada.

3. Exchange Rate Information

You’ll need to convert your foreign amounts into Canadian dollars. Here’s how to do it:

- Use the Bank of Canada exchange rate for the tax year, unless CRA asks for daily rates.

- Use the same rate for both your income and the tax you paid.

- Write down the rate and where you found it (for example, “Bank of Canada 2024 average rate”) in case the CRA asks later.

4. Your T1 Tax Return

When you finish Form T2209, add your final foreign tax credit to your T1 tax return. Keep both forms together so your numbers match. It’s also smart to store your income and tax records with your T1, just in case CRA asks for them later.

The table below shows the documents needed for Form T2209:

| Document Type | What You Need | Examples | Why It’s Important |

| Proof of Foreign Income | Records of income earned outside Canada | Payslips, US W-2, 1099 | To claim foreign tax credit accurately. |

| Proof of Tax Paid Abroad | Documents showing foreign tax paid | Tax returns, receipts | To verify the taxes already paid abroad. |

| Exchange Rate Info | Conversion rate for foreign amounts | Bank of Canada rate | Ensures correct conversion to Canadian dollars. |

| Your T1 Tax Return | Your completed Canadian tax return | T1 Tax form | To match the foreign tax credit with your return. |

Filing Form T2209: When to Send It and the Easiest Ways to Do It

You’ll file Form T2209 along with your regular tax return. Doing it at the right time and in the right way helps you avoid delays or missing your foreign tax credit.

Filing Deadline

Form T2209 follows the same deadline as your regular tax return.

- For most people, that’s April 30 of the following year.

- If you or your spouse is self-employed, you have until June 15, but any tax you owe is still due by April 30.

It’s best not to wait until the last week. Filing early gives you time to fix errors if the CRA flags something. The way the tax treaty works between Canada and the US helps you a lot.

How to File

You can file the form in two ways:

- Online: Use certified CRA-approved tax software. Most programs include Form T2209 and calculate your foreign tax credit automatically.

- On paper: Print the form from the CRA website, fill it out, and attach it to your T1 tax return before mailing it in.

Check that the numbers on your T2209 match the amounts on your return before you send it.

Keep Your Records Safe

The CRA doesn’t usually ask for proof right away, but it can request it later.

Keep copies of:

- All foreign income documents,

- Tax receipts or payment proofs, and

- The exchange rate you used.

Store them with your T1 return for at least six years. If the CRA reviews your file, you’ll have everything ready. Learn more about reporting foreign business income in Canada.

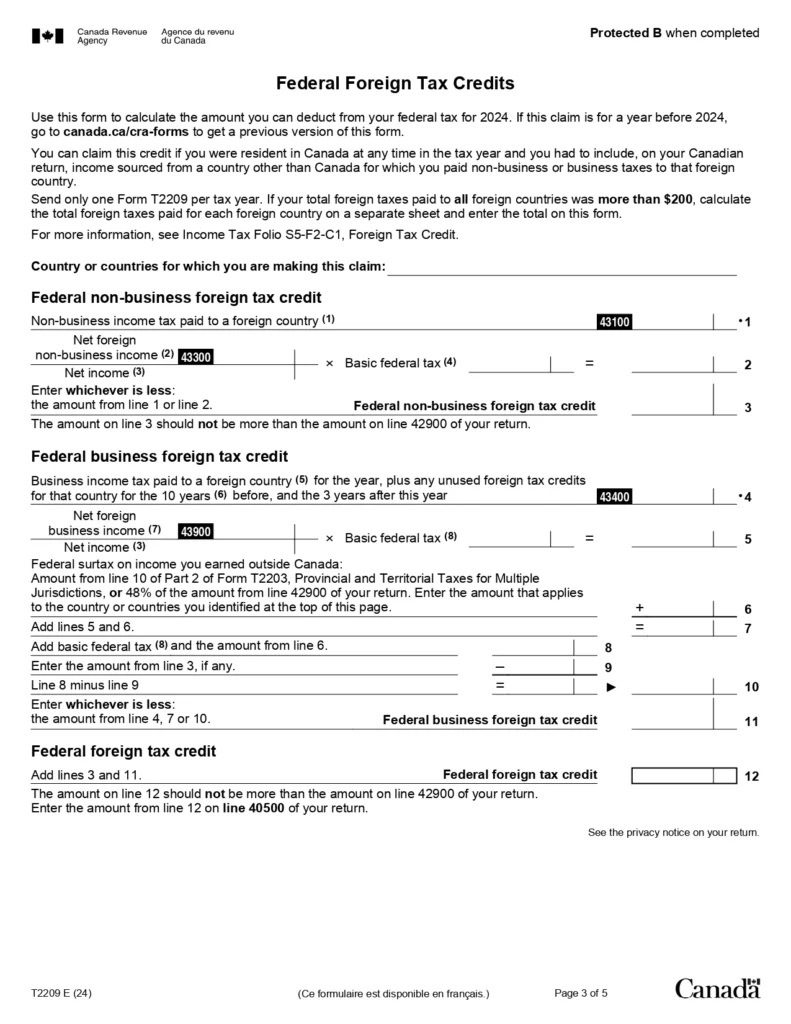

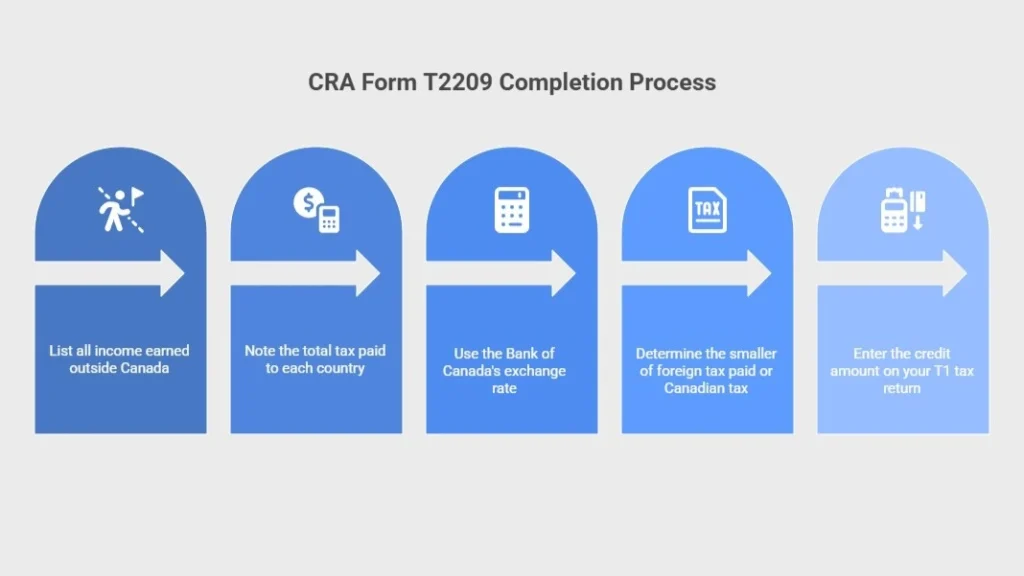

How to Fill Out CRA Form T2209 (Step-by-Step Guide)

Once you have all your documents ready, filling out Form T2209 is much easier than it looks. This form helps you figure out how much of your foreign taxes you can claim as a credit on your Canadian return. Let’s go through it step by step.

Step 1: Identify Your Eligible Foreign Income

Start by listing all the money you earned outside Canada. This includes:

- Salary or wages from a foreign employer

- Freelance or business income earned abroad

- Interest, dividends, or rental income from another country

Add up all your foreign income for the year. You’ll need the total amount before you can calculate your tax credit.

Step 2: Record the Foreign Taxes You Paid

Next, write down the total tax you paid to each country. Use your tax slips or payment receipts as proof. Only include income taxes, not social security payments or other deductions. If you worked in more than one country, note the tax paid for each one separately.

Step 3: Convert Amounts to Canadian Dollars

You need to show all amounts in Canadian dollars. Here’s how:

- Use the Bank of Canada’s annual average exchange rate for the year unless CRA asks for daily rates.

- Apply the same rate for both your income and taxes.

- Write down the rate and the source you used in your notes.

This keeps your records consistent if CRA ever wants to double-check your math. Also, check important tax implications for Canadians owning US property.

Step 4: Calculate Your Federal Foreign Tax Credit

Now comes the key part, calculating your credit. You can only claim the smaller of these two amounts:

- The foreign tax you actually paid, or

- The Canadian tax that applies to that same income.

Example: If you paid $1,200 in tax to the US, but your Canadian tax on that income is $1,000, you can only claim $1,000 as your federal foreign tax credit.

If your foreign tax is higher than the Canadian tax, don’t worry. You may be able to carry forward the extra amount for up to 10 years or carry it back three years.

Step 5: Transfer the Credit to Your T1 Return

Once you’ve found your credit amount, transfer it to your T1 tax return. It goes under the section for Federal Foreign Tax Credit (usually on Schedule 1 or line 40500, depending on your software). Double-check that the number matches what you wrote on your T2209. Small differences can cause CRA to delay processing or ask for clarification later.

Pro Tip: Don’t claim the same income under both Form T2209 and the Section 20(11) deduction. It’s one or the other. Claiming both can lead to a CRA adjustment or rejection.

Top CRA Form T2209 Mistakes and How to Avoid Them

Even small errors on Form T2209 can slow down your return or reduce your foreign tax credit. US–Canada dual citizenship taxes won’t be a headache if you are mistake-free. These are the mistakes the CRA sees most often, and the simple ways to avoid them:

- Wrong exchange rate. Use the Bank of Canada’s annual average rate for the year unless the CRA instructs you to use daily rates.

- Taxes are not actually paid. Claim only taxes that you paid legally and did not receive as a refund.

- Missing Form T2036. Form T2209 covers only your federal credit. File Form T2036 for the provincial or territorial portion.

- Mixed income types. Keep business income and non-business income (types of income) separate when you calculate your credit.

- Missing proof of income or tax paid. Keep slips, receipts, and payment records in case the CRA requests them.

- Mismatched numbers. Ensure the totals on Form T2209 match the numbers on your T1 tax return.

A quick review before you file prevents delays and helps you receive your credit faster. Our US Canada tax accountant can help you stay compliant.

| Mistake | How to Avoid It | Impact of the Mistake | Solution |

| Wrong exchange rate | Use the Bank of Canada’s annual average rate. | Incorrect credit calculation. | Verify the exchange rate used. |

| Taxes not actually paid | Only claim taxes actually paid and not refunded. | Risk of audit and adjustment. | Ensure taxes were paid legally. |

| Missing Form T2036 | File Form T2036 for provincial/territorial credit. | Missed provincial/territorial credit. | Complete both T2209 and T2036. |

| Mixed income types | Separate business and non-business income. | Incorrect credit claim. | Categorize income accurately. |

| Missing proof of income/tax paid | Keep slips, receipts, and records. | Delayed processing or reduced credit. | Organize and store all documents. |

| Mismatched numbers | Ensure totals match the T1 tax return. | Delayed processing or rejections. | Double-check for consistency. |

Case Study: Losing a Credit Due to Missing Proof1

Problem:

Michael lives in Ottawa and works as a freelancer for clients in the U.K. He tells the government how much money he makes, but he doesn’t keep track of how much tax he pays in other nations. He sends in Form T2209 with his guesses about the exchange rate, but he forgets to submit in Form T2036 for the provincial credit. The CRA doesn’t trust his claim and holds some of his money.

What We Do:

At SAL Accounting, we collect his tax receipts from the U.K., check the payment dates, and utilize the proper Bank of Canada yearly rate. We amend his summary of foreign income and check that both Form T2209 and Form T2036 are correct. We retain his supporting documents in a secure cloud folder so that the CRA can get them later.

Result:

Michael gets the whole $1,500 credit that he almost lost. He keeps his papers in order, and the CRA doesn’t have to follow up with him about his return for the next year.

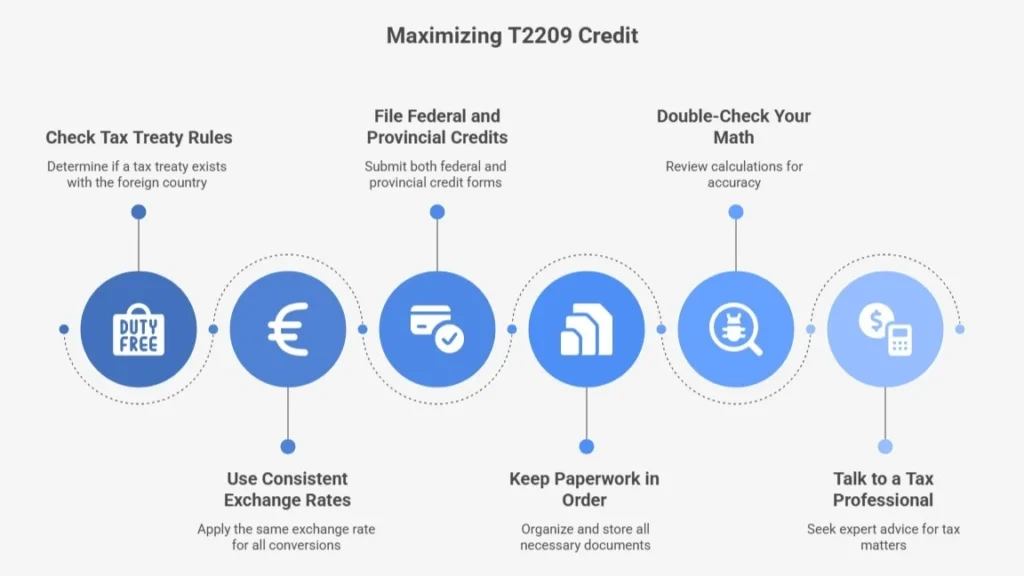

Smart Ways to Get the Most from Your T2209 Credit

A few simple steps can help you get the full credit you deserve. These ideas keep your numbers right and make tax time a lot smoother.

1. Check Tax Treaty Rules

Many countries have tax treaties with Canada. Check if the country you paid tax to has one. The treaty might lower the amount of foreign tax you can claim. Knowing the rules keeps your return clean and accurate. You can withhold taxes under the U.S.-Canada tax treaty.

2. Use Consistent Exchange Rates

Use the same exchange rate when you convert your foreign income and taxes.

- The Bank of Canada’s annual average rate works best for most people.

- Keeping one rate makes your math clear and helps you avoid CRA questions later.

3. File Both Federal and Provincial Credits

Use Form T2209 for your federal foreign tax credit and Form T2036 for your provincial or territorial credit. Filing both forms helps you get the full amount you qualify for.

4. Keep Your Paperwork in Order

Keep all your documents together so you can find them easily.

- Put tax slips, payment receipts, and exchange rate notes in one folder.

- Sort papers by country if you worked in more than one.

- Save digital copies in a safe folder or cloud storage.

- Keep everything for at least six years in case the CRA asks for it later.

5. Double-Check Your Math

Look over your numbers before you file. Even small mistakes can cut your credit or slow down your refund. Correct numbers save time and stress.

6. Talk to a Tax Professional if You Need Help

A tax expert can check your calculations and make sure you claim everything you should. Getting advice early can save you both money and trouble later. Get help from our US-Canada cross-border tax accountant with your cross-border taxes.

Case Study: Claiming the Full Credit Without Issues2

Problem:

Emma, a freelance designer in Calgary, gets paid by a client in the US who doesn’t pay taxes. She doesn’t want to pay taxes twice, but she doesn’t know how to use the credit card properly.

What We Do:

We look at her income statements to make sure that the US tax was taken out. Using the Bank of Canada’s average rate for the year, we alter all the values. We fill out both Form T2209 and Form T2036, double-check the math, and submit them in with her T1 return. We also keep all of her slips, receipts, and notes on currency rates in her digital record folder.

Result:

The CRA immediately accepts her return. Emma earns her full foreign tax credit, saves hundreds of dollars, and feels better knowing that her paperwork is ready for an audit.

Final Thoughts

Form T2209 helps you avoid paying tax twice on income earned abroad and lets you claim the credit you deserve. Follow the steps in this guide: gather your documents, use the right exchange rate, and avoid common mistakes. This approach keeps your filing accurate and saves you money.

For help with Form T2209 or any cross-border tax issues, contact us at SAL Accounting. Our team makes the process clear and stress-free.

It helps you claim a federal foreign tax credit for taxes paid on income earned abroad.

You can file if you live in Canada, earned income abroad, paid foreign taxes, and want to reduce your Canadian tax.

Yes, if you paid foreign taxes during your time abroad.

Use the Bank of Canada’s average exchange rate for the year, unless CRA requests daily rates.

It allows a deduction for foreign taxes on business income, but you can’t claim both this and the foreign tax credit for the same income.

You can carry forward the excess for up to 10 years or carry it back for 3 years.

Yes, use CRA-approved software to file it electronically.